- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Need to Know About LITM Stock’s Volatility in 2025

Image Source: unsplash

LITM stock has captured attention in 2025 with a surge in trading activity and ongoing volatility. On August 12, 2025, the stock closed at $4.05, down 2.41% for the day, while the pre-market price on August 13 showed a slight recovery to $4.13.

| Year | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) | Year-to-Date % Change |

|---|---|---|---|---|---|

| 2025 | 6.04 | 12.21 | 3.30 | 4.05 | -67.55% |

Recent news has highlighted strong investor sentiment, supported by positive news about a share buyback program and technical indicators. News of exploration milestones and secured funding has fueled optimism among investors. The company overview reveals that production efficiency and strategic projects continue to influence both price and sentiment.

Key Takeaways

- LITM stock shows high volatility in 2025 due to frequent news on production, strategic projects, and market demand shifts.

- Improved production efficiency and strategic investments boost investor confidence but also cause sharp price swings.

- The company has a strong balance sheet with low debt and good cash reserves, supporting ongoing growth and stability.

- Institutional ownership is low but growing, signaling cautious optimism among major investors.

- Investors should start small, diversify their portfolios, and closely monitor company news, lithium market trends, and key financial indicators to manage risk effectively.

LITM Stock Surge

Image Source: unsplash

Recent Price Movements

LITM stock has experienced significant market movement in 2025, marked by sharp changes in share price and heightened trading activity. On May 23, 2025, the share price jumped by 14.22%. This surge followed positive news about strategic developments, including new partnerships and strong financial reports. The share price has shown high volatility over the past six months. The stock reached a 52-week high of $24.44 and a low of $1.98. The last recorded share price stood at $4.05. During this period, LITM stock hit new highs only twice, with a drop of nearly 61% from the last price, while it reached new lows 17 times, showing a 30% increase from the last low. This pattern highlights the unpredictable nature of the share price and the influence of recent news on investor sentiment.

| Metric | Value / Frequency | Price Change from Last Price |

|---|---|---|

| 52-Week High | 24.44 | N/A |

| 52-Week Low | 1.98 | N/A |

| Last Price | 4.05 | N/A |

| New Highs (6-Month) | 2 times | -60.98% |

| New Lows (6-Month) | 17 times | +30.00% |

The share price also responded strongly to news about financing and exploration. For example, securing funds for 2025 exploration programs led to a share price increase of over 70%. Announcing new financing arrangements resulted in a 54% rise. These events show that news and sentiment play a major role in driving the share price.

Key Announcements

Several key announcements have shaped the recent surge in LITM stock. Analysts point to multiple factors behind the share price movement:

- Heightened interest in lithium as a clean energy solution, driven by global demand for lithium-based batteries.

- Strategic partnership announcements with top-tier automakers, positioning Snow Lake Resources Ltd. as a major player in the lithium supply chain.

- A strong balance sheet with manageable liabilities and attractive valuation ratios, such as price-to-book and price-to-tangible book.

- Company ambitions to expand beyond lithium supply into broader energy initiatives.

- Prudent financial management and a thoughtful capital strategy, which have boosted investor sentiment and share price.

The Thompson Brothers Lithium Project stands out as a central driver of both news and share price. Snow Lake Lithium engaged SLR Consulting Canada to conduct an Initial Assessment and Technical Report Summary, moving toward a Pre-Feasibility Study. The project covers 21,703 acres, with drilling campaigns extending the strike by 10%. Drill results revealed high-grade lithium-bearing pegmatite swarms, with spodumene content between 20% and 25%. These findings support the potential for open-pit mining and have influenced both sentiment and share price.

Snow Lake Lithium also fast-tracked the Thompson project by starting a Preliminary Economic Assessment for Direct Shipping Ore, aiming to generate early cash flow. The company expanded its land holdings to 59,587 acres, signaling significant resource potential. The Thompson project now has an indicated resource of 11.1 million metric tonnes at 1% Li2O. These technical advances and corporate updates have caused notable volatility in the share price.

Recent news about the Thompson project and changes in corporate governance have led to sharp swings in share price. While the company holds enough assets to support ongoing exploration and development, financial data show ongoing cash burn. Despite positive news, some valuation metrics suggest that LITM stock remains overvalued compared to its fair value. Investors should continue to monitor news and sentiment, as these factors will likely drive future share price movements.

Volatility Drivers

Image Source: unsplash

Production Efficiency

Production efficiency stands as a central factor influencing LITM stock’s volatility in 2025. Snow Lake Resources Ltd. reported notable improvements in operational capacity, which led to a 12.64% increase in its stock price. The company enhanced its cash reserves to approximately $2.5 million USD, supporting ongoing production upgrades and financial stability. Total liabilities remain manageable at around $4.4 million USD, with a leverage ratio near 1.2, indicating a balanced financial position that supports further production growth.

Market analysts observe that Snow Lake’s financial repositioning efforts reflect ongoing struggles with profitability and a thin enterprise value. These efforts have shaped investor reactions and contributed to trading swings.

Strategic collaborations with electric vehicle manufacturers have increased demand for lithium, encouraging Snow Lake to expand production and improve efficiency. The company’s financial restructuring and operational boosts have increased investor confidence, highlighting tangible improvements in production efficiency. Analysts expect these changes to drive significant growth in market share and enhance overall stock performance.

- Improved production efficiency contributed to a rise in stock price.

- Enhanced cash reserves support operational improvements.

- Manageable debt levels aid production capacity.

- Strategic collaborations signal increased lithium demand.

- Financial restructuring boosts investor confidence.

Production efficiency improvements have created optimism among investors, but competitive pressures and fluctuating commodity prices continue to impact market sentiment and stock performance.

Strategic Projects

Strategic projects play a vital role in shaping LITM stock’s volatility and future growth prospects. Snow Lake Resources Ltd. invested AUD$1.4 million USD in GTi Energy’s uranium project and acquired a 5% stake in Resolution Minerals for antimony. The company also invested C$1.1 million USD in Commerce Resources for rare earth elements. These investments align with U.S. government initiatives to secure critical minerals supply chains, especially for uranium, antimony, and rare earth elements.

- The Lo Herma uranium project in Wyoming holds a JORC resource of 8.7 million lbs U3O8, with a projected mine life of seven years and an annual production target of 800,000 lbs. The project’s net present value stands at A$100 million USD, with a 56% pre-tax internal rate of return.

- The Stibnite Project is expected to supply about 35% of U.S. antimony demand during its first six years.

- The Ashram Rare Earth Project represents one of North America’s largest undeveloped rare earth deposits, with 204.3 million tonnes averaging approximately 1.94% total rare earth oxides.

Snow Lake’s Strategic Growth Plan, launched in April 2025, focuses on three sectors: Solana blockchain infrastructure, clean energy technologies, and critical minerals development. The plan aims to diversify the company’s portfolio, strengthen its treasury, and create new value streams while maintaining core resource operations. Investments in blockchain infrastructure, clean energy, and AI-driven energy platforms align with global electrification and energy transition trends.

Snow Lake continues to advance uranium and lithium exploration projects in Wyoming, Namibia, Saskatchewan, and Manitoba, supporting U.S. national and energy security policies.

The company’s selective investments in high-growth technology sectors build a resilient, future-facing business model. These strategic projects increase balance sheet strength, provide financial agility, and support long-term shareholder value. The overall tug-of-war between optimism for growth and industry constraints emphasizes the importance of strategic initiatives and financial management in driving stock performance.

LITM Stock Report: Financial Health

Earnings and Revenue

The litm stock report shows that Snow Lake Resources continues to face challenges with earnings. The company reported an earnings per share (EPS) of -$0.13 for Q2 2025. This marks an improvement from the previous year, when EPS stood at -$0.78 for Q2 2024. The table below summarizes these results:

| Quarter | Reported EPS | Consensus Estimate |

|---|---|---|

| Q2 2025 | -$0.13 | N/A |

| Q2 2024 | -$0.78 | N/A |

No consensus analyst estimate was available for these quarters, so direct comparison to expectations is not possible. Despite the negative EPS, the smaller loss in 2025 signals progress in cost management and operational efficiency. Investors reviewing the litm stock report should note that revenue growth remains a key focus for future stock analysis. The company’s ability to narrow losses may support improved investor sentiment if revenue trends continue upward.

Debt and Balance Sheet

Snow Lake Resources maintains a strong balance sheet, which supports its financial health. The company holds only $10,155 in debt and has $19.74 million in cash. This results in a net cash position of about $19.73 million, or $2.52 per share. The current ratio stands at 2.69, and the Debt/Equity ratio is 0.00. These figures show that the company has no significant leverage and ample liquidity to fund operations and strategic projects.

Analysts highlight that a strong balance sheet can help the company weather market volatility and invest in growth opportunities. In stock analysis, this financial strength often leads to more stable performance and lower risk for shareholders.

The litm stock report indicates that Snow Lake Resources has improved its financial position over the past year. Investors should continue to monitor earnings, cash flow, and liquidity as part of their ongoing stock analysis.

Market Cap and Valuation

Analyst Ratings

Market cap plays a key role in how analysts view LITM stock. Snow Lake Resources Ltd. holds a market cap of $174.9 million USD, which stands far below the industry median. The table below shows how LITM compares to its peers in the industrial materials sector:

| Metric | LITM (Snow Lake Resources Ltd.) | Industry Median / Peers |

|---|---|---|

| Market Capitalization | $174.9 million USD | N/A |

| Rule of X Metric | 0.0% (undefined) | 21.1% (Industrial Materials industry) |

| Comparison Summary | Significantly below industry median, indicating less favorable valuation or financial performance relative to peers such as STR, MTRN, RIO, BHP, VALE, SGML, MP, TECK, SKE, and USAR |

Analysts often use market cap to measure a company’s size and stability. A lower market cap can signal higher risk and more volatility in the share price. LITM’s market cap suggests that the company faces challenges in matching the financial strength of larger competitors. Stock analysis reports show that analysts remain cautious, noting that LITM’s valuation lags behind peers. They recommend investors watch for changes in market cap and share price trends before making decisions.

Analysts highlight that market cap changes can reflect shifts in investor sentiment and company performance.

Technical Trends

Technical trends help investors understand how the share price moves over time. LITM stock analysis uses several valuation metrics to track these trends. The table below lists the most relevant metrics for 2025:

| Valuation Metric | Value (as of Aug 13, 2025) | Interpretation / Relevance |

|---|---|---|

| Price-to-Book (P/B) | 0.64 | Indicates the stock is trading below book value, useful for asset-based valuation. |

| Free Cash Flow Yield | -22.30 | Negative FCF yield suggests cash flow challenges, important for cash flow-based valuation. |

| Forward Price-to-Earnings (P/E) | Not specified | Common earnings-based valuation metric, mentioned as relevant though exact value unavailable. |

| Forward Price-to-Sales (P/S) | Considered Fair | The stock is in the ‘Fair’ valuation zone relative to historical averages, indicating reasonable valuation based on sales. |

A price-to-book ratio below 1 means the share price trades under the company’s book value. This can attract investors looking for undervalued stocks. However, a negative free cash flow yield points to cash flow problems, which may hurt the share price in the future. Stock analysis also considers forward price-to-sales and price-to-earnings ratios. These help investors decide if the market cap and share price reflect fair value.

Investors should monitor technical trends and valuation metrics. Changes in market cap, share price, and financial ratios can signal new opportunities or risks. Regular stock analysis helps investors make informed choices.

Investors and Institutional Activity

Institutional Ownership

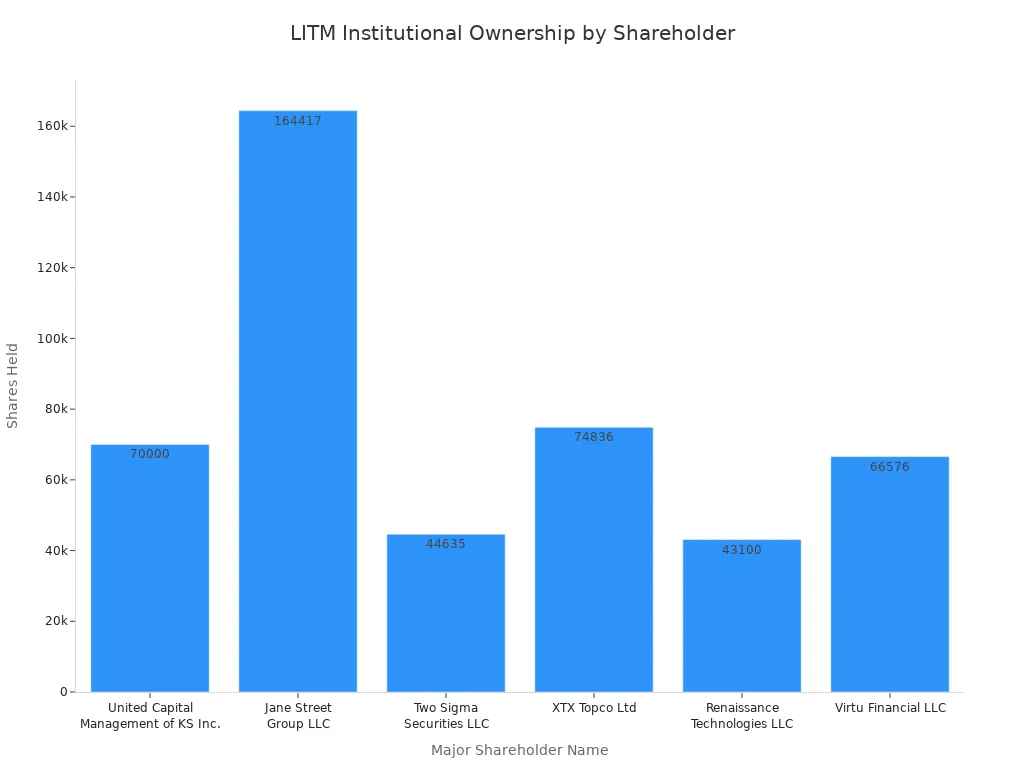

Institutional ownership in Snow Lake Resources (LITM) remains limited but shows signs of growth. The most recent data highlights several major shareholders who have increased their positions. The table below summarizes the latest institutional holdings:

| Reporting Date | Major Shareholder Name | Shares Held | Market Value | Ownership % | Quarterly Change |

|---|---|---|---|---|---|

| 5/13/2025 | United Capital Management of KS Inc. | 70,000 | $36K | 0.895% | +100.0% |

| 2/14/2025 | Jane Street Group LLC | 164,417 | $158K | 0.285% | N/A |

| 2/14/2025 | Two Sigma Securities LLC | 44,635 | $43K | 0.077% | +81.7% |

| 2/13/2025 | XTX Topco Ltd | 74,836 | $72K | 0.130% | N/A |

| 2/13/2025 | Renaissance Technologies LLC | 43,100 | $41K | 0.075% | +284.8% |

| 2/11/2025 | Virtu Financial LLC | 66,576 | $64K | 0.115% | +308.7% |

Over the past 24 months, institutional investors have purchased 411,507 shares, totaling about $4.93 million USD (see exchange rates). Despite these purchases, total institutional ownership stands at only 0.24%. This low percentage suggests that most investors in LITM are retail participants. However, the recent increases in holdings by several firms may signal growing interest and could boost investor confidence in the future.

Short Interest

Short interest provides insight into how investors view the stock’s prospects. Currently, short interest in LITM stands at 4.28% of the float. The short interest ratio is 0.5 days to cover, which remains acceptable for the trading volume. Compared to the previous month, short interest has dropped by 23.87%. This decline points to improving sentiment among investors and a reduction in bearish bets. Lower short interest often reflects a more positive outlook and can reduce volatility, making the stock more attractive to both new and existing investor groups.

Industry Trends

Lithium Market Outlook

The lithium market in 2025 faces a unique period of transition. Analysts observe a short-term oversupply, mainly due to aggressive capacity expansions by producers in China and emerging sources in Africa. However, most forecasts indicate that this surplus will narrow quickly. By 2026, many expect the market to shift into deficit as demand outpaces supply.

- Lithium supply increased by 22% in 2024, with China’s mined output rising by nearly 15% from 2023 to 2024.

- Production cuts and delayed expansions in Australia and China have started to address oversupply, with some mines halting operations because of low prices.

- Lithium prices fell to multi-year lows in 2024 but began to recover in early 2025 as the market started to rebalance.

- The global lithium market size reached USD 28.08 billion in 2024 and is projected to grow to USD 74.81 billion by 2030, at a compound annual growth rate of 18.2%.

- Electric vehicles (EVs) account for over half of lithium demand in 2024, and this share is expected to rise to 75% by 2030.

- Energy storage installations are forecasted to increase 15-fold by 2030, further boosting demand.

- Government policies, such as the US Inflation Reduction Act and the EU’s REPowerEU plan, support clean energy and drive global demand for lithium.

Market participants see 2025 as a transitional year. Most expect a slight oversupply of about 10,000 tonnes, but by 2026, a deficit could emerge. The lithium battery boom continues to fuel strong demand, especially as EV sales are forecasted to surpass 20 million units in 2025. Despite large reserves, U.S. production remains limited but is expected to increase, with projects like the Thacker Pass Lithium Mine aiming to produce 60 kilotons annually by 2026. For current exchange rates, see here.

Competitive Position

Snow Lake Resources Ltd. (LITM) holds a weaker competitive position compared to established lithium producers. Investment analysts remain cautious, as reflected by a significant negative price percentage difference of -50.42%. This figure signals potential risks in project development and market conditions. In contrast, companies like IGO Limited show a positive price percentage difference, indicating more stable operations and stronger market sentiment.

A comparison with Smart Sand (SND) highlights LITM’s challenges:

| Metric | Snow Lake Resources (LITM) | Smart Sand (SND) |

|---|---|---|

| Gross Revenue | Not reported | $293.88M |

| Net Income | -$5.06M | $2.99M |

| Institutional Ownership | 0.2% | 35.2% |

| Insider Ownership | 13.4% | 32.3% |

| MarketRank Percentile | 26th | Higher |

| 1-Year Price Performance | -30.8% | Better |

| Beta (Volatility) | 0.51 | 0.83 |

| Media Sentiment Score | 0.73 | 0.92 |

LITM reports lower revenue, negative net income, and minimal institutional support. Its market and media sentiment also lag behind peers. These factors suggest that LITM is less mature and faces more volatility. The company must address these gaps to strengthen its position as global demand for lithium continues to rise.

Risks for Investors

Short-Term Risks

LITM investors face several short-term risks in 2025. Economic instability remains a major concern. The ongoing slowdown in global markets affects the banking sector, especially small and medium-sized banks. Commercial real estate downturns have impacted institutions such as New York Community Bank, Aosora Bank of Japan, and Deutsche Bank. Hong Kong banks also experience pressure from these trends. Central banks continue to maintain high interest rate policies, even after pausing rate hikes. This environment creates uncertainty for financial institutions and commercial real estate, which indirectly influences LITM’s market performance.

Investors should monitor macroeconomic indicators and banking sector news. Changes in interest rates or commercial real estate values can quickly affect stock prices. LITM’s exposure to these factors means that short-term volatility may persist.

Other immediate risks include fluctuating lithium prices and unpredictable demand from China. Supply chain disruptions and regulatory changes can also impact operations. Investors must stay alert to news about exploration funding, production delays, and changes in government policy. These factors can trigger rapid price swings and affect short-term returns.

Long-Term Risks

Long-term risks for LITM investors center on industry competition, project execution, and market demand. The lithium sector attracts new entrants, increasing competition for resources and contracts. LITM must continue to innovate and expand production to maintain its position. Failure to deliver on strategic projects, such as the Thompson Brothers Lithium Project, could result in lost market share and declining investor confidence.

| Risk Factor | Description | Potential Impact |

|---|---|---|

| Industry Competition | Rising number of lithium producers, especially in China | Lower margins |

| Project Execution | Delays or cost overruns in mining projects | Reduced profitability |

| Regulatory Environment | Changes in government policy or environmental standards | Increased compliance costs |

| Market Demand | Shifts in EV and energy storage trends | Uncertain revenue growth |

Long-term success depends on LITM’s ability to manage costs, secure funding, and adapt to changing market conditions. Investors should evaluate the company’s financial health, project pipeline, and competitive strategy. Monitoring global lithium demand, especially from China, and staying informed about exchange rates (see USD rates) will help investors assess future risks and opportunities.

Action Steps for Investors

Portfolio Strategy

Investors considering LITM stock in 2025 should approach with a balanced and cautious strategy. Many sources suggest starting with a small investment, such as $100, to test the waters and limit exposure to risk. This approach allows individuals to observe market behavior and company performance before committing larger amounts. Some platforms highlight the potential for high monthly returns and exponential growth, especially when using blockchain-powered or AI-driven tools. However, these claims often lack detailed guidance on risk management or diversification.

A prudent portfolio strategy involves spreading investments across multiple sectors, not just lithium or clean energy. Diversification helps reduce the impact of volatility from any single stock. Investors should also set clear goals for their LITM holdings, whether seeking short-term gains or long-term growth. Regularly reviewing the portfolio and adjusting positions based on market changes can help maintain a healthy risk profile.

Tip: Start small, diversify across sectors, and review your portfolio regularly to manage risk and capture opportunities.

Monitoring Indicators

Successful investing in LITM stock requires ongoing monitoring of key indicators. Investors should track company news, especially updates on production efficiency, strategic projects, and financial health. Watching for changes in lithium prices and global demand, particularly from China, can provide early signals of market shifts.

Important indicators include:

- Share price trends: Observe daily and weekly movements for signs of volatility.

- Trading volume: High volume often signals increased interest or news events.

- Institutional activity: Increases in institutional ownership may indicate growing confidence.

- Short interest: A drop in short interest can reflect improving sentiment.

- Industry news: Monitor developments in the lithium sector and related government policies.

Staying informed through reliable financial news sources and company reports helps investors make timely decisions. Using tools that track these indicators can support a proactive investment approach.

LITM stock shows sharp price swings due to frequent news about production, strategic projects, and financial health. Investors see sentiment shift quickly when new reports appear. They should watch company news, analyst updates, and market trends to stay informed. Smart investors review news daily, track sentiment, and adjust their risk management plans. Using these insights helps investors make better decisions in 2025.

FAQ

What causes LITM stock’s volatility in 2025?

News about production efficiency, strategic projects, and changes in lithium demand drive LITM stock volatility. Investor sentiment shifts quickly after company updates or global market changes. Monitoring these factors helps investors understand price swings.

How does institutional ownership affect LITM stock?

Institutional ownership remains low for LITM. Most shares belong to retail investors. When major firms increase holdings, confidence may rise. Investors should watch for changes in institutional activity, as this can influence price stability.

Why do lithium prices fluctuate so much?

Lithium prices change due to supply and demand shifts. China’s production and global electric vehicle trends impact prices. Delays in mining projects or policy changes also cause price swings. Investors should track market news for updates.

What financial metrics matter most for LITM investors?

Key metrics include earnings per share, cash reserves, debt levels, and market capitalization. Investors should review the company’s balance sheet and liquidity. Reliable financial health supports long-term growth and reduces risk.

Where can investors find current USD exchange rates?

Investors can view up-to-date USD exchange rates at XE Currency Converter. This resource helps compare international investments and understand global market impacts.

LITM stock’s volatility in 2025 presents a clear case of high risk and potential reward, driven by a dynamic mix of strategic projects, production efficiency, and speculative market sentiment. For a well-informed investor, navigating this landscape requires not only a solid strategy but also a reliable financial platform. This is especially true for those outside the United States who face logistical and cost challenges when accessing the US stock market. BiyaPay provides a seamless and efficient solution to this problem. Our platform allows you to easily fund your account and trade US-listed stocks like LITM with speed and convenience. With low, transparent fees for cross-border transactions and a built-in real-time exchange rate converter, you can minimize costs and maximize your investment potential. By simplifying the financial process, BiyaPay empowers you to focus on your trading decisions and risk management. Take control of your investments. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.