- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

ETHU Stock Trends and Market Outlook for 2025

Image Source: pexels

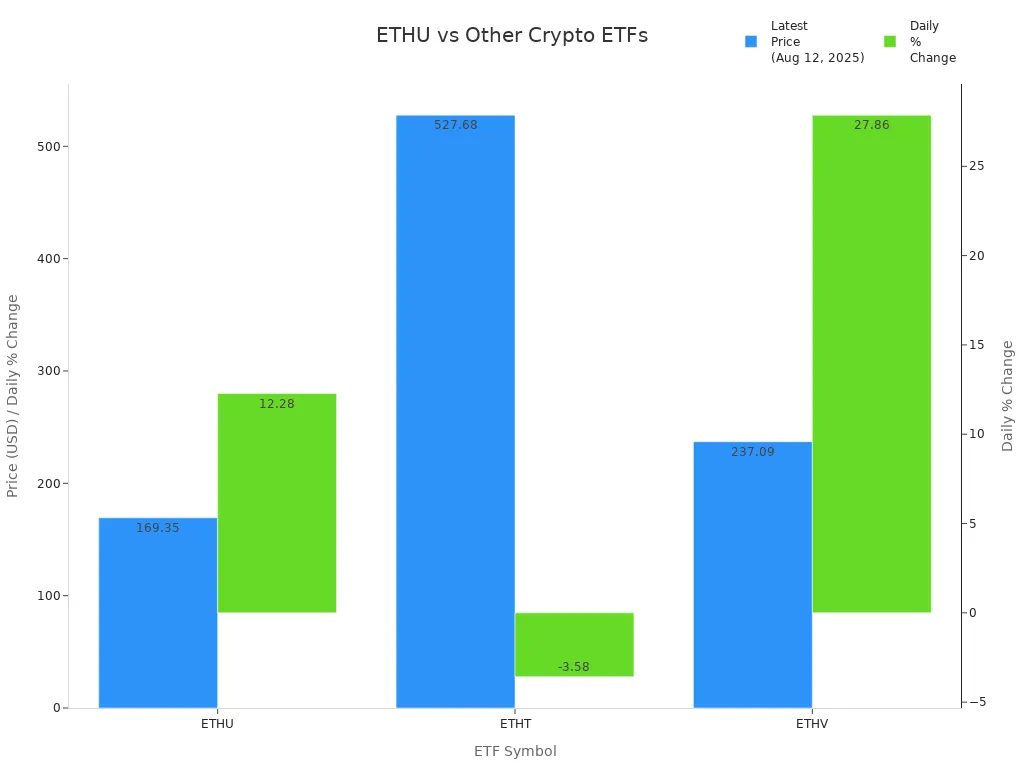

ETHU stock shows strong upward momentum for 2025, driven by its 2x leveraged exposure to CME Ether futures. This structure appeals to sophisticated traders seeking amplified returns and volatility. Recent data highlights ETHU’s latest price at $169.35 USD and a daily gain of 12.28%, outpacing other leveraged crypto ETFs.

| ETF Symbol | Latest Price (USD) | Daily % Change | Leverage | Notes |

|---|---|---|---|---|

| ETHU | $169.35 | +12.28% | 2x | High volatility; futures-based |

| ETHT | $527.68 | -3.58% | 2x | Lower momentum |

| ETHV | $237.09 | +27.86% | None | Strong price increase |

Understanding ETHU’s trends and outlook allows investors to assess risk and identify opportunities in a rapidly changing market.

Key Takeaways

- ETHU is a 2x leveraged Ether ETF that uses CME Ether futures to amplify daily returns, making it suitable for active traders with high risk tolerance.

- ETHU showed strong price gains in 2025, outperforming many crypto ETFs, but its daily reset and volatility decay make it risky for long-term holding.

- Regulatory updates and Ethereum network developments strongly influence ETHU’s price and trading volume, so investors should stay informed.

- Experts forecast continued growth for ETHU in 2025, supported by institutional adoption, ETF inflows, and Ethereum upgrades, but technical resistance and market risks remain.

- ETHU offers high reward potential but carries amplified risks like volatility drag and futures market effects, so it fits only experienced investors who can manage short-term trades.

Overview

ETHU Stock Basics

ETHU stock operates as a 2x leveraged Ether ETF. This fund seeks to deliver daily investment results that are approximately twice the daily performance of Ether, before fees and expenses. ETHU stock charges an expense ratio of 94 basis points, which is lower than some similar leveraged ETFs, such as Defiance Daily Target 2X Long SOFI ETF (1.29%) and GraniteShares 2x Long COIN Daily ETF (1.31%). ETHU stock amplifies daily returns, making it suitable for investors who have a higher risk tolerance and prefer active trading strategies.

ETHU aims to deliver 2x the daily performance of Ether, similar to other leveraged crypto ETFs like SOLT, which targets Solana. Both funds use derivatives, such as futures contracts and swap agreements, instead of holding the underlying asset directly. Daily rebalancing and compounding effects mean that performance over longer periods may not simply double the underlying asset’s return. ETHU stock is designed for tactical, short-term trading rather than long-term holding because of amplified volatility and risks. Futures market dynamics, such as contango and backwardation, can affect performance, with leverage amplifying these effects.

| ETF Name | Leverage | Expense Ratio | Trading Focus |

|---|---|---|---|

| ETHU | 2x | 0.94% | Daily, short-term |

| SOLT | 2x | 1.29% | Daily, short-term |

| COIN | 2x | 1.31% | Daily, short-term |

Volatility Shares Trust Role

Volatility Shares Trust manages ETHU stock by investing in cash-settled Ether futures traded on the CME. The fund does not hold Ether directly. Instead, it uses money market instruments as collateral to support futures investments. Volatility Shares Trust may also use reverse repurchase agreements, options, swaps, and other Ether-linked investments to manage leverage. A wholly-owned Cayman Island subsidiary helps the fund manage exposure effectively.

- ETHU stock resets daily, which means returns can deviate from the 2x exposure if held longer than a day.

- The fund is intended for short-term trading, not long-term investment.

- Risks include imperfect correlation of futures to Ether price, liquidity issues, margin requirements, and rapid price fluctuations.

Investors should understand that ETHU stock is a specialized tool for sophisticated traders who seek leveraged exposure to Ether price movements. The fund’s structure and management approach make it important to monitor daily performance and market conditions closely.

Performance Trends

Image Source: pexels

ETHU Stock Price Movements

ETHU stock has demonstrated significant price action over the past year. The latest available price stands at $169.35 USD (USD exchange rate), reflecting a strong upward trend. Over the last twelve months, ETHU stock delivered a 1-year price return of +32.8%, outperforming the SPY ETF, which returned +21.9% in the same period. In the most recent three months, ETHU surged by 190.0%, while SPY gained only 10.5%. The past two weeks saw ETHU rise by 41.4%, compared to SPY’s 1.2% increase. These figures highlight ETHU’s ability to capture rapid market moves.

| Metric | Value | Context/Notes |

|---|---|---|

| Price as of Aug 12, 2025 | $169.35 | Latest available stock price |

| Shares Traded | 6,142,343 | Trading volume on the date |

| 1-Year Price Return | +32.8% | ETHU outperformed SPY (+21.9%) |

| 3-Month Price Return | +190.0% | Strong short-term gains vs SPY (+10.5%) |

| 2-Week Price Return | +41.4% | Recent short-term gains vs SPY (+1.2%) |

| Beta | 2.85 | High sensitivity to market movements |

| Correlation to SPY | 0.13 | Low correlation with broad market ETF |

| Support Price Level | $138.95 | Statistically defined support |

| Resistance Price Level | $162.71 | Statistically defined resistance |

ETHU’s beta of 2.85 signals high sensitivity to market swings. The low correlation to SPY (0.13) suggests ETHU moves independently from broader equity markets. Support and resistance levels at $138.95 and $162.71, respectively, provide important reference points for traders.

Volume and Volatility

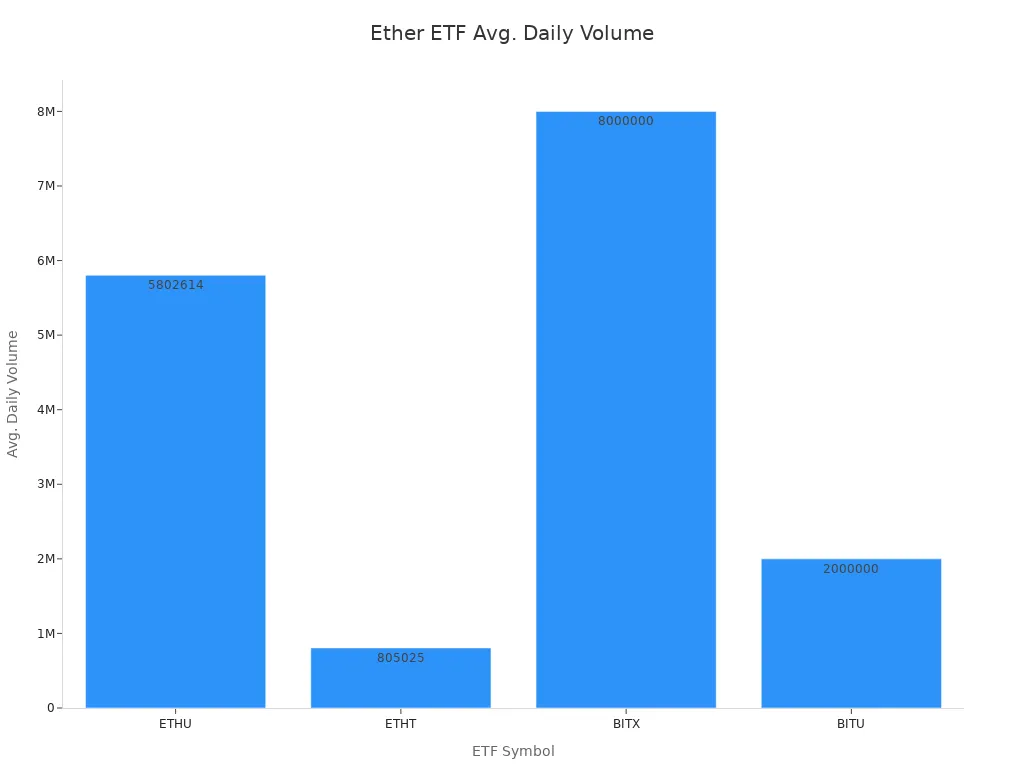

ETHU stock consistently ranks among the most actively traded Ether-based ETFs. Over the past month, average daily volume reached 5,802,614 shares, with a three-month average of 4,382,709 shares. This volume far exceeds ETHT (805,025) and BITU (2,000,000), and is competitive with BITX (8,000,000). High trading activity signals strong investor interest and liquidity.

ETHU’s volatility profile reflects its 2x leveraged structure. Since its launch on June 4, 2024, the fund has shown amplified price swings and short-term fluctuations. The daily reset mechanism and compounding effects can cause capital decay over time, making ETHU unsuitable for long-term holding. The average annual return since inception stands at -38.40%, highlighting the impact of volatility decay. ETHU’s performance trends depend on daily 2x Ether futures returns, not long-term Ether price tracking. The fund’s rolling of futures contracts, influenced by market conditions such as contango and backwardation, can further affect returns. As a result, ETHU is best suited for short-term tactical trading, where traders can take advantage of rapid price movements and high liquidity.

Key Drivers

Regulatory Factors

Regulatory changes shape the landscape for ETHU stock. The United States Securities and Exchange Commission (SEC) continues to review rules for crypto ETFs. Approval of new Ether futures products can boost investor confidence. Stricter regulations may limit trading activity or increase compliance costs. Hong Kong regulators also influence global sentiment. Their decisions on crypto ETF listings often set precedents for other markets.

Investors monitor regulatory updates closely. A new rule or policy can shift ETHU’s trading volume and price within hours.

| Regulatory Body | Recent Action | Impact on ETHU Stock |

|---|---|---|

| SEC (United States) | Ether futures ETF approvals | Increased legitimacy, volume |

| SFC (Hong Kong) | Crypto ETF listing reviews | Global sentiment shift |

| CFTC (United States) | Futures market oversight | Enhanced transparency |

Ethereum Market Trends

Ethereum’s price and network activity drive ETHU’s performance. Rising transaction volumes and new decentralized applications (dApps) attract more users. The shift to Ethereum 2.0, with proof-of-stake, reduces energy use and may increase investor interest. ETHU tracks Ether futures, so sharp price moves in the underlying asset create amplified returns.

- High Ether price volatility leads to larger swings in ETHU stock.

- Increased adoption of Ethereum technology supports long-term growth.

- Major upgrades, such as protocol changes, can trigger rapid price movements.

Macroeconomic Impact

Global economic conditions affect ETHU stock. Changes in interest rates, inflation, and currency exchange rates influence investor behavior. For example, rising USD interest rates (USD exchange rate) often reduce demand for risk assets like crypto ETFs. Economic uncertainty in China or the United States can cause market volatility.

- Investors seek safe assets during economic downturns.

- Strong USD discourages foreign investment in crypto products.

- Policy shifts in China or Hong Kong may impact global crypto flows.

ETHU’s price responds quickly to macroeconomic news. Traders watch central bank announcements and global events to adjust their strategies.

2025 Outlook

Image Source: pexels

Expert Forecasts

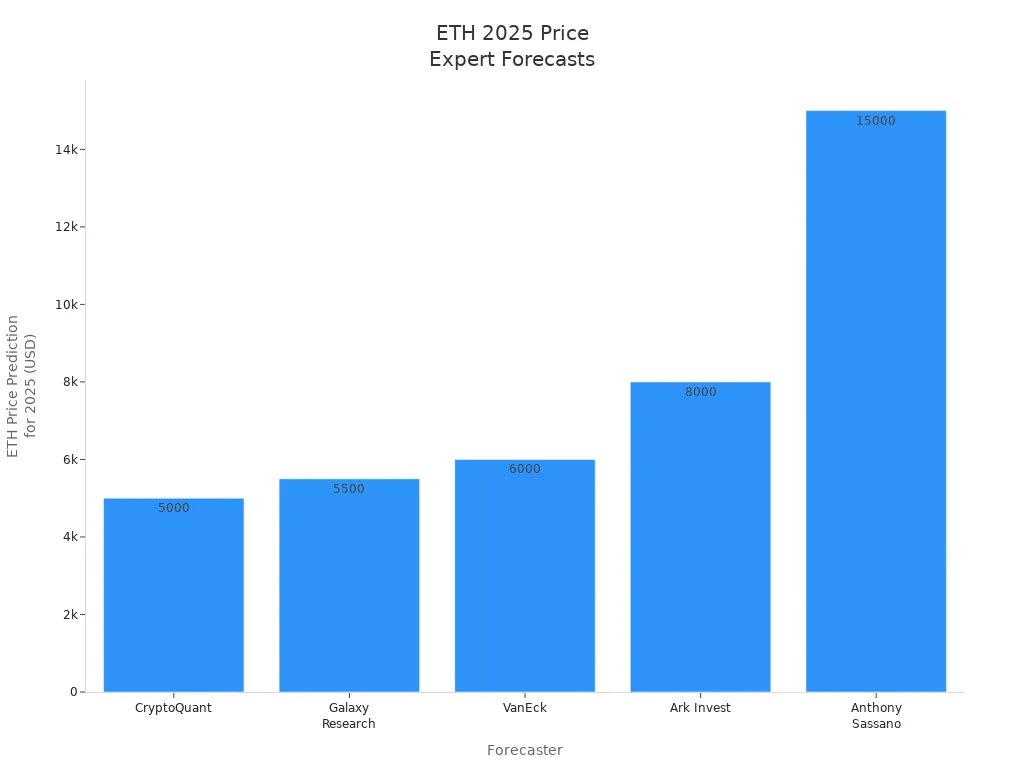

Analysts expect ETHU stock to continue its upward trajectory in 2025, reflecting optimism about Ethereum’s future and the leveraged nature of the fund. Forecasts for Ethereum’s price in 2025 range widely, with most experts predicting significant gains. The following table summarizes key expert predictions and their rationales:

| Forecaster | ETH Price Prediction for 2025 | Rationale / Highlights |

|---|---|---|

| CryptoQuant | $5,000 | Institutional demand and renewed investor interest |

| Galaxy Research | $5,500 | Pro-crypto US administration and Layer-2 adoption |

| VanEck | $6,000 | Staking and network upgrades expected to boost price |

| Ark Invest | $8,000 | Market cap reaching $1 trillion driven by Wall Street adoption |

| Anthony Sassano | $15,000 | Highly optimistic scenario based on broad ecosystem growth |

A broader consensus among six reputable experts places the average Ethereum price target around $6,325 for 2025. Most forecasts suggest a price rally between 42% and 330%, reflecting both volatility and strong bullish sentiment. Analysts also highlight Ethereum’s high correlation with Bitcoin (correlation coefficient of 0.82). If Bitcoin achieves a new all-time high, Ethereum could capture a large portion of those gains. Spot Ethereum ETFs have attracted over $1 billion in investments, providing consistent buying pressure. These factors support a bullish outlook for Ethereum and, by extension, leveraged products like ETHU stock.

Historical data supports this optimism. Analysts project a 1-year price forecast for ETHU stock at $198.69 USD, representing a 17.33% gain from current levels. The 5-year forecast reaches $454.90 USD, a potential increase of 168.62%. These projections align with the positive cycle observed over the past year.

| Metric | Historical Data (as of 2025-08-13) | Analysts’ Projections |

|---|---|---|

| Current Price (USD) | 169.350 | N/A |

| 52-Week Change (USD) | 162.900 | N/A |

| 52-Week High (USD) | 248.3997 | 198.694 (1-year forecast) |

| 52-Week Low (USD) | 22.0483 | 134.306 (1-year forecast low) |

| 50-Day Moving Average (USD) | 79.4014 | N/A |

| 90-Day Moving Average (USD) | 80.762 | 142.857 (forecast) |

| 200-Day Moving Average (USD) | 96.5425 | N/A |

| 1-Year Price Forecast (USD) | N/A | 198.694 (+17.33% gain) |

| 5-Year Price Forecast (USD) | N/A | 454.903 (+168.62% gain) |

All USD values are based on the current exchange rate.

Bullish and Bearish Scenarios

Bullish Scenarios

Several factors could drive ETHU stock higher in 2025. Corporate adoption continues to rise, with companies like BitMine Immersion Technologies increasing their Ethereum holdings by over 400% in just 30 days. The top 10 corporate holders now control approximately 2.63 million ETH, or about 2.63% of the total supply. Spot Ethereum ETFs have seen cumulative inflows exceeding $8.9 billion USD since July 2024, with a single day’s inflow reaching $533.8 million USD. Regulatory clarity in the United States and China, including new digital asset frameworks and favorable tax structures, has reduced uncertainty and encouraged institutional buying.

Technical momentum remains strong. Ethereum’s price is poised to challenge the $5,000 USD level, with some analyses projecting even higher targets in longer-term cycles. Institutional whale activity also supports the bullish case, as large investors accumulated nearly $1 billion USD in a single week. Ethereum’s market capitalization now surpasses Mastercard, ranking 22nd among global assets.

| Key Bullish Factor | Evidence Details |

|---|---|

| Corporate Adoption | BitMine Immersion Technologies increased ETH holdings by 410.68% in 30 days to 833,100 ETH; top 10 corporate holders control 2.63 million ETH (~2.63% of supply). |

| ETF Inflows | Spot Ethereum ETFs saw $533.8 million inflows in one day; cumulative inflows since July 2024 exceed $8.9 billion. |

| Regulatory Clarity | New US digital asset frameworks and Ripple-SEC case resolution reduce uncertainty; tax-advantaged structures encourage institutional buying. |

| Technical Momentum | Ethereum price poised to challenge $5,000, with some analyses projecting $6,000 to $26,000 in longer-term cycles. |

| Institutional Whale Activity | Large investors accumulated $946.6 million in one week; a single institution bought 221,166 ETH (~$1 billion) signaling strong confidence. |

| Market Capitalization Milestone | Ethereum surpassed Mastercard with a market cap over $519 billion, ranking 22nd among global assets. |

| Short-term Risks | High leverage ratio and neutral options delta skew indicate potential volatility and cautious sentiment despite bullish fundamentals. |

Bearish Scenarios

Despite the positive outlook, ETHU stock faces several downside risks. Ethereum currently trades near a major resistance level around $4,000 USD. If price action rejects this resistance, a significant bearish move could follow. A deviation above $4,000 USD followed by a retracement may confirm a local top, leading to a downward correction. Technical analysis highlights bearish patterns, such as the Bearish 5-0 zone and Bearish Head and Shoulders pattern. If key support levels break, Ethereum’s price could fall as low as $355 USD, especially if the $1,600 USD support fails. These scenarios would negatively impact leveraged products like ETHU stock, amplifying losses for investors.

Potential Catalysts

Several catalysts could drive significant price changes in ETHU stock during 2025:

- Technical breakout confirmations above key resistance levels, such as $2,640–2,660 USD, with strong trading volume.

- On-chain fundamentals, including increased active addresses, over 35 million ETH staked, and a high percentage of long-term holders (76%), which create supply constraints and enhance network security.

- Continued institutional inflows through ETFs and growing investments, supporting bullish momentum.

- Derivative market structure, with heavy call dominance and elevated implied volatility, indicating market expectations of directional moves.

- Macroeconomic events, such as Federal Reserve rate decisions, CPI data, and ETF approvals, which can influence sentiment and price volatility.

- Sentiment indicators, like the Fear & Greed Index at 78, suggest a euphoric but high-risk environment, where sudden shifts could cause volatility.

- Whale behavior and netflows show cautious accumulation, supporting price stability.

- The Pectra upgrade, which aims to improve staking and user experience, serves as a long-term bullish factor.

Investors should monitor these catalysts closely, as they can trigger rapid price movements in ETHU stock. Staying informed about regulatory changes in the United States, China, and Hong Kong, as well as macroeconomic developments, will help investors manage risk and seize opportunities.

Risks and Opportunities

Main Risks

Leveraged ETFs like ETHU stock present unique risks that investors must understand before trading. The most significant risk is volatility decay, also known as volatility drag. This effect occurs because the fund resets its leverage daily. Over time, especially during periods of high market volatility, the compounding of daily returns can erode the value of the investment. Short-term traders may benefit from sharp price movements, but long-term investors often experience value erosion. The decay accumulates monthly and yearly, making ETHU stock generally unsuitable for buy-and-hold strategies.

ETHU stock uses CME Ether futures rather than holding Ether directly. This structure introduces additional risks, such as imperfect correlation with spot Ether prices and exposure to futures market dynamics like contango and backwardation. When the futures market is in contango, the fund may incur losses as it rolls contracts forward. In backwardation, the fund can benefit, but these conditions change frequently and unpredictably.

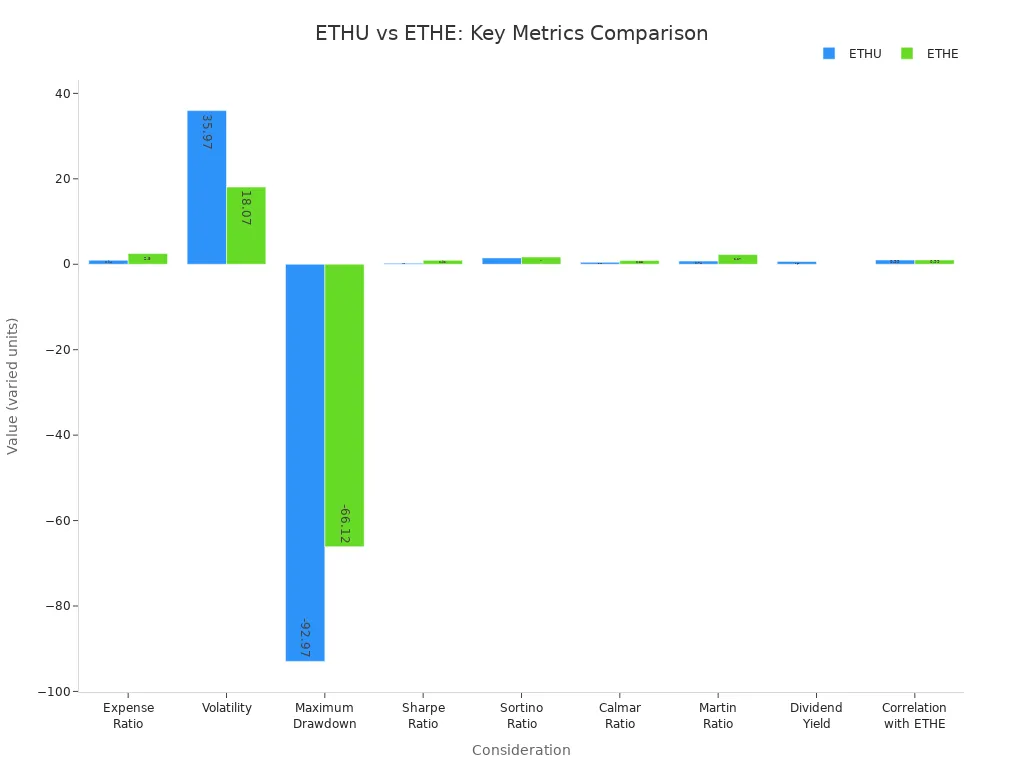

The risk profile of ETHU stock is amplified compared to traditional Ether ETFs. The fund’s beta, which measures sensitivity to market movements, stands at 3.6x. This high beta signals that ETHU stock can experience rapid and significant price swings. The maximum drawdown for ETHU stock reached -92.97%, much larger than the -66.12% seen in non-leveraged Ether ETFs. Investors face the possibility of large losses in a short period, especially during sharp market downturns.

Investors should note that leveraged ETFs like ETHU stock are designed for short-term tactical trading, not for long-term holding. The risk of capital loss increases with holding period length.

Other risks include counterparty risk from the use of derivatives, liquidity risk due to limited market depth, and regulatory risk as authorities in the United States, China, and Hong Kong continue to shape the crypto ETF landscape. Both leveraged and traditional Ether ETFs face risks from Ether’s inherent volatility, illiquidity, and the evolving regulatory environment, but leveraged ETFs amplify these risks due to their structure.

Potential Rewards

ETHU stock offers unique opportunities for sophisticated investors who understand leveraged products and can actively manage their positions. The fund’s 2x leverage allows traders to capture amplified gains during strong upward trends in Ether prices. In periods of sustained momentum, ETHU stock can outperform its leverage factor due to compounding effects. This makes it attractive for aggressive traders seeking to capitalize on short-term rallies or volatility spikes.

The futures-based structure of ETHU stock provides regulatory and operational advantages over margin-based leveraged products. Losses are limited to the invested amount, unlike margin trading where losses can exceed the initial investment. ETHU stock also offers a lower expense ratio (0.94%) compared to some other leveraged crypto ETFs, reducing the cost burden for active traders.

For investors who can accurately time market rallies, ETHU stock can deliver spectacular gains. The fund’s high trading volume and liquidity support efficient trade execution, allowing traders to enter and exit positions quickly. ETHU stock also provides a small dividend yield (~0.65%), which is uncommon among crypto ETFs.

Opportunities for leveraged ETFs like ETHU stock include the ability to profit from both upward and downward moves in Ether’s price, without the complexities of shorting or using margin.

Sophisticated investors may use ETHU stock as a tactical tool to hedge other crypto exposures or to express short-term views on Ether’s price direction. However, these opportunities require a deep understanding of the risks and the discipline to monitor positions closely.

Investor Suitability

ETHU stock is not suitable for all investors. The fund’s risk and reward profile aligns best with those who have a high risk tolerance and experience with leveraged or derivative-based products. The table below summarizes key suitability metrics:

| Metric | Value / Description |

|---|---|

| Beta (LTM) | 3.6x (amplified volatility and risk) |

| Expense Ratio (net) | 2.67% (reflects active management and leverage costs) |

| 52-Week Price Range | $22.10 - $251 (USD exchange rate) |

| Investment Type | Leveraged 2x Ether Strategy ETF using CME Ether futures |

| Management Style | Actively managed |

| Suitable Investor Profile | High risk tolerance, seeking leveraged exposure to Ether price movements |

| Unsuitable Investor Profile | Conservative or risk-averse investors, or those seeking long-term, stable returns |

The fund’s performance depends on futures market structure, including contango and backwardation. These factors add complexity and risk, making ETHU stock appropriate only for investors who understand and accept the amplified risks of futures-based leveraged ETFs.

Traditional Ether ETFs may suit investors seeking more direct and stable exposure to Ether’s price movements. These funds generally carry lower volatility and risk, but do not offer the amplified returns or tactical flexibility of leveraged products like ETHU stock.

Investors should carefully assess their risk tolerance, investment goals, and understanding of leveraged ETF mechanics before adding ETHU stock to their portfolios.

ETHU stock demonstrated strong momentum in 2025, outperforming many leveraged crypto ETFs and reflecting robust investor demand for Ethereum exposure. Investors should monitor trading volume, inflows, and risk metrics to optimize entry and exit points. The fund’s leveraged structure offers significant upside but requires active management due to volatility and compounding effects. ETHU stock’s performance signals growing institutional interest and may shape broader trends in the crypto ETF market, especially as regulatory clarity improves in the United States, Hong Kong, and China.

FAQ

What is ETHU stock?

ETHU stock is a 2x leveraged Ether ETF. It seeks to deliver twice the daily performance of Ether using CME Ether futures. Volatility Shares Trust manages the fund, which targets active traders who want amplified exposure.

How does volatility decay affect ETHU stock?

Volatility decay occurs when daily compounding erodes returns over time. ETHU stock resets leverage daily, so holding it for long periods can reduce gains, especially during volatile markets.

Tip: Traders should monitor ETHU stock daily and avoid long-term holding to minimize volatility decay.

Who should consider investing in ETHU stock?

ETHU stock suits investors with high risk tolerance and experience in leveraged products. It is not appropriate for conservative investors or those seeking stable, long-term returns.

How do regulatory changes in China and Hong Kong impact ETHU stock?

Regulatory decisions in China and Hong Kong can influence global sentiment and trading volume. For example, Hong Kong banks may adjust crypto ETF policies, affecting investor access and liquidity.

| Region | Regulatory Impact | Example Bank (Hong Kong) |

|---|---|---|

| China | Market sentiment | N/A |

| Hong Kong | ETF access | HSBC |

What fees apply to ETHU stock?

ETHU stock charges a 0.94% expense ratio. All fees are listed in USD. Investors can check the current USD exchange rate for accurate conversions.

The analysis of ETHU highlights that high returns come with complex risks like hedging and compounding effects. For investors navigating this volatile market, traditional remittance methods and managing multiple platforms are significant hurdles.

BiyaPay offers a streamlined solution, allowing you to manage your global investment portfolio easily without the need for a complex overseas bank account. We support conversions between various fiat and digital currencies with remittance fees as low as 0.5%, and you can always check our real-time exchange rates for the best value. Most importantly, you can trade both cryptocurrencies and stocks on a single platform, with funds arriving the same day, truly enabling one-stop investment. Ready to simplify your investment journey? Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.