- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Canbas Stock in Focus as Market Volatility Rises

Image Source: unsplash

Market volatility has created significant shifts in canbas stock performance. Investors now analyze market trends to make informed decisions. Recent growth in the Canvas products sector has sparked new interest among market participants. Investor sentiment continues to fluctuate, shaping short-term opportunities. Those tracking canbas stock should focus on actionable data and timely insights for better portfolio management.

Key Takeaways

- Canbas stock is influenced by market volatility, sector growth, and investor sentiment, making it important to track these factors closely.

- The canvas products market is growing steadily, driven by technology, innovation, and rising demand, which supports Canbas stock’s potential.

- Monitoring stock price movements, trading volume, and volatility helps investors spot opportunities and manage risks effectively.

- Macroeconomic factors like inflation, interest rates, and GDP growth significantly impact Canbas stock performance and should guide investment decisions.

- Using technical analysis, diversification, and risk management strategies can improve timing and protect investments during market fluctuations.

Market Trends

Image Source: pexels

Volatility Impact

Market volatility has played a significant role in shaping stock prices for companies like Canbas. Investors have seen rapid changes in value as global events and economic data influence trading decisions. The technology sector, which includes Canbas, has experienced strong momentum. AI-driven predictions and robust earnings reports have improved investor sentiment. For example, Zhibao Technology Inc. reported a 265% year-on-year revenue surge in the fourth quarter of 2023, reaching $22.1 billion. This performance, despite lower sales in China, has encouraged a more optimistic outlook among traders. The use of advanced forecasting tools has also contributed to positive sentiment, which often leads to higher stock prices.

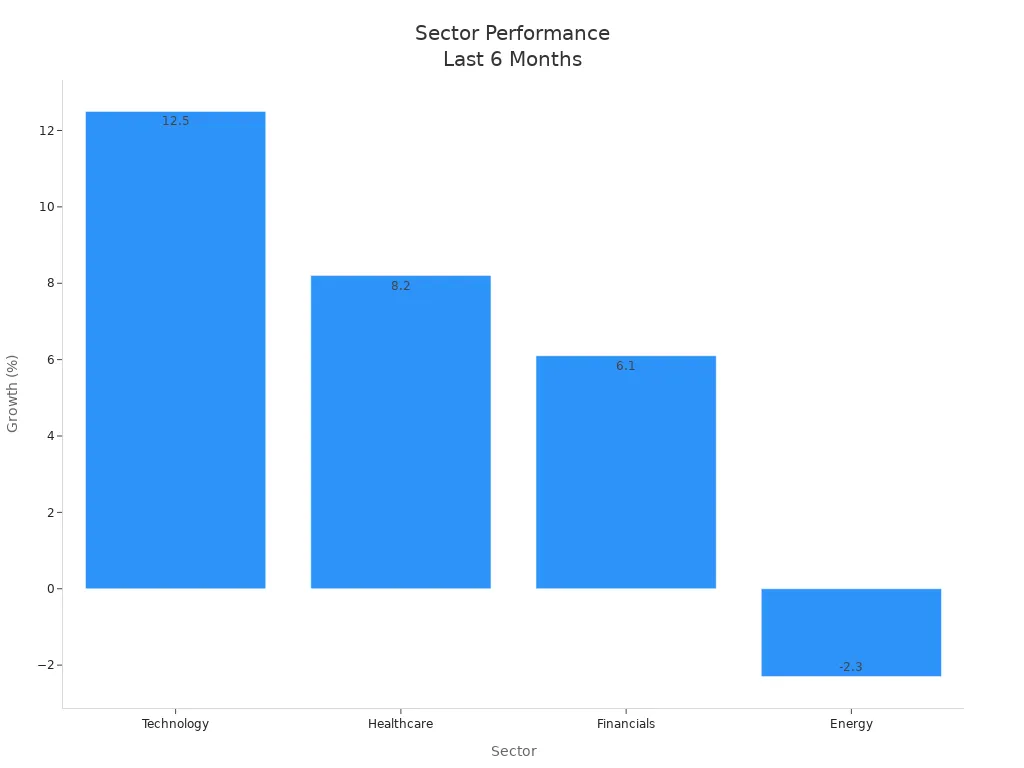

Recent data shows that the technology sector has grown by approximately 12.5% over the last six months. This growth outpaces other sectors such as healthcare and financials. The following table highlights recent sector performance:

| Sector | Recent Performance (Last 6 Months) | Key Players |

|---|---|---|

| Technology | +12.5% | Apple, Microsoft, Google |

| Healthcare | +8.2% | Pfizer, Johnson & Johnson, Moderna |

| Financials | +6.1% | JPMorgan Chase, Bank of America, Visa |

| Energy | -2.3% | ExxonMobil, Chevron, BP |

Sector Growth

The Canvas products market continues to expand, which supports the upward movement of stock prices for related companies. In 2024, the market size reached USD 4.1 billion. Projections suggest it will grow to USD 6.2 billion by 2033, with a compound annual growth rate of 5%. Technological advancements, increased infrastructural investments, and rising demand for products like tents, awnings, and footwear drive this expansion. Asia Pacific leads the region due to large-scale fabrication and raw material availability, especially in China.

| Aspect | Details |

|---|---|

| Market Size (2024) | USD 4.1 billion |

| Projected Market Size (2033) | USD 6.2 billion |

| CAGR (2025-2033) | 5% |

| Key Growth Drivers | Technological advancements, infrastructural investments, rising demand in tents, awnings, footwear, bags, apparel |

| Regional Leader | Asia Pacific (notably China) |

| Major Companies | Bainbridge International, Challenge Sailcloth, Whaleys Bradford, Serena & Lily, others |

| Stock Impact | Positive growth trends likely to favor companies involved |

These market trends suggest that stock prices for Canbas and similar companies could benefit from ongoing sector growth. Investors should monitor these factors closely, as shifts in demand and innovation often lead to changes in stock prices.

Canbas Stock Performance

Image Source: pexels

Price Movements

Canbas stock has experienced notable shifts in stock prices over recent months. Investors have observed both upward and downward trends as market volatility increases. Stock prices for Canbas stock often respond quickly to changes in sector momentum and global economic signals. Analysts track daily closing stock prices to identify patterns and potential turning points.

Stock prices for Canbas stock reached a peak in early 2024, reflecting strong demand in the Canvas products sector. This surge followed positive earnings reports and increased investor confidence. However, stock prices also faced downward pressure during periods of heightened uncertainty. For example, when global economic data signaled slower growth, stock prices for Canbas stock declined as investors sought safer assets.

A review of historical stock prices shows that Canbas stock tends to move in line with sector trends. When the technology sector outperforms, stock prices for Canbas stock often rise. Conversely, when sector momentum slows, stock prices may fall. Investors use moving averages and technical indicators to monitor these shifts.

Note: Monitoring stock prices daily can help investors identify short-term opportunities and risks.

The following table summarizes recent price movements for Canbas stock:

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| 2024-06-01 | 52.10 | 54.30 | 55.00 | 51.80 |

| 2024-06-02 | 54.40 | 53.90 | 55.20 | 53.20 |

| 2024-06-03 | 53.80 | 52.70 | 54.00 | 52.10 |

| 2024-06-04 | 52.80 | 53.50 | 54.10 | 52.60 |

| 2024-06-05 | 53.60 | 54.10 | 54.80 | 53.20 |

Stock prices for Canbas stock continue to reflect both sector growth and broader market sentiment. Investors should remain alert to sudden changes in stock prices, as these can signal shifts in market dynamics.

Volume and Volatility

Trading volume and volatility play a crucial role in understanding the behavior of stock prices for Canbas stock. High trading volume often indicates strong investor interest and can lead to larger price swings. Low volume may signal less conviction among traders, resulting in more stable stock prices.

Volatility measures the degree of variation in stock prices over time. Investors use several statistical tools to assess volatility. Historical volatility, calculated as the standard deviation of stock price returns over a set period, quantifies how much stock prices have fluctuated in the past. A higher historical volatility means stock prices have experienced larger swings, which signals greater uncertainty and risk. Lower historical volatility suggests more stable stock prices.

Implied volatility, derived from options prices, reflects what the market expects for future volatility in stock prices. This measure helps investors gauge potential risk and prepare for possible changes in stock prices. Other related metrics, such as variance and standard deviation, also provide insights into the magnitude of price fluctuations.

Tip: Investors should use both historical and implied volatility to get a complete picture of risk. Historical volatility looks backward, while implied volatility offers a forward-looking view.

Recent data shows that Canbas stock has seen periods of elevated volatility. During times of market stress, stock prices for Canbas stock can move sharply in either direction. Investors often adjust their strategies based on these changes in volatility.

A summary of recent trading volume and volatility for Canbas stock:

| Date | Trading Volume (Shares) | Historical Volatility (%) | Implied Volatility (%) |

|---|---|---|---|

| 2024-06-01 | 1,200,000 | 28 | 32 |

| 2024-06-02 | 1,050,000 | 27 | 31 |

| 2024-06-03 | 1,300,000 | 29 | 33 |

| 2024-06-04 | 1,100,000 | 26 | 30 |

| 2024-06-05 | 1,250,000 | 28 | 32 |

Stock prices for Canbas stock remain sensitive to shifts in trading volume and volatility. Investors should monitor these metrics closely to manage risk and identify potential opportunities.

Drivers and Risks

Macroeconomic Factors

Macroeconomic indicators shape the outlook for canbas stock. Investors monitor inflation, GDP growth, interest rates, and exchange rates to assess risk and opportunity. Each factor influences stock prices in unique ways. High inflation reduces real returns and weakens the value of the USD, making stocks less attractive. Strong GDP growth signals a healthy economy and supports higher stock prices. Rising interest rates increase borrowing costs and shift investor preference toward safer assets, which can increase market volatility. Exchange rate fluctuations create uncertainty and may discourage long-term investment, especially when investors seek stability in assets like the USD. The table below summarizes these impacts:

| Macroeconomic Indicator | Impact on Stock Performance (including Canbas stock) |

|---|---|

| Inflation | High inflation reduces real returns and depreciates the USD, lowering investment attractiveness and potentially harming stock performance. |

| GDP Growth | Reflects overall economic strength; higher GDP growth generally supports stronger stock performance by boosting investment levels. |

| Interest Rates | High interest rates increase borrowing costs, reduce investments in safer instruments, and push investors toward riskier assets like stocks, increasing volatility. |

| Exchange Rates | Fluctuations create uncertainty, reduce investor confidence, discourage long-term investments, and encourage shifts to safe-haven assets, affecting stock market stability. |

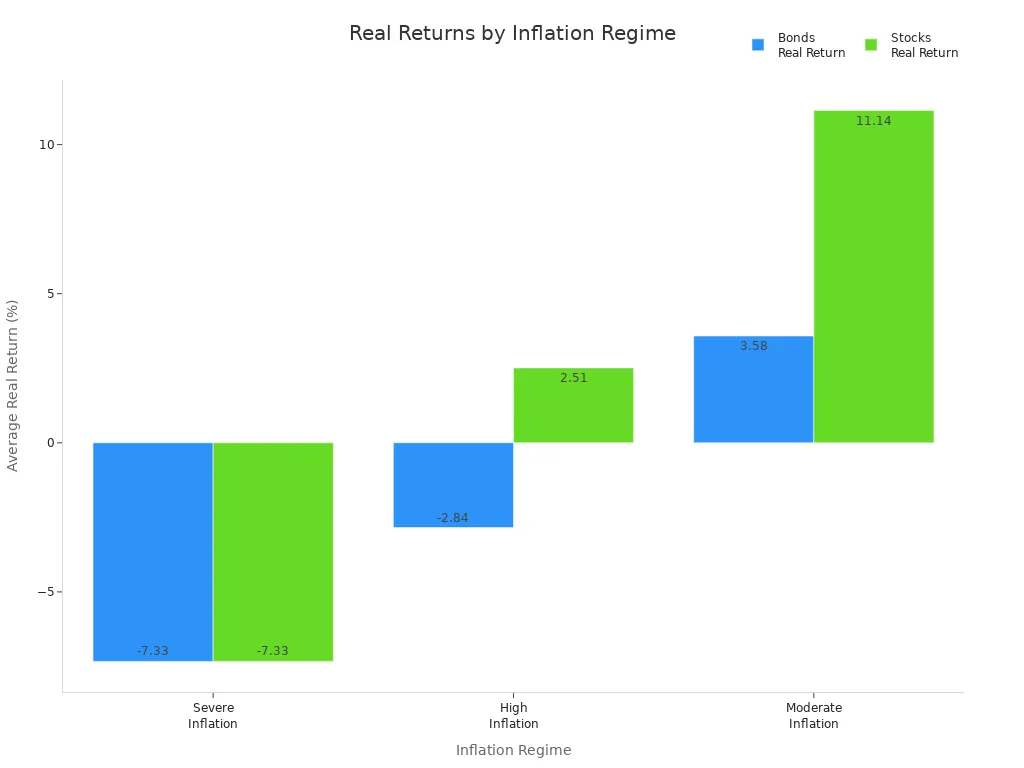

Inflation and interest rates have played a major role in recent stock valuations. When inflation rises, central banks often respond by increasing interest rates. This makes bonds and cash more attractive, raising the risk for stocks and lowering their valuations. However, if central banks keep rates low despite inflation, stocks can act as a hedge. For example, after World War II, the Federal Reserve kept rates low during inflation, and stocks performed well. Today, negative real interest rates make equities more appealing, as fixed income returns remain unattractive. The relationship between inflation, interest rates, and stock returns is complex. The chart below shows how bonds and stocks performed during different inflation periods:

Active investment strategies, such as focusing on shareholder yield and price momentum, have historically outperformed during inflationary periods. Investors should consider these macroeconomic factors when evaluating the financial performance of companies.

Industry Trends

Several industry trends drive the outlook for companies in the canvas products sector. Japan’s aging population, with 29% aged 65 or older, increases demand for ergonomic and lightweight canvas goods. Elderly consumers value practicality and eco-friendly products. Minimalist design, rooted in Japanese culture, boosts the popularity of simple and functional canvas items in fashion and homeware. Innovation in smart textiles and weather-resistant materials supports growth, especially in outdoor and industrial markets. The smart fabric market in Japan is expected to grow at a 10.1% compound annual rate.

Japan exports premium canvas products and limited-edition lifestyle goods to Western markets, especially North America. This trend enhances local production and international visibility. Corporate sustainability initiatives, such as using reusable canvas bags to reduce plastic waste and align with Sustainable Development Goals (SDGs), drive bulk orders for branded canvas products.

- Japan’s aging population drives demand for ergonomic, durable, and lightweight canvas products.

- Minimalist design trends support the popularity of simple and functional canvas goods.

- Innovation in smart textiles and weather-resistant materials fuels growth in outdoor and industrial segments.

- Exports of premium canvas products to North America increase international visibility.

- Corporate sustainability initiatives boost demand for reusable canvas bags and branded products.

These trends indicate strong and growing demand for high-quality canvas products. Companies that adapt to these shifts can gain a competitive edge.

Investor Sentiment

Investor sentiment plays a key role in stock price movements. Positive sentiment often leads to higher trading volumes and rising prices, while negative sentiment can trigger sell-offs and increased volatility. Investors watch for signals such as earnings reports, sector growth, and macroeconomic news to gauge market mood.

Shifts between growth and value stocks also impact performance. When investors expect strong economic growth, they favor growth stocks with high potential returns. In uncertain times, they move toward value stocks, which offer stability and lower risk. Canbas stock often reflects these shifts, as investors adjust their portfolios based on changing market conditions.

Note: Monitoring investor sentiment and sector rotation helps investors anticipate price movements and manage risk.

Understanding the drivers and risks in the current market environment allows investors to make informed decisions. By tracking macroeconomic factors, industry trends, and sentiment, investors can better position themselves for future opportunities.

Opportunities for Canbas Stock

Entry and Exit Points

Investors seeking opportunities in canbas stock should focus on identifying optimal entry and exit points. Technical indicators provide valuable guidance for timing trades. Candlestick patterns such as doji, hammer, engulfing, and morning star often signal changes in market sentiment and potential reversals in stock prices. Chart formations like head and shoulders, double tops, and double bottoms help traders spot trend reversals. Triangle patterns—ascending, descending, and symmetrical—suggest possible breakouts, with confirmation coming when stock prices move beyond trendlines.

Effective entry points often rely on trend lines, moving averages, and support and resistance levels. Confirmation signals, including volume spikes and trend reversals on higher timeframes, help validate decisions and reduce premature trades. Investors manage exit points by setting stop-loss orders, trailing stops, and profit targets based on technical indicators and overbought or oversold conditions. Adjusting entry and exit strategies according to market conditions and using multiple timeframes provides a broader perspective. Combining technical analysis with fundamental research and market news enhances timing and decision-making.

Tip: Use a combination of technical indicators and market news to improve the accuracy of entry and exit points for stock prices.

Risk Management

Managing risk is essential for investors holding canbas stock, especially during periods of market volatility. Aligning investment strategy with personal risk tolerance, financial goals, and time horizon helps guide decisions. Understanding historical patterns of stock prices allows investors to anticipate and manage risks more effectively.

Diversification across asset classes and sectors reduces the impact of downturns in any single market. Investors tailor asset allocation to balance growth potential and risk. Regular reviews and adjustments ensure strategies remain aligned with changing financial circumstances and market conditions.

Recommended risk management strategies include:

- Use dollar-cost averaging by purchasing a fixed amount of stock regularly to reduce risk from market timing.

- Employ buy-write strategies by combining stock purchases with selling call options to generate income and lower risk.

- Hedge portfolios by buying put options to protect against declines in stock prices.

- Apply value investing principles by focusing on undervalued stocks with strong fundamentals.

- Diversify investments and monitor sectors to balance risk and opportunity.

- Set clear investment plans and practice regular portfolio rebalancing.

- Implement stop-loss orders to limit downside risk by predefining exit points.

Common risks include market risk, geopolitical risk, inflationary risk, liquidity risk, counter-party risk, operational risk, and interest rate risk. Investors mitigate these risks by diversifying, using stop-loss orders, assessing counterparties, hedging, maintaining liquidity, and actively managing portfolios.

Market trends and rising volatility continue to shape Canbas stock’s outlook. The sector is projected to grow at a 9.5% annual rate through 2033, supporting long-term opportunities. Investors benefit from strategies such as diversification, technical analysis, and risk management. They should monitor company fundamentals, sector performance, and market sentiment using reliable sources like analyst reports and real-time data feeds. Adopting advanced analytics and AI tools can further enhance decision-making and help navigate changing market conditions.

FAQ

What factors influence Canbas stock price the most?

Canbas stock price responds to sector growth, macroeconomic indicators, and investor sentiment. Market volatility and global events also play key roles. Investors should monitor these factors for timely decisions.

How does market volatility affect Canbas stock?

Market volatility increases price swings for Canbas stock. Investors may see rapid gains or losses. High volatility often signals uncertainty, which can create both risks and opportunities.

Why is sector growth important for Canbas stock?

Sector growth drives demand for canvas products. Rising market size and innovation support higher stock prices. Companies that adapt to new trends often outperform competitors.

What risk management strategies work best for Canbas stock?

Investors use diversification, stop-loss orders, and regular portfolio reviews. These strategies help reduce losses during market downturns. Combining technical analysis with fundamental research improves risk control.

Where can investors find current USD exchange rates?

Investors can check XE.com for real-time USD exchange rates. This helps when evaluating international investments or comparing prices across markets.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.