- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

CTL to Lumen Technologies Stock Symbol Change and Its Impact on Your Portfolio

Image Source: pexels

The stock symbol ctl changed to lumen technologies after centurylink announced a name change and rebranding. Investors who held centurylink shares saw no impact on the number of shares or their value. The ticker update did not require any action from investors. Centurylink aimed for a strategic transformation with the rebranding, focusing on new technology solutions.

Key Takeaways

- The stock symbol changed from CTL to LUMN on September 18, 2020, with no impact on share ownership or value.

- Investors did not need to take any action; brokerage firms updated the ticker automatically without fees or changes to dividends.

- Lumen Technologies rebranded to focus on advanced technology, fiber networks, and growth in the digital sector.

- The market reacted positively to the change, with a 2% stock price rise on announcement day and cautious optimism from analysts.

- Financially, Lumen is improving net losses and focusing on fiber infrastructure, but investors should watch revenue trends, debt levels, and company updates closely.

Ticker Change Impact

Image Source: unsplash

Shares and Portfolio

The transition from stock symbol ctl to lumen technologies (LUMN) took place on September 18, 2020. Brokerage firms notified investors about this change before it happened. They explained that the company would now operate under the name Lumen Technologies, but the legacy CenturyLink brand would still exist for certain services. The stock symbol ctl had represented CenturyLink for many years. When the company adopted the new ticker, investors did not lose any shares. The number of shares in each investor’s portfolio stayed the same. The value of those shares did not change because of the ticker update.

Investors often worry that a change in a stock symbol could affect their holdings. In this case, the stock symbol ctl simply became LUMN. The underlying stock remained the same. The price of the stock did not drop because of the change. In fact, the market responded positively, and the stock price rose by about 2% on the day of the announcement. This increase showed that investors felt optimistic about the company’s new direction.

Brokerage communications made it clear that the name change and ticker update were part of a larger plan. Lumen Technologies wanted to focus on advanced technology and fiber-optic networks. The company aimed to position itself as a leader in the Fourth Industrial Revolution. The stock symbol ctl had become linked to older telecom services, while LUMN signaled a shift toward modern solutions.

Investor Actions

Investors did not need to take any action because of the ticker change. Brokerage firms reassured investors that their shares would automatically update in their accounts. The change from stock symbol ctl to LUMN happened behind the scenes. Investors could see the new ticker in their portfolios after September 18, 2020. No forms or special steps were required.

- Investors did not need to sell or buy shares.

- No fees or charges resulted from the ticker update.

- The change did not affect dividends or voting rights.

The company and brokerage firms both stressed that the ticker change was symbolic. It reflected a new focus for Lumen Technologies but did not alter the fundamentals of the stock. Investors could continue to track their shares under the new ticker, LUMN, and watch for future updates about the company’s strategy and performance.

Rebranding Reasons

Strategic Focus

Lumen Technologies launched its rebranding to signal a new growth chapter beyond the legacy of CenturyLink. The company wanted to lead enterprises through the fourth industrial revolution. Leaders at Lumen Technologies described this shift as a commitment to advancing technology and furthering human progress. The rebranding highlights the company’s focus on helping customers unlock their potential using a powerful technology platform, skilled people, and strong partnerships.

The company outlined several key areas for this transformation:

- Adaptive networking, which offers hybrid solutions that respond to changing data and application needs.

- Edge cloud and IT agility, which moves data and workloads closer to customers for faster access.

- Connected security, which uses global threat intelligence to protect data and applications.

- Communications and collaboration, which keeps customers connected and productive anywhere.

Lumen Technologies placed special emphasis on its fiber network. The rebranding aimed to move away from the old CenturyLink image and highlight the advanced fiber infrastructure at the company’s core. The name “Lumen,” which means “light” in Latin, reflects this focus on fiber and technological advancement.

New Direction

CenturyLink made the official announcement about the rebranding on September 14, 2020. The company stated that the legal name change to Lumen Technologies, Inc. would happen after all legal and regulatory steps were complete. The stock ticker symbol changed from CTL to LUMN at the start of trading on September 18, 2020.

Lumen Technologies described its new direction as a partner for customers in a data-driven world. The company helps customers use data from smart devices and supports real-time data processing at the network edge. Lumen Technologies also invests in new skills, such as data science and software expertise, to help customers succeed. The rebranding did not bring immediate structural or financial changes, but it set the stage for future growth and innovation. The company continues to build on its fiber strengths to support customers and drive new opportunities.

Market Reaction

Image Source: pexels

Stock Price Movement

The market responded quickly to the rebranding and ticker change from CTL to LUMN. On the day of the announcement, the stock price increased by about 2%. This movement reflected investor optimism about the company’s new direction. Many investors saw the rebranding as a sign that Lumen Technologies wanted to focus on growth and innovation. The market often reacts to changes in company strategy, especially when a business shifts toward technology and advanced services.

After the initial rise, the stock price experienced normal fluctuations. The market continued to watch for updates from Lumen Technologies about its plans and financial performance. Investors paid close attention to quarterly earnings and any news about the company’s fiber network expansion. The stock remained a topic of interest for those following the technology and communications sector.

Analyst Views

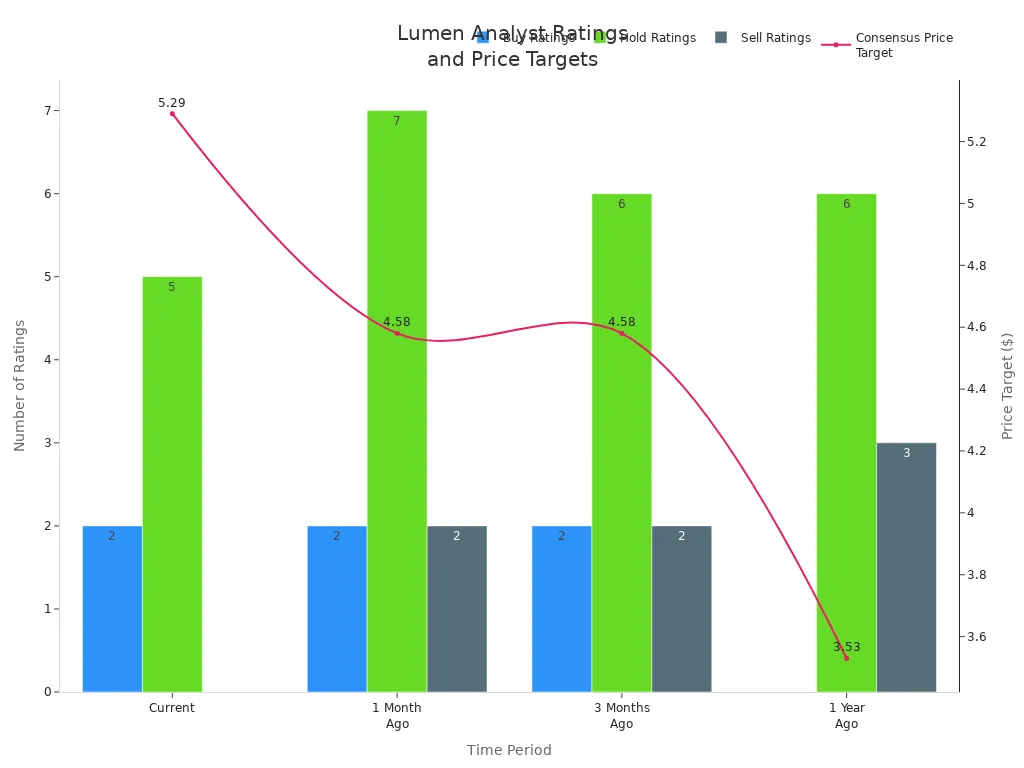

Analysts reviewed the company’s prospects after the ticker change. They considered the new strategy and the potential for growth in the technology sector. The consensus rating from seven analysts stood at “Hold,” with two giving a “Buy” rating and five recommending “Hold.” None of the analysts issued a “Sell” rating. The average price target reached $5.29, which suggested a possible upside of 33.63% from the current price.

| Metric | Value |

|---|---|

| Number of Analysts | 7 |

| Buy Ratings | 2 |

| Hold Ratings | 5 |

| Sell Ratings | 0 |

| Consensus Rating | Hold |

| Average Price Target | $5.29 |

| Upside from Current Price | 33.63% |

Most analysts from major firms, such as Raymond James, Citigroup, and Wells Fargo, maintained a cautious but moderately positive outlook. The market viewed the stock as stable, with some potential for growth. Over the past year, the consensus rating improved from “Reduce” to “Hold,” and the price target increased. The market continues to monitor Lumen Technologies for signs of progress in its new strategy.

Lumen Technologies Financials

Performance

Lumen Technologies experienced significant changes in its financial results after the transition from CenturyLink. The company reported total revenue of $13.11 billion for fiscal year 2024, which marked a decline from $17.90 billion in 2023. Net income showed improvement, with a loss of $55 million in 2024 compared to a much larger loss of $10.30 billion in the previous year. This reduction in net losses signals progress in financial management following the ticker change.

| Metric | Fiscal Year 2024 | Fiscal Year 2023 |

|---|---|---|

| Total Revenue | $13.11 billion | $17.90 billion |

| Net Income (Loss) | -$55 million | -$10.30 billion |

Lumen Technologies’ segment, Lumen Content Delivery, displayed mixed financial performance after rebranding. The company faced volatility in its credit profile and moderate credit risk compared to peers. Credit spreads for Lumen widened, indicating deteriorating credit quality, but remained tighter than some competitors. In Q2 2025, Lumen Content Delivery reported revenues slightly below expectations at $3.09 billion, but achieved strong adjusted EBITDA of $877 million. The ‘Grow’ segment increased revenue by 8.5% year-over-year, while the ‘Harvest’ segment grew by 2.1%. Lumen proactively managed liquidity and leverage, including a $2 billion bond offering and a $5.75 billion sale of its consumer fiber business to AT&T. These moves improved financial flexibility and allowed the company to focus on enterprise and fiber network expansion.

Lumen Technologies raised its 2025 free cash flow guidance to a midpoint of $1.3 billion, despite reporting negative free cash flow of $209 million in Q2 2025. The company continues to show signs of recovery and strategic financial management post-rebranding, although it faces challenges relative to some industry peers.

Note: Lumen Technologies’ capital expenditures shifted after the rebranding. In 2020, the company reported $3.7 billion in capital spending. The divestiture of its local telecom business for $7.5 billion in 2021 allowed Lumen to reallocate investment toward enterprise, fiber connectivity, and cloud services. This strategic focus supports long-term growth and strengthens the company’s network infrastructure.

Dividend Policy

After the ticker change from CenturyLink to Lumen Technologies in September 2020, the company made major adjustments to its dividend policy. In November 2022, Lumen eliminated its $1.00 annual dividend. The Board of Directors replaced the dividend with a stock buyback program, authorizing up to $1.5 billion over two years. This shift aimed to raise cash, reduce debt, and prioritize capital allocation during financial restructuring.

- Lumen Technologies paid quarterly dividends up to September 9, 2022, with yields ranging from 1.66% to 2.51%.

- The last dividend payment occurred on September 9, 2022, at $0.250 per share.

- Following the suspension, the forward dividend yield dropped to zero.

| Date of Last Dividend Payment | Dividend Amount | Dividend Yield (TTM) | Notes |

|---|---|---|---|

| September 9, 2022 | $0.250 | 2.51% | Last dividend paid before suspension |

| Following year (post ticker change) | $0.00 | 0% | Dividends suspended, yield dropped to zero |

Lumen Technologies completed a major divestiture of its 20-state ILEC business in October 2022, which coincided with the dividend elimination and buyback authorization. The company now focuses on strengthening its fiber network and improving financial flexibility.

Growth Outlook

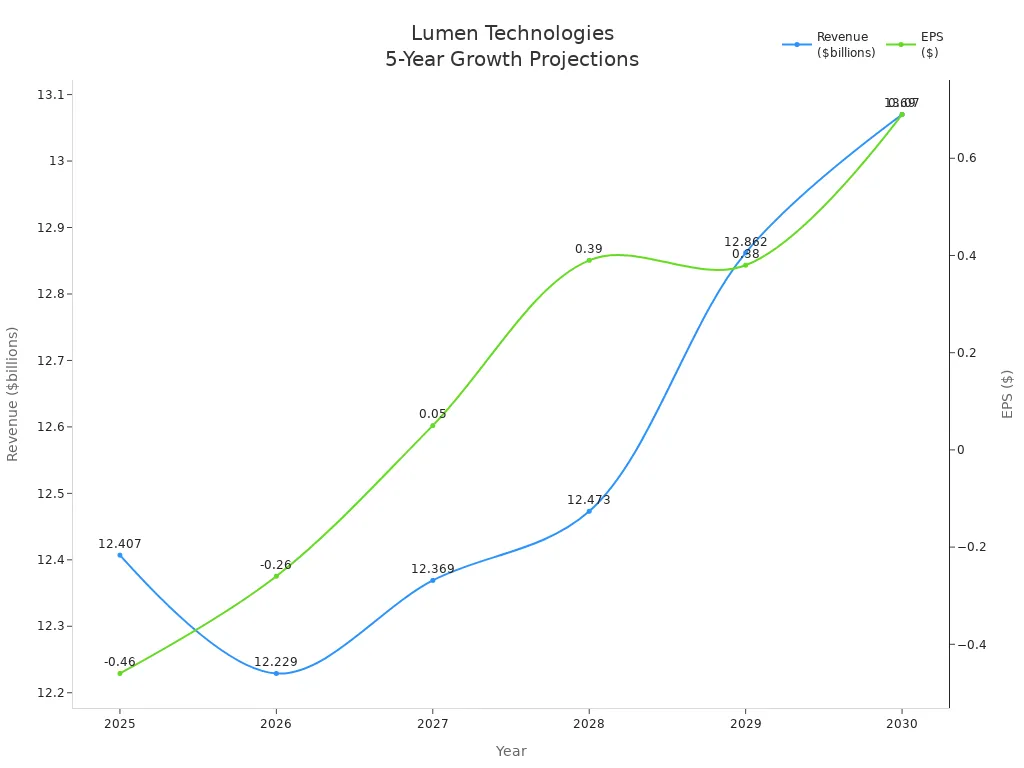

Financial analysts project a cautious but improving outlook for Lumen Technologies over the next five years. Revenue is expected to grow modestly from 2027 onward, with EPS turning positive in 2027 and continuing to rise through 2030. Debt restructuring and insider buying support future growth potential.

| Year | Revenue (in $billions) | EPS ($) |

|---|---|---|

| 2025 | 12.407 | -0.46 |

| 2026 | 12.229 | -0.26 |

| 2027 | 12.369 | 0.05 |

| 2028 | 12.473 | 0.39 |

| 2029 | 12.862 | 0.38 |

| 2030 | 13.070 | 0.69 |

Wall Street analysts expect a compound annual growth rate (CAGR) of approximately -4% for revenue over the next three years, indicating a declining revenue trajectory in the near term. However, operating income is forecasted to improve with an 11% CAGR, which should help EPS turn positive by 2027. The average 1-year price target stands at $5.08, with a range from $2.02 to $7.35.

Lumen Technologies continues to invest in its fiber network and enterprise solutions. The company’s strategic decisions, including divestitures and capital reallocation, position it for future growth. The focus on fiber infrastructure and technology-driven services supports a gradual improvement in financial performance and revenue trajectory. Investors should monitor changes in the network, capital expenditures, and financial results to assess long-term prospects.

What Investors Should Watch

Key Metrics

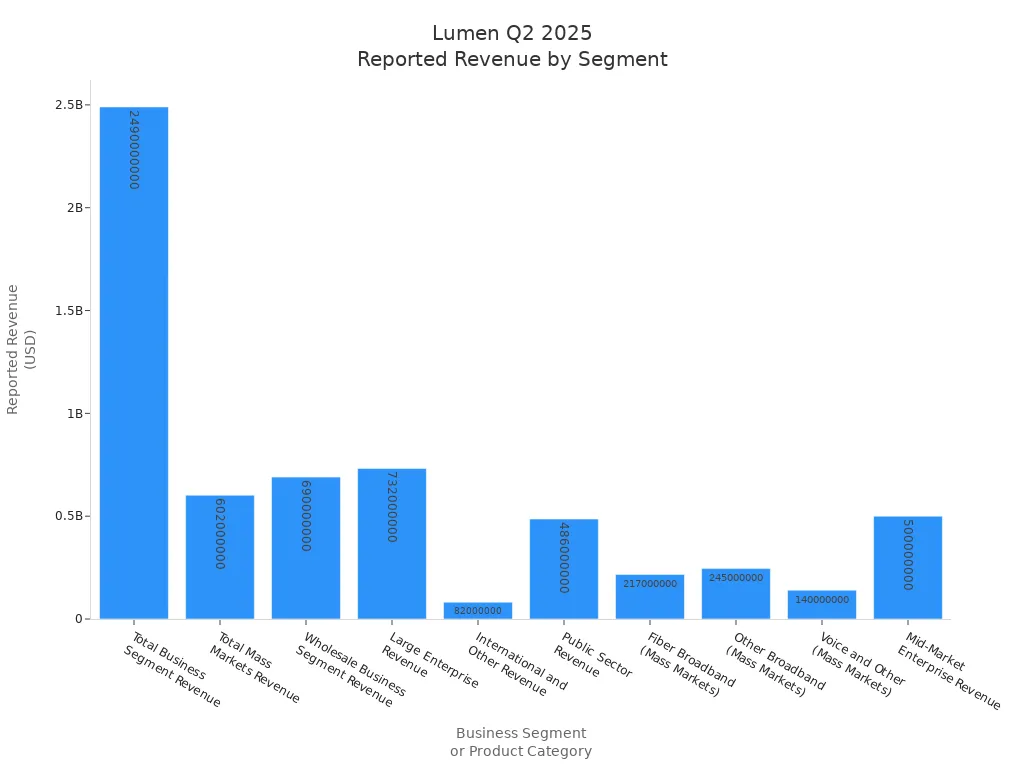

Investors tracking Lumen Technologies after the centurylink ticker change should focus on several important financial indicators. Segment-specific revenue figures reveal how the company performs in different markets and product categories. The following table summarizes key metrics from Q2 2025:

| Financial Metric | Reported Value (Q2 2025) | Analyst Estimate (Average) | Year-over-Year Change |

|---|---|---|---|

| Total Business Segment Revenue | $2.49 billion | $2.48 billion | -3.4% |

| Total Mass Markets Revenue | $602 million | $649.47 million | -12.9% |

| Wholesale Business Segment Revenue | $690 million | $685.96 million | -4.6% |

| Large Enterprise Revenue | $732 million | $713.65 million | -12.5% |

| International and Other Revenue | $82 million | $85.85 million | N/A |

| Public Sector Revenue | $486 million | $475.71 million | +8.5% |

| Fiber Broadband (Mass Markets Product Category) | $217 million | $216.54 million | +19.9% |

| Other Broadband (Mass Markets Product Category) | $245 million | $241.35 million | -17.8% |

| Voice and Other (Mass Markets Product Category) | $140 million | $191.08 million | -34% |

| Mid-Market Enterprise Revenue | $500 million | $514 million | +4.6% |

Investors should also watch the debt-to-equity ratio. Lumen Technologies reported a ratio of 59.98 after selling its Mass Markets fiber-to-the-home business to AT&T for $5.75 billion USD. The company used the proceeds to pay down $4.8 billion in superpriority debt, reducing interest expenses by $300 million each year. This move lowered the net debt to aEBITDA ratio from 4.9x to 3.9x, showing a positive shift in leverage.

Institutional investors continue to adjust their holdings. BlackRock, Vanguard, and Charles Schwab reduced their shares, while Northern Trust and Geode Capital increased their positions. Smaller firms such as Wealth Enhancement Advisory Services LLC and Farther Finance Advisors LLC raised their stakes, reflecting ongoing interest in centurylink’s transformation.

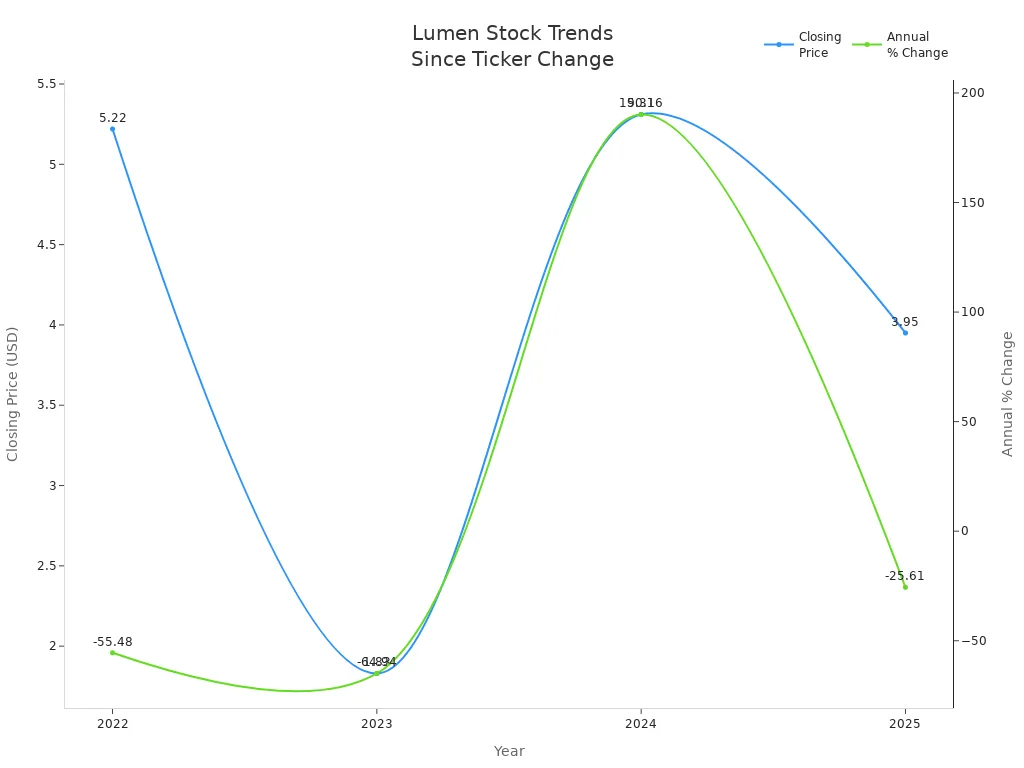

Long-Term Impact

Lumen Technologies faces ongoing volatility in its stock performance since the centurylink ticker change. Technical analysis shows mixed signals, with short-term buy indicators but long-term sell pressure. The stock remains high risk, and investors should expect price swings. The table below highlights annual closing prices and percentage changes:

| Year | Closing Price (Year End) | Annual % Change |

|---|---|---|

| 2022 | $5.22 | -55.48% |

| 2023 | $1.83 | -64.94% |

| 2024 | $5.31 | +190.16% |

| 2025* | $3.95 | -25.61% |

*As of August 12, 2025

Lumen Technologies invests in AI, fiber, and cloud services to support customers and drive growth. However, legacy business pressures and heavy debt continue to affect stock performance. The company trades at a discount compared to industry peers, with a trailing 12-month price-to-sales ratio of 0.35 versus an industry average of 1.57. Investors should monitor how centurylink adapts to market changes and how customers respond to new services. Ongoing adjustments by institutional investors and segment-specific revenue trends will help guide future decisions.

The change from stock symbol ctl to lumen technologies did not impact share ownership or portfolio value. Investors should continue to monitor LUMN for important updates, as the company has reported new financial strategies, credit rating upgrades, and a focus on AI-driven infrastructure.

Staying informed about strategic developments and market cycles helps investors make better decisions in the evolving telecommunications sector.

FAQ

What happened to the CTL stock symbol?

CenturyLink changed its name to Lumen Technologies and updated its stock symbol from CTL to LUMN on September 18, 2020. Investors saw this change reflected automatically in their brokerage accounts.

Did the ticker change affect my shares or their value?

The ticker change did not impact the number of shares or their value. Investors continued to own the same amount of stock, and the market price remained unaffected by the symbol update.

Do investors need to take any action after the ticker change?

Investors did not need to take any action. Brokerage firms updated the ticker symbol automatically. No forms, fees, or special steps were required from shareholders.

Why did CenturyLink rebrand as Lumen Technologies?

CenturyLink rebranded as Lumen Technologies to focus on advanced technology, fiber networks, and digital solutions. The new name reflects the company’s commitment to innovation and growth in the technology sector.

Will Lumen Technologies pay dividends in the future?

Lumen Technologies suspended its dividend in 2022 and replaced it with a stock buyback program. The company has not announced plans to reinstate dividends. Investors should monitor official updates for any changes to the dividend policy.

The analysis of the CTL to LUMN ticker change underscores a key aspect of modern investing: staying ahead of strategic shifts is as important as tracking financial metrics. For many investors, managing a portfolio of U.S. stocks, especially through periods of corporate change, can be cumbersome, with challenges like complex transfers and foreign exchange.

BiyaPay simplifies this process entirely. Our platform allows you to manage your entire investment portfolio, providing low fees for funding your account and access to real-time exchange rates for optimal value. Beyond just U.S. equities, you can participate in US and Hong Kong stock trading from a single, unified account, eliminating the need for a separate overseas bank account. This makes it easier to respond to market changes and diversify your holdings. Ready to streamline your global investment strategy? Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.