- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Need to Know About WKSP Stock in 2025

Image Source: pexels

Analysts currently rate wksp stock as a strong buy for 2025, with a consensus price target of $6.83 and no expected price change.

| Metric | Value |

|---|---|

| Analyst Consensus | Strong Buy (3 analysts) |

| Price Target for 2025 | $6.83 |

| Expected Price Change | 0.00% (no increase) |

| Date of Data | August 13, 2025 |

Recent results for worksport ltd show over 100% production growth since March and a projected annual revenue above $20 million. The company’s financial health is improving, with reduced liabilities and strong liquidity. However, wksp remains speculative. Investors should consider risk management when evaluating worksport ltd and wksp stock.

Key Takeaways

- WKSP stock shows strong analyst support with high price targets, signaling potential for significant growth despite current risks.

- Worksport Ltd has rapidly increased production and revenue, driven by innovative clean-energy products and expanding dealer networks.

- The company faces financial challenges like negative cash flow and ongoing losses but manages debt carefully and aims for profitability by year-end 2025.

- Investors should balance WKSP’s growth potential with its volatility by using risk management strategies and monitoring market and technical signals.

- Upcoming product launches and earnings reports could act as key catalysts, making WKSP a speculative but promising investment opportunity.

WKSP Stock Outlook

Buy, Hold, or Sell?

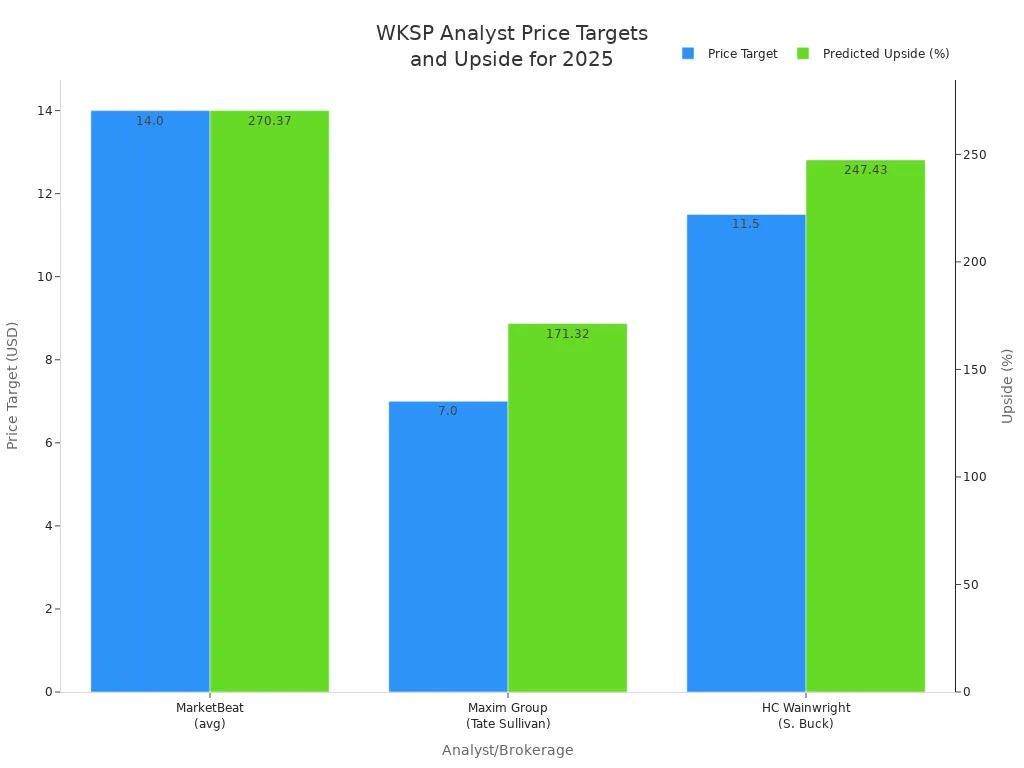

Analysts covering wksp stock in 2025 show a strong consensus. All major Wall Street analysts rate wksp as a buy, with no hold or sell recommendations. This clear stance stands out in the small-cap sector, where mixed ratings are common. The analysis from MarketBeat, Maxim Group, and HC Wainwright all point to a buying opportunity. These firms highlight the company’s rapid revenue growth and improving production capacity.

Note: Investors should recognize that while the analyst consensus is positive, wksp remains a speculative investment. The company faces ongoing profitability challenges, with negative return on equity and assets. However, the strong buy ratings suggest confidence in the company’s long-term strategy and growth prospects.

The table below summarizes the latest analyst ratings and price targets for wksp stock:

| Analyst/Brokerage | Rating | Price Target (USD) | Predicted Upside (%) |

|---|---|---|---|

| MarketBeat (3 analysts) | Buy | $14.00 (avg) | +270.37% |

| Maxim Group (Tate Sullivan) | Buy | $7.00 | +171.32% |

| HC Wainwright (S. Buck) | Buy | $11.50 | +247.43% |

| Industrial Alliance Securities | N/A | $17.50 | +196.11% |

Most analysts see significant upside for wksp stock. The average price target stands at $14.00, which is much higher than the current stock price of $3.78. This gap signals a strong buying opportunity for investors willing to accept higher risk.

Analyst Price Targets

The analysis of price targets for wksp stock reveals a bullish outlook for 2025. The average forecast from WallStreetZen places the stock price at $9.25, representing a predicted upside of 144.71%. MarketBeat analysts set an even higher average target of $14.00. These forecasts reflect optimism about the company’s revenue growth, which is expected to reach 115.54% per year.

Despite these positive forecasts, analysts note that wksp continues to report negative earnings per share. The company’s return on equity and assets also remain negative. This means that while the stock price could rise sharply, investors must weigh the risks of ongoing losses.

The consensus among analysts is clear: wksp stock on nasdaq:wksp offers a compelling buying opportunity for 2025. The strong buy ratings and high price targets suggest that the market expects significant growth. However, investors should use careful analysis and risk management before making decisions. Those who believe in the company’s strategy and can tolerate volatility may find wksp an attractive addition to their portfolios.

Price Trends

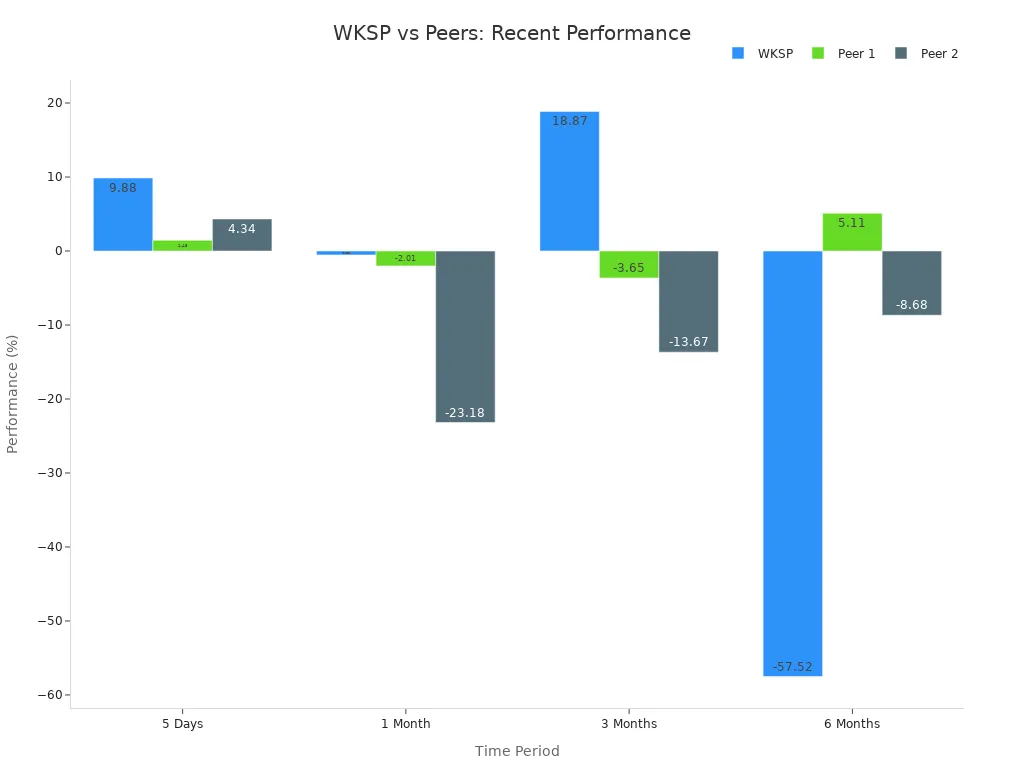

Recent Performance

WKSP stock has shown notable volatility over the past year. The trend in its price reflects both sharp declines and periods of strong recovery. Over the past 12 months, WKSP returned -39.0%, while the SPY benchmark gained +21.9%. This underperformance highlights the challenges facing the company. However, the short-term trend has shifted. In the last three months, WKSP delivered a +18.9% return, outpacing the SPY’s +10.5%. Over the past two weeks, WKSP surged +18.1%, compared to SPY’s modest +1.2%. This recent trend signals renewed investor interest.

| Time Period | WKSP Return | SPY Return | Interpretation |

|---|---|---|---|

| Past 12 months | -39.0% | +21.9% | WKSP underperformed the market |

| Last 3 months | +18.9% | +10.5% | WKSP outperformed the market |

| Last 2 weeks | +18.1% | +1.2% | WKSP outperformed the market |

The analysis of sector trends shows WKSP outperforming its peers in the short term. Over five days, WKSP gained +9.88%, while Peer 1 rose +1.45% and Peer 2 increased +4.34%. In the last three months, WKSP climbed +18.87%, while its peers posted negative returns. Despite a six-month decline of -57.52%, WKSP’s recent trend demonstrates resilience.

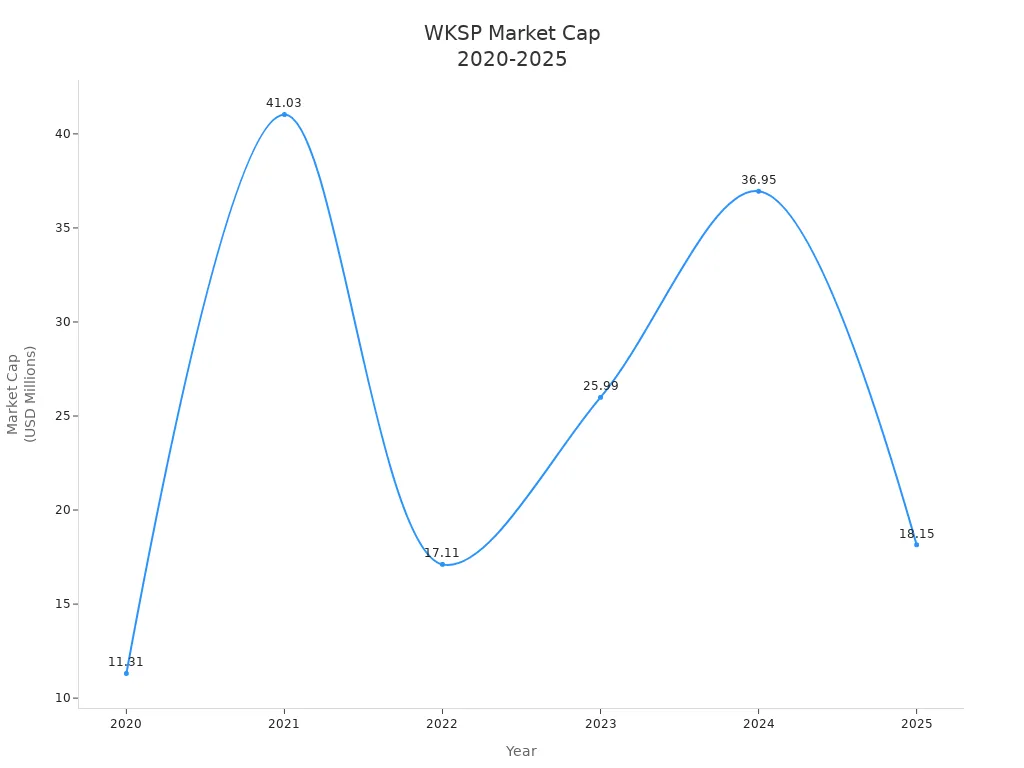

Worksport Ltd’s market capitalization trend over five years reveals significant fluctuations. The company saw a compound annual growth rate of 26.72%, with notable increases in 2021 and 2024. However, 2025 brought a sharp decline, reflecting the speculative nature of WKSP.

| Year | Market Capitalization (USD) | Yearly Change (%) |

|---|---|---|

| 2020 | 11.31M | N/A |

| 2021 | 41.03M | +262.73% |

| 2022 | 17.11M | -58.31% |

| 2023 | 25.99M | +51.91% |

| 2024 | 36.95M | +42.22% |

| 2025 | 18.15M | -50.88% |

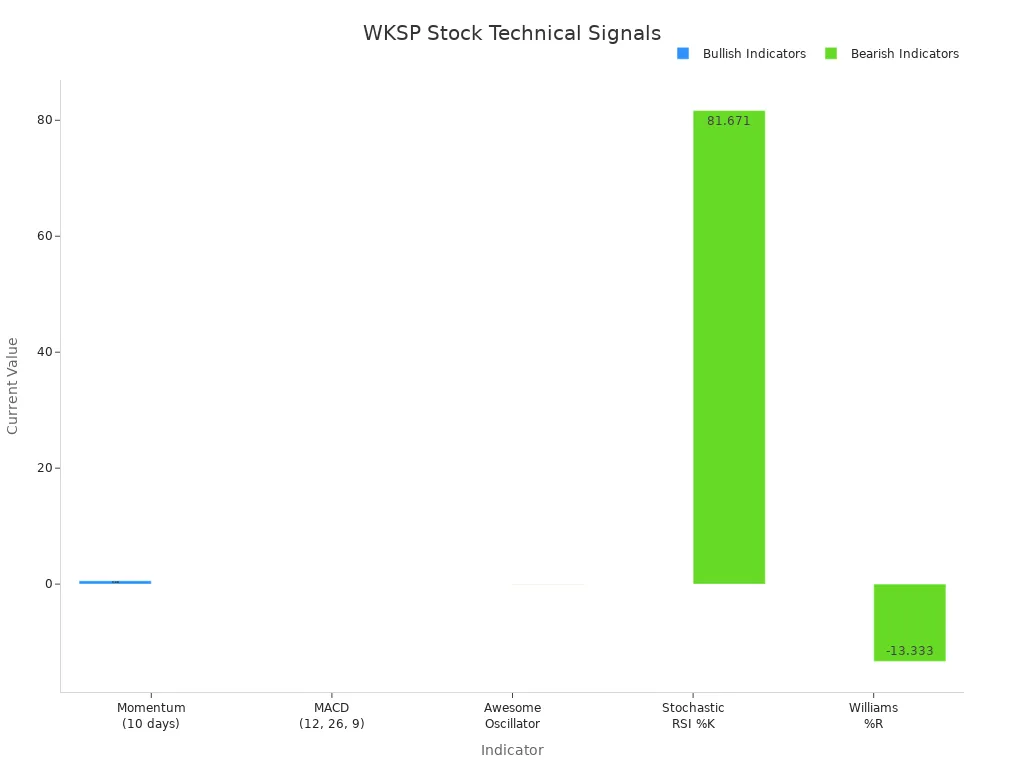

Technical Signals

Technical analysis of WKSP stock reveals a mixed outlook. The short-term trend appears bullish, supported by positive momentum and moving averages. The 10-day momentum indicator stands at 0.58, signaling an upward trend. The MACD value of 0.00291 also suggests bullish momentum. WKSP’s price currently sits above both the 5-day and 20-day simple moving averages, which typically signals a buy.

| Indicator | Signal Condition | Current Value | Signal Type | Interpretation |

|---|---|---|---|---|

| Momentum (10 days) | MOM_10 > 0 | 0.58 | Bullish | Upward trend |

| MACD (12, 26, 9) | MACD_12_26_9 > 0 | 0.00291 | Bullish | Bullish momentum |

| Price crossing 5-day SMA | Price > SMA_5 | N/A | Bullish | Buy signal |

| Price crossing 20-day SMA | Price > SMA_20 | N/A | Bullish | Buy signal |

| Awesome Oscillator (5, 34) | AO_5_34 < 0 | -0.0274 | Bearish | Bearish momentum |

| Stochastic RSI %K (14,14,3,3) | STOCHRSIk_14_14_3_3 > 80 | 81.671 | Bearish | Overbought |

| Williams %R (14 days) | WILLR_14 > -20 | -13.333 | Bearish | Overbought |

Moving average trends show buy signals in short and medium timeframes, but sell signals in longer periods. The 20-day and 50-day moving averages indicate a buy, while the 200-day average signals a sell. This pattern suggests bullish momentum in the short-term trend, but lingering bearish pressure over the long term.

Investors should monitor these trends closely. The mixed technical signals highlight the importance of ongoing analysis and careful forecast evaluation. WKSP’s price action may continue to shift rapidly, so risk management remains essential.

Revenue Growth

Image Source: unsplash

Q2 2025 Results

Worksport Ltd reported strong revenue performance in its Q2 2025 earnings, marking a significant milestone for the company. Revenue increased by 83% compared to the previous quarter, reaching $4.1 million. Management projects full-year revenue to surpass $20 million, reflecting the company’s momentum in both B2C and B2B channels. The Q2 report, released on August 13, 2025, highlighted record production output and expanding profit margins. CEO Steven Rossi led the earnings call, emphasizing the company’s progress toward cash flow positivity and profitability. Worksport Ltd’s strategic focus on clean energy solutions, including the upcoming launches of the COR Portable Energy System and SOLIS Solar Tonneau Cover, positions the company for continued growth. The management team remains confident in achieving cash flow breakeven by year-end, supported by margin expansion and operational leverage.

Note: The company’s shift toward Made in America products and the introduction of new clean-tech offerings have played a key role in driving revenue growth and improving margins.

Production and Margins

Worksport has achieved remarkable gains in production and margins throughout 2025. Since March, monthly production volume increased by 50%. In May, the company produced more units than in the entire third quarter of 2024. By July, production output doubled compared to March, reaching 2,499 tonneau covers in just four weeks. These results were accomplished without a proportional increase in headcount, demonstrating improved operational efficiency.

Gross profit margins have more than doubled, rising from 11% in Q4 2024 to over 23% in May 2025. Management expects margins to exceed 30% by the end of the year. The expansion of the dealer network, nearly six-fold, has supported sales growth and strengthened the company’s market position. CEO Steven Rossi attributes these improvements to increased factory utilization and a strategic focus on premium products. These operational advances bring Worksport Ltd closer to sustainable profitability and long-term value creation.

Worksport Ltd Financial Health

Cash Flow and Debt

Worksport Ltd faces challenges with cash flow. In fiscal year 2024, the company reported a free cash flow of -$10.67 million and an operating cash flow of -$10.14 million. These negative figures show that worksport ltd spends more cash than it generates from its core business. Despite this, the company maintains a positive cash balance of $4.88 million. Total debt stands at $5.62 million, which is considered low for a company in its sector. The debt-to-equity ratio is 0.0388, indicating that worksport manages its debt carefully and does not rely heavily on borrowing.

The following table summarizes key financial metrics for worksport ltd:

| Metric | Value | Interpretation |

|---|---|---|

| Free Cash Flow (FY 2024) | -$10.67M | Significantly negative |

| Operating Cash Flow (FY 2024) | -$10.14M | Significantly negative |

| Cash Balance (FY 2024) | $4.88M | Positive cash balance |

| Total Debt (FY 2024) | $5.62M | Relatively low |

| Debt-to-Equity Ratio (TTM) | 0.0388 | Low, manageable debt |

| Current Ratio (TTM) | 3.26 | Good short-term liquidity |

| Cash Ratio (TTM) | 1.44 | Good short-term liquidity |

Worksport ltd’s short-term liquidity remains strong. The current ratio of 3.26 and cash ratio of 1.44 suggest the company can meet its short-term obligations. However, the cash flow to debt ratio is -14.30, which points to poor cash flow relative to debt.

Investors should note that worksport’s revenue growth rate of 581.02% far exceeds industry peers, but its return on equity and assets remain below average. The company’s debt-to-equity ratio is lower than most competitors, showing prudent debt management.

Capital Raises

Worksport has relied on capital raises to support its growth and operations. The company completed several equity offerings over the past two years. These capital injections helped maintain liquidity and fund expansion, including new product launches and increased production capacity. Management continues to monitor market conditions to determine the timing and size of future capital raises.

Worksport ltd’s approach to raising capital focuses on minimizing dilution for existing shareholders. The company aims to balance growth needs with shareholder value. Investors should watch for announcements about new capital raises, as these can impact stock price and ownership structure.

WKSP Risks

Image Source: unsplash

Volatility and Speculation

WKSP stock faces high volatility in 2025. Several factors drive this trend. The company’s financial health has changed over time, with credit ratings dropping from stable to higher risk. The table below shows key events and their impact on volatility:

| Period | Key Volatility Drivers and Events |

|---|---|

| Aug-Nov 2021 | Stable credit profile with moderate default risk, showing initial operational stability. |

| Dec 2021 - 2022 | Credit rating decline, default probability rises, reflecting growing financial pressure. |

| Late 2022 - Mid 2025 | Further credit deterioration, default probability peaks, signaling heightened risk. |

| March 18, 2025 | Reverse stock split improves share liquidity but adds to short-term volatility. |

| June 2025 | Dealer network expansion boosts revenue trend, but financial challenges remain. |

Other sources of volatility include persistent negative net margins and poor return on equity. WKSP operates in a sector exposed to uncertain U.S. EV tax credits and faces competition in clean energy and automotive accessories. Macroeconomic trends, such as rising interest rates and inflation, also affect the stock. Investors see that these risks can cause sharp price swings and unpredictable trends.

Risk Management

Investors should use clear strategies to manage risks with WKSP. First, they can set stop-loss orders to limit losses during sudden downturns. Second, they should diversify their portfolios to avoid overexposure to one stock. Third, monitoring sector trends and company news helps investors react quickly to changes.

Note: WKSP’s capital-intensive product development and ongoing losses increase risk. Investors should review financial statements and watch for updates on profitability and cash flow.

A careful approach helps investors handle the speculation around WKSP. By staying informed and using risk management tools, they can better navigate the stock’s volatility and changing trends.

Worksport Strategy

Product Launches

Worksport has focused on innovation to drive revenue and market presence. Over the past year, the company introduced several new products that have shaped its financial performance. The table below summarizes the key launches and their impact:

| Product Name | Description | Revenue Impact |

|---|---|---|

| Worksport SOLIS Solar Cover | Patented solar tonneau cover generating up to 650W power; integrates with portable battery systems. | Expected to drive mid to long-term revenue growth in clean-tech product segment. |

| Worksport COR Portable Energy System | 7kWh modular storage with hot-swap capability; supports high-demand appliances; pairs with SOLIS. | Projected to contribute to mid to long-term revenue growth; tested as EV range extender. |

| Worksport AL4 Premium Tonneau Cover | Innovative four-fold tonneau cover design; projected Q4 2024 release; high demand anticipated. | Expected to elevate tonneau cover business revenues; pre-order campaign underway for national sales. |

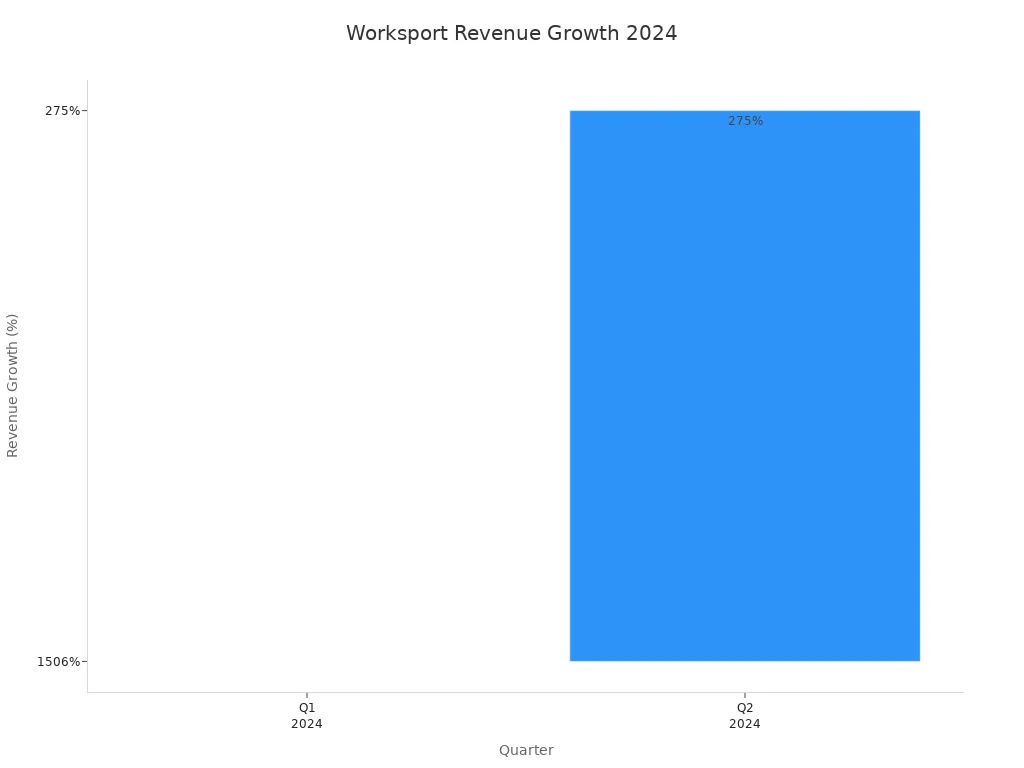

These product launches have led to record sales and significant revenue growth for worksport ltd. In Q1 2024, the company reported a 1,506% surge in revenue, followed by 275% growth in Q2. Management credits this success to a strategy centered on rapid product development and market expansion. CEO Steven Rossi highlighted the shift from million-dollar years to million-dollar months, reflecting the impact of these innovations.

Expansion Plans

Worksport ltd has set ambitious goals for future growth. The company aims to reach $1 million in weekly revenue within the next 12 to 24 months. Early in 2025, worksport expanded its dealer network by 30%, increasing its reach in the light truck and electric vehicle markets. The following points outline the main expansion strategies:

- Launch of the SOLIS Solar Tonneau Cover, targeting the $4 billion tonneau cover market for both electric and traditional pickup trucks.

- Introduction of the COR Portable Energy System, designed for off-grid power and integration with SOLIS.

- Development of Terravis Energy’s AetherLux heat pump technology, a clean energy HVAC solution.

- Focus on clean energy integrations, including proprietary solar solutions and mobile energy storage.

- Expansion of manufacturing capacity to support higher production volumes.

- Targeting the light truck, EV, overlanding, and global consumer goods sectors.

- Expectation of significant revenue contributions from SOLIS and COR products starting in Q3 and Q4 of 2025.

- Management projects cash flow positivity by the end of 2025.

Worksport’s strategy combines product innovation with market expansion. This approach positions worksport ltd to capture new opportunities and strengthen its competitive edge.

Worksport Ltd News

Recent Announcements

Worksport Ltd has delivered a series of impactful announcements over the past six months. The company implemented strategic cost-saving measures, which are expected to save over $2 million and strengthen financial stability. Worksport accelerated its path to profitability, aiming for cash flow positivity in 2025. The product pipeline expanded rapidly, with 19 new models added to the catalog. The AL4 Premium Tonneau Cover, COR Portable Energy System, and SOLIS Solar Cover are undergoing real-world testing and design optimization. Worksport entered advanced discussions with a globally recognized manufacturer to support new product production.

The company highlighted progress in Terravis Energy’s Extreme Climate Heat Pump, targeting clean energy solutions. Worksport Ltd began direct sales to U.S. government departments, securing initial orders. New York State awarded a $2.8 million grant to support growth and innovation. The company reported record revenues, with 275% growth in Q2 2024. Worksport achieved successful Level 1 Tesla charging capability with the COR battery generator, expanding product functionality.

- Strategic cost-saving measures ($2 million+ savings)

- Accelerated path to profitability (targeting 2025)

- 19 new product models added

- Advanced manufacturer partnership discussions

- Terravis Energy heat pump developments

- Direct sales to U.S. government departments

- $2.8 million New York State grant

- Record Q2 2024 revenue growth (275%)

- Level 1 Tesla charging capability with COR generator

Upcoming Catalysts

Several upcoming events could influence the WKSP stock price. Worksport announced a 1-for-10 reverse stock split effective March 18, 2025, designed to enhance share price and maintain Nasdaq compliance. The commercial launch of flagship clean-energy products, including the SOLIS Solar Tonneau Cover and COR Portable Energy System, is planned for late 2025 after Beta testing in North America. Management projects $20 million in full-year revenue for 2025, with anticipated cash flow positivity.

The Q2 2025 earnings call, scheduled for August 13, 2025, may act as a catalyst for investor sentiment. Recent production records show increased output, indicating scaling operations. Worksport Ltd has initiated new automotive OEM discussions and brand visibility campaigns, which could positively impact the stock price. The company increased its Bitcoin holdings, potentially adding value. Insider buying activity and institutional investor interest also contribute to potential stock movement.

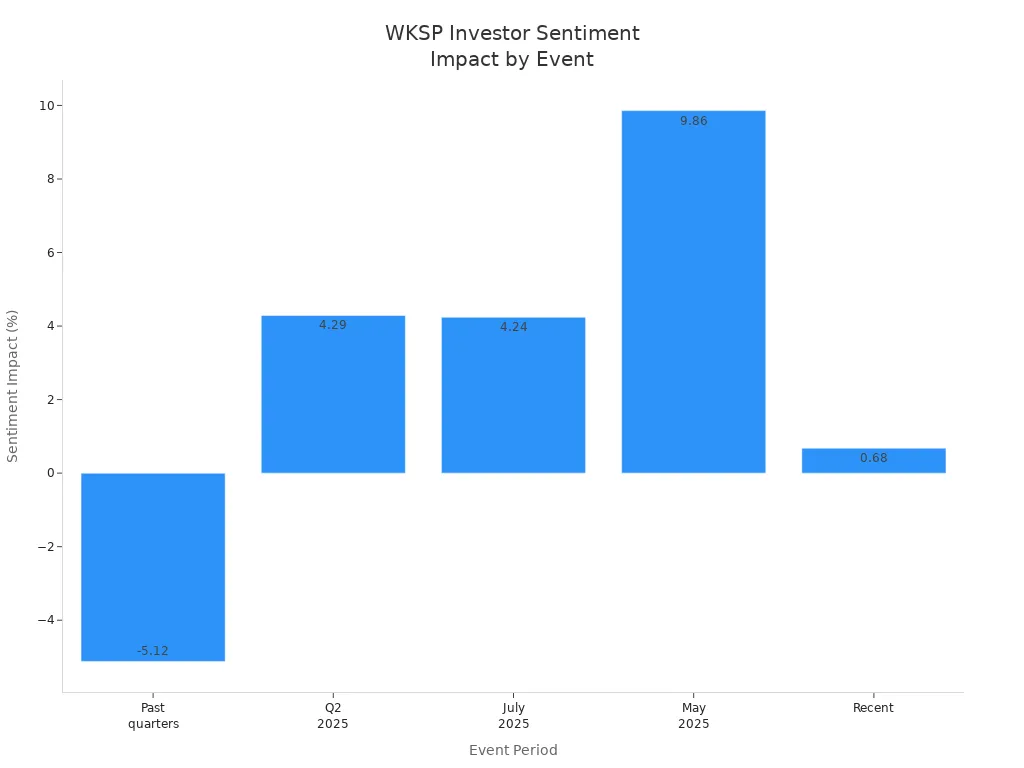

| Date/Period | Key News/Event | Financial/Operational Metrics | Sentiment Impact (%) | Investor Sentiment Implication |

|---|---|---|---|---|

| Q2 2025 | Record revenue growth reported | Revenue $4.1M, up 83% QoQ; Gross margin improved from 17.7% to 26.0% | +4.29% | Positive sentiment driven by strong growth and margin expansion |

| May 2025 | Production and dealer network expansion | 50% increase in monthly production; Dealer network grew from 94 to 550+ | +9.86% | Strong operational execution boosts optimism |

| July 2025 | Production milestone | Manufactured 2,499 tonneau covers, doubling March output | +4.24% | Operational efficiency supports positive outlook |

| Fall 2025 (planned) | Launch of SOLIS solar tonneau cover and COR portable energy system | Projected $2-3M revenue in 2025, targeting $13B market | N/A | Anticipation of new product launches adds to positive sentiment |

| Recent | Strategic partnership | Paid pilot project with major US construction firm | +0.68% | Validation of products in real-world settings supports confidence |

| Past quarters | Earnings misses and EPS expectations | Expected EPS -$0.76 for Q2 2025; previous EPS miss caused 11.48% share drop | -5.12% to -3.41% | Negative sentiment due to profitability concerns and earnings volatility |

| Last 52 weeks | Stock price trend | 42.28% decline in share price | N/A | Reflects cautious investor sentiment despite operational progress |

Investor sentiment remains sensitive to earnings results and forward guidance. The upcoming earnings call and product launches represent key moments for worksport ltd and its shareholders.

Actionable Insights

Key Takeaways

- Worksport stands out as an emerging growth company. Its sales growth comes from strong demand for tonneau covers for pickup trucks.

- The company recently doubled its Bitcoin holdings. This move supports a long-term value preservation strategy.

- Production capacity continues to expand. In a recent four-week period, Worksport produced 2,499 tonneau covers, setting a new record.

- Management is in ongoing talks with automotive OEMs. Brand visibility efforts are underway to strengthen market presence.

- Insider, hedge fund, and congressional trading activity remains neutral. No significant trading shifts have occurred.

- Valuation metrics show improvement. The forward P/E ratio is -1.41, better than the five-year average of -3.38, but earnings remain negative.

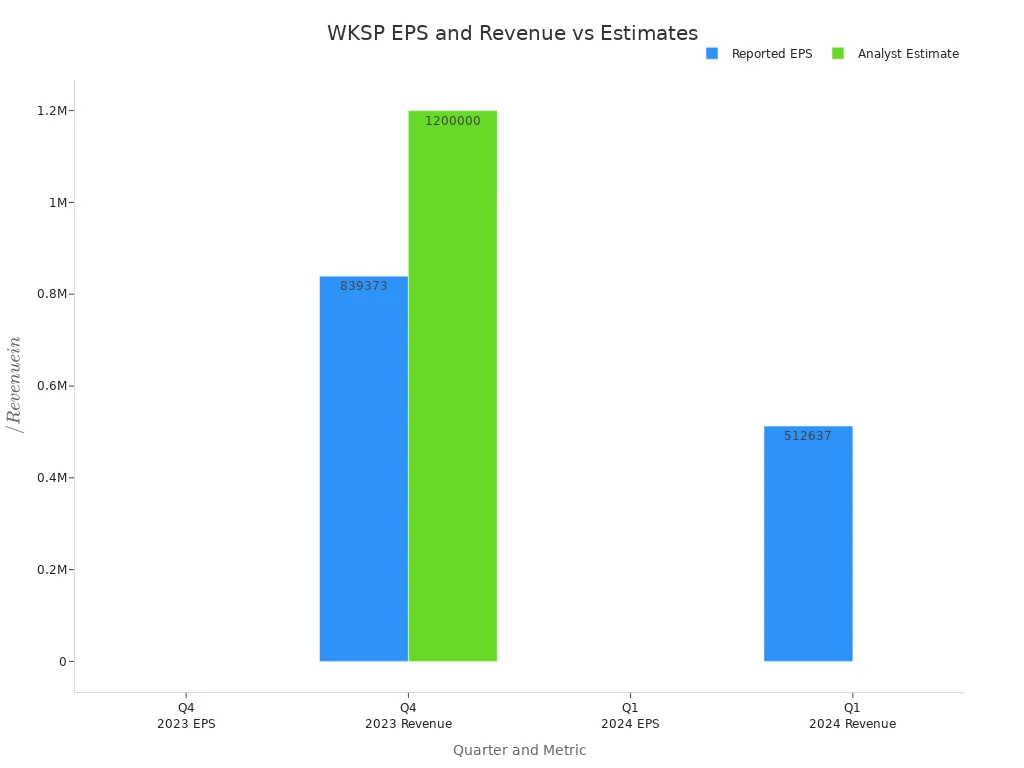

| Metric | Reported Value | Analyst Estimate | Difference/Note |

|---|---|---|---|

| Q4 2023 EPS | -$0.19 | -$0.24 | EPS beat estimate |

| Q4 2023 Revenue | $839,373 | $1.20 million | 30.05% below estimate |

| Q1 2024 EPS | -$0.18 | -$0.19 | EPS beat estimate |

| Q1 2024 Revenue | $512,637 | N/A | 48.74% below estimate |

Investors should note that while Worksport beat EPS estimates, revenue fell short of analyst expectations in recent quarters.

Steps for Investors

- Consider buying wksp stock before the Q4 2025 launches of SOLIS and COR. These products target a $13 billion clean-energy market and may drive margin expansion.

- Monitor institutional investor activity. Increased stakes by firms like Armistice Capital can signal growing confidence in wksp.

- Track technical indicators. Watch for Golden Star buy signals, moving average crossovers, and chart patterns such as double bottoms or Bollinger breakouts to identify entry points.

- Evaluate risks, including supply chain delays. Worksport’s U.S.-based supply chain and dealer network help reduce some of these risks.

- Use both fundamental growth drivers and technical signals to support a buy decision. This approach can help investors decide if wksp fits their portfolio.

A balanced strategy that combines growth potential with risk management will help investors navigate the volatility of wksp stock.

Analyst sentiment for wksp remains optimistic, supported by strong revenue growth and strategic product launches from worksport ltd. The company reported a 337% revenue increase and continues to expand its sales channels, but risks such as competition and supply chain challenges persist. Investors should monitor the upcoming Q2 2025 earnings call for worksport ltd, as management will discuss financial results and future plans. Balancing the growth potential of wksp with its speculative nature is essential. Each investor should align decisions with personal risk tolerance and long-term goals.

FAQ

What does worksport ltd specialize in?

Worksport ltd designs and manufactures innovative tonneau covers and clean energy solutions for pickup trucks. The company focuses on products like the SOLIS Solar Tonneau Cover and COR Portable Energy System, targeting both traditional and electric vehicle markets.

How does worksport ltd generate revenue?

Worksport ltd earns revenue by selling tonneau covers and portable energy systems through its dealer network and direct sales channels. The company also explores partnerships with automotive OEMs and government departments to expand its customer base.

Is worksport ltd profitable in 2025?

Worksport ltd has not yet achieved profitability in 2025. The company reports strong revenue growth and improved margins, but ongoing investments in production and product development keep net earnings negative.

What risks should investors consider with worksport ltd?

Investors face risks such as high stock volatility, negative cash flow, and competition in the clean energy sector. Worksport ltd also depends on successful product launches and effective risk management to achieve long-term growth.

Where can investors find financial updates about worksport ltd?

Investors can access worksport ltd financial updates through the company’s official website, Nasdaq filings, and quarterly earnings calls. Reliable financial news platforms and analyst reports also provide timely information.

WKSP stock is a classic high-risk, high-reward opportunity, with strong growth potential balanced by significant volatility and financial challenges. Successfully navigating this landscape requires more than just market savvy—it demands a reliable, efficient financial platform. For investors outside the United States, the process of accessing and trading US-listed stocks can be complex and costly. This is where BiyaPay provides a clear advantage. Our platform offers a seamless way to fund your brokerage account and trade US-listed stocks like WKSP with minimal friction. With our low fees for cross-border transactions and a transparent real-time exchange rate converter, you can execute your trades efficiently and keep your costs low. By simplifying the complexities of international finance, BiyaPay empowers you to focus on what matters most: your trading strategy and risk management. Take control of your portfolio. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.