- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

WISA Stock’s Rapid Growth Signals a Shift in Investor Sentiment

Image Source: unsplash

You see wisa stock making headlines as it posts a sharp climb in value. Wisa has sparked curiosity among investors who watch for signs of lasting momentum and strategic change. The move to rebrand as Datavault AI Inc. marks a bold step for wisa, signaling a new direction. Wisa aims to capture market attention with an upcoming ticker change. Understanding why wisa stock surges helps you spot the factors driving this shift. Wisa’s transformation invites you to look deeper at what fuels investor excitement.

Key Takeaways

- WISA stock surged sharply in early 2025 due to major partnerships and technology showcases, attracting more investor attention and trading activity.

- Insider and institutional investor moves show mixed signals; some insiders sold shares while key funds increased holdings, indicating cautious optimism.

- The company’s rebranding to Datavault AI Inc. and acquisition of CompuSystems position WISA for growth in data monetization and immersive audio markets.

- WISA shows strong revenue growth and liquidity but faces challenges with profitability and high stock price volatility.

- Investors should watch for upcoming events, ticker changes, and new partnerships while using momentum-based trading strategies to manage risks.

WISA Stock Trends

Image Source: pexels

Recent Surge

You have seen wisa stock capture attention with a sharp price increase in February 2025. On February 12, the stock jumped by about 13.09%. This surge followed news of a major partnership with the National Football League Alumni for VerifyU tokens and high-profile technology showcases at CES 2025 and New York Fashion Week. These events fueled market sentiment and led to increased volatility.

The trading volume on that day reached nearly $46.7 million, showing a clear spike in activity. When you compare the current trading volume of 2,599,400 shares to the 20-day average of 2,540,980 shares, you notice that recent trading has slightly exceeded typical levels. This uptick signals that more investors are paying attention to wisa and responding to the latest developments.

| Date | Price Movement | Trading Volume (USD) | Insider Trading Activity (Past 6 Months) | Institutional Investor Activity (Recent Quarters) |

|---|---|---|---|---|

| February 12, 2025 | +20% | ~$46,714,647 | 6 insider sales, 0 purchases; notable sales by Brett Moyer (8,857 shares), Stanley Mbugua (2,267 shares), Gary Williams (890 shares) | Mixed activity: 7 investors added shares, 7 removed shares; notable additions by Anson Funds Management LP (+353,121 shares), Vanguard Group (+52,386 shares), and removals by Schonfeld Strategic Advisors LLC (-40,400 shares), Jane Street Group LLC (-19,829 shares) |

You can see that insider activity has leaned toward selling, while institutional investors have shown mixed moves. Some large funds, such as Anson Funds Management LP and Vanguard Group, increased their holdings, which suggests confidence in the company’s direction.

Investor Sentiment

You notice that analyst sentiment around wisa stock remains strong. As of August 13, 2025, three analysts rate the stock as a Strong Buy. This consensus has not changed over the past six months, reflecting steady optimism about wisa’s growth prospects. Analysts point to the company’s acquisition of Data Vault and ongoing product developments as key reasons for their positive outlook. The price target stands at $5.67, which matches the current stock price and signals stability in expectations.

Note: Analysts highlight several factors behind the strong buy rating:

- Consistent upward trend in earnings estimates.

- A 17.1% increase in the Zacks Consensus Estimate for Summit Wireless Technologies over the past three months.

- Improved business performance, which is expected to drive the stock price higher.

- Placement in the top 20% of Zacks-covered stocks for earnings estimate revisions, suggesting strong potential for market-beating returns.

You should also consider historical trends. Wisa has experienced short-term price spikes during major corporate events, such as acquisitions and rebranding announcements. For example, the stock rose over 11% after the CompuSystems acquisition and rebranding plans. However, the longer-term trend has been volatile, with a significant decline of more than 87% year-to-date in 2024. These patterns show that while event-driven momentum can boost wisa stock in the short term, you need to stay alert to ongoing volatility.

Growth Drivers

Image Source: unsplash

Insider Activity

You can learn a lot about wisa by watching insider trading activity. In the past year, Wendy Wilson, an insider at wisa technologies, acquired shares actively. She picked up 11,000 shares in 2023 at no cost and made two more acquisitions in 2024, with June being her busiest month. Other executives did not report significant purchases or sales during this period.

You should also note the actions of Nathaniel Bradley, the CEO and a major shareholder. On August 8, 2025, he transferred 1,000,000 shares as part of a services agreement through EOS Technology Holdings Inc. He also disposed of over 4.7 million shares, though the price was not disclosed. These moves show that leadership remains involved in shaping the company’s future, even as they adjust their holdings.

| Insider Name | Role | Date | Transaction Type | Shares | Price | Notes |

|---|---|---|---|---|---|---|

| Wendy Wilson | Insider | 2023-2024 | Acquisition | 11,000+ | $0 | Acquired shares at no cost; active in June 2024 |

| Nathaniel Bradley | CEO, Director, 10% owner | 08/08/2025 | Sale (Disposition) | 1,000,000 | $0 | Transfer via EOS Technology Holdings Inc.; part of services agreement |

| Nathaniel Bradley | CEO, Director, 10% owner | N/A | Disposition | 4,765,361 | N/A | Shares disposed; no price disclosed |

| EOS Technology Holdings Inc. | Indirect holder | N/A | Holding | 2,399,911 | N/A | Shares held indirectly; Bradley has voting power |

| Spouse of Bradley | Indirect holder | N/A | Holding | 2,980,680 | N/A | Indirect holdings; no purchase price disclosed |

You see that insider moves can signal confidence or caution. When insiders acquire shares, it often means they believe in the company’s direction. When they sell or transfer shares, you should look for the reasons behind those actions.

Institutional Moves

You should pay attention to institutional investors and hedge fund activity, as these groups can influence wisa’s stock price and stability. On August 6, 2025, wisa technologies completed a direct offering of senior secured convertible notes with institutional investors, raising $6 million USD (see current exchange rate). The notes carry a 10% original issue discount, mature in 18 months, and can convert into common stock at $1.00 per share or at a price tied to the volume-weighted average price, with a set floor.

Institutional investors also agreed to exchange warrants for about 31 million shares into common stock, pending stockholder approval. This move could increase institutional holdings and add liquidity to the market. You should note that EOS Technology Holdings Inc. decreased its holdings by transferring 1.6 million shares to third parties. At the same time, Nathaniel Bradley increased his holdings through stock-based compensation, receiving 50,000 vested RSUs and 500,000 restricted shares. Sonia Choi, another major holder, did not change her position and holds over 7.2 million shares.

| Institutional Investor | Recent Change in Holdings | Amount/Details |

|---|---|---|

| EOS Technology Holdings Inc. | Decreased holdings via share transfer | Transferred 1,600,000 shares to third parties |

| Nathaniel Bradley | Increased holdings via stock-based compensation | Received 50,000 vested RSUs and 500,000 restricted shares |

| Sonia Choi | No recent change explicitly reported | Holds 7,246,041 shares (7.4% ownership) |

You see that these moves by institutional investors and hedge funds can affect the supply and demand for wisa stock. When large investors increase their stakes, it can show confidence in the company’s future. When they reduce their holdings, you should watch for possible shifts in sentiment.

Company Developments

You should focus on company developments that drive wisa’s growth. The acquisition of CompuSystems, Inc. stands out as a major move. Wisa technologies entered a definitive agreement to acquire CompuSystems, a leader in event registration, data analytics, and lead management. This deal is expected to add $13 million to $15 million in revenue and $3 million to $4 million in EBITDA for 2025. The acquisition expands wisa’s reach into event data monetization and immersive audio tours.

Wisa also integrated its ADIO technology into CompuSystems’ M3 Expo Wallet App. This platform now enables immersive audio tours and Web 3.0 data monetization, unlocking new revenue streams by converting event data into digital assets. The combination of CompuSystems’ event management expertise and Datavault’s ADIO technology allows for rapid scaling of the M3 platform and advanced data analytics for event organizers.

Note: The rebranding to Datavault AI Inc. and the upcoming ticker change to ADIO signal a new era for wisa. You should expect the market to react to these changes, as they reflect a shift toward advanced technology and data-driven solutions. The new ticker could attract fresh attention from investors looking for exposure to artificial intelligence and Web 3.0 trends.

You see that these strategic moves position wisa technologies for growth in immersive entertainment and data monetization markets. The company’s focus on partnerships and innovation strengthens its competitive edge and supports long-term value creation for shareholders.

WISA Financials

Revenue Growth

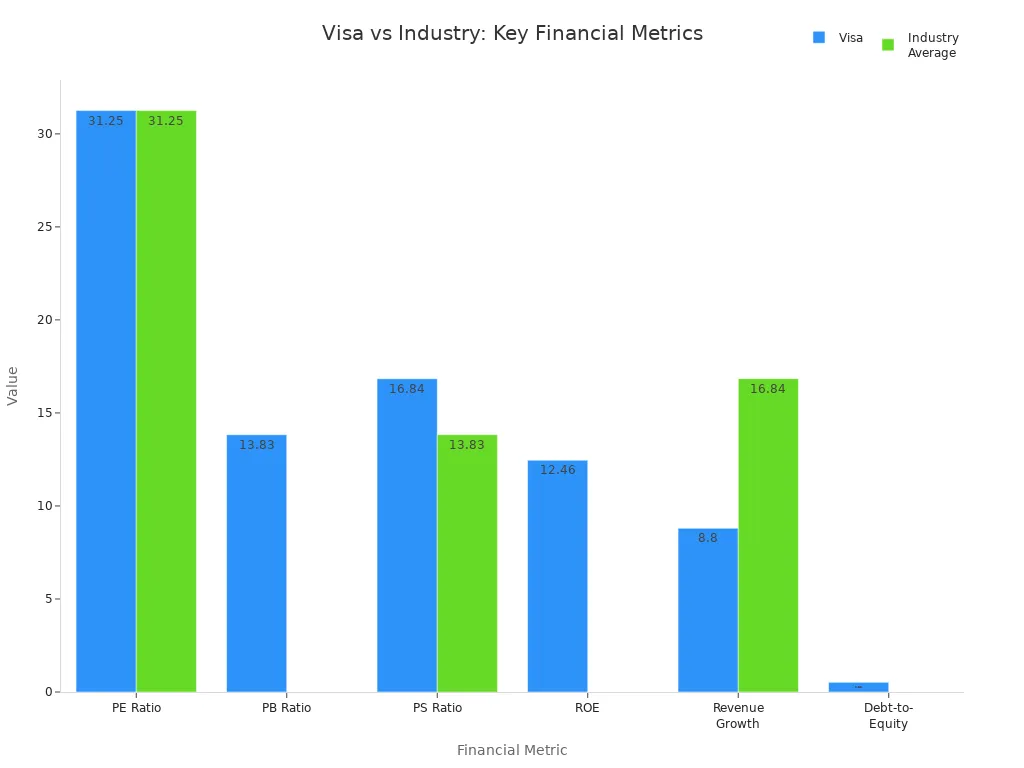

You see Datavault AI Inc. (WISA) posting a strong 63% year-over-year revenue growth in the most recent period. This jump stands out, even though you cannot establish a full three-year trend due to missing data for prior years. You also notice gross profit rising by 123% and gross margin climbing by 114%. These figures show that WISA’s core business is expanding rapidly. When you compare these results to industry averages, WISA’s revenue growth rate outpaces many peers, but you should stay alert to volatility in future quarters.

- 63% YoY revenue growth (latest year)

- 123% YoY increase in gross profit

- 114% YoY increase in gross margin

You can check the current USD exchange rate here.

Earnings and Liquidity

You need to look closely at the latest earnings report to understand WISA’s financial position. The Q2 2024 earnings report shows earnings per share (EPS) at -$11.88, which missed analyst expectations of -$0.929. Revenue matched expectations at $0.35 million USD. Despite the earnings miss, the stock price rose by 0.59% the next day. Analysts estimate Q3 2024 EPS at -$0.67 and revenue at $0.65 million USD. For the full year, EPS estimates declined from -$3.69 to -$13.75, and revenue estimates dropped from $2.60 million to $1.95 million USD.

| Metric | Actual (Q2 2024) | Analyst Expectations (Q2 2024) | Analyst Estimates (Q3 2024) | Notes on Estimates (Full Year 2024) |

|---|---|---|---|---|

| Earnings per Share (EPS) | -$11.88 | -$0.929 | -$0.67 | EPS estimate declined from -$3.69 to -$13.75 |

| Revenue | $0.35 million | $0.35 million | $0.65 million | Revenue estimate declined from $2.60M to $1.95M |

| Stock Price Reaction | +0.59% | N/A | N/A | Despite earnings miss, stock rose slightly |

| Analyst Price Target | N/A | N/A | N/A | Average target $14, implying ~661% upside |

| Brokerage Recommendation | N/A | N/A | N/A | Average rating 2.5 (Outperform) on 1-5 scale |

Financial Health

You should compare WISA’s financial health to industry peers. The company’s quick ratio stands at 0.6x, matching the industry median and indicating adequate liquidity. Net debt to free cash flow is 0.3x, showing low leverage. WISA covers interest payments well, with a free cash flow to interest ratio of 39.8x. The total debt-to-equity ratio is 65%, which aligns with the industry median.

| Metric | WISA Value | Industry Median | Interpretation |

|---|---|---|---|

| Quick Ratio | 0.6x | 0.6x | Adequate liquidity |

| Net Debt to FCF | 0.3x | 0.3x | Low leverage |

| FCF to Interest | 39.8x | 39.8x | Strong interest coverage |

| Total Debt to Equity | 65.0% | 65.0% | Comparable debt level |

You see that WISA’s debt-to-equity ratio is low at 0.01, which signals conservative debt management. However, profitability metrics such as return on equity (-2268.81%) and net margin (-12366.67%) fall far below industry averages. These numbers show that WISA faces challenges in turning revenue into profit, even as it maintains a strong liquidity position.

Strategic Moves

Partnerships

You see wisa technologies building momentum through strategic partnership agreements and targeted acquisitions. The company’s recent acquisition of CompuSystems, Inc. stands out. This move diversifies revenue streams and strengthens the company’s position in event data monetization. The partnership with the National Football League Alumni for VerifyU tokens also expands wisa technologies’ reach into sports and entertainment, driving brand visibility.

At CES 2025, wisa technologies showcased collaborations with technology leaders, highlighting the integration of ADIO technology into the M3 Expo Wallet App. These partnerships enable immersive audio tours and Web 3.0 data monetization, unlocking new business opportunities. The company’s licensing agreements now cover a large portion of the Android HDTV market, with plans to expand to Linux platforms in 2025. You should expect these partnerships to support broad market penetration and sustained growth.

| Partnership/Acquisition | Focus Area | Expected Impact |

|---|---|---|

| CompuSystems, Inc. | Event data monetization | $13–$15 million revenue boost (USD exchange rate) |

| NFL Alumni (VerifyU tokens) | Sports/entertainment | Increased brand visibility |

| Technology leaders (CES 2025) | Audio/data integration | New business opportunities |

Note: Strategic partnership agreements and acquisitions position wisa technologies for rapid expansion in new markets.

Technology and Innovation

You notice wisa technologies leading the industry with advanced wireless audio and data solutions. The introduction of WiSA E technology enables wireless, high-resolution, multi-channel audio transmission over standard 5 GHz Wi-Fi networks. This software-based solution reduces integration costs and offers flexibility for consumers. The launch of the SoundSend E Transmitter with Dolby Atmos decoding and mobile applications for certification and user control further enhances the product lineup.

The acquisition of Data Vault Holdings’ intellectual property expands wisa technologies’ portfolio into patented innovations such as data valuation, AI-enabled digital twins, acoustic mobile response technology, and data-driven holograms. At CES 2025, the company demonstrated DVHolo for holographic experiences, which Forbes recognized for its industry impact. The Twinstitute and The Digital Twin at The Wynn enable virtual digital twins and individualized voice fonts, supporting next-generation monetization. The digital twin market is projected to reach $131 billion by 2030, while the holographic display market may exceed $23 billion by 2032.

- WiSA E technology: Wireless audio over Wi-Fi

- SoundSend E Transmitter: Dolby Atmos decoding

- DVHolo: Real-time holographic media solution

- Twinstitute: Virtual digital twins and voice fonts

- ADIO: Inaudible audio tone broadcasting for personalized advertising

You see wisa technologies holding 37 active wireless audio technology patents, underscoring its leadership in innovation. The company’s focus on AI, IoT, and sustainability initiatives drives future growth through technology licensing and new data ventures.

Future Outlook

Analyst Projections

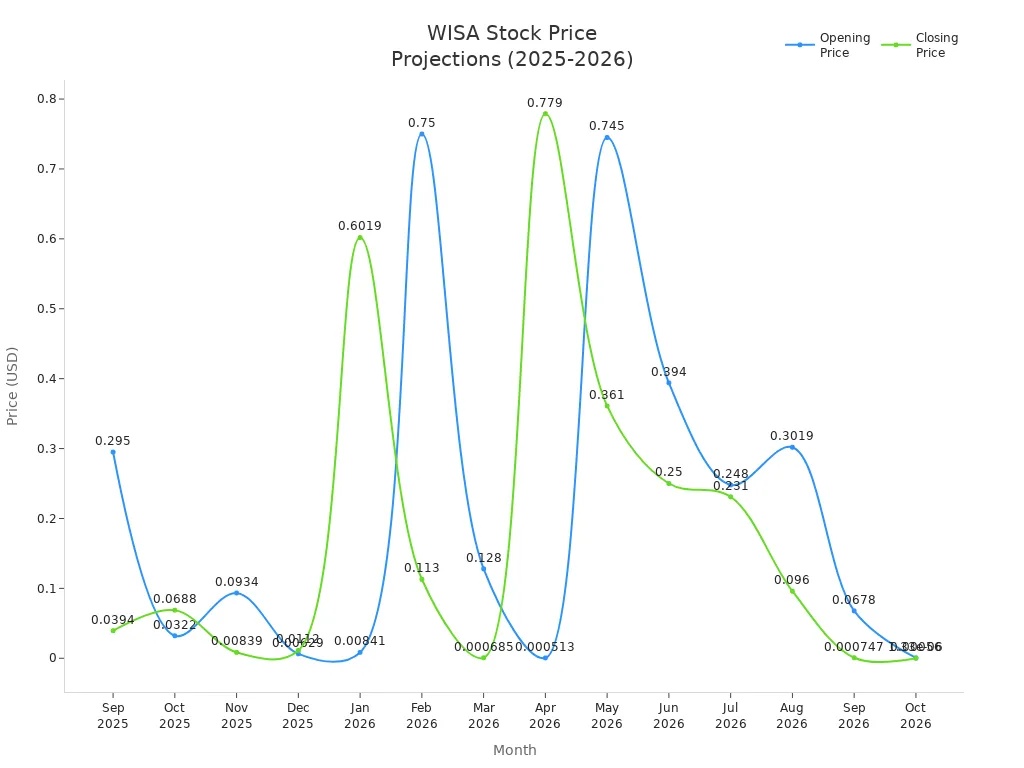

You see analysts projecting a positive path for WISA stock over the next year. CNN Business analysts set a median price target of $4.50 and a high of $5.50, which suggests over 600% growth from current levels. They expect third-quarter sales between $1.2 million and $1.6 million, with full-year sales reaching up to $15 million. The consensus remains a buy, even though the forecasted earnings per share for Q3 is -$0.22. Analysts highlight WISA’s strong partnerships, a growing patent portfolio, and the expanding home theater market as key reasons for optimism.

| Month | Opening Price (USD) | Closing Price (USD) | % Change |

|---|---|---|---|

| September 2025 | 0.295 | 0.0394 | -649.09% |

| October 2025 | 0.0322 | 0.0688 | +53.23% |

| November 2025 | 0.0934 | 0.00839 | -1013.1% |

| December 2025 | 0.00629 | 0.0112 | +43.92% |

| January 2026 | 0.00841 | 0.6019 | +98.6% |

| February 2026 | 0.750 | 0.113 | -561.88% |

| March 2026 | 0.128 | 0.000685 | -18645.98% |

| April 2026 | 0.000513 | 0.779 | +99.93% |

| May 2026 | 0.745 | 0.361 | -106.33% |

| June 2026 | 0.394 | 0.250 | -57.71% |

| July 2026 | 0.248 | 0.231 | -7.34% |

| August 2026 | 0.3019 | 0.0960 | -214.68% |

| September 2026 | 0.0678 | 0.000747 | -8978.45% |

| October 2026 | 0.000560 | 0.00000133 | -41944.34% |

Note: You should expect high volatility in price movements, with sharp swings both up and down. This pattern means you need to stay alert and review analyst updates often.

Trading Strategies

You can use momentum and event-driven trading strategies for WISA stock. Analysts and financial advisors recommend focusing on current news, such as new partnerships, product launches, and earnings reports. Tim Bohen, a lead trainer with StocksToTrade, suggests you trade based on visible momentum and avoid making long-term predictions. You should watch for sudden price changes after major announcements and be ready to act quickly. This approach helps you manage risk in a stock that moves sharply on news events.

Tip: Track upcoming events and news releases. Use stop-loss orders to protect your investments from large swings.

What to Watch

You should monitor several key events and milestones in the coming quarters:

| Key Event / Milestone | Description | Expected Timing |

|---|---|---|

| Asset Purchase Agreement Closing | Completion of asset purchase between WiSA Technologies and Data Vault Holdings | Before December 31, 2024 |

| Industry Conference Participation | Company leaders to speak at the 2024 Gaming, Media & Entertainment Virtual Conference | September 17, 2024 |

| Investor Business Update Call | Scheduled call to discuss company progress | April 3, 2025 |

| Launch of Digital Asset Platforms | New platforms using Web 3.0 technologies | Q3 2025 |

| High-Performance Supercomputing Initiative | Deployment of Datavault AI’s software with IBM WatsonX | Q3 2025 |

| Revenue Target | Full year 2026 revenue goal of $40–$50 million | Full year 2026 |

Regulatory changes, such as the GENIUS Act and STABLE Act, could impact WISA’s digital asset business. You should also watch for new data privacy and intellectual property rules, which may affect costs and compliance.

You have seen WISA’s rapid growth, bold rebranding, and strong analyst support signal a real shift in investor perception. Despite past price declines and operational challenges, the company’s high Stocklytics score and strong liquidity show cautious optimism. As you consider your next move, focus on these key points:

- Watch for the ticker change and new partnerships.

- Track liquidity and Nasdaq listing status.

- Evaluate opportunities in AI, blockchain, and data monetization.

- Stay alert to risks from competition, financing, and regulatory changes.

You can position yourself for WISA’s evolving story by staying informed and ready to act.

FAQ

What does the ticker change from WISA to ADIO mean for you?

You will see the company’s shares trade under a new symbol. This change reflects the rebranding to Datavault AI Inc. You do not need to take action if you already own shares. Your holdings will update automatically.

How does the CompuSystems acquisition affect your investment?

You gain exposure to new revenue streams. The acquisition brings event data monetization and immersive audio technology into the company’s portfolio. This move supports growth and may improve long-term value for shareholders.

Should you worry about recent insider selling?

You should watch insider activity, but not panic. Executives sometimes sell for personal reasons. Look for patterns over time. If you see consistent selling without positive news, consider reviewing your investment strategy.

What risks should you watch with WISA stock?

You face risks from high price volatility, changing regulations, and competition. The company’s financials show growth, but profitability remains a challenge. Stay alert to news about partnerships, earnings, and regulatory updates.

How can you track important WISA stock events?

You can follow company press releases, earnings calls, and financial news sites. Set alerts for major announcements. Use the company’s investor relations page for updates on partnerships, ticker changes, and new product launches.

WISA’s journey shows the power of strategic shifts and market momentum. For investors, success hinges not only on staying informed but also on having the right tools to act swiftly and efficiently. If you’re looking for a platform that simplifies your trading and investment strategy, consider a comprehensive solution.

BiyaPay offers a seamless way to fund your investments with low fees, so you can execute trades on the latest market trends without worrying about high costs. With BiyaPay, you can access global markets and invest in US and Hong Kong stocks from a single account, no overseas bank account required. This empowers you to respond to shifts like WISA’s with agility. Plus, you can easily manage and convert assets between various fiat and digital currencies, always checking the real-time exchange rates. Take control of your investment journey. Register with BiyaPay to get started.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.