- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding the Volatility in JNVR Stock Recent Trends Explained

Image Source: unsplash

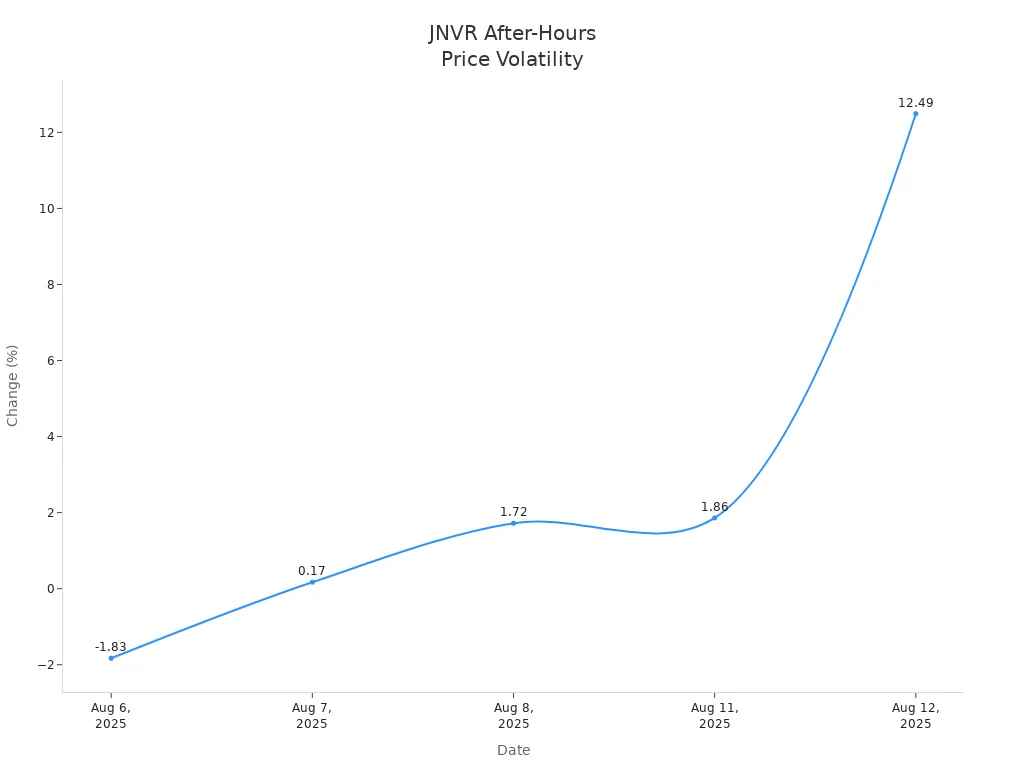

JNVR stock has shown extreme price swings, capturing market attention with a massive surge in JNVR shares. The recent stock price rally saw shares jump from $4.44 to $48.47 in one day, with trading volume soaring past 25 million shares. Retail enthusiasm, a bold Solana strategy pivot, and new leadership drove this volatility. The stock’s price changes, like a 12.49% after-hours gain on August 12, 2025, highlight the risks investors face.

| Date | Market Close Price | After-Hours Price | Change (%) |

|---|---|---|---|

| Aug 12, 2025 | $17.77 | $19.99 | +12.49 |

| Aug 11, 2025 | $15.02 | $15.30 | +1.86 |

| Aug 8, 2025 | $15.68 | $15.95 | +1.72 |

| Aug 7, 2025 | $13.69 | $13.71 | +0.17 |

| Aug 6, 2025 | $14.25 | $13.99 | -1.83 |

Key Takeaways

- JNVR stock has shown extreme price swings driven by new leadership, a shift to Solana and digital assets, and strong retail investor interest.

- The stock’s price often moves sharply and unpredictably, reflecting hype and speculation rather than the company’s current financial health.

- Investors should watch technical signals like trading volume and price support levels, and stay updated on company news to manage risks.

- JNVR’s focus on Solana offers unique opportunities through staking rewards and digital asset exposure, but also adds risk due to market uncertainty.

- Careful research, diversification, and setting clear investment limits can help protect portfolios in this highly volatile and speculative stock.

JNVR Stock Volatility

Image Source: pexels

Recent Price Moves

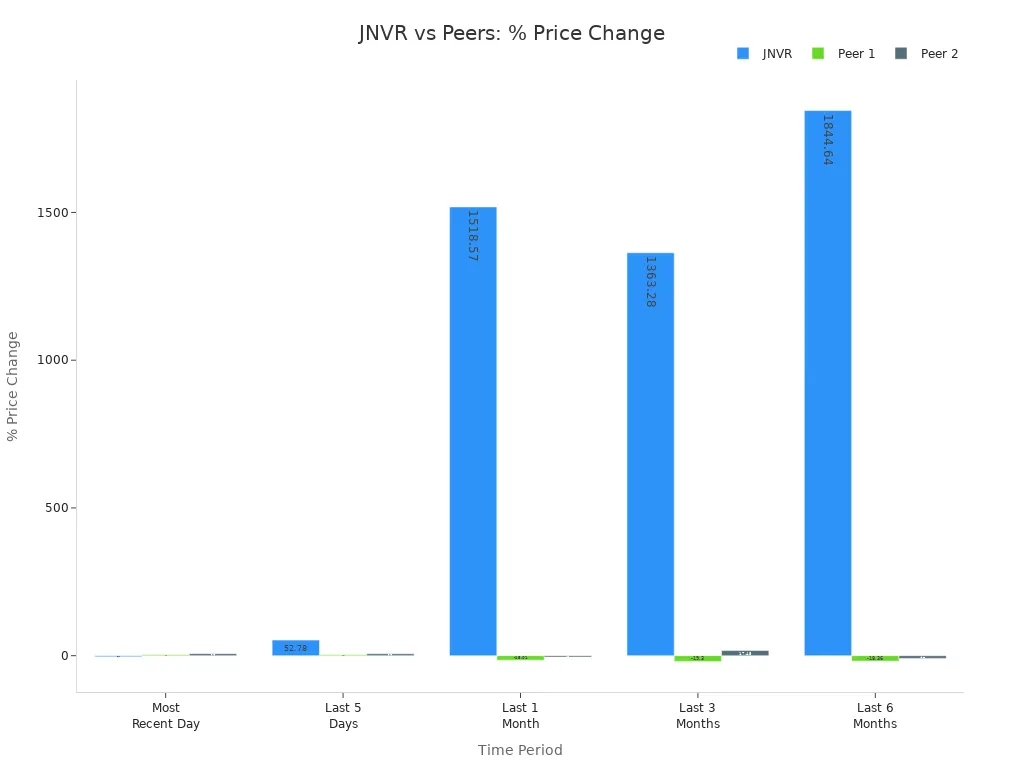

JNVR stock has experienced dramatic price swings that set it apart from other stocks in the Real Estate Operations sector. Over the last six months, the price of JNVR stock surged by more than 1,800%. This growth far exceeds the performance of its sector peers, which mostly saw declines or modest gains. The table below compares the percentage price changes of JNVR stock with two peer stocks across several time periods:

| Time Period | JNVR % Change | Peer 1 % Change | Peer 2 % Change |

|---|---|---|---|

| Last 5 Days | +52.78% | +2.87% | +6.46% |

| Last 1 Month | +1,518.57% | -15.01% | -4.68% |

| Last 3 Months | +1,363.28% | -19.30% | +17.45% |

| Last 6 Months | +1,844.64% | -18.36% | -9.15% |

| Most Recent Day | -3.61% | +2.80% | +6.76% |

Janover Inc. (JNVR) has demonstrated exceptionally strong and volatile price growth compared to other stocks in its sector. Over the medium term, JNVR stock price increased by over 1,300% to 1,800%, while comparable stocks mostly declined. Even with a recent daily pullback of -3.61%, the overall market trend for JNVR stock remains much stronger than its peers. This volatility reflects both the speculative nature of the current rally and the influence of retail investor enthusiasm.

Market experts point to several factors behind these price moves. The stock price dropped 16.84% to $4.00 during a period of volatility linked to new leadership and a strategic pivot. Technical analysis shows the stock below its 50-day and 200-day moving averages, which signals short-term bearish momentum. The Relative Strength Index (RSI) remains near neutral but close to oversold territory. Support at $3.93 may attract buyers, while resistance at $4.60 could limit gains. The Average True Range (ATR) of 18.04 confirms high volatility. Despite these technical signals, the stock forecast remains uncertain due to negative earnings per share and a negative price-to-earnings ratio, which highlight ongoing profitability challenges.

Note: JNVR stock’s price prediction remains speculative. The company’s strategic pivot toward blockchain and DeFi, especially its Solana backing, introduces both growth potential and additional risk. Investors should monitor technical analysis and news updates closely when considering any stock forecast for JNVR.

Trading Volume Spikes

Trading volume for JNVR stock has also reached extraordinary levels. On April 15, 2025, the stock recorded its highest trading volume in six months, with 3,185,275 shares changing hands. This figure stands 1,408% above the average daily trading volume of 226,172 shares. Such spikes in trading volume often signal heightened investor interest and can amplify price volatility.

| Date | Trading Volume (Shares) | Average Trading Volume (Shares) | Notes |

|---|---|---|---|

| April 15, 2025 | 3,185,275 | 226,172 | Highest explicitly stated daily volume, 1408% above average |

Several key events have coincided with these trading volume surges. In early August 2025, multiple 8-K filings and insider trading disclosures appeared. Material event reports dated July 31, August 4, and August 12, 2025, as well as insider trading activity on August 1, 2025, all occurred during periods of high trading volume and sharp price movements. These news releases and company disclosures have a direct impact on both trading volume and price action.

Market experts explain that the recent volatility in JNVR stock results from a combination of factors:

- New leadership and a strategic pivot toward blockchain and decentralized finance have created emotional investor reactions.

- Technical analysis shows the stock near support but below key moving averages, indicating short-term bearish momentum.

- Mixed financial results, including a slight revenue increase but a significant net income drop, raise concerns about profitability.

- Speculation about cost-cutting measures and merger rumors further fuel sharp price fluctuations.

The stock forecast for JNVR remains highly uncertain. Experts advise investors to observe the market trend and technical analysis indicators before making decisions. The combination of high trading volume, rapid price changes, and speculative sentiment makes JNVR stock a high-risk, high-reward opportunity.

What’s Driving JNVR Stock?

Solana Strategy Shift

The Solana strategy shift stands as the most significant factor behind the recent stock forecast and price action. In early 2025, JNVR underwent a major transformation. The company rebranded as DeFi Development Corporation and changed its Nasdaq ticker to DFDV. This move reflected a new mission: to operate as a crypto treasury vehicle for public market investors. The leadership team, including former Kraken executives, introduced a treasury policy that prioritized acquiring Solana (SOL) and operating validator nodes. This pivot marked a clear departure from the company’s previous focus on fintech and real estate data services.

By April 2025, DeFi Development Corp held about 317,273 SOL tokens, valued at $48.2 million. This holding equated to roughly 0.22 SOL per share, with a 40% increase since the last acquisition. CEO Joseph Onorati emphasized the importance of acquiring discounted SOL inventory and building deeper ties with the Solana ecosystem. The company’s public disclosures about its Solana holdings and treasury metrics provided transparency and reinforced its commitment to a crypto-centric business model.

Other companies that pivoted to Solana also experienced strong stock forecast momentum. For example, BIT Mining Limited saw its shares soar over 120% after announcing a $300 million Solana treasury pivot. Multiple public firms have accumulated more than 3.5 million SOL tokens, worth over $590 million. These companies benefit from Solana’s staking model, which generates recurring yield-driven revenue streams. The trend of building validator infrastructure and earning daily staking rewards has attracted institutional investors seeking stable crypto cash flows. This broader market context supports the current sentiment that a Solana-focused strategy can drive positive stock price performance.

Retail Investor Hype

Retail investor hype has played a crucial role in shaping the current sentiment and driving the stock forecast for JNVR. The stock’s trading volume reached extraordinary levels, with a total trading volume of approximately $10,262,628 during peak periods. Insider trading activity showed only sales by insiders, and institutional investor portfolio changes were also observed. While there is no direct data quantifying retail investor participation, the surge in trading volume and rapid price movements suggest that retail investors have contributed to the heightened sentiment and volatility.

The stock’s price swings and high trading activity often reflect the influence of retail investors who respond quickly to news, social media trends, and speculative opportunities. This behavior can amplify both upward and downward price movements, making the stock forecast more unpredictable. The current sentiment among retail investors appears highly speculative, with many seeking short-term gains rather than long-term investment stability. This dynamic adds another layer of risk to the investment landscape.

Leadership Changes

Leadership changes at JNVR have had a profound impact on investor confidence and the stock forecast. After the appointment of Joseph Onorati as Chairman and CEO and Parker White as Chief Investment Officer and COO, the company experienced a nearly 99% surge in share price. Intraday trading volumes also increased dramatically, reflecting strong optimism about the new direction toward blockchain and digital assets.

The new leadership team brought deep experience from the cryptocurrency industry. Onorati previously served as Chief Strategy Officer at Kraken, while White managed a Solana validator with $75 million in delegated stake and had institutional bond portfolio management experience. The company also appointed John Han as Chief Financial Officer, who brought over 15 years of experience in both traditional finance and cryptocurrency. Former CFO Bruce Rosenbloom transitioned to Executive Vice President of Finance, ensuring continuity. Dan Kang joined as Head of Investor Relations, and Bill Caragol, a former public company CEO/CFO, took on the role of Audit Committee Chair.

These changes signaled a deliberate shift in strategy and governance. The company’s focus on digital assets, especially Solana, and its commitment to transparency and investor communication have shaped the current sentiment and stock forecast. However, history shows that leadership transitions can also increase stock volatility. For example, Lucent Canada’s leadership change in 1999 coincided with significant stock price swings and eventual collapse during broader market turmoil. This example highlights the importance of monitoring both internal changes and external market conditions when evaluating the stock forecast for JNVR.

Fundamentals vs. Hype

Image Source: pexels

Disconnect from Financials

Many investors have noticed a significant gap between JNVR stock price movements and the company’s underlying financials. The stock has experienced sharp price increases, but the business fundamentals do not support such growth. Several financial metrics highlight this disconnect:

- Market capitalization jumped from about $5.7 million to over $47 million after the crypto pivot announcement, even though the company had not yet purchased Solana assets.

- Janover currently generates zero operating revenue from its crypto activities, so the stock price relies on future expectations rather than present results.

- The company’s performance depends heavily on Solana price appreciation, which introduces additional risk for the stock.

- Shareholders face dilution risk because the company raised funds through convertible notes to support its crypto strategy.

- Insider ownership stands at 58.9%, showing concentrated control, while institutional ownership remains very low at 0.27%, reflecting limited confidence from large investors.

- The float is small, with only 631,170 shares available, which can lead to sharp price swings based on sentiment rather than fundamentals.

These factors suggest that the stock price has become disconnected from the company’s actual financial health. Investors should recognize that the current price may reflect hype and speculation more than sustainable business growth.

Meme Stock Comparisons

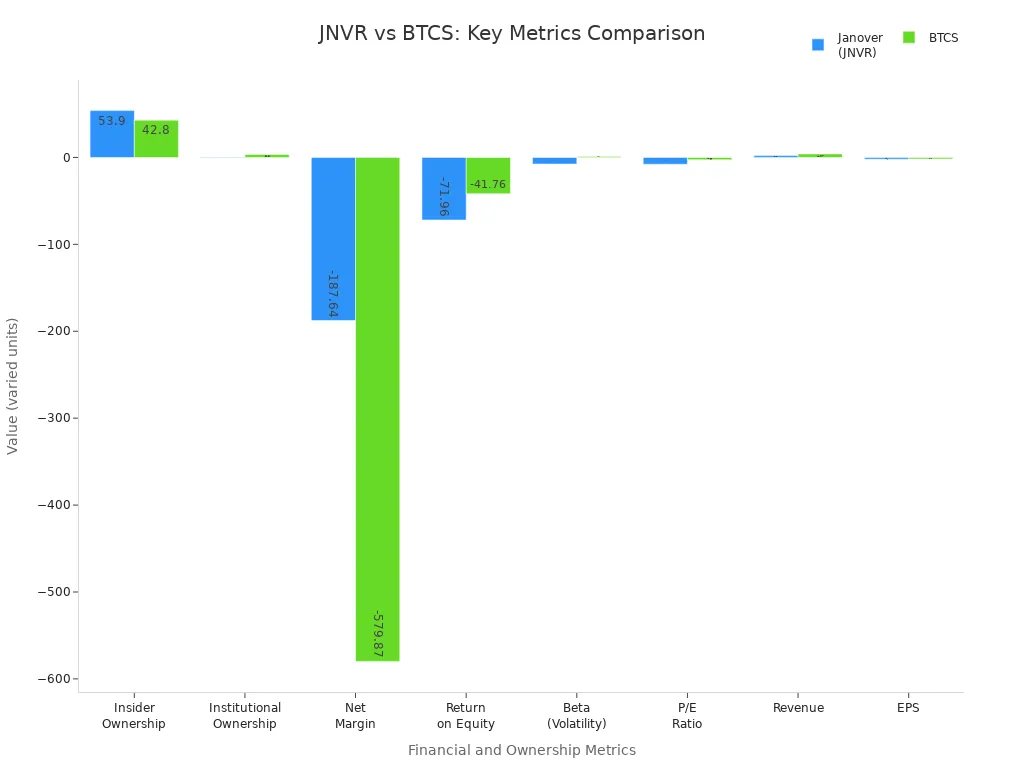

JNVR stock shares several characteristics with other well-known meme stocks. The table below compares JNVR with BTCS, another stock that has attracted retail attention:

| Metric | Janover (JNVR) | BTCS |

|---|---|---|

| Insider Ownership | 53.9% | 42.8% |

| Institutional Ownership | 0.5% | 3.5% |

| Net Margin | -187.64% | -579.87% |

| Return on Equity | -71.96% | -41.76% |

| Beta (Volatility) | -7.59 | 1.17 |

| Price-to-Earnings Ratio | -7.77 | -2.66 |

| Revenue | $2.10M | $4.07M |

| Earnings Per Share | -$1.94 | -$1.71 |

| Media Sentiment | Neutral (0.00) | Positive (1.28) |

| Analyst Ratings | None | Buy rating |

Both stocks show high insider ownership and low institutional participation, which can lead to volatile price action. JNVR stock, like other meme stocks, has seen rapid price changes driven by retail enthusiasm rather than strong financial performance. Academic studies show that meme stock rallies often involve small companies with low market caps and cultural relevance. These rallies rarely benefit long-term investors, as seen with GameStop and AMC, where stock prices soared and then collapsed. Meme stocks tend to experience extreme price volatility, frequent trading halts, and sharp reversals, making them risky for those seeking stable returns.

JNVR Stock Risks

Overbought Signals

Analysts have observed clear overbought signals in the stock. The Relative Strength Index (RSI) often rises above 70, which suggests that the price may have climbed too quickly. When the RSI reaches these levels, the stock can become vulnerable to sharp corrections. Technical indicators also show that the price sometimes moves far above its moving averages. This pattern often leads to a reversal as traders seek to lock in profits. High price momentum can attract more buyers, but it also increases the risk of a sudden drop. Investors should watch for these signals before making decisions.

Speculative Trading

Speculative trading has played a major role in recent price action. Many traders enter and exit positions quickly, hoping to benefit from short-term price swings. This behavior can cause the stock to move away from its true value. High trading volume often reflects this speculative activity. When sentiment shifts, the price can fall just as fast as it rose. The stock’s price has shown large gaps between sessions, which points to a lack of stability. Speculation can create opportunities, but it also brings significant risk for those who do not manage their positions carefully.

Analyst Warnings

Several analysts have issued warnings about the current environment. They note that the price does not reflect the company’s financial health. Some experts compare the situation to past episodes where sentiment drove the stock higher, only for the price to collapse later. Analysts highlight the lack of consistent revenue and negative earnings as red flags. They also point to the influence of social media on sentiment, which can change quickly. Investors should consider these warnings and avoid making decisions based only on hype. Careful research and risk management remain essential in such a volatile market.

Opportunities in JNVR Stock

Solana and Digital Assets

Investors see unique opportunities in JNVR stock due to its focus on Solana and digital assets. The company shifted its strategy from real estate software to decentralized finance, which led to a surge in stock price by up to 1,000%, settling at an 842.5% gain after the announcement. This move attracted attention from those seeking potential roi in the digital asset space. Janover raised $42 million from crypto venture funds, which supports its plan to acquire Solana validators and earn staking rewards. These rewards create yield beyond simple token price appreciation, offering new streams of potential roi for stockholders.

The leadership team includes experienced crypto executives who drive the new vision. Janover invested about $4.6 million in Solana (SOL) as part of its digital asset treasury strategy. The company plans to stake its SOL holdings and operate validators, which supports the Solana network and generates additional revenue. This approach provides investors with economic exposure to the Solana ecosystem, combining staking yield and ecosystem participation. Solana stands out for its speed, usability, and programmability, which differentiates it from other blockchains like Bitcoin. Growing institutional interest is clear, as multiple asset managers have filed for SOL ETFs. Janover’s strategy offers a novel public market vehicle for Solana exposure, which can enhance a portfolio’s potential roi.

Note: Management emphasizes efficient capital deployment and transparency in crypto accumulation. Operating validators and staking SOL creates revenue streams that go beyond price appreciation, increasing the potential roi for stockholders.

Nasdaq Compliance

JNVR stock benefits from its compliance with Nasdaq listing standards. The company received approval to list its shares on the Nasdaq Capital Market and began trading on July 25, 2023. This milestone increases the visibility and credibility of the stock. Nasdaq listing means the company follows strict regulatory oversight, which boosts confidence among institutional investors. Adherence to these standards signals improved corporate governance and financial reporting. Institutional investors often prefer stocks listed on major exchanges like Nasdaq because they trust the regulatory environment. This compliance status makes JNVR stock more attractive for inclusion in institutional portfolios, which can support price stability and long-term potential roi.

JNVR Stock Forecast

Price Prediction

Analysts continue to debate the stock forecast for JNVR. The recent price action has shown extreme volatility, with the price moving from single digits to nearly $50 in a short period. Many experts believe the price prediction for JNVR remains highly speculative. The stock forecast often relies on momentum rather than company fundamentals. Some analysts use technical analysis to set short-term price targets, but these targets change quickly as the price moves. The current sentiment in the market shows that traders focus on quick gains. The price prediction for JNVR often ignores the company’s negative earnings and lack of stable revenue. The stock forecast from several sources points to a wide range of possible outcomes. Some see the price reaching new highs if retail enthusiasm continues, while others warn of sharp declines if the market trend shifts. The price prediction for JNVR depends on both Solana’s value and the company’s ability to deliver on its digital asset strategy. Investors should remember that the stock forecast is not a guarantee of future results.

What to Watch

Investors should watch several key factors when considering the stock forecast for JNVR. The price prediction will depend on news about Solana, updates from the leadership team, and changes in trading volume. Technical analysis can help identify support and resistance levels for the price. The stock forecast may also shift if the company announces new partnerships or changes its strategy. Investors should monitor the price closely and look for signs of a reversal or continued momentum. The price prediction for JNVR will also reflect the balance between speculative trading and real business growth. The stock forecast should consider both the risks and the potential roi. Investors seeking potential roi must stay alert to sudden changes in price and sentiment. The price prediction for JNVR will remain uncertain as long as speculation drives the stock. The stock forecast will become clearer if the company shows progress in generating revenue from digital assets. Until then, the price prediction for JNVR will likely stay volatile. Investors should weigh the potential roi against the risks before making decisions.

The recent surge in price reflects a mix of new leadership, a Solana strategy, and retail excitement. The price often moves sharply, showing a disconnect from company results. Investors should treat each price move with caution. Monitoring news, technical signals, and company updates helps protect a portfolio. Diversifying investment and setting clear limits can reduce risk. Reviewing each price change before making an investment decision supports a stronger portfolio. This blog does not offer investment advice. Careful research and ongoing learning help build a safer investment plan.

FAQ

What caused the recent surge in JNVR stock price?

Several factors contributed to the surge. New leadership, a strategic shift toward Solana and digital assets, and increased retail investor interest all played key roles. High trading volume and speculative sentiment also amplified price movements.

Is JNVR stock considered a meme stock?

Analysts compare JNVR to meme stocks because of its rapid price swings, high retail participation, and disconnect from financial fundamentals. Like other meme stocks, JNVR shows extreme volatility and unpredictable trading patterns.

What risks should investors watch with JNVR stock?

Investors face risks such as overbought technical signals, speculative trading, and a lack of consistent revenue. Analyst warnings highlight the potential for sharp price corrections. Investors should monitor news and technical indicators closely.

How does JNVR’s Solana strategy benefit shareholders?

JNVR’s Solana strategy provides exposure to digital assets and staking rewards. By operating validator nodes and holding Solana, the company aims to generate new revenue streams. This approach offers shareholders potential returns beyond traditional business models.

JNVR stock presents a high-risk, high-reward opportunity defined by its bold strategic pivot and retail investor hype. Its extreme volatility means that success relies on disciplined risk management and a keen eye on market sentiment, not on traditional financial analysis. For a global investor, the logistical hurdles of accessing the US stock market can add another layer of complexity. This is where a modern financial platform becomes essential. BiyaPay provides a seamless way to fund your brokerage account and trade US-listed stocks like JNVR without the friction of traditional cross-border banking. Our platform simplifies the process with low, transparent fees and a real-time exchange rate converter, ensuring you can execute your strategy efficiently. By empowering you to focus on your trading plan and risk limits, BiyaPay gives you the tools you need to navigate this speculative market with confidence. Take control of your investments. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.