- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Open a Business Account at Hang Seng Bank in Hong Kong

Hong Kong, as an international financial center, attracts countless entrepreneurs and enterprises to explore the market by virtue of its unique geographical advantages, mature financial system and extensive business network. For those who plan to start a business in Hong Kong, choosing a suitable bank to open a business account is a crucial step in laying a solid financial foundation.

Hang Seng Bank, affiliated with the globally renowned HSBC Group, occupies a pivotal position in the financial field of Hong Kong and can be regarded as an industry leader.

For a long time, relying on its profound industry accumulation, professional financial services and accurate insights into the local market, it has provided stable and efficient financial support for numerous enterprises, helping a large number of small and medium-sized enterprises stand out in the fierce market competition. The proportion of small and medium-sized enterprises it serves accounts for nearly a quarter, which is quite an achievement.

The following will analyze the types of business accounts of Hang Seng Bank, introduce in detail various characteristic services, clarify the composition of various fees, and guide you through the account opening application process to help your enterprise take the financial express train of Hang Seng Bank, efficiently integrate into the commercial and financial ecosystem of Hong Kong, and steadily start the journey of chasing dreams.

In the current era of booming fintech, there are also solutions for flexible fund allocation like the multi-asset wallet Biyapay. As a global multi-asset wallet, Biyapay supports local transfers in multiple currencies with low handling fees. It is also a preferred option for helping enterprises with cross-border fund transfers, and more details will be provided later. Don’t miss it.

Detailed Explanation of Hang Seng Bank’s Business Account Types

Basic Business Account: The Financial Steward for Start-up Enterprises

For newly established small start-up companies, the Basic Business Account of Hang Seng Bank provides an affordable starting point.

This type of account is specifically designed for start-up enterprises with limited funds and relatively simple business operations, minimizing costs.

The monthly account management fee is at a relatively low level in the industry, and for newly opened accounts, Hang Seng Bank often launches a preferential policy of free service in the first year, effectively alleviating the financial burden of start-up enterprises.

In terms of functions, the Basic Business Account covers the core needs of daily operations, such as handling the collection and payment of accounts from local customers. Whether it is collecting payments for small orders or making regular payments to suppliers, the operations are simple and fast.

The account also provides a limited local transfer function to meet the needs of enterprises to allocate funds among local partners, helping enterprises gradually build a solid local business network.

In addition, apart from the Basic Business Account of Hang Seng Bank, Biyapay, as a global multi-asset wallet, stands out with its unrestricted local transfer and remittance functions. Biyapay supports fast local transfers in multiple currencies while maintaining low handling fees, which is an advantage that cannot be ignored for enterprises that need flexible fund allocation. It also supports the mutual conversion between more than 30 legal currencies and over 200 digital currencies worldwide, as well as convenient remittances in multiple currencies.

Whether it is for overseas asset allocation or international payments, Biyapay can provide efficient fund flow solutions. For foreign trade companies, Biyapay can simplify the cross-border transaction process, support the local transfer method of same-day remittance and same-day arrival, and avoid the cumbersome procedures of traditional banks.

Global Business Account: The International Expansion Partner for Growing Enterprises

As enterprises grow and their businesses begin to expand into the international market, the Global Business Account of Hang Seng Bank becomes a powerful tool for enterprise internationalization.

This account is specifically designed for complex cross-border businesses, and its multi-currency transaction function is the core advantage. It can seamlessly connect with global mainstream currencies such as the US dollar, the euro, and the pound sterling, effectively solving the currency exchange problems in import and export trade and reducing the exchange rate losses and handling fees caused by frequent currency exchanges.

The Global Business Account performs excellently in terms of international fund collection and payment. Whether it is receiving large orders from European and American markets or paying for goods to suppliers in emerging Asian markets, the funds can arrive quickly under the efficient bank clearing system.

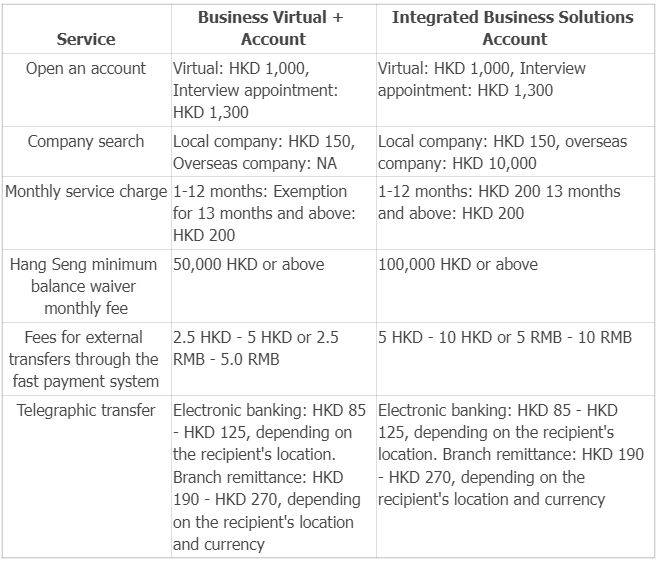

Fee Considerations

You need to carefully examine the types of transactions that are frequently carried out in the daily operations of your enterprise and accurately understand the fee details related to these transactions. This includes the handling fee standards for routine business operations such as local transfers, cross-border remittances, and currency exchanges.

These fees accumulate over time and have an important impact on the enterprise’s cost control.

General Guidelines for Opening an Account at Hang Seng Bank

Step 1: Apply for a Hang Seng Business Account Online

First, visit the official website of Hang Seng Bank, download and fill in the online application form. During this process, you need to provide basic information, including the username you choose, the contact person’s name, the email address, and the contact phone number. After submitting your personal information, you will receive a one-time password (OTP) via email or text message.

After creating your personal profile at Hang Seng Bank, log in to the “My Profile” portal and initiate a new account application in the “Business Account” section.

When filling in the application form, you need to enter detailed company information, details of relevant parties, and information of the account opening contact person. Please ensure that the information provided matches your Hong Kong identity card so that you and the relevant parties can successfully complete the digital identity verification.

Step 2: Complete Digital Identity Verification

After submitting the application for a Hang Seng Business Account, the portal website will guide you to upload all necessary legal documents. You will receive a text message containing the digital verification ID and a link to download the Hang Seng Bank mobile application. Please prepare your Hong Kong identity card and follow the instructions in the application to complete the verification steps, including selfie verification. In addition, you need to set a password, which will be used in the subsequent electronic signature process.

Please ensure that all relevant parties are reminded to complete their digital identity verification.

Step 3: Complete the Application with Electronic Signature

After the review process is completed, you will receive a text message notification from Hang Seng Bank. At this time, you can complete the electronic signature on the website of Hang Seng Bank. Please note that you and all relevant parties must be located in Hong Kong or major cities in mainland China when performing this step.

Log in to the electronic signature portal using the password set in Step 2. You will see a list of documents to be signed, and there is an “Immediate Signature” button beside each document. Click the button, carefully read each document, and follow the instructions on the screen to complete the electronic signature.

After completing the above steps, your Hang Seng Bank business account has been successfully opened and is ready for business operations.

In conclusion, opening a business account at Hang Seng Bank in Hong Kong is an important step for enterprises to integrate into the local financial market and expand their international business. Through careful selection of account types, analysis of fee structures, and following a clear account opening process, enterprises can efficiently complete the account opening.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.