- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Investors Should Know Before Buying CONL Stock

Image Source: pexels

Investors often ask about the main risks and rewards when considering conl stock. This fund tracks Coinbase (COIN) and uses 2x daily leverage, which can amplify gains and losses. As leveraged ETFs account for a significant share of trading volume, they attract short-term traders rather than long-term investors. The volatility of conl stock stands out, given its leverage and narrow focus.

Understanding leverage and volatility is crucial before deciding to buy. Each investor should assess personal risk tolerance and investment goals carefully.

Key Takeaways

- CONL stock offers the chance for amplified gains by providing 2x daily exposure to Coinbase, making it attractive for short-term traders seeking quick profits.

- The ETF is highly volatile and uses daily leverage resets, which can cause value to drop quickly during market swings, so it is not suitable for long-term holding.

- Investors should carefully assess their risk tolerance and investment goals before buying CONL stock, as it carries significant risks due to leverage and concentration in the crypto sector.

- Active monitoring and setting clear price targets are essential when trading CONL stock to manage risks and avoid large losses.

- Thorough research, including understanding the business, fees, and market trends, helps investors make informed decisions and use CONL stock effectively for short-term strategies.

CONL Stock Rewards

Image Source: pexels

Amplified Gains

Investors in conl stock seek the potential for amplified gains. This leveraged ETF uses financial derivatives such as futures contracts and swaps to achieve 2x daily exposure to Coinbase (COIN). The fund resets its leverage each day, which creates a compounding effect. When the price of COIN rises, conl stock can deliver twice the daily percentage change, allowing investors to reach their upside target faster than with non-leveraged ETFs. The daily reset mechanism means that, during strong upward trends, the gain can outpace the underlying asset’s simple price movement. However, this compounding effect also introduces divergence from long-term index performance, especially in volatile markets.

Key factors contributing to amplified gains include:

- Use of derivatives to achieve 2x daily returns.

- Daily resetting of leverage, which compounds returns over short periods.

- Ability to capitalize on sharp price movements and volatility.

- Designed to help traders reach their upside target quickly in trending markets.

Note: While the potential for reward is high, the same mechanisms can amplify losses if the price trend reverses.

Liquidity and Trading Flexibility

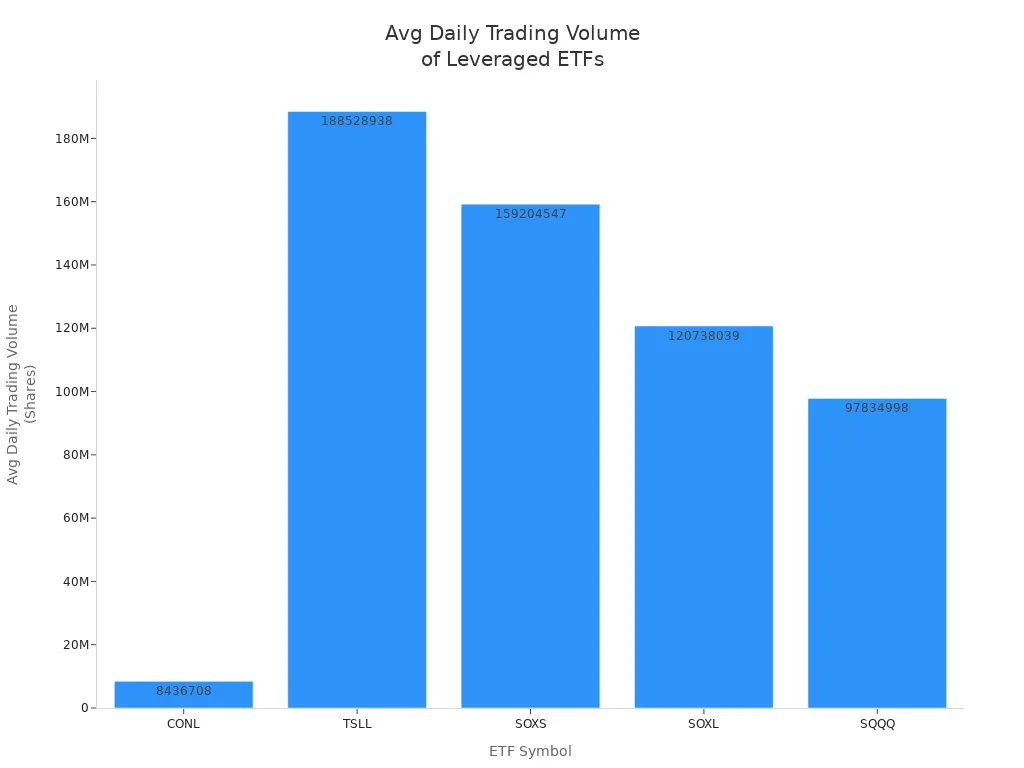

Liquidity plays a crucial role in the effectiveness of any ETF. Conl stock trades on major exchanges, offering investors the ability to enter and exit positions throughout the trading day. The average daily trading volume for conl stock stands at 8,436,708 shares. This figure, while lower than some of the largest leveraged ETFs, still provides sufficient liquidity for most retail traders. High volume ensures that price spreads remain tight and that investors can execute trades near their target price.

| ETF Symbol | ETF Name | Avg Daily Trading Volume (Shares) |

|---|---|---|

| CONL | GraniteShares 2x Long COIN Daily ETF | 8,436,708 |

| TSLL | Direxion Daily TSLA Bull 2X Shares | 188,528,938 |

| SOXS | Direxion Daily Semiconductor Bear 3x Shares | 159,204,547 |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares | 120,738,039 |

| SQQQ | ProShares UltraPro Short QQQ | 97,834,898 |

Traders benefit from this liquidity by being able to react quickly to price changes and trends. The intraday trading feature allows for flexible strategies, including scalping and day trading. Investors can set their upside target and adjust positions as the price moves, taking advantage of both short-term trends and sudden spikes in volume.

Crypto Market Exposure

Conl stock provides direct exposure to the crypto sector through its 2x daily leverage on Coinbase (COIN). This structure allows investors to participate in the price movements of a leading crypto exchange without holding cryptocurrencies directly. The ETF’s design means that when the price of COIN rises, conl stock magnifies the upside target, making it attractive for those seeking aggressive exposure to crypto trends.

The fund’s performance depends on the price action of COIN and the overall sentiment in the crypto market. Traders who anticipate strong upward trends in COIN can use conl stock to pursue higher gains over short periods. The ETF’s structure also limits losses to the initial investment, unlike margin trading, which can require additional capital if the price moves against the trader’s target.

Investors should monitor the price and volume closely, as the crypto sector often experiences rapid shifts in trend and trading activity.

CONL Stock Risks

Image Source: pexels

Leverage Risk

Leveraged ETFs like CONL stock use derivatives such as futures, swaps, and options to achieve their 2x daily exposure. This approach introduces several risks that investors must consider before setting a target or making a trading decision.

- Derivatives can behave differently than the underlying asset, causing unexpected price movements.

- Counterparty risk arises if the other party in a derivative contract defaults.

- Liquidity risk may force the ETF to trade derivatives at unfavorable prices during market turmoil.

- Interconnection risk means that problems in one market can quickly affect others.

- Volatility is amplified, leading to dramatic price swings and potential major losses.

- The daily reset mechanism requires rebalancing every day, which can cause value decay over time.

- Leveraged ETFs are designed for very short holding periods. Holding overnight or longer increases risk.

- Even moderate market drops or choppy price movements can result in significant losses due to daily resets.

- For example, in March 2020, a triple-leveraged Nasdaq-100 ETF dropped 70%, while the index itself fell only 28%. This shows how losses can exceed the underlying asset’s decline.

Leverage amplifies market risk, increasing both potential profits and losses. The compounding effect in volatile markets can cause substantial losses over time. A sharp drop in the underlying index, such as 33%, can wipe out all invested capital. High fees also erode investor returns. These risks make leveraged ETFs particularly dangerous for passive or long-term investors who do not actively monitor price or trend.

Volatility and Compounding

CONL stock tracks Coinbase with 2x daily leverage, which means price movements are amplified each day. The daily reset mechanism causes the ETF to rebalance its exposure, leading to compounding effects. In volatile markets, this compounding can erode value quickly, especially when price fluctuates up and down.

Losses often exceed those of the underlying asset, especially over longer holding periods.

- Losses are more pronounced in downward trending markets and during periods of high volatility.

- Daily amplification of underlying index movements causes leveraged ETFs to incur larger losses when the market moves against their position.

- In sideways markets with frequent daily fluctuations, leveraged ETFs suffer from value erosion due to compounding effects, leading to losses greater than the underlying index.

- Longer holding periods increase the likelihood of divergence and larger losses relative to the underlying assets.

Daily compounding means interest or returns are calculated and added to the investment more frequently than annual compounding. For example, $10,000 invested at a 5% annual interest rate grows differently depending on compounding frequency over 10 years:

| Compounding Frequency | Final Balance |

|---|---|

| Annual | $16,288.95 |

| Monthly | $16,470.09 |

| Daily | $16,486.65 |

While daily compounding can accelerate growth in some cases, leveraged ETFs like CONL stock experience value decay in volatile markets. Volatility decay occurs because leveraged ETFs reset daily, causing losses when the underlying index fluctuates up and down. For example, if the underlying index goes up 8% one day and down 7% the next, the index itself ends up slightly positive, but a 3x leveraged ETF would lose about 2%. Repeated volatility like this can cause the leveraged ETF to lose value over time even if the underlying index trends upward.

Sector and Concentration Risk

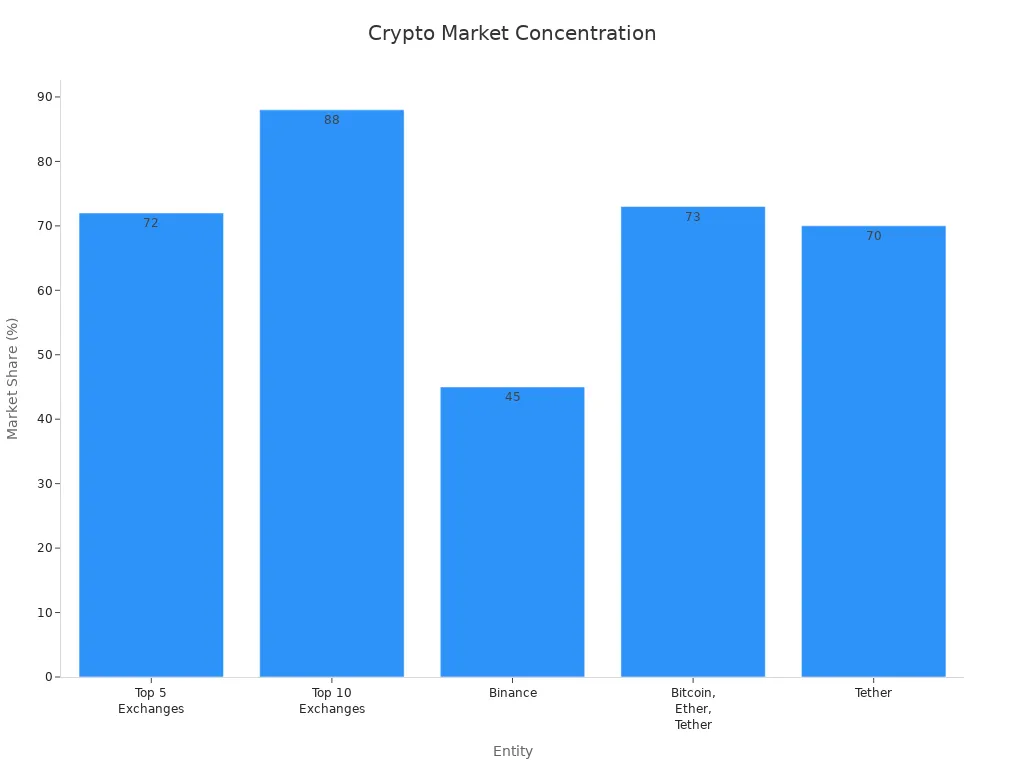

CONL stock focuses entirely on Coinbase and the crypto sector, which introduces significant concentration risk. Coinbase uses strict risk management, including collateralization and stress testing, to reduce counterparty credit risk. However, the broader crypto market remains highly concentrated, which poses systemic risks.

The top five crypto exchanges hold 72% of the market share, and the top ten hold 88%. Binance leads with a 40-49% share, followed by Coinbase. Bitcoin, Ether, and Tether make up 73% of market cap and 55% of trading volume. Tether alone accounts for 70% of stablecoin market cap and 80-90% of stablecoin trading volumes.

| Aspect | Details |

|---|---|

| Market Concentration | Top 5 crypto exchanges hold 72% market share; top 10 hold 88% |

| Leading Exchanges | Binance leads with 40-49% share; Coinbase follows |

| Market Structure Trend | Crypto exchanges moved from competitive (2018-2021) to highly concentrated (2023) |

| Asset Concentration | Bitcoin, Ether, and Tether make up 73% of market cap and 55% of trading volume (2023) |

| Stablecoin Dominance | Tether accounts for 70% market cap and 80-90% of stablecoin trading volumes |

| Geographic Note | Most exchanges headquartered in tax havens |

This concentration means that any negative trend or event affecting Coinbase or the crypto sector can have a major impact on CONL stock’s price. Investors must monitor price and trend closely and set a clear target for when to sell.

Short-Term vs. Long-Term Holding

Analysis of historical outcomes shows that leveraged ETFs like CONL stock amplify daily returns but suffer from volatility decay over longer periods.

- Short-term holding can yield amplified gains in strong bull markets.

- Long-term holding often results in subpar or negative returns due to volatility and compounding effects.

- For example, from February 2020 to January 2023, QQQ (Nasdaq-100) gained about 30.76%, while TQQQ (3x leveraged) declined by 11.37%.

- In 2022, TQQQ fell by 80%, showing the risk of holding leveraged ETFs long-term during volatile or down markets.

- Volatility decay means that even if the underlying index gradually increases, the leveraged ETF can lose value due to the amplified impact of daily fluctuations.

Academic research shows that institutional investors use leveraged ETFs for short-term tactical strategies. Skilled institutions may extract value from these instruments, but less sophisticated portfolios risk excessive exposure and diminished returns if leveraged ETFs are held long-term without proper risk management.

CONL stock is generally not recommended for long-term holding. The ETF has 100% of its assets in Coinbase, with extremely high volatility and a beta of 9.98. The expense ratio stands at 1.10%, higher than average ETF ratios. The combination of extreme volatility, concentrated single-asset exposure, and leverage-induced compounding effects explains why CONL stock is more appropriate for short-term trading. Investors should set a clear target for price and trend, monitor their position, and be ready to sell quickly if the market moves against their target.

| Metric Category | Metric Description | Value / Explanation |

|---|---|---|

| Concentration Risk | Number of Holdings | 1 (100% in Coinbase stock) |

| % of Assets in Top 10 | 100% | |

| Volatility | 5 Day Volatility | Extremely high at 493.51% |

| Beta | Very high at 9.98 | |

| Performance | 1 Month Return | Large negative swing: -36.82% |

| 3 Month Return | Large positive swing: 105.76% | |

| Expense Ratio | Expense Ratio | 1.10%, higher than average ETF ratios |

| Qualitative Factors | Leveraged ETF nature | 2x leverage causes compounding effects and value erosion over time |

| Suitability | More appropriate for short-term trading due to volatility and leverage risks |

Investors must understand that CONL stock is designed for active trading and short-term price targets. Holding for longer periods increases risk and can lead to losses that exceed the underlying asset’s decline. Setting a clear target for price and trend, monitoring the market, and being prepared to sell quickly are essential steps for managing risk in leveraged ETFs.

Is CONL Stock Right for You?

Assessing Risk Tolerance

Investors must first understand their own risk tolerance before they buy conl stock. Risk tolerance reflects how much uncertainty and potential loss an investor can handle. Some investors accept high volatility and seek large gains, while others prefer stability and lower risk. The table below shows how different risk tolerance levels influence investment behavior:

| Risk Tolerance Level | Investor Profile | Investment Behavior | Relevance to CONL Stock Investment |

|---|---|---|---|

| Aggressive | High risk tolerance, willing to accept losses for higher returns | Focus on capital appreciation, mostly stocks, little to no bonds or cash | More likely to invest in CONL stock seeking higher returns despite volatility |

| Moderate | Balanced risk tolerance, seeks growth with some risk management | Mix of stocks and bonds (e.g., 50/50 or 60/40 allocation) | May invest in CONL stock as part of a diversified portfolio to balance risk |

| Conservative | Low risk tolerance, prioritizes capital preservation and low volatility | Prefers guaranteed, highly liquid investments like CDs, money markets, U.S. Treasuries | Likely to avoid or limit exposure to CONL stock due to volatility |

Investors should use risk assessment tools such as ETF screeners, scenario analysis tools, and head-to-head ETF comparison tools. These resources help investors match their comfort level with the risks involved.

Aligning with Investment Goals

The strategy behind buying conl stock should match the investor’s goals. This ETF suits those who want short-term tactical trading or speculative gains. It does not fit long-term buy-and-hold strategies. The fund’s high beta and wide price swings mean that investors must prepare for rapid changes in value. Those who seek steady growth or income may find this ETF unsuitable. Investors should focus on capitalizing on short-term market movements and use risk management techniques to protect their capital.

Research and Due Diligence

Thorough analysis is essential before making a decision to buy. Investors should review the ETF manager’s expertise, the fund’s concentration in Coinbase, and the frequency of holdings reporting. They should also examine the structure, regulatory framework, and use of derivatives. Monitoring technical indicators, such as moving averages and MACD, can help identify a buy signal, but mixed signals often appear. Investors must also understand the expense ratio, trading costs, and liquidity. Ongoing monitoring and a clear risk management plan are critical for success with leveraged ETFs.

Steps Before Buying

Key Questions to Ask

Investors should ask themselves several important questions before they buy CONL stock. These questions help clarify if the investment fits their goals and risk profile:

- How does the company make money? Understanding the business model and revenue sources is essential for any analysis.

- Are the sales real? Investors should verify revenue growth and check for signs of unstable sales.

- How is the company doing compared to competitors? Comparing growth and market position helps set a realistic target.

- How does the broader economy affect the company? Market conditions can impact price and trading volume.

- What risks could seriously harm the company in the next few years? Product concentration or lack of diversification can trigger a sell signal.

- Is management transparent about expenses? Recurring charges may indicate deeper issues.

- Is the company living within its means? High debt levels can lead to a forced sell.

- Who is running the company? The CEO’s track record matters for long-term stability.

- What is the company really worth? Investors should analyze valuation metrics like P/E ratio and EPS to avoid overpaying.

- Do I really need to own this stock? Reflecting on personal risk tolerance and investment goals can prevent impulsive buy or sell decisions.

Investors should also review financial reports for consistent net income and cash flow before making a buy decision.

Red Flags to Watch

Before buying, investors must watch for warning signs that may trigger a sell signal or indicate excessive risk:

- Leveraged ETFs like CONL may not track the underlying index accurately over periods longer than one day due to daily resets and volatility.

- Holding leveraged ETFs for more than a day can lead to unexpected losses, even if the underlying price moves favorably.

- High fees and expenses can erode gains and make it harder to reach a price target.

- Leveraged ETFs often generate significant short-term capital gains, which can impact after-tax returns.

- These products use complex derivatives, which may not always reflect the true price or trading volume of the underlying asset.

- Leveraged ETFs are best suited for active traders with a clear trading strategy and strong understanding of market timing.

- A lack of understanding about how leverage works or how to interpret a buy signal or sell signal increases risk.

- Regulatory actions and studies show that even skilled investors can underperform with leveraged ETFs, especially without a disciplined trading strategy.

If investors notice performance drift, high volatility, or repeated sell signals, they should consider reducing exposure or selling the position.

Research Resources

Reliable research resources support better analysis and decision-making before a buy or sell. Public.com offers fundamental data, including assets under management, beta, expense ratio, price ranges, and dividend information. This platform also provides news updates and market sentiment, which can help investors spot a buy signal or sell signal based on price and volume trends.

Seeking Alpha delivers in-depth analysis on CONL’s exposure to Bitcoin and the crypto sector, helping investors understand risk factors and growth drivers. ETF Trends supplies timely news and performance analysis on leveraged ETFs, which is useful for tracking price movements and trading volume.

TradingView stands out for technical analysis. It offers tools like Moving Averages, Oscillators, and Pivots, along with real-time charts and community ideas. Investors can use these features to identify a buy signal, set a price target, or spot a sell signal based on trading volume and price action.

Third-party platforms provide valuable data and analysis, but investors should always verify information and align it with their own trading strategy and risk tolerance before making a buy or sell decision.

CONL stock offers amplified gains but also exposes investors to significant risks due to its leveraged structure and high volatility. Investors should understand that factors like global market trends and limited trading activity can affect price and liquidity.

- Careful self-assessment and thorough research remain essential before investing.

- Investors can follow these steps: research the business model, assess risk tolerance, compare valuations, and verify information from trusted sources.

By applying these steps, investors can make informed decisions and may benefit from consulting a financial professional.

FAQ

What is the main purpose of CONL stock?

CONL stock aims to provide investors with 2x daily exposure to Coinbase (COIN) shares. The fund targets short-term traders who want to amplify gains from daily price movements in the crypto sector.

Is CONL stock suitable for long-term investors?

CONL stock does not suit long-term investors. The daily reset and compounding effects can erode value over time. Most professionals recommend using leveraged ETFs like CONL for short-term trading only.

How does leverage affect potential losses?

Leverage increases both gains and losses. If COIN’s price drops, CONL stock can lose value twice as fast. Investors risk losing their entire investment quickly if the market moves against them.

What fees should investors expect with CONL stock?

CONL stock charges an expense ratio of 1.10%. This fee is higher than average for ETFs. High fees can reduce overall returns, especially if the investment is held for more than a few days.

Can investors lose more than their initial investment with CONL stock?

No, investors cannot lose more than their initial investment in CONL stock. The ETF structure limits losses to the amount invested, unlike margin trading, which can require additional funds.

CONL stock offers a powerful tool for experienced, risk-tolerant traders seeking to capitalize on short-term movements in the crypto market. Its 2x daily leverage provides the potential for amplified gains, but this comes with significant risks that demand a disciplined strategy. For global investors, navigating the complexities of cross-border finance to access US-listed stocks can be a major hurdle. BiyaPay provides a seamless solution. Our platform enables you to easily fund your account and trade US-listed stocks like CONL with minimal friction. With our low, transparent fees for cross-border transactions and a built-in real-time exchange rate converter, you can efficiently manage your trades and maximize potential returns. By simplifying the financial process, BiyaPay empowers you to focus on your core trading strategy, including using stop-loss orders and monitoring market trends. Take control of your portfolio and begin your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.