- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Is MSTX Stock and the Defiance Daily Target 2X Long MSTR ETF

Image Source: unsplash

You may hear about mstx stock if you watch the market for leveraged investment options. The mstx defiance daily target 2x long mstr etf gives you a way to seek amplified returns from MicroStrategy’s stock. This ETF aims to give you twice the daily returns of MSTR, after fees and expenses.

- The mstx ETF uses special strategies to target 2x exposure to the daily movement of MicroStrategy’s stock price.

- You need to understand that mstx is made for investors who want to manage their investment closely.

- The ETF’s design means your returns can change quickly, and you may face large losses in a single day.

Mstx can help you pursue higher returns, but you must know the risks and watch your investment daily.

Key Takeaways

- MSTX is a special ETF that aims to give twice the daily return of MicroStrategy stock using leverage and derivatives.

- This ETF is designed for short-term trading and requires daily monitoring because its value can change quickly and unpredictably.

- Holding MSTX for more than one day can lead to unexpected results due to daily resets and compounding effects.

- MSTX carries high risks, including large losses, and charges higher fees than regular ETFs, so it suits experienced investors with high risk tolerance.

- Before investing, check MSTX’s price, trading volume, and understand its risks and costs to make informed decisions.

MSTX Stock Overview

Image Source: pexels

What Is MSTX Stock?

You may wonder what sets mstx stock apart from other investment options. The mstx stock profile shows that this ETF is not a traditional stock. Instead, it is a fund that tracks the daily movement of MicroStrategy (MSTR) shares. The mstx ETF uses financial tools called derivatives to give you twice the daily change in MSTR’s price. This means if MicroStrategy’s price goes up by 5% in one day, mstx aims to go up by 10%. If MSTR falls by 3%, mstx could drop by 6%. You do not own MicroStrategy shares directly when you buy mstx stock. Instead, you hold a share in a fund that uses swaps and other agreements to match the target returns.

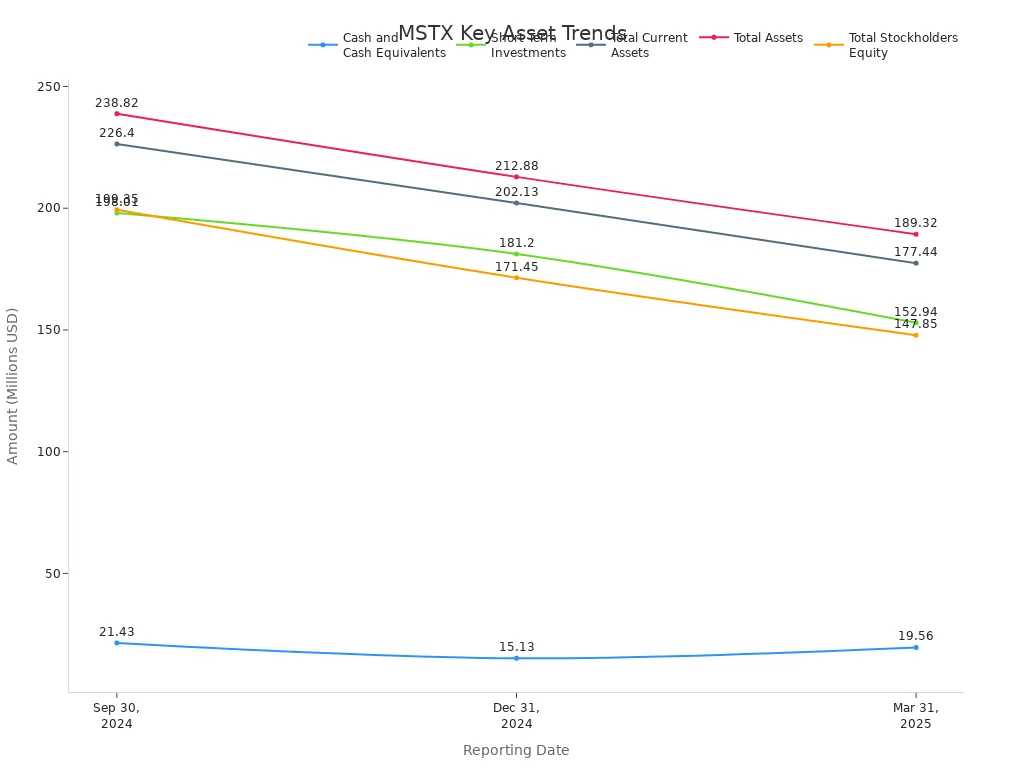

The mstx ETF manages a large pool of assets. Here is a snapshot of its key financials over recent quarters:

| Metric | March 31, 2025 | December 31, 2024 | September 30, 2024 |

|---|---|---|---|

| Cash and Cash Equivalents | $19.56M | $15.13M | $21.43M |

| Short Term Investments | $152.94M | $181.20M | $198.01M |

| Total Current Assets | $177.44M | $202.13M | $226.40M |

| Total Non-Current Assets | $11.87M | $10.74M | $12.42M |

| Total Assets | $189.32M | $212.88M | $238.82M |

| Total Current Liabilities | $11.90M | $14.72M | $12.79M |

| Long Term Debt | $29.52M | $26.62M | $26.55M |

| Total Liabilities | $41.47M | $41.43M | $39.47M |

| Total Stockholders Equity | $147.85M | $171.45M | $199.35M |

| Total Investments | $181.20M (Dec 31, 2024) | N/A | N/A |

You can see that mstx holds most of its assets in cash and short-term investments. This structure supports its goal of tracking MSTR’s daily price moves.

MSTX ETF Objective

The mstx ETF has a clear objective. It seeks to deliver 2x the daily returns of MicroStrategy stock. You can use mstx as a short-term tactical tool in your portfolio. The fund uses swaps and other derivatives to reach its target. This approach makes mstx different from traditional equity investments, which do not use leverage or derivatives. The mstx ETF charges an annual expense ratio of 1.29%. It manages over $1 billion in assets and focuses on the information technology sector, mainly application software.

You should know that mstx is designed for daily trading, not long-term holding. If you hold mstx for more than one day, your returns may not match twice the movement of MSTR due to compounding effects. The mstx intraday price can change quickly, so you need to watch your investment closely. If you want to seek amplified returns from MSTR’s price swings, mstx gives you a way to do that, but you must understand the risks and monitor your investment every day.

MSTX Defiance Daily Target 2X Long MSTR ETF Structure

How MSTX Achieves Leverage

You may wonder how the mstx etf gives you amplified exposure to MicroStrategy’s stock. The fund uses a strategy that targets 2x the daily movement of MSTR. This means if MicroStrategy rises by 4% in a day, mstx aims to rise by 8%. If MSTR falls by 3%, mstx could drop by 6%. The mstx etf does not require you to use a margin account. Instead, the fund handles the leverage for you inside the etf structure.

To reach this goal, mstx resets its leverage every trading day. The fund buys more exposure when MicroStrategy’s price goes up and reduces exposure when the price drops. This daily rebalancing keeps the leverage close to the 2x target. However, in some periods, regulatory rules limited the leverage to 1.75x. As of October 29, 2024, mstx returned to its 2x leverage target. You should know that this daily reset can cause your investment returns to differ from what you might expect over longer periods. If you hold mstx for more than one day, the effects of compounding and volatility can make your returns unpredictable. For example, if MicroStrategy’s price moves up and down over several days, your mstx investment may not double the total return of MSTR. This structure makes mstx best for short-term trading, not for long-term holding.

Note: The mstx etf is designed for experienced investors who want to manage their investment closely. The fund’s daily reset can lead to large gains or losses in a short time. You should monitor your investment every day to avoid unexpected results.

Use of Swaps and Derivatives

The mstx etf uses swaps and other derivatives to achieve its leveraged exposure. Swaps are agreements with banks or other financial firms. These agreements let the fund track the daily returns of MicroStrategy without owning the stock directly. The mstx etf combines these swaps with cash-like investments to keep its leverage at the 2x target. The fund also uses call options as a backup when swaps are not available. Swaps usually provide more precise tracking, but their supply can be limited, especially as the mstx etf grows larger. When the fund cannot get enough swaps, it turns to call options, which can cause tracking errors, especially in volatile markets.

Here are some key points about the use of swaps and derivatives in mstx:

- The mstx etf uses swaps and call options to reach 2x leveraged exposure to MicroStrategy.

- Swaps offer precise tracking but can be hard to get when the fund is large.

- Call options help fill the gap but may cause tracking errors.

- The use of derivatives can lead to structural costs and tracking errors, which may cause your investment to perform differently from the underlying stock.

- The large size of mstx can make it harder to maintain precise leverage, increasing risk.

- You may see outsized gains if MicroStrategy and Bitcoin perform well, but you also face the risk of large losses, especially if you hold the fund for a long time.

- The mstx etf is best used for short-term tactical trading, not as a buy-and-hold investment.

- Active management and risk controls are important for handling the high-risk, high-reward nature of mstx.

The daily rebalancing and use of derivatives mean that mstx can behave very differently from MicroStrategy over time. Even if MicroStrategy’s price rises over several months, your mstx investment could lose value because of volatility and the effects of daily resetting. The fund’s prospectus warns that mstx is not suitable for long-term investors. You should only use mstx if you understand the risks and can watch your investment every day.

Performance & Fees

Image Source: pexels

Price and Trading Data

You need to track the price and trading activity of the mstx etf if you want to manage your investment well. The most recent 5-day moving average price for mstx stands at $35.28 USD. The price increased by $2.91 over five days, which is a 9.07% gain. The average daily trading volume reached 4,971,660 shares. This high volume shows that mstx is popular among active traders. You can find up-to-date price, volume, and performance data for mstx on Barchart.com. This site gives you real-time prices, interactive charts, and technical analysis during market hours. DividendInvestor.com also provides current price quotes, dividend yield, and dividend history for mstx. These resources help you monitor your investment and make informed trading decisions.

| Period | 5-Day Moving Average Price | 5-Day Price Change | 5-Day Percent Change | 5-Day Average Volume |

|---|---|---|---|---|

| MSTX ETF | $35.28 | +2.91 | +9.07% | 4,971,660 shares |

Performance History

The mstx etf launched on August 14, 2024. Since then, the price has shown wide swings. The 52-week low price was $15.18 USD, while the 52-week high price reached $220.99 USD. This range shows the high volatility of leveraged ETFs. The mstx etf manages about $1.03 billion in assets. The fund paid a dividend of $14.42761 USD on January 3, 2025. You should know that the median 1-year return for mstx is a loss of 79%. The probability of losing more than 50% in one year is 56%. The chance of a 99% loss ranges from 15% to 50%, depending on market volatility. These numbers show that mstx carries much higher risk than the underlying MicroStrategy stock.

| Metric | Value |

|---|---|

| Inception Date | August 14, 2024 |

| 52-Week Low Price | $15.18 USD |

| 52-Week High Price | $220.99 USD |

| Assets Under Management | $1.03 billion USD |

| Expense Ratio | 1.29% |

| Dividend Ex-Date | December 31, 2024 |

| Dividend Amount Paid | $14.42761 USD |

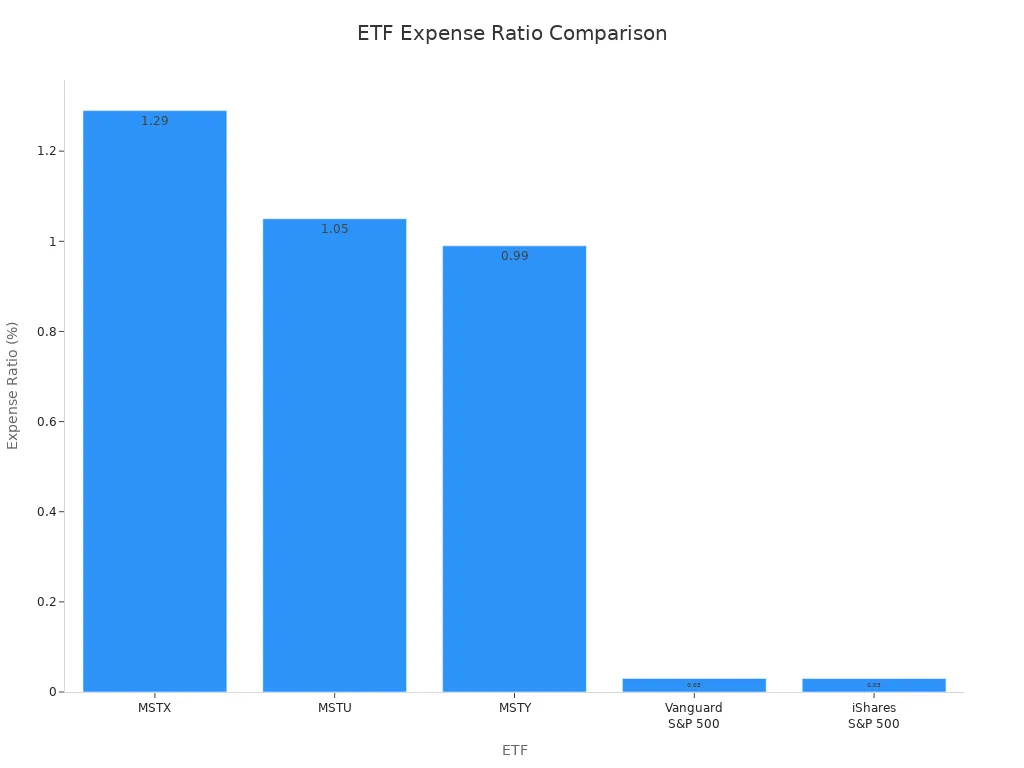

Fees and Expenses

You pay higher fees for leveraged ETFs like mstx. The mstx etf charges an expense ratio of 1.29%. This is much higher than the average stock ETF, which usually charges less than 0.20%. Other leveraged ETFs focused on MicroStrategy, such as MSTU and MSTY, charge 1.05% and 0.99% respectively. Popular broad-market ETFs like Vanguard S&P 500 and iShares S&P 500 charge only 0.03%. You need to consider if the higher fees of mstx are worth the potential for amplified returns. High fees can reduce your investment gains over time, especially if you hold the fund for longer periods.

| ETF | Expense Ratio (%) | Comparison to Average Stock ETF | Notes |

|---|---|---|---|

| MSTX | 1.29 | Much higher (<0.20%) | Highest among compared leveraged ETFs |

| MSTU | 1.05 | Much higher | Lower than MSTX |

| MSTY | 0.99 | Much higher | Lowest among these leveraged ETFs |

| Vanguard S&P 500 | 0.03 | Significantly lower | Popular low-cost benchmark ETF |

| iShares S&P 500 | 0.03 | Significantly lower | Popular low-cost benchmark ETF |

Tip: Always review the expense ratio before adding a leveraged ETF to your portfolio. High fees can impact your returns, especially in volatile markets.

Risks & Tax

Main Risks of MSTX

When you consider the mstx etf, you face a unique set of risks. This etf uses leverage to target about twice the daily return of MicroStrategy stock. You do not get the same risk profile as a non-leveraged etf or direct stock ownership. The etf relies on financial tools like total return swaps and call options. These tools can create tracking errors, especially when markets move quickly or when the etf grows in size. For example, on one trading day, the etf dropped much more than expected compared to MicroStrategy. This happened because the supply of swaps was limited, so the etf had to use call options, which did not track the stock well during high volatility.

You should know that leveraged etfs like this one can swing much more than the underlying stock. If you hold your investment for more than one day, the effects of compounding and daily resets can make your returns unpredictable. You may see large gains, but you also risk steep losses. Non-leveraged etfs and direct stock investments do not have these extra layers of risk. You need to watch your investment closely and understand that the complexity of this etf can make it hard to predict your results.

Note: Leveraged etfs are best for short-term trading. If you want to hold an investment for a long time, you may want to look at other options.

Tax Implications

You need to think about taxes when you invest in a leveraged etf. The mstx etf pays out income and capital gains distributions. Under current U.S. tax law, you pay the highest federal tax rate on income and short-term capital gains from these distributions. Long-term capital gains from the etf are taxed at a 15% federal rate. These rates affect your after-tax returns. The etf uses these tax rates to show you tax-adjusted returns and tax cost ratios. State and local taxes are not included in these numbers.

If you sell your investment for a profit, you may owe capital gains tax. If you hold the etf for less than a year, your gains count as short-term and are taxed at your ordinary income rate. If you hold it longer, you may qualify for the lower long-term rate. You should keep good records of your trades and distributions. Taxes can reduce your overall investment gains, so you need to plan ahead.

MSTX ETF Comparison

MSTX vs. Other Leveraged ETFs

When you compare the MSTX etf to other leveraged etfs, you see some important differences in performance and risk. MSTX stands out for its high volatility and strong trading activity. You can see this in the table below:

| Metric | MSTX ETF (MicroStrategy) | Tesla Stock | Nvidia Stock | Leveraged Nvidia ETFs (GraniteShares & Direxion) |

|---|---|---|---|---|

| 90-day Volatility (%) | 97 | 66 | 63 | N/A |

| Year-to-date Return (%) | N/A | N/A | N/A | 351 (GraniteShares), 292 (Direxion) |

| Targeted Daily Exposure (%) | 175 | N/A | N/A | N/A |

| Single-day Volume (USD) | $22 million | N/A | N/A | N/A |

| Expense Ratio (%) | ~1 | N/A | N/A | ~1 |

MSTX etf shows much higher volatility than Tesla or Nvidia. This means your investment can swing up or down more quickly. The etf also attracts strong trading interest, with a single-day volume of $22 million USD (see exchange rates). Leveraged etfs for Nvidia have seen high returns, but MSTX focuses on daily exposure to MicroStrategy, which brings unique risks.

You should also look at liquidity and trading spreads when you choose an etf for your investment. Here are some key points:

- MSTX etf has lower assets under management ($477 million USD) than MSTU, which has $685 million USD.

- Higher assets often mean better liquidity, so MSTU may be easier to trade.

- Both MSTX and MSTU use swaps and options to reach 2X daily leverage, which can cause wider bid-ask spreads.

- The high volatility of MicroStrategy stock makes MSTX’s trading spreads wider than less volatile etfs.

- MSTX trades on NASDAQ during U.S. market hours, but its lower assets suggest less liquidity than MSTU.

- You may find MSTX’s liquidity and spreads similar to other leveraged etfs that track volatile stocks.

Key Differences

You need to understand what sets MSTX apart from other leveraged etfs before you add it to your investment plan. MSTX targets 2X the daily move of MicroStrategy, which is a stock known for big price swings. This makes MSTX one of the most volatile etfs you can buy. If you want to use MSTX in your portfolio, you must watch your investment every day. The etf’s structure, which uses swaps and options, can lead to tracking errors and higher costs.

Other leveraged etfs, like those tracking Nvidia, may offer high returns, but they do not match MSTX’s volatility. MSTX’s lower assets under management also mean you may face wider trading spreads. This can affect your ability to enter or exit your investment at the price you want. You should use MSTX for short-term trading, not as a long-term investment. If you want to manage risk, you may prefer etfs with higher liquidity and lower volatility.

Tip: Always check the trading volume, assets under management, and volatility before you choose a leveraged etf for your investment. These factors can impact your results and your ability to manage risk.

You see that the MSTX stock and Defiance Daily Target 2X Long MSTR ETF offer a way to amplify your exposure to MicroStrategy’s price moves. The etf uses daily resets and derivatives, which can lead to volatility drag and compounding losses over time. You may notice that the etf underperforms in sideways or volatile markets, making it best for short-term trading.

- Many investors misunderstand how the etf works, often overlooking the daily reset, magnified losses, and higher fees.

- You should use this etf only if you have a high risk tolerance and want to make short-term bets.

Always review your financial goals and speak with a professional before trading leveraged etfs.

FAQ

What does MSTX track?

You get exposure to MicroStrategy (MSTR) stock. MSTX aims to give you twice the daily return of MSTR. The fund uses swaps and options to reach this goal.

Can you hold MSTX for more than one day?

You can hold MSTX longer, but your returns may not match twice the movement of MSTR. Daily resets and compounding can change your results over time.

How risky is MSTX compared to regular ETFs?

MSTX carries much higher risk than regular ETFs. You may see large gains or steep losses in a short time. Leveraged ETFs like MSTX suit experienced traders.

Where can you check MSTX’s current price?

You can find MSTX’s latest price and trading data on Yahoo Finance, MarketWatch, or Nasdaq. These sites show real-time prices in USD. Check current exchange rates if you need conversions.

What fees do you pay for MSTX?

You pay an annual expense ratio of 1.29% for MSTX. This fee is higher than most regular ETFs. High fees can reduce your returns, especially if you hold MSTX for a long time.

MSTX stock is a powerful tool for short-term traders with a high risk tolerance who want to amplify their exposure to MicroStrategy’s daily movements. Its leveraged structure offers the potential for significant gains, but it also carries extreme risks, including volatility decay and the potential for large losses. For investors outside the United States, accessing and trading US-listed ETFs like MSTX requires a reliable and efficient financial platform. BiyaPay provides a seamless solution. Our platform enables you to easily fund your account and trade US-listed stocks, including high-volatility ETFs, with minimal friction. With our low fees for cross-border transactions and a transparent real-time exchange rate converter, you can execute your trades efficiently and keep your costs low. By simplifying the complexities of international finance, BiyaPay empowers you to focus on your trading strategy and daily risk management. Take control of your portfolio and begin your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.