- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Is Cony Stock and How Does the YieldMax COIN Option Income Strategy ETF Work

Image Source: pexels

Cony stock refers to the YieldMax COIN Option Income Strategy ETF, which connects directly to Coinbase Global, Inc. (COIN), a major cryptocurrency exchange. Coinbase stands out for its strong regulatory compliance and security standards, attracting investors who value transparency. The table below shows Coinbase’s market capitalization compared to other leading exchanges:

| Company | Market Capitalization (USD) | Comparison to Coinbase (%) |

|---|---|---|

| Coinbase (COIN) | $82.89 Billion | Reference value |

| Intercontinental Exchange (ICE) | $104.60 Billion | 26.19% higher |

| Nasdaq (NDAQ) | $55.15 Billion | 33.46% lower |

YieldMax COIN Option Income Strategy ETF (CONY) aims to generate monthly income for investors by using a strategy based on options linked to Coinbase stock. This approach helps investors seek steady income while staying connected to a leading name in the crypto industry.

Key Takeaways

- Cony stock refers to the YieldMax COIN Option Income Strategy ETF, which uses options linked to Coinbase stock to generate high monthly income without owning the stock directly.

- The ETF uses a synthetic covered call strategy combined with U.S. Treasury holdings to provide steady income while limiting large gains and losses.

- Investors receive monthly payouts that depend on Coinbase stock volatility, making income levels change over time.

- CONY suits investors who want regular income and can accept high risk and price swings, but it is not ideal for those seeking stable returns or direct Coinbase ownership.

- Before investing, review your risk tolerance and understand that the fund’s high yield comes with potential for significant losses and capped upside.

What Is Cony Stock?

Image Source: pexels

Definition

Cony stock does not have an official definition in financial markets. Instead, the term refers to the YieldMax COIN Option Income Strategy ETF, which trades under the ticker symbol CONY. This ETF uses a synthetic covered call strategy to provide investors with current income and capped gains based on the performance of Coinbase Global Inc. stock (COIN). The fund does not invest directly in Coinbase shares. Instead, it uses options strategies that are backed by cash and U.S. Treasurys. This approach gives investors indirect exposure to the price movements of COIN. The ETF aims to generate monthly income from option premiums, allowing investors to benefit from some of COIN’s price gains while limiting the potential for large losses. The fund and Coinbase operate as separate entities.

Note: Investors should understand that owning cony stock means holding an ETF that uses options, not actual Coinbase shares.

Cony Stock and COIN

Recent financial articles use the term cony stock to describe the YieldMax ETF that focuses on Coinbase. This ETF stands out because it transforms a non-yielding asset, like Coinbase stock, into a source of monthly income through options strategies. Investors who buy cony stock do not own Coinbase directly. Instead, they participate in an options-based income strategy linked to COIN. Many articles highlight that this ETF suits investors who want regular income and have a neutral or slightly positive outlook on Coinbase, rather than those seeking large price gains.

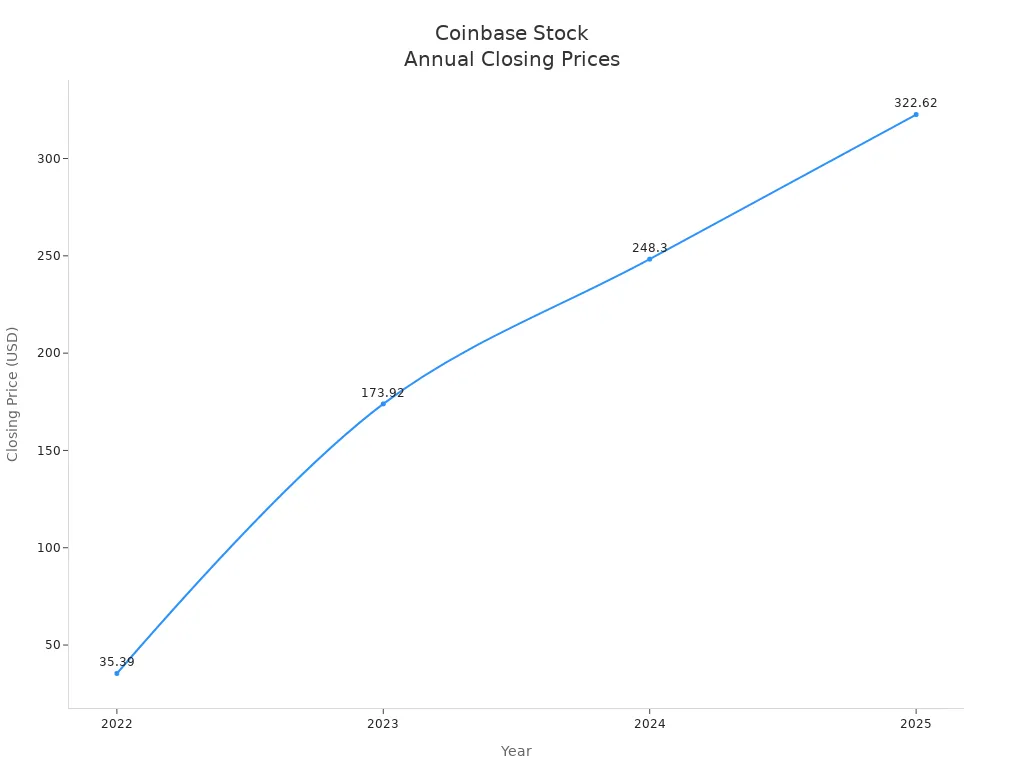

Coinbase stock has shown significant price swings since its IPO. The table below shows the annual performance of COIN:

| Year | Annual % Change | Year Open | Year High | Year Low | Year Close |

|---|---|---|---|---|---|

| 2022 | -85.98% | 251.05 | 251.05 | 32.53 | 35.39 |

| 2023 | 391.44% | 33.60 | 186.36 | 33.26 | 173.92 |

| 2024 | 42.77% | 156.88 | 343.62 | 117.30 | 248.30 |

| 2025 | 29.93% | 257.21 | 419.78 | 151.47 | 322.62 |

This data shows that COIN can be very volatile. Cony stock offers a way for investors to seek income from this volatility without owning the stock directly.

YieldMax COIN Option Income Strategy ETF

Image Source: pexels

Overview

The YieldMax COIN Option Income Strategy ETF, known as CONY, uses an active management approach. The fund aims to provide high monthly income by selling call options on Coinbase Global Inc. (COIN) stock. The managers do not buy COIN shares directly. Instead, they use a synthetic covered call strategy. This means the fund writes call options on COIN while holding a large portion of its assets in U.S. Treasury Notes. These Treasurys help provide a stable income base, while the options generate extra income from premiums.

The table below summarizes the main features of the ETF:

| Aspect | Details |

|---|---|

| Strategy | Synthetic covered call strategy writing call options on Coinbase Global Inc. (COIN) stock |

| Asset Composition | Significant holdings in U.S. Treasury Notes |

| Income Generation | Monthly income from option premiums and stable income from Treasury holdings |

| Target Investors | Income-focused investors seeking cryptocurrency exposure without direct Bitcoin investment |

| Dividend Yield | Approximately 96.79% with monthly distributions |

| Expense Ratio | 1.01% |

| Volatility (Beta) | High beta of 2.15 indicating significant volatility due to COIN stock exposure |

| Risk Considerations | Volatility of COIN stock, regulatory developments, and cryptocurrency market trends |

| Capital Appreciation | Capped due to covered call strategy |

| Fund Size (AUM) | Around $717 million |

This structure attracts investors who want steady income and exposure to the crypto sector. The fund’s high dividend yield stands out, but the covered call strategy limits how much the fund can gain if COIN’s price rises sharply.

Link to COIN

CONY’s performance closely tracks the price movements of Coinbase stock. The fund’s strategy creates a strong connection between the two. The table below shows how CONY and COIN compare:

| Metric | CONY (ETF) | COIN (Stock) | Interpretation |

|---|---|---|---|

| Correlation | 0.98 | N/A | Very high positive correlation, indicating price movements closely track each other |

| Volatility | 19.82% | 21.23% | CONY has slightly lower volatility, implying less price fluctuation |

| Sharpe Ratio | 0.39 | 0.80 | COIN has a higher risk-adjusted return compared to CONY |

| Dividend Yield (TTM) | ~149.26% | 0% | CONY pays a very high dividend yield, COIN pays none |

The high correlation means that when COIN’s price changes, cony stock usually moves in the same direction. However, CONY’s covered call strategy reduces its volatility and provides regular income. Investors should note that while the fund offers high yields, it also faces risks from COIN’s price swings and the broader cryptocurrency market.

How CONY Works

Option Income

The YieldMax COIN Option Income Strategy ETF uses a covered call strategy to generate income. The fund sells call options on Coinbase Global stock. When the fund sells these options, it collects premiums from buyers. These premiums create a steady stream of income for investors. The fund distributes this income monthly. Investors who focus on income rather than large price gains often find this approach appealing. The covered call strategy limits how much the fund can earn if Coinbase stock rises quickly. If the stock price jumps, the call options may get exercised early. This action caps the gains for the fund. The strategy works best when Coinbase stock grows steadily, not when it surges sharply.

Income Generation

CONY aims to provide high monthly distributions to its investors. The fund collects option premiums as its main source of income. The amount of income depends on the volatility of Coinbase stock. When the stock becomes more volatile, option premiums increase. This situation allows the fund to generate more income. If volatility drops, the premiums become smaller, and the fund’s income decreases. The managers of the fund watch the market closely. They adjust the strike prices and timing of the options to collect the highest possible premiums. The fund also holds U.S. Treasury Notes, which add stability and a small amount of extra income. The combination of option premiums and Treasury income supports the fund’s goal of steady monthly payouts.

Note: The income from CONY can change from month to month. Changes in Coinbase stock volatility have a direct impact on the amount of income the fund can generate.

Features

CONY offers several features that make it unique among ETFs:

- Monthly Income: The fund pays out income every month, which attracts investors who want regular cash flow.

- Capped Upside: The covered call strategy limits how much the fund can gain if Coinbase stock rises sharply. Investors trade some potential growth for steady income.

- High Volatility Exposure: The fund’s income depends on the volatility of Coinbase stock. High volatility can boost income, but it also increases risk.

- Indirect Exposure to Coinbase: Investors do not own Coinbase shares directly. Instead, they gain exposure through options linked to the stock.

- Active Management: The fund managers actively select option strike prices and timing to maximize income.

- High Expense Ratio: The fund charges higher fees than many traditional ETFs. These fees can reduce the net returns for investors.

- Risk of Value Loss: The fund can lose value if Coinbase stock falls sharply. The strategy does not protect against large losses.

Investors should understand that cony stock uses a strategy designed for income, not for large capital gains. The fund works best for those who want steady monthly payouts and can accept the risks that come with high volatility and capped upside.

Benefits and Risks

Advantages

Investors often choose the YieldMax COIN Option Income Strategy ETF for its strong income potential. Financial analysts highlight several key benefits. The ETF delivers a high dividend yield, which can reach up to 150%. This yield comes from the fund’s synthetic covered call strategy. The managers use options to generate monthly distributions. They also maintain a net short position of about 20% to help manage risk. The ETF has shown notable total returns since its launch. The average annual return stands at 50.25%, and the total return over the past year, including dividends, reached 26.52%. These features make the ETF attractive to those who want regular income and exposure to the cryptocurrency sector.

| Advantage | Explanation |

|---|---|

| High Dividend Yield | The ETF offers a very high dividend yield (around 149.26% to 150%) driven by Coinbase’s volatility, providing substantial monthly distributions. |

| Synthetic Covered Call Strategy | Uses a synthetic covered call approach to generate income, which is a key factor in producing the high yield. |

| Risk Management via Net Short Position | Fund managers maintain a net short position (~20%) to balance potential gains with risk, hedging against volatility. |

| Notable Total Returns | Since inception, the ETF has shown strong total returns (average annual return ~50.25%, 26.52% total return in the past year including dividends), highlighting the effectiveness of its income-focused strategy. |

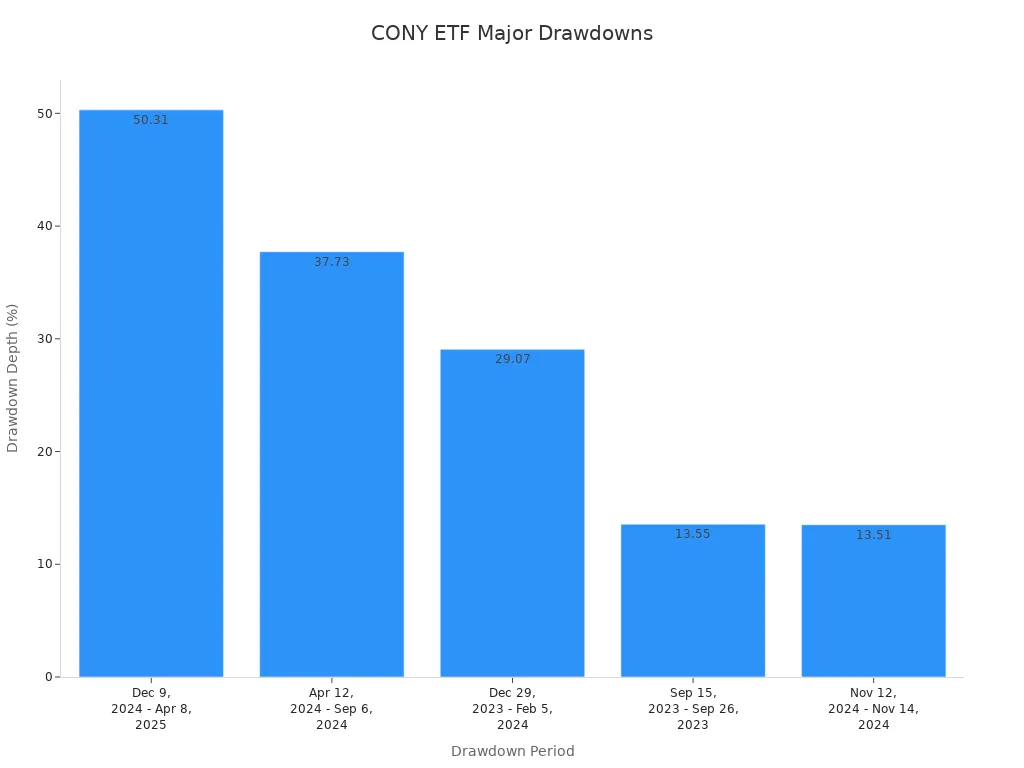

Risks

The ETF also carries significant risks. The fund’s value can drop sharply when Coinbase stock falls. Investors have seen drawdowns as deep as 50.31% since the ETF’s inception. Some losses lasted for months before recovering. The table below shows major drawdowns and their recovery status.

| Drawdown Depth | Start Date | Bottom Date | Duration to Bottom (days) | Recovery Status |

|---|---|---|---|---|

| 50.31% | Dec 9, 2024 | Apr 8, 2025 | 121 | Not recovered |

| 37.73% | Apr 12, 2024 | Sep 6, 2024 | 147 | Recovered Nov 8, 2024 |

| 29.07% | Dec 29, 2023 | Feb 5, 2024 | 38 | Recovered Mar 4, 2024 |

| 13.55% | Sep 15, 2023 | Sep 26, 2023 | 11 | Recovered Oct 24, 2023 |

| 13.51% | Nov 12, 2024 | Nov 14, 2024 | 2 | Recovered Dec 4, 2024 |

The covered call strategy also limits gains. When Coinbase stock rises quickly, the ETF cannot capture all the upside. Technical signals sometimes suggest selling the ETF during periods of high risk. Investors should watch for these signals and review their risk tolerance. The ETF’s high volatility means that monthly income can change. Those who want stable returns must understand that losses can be large and recovery may take time.

Investor Suitability

Who Should Consider

The YieldMax COIN Option Income Strategy ETF suits investors who seek high monthly income and accept significant risk. These individuals often prefer income generation over capital growth. They understand that the fund uses options linked to Coinbase Global, Inc. and does not invest directly in the stock. The ETF appeals to those comfortable with volatility and complex strategies. Investors with high risk tolerance may find the fund attractive, especially if they want exposure to the cryptocurrency sector without buying digital assets. People who want stable returns or capital preservation should consider more traditional ETFs, such as SCHD or VYM, which offer moderate yields and lower risk. Conservative investors or those seeking direct dividends from underlying stocks may not find this ETF suitable.

Note: The fund’s high yield comes with the possibility of large losses and price swings. Investors must accept that the principal value can drop sharply, as seen in past performance.

Evaluation Tips

Investors should review several factors before choosing an option income ETF like CONY. The following table highlights common mistakes and important evaluation tips:

| Mistake or Tip | Description |

|---|---|

| Overestimating Dividend Sustainability | Projecting a single quarter’s yield over a year can lead to unrealistic expectations. |

| Misunderstanding Income Source | Option premiums differ from traditional dividends or interest payments. |

| Ignoring Lack of Diversification | Funds tied to one stock, such as Coinbase, carry higher risk. |

| Overlooking Correlation | ETF prices often move with the underlying stock, even without direct ownership. |

| Not Considering Asset Composition | Many option income ETFs hold large portions in bonds, affecting risk and returns. |

| Underestimating Market Impact | Market conditions and stock performance can change ETF prices quickly. |

Investors should check their risk tolerance and investment goals. They need to understand how option strategies work and how monthly income may change. Reading fund documents and performance reports helps clarify expectations. Comparing CONY to other ETFs can show differences in risk and yield. Careful evaluation helps avoid surprises and supports better investment decisions.

Investors see CONY as a way to earn high monthly income by using options linked to Coinbase stock. The ETF pays cash distributions and holds U.S. Treasury bonds for stability. Its covered call strategy limits gains during rallies and exposes investors to risks like price drops and market volatility. The fund is not diversified and may face liquidity and counterparty risks. Investors should review their goals and risk tolerance before choosing CONY, especially if they want steady income rather than growth.

FAQ

What is the main goal of the YieldMax COIN Option Income Strategy ETF?

The main goal of the ETF is to provide high monthly income. The fund uses options linked to Coinbase stock to generate this income for investors.

Does CONY invest directly in Coinbase shares?

CONY does not buy Coinbase shares. The fund uses a synthetic covered call strategy with options and holds U.S. Treasury Notes for stability.

How often does CONY pay income to investors?

CONY pays income every month. The amount can change based on the volatility of Coinbase stock and the premiums collected from selling options.

What risks should investors consider before buying CONY?

Investors face risks such as sharp drops in value, capped gains during price rallies, and high volatility. The fund’s value depends on Coinbase stock performance and market trends.

Who should avoid investing in CONY?

Investors who want stable returns, low risk, or direct ownership of Coinbase stock should avoid CONY. The ETF suits those who accept high risk and seek monthly income.

CONY stock is a unique product for a specific type of investor: those who seek high monthly income and can accept the significant risks of a volatile, options-based strategy. While the fund offers a compelling yield, its capped upside and potential for steep drawdowns mean it is not for everyone. For international investors, accessing US-listed ETFs like CONY can add a layer of complexity. BiyaPay provides a seamless and cost-effective solution. Our platform allows you to easily fund your account and trade US-listed stocks, including ETFs, with minimal friction. With our low fees for cross-border transactions and a transparent real-time exchange rate converter, you can preserve more of your investment and monthly distributions. By simplifying the complexities of global finance, BiyaPay empowers you to focus on assessing risk and achieving your investment goals. Take control of your portfolio and start your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.