- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why QNTM stock surged and what investors should watch for now

Image Source: pexels

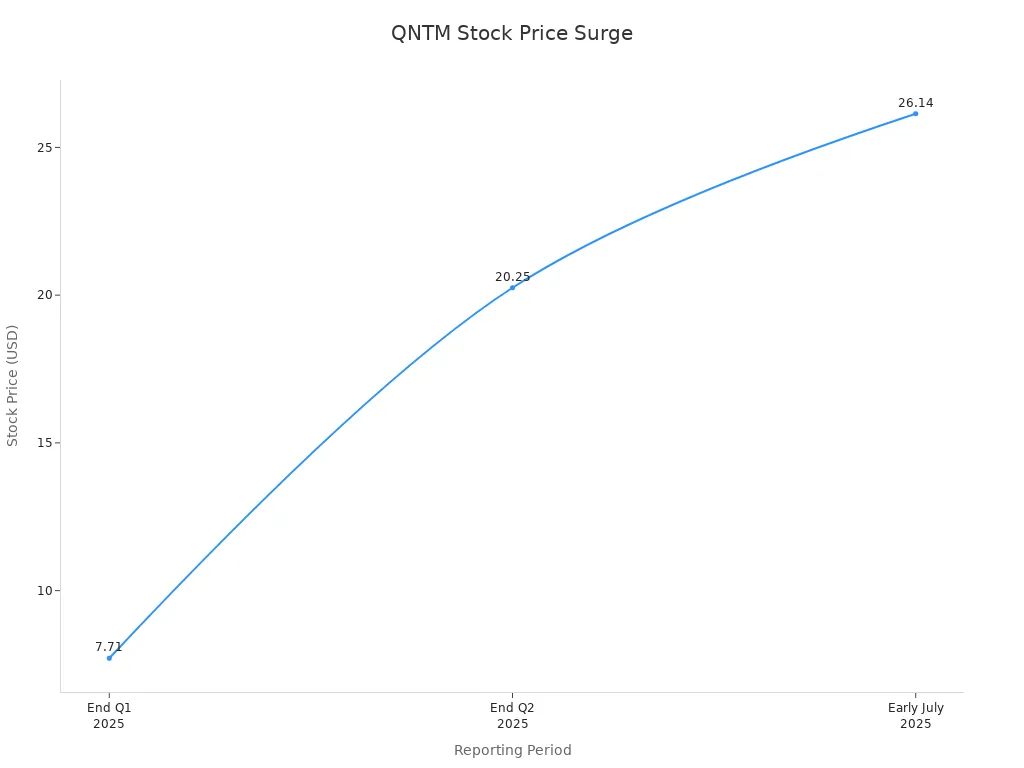

Quantum BioPharma Ltd’s QNTM stock experienced a notable stock surge driven by two main factors: a pivotal contract agreement for manufacturing Lucid-MS and robust financial results. The company reported a jump in total assets and eliminated all debt, which reassured investors and fueled market impact. The table below highlights key financial metrics that contributed to the surge:

| Financial Metric | Value / Description |

|---|---|

| Current Assets (as of June 30) | $10.3 million (up from $9.9 million previous quarter) |

| Total Assets (as of June 30) | $15.3 million (up from $14.9 million previous quarter) |

| Debt Status | All outstanding debentures converted to equity, eliminating debt liabilities |

| Cash Position | Sufficient to sustain operations beyond March 2027 |

| Q2 Revenue | Decreased by 15% |

| Cryptocurrency Reserves Value | Appreciated by over $500,000 USD |

| Stock Price (end Q1) | $7.71 |

| Stock Price (end Q2) | $20.25 (tripled from Q1) |

| Stock Price (early July 2025) | $26.14 |

Investors should focus on how these results and the new contract agreement shape future stock performance and market impact.

Key Takeaways

- QNTM stock surged mainly due to a new contract to produce Lucid-MS and strong financial results, including asset growth and debt elimination.

- The company’s investment in cryptocurrencies added value but also brings volatility, so investors should watch this closely.

- Investor sentiment shifted from cautious to more optimistic after positive clinical milestones and strategic moves, increasing trading activity.

- Risks remain high with strong selling pressure, technical bearish signals, and financial uncertainties, so careful analysis is essential.

- Upcoming FDA approvals, clinical trial updates, and capital initiatives could greatly impact QNTM stock, making them key events to watch.

QNTM Stock: Recent Surge

Image Source: unsplash

Key Catalyst

Quantum BioPharma Ltd triggered a significant stock surge through a combination of strategic milestones and strong financial results. The most influential catalyst involved a contract agreement with a leading contract development and manufacturing organization. This partnership will produce an oral formulation of Lucid-MS, the company’s flagship drug candidate, for an upcoming Phase 2 clinical trial. This step marks a critical advancement in the drug’s development, signaling progress toward evaluating its effectiveness in human patients. The announcement of this agreement immediately boosted investor confidence, as it demonstrated tangible movement in the company’s pipeline.

The financial results further fueled the surge. During Q2 2025, QNTM stock nearly tripled, rising from $7.71 at the end of Q1 to $20.25 at the end of Q2. This represents an approximate 163% increase, a rare event in the biotechnology sector. The company also reported a strong asset position and eliminated all outstanding debt, which reassured the market about its financial stability. These results, combined with the contract news, created a powerful narrative of growth and operational discipline.

Biotechnological advancements played a crucial role in the recent surge. Quantum BioPharma’s FSD202 program received Phase 2 clinical trial approval for Idiopathic Mast Cell Activation Syndrome (MCAS), addressing a significant unmet medical need. The Lucid-MS program is preparing for an IND filing, supported by a joint study with Massachusetts General Hospital. The company’s subsidiary, Unbuzzd Wellness Inc., is preparing for an IPO, which will enhance capital for marketing its alcohol metabolism aid. Quantum BioPharma also diversified its treasury by investing $5 million in Bitcoin and plans to issue Contingent Value Rights linked to potential litigation proceeds. These clinical and strategic initiatives contributed to increased investor confidence and a 15.67% stock surge on June 20, 2025.

Trading activity reflected the market’s reaction. On the day of the surge, QNTM stock’s trading volume was nearly 350 times higher than its daily average of 57,300 shares. This dramatic spike in trading activity signaled heightened retail enthusiasm and strong market interest. The surge in volume followed positive clinical trial results and reinforced the perception of QNTM stock as a high-growth opportunity.

Investor Sentiment

Investor sentiment toward QNTM stock shifted dramatically during the recent surge. Before the surge, retail investors expressed bearish views, with skepticism about the company’s profitability and financial stability. The announcement of the Unbuzzd product, which accelerates alcohol metabolism, attracted new interest and increased trading volumes. As the company reported substantial assets and eliminated debt, cautious optimism began to replace earlier concerns.

The sentiment change became evident on social platforms. One week after the surge, sentiment shifted to neutral, with a score of 45 out of 100. This change coincided with a surge in trading volume, more than doubling the daily average. Investors responded positively to the company’s rebranding, share consolidation to meet Nasdaq requirements, and a private placement to restore voting rights. The upcoming launch of the Unbuzzd product and the company’s strategic moves further increased retail interest.

Despite the positive momentum, some investors remained cautious. Concerns about financial stability and profitability persisted, even as the company demonstrated growth and operational improvements. The overall sentiment moved from bearish to neutral, reflecting a balance between optimism about future growth and awareness of ongoing risks.

Note: The combination of clinical milestones, financial discipline, and strategic initiatives has positioned QNTM stock as a focal point for growth-oriented investors. However, the evolving sentiment highlights the importance of monitoring both positive developments and potential risks.

Financial Health

Assets and Earnings

Quantum BioPharma Ltd. demonstrated notable financial resilience in the latest reporting period. The company’s total assets reached $15.3 million USD as of June 30, 2025. This figure reflects a stable asset base, which supports ongoing research and development activities. The table below summarizes the most recent asset and earnings data:

| Metric | Trailing Twelve Months (TTM) Ending June 30, 2025 |

|---|---|

| Total Assets | 15.3 million USD |

| Net Earnings | Not explicitly provided in the available data |

Although net earnings were not disclosed, the company’s earnings per share (EPS) improved year-over-year. EPS rose from -$3.78 to -$3.23, indicating progress despite remaining negative. Quantum BioPharma’s total operating revenue declined sharply, dropping by approximately 192.24% from -1,801,126 yuan in 2023 to -6,241,228 yuan in 2024. Increased R&D expenses contributed to ongoing financial challenges, but the improvement in EPS signals a positive trend for future stock performance.

Cryptocurrency Gains

Quantum BioPharma diversified its treasury by investing in Bitcoin and other cryptocurrencies. The company allocated approximately $5.5 million USD to these assets, which appreciated by over $500,000 USD during the second quarter of 2025. This gain directly strengthened the company’s financial position and contributed to asset growth.

- Quantum BioPharma’s cryptocurrency investment represents about 15.6% of its market capitalization.

- The company realized over $500,000 USD in gains from crypto assets, enhancing its financial stability.

- Secure custody and regulatory compliance help manage risks associated with crypto holdings.

- Treasury diversification aims to hedge against inflation and enable future crypto-based financing.

Despite the positive impact, stocks exposed to cryptocurrency markets face significant volatility. Quantum BioPharma’s strategy introduces complexity and risk, but also positions the company for potential future growth.

Debt Status

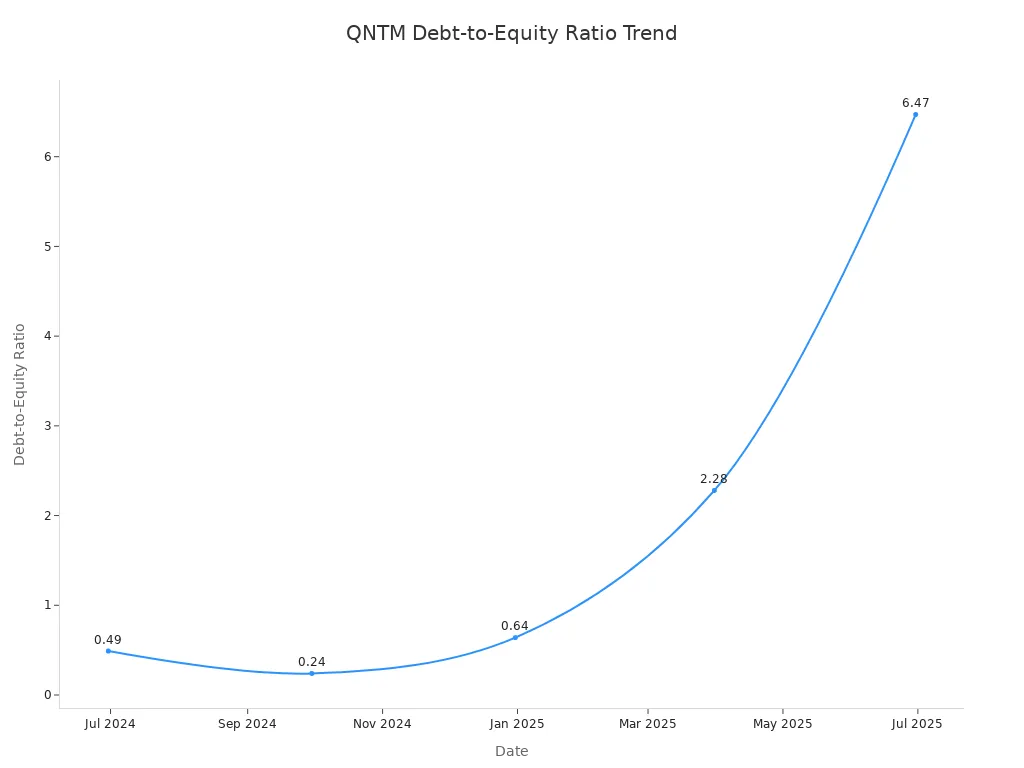

Quantum BioPharma’s debt profile changed dramatically over the past year. The debt-to-equity ratio surged from 0.49 in June 2024 to 6.47 in June 2025, indicating a sharp increase in financial leverage.

Interest expenses grew by 2,996.1%, far outpacing the industry average of 0.7%. This rapid escalation signals a higher debt burden compared to industry peers. Investors should monitor debt levels closely, as elevated leverage can impact stock stability and future growth prospects.

Note: Quantum BioPharma’s financial health reflects both opportunities and risks. Asset growth, cryptocurrency gains, and rising debt levels shape the outlook for stocks in this sector.

Trading Activity

Volume Trends

QNTM stock saw a dramatic change in trading volume during the recent surge. Investors traded far more shares than usual, showing strong interest in the company. On the day of the main surge, the trading volume reached nearly 350 times the daily average. This spike in activity signaled that both retail and institutional investors paid close attention to the stock. High trading volume often means that many investors want to buy or sell at the same time. This can lead to bigger moves in the stock price.

The increased volume also reflected growing confidence in the company’s future. Many investors believed that the new contract agreement and strong financial results would support higher prices. As a result, more people entered the market, hoping to benefit from the stock’s upward momentum. The surge in trading activity made QNTM one of the most watched stocks in its sector during this period.

Price Fluctuations

QNTM stock price showed large swings during the surge period. The most notable movement happened on May 19, 2025, when the stock price jumped by 19.61% in a single day. This sharp increase was part of a three-day run, where the price rose by a total of 49.15%. During this time, the stock price reached its highest point since February 2025.

Investors should note that QNTM stock has a history of big price changes. Over the past five years, the stock experienced a maximum drawdown of 21.9%. This means that the price can fall sharply after a period of gains. Such volatility is common in biotechnology stocks, where news about clinical trials or contracts can quickly change investor sentiment.

- Key price movements during the surge:

- Single-day price increase of 19.61% on May 19, 2025

- Three-day cumulative price gain of 49.15%

- Highest stock price since February 2025

- Historical maximum drawdown of 21.9% over five years

Investors should watch for continued volatility in QNTM stock price. Large price swings can create both opportunities and risks for those trading or holding the stock.

Risks and Volatility

Image Source: pexels

Selling Pressure

Quantum BioPharma Ltd. has faced significant selling pressure following its recent stock surge. After the sharp rise in price, several market dynamics began to weigh on the stock. The company filed a $700 million lawsuit, alleging that major financial institutions engaged in spoofing. This practice artificially depressed the price over several years and highlighted ongoing concerns about manipulative selling activities. The legal action brought attention to the complex forces influencing the stock’s price and the challenges that investors face in understanding true market value.

Several structural factors have contributed to this selling pressure. Borrow fees on QNTM shares soared above 437% annually, which signals extreme short selling activity. The limited availability of shares—fewer than 15,000 available to borrow—created a tight float and made it difficult for short sellers to find shares to sell. Approximately 59% of daily trading volume occurred through dark pools, which can obscure real demand and suppress visible price momentum. These conditions suggest that the market experienced significant tension related to selling, with high borrow costs and limited share supply amplifying volatility.

Technical analysis also reveals bearish signals. The stock chart shows a narrowing of Bollinger Bands, which often precedes a downward move in price. The KDJ Death Cross, a momentum indicator, signals a shift from bullish to bearish sentiment. The appearance of a Bearish Marubozu candlestick pattern indicates that sellers have taken control, pushing the price to close at its lowest point for the day. These patterns suggest that the stock may continue to face downward pressure as sellers dominate the market.

Investors should recognize that such selling pressure can lead to rapid declines in price, especially after a period of strong gains. The combination of high short interest, limited share availability, and technical bearish signals creates an environment where the price can fall quickly. Careful analysis of these factors is essential for anyone considering a position in QNTM stock.

Market Uncertainty

Market uncertainty remains high for Quantum BioPharma Ltd. despite recent achievements. The announcement of a promising cancer therapy generated optimism, but it also increased volatility in the price. Strategic partnerships and alliances have attracted speculative trading, which can drive the price higher in the short term but also lead to sharp corrections.

Financial analysis reveals several concerns. The company reported a highly negative pretax profit margin of -43,405.8 and a very low return on equity of -393.83. Revenue patterns remain erratic, and profitability appears unstable. These financial weaknesses raise doubts about the sustainability of recent price gains. Key valuation metrics, such as the PE ratio and price-to-sales, remain undisclosed, making intrinsic analysis difficult. Although the company holds a strong cash reserve of $3,513.1 million USD and a price-to-book value of 0.82 suggests potential undervaluation, a 100% decline in tangible revenue growth over five years undermines confidence in long-term prospects.

Institutional investors have responded to this volatility with caution. For example, the AdvisorShares Psychedelics ETF (PSIL) actively managed its QNTM holdings during periods of high price swings. Rather than making new investments, the fund adjusted its positions by adding or trimming shares based on clinical developments and market conditions. QNTM delivered a 155.88% return in the second quarter of 2025 and maintained a significant portfolio weight of 7.24%. This approach demonstrates that institutional investors use careful analysis to balance risk and opportunity in a sector known for high volatility.

Technical indicators further highlight the risks. The RSI shows an overbought condition, suggesting that the price may reverse downward. The KDJ Death Cross confirms bearish momentum, while narrowing Bollinger Bands indicate reduced volatility and a possible pause before a downward move. These signals point to a potential reversal and continuation of bearish trends.

Investors should approach QNTM stock with caution. The combination of selling pressure, technical bearish signals, and financial uncertainty requires thorough analysis before making investment decisions. Monitoring price movements, sell activity, and market sentiment will help investors navigate the risks and identify opportunities in this volatile environment.

What to Watch Next

Upcoming Milestones

Quantum BioPharma Ltd. faces several important milestones that could impact QNTM stock. The most significant event is the FDA approval process for Lucid-MS, a drug designed to help people regain mobility lost to multiple sclerosis. The company recently signed an agreement with a leading contract development and manufacturing organization to produce an oral formulation of Lucid-MS for its Phase 2 clinical trial. This move advances the drug to human testing, a critical step that investors often watch closely. Regulatory progress, such as clinical trial updates and FDA submissions, can shift investor sentiment and create new buy or hold opportunities. Investors should monitor these developments, as they often trigger increased trading activity and price movement.

Analyst Attention

Over the past six months, analyst coverage of QNTM has remained minimal. Only one upgrade occurred, with Singular Research raising its rating to Moderate Buy on June 18, 2025. No other Wall Street analysts have provided ratings or price targets in the last year. This limited analysis means investors must rely more on their own research and market signals. When analyst attention increases, it can lead to more buy or hold recommendations and influence broader market interest. Investors should watch for any new coverage or analysis, as this could provide fresh insights and affect the decision to buy or hold QNTM stock.

Capital Initiatives

Quantum BioPharma has announced a new capital initiative involving a non-brokered private placement of class A multiple voting shares to raise up to $600 USD in gross proceeds. The company will seek shareholder approval for this at its annual general meeting on September 26, 2025. Existing holders are expected to fully subscribe, showing continued confidence. The proceeds will support general working capital. Previous capital initiatives, such as legal settlements and private placements, have influenced both financial health and stock price. For example, a $2.35 million USD legal settlement with the former CEO led to a 13.97% stock price increase. The company’s ongoing lawsuit against major banks, including those in Hong Kong, could also provide significant financial gains if successful. Investors should conduct careful analysis of these capital moves, as they often create new buy or hold opportunities and can drive stock performance.

Investors should stay alert to upcoming milestones, shifts in analyst coverage, and new capital initiatives. These factors often present key opportunities to buy, hold, or reassess positions based on fresh analysis and market conditions.

QNTM stock surged due to strong financial results and a key contract for Lucid-MS. Investors should watch for price swings and upcoming clinical milestones. To manage risk, they can buy small amounts, hold positions, and monitor monthly returns. Some may buy more if Tencent’s share buyback plans help stabilize the price, while others may hold through volatility. Smart strategies encourage investors to buy gradually and hold rather than make large upfront investments. Those who buy and hold can better respond to changes in the market.

- Start with a small buy to limit exposure.

- Hold and review returns each month.

- Buy more if Hong Kong banks or Tencent actions support stability.

- Hold positions to manage risk and avoid sudden losses.

FAQ

What caused QNTM stock to surge recently?

The main drivers included a new contract for Lucid-MS production and strong financial results. These events increased investor confidence and led to higher trading volumes. The company also reported asset growth and eliminated debt, which further supported the stock price.

How does Quantum BioPharma’s cryptocurrency investment affect its stock?

Quantum BioPharma invested about $5.5 million USD in Bitcoin and other cryptocurrencies. This move increased asset value by over $500,000 USD in Q2 2025. Cryptocurrency exposure can add both growth potential and volatility to the company’s financial profile.

What risks should investors consider with QNTM stock?

Investors face risks from high volatility, selling pressure, and uncertain profitability. Technical indicators show bearish signals. The company’s lawsuit against Hong Kong banks and high borrow fees also create uncertainty. Careful analysis and risk management remain important for all investors.

Are there any upcoming events that could impact QNTM stock?

Key events include the FDA approval process for Lucid-MS and updates on clinical trials. The company’s annual general meeting in September 2025 will address new capital initiatives. Investors should also watch for analyst coverage and results from ongoing legal actions.

How can investors manage risk when trading QNTM stock?

Investors can start with small purchases and review returns monthly. They may increase holdings if actions by Hong Kong banks or major shareholders, such as Tencent, support price stability. Holding positions through volatility can help manage risk and avoid sudden losses.

QNTM stock’s recent surge highlights the high-risk, high-reward nature of the biotechnology sector. While the company’s financial discipline and new contract agreement are encouraging, the stock remains vulnerable to extreme volatility and market uncertainty. For investors, particularly those outside the United States, navigating these market dynamics requires a financial platform built for speed, transparency, and low costs. BiyaPay provides the tools to manage these turbulent markets. Our platform enables you to easily trade both US and Hong Kong-listed stocks, with unparalleled efficiency. By offering low fees for cross-border transactions and a transparent real-time exchange rate converter, we help you preserve capital in a high-risk environment. A platform that minimizes costs and provides seamless access to multiple markets is an invaluable asset. Take control of your investments. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.