- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why MGOL Stock Is Falling and What Investors Should Watch

Image Source: pexels

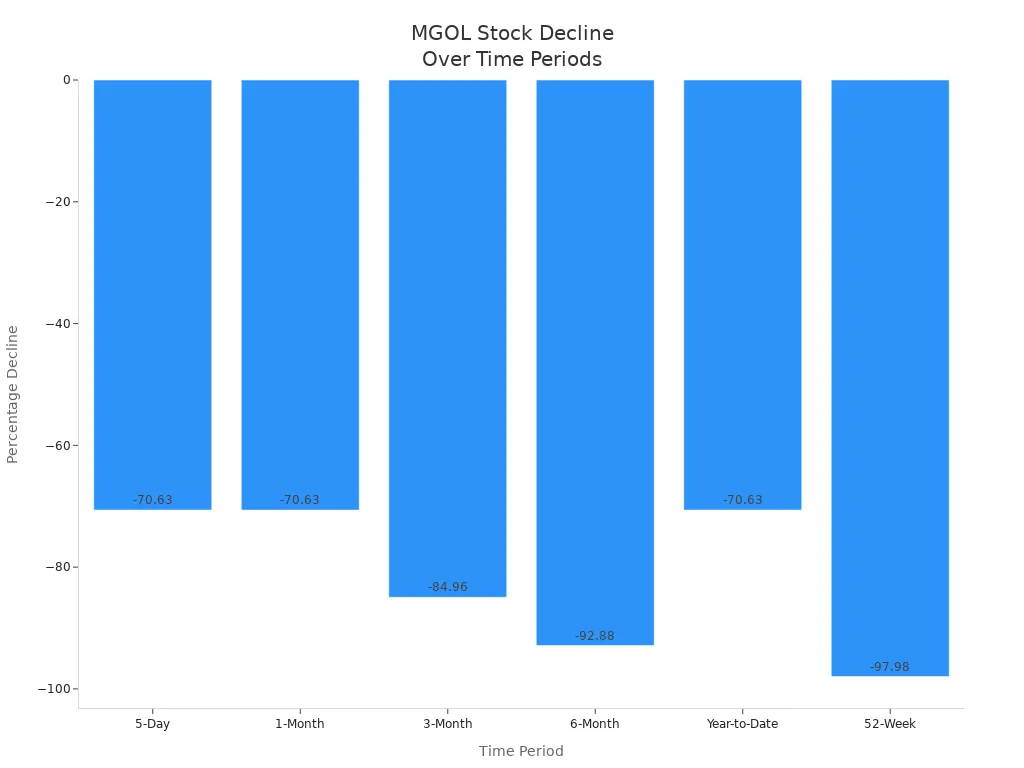

You see MGOL stock falling sharply. The most urgent reason is extreme shareholder dilution, which pushes the current price down fast. The stock lost 70.63% of its value in just one month, as shown below:

Investors should watch for new news about possible delisting and more dilution. When you track these signals, you protect your investment and respond quickly to sudden changes.

Key Takeaways

- MGOL stock fell sharply due to heavy shareholder dilution and merger uncertainty, which lowered investor confidence.

- The company faces risks like possible delisting, weak financial results, and high short interest that increase stock volatility.

- Investors should watch for news about the merger, regulatory updates, and financial reports to respond quickly.

- Using trading tools and setting alerts can help you track important changes and protect your investment.

- Consider diversifying your portfolio and using stop-loss orders to manage risk while waiting for signs of recovery.

MGOL Stock Decline

Image Source: pexels

Recent News

You have likely seen many headlines about mgo global in the past few weeks. Major financial media outlets report that no institutional investors have increased their mgol stock holdings recently. Instead, six large funds, including Geode Capital Management and Vanguard Group, have reduced their positions in Q3 2024. This signals that investor confidence is falling. The announcement of the merger with Heidmar, which will create Heidmar Maritime Holdings Corp. under the ticker ‘HMR,’ has also made the news. While some see this as a possible turning point, the company still faces big financial challenges.

The 52-week low for mgol stock is $0.1017, while the 52-week high is $5.54. This wide range shows how much the price can change in a short time. High trading volume in recent sessions means many people are buying and selling, often reacting to the latest news about mgo global and the merger. This activity creates more volatility and risk for you as an investor.

Note: When you see high trading volume and sharp price swings, it often means that the market is reacting to uncertainty or new information.

Shareholder Dilution

Shareholder dilution is one of the main reasons for the decline in mgol stock. Over the past year, mgo global has issued more than 90 million new shares. There was also a 60:1 share conversion, which changed the value of each share. After the merger, mgol stockholders now own only about 5.6% of the new company. This heavy dilution puts strong downward pressure on the price.

- Community members have discussed the impact of dilution:

- Over 90 million new shares were added.

- The 60:1 share conversion changed the value of each share.

- After dilution, the estimated value per share is about $2.98, but the actual trading price is much lower, around $0.80 or less.

- Some believe the adjusted share price could fall as low as $0.04-$0.05.

- On January 24, 2025, mgol shareholders approved the issuance of up to 94,725,000 new shares tied to warrants from a December 2024 offering.

This large increase in shares means your ownership in mgo global is now much smaller. The market reacts to this by lowering the price, making it harder for the stock to recover.

Delisting Risk

Delisting risk is another major concern for you as an investor. When a stock trades near its 52-week low and stays below $1 for a long time, it can face removal from the exchange. Mgo global’s current price is far below its previous highs, and the company’s financial health remains weak. The table below shows some key financial data:

| Aspect | Details |

|---|---|

| Financial Performance | Revenue approx. $5.36M; EBIT margin -131.7%; Pretax profit margin -147.8%; Net income loss $3.24M |

| Liquidity | Current ratio 14.1; Quick ratio 8 |

| Profitability | Return on assets -191.7%; Return on equity -191.47% |

| Operating Cash Flow | Negative $1.49M |

| Institutional Investor Activity | 6 institutional investors reduced holdings in Q3 2024, including major funds |

| Market Sentiment | Stock price volatility linked to merger news with Heidmar |

If mgo global cannot improve its financial results or raise its price above the minimum required by the exchange, it could be delisted. This would make it much harder for you to buy or sell shares and could lead to even bigger losses.

MGO Global Fundamentals

Revenue Trends

You can see that mgo global’s revenue has changed a lot over the past year. The company’s most recent quarter, ending September 30, 2024, showed revenue of $565,400 USD. This is a sharp drop from $1,054,161 USD in the same quarter last year. Earlier in 2024, mgo global reported $670,264 USD in revenue for the first quarter, which was much higher than the $45,147 USD from the previous year. This shows that mgo global’s revenue moves up and down from quarter to quarter.

| Period Ended | Revenue (USD) | Comparison | Notes |

|---|---|---|---|

| September 30, 2024 (Q3) | $565,400 | Decreased from $1,054,161 in same quarter previous year | Significant decline in revenue |

| March 31, 2024 (Q1) | $670,264 | Increased from $45,147 a year ago | Shows variability in quarterly revenues |

| Last quarter (unspecified) | $1,330,000 | No recent quarter for direct comparison | Data from Barchart, no exact date |

Mgo global saw double-digit revenue growth in its Stand Flagpoles product line during the first half of 2024 compared to 2023. This growth led to a jump in the stock price and more interest from retail investors. The company also sold The Messi Store asset and is now merging with Heidmar, which could change its future performance.

Debt and Liquidity

You should pay close attention to mgo global’s debt and liquidity. The company’s current ratio stands at 14.1, and its quick ratio is 8. These numbers mean mgo global has enough short-term assets to cover its short-term debts. However, the company still reports a net loss from continuing operations, which improved from $2,031,500 USD last year to $1,346,804 USD this year. The cost of sales for Q3 2024 was $72,414 USD, about 13% of sales, which is lower than the 22% seen last year. Gross profit for the same period was $492,986 USD, down from $819,158 USD. Even though expenses have dropped, mgo global continues to lose money, which affects investor sentiment and the stock’s performance.

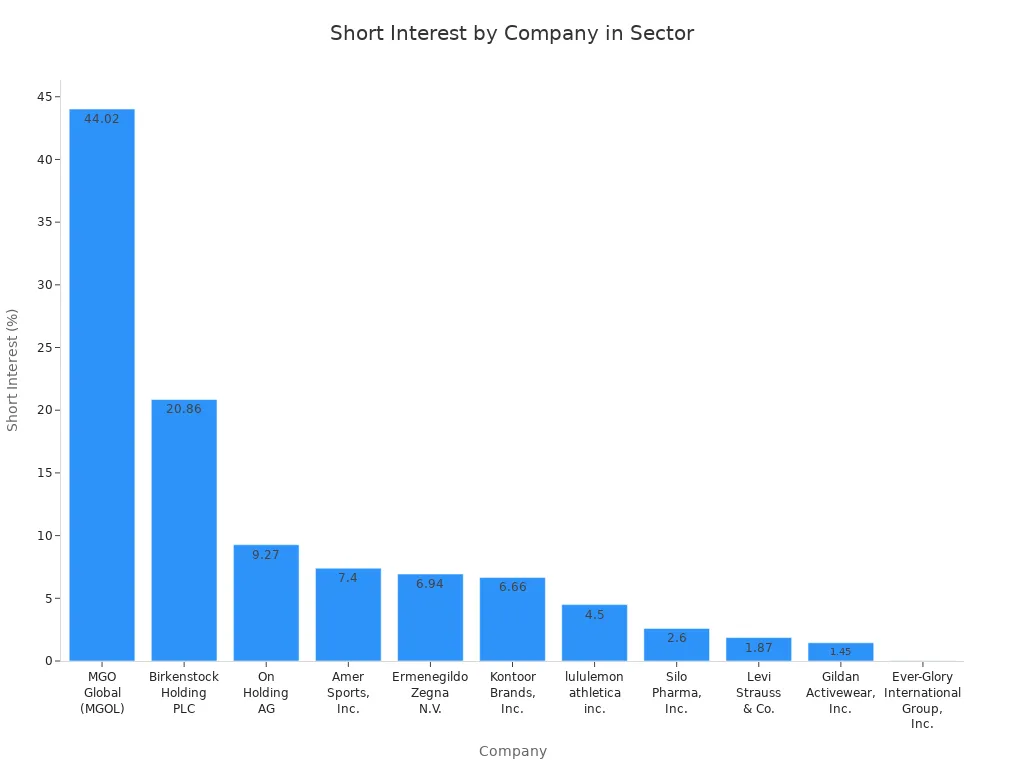

Short Interest

You need to watch short interest because it shows how many traders are betting against mgo global. The company’s short interest is 44.02%, which is much higher than other companies in the same sector. For example, Birkenstock Holding PLC has a short interest of 20.86%, and On Holding AG has 9.27%. High short interest often means that many people expect the stock price to fall. This can lead to more volatility and bigger price swings, especially when trading volume is high.

When you see high short interest and increased trading volume, you should be careful. These signs can mean that the market expects more trouble for mgo global. If the company cannot improve its financial results, the stock may keep falling.

What to Watch Next

Image Source: pexels

Upcoming News

You should keep an eye on upcoming announcements from mgo global. Company updates about the merger with Heidmar can move the stock price quickly. Regulatory news, such as any notice about possible delisting, will also affect your decision to buy or sell. Earnings reports and new financial statements may give you clues about the company’s future. Analysts often update their stock forecast after these events, so you should check for new analysis and recommendations. If mgo global announces a successful merger or new partnerships, you might see a change in investor sentiment.

Tip: Set alerts for official press releases and regulatory filings. This helps you react fast to important news.

Technical Signals

You can use technical indicators to guide your buy or sell decisions. The Relative Strength Index (RSI) for mgo global is now at 16, which means the stock is deeply oversold. This could signal a possible price reversal or a period of stabilization. However, the 50-day and 200-day moving averages are much higher than the current price, showing that the stock is still in a strong downtrend. The MACD remains negative, which supports a bearish short-term outlook. Other tools, like the Stochastic Oscillator and Parabolic SAR, can help you spot entry and exit points. The Volume Weighted Average Price (VWAP) acts as a support or resistance level, helping you confirm the strength of a trend.

| Level Type | Price (USD) |

|---|---|

| Resistance Level (R3) | 5.950 |

| Resistance Level (R2) | 5.950 |

| Resistance Level (R1) | 5.950 |

| Pivot Point | 5.950 |

| Support Level (S1) | 5.950 |

| Support Level (S2) | 5.950 |

| Support Level (S3) | 5.950 |

You should watch these price levels closely. If the stock moves above or below $5.950, it could signal a new trend.

Recovery or Risk

You face both risk and opportunity with mgo global. Recent analysis shows that the company has large net losses and negative profitability. The stock has dropped over 89% in one year, and the market remains very volatile. Analysts say that the future depends on the success of the merger and any operational turnaround. If mgo global can improve its financial results, you might see a recovery. However, the stock remains speculative, and many experts suggest a hold or cautious approach. You should review each new forecast and stock forecast before you decide to buy or hold. Always manage your risk and stay alert for sudden changes in performance.

You have seen mgol stock fall because of dilution, weak financials, and merger risks. To protect your money, watch for these risks:

- Falling revenue and high net losses

- Negative market sentiment and high short interest

- Regulatory and merger integration challenges

You can take action by following these steps:

- Track financial health and news updates.

- Use trading tools and set alerts.

- Diversify your investments.

- Use stop-loss orders before you buy.

Stay alert to changes so you can respond quickly.

FAQ

What caused MGOL stock to drop so quickly?

You saw MGOL stock fall because of heavy shareholder dilution, merger uncertainty, and delisting risk. These factors made investors lose confidence and sell their shares. The price dropped sharply as a result.

How does shareholder dilution affect you?

Shareholder dilution means the company issues more shares. Your ownership percentage shrinks. The value of each share often drops. You may see your investment lose value even if the company’s total value stays the same.

What happens if MGOL gets delisted?

If MGOL gets delisted, you cannot trade it on major exchanges. You may need to use over-the-counter (OTC) markets, which have less liquidity. This makes it harder to buy or sell shares at a fair price.

Should you buy MGOL stock now?

You should be careful. The stock faces big risks, including possible delisting and more dilution. Most experts suggest you wait for clear signs of recovery or improved financial health before buying.

How can you track MGOL’s recovery?

Set alerts for company news, earnings reports, and regulatory filings. Watch technical indicators like RSI and moving averages. Review analyst updates and forecasts. These steps help you spot early signs of recovery or more risk.

The path forward for MGOL stock is highly speculative and fraught with risk. The company’s future hinges on its ability to successfully complete the merger with Heidmar and demonstrate a clear path to profitability. For investors, especially those outside the United States, managing this level of volatility requires a financial platform built for speed, transparency, and low costs. BiyaPay provides the tools to navigate these turbulent markets. Our platform enables you to easily trade US-listed stocks with unparalleled efficiency. By offering low fees for cross-border transactions and a transparent real-time exchange rate converter, we help you preserve capital in a high-risk environment. When every cent counts, a platform that minimizes costs is an invaluable asset. Use our professional tools and real-time data to set alerts and execute trades with confidence. Don’t let the complexities of international finance hold you back from your trading strategy. Take control of your investments. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.