- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analyzing LTCN Stock Performance and Investor Takeaways

Image Source: pexels

LTCN stock has shown notable volatility in recent months. The Grayscale Litecoin Trust offers investors a way to gain litecoin exposure without direct ownership. On August 12, 2025, LTCN closed at $10.49, up 6.82%. Technical signals, such as a positive momentum indicator and MACD of 0.48, suggest an upward trend. The trust’s price recently broke above its upper Bollinger Band, which may warn of a potential price drop. ETF conversion delays and changes in NAV continue to affect the stock.

| Metric | Value |

|---|---|

| Closing Price (Aug 12, 2025) | $10.49 |

| Price Change (Aug 12, 2025) | +$0.67 (+6.82%) |

| Support Levels | $9.9150, $9.3400, $9.0400 |

| Resistance Levels | $10.79, $11.09, $11.665 |

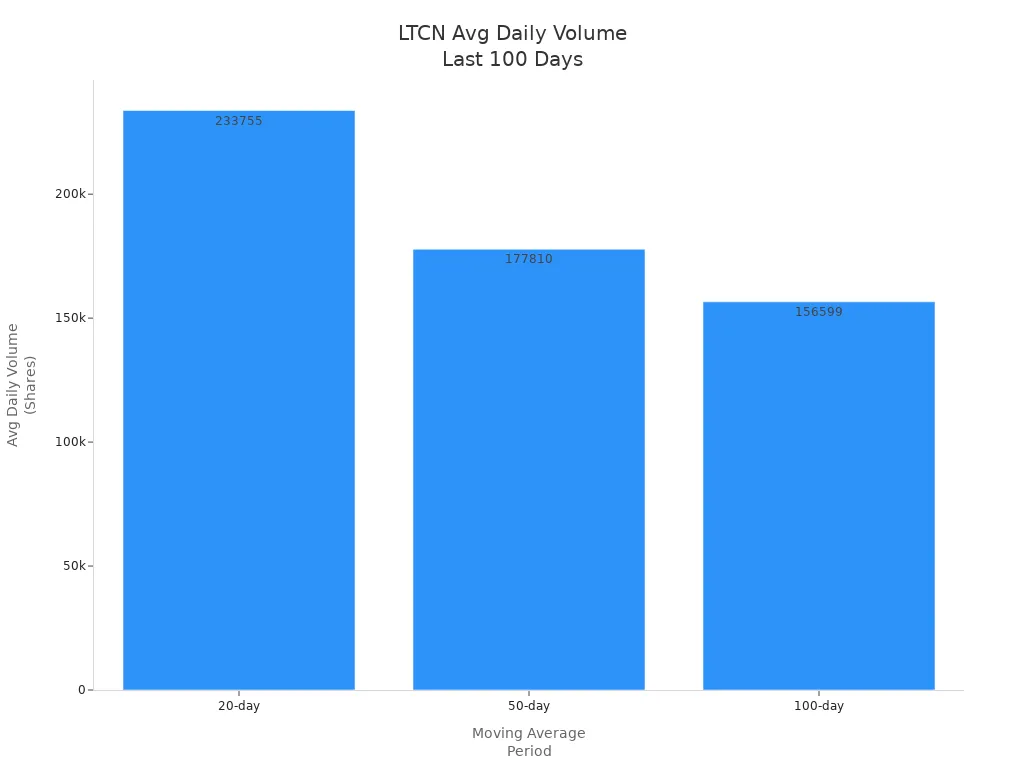

| Average Daily Volume | 156,599 to 233,755 shares |

| Volatility Indicator | Broke above upper Bollinger Band |

| Momentum Indicator | Turned positive on Aug 7, 2025 |

Key Takeaways

- LTCN stock shows strong growth with a 113% return in the past year, supported by positive technical signals like momentum and MACD.

- Volatility remains high, so investors should watch key support and resistance levels and use technical patterns to time trades.

- The Grayscale Litecoin Trust offers a safe and regulated way to invest in Litecoin without owning it directly, simplifying exposure to crypto.

- Regulatory decisions, especially the potential ETF conversion, will impact LTCN’s liquidity and price, so staying updated is crucial.

- Effective risk management, including stop-loss orders and monitoring market sentiment, helps protect investments amid LTCN’s price swings.

LTCN Stock Trends

Image Source: pexels

Price Movement

LTCN stock has demonstrated a strong rising trend over the past year. The stock price closed at $10.49 on August 12, 2025, reflecting a significant increase from earlier periods. Year-to-date and 12-month returns highlight the robust performance of LTCN compared to other crypto-related securities. The following table summarizes the latest available data:

| Security | Current Price (USD) | Daily Change (%) | 12-Month Return (%) |

|---|---|---|---|

| LTCN (Litecoin) | 130.80 (price) / 10.49 (stock) | 8.72% (price) / 6.77% (stock) | 113.0% (price) |

| GBTC | 94.06 | +0.50% | N/A |

| ETHE | 37.35 | +6.11% | N/A |

| GBAT | 2.05 | +13.89% | N/A |

| BTC | 53.02 | +0.53% | N/A |

| ETCG | 11.75 | +4.88% | N/A |

| GXLM | 42.00 | +13.21% | N/A |

| GLIV | 6.50 | +12.41% | N/A |

| GDLC | 53.69 | +0.83% | N/A |

| ZCSH | 3.40 | +4.94% | N/A |

LTCN has outperformed many peers, with a 113% return in the past 12 months. This strong rising trend supports a positive forecast for the near term. Analysts expect the price to remain above $10.34, with a high probability of holding this level if current momentum continues. The stock price often mirrors Litecoin’s movements, which show a strong correlation with Bitcoin and broader market trends.

Volatility

Volatility remains a defining feature of LTCN stock. The price frequently experiences sharp swings, reflecting both the underlying Litecoin market and investor sentiment. Technical signals have historically predicted major price movements in LTCN. These include:

- RSI approaching overbought levels, often preceding price surges.

- Bullish signals from Stochastic RSI and RSI indicators.

- Key Fibonacci retracement levels acting as support and resistance.

- Classic chart patterns, such as inverse head and shoulders or cup and handle, signaling rallies or corrections.

- Volume spikes during breakout points.

- Divergences between LTCN stock price and Litecoin price.

- Breaks above resistance levels, such as $28.50, triggering rapid advances.

- Descending triangle patterns and false breakdowns, which can indicate either bullish or bearish setups.

LTCN’s volatility also reflects broader cryptocurrency market dynamics. The stock shows an 88% correlation with Bitcoin over the past month, indicating that major moves in the crypto market often impact LTCN. At times, LTCN benefits from capital rotation into altcoins, especially when Bitcoin consolidates.

Recent Gains

LTCN stock has posted notable gains in several periods. The most significant increases occurred during the three months ended March 31, 2023, when net assets rose by 27%. This gain resulted from Litecoin’s price climbing from $70.34 to $89.75. Over the nine months ended March 31, 2023, net assets surged by 71%, driven by Litecoin’s appreciation from $51.43 to $89.75. Sponsor’s Fees, paid in Litecoin, partially offset these gains. The primary driver of these increases was the strong rising trend in Litecoin’s price.

External factors, such as government regulation, security incidents, and global economic uncertainty, also influence LTCN’s performance. Institutional anticipation of a Litecoin ETF approval and Litecoin’s classification as a commodity by the CFTC have contributed to a positive outlook. Whale activity and on-chain accumulation at key support levels further support the strong rising trend in LTCN.

Note: Technological upgrades, such as the launch of Layer-2 smart contracts on Litecoin, are expected to enhance LTCN’s appeal and price momentum. These innovations align with trends in the broader crypto market and may provide additional upside for investors.

LTCN’s recent gains, combined with technical and fundamental signals, suggest a strong rising trend and a positive forecast for the stock. Investors should monitor price levels, technical indicators, and broader market developments to identify potential opportunities and risks.

Grayscale Litecoin Trust Overview

Structure

The grayscale litecoin trust provides investors with a regulated way to gain exposure to litecoin without direct ownership. The trust issues shares that reflect the price of litecoin, allowing investors to participate in price movements through the over-the-counter market. Investors do not need to manage private keys or conduct transactions on the litecoin network. The grayscale litecoin trust holds litecoin on behalf of investors, with a custodian responsible for secure storage. Private keys are generated offline, encrypted, split into shards, and stored in secure vaults across different locations. This process ensures the safety of litecoin assets within the grayscale litecoin trust.

Shares of the grayscale litecoin trust can be created or redeemed in large blocks called “Baskets” by authorized participants. This mechanism supports liquidity and keeps share prices aligned with the underlying litecoin value. The trust values litecoin using a composite index from several digital asset trading platforms. This approach provides transparent and fair pricing for all investors. The grayscale litecoin trust structure removes the complexities of direct litecoin ownership and offers a convenient investment vehicle for those seeking exposure to litecoin’s price movements.

Note: Investors who choose the grayscale litecoin trust avoid the risks associated with handling private keys and the technical challenges of managing litecoin wallets.

- Investors benefit from:

- Regulated exposure to litecoin

- Secure custody of assets

- Transparent pricing based on market indices

- Simplified investment process

Institutional Ownership

Institutional interest in the grayscale litecoin trust has remained steady over the past year. Key holders such as Horizon Kinetics Asset Management increased their shares by approximately 5% between March and June 2025. Atlas Capital Advisors maintained a consistent position during the same period. The following table summarizes recent institutional holdings:

| Institution | Date | Shares Held | Change from Previous Period |

|---|---|---|---|

| Horizon Kinetics Asset Management | Mar 31, 2025 | 515,220 | N/A |

| Horizon Kinetics Asset Management | Jun 30, 2025 | 542,480 | +5% |

| Atlas Capital Advisors | Mar 31, 2025 | 100 | N/A |

| Atlas Capital Advisors | Jun 30, 2025 | 100 | 0% |

Institutional ownership of the grayscale litecoin trust shows limited change, indicating stable interest from major investors. Regulatory filings confirm that the number of institutional holders and ownership percentages have not shifted significantly. This stability suggests that institutions view the grayscale litecoin trust as a reliable vehicle for litecoin exposure.

LTCN Technical Analysis

MACD and RSI

LTCN has shown strong signals in recent technical analysis. The MACD stands at 0.48, which indicates a positive short-term trend. This value suggests that buyers have gained control and that the stock may continue to rise if momentum holds. The RSI currently reads 64.23. This level approaches the overbought zone but does not yet signal an immediate reversal. Traders often watch for RSI values above 70 to indicate overbought conditions. At 64.23, LTCN remains in a healthy range, supporting the ongoing trend.

The combination of a positive MACD and a high RSI points to continued strength. These indicators often work together to confirm the direction of the trend. When both show bullish signals, investors may expect further gains. However, a sudden spike in RSI could warn of a short-term pullback. Regular analysis of these indicators helps investors make informed decisions about entry and exit points.

Momentum

Momentum plays a key role in understanding LTCN’s price action. On August 7, 2025, the momentum indicator moved above zero. This shift marks a significant change in the trend. Historically, when momentum rises above zero, LTCN enters an uptrend. Traders often view this as a buying opportunity, expecting the stock to increase in value in the following days.

- The momentum indicator for LTCN rose above zero on August 7, 2025.

- This rise signals that LTCN has entered an uptrend.

- Historically, when the momentum indicator moves above zero, it suggests the start of a new upward price trend.

- Traders often interpret this as a buying opportunity, expecting the stock to increase in value in the following days.

A positive momentum reading confirms that buyers have taken control. This indicator often leads to increased trading volume and higher prices. Investors should monitor momentum closely, as a drop below zero could signal a reversal or a period of consolidation. Consistent analysis of momentum helps identify the strength of the current trend and potential shifts in market sentiment.

Support and Resistance

Support and resistance levels provide important guidance for LTCN investors. Recent technical analysis highlights several key areas:

- Major support and resistance pivot at $7, confirmed by Fibonacci retracement as the golden zone, with expected consolidation around this level for about 5 weeks.

- Support zone at $18-$20, previously resistance, now acting as support, supported by bullish RSI divergence and volume patterns.

- Resistance near the $30 local top, with a potential correction down to $15.

- Technical patterns such as a giant cup and handle and bull pennant formations indicate potential significant upside beyond current levels.

- Price action shows a pattern of upward movement followed by sideways consolidation, with a new trading range expected in 2025.

The $7 level acts as a critical support level, where buyers have historically stepped in to prevent further declines. The $18-$20 range, once a resistance area, now serves as a strong support zone. This shift often occurs when a stock breaks above resistance and then retests it as support. The $30 mark represents a major resistance level. If LTCN approaches this price, traders may expect increased selling pressure and possible corrections.

Technical analysis also reveals patterns like the cup and handle and bull pennant. These formations suggest that LTCN could see significant gains if it breaks above resistance. Investors should watch for consolidation near support levels, as these periods often precede strong moves in either direction. Regular review of support and resistance helps investors manage risk and identify optimal trading opportunities.

Note: Support and resistance levels can change as new price data emerges. Investors should update their analysis frequently to reflect the latest market conditions.

LTCN and Litecoin Relationship

Litecoin Price Impact

Litecoin plays a central role in shaping the performance of the grayscale litecoin trust. When litecoin experiences a surge, the grayscale litecoin trust often reflects this movement. The trust tracks litecoin’s price through a composite index, which means that any significant change in litecoin’s value can quickly influence the trust’s share price. For example, when litecoin moved above its 50-day and 200-day moving averages, the grayscale litecoin trust also saw a notable increase in its price. This pattern shows a strong correlation between litecoin and the trust.

Investors watch litecoin’s moving averages to predict possible trends in the grayscale litecoin trust. A sustained move above key averages often signals continued strength. The grayscale litecoin trust responds to these signals, making it important for investors to monitor litecoin’s technical indicators. When litecoin’s price rises, the trust usually benefits. However, if litecoin faces a sharp decline, the grayscale litecoin trust may also see a drop in share price.

Note: The grayscale litecoin trust does not hold any other assets. Its value depends entirely on litecoin’s market performance.

NAV Premium/Discount

The grayscale litecoin trust trades at a price that can differ from its net asset value (NAV). This difference is called the NAV premium or discount. When demand for the grayscale litecoin trust is high, the share price may trade above the NAV, creating a premium. If demand falls, the share price can drop below NAV, resulting in a discount.

Recently, the NAV discount for the grayscale litecoin trust has narrowed. This change happened as more investors became aware of reduced arbitrage opportunities. In the past, traders could buy litecoin and redeem shares of the grayscale litecoin trust to profit from the price gap. Now, with stricter redemption rules and delays in ETF conversion, these opportunities have decreased.

| Date | NAV ($) | Share Price ($) | Premium/Discount (%) |

|---|---|---|---|

| Aug 1, 2025 | 10.20 | 10.49 | +2.8 |

| Jul 1, 2025 | 9.85 | 9.90 | +0.5 |

| Jun 1, 2025 | 9.60 | 9.30 | -3.1 |

Investors should track the NAV premium or discount before making decisions. A large premium may signal overvaluation, while a discount could offer a buying opportunity. The grayscale litecoin trust’s NAV relationship with litecoin remains a key factor for investors seeking exposure to litecoin’s price movements.

Market Context

Regulatory Developments

Recent regulatory actions have shaped the crypto trust market. The U.S. SEC postponed its decision on Grayscale’s proposal to convert LTCN into a spot ETF until October 10, 2025. This delay reflects ongoing caution in the market. The SEC reviews new features, such as staking in crypto ETFs, which shows a careful but evolving approach. Approval of in-kind creation and redemption mechanisms aims to improve efficiency and reduce market distortions. The SEC’s stance on LTCN’s ETF proposal signals broader trends in the market, balancing investor protection with innovation. The shrinking NAV discount for LTCN suggests that participants have already priced in the potential approval, which may limit the impact of a final decision.

Note: Regulatory changes often influence market sentiment and can lead to increased volatility. Investors should monitor updates from the SEC and other authorities to understand how new rules may affect LTCN and similar products.

ETF Conversion

The SEC accepted Grayscale Investments’ application to convert the Grayscale Litecoin Trust (LTCN) into a spot ETF on February 6, 2025. This action started the formal review process. Based on previous cases, such as Canary Capital’s spot Litecoin ETF filing, the approval decision for Grayscale’s ETF conversion will likely occur by late 2025. Analysts estimate a high probability of approval within the year. If approved, the ETF conversion will improve LTCN’s market accessibility, liquidity, and visibility. This change could attract more investors and institutions, boosting LTCN’s market price. Grayscale manages $127.4 million in assets and plans to list the ETF on NYSE Arca. The conversion is expected to open new trading channels and increase Litecoin’s market presence. However, price volatility and tracking errors remain important risk factors.

Economic Risks

Investors face several risks in the current market. Global events, such as changes in monetary policy, geopolitical tensions, and regulatory shifts, can affect LTCN’s price. The crypto market remains sensitive to news about China, Hong Kong banks, and major exchanges. Regulatory changes in the U.S. and abroad may introduce new compliance requirements or restrictions. Market participants should consider the risk of sudden price swings, liquidity shortages, and tracking errors. Economic uncertainty can lead to rapid changes in investor sentiment, impacting LTCN and the broader market. Careful monitoring of market conditions and regulatory updates helps investors manage risk and make informed decisions.

Investor Strategies

Image Source: pexels

Entry and Exit Points

Investors often look for clear signals before they buy or sell LTCN stock. Technical and fundamental signals help guide these decisions. Chart patterns such as the cup and handle or inverse head and shoulders often indicate a potential buy signal. A descending triangle pattern may warn of a possible sell signal if support fails. Breakouts above resistance levels, like $28.50 or $124.2, confirmed by candle closes and strong trading volume, often provide reliable buy signals. Momentum indicators, such as RSI near overbought regions or Stochastic RSI, help traders time their entries and exits. Elliott Wave patterns, especially the 1-2, 1-2 wave, can signal the start of a strong rally, making it a good time to buy or hold.

| Signal Type | Specific Signals / Patterns | Relevance |

|---|---|---|

| Technical Patterns | Cup and Handle, Inverse Head/Shoulders | Indicate bullish or bearish setups |

| Fibonacci Levels | 0.236, 0.382, 0.618, 0.7, 0.786 | Identify support/resistance for reversals |

| Momentum Indicators | RSI, Stochastic RSI | Signal price exhaustion or continuation |

| Price Action | Breakouts, candle closes, volume | Confirm trend continuation or reversal |

| Fundamental | Litecoin price, NAV premium/discount | Affect LTCN price and timing |

Traders should wait for confirmation before entering a trade. A candle close above resistance or a volume-backed breakout often signals a strong buy. Monitoring Litecoin’s price and regulatory news, such as Grayscale’s ETF conversion, also helps refine entry and exit points for LTCN trade ideas.

Risk Management

Managing risk is essential in LTCN trading. Investors should use stop-loss orders near recent swing lows, such as around $82.00, to limit losses. Trailing stops help lock in profits as the stock price rises. Avoiding trading during volatile news releases reduces exposure to unpredictable moves. Entering trades after confirmed breakouts above moving averages, like a breakout above $86.00, increases the chance of success. Setting profit targets at prior consolidation zones, such as near $92.00, helps plan exits. Adjusting stop-loss levels based on position size and risk tolerance is important. Combining technical signals with disciplined stop-loss placement forms a strong trading strategy.

Tip: Always review market conditions and adjust your risk management plan as needed.

Sentiment

Investor sentiment for LTCN remains mostly positive. Social media posts often show bullish expectations, with users sharing technical charts and highlighting Litecoin’s resilience. High trading volume supports this sentiment, showing strong interest in the stock. While direct sentiment data for LTCN is limited, Litecoin’s positive outlook often influences LTCN. Traders use this information to decide whether to buy or sell. Monitoring both social media and trading volume helps investors gauge market mood and adjust their buy or hold decisions.

LTCN stock has shown strong trends and positive technical signals, but volatility remains high. Investors should watch for changes in market risk, company-specific risk, emotional risk, lack of diversification, and liquidity risk. Ongoing research can help improve outcomes by enabling investors to:

- Understand the fundamentals of Grayscale Litecoin Trust.

- Monitor market trends and industry news.

- Review company performance and financial updates.

- Apply risk management strategies, such as stop-loss orders and portfolio diversification.

- Regularly check investment goals for alignment with risk tolerance.

- Avoid emotional reactions to short-term moves and focus on long-term results.

Investors should only buy after careful analysis and ongoing monitoring. Professional advice and further research remain essential for managing risk and making informed decisions.

FAQ

What is the Grayscale Litecoin Trust (LTCN)?

The Grayscale Litecoin Trust (LTCN) allows investors to gain exposure to Litecoin without holding the cryptocurrency directly. The trust holds Litecoin on behalf of investors and trades shares over the counter in USD.

How does LTCN track Litecoin’s price?

LTCN tracks Litecoin’s price using a composite index from several digital asset trading platforms. The trust’s share price reflects changes in Litecoin’s market value, but it may trade at a premium or discount to its net asset value (NAV).

What risks should investors consider with LTCN?

Investors face risks such as price volatility, regulatory changes, and tracking errors. Global events, including those in China and actions by Hong Kong banks, can also impact LTCN’s price. Careful monitoring and risk management remain important.

How does the ETF conversion affect LTCN?

If approved, the ETF conversion will increase LTCN’s liquidity and accessibility. The conversion could attract more institutional investors and may reduce the NAV discount. Approval depends on regulatory decisions in the United States.

Why does LTCN sometimes trade at a premium or discount?

LTCN’s share price can differ from its NAV due to supply and demand. Limited redemption options and delays in ETF conversion can widen the premium or discount. Investors should check the latest USD exchange rates for accurate valuation.

The analysis of LTCN highlights a crucial point for modern investors: managing volatility and seizing opportunities requires a platform that’s both nimble and powerful. While LTCN offers exposure to a single digital asset, your broader portfolio likely includes various cryptocurrencies, stocks, and other assets. Juggling these across different platforms can be inefficient and costly.

BiyaPay simplifies this complexity. With our platform, you can convert between various fiat and digital currencies with ease, always checking real-time exchange rates for optimal value. Our low remittance fees, starting at just 0.5%, make funding your accounts more cost-effective. Plus, you can access global markets and invest in US and Hong Kong stocks without needing a separate overseas bank account. Ready to consolidate your investments and trade more efficiently? Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.