- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring LABD Stock as a Tool for Biotech Bearish Bets

Image Source: unsplash

LABD stock represents a leveraged inverse ETF designed for traders who seek to capitalize on declines in the biotechnology sector. This ETF aims to deliver triple inverse returns by targeting the biotech industry, making it a popular choice for bear strategies and short-term tactical moves. LABD stock holds micro cap status, with a market capitalization near $54.42 million and an average daily trading volume of about 15.44 million shares. Investors use this ETF to express a bearish outlook on biotechnology, but they must understand the risks and mechanics before investing. The complexity and volatility of bear ETFs like LABD require careful consideration of investor suitability.

Key Takeaways

- LABD is a leveraged inverse ETF that aims to deliver triple the opposite daily returns of the biotech sector, making it ideal for short-term bearish trades.

- The ETF uses financial derivatives and daily rebalancing, which can cause its long-term returns to differ from expected results due to compounding and volatility.

- LABD carries high risk and is not suitable for long-term investors; it requires careful monitoring and understanding of its mechanics before trading.

- Investors should consider costs like expense ratios and bid-ask spreads, and use strategies like stop-loss orders to manage risk effectively.

- LABD offers a way to hedge or bet against biotech stocks but works best for experienced traders who match it to their risk tolerance and investment goals.

LABD Stock Overview

Image Source: unsplash

What Is LABD?

LABD stock stands out as a specialized inverse ETF. This fund targets the biotechnology sector and aims to deliver triple inverse returns compared to the S&P Biotechnology Select Industry Index. Investors use LABD stock to profit from declines in biotech companies. The fund trades on major exchanges and belongs to the family of leveraged ETFs. These products offer amplified exposure to market movements, making them popular among traders who seek short-term opportunities.

LABD stock operates as an exchange traded fund. It allows investors to access bearish positions in biotechnology without directly shorting individual stocks. The ETF structure provides liquidity and transparency. Investors can buy and sell shares throughout the trading day, just like regular stocks. LABD stock appeals to those who want to hedge their portfolios or speculate on downward trends in biotech.

Note: LABD stock is not designed for long-term investing. Its structure favors short-term tactical trading due to daily resets and compounding effects.

Structure and Purpose

LABD stock uses a unique structure to achieve its investment goals. The fund relies on financial derivatives, including swaps, options, and futures. These instruments help the ETF deliver triple inverse exposure to the S&P Biotechnology Select Industry Index. The portfolio includes significant cash and collateral positions to support these derivatives.

- LABD stock achieves -3x daily returns by holding swap agreements that mirror the inverse performance of the biotechnology index.

- The fund rebalances its swaps every day to maintain the targeted leverage and inverse exposure.

- The ETF invests differently than non-leveraged exchange traded funds, resulting in higher volatility and risk.

- Daily rebalancing means LABD stock tracks approximately -3x the daily movement of the biotech index, but returns can deviate over longer periods due to compounding.

The purpose of LABD stock centers on providing traders with a tool for bearish bets on biotechnology. The ETF enables investors to gain exposure to declines in biotech stocks without the need for margin accounts or direct short selling. LABD stock suits those who want to make tactical moves in response to market events or sector news.

| Aspect | Evidence Summary |

|---|---|

| Asset Growth | Leveraged ETFs first issued in 2006; by end of 2018, index ETFs held over 18% of US investment assets; leveraged ETFs experienced similar growth. |

| Institutional Participation | Over 20% of quarterly 13F filings (2006-2016) included leveraged ETFs; participation mainly by independent investment advisors, quasi-indexers, and transient portfolio managers. |

| Investor Demographics | University/foundation endowments, public pension funds, and insurance companies generally avoid leveraged ETFs; skilled institutions use them for dynamic strategies; less skilled managers show weak portfolio performance. |

| Behavioral Patterns | Institutions tend to reduce leveraged ETF holdings after good performance, possibly to lock in gains linked to compensation incentives; leveraged ETFs used for diversification and strategic bets. |

| Performance Implications | Institutional holdings of leveraged ETFs correlate with weaker future portfolio returns, likely due to poor timing and manager skill. |

LABD stock fits into a broader market for exchange traded funds and leveraged ETF products. The ETF attracts skilled institutional investors who use it for dynamic strategies, but less skilled managers often experience weaker portfolio performance. Most long-term investors, such as pension funds and insurance companies, avoid leveraged ETFs like LABD stock due to their risk profile.

LABD stock provides a way for investors to express a bearish view on biotechnology. The ETF offers daily reset features and amplified inverse exposure, making it suitable for short-term trades rather than buy-and-hold strategies. Investors should understand the mechanics and risks before using LABD stock in their portfolios.

Inverse ETF Mechanics

Daily Performance Tracking

An inverse ETF like LABD uses financial tools to deliver the opposite performance of a target index. LABD focuses on the S&P Biotechnology Select Industry Index. The fund aims to provide three times the inverse daily returns of this biotechnology benchmark. Each trading day, the ETF resets its exposure to maintain this target. This means if the index drops by 1% in a day, LABD seeks to rise by about 3%. If the index rises by 1%, LABD aims to fall by 3%. The ETF achieves this by using swaps and other derivatives that mirror the index’s moves in reverse.

LABD has shown a strong inverse relationship with the S&P Biotechnology Select Industry Index over the past year. The correlation coefficient stands at about -0.78, which signals that the ETF tracks the daily inverse performance with reasonable accuracy. However, the tracking is not perfect. The leveraged structure makes LABD suitable for short-term trading rather than long-term investing. Investors use this inverse ETF to make tactical bets on biotechnology sector declines.

Compounding and Volatility

The mechanics of an inverse ETF like LABD involve daily rebalancing. This process causes the ETF’s performance to diverge from the expected result over longer periods. Compounding effects become more pronounced during volatile markets. When the biotechnology sector experiences sharp swings, the ETF’s daily resets can erode value. Over time, this leads to what experts call volatility decay.

For example, if the biotechnology index moves up and down sharply but ends flat, LABD can still lose significant value. This happens because the ETF compounds daily losses and gains, which do not add up linearly. Real-world data shows that 3x leveraged ETFs like LABD can lose nearly all their value in volatile, sideways markets. Non-leveraged ETFs do not face this risk to the same degree. The path of daily returns matters as much as the overall trend. Investors should understand that the performance of an inverse leveraged ETF depends on both the direction and the volatility of the biotechnology sector.

Leveraged ETF Risks

Image Source: unsplash

High-Risk Profile

LABD stock carries a high-risk profile that sets it apart from traditional investment products. The fund uses financial derivatives to achieve its triple inverse exposure to the biotechnology sector. This structure creates significant risk exposure for investors. The value of LABD can change rapidly, sometimes within minutes, due to the amplified effect of daily index movements. Even small shifts in the underlying biotechnology index can lead to large gains or losses in the ETF.

Regulatory agencies such as the SEC and FINRA have highlighted the risks associated with leveraged etf products like LABD. They classify these funds as complex products because many investors find it difficult to understand how they work, especially under different market conditions. Regulatory guidance emphasizes several key points:

- Regulation Best Interest (Reg BI) requires broker-dealers to fully understand the risks and features of leveraged etf products before making recommendations.

- FINRA Rule 2111 mandates that recommendations must be suitable for the investor, considering their experience and risk tolerance.

- FINRA has issued warnings that leveraged and inverse ETFs are typically unsuitable for retail investors who plan to hold them for more than one trading session, especially during volatile periods.

- Firms must provide training, written procedures, and due diligence to ensure proper recommendations.

- Enforcement actions have targeted firms and representatives who failed to understand or supervise the sale of these products.

Both the SEC and FINRA require firms to implement strong internal controls and provide clear disclosures about the risks of leveraged etf investments. These agencies have taken enforcement actions against firms for failing to supervise sales of these products, showing the seriousness of the risk involved.

Short-Term Trading

LABD stock is designed for short-term trading, not for long-term investing. The ETF resets its exposure daily, which means it aims to deliver three times the inverse of the biotechnology index’s daily performance. Over longer periods, the effects of compounding and volatility can cause the ETF’s returns to diverge sharply from what an investor might expect. This makes LABD unsuitable for buy-and-hold strategies.

Investors who hold LABD for more than one day face increased risk. The ETF’s value can erode quickly in volatile or sideways markets, even if the biotechnology sector does not trend strongly in one direction. Regulatory notices from FINRA and the SEC stress that leveraged etf products like LABD require heightened supervision and are generally not appropriate for most retail investors. Firms must assess each investor’s experience, risk tolerance, and investment goals before recommending these products.

Note: The SEC Staff Bulletin advises broker-dealers to apply “heightened scrutiny” when recommending leveraged or inverse ETFs, reflecting the complexity and risk of these products.

Biotechnology Sector Exposure

Biotech Industry Focus

The biotechnology sector plays a vital role in the healthcare industry. It includes companies that develop new drugs, therapies, and diagnostic tools. Many biotech firms focus on high growth potential areas such as cancer immunotherapy treatments and rare diseases. The S&P Biotechnology Select Industry Index, which LABD tracks, represents a broad range of biotechnology companies. This index uses strict criteria to select its components.

| Criteria | Description |

|---|---|

| Primary Sub-Industry | Biotechnology Sub-Industry (GICS classification) |

| Supplementary Sub-Industry | Life Sciences Tools & Services (if needed to meet minimum constituents) |

| Company Type | U.S. companies filing 10-K, with U.S. plurality of assets and revenues |

| Security Type | Only common stocks included; ADRs excluded |

| Exclusions | Pharmaceutical companies and ADRs excluded |

This table shows that the biotechnology index focuses on U.S. biotech firms and excludes pharmaceutical companies. The index sometimes adds life sciences companies to ensure enough biotechnology exposure. Investors use LABD to gain exposure to the downside of this specific group. The biotechnology sector often leads the healthcare sector in innovation, especially during periods of rapid biotech innovation.

Use in Bearish Strategies

Investors use LABD to express a bear outlook on the biotechnology sector. LABD provides leveraged inverse exposure, which means it moves in the opposite direction of the biotech sector. When biotech firms underperform, LABD can deliver strong returns for bear strategies. The performance of LABD depends on daily moves in the biotechnology sector. For example:

- When the biotech sector rises, LABD returns fall sharply.

- During periods of weak biotech performance, LABD can generate gains for bear traders.

- In early 2024, the biotechnology sector showed muted returns, which limited LABD’s upside.

- As the healthcare sector improves and biotech valuations rise, LABD faces downward pressure.

Bear markets in biotechnology often lead to increased trading in LABD. Investors use technical analysis, such as volume and moving averages, to time their trades. Some traders short sell LABD, betting that the ETF’s price will drop as biotech firms recover. Others use options or watch for breakouts to manage their exposure. LABD’s high growth potential for gains comes with high risk, so only experienced investors should use it for bear strategies in the healthcare sector.

Comparing Biotechnology ETFs

LABD vs. LABU

LABD and LABU represent two of the most popular biotechnology ETFs for traders seeking leveraged exposure. LABD, a bear ETF from the Direxion ETFs family, delivers triple inverse daily returns of the S&P Biotechnology Select Industry Index. LABU, also from Direxion ETFs, provides triple leveraged long exposure to the same index. These biotechnology ETFs move in opposite directions, with a perfect negative correlation of -1.00. When the biotechnology sector rises, LABU gains value while LABD loses value, and vice versa.

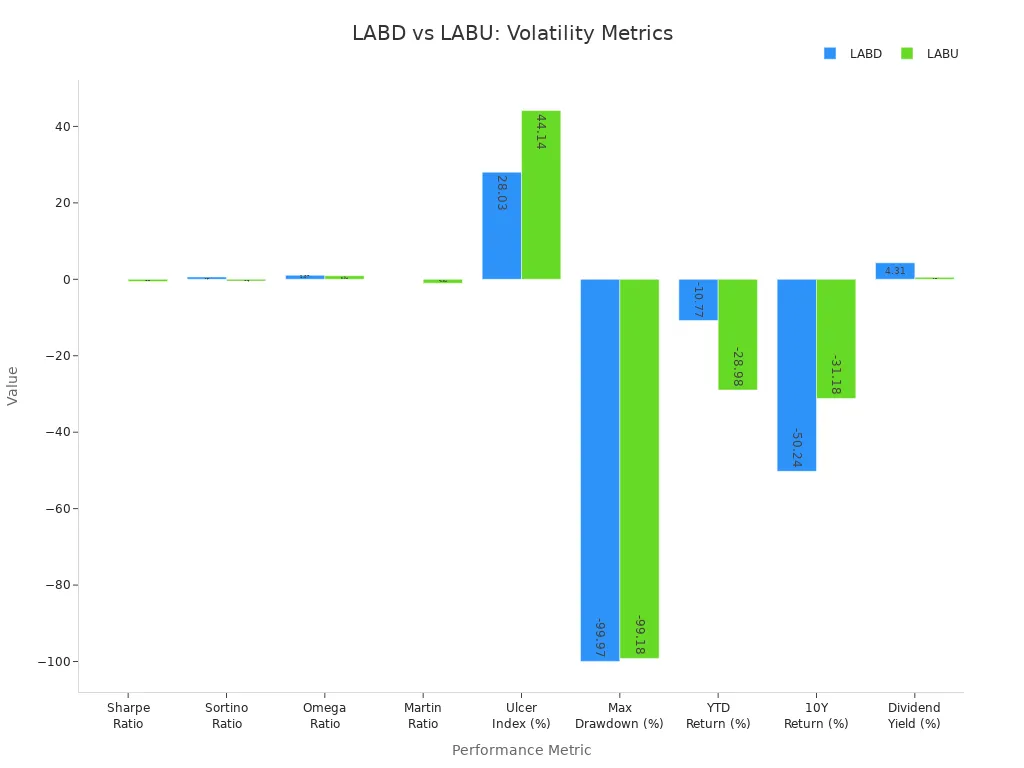

During periods of high volatility in the biotechnology sector, LABD has demonstrated stronger risk-adjusted performance than LABU. LABD shows higher Sharpe, Sortino, Omega, and Martin ratios, indicating better risk management. LABD also has a lower Ulcer Index, which means less severe drawdowns compared to LABU. However, both ETFs have experienced extreme maximum drawdowns, with LABD at -99.97% and LABU at -99.18%. LABU has outperformed LABD in long-term returns over ten years, but with higher risk and deeper drawdowns.

| Metric | LABD Value | LABU Value |

|---|---|---|

| Sharpe Ratio | 0.03 | -0.58 |

| Sortino Ratio | 0.62 | -0.46 |

| Omega Ratio | 1.07 | 0.94 |

| Martin Ratio | 0.01 | -1.04 |

| Ulcer Index (%) | 28.03 | 44.14 |

| Max Drawdown (%) | -99.97 | -99.18 |

| YTD Return (%) | -10.77 | -28.98 |

| 10Y Return (%) | -50.24 | -31.18 |

| Dividend Yield (%) | 4.31 | 0.51 |

Expense ratios and trading costs also differ. LABD has a higher expense ratio at 1.07% compared to LABU’s 0.93%, but LABD shows much lower turnover, which may reduce trading costs for active bear traders.

Other Bearish ETFs

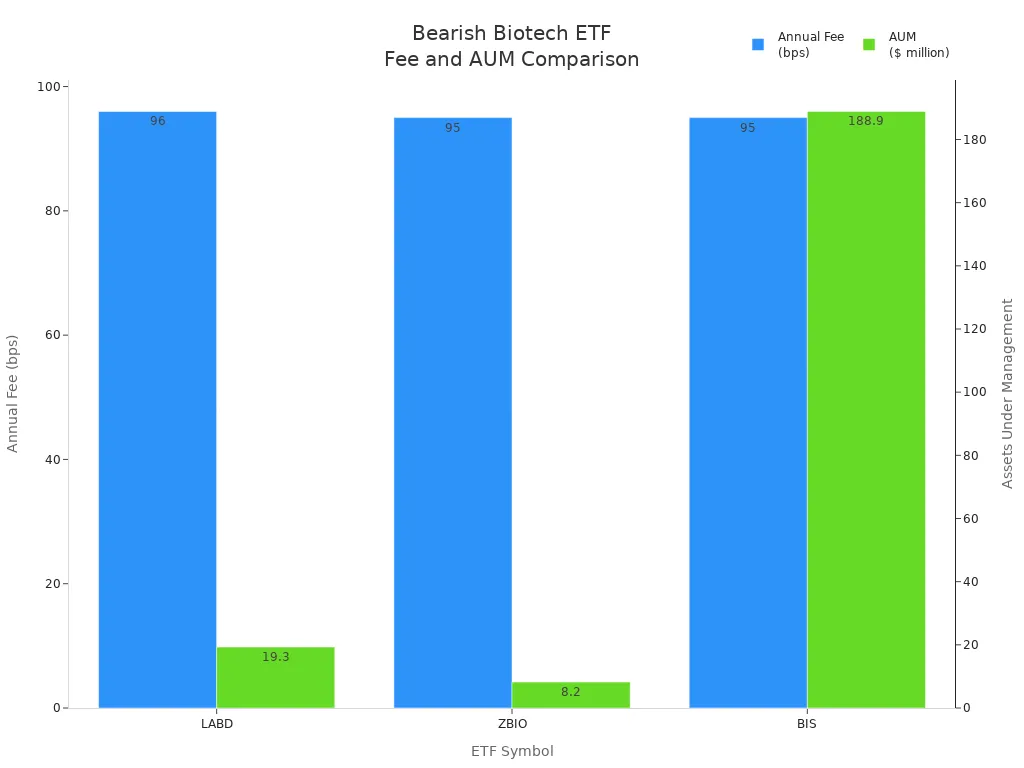

Several biotechnology ETFs offer bearish exposure, each with unique structures and trading characteristics. Direxion ETFs provides LABD, which tracks the S&P Biotechnology Select Industry Index with 3x inverse leverage. ZBIO, from ProShares, delivers 3x inverse exposure to the NASDAQ Biotechnology Index. BIS, another ProShares ETF, offers 2x inverse exposure to the same NASDAQ index. These biotechnology ETFs differ in index tracked, leverage, annual fees, and liquidity.

| ETF Symbol | ETF Name | Index Tracked | Leverage (Inverse Exposure) | Annual Fee (bps) | Average Daily Volume | Assets Under Management (AUM) |

|---|---|---|---|---|---|---|

| LABD | Direxion Daily S&P Biotech Bear 3x | S&P Biotechnology Select Industry | 3x | 96 | ~233,000 shares | $19.3 million |

| ZBIO | ProShares UltraProShort Nasdaq Biotech | NASDAQ Biotechnology Index | 3x | 95 | ~55,000 shares | $8.2 million |

| BIS | ProShares UltraShort Nasdaq Biotech | NASDAQ Biotechnology Index | 2x | 95 | >650,000 shares | $188.9 million |

LABD and ZBIO both offer 3x inverse exposure but track different biotechnology indexes. BIS provides 2x inverse exposure with higher liquidity and assets under management. All these bear ETFs are designed for short-term trading due to daily rebalancing. Investors should compare expense ratios, trading volumes, and index coverage when selecting biotechnology ETFs for bear strategies.

Investor Considerations

Costs and Fees

Investors who trade leveraged etf products such as LABD must consider several cost factors. The expense ratio for LABD stands at 0.95% annually, which is higher than many traditional exchange traded funds. This fee can erode returns, especially for those who hold the etf for more than a few days. Trading costs also include bid-ask spreads. The spread is the difference between the price buyers pay and sellers accept. Wider spreads increase costs for retail investors. LABD often has lower liquidity compared to large-cap stocks, which leads to wider spreads and higher costs. Market makers profit from these spreads while providing liquidity. Investors can reduce costs by using limit orders instead of market orders. Limit orders help control the execution price and minimize the impact of the spread.

| Cost Type | Description | Impact on Investors |

|---|---|---|

| Expense Ratio | Annual fee for managing the etf | Reduces net returns |

| Bid-Ask Spread | Difference between buy and sell prices | Increases trading costs |

| Liquidity | Ease of trading shares without price impact | Affects execution price |

Exchange traded funds like LABD also charge management fees and may have additional costs for frequent trading. Investors should review all costs before making trades in biotech investing.

Best Practices

Successful investing in leveraged etf products requires discipline and awareness. Many investors make mistakes when using LABD for bearish bets on biotechnology stocks. Common errors include underestimating the volatility of the biotech index, which has a standard deviation of 30.3%. Triple leverage amplifies risk and potential losses. High expense ratios can further erode performance. LABD tracks an equal-weighted index tilted toward small- and mid-cap biotech stocks, increasing risk compared to cap-weighted indexes. Some investors chase recent strong performance without understanding the risks of daily reset leveraged etfs and the potential for rapid reversals in healthcare stocks.

Tip: Investors should set clear entry and exit points, monitor daily performance, and avoid holding leveraged etfs for long periods. Using stop-loss orders can help manage risk. Reviewing sector news and healthcare trends supports better decision-making.

Investors should also compare exposure, liquidity, and costs across different exchange traded funds. Staying informed about the healthcare sector and biotech investing trends helps improve outcomes. Careful planning and risk management remain essential for those seeking exposure to leveraged etf products.

LABD serves as a specialized tool for traders seeking leveraged bearish exposure to the biotechnology sector. Historical data highlights its effectiveness during sector downturns, with notable price declines and increased trading volume signaling heightened risk and opportunity.

- LABD’s price fell in 6 of the last 10 days, and technical indicators suggest continued volatility.

- Forecasts predict further declines, reinforcing its role for tactical bearish strategies.

Financial experts emphasize the need to match LABD with an investor’s risk tolerance and investment goals. Suitability depends on factors such as age, financial situation, and investment horizon.

Investors should review their objectives and risk profile before using LABD, as regulatory guidelines require careful alignment with individual needs.

FAQ

What is the main purpose of LABD stock?

LABD stock allows investors to profit from declines in the biotechnology sector. The ETF provides triple inverse daily returns of the S&P Biotechnology Select Industry Index. Traders use LABD for short-term bearish strategies rather than long-term investing.

How long should investors hold LABD?

Investors should hold LABD for short periods, usually one day or less. The ETF resets daily, so holding it longer increases risk due to compounding and volatility effects. LABD does not suit long-term investment goals.

What are the main risks of trading LABD?

LABD carries high risk because of its triple leverage and daily reset. Small moves in the biotech index can cause large gains or losses. Volatility and compounding can erode value quickly, especially in sideways or choppy markets.

Can investors use LABD to hedge other biotech investments?

Yes, investors sometimes use LABD to hedge exposure to biotechnology stocks or ETFs. LABD can offset losses in a biotech-heavy portfolio during sector downturns. Hedging with LABD requires careful monitoring and risk management.

Are there any special costs or fees with LABD?

LABD charges a higher expense ratio than traditional ETFs, currently 0.95% per year. Investors also face trading costs, such as bid-ask spreads. These costs can reduce returns, especially for frequent traders. Always review all fees before trading.

Navigating the complexities of leveraged inverse ETFs like LABD requires both a deep understanding of market mechanics and the right tools to execute your strategy efficiently. Traditional trading platforms and high-cost brokerage services can add friction to a process that demands speed and precision. BiyaPay provides a comprehensive financial solution that empowers you to manage your investments with greater control.

Our platform offers low remittance fees, starting at just 0.5%, making it cost-effective to move funds. With BiyaPay, you can trade not only a wide range of cryptocurrencies but also stocks in major global markets like the U.S. and Hong Kong, all from a single account. Our real-time exchange rate updates give you the clarity you need to make timely decisions, and you can check them at our real-time exchange rate converter. Take advantage of an integrated, low-friction platform designed for the modern investor.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.