- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Should Know About the Recent Surge in LTRY Stock

Image Source: unsplash

LTRY stock captured attention with a remarkable 20.06% gain in the most recent trading session. Strong quarterly earnings fueled this surge, while growing investor confidence pushed the stock higher. Many investors now monitor LTRY stock closely, as rapid price changes and increased activity often signal both opportunity and risk. Understanding the dynamics behind these movements helps investors make informed decisions.

Key Takeaways

- LTRY stock surged over 100% recently due to strong earnings and new international operations.

- The company is expanding globally with major funding and acquisitions in sports and entertainment.

- Investor interest is high, but mixed insider and institutional activity signals caution.

- High trading volumes and price volatility mean investors should use stop-loss strategies to manage risk.

- Long-term growth depends on successful execution of expansion plans amid ongoing financial challenges.

LTRY Stock Drivers

Earnings Impact

Lottery.com Inc. reported financial results that drew attention from investors. The latest earnings report showed revenue of approximately $6.98 million. Although this figure represents a 76% decline over three years, it remains notable for a company in transition. The price-to-sales ratio stands at about seven times, suggesting a moderate valuation. However, the pretax profit margin reached -261.6%, and both return on assets and return on equity were deeply negative. These numbers highlight ongoing profitability challenges and raise questions about financial health. Despite these concerns, the announcement of international lottery operations sparked a surge in ltry stock, with prices climbing over 100% in just a few days. The launch of new international ventures excited investors, who anticipate fresh revenue streams and strategic growth.

| Financial Metric | Value | Explanation/Impact on Stock Surge |

|---|---|---|

| Revenue | ~$6.98 million | Despite a 76% decline over 3 years, still a notable figure. |

| Price-to-Sales Ratio | ~7 times | Indicates moderate valuation, not overly high or low. |

| Pretax Profit Margin | -261.6% | Deeply negative, showing significant profitability challenges. |

| Return on Assets (ROA) | -35.61% | Negative, indicating poor asset efficiency. |

| Return on Equity (ROE) | -81.3% | Deeply negative, signaling losses to shareholders. |

| Stock Price Increase | Over 100% in a few days | Driven primarily by announcement of international expansion, not current profitability. |

| Key Driver | International lottery operations launch | Expected new revenue streams and strategic growth plans excited investors. |

Investor Confidence

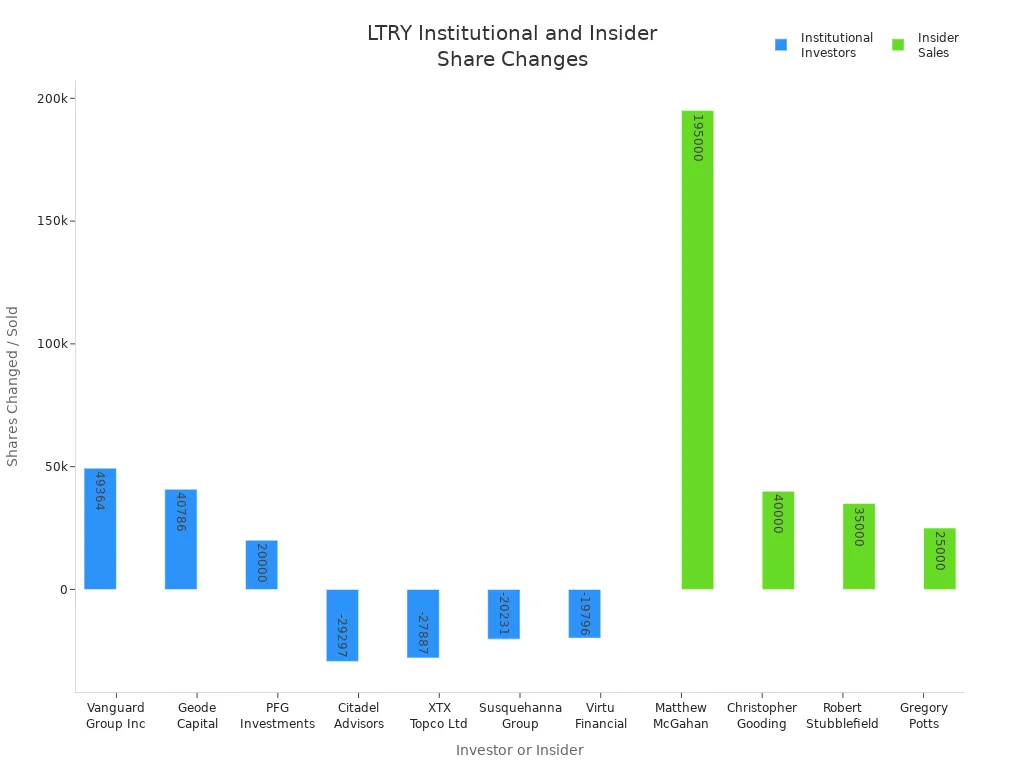

Investor interest in LTRY stock has grown rapidly. Institutional investors made significant changes to their holdings during the most recent quarter. Vanguard Group Inc. and Geode Capital Management, LLC increased their positions, adding tens of thousands of shares. PFG Investments, LLC also boosted its stake. At the same time, some large shareholders, including Citadel Advisors LLC and XTX Topco Ltd, fully exited their positions. Insider trading activity showed only sales, with executives such as Matthew Howard McGahan and Christopher Anderson Gooding reducing their stakes. This mixed pattern suggests that while some investors see opportunity, others remain cautious.

| Investor / Insider | Action | Shares Changed | Estimated Value (USD) | Notes |

|---|---|---|---|---|

| Vanguard Group Inc | Increased | +49,364 | $43,933 | Significant addition |

| Geode Capital Management, LLC | Increased | +40,786 | $36,299 | Large increase (+173.4%) |

| PFG Investments, LLC | Increased | +20,000 | $17,800 | Added shares |

| Citadel Advisors LLC | Decreased | -29,297 | $26,074 | Complete removal (-100%) |

| XTX Topco Ltd | Decreased | -27,887 | $24,819 | Complete removal (-100%) |

| Susquehanna International Group, LLP | Decreased | -20,231 | $18,005 | Complete removal (-100%) |

| Virtu Financial LLC | Decreased | -19,796 | $17,618 | Complete removal (-100%) |

| Insider Name | Insider Trading Activity | Shares Sold | Estimated Value (USD) | Purchases |

|---|---|---|---|---|

| Matthew Howard McGahan | Sales only | 195,000 | $73,450 | 0 |

| Christopher Anderson Gooding | Sales only | 40,000 | $55,599 | 0 |

| Robert J Stubblefield (CFO) | Sales only | 35,000 | $48,620 | 0 |

| Gregory A Potts (COO) | Sales only | 25,000 | $37,000 | 0 |

Sector Trends

Analysts point to several factors driving the recent surge in LTRY stock. Lottery.com Inc. acquired DotCom Ventures, expanding into the entertainment sector with concerts and ticketing. This move opens new market opportunities and integrates lotteries with live entertainment. The acquisition stands out as a major growth initiative, attracting investor interest. The stock price jumped from around $0.77 to peaks above $2.50 in 2025. Despite negative EBIT and EBITDA margins, the company maintains a strong gross margin of about 69.9% and a relatively low debt-to-equity ratio. These financial indicators provide a foundation for potential future growth. Strategic moves and market optimism have combined to draw strong analyst attention.

- Lottery.com Inc.'s acquisition of DotCom Ventures expands its reach into entertainment, including concerts and ticketing.

- The integration of lotteries with live entertainment ecosystems attracts new investors.

- Stock price momentum increased sharply, rising from approximately $0.77 to over $2.50 in 2025.

- The company faces challenges with negative EBIT and EBITDA margins but maintains a strong gross margin and low debt-to-equity ratio.

- Strategic growth initiatives and financial health have contributed to the recent surge.

Performance and Volatility

Image Source: unsplash

Price Movements

LTRY stock has experienced dramatic price swings in recent months. The stock price climbed sharply, with gains exceeding 100% over a short period. This rapid appreciation followed the announcement of new international operations and strategic acquisitions. Technical analysts observed that the stock broke through key resistance levels, signaling a strong upward trend. Moving averages turned positive, and momentum indicators such as the Relative Strength Index (RSI) reached overbought territory. These signals often attract short-term traders who seek to capitalize on volatility. The price action reflects both optimism about future growth and the risks associated with sudden reversals.

Trading Volume

Trading volume for LTRY stock reached extraordinary levels during the surge period. Daily volumes frequently surpassed 30 million shares, and on May 27, 2025, trading peaked at over 166 million shares. This made LTRY one of the most actively traded stocks on Nasdaq that day. The CEO, Matthew McGahan, described this as a turning point for the company, highlighting strong market engagement. High trading volumes suggest increased interest from both institutional and retail investors. Some of this activity may relate to speculative trading or institutional repositioning. The company also began investigating suspected illegal short selling, which could have influenced these trading patterns.

| Metric | Value |

|---|---|

| Current Trading Volume | Over 82 million shares |

| Previous Session Volume | Approximately 37 million shares |

| Percentage Increase | 121% |

The table above shows that current trading volume far exceeds recent averages. This spike in activity signals heightened investor attention and may contribute to increased price volatility.

Short Interest

Short interest in LTRY stock has shifted significantly. As of June 15, 2025, short interest stood at 1,120,000 shares, representing 5.70% of the public float. This figure marks a 41.4% decrease from the previous total of 1,910,000 shares. The reduction in short selling activity suggests that bearish sentiment has eased. Investors who previously bet against the stock may have closed their positions as the price surged. Short interest data, reported twice monthly by Nasdaq, provides insight into changing market sentiment. Lower short interest often indicates growing confidence among investors and can reduce downward pressure on the stock price.

Note: Technical signals such as trendline breakouts, high trading volumes, and declining short interest all point to increased volatility. Investors should monitor these factors closely, as they can signal both opportunity and risk in the near term.

Growth Plans

Image Source: unsplash

Strategic Expansions

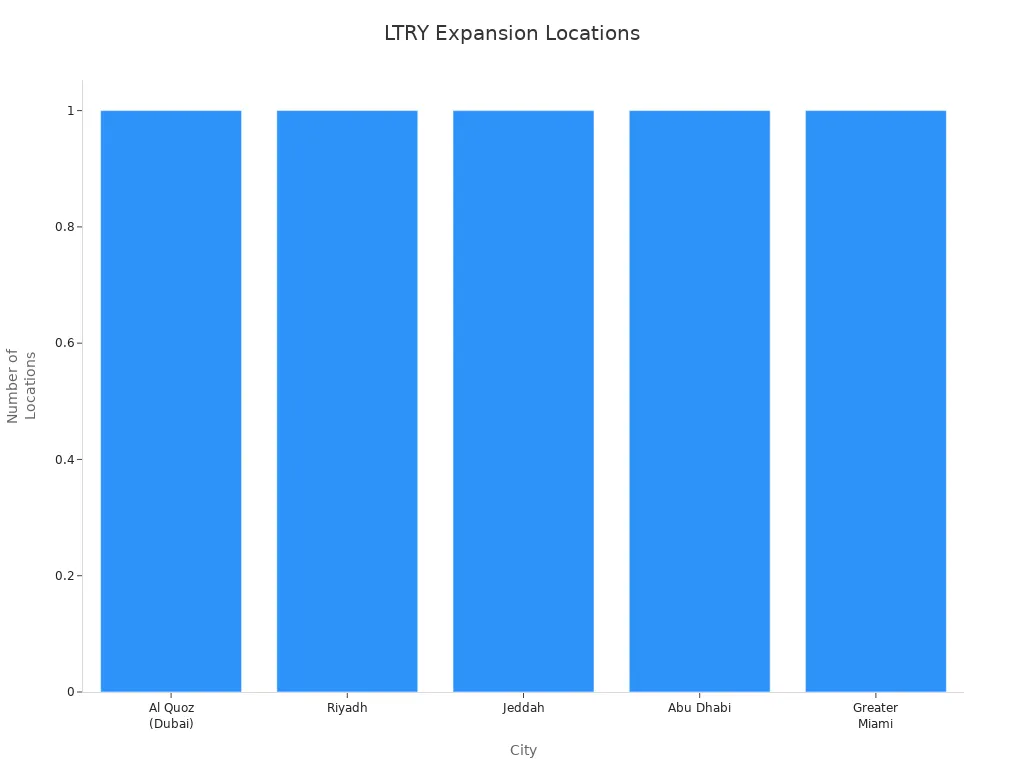

Lottery.com Inc. has launched a bold expansion strategy supported by significant funding. The company secured $150 million from United Capital Investments London and a $100 million stock purchase agreement with Generating Alpha. These funds support global expansion, acquisitions, and technology scaling. LTRY recently acquired a 90% stake in Nook Holdings Limited, a sports and wellness incubator based in the UAE. The company expects to complete this acquisition by June 30, 2025. Nook will rebrand under the Sports.com name, with new hubs planned in Dubai, Riyadh, Jeddah, Abu Dhabi, and Miami. This expansion aims to create a scalable model for growth in sports, health, wellness, and entertainment.

| Aspect | Details |

|---|---|

| Acquisition | 90% stake in Nook Holdings Limited (UAE) |

| Completion Date | Expected by June 30, 2025 |

| Financing | $100 million facility with Generating Alpha |

| Rebranding | Nook to become Sports.com |

| Expansion Locations | Dubai, Riyadh, Jeddah, Abu Dhabi, Miami |

| New Hub Opening | Al Quoz (Dubai) in Q4 2025 |

| Financial Impact | Nook net profit $354,000 in 2024; projected $490,000 in 2025 |

| Strategic Significance | Blueprint for global expansion and diversified revenue streams |

Following these announcements, LTRY’s stock price surged over 100% in days, reflecting strong investor optimism about the company’s new direction.

Partnerships

LTRY has formed several new partnerships and completed three acquisitions in the past 18 months. Two of these acquisitions involved technology companies, while one provided access to industry partners in the MENA region. Through its Sports.com subsidiary, LTRY is negotiating with professional sports organizations, including clubs in the UK and US. These partnerships aim to enhance technology platforms, improve media and streaming capabilities, and enter the esports market. The company secured $350 million in funding commitments to support these efforts. These moves are expected to accelerate growth, diversify revenue, and position LTRY as a leader in digital lottery and sports entertainment.

Technology Updates

LTRY completed a corporate turnaround with a new leadership team and improved compliance. The company introduced innovative business models for both Lottery.com and Sports.com. A $10 million acquisition of GXR World Sports assets enabled the global launch of the Sports.com super app. LTRY also advanced its mobile platform and integrated new features to support digital lottery and sports engagement. The company’s technology infrastructure now supports aggressive acquisition and growth strategies, with a $100 million financing facility dedicated to technology-driven expansion. These updates strengthen LTRY’s competitive edge and support its ambitious growth plans.

Risks and Opportunities

Upside Potential

LTRY stock offers significant upside potential for investors who seek growth in the online lottery and sports entertainment sectors. The company has secured major funding agreements and completed strategic acquisitions. These moves support global expansion and technology upgrades. If LTRY executes its business plan successfully, it could capture new markets and diversify its revenue streams. Some analysts view LTRY as a buy or hold candidate, especially after the recent surge in trading volume and price momentum. The company’s ability to innovate and form new partnerships may help it outperform smaller competitors.

Key Risks

Despite the recent optimism, LTRY faces several key risks. The company’s financial health remains a concern, with negative profit margins and ongoing losses. High volatility in the stock price can lead to sudden reversals, which may catch investors off guard. Insider selling and mixed institutional activity suggest that not all stakeholders share the same confidence in the company’s future. Regulatory changes or delays in international expansion could also impact growth plans. Investors should monitor these risks closely before making investment decisions.

Market Challenges

LTRY operates in a highly competitive environment. The online lottery sector includes established players and new entrants, all competing for market share. The company must navigate strict regulatory requirements and bear the costs of compliance with online gambling licenses. Cybersecurity threats and potential data breaches present ongoing risks to user trust and business operations. LTRY also manages high operating expenses for technology, marketing, customer support, and compliance. Larger competitors, such as International Game Technology and Scientific Games Corporation, hold significant advantages in global reach and innovation. These factors create strong competitive pressure for LTRY.

Trading Tips for LTRY Stock

Support Levels

Technical analysis identifies several key support levels for LTRY stock. These price points often attract buyers and can help stabilize the stock during periods of volatility. Traders watch these levels closely to determine entry and exit points. The table below shows the most important support levels based on recent pivot point calculations:

| Support Level | Price |

|---|---|

| 1st Support Level | 1.2967 |

| 2nd Support Level | 1.2233 |

| 3rd Support Level | 1.1817 |

Support levels may shift as new price data emerges. Investors should monitor these levels during active trading sessions, as they can signal potential buy signals when the price approaches or rebounds from these points.

Stop-Loss Strategies

Risk management remains essential when trading LTRY stock. Experts recommend several stop-loss strategies to protect capital and secure profits:

- Trailing stop losses move with the price, helping traders lock in gains as the market rises.

- ATR Trailing Stops use the Average True Range to set a trailing distance that adapts to volatility.

- Typical ATR trailing stop distances range from 1.5 to 3 ATRs, depending on whether the trader prefers short-term momentum or trend following.

- Trailing stops allow trades to run longer in trending markets.

- Other trailing stop methods include Lowest Low Value (LLV) for long trades and Highest High Value (HHV) for short trades, using lookback periods to set stop levels.

Experts also suggest combining multiple stop-loss methods for better risk control. For example, traders may use percentage-based stops, volatility-based stops, technical analysis stops, time-based stops, or fixed dollar amount stops. Consistency in applying stop-loss rules helps avoid emotional decision-making. Traders should always use stops, avoid moving them further away after entering a trade, and review their approach if stopped out too often.

Tip: Adjust stop-loss placement based on market conditions. Use tighter stops in low volatility and wider stops in high volatility. Place stops beyond key support or resistance levels to reduce the risk of premature exit.

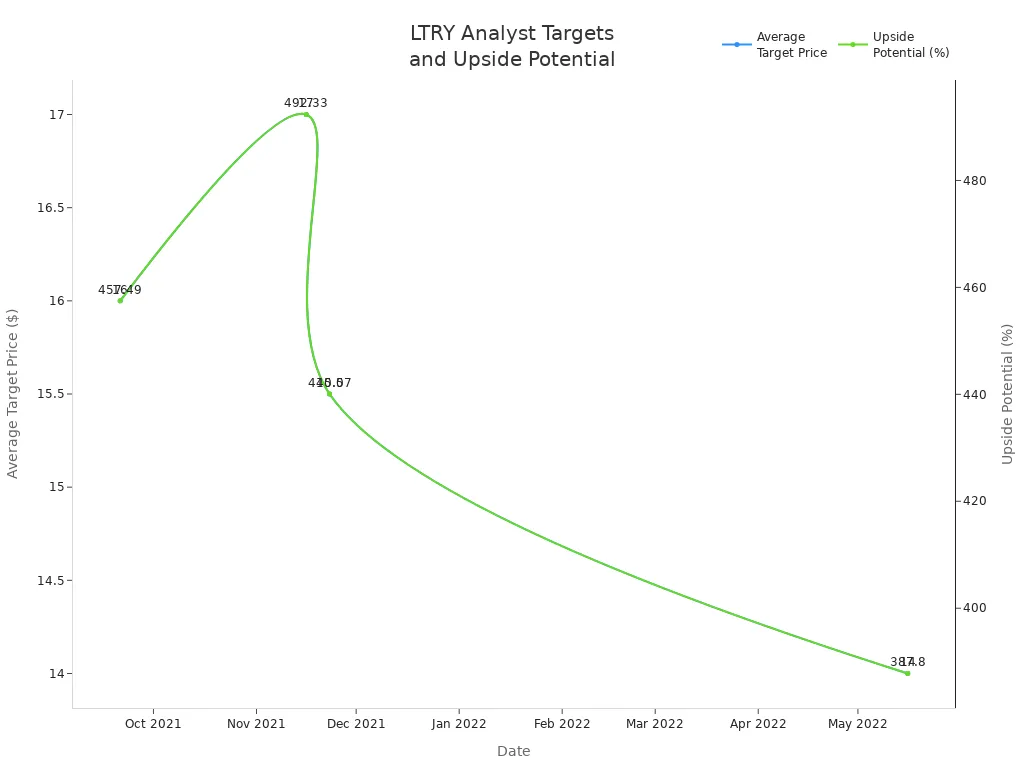

Analyst Views

Analyst coverage for LTRY stock remains limited, but historical ratings show strong upside potential. The table below summarizes recent analyst ratings and price targets:

| Date | Number of Analysts | Highest Target Price | Lowest Target Price | Average Target Price | Current Price | Upside Potential |

|---|---|---|---|---|---|---|

| 2021-09-21 | 1 | $16 | $16 | $16 | $2.87 | 457.49% |

| 2021-11-16 | 1 | $17 | $17 | $17 | $2.87 | 492.33% |

| 2021-11-23 | 2 | $17 | $14 | $15.5 | $2.87 | 440.07% |

| 2022-05-16 | 1 | $14 | $14 | $14 | $2.87 | 387.8% |

Only one analyst currently rates LTRY as a Strong Buy. No updated ratings or price targets have appeared since 2022. Investors should consider the lack of recent coverage when evaluating analyst opinions.

Lottery.com Stock Outlook

Short-Term Forecasts

Analysts observe that the short-term trend for lottery.com stock remains volatile. The stock price surged over 100% in recent weeks, driven by news of international expansion and strategic acquisitions. Technical indicators show momentum, with moving averages turning positive and the Relative Strength Index signaling overbought conditions. Many traders expect continued price swings as investors react to new developments. High trading volume and reduced short interest suggest strong market engagement. Investors should watch for updates on new partnerships and earnings reports, as these events often trigger rapid price changes.

Tip: Traders may benefit from monitoring support levels and using stop-loss strategies to manage risk during periods of heightened volatility.

| Indicator | Current Status | Implication |

|---|---|---|

| Price Movement | Upward surge | Signals bullish sentiment |

| Trading Volume | Elevated | Indicates strong interest |

| Short Interest | Decreasing | Suggests reduced bearishness |

| Technical Signals | Overbought | Warns of possible pullback |

Long-Term Prospects

Lottery.com stock presents both opportunities and challenges for long-term investors. The company has secured significant funding and completed several acquisitions, which support its global expansion strategy. New ventures in sports, wellness, and entertainment may diversify revenue streams and strengthen the business model. However, the company faces ongoing profitability issues and operates in a competitive sector. Regulatory risks and technology costs remain concerns. Long-term growth depends on successful execution of strategic plans and continued innovation. Investors should review quarterly financials and monitor progress on international projects to assess future potential.

Note: Long-term investors may want to balance optimism with caution, considering both the company’s growth initiatives and the risks associated with rapid expansion.

LTRY stock surged due to strategic expansion, strong financial backing, and increased brand visibility. Investors should balance optimism with caution, as high volatility and financial challenges persist.

- Key drivers include the $10M DotCom Ventures acquisition, a $100M stock agreement, and a $250M growth plan.

- Practical steps:

- Monitor earnings reports and technical trends.

- Use risk management tools and compare performance to benchmarks.

- Stay informed with expert analysis and scenario testing.

FAQ

What caused the recent surge in LTRY stock?

Strong quarterly earnings, new international operations, and strategic acquisitions drove the surge. Increased trading volume and investor optimism also played key roles.

Investors should review official earnings reports for detailed financial data.

Is LTRY stock considered a high-risk investment?

Yes. LTRY stock shows high volatility and rapid price swings. Investors face risks from negative profit margins and unpredictable market reactions.

Risk management strategies, such as stop-loss orders, can help limit potential losses.

How can investors manage risk when trading LTRY stock?

Investors can use stop-loss strategies, monitor support levels, and follow technical signals.

| Strategy | Description |

|---|---|

| Stop-Loss Orders | Automatically sell at set prices |

| Support Levels | Identify likely price floors |

Does LTRY have plans for further expansion?

LTRY plans global expansion, including new hubs in Dubai, Riyadh, Jeddah, Abu Dhabi, and Miami. The company secured major funding to support these efforts.

For updates, visit LTRY’s investor relations page.

Where can investors find the latest USD exchange rates?

Investors can check current USD exchange rates at XE.com.

Accurate exchange rates help when comparing international investments or converting returns.

LTRY stock’s recent surge is driven by a combination of strategic expansion, strong financial backing, and increased investor confidence. The company’s acquisition of DotCom Ventures and other technology firms, along with a significant $250 million growth plan, has ignited optimism. However, investors should balance this optimism with caution, as high volatility and persistent financial challenges remain key risks. A prudent approach involves a deep understanding of the stock’s drivers and risks. For investors outside the US, navigating this market can be challenging. A platform that simplifies international stock trading is essential. BiyaPay provides a seamless solution for funding your account and trading US-listed stocks like LTRY. With low, transparent fees for cross-border transactions and a built-in real-time exchange rate converter, you can execute your trades efficiently and minimize costs. By simplifying the complexities of global finance, BiyaPay empowers you to focus on your trading strategy and risk management. Take control of your portfolio and start your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.