- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring the Growth Potential of YMAX Stock Through Its Fund of Funds Strategy

Image Source: pexels

YMAX stock uses a fund of funds strategy that stands out in the high-yield segment. The YieldMax approach focuses on generating income through options-based tactics, not direct stock ownership. Over the past three years, the fund’s assets grew from $875.9 million to about $1.15 billion USD, highlighting strong investor interest. YieldMax funds use synthetic covered calls, which provide high-yield payouts but limit growth compared to traditional ETFs. Investors should examine performance data, as YieldMax strategies often show higher income but capped upside. Each fund in the YieldMax lineup targets specific investments, aiming for monthly income. Before considering YieldMax, investors must weigh their risk tolerance and long-term goals.

Key Takeaways

- YMAX uses a fund of funds strategy that invests in multiple YieldMax ETFs to generate high monthly income through options-based tactics.

- The fund offers strong income with an annualized return near 24%, but its covered call strategy limits growth during strong market rallies.

- YMAX provides diversification across sectors and ETFs, reducing risk compared to single-stock funds, but it carries higher volatility and fees.

- Investors should expect some net asset value erosion due to return-of-capital distributions and understand that high yields may not always mean long-term growth.

- YMAX suits income-focused investors who accept moderate risk and capped upside; limiting allocation to about 5% and pairing with other strategies helps manage risk.

YMAX Stock Growth Potential

Image Source: pexels

Direct Assessment

YMAX stock demonstrates notable growth through its unique fund-of-funds structure. The fund invests in a basket of YieldMax ETFs, each using strategies such as synthetic covered calls, buying T-Bills, and options trading. This approach allows the fund to maximize yield and generate growth-like returns. Analysts report that the fund has outperformed the S&P 500 since its launch, which highlights its strong performance compared to traditional benchmarks.

The fund’s total return since inception reached 40.07%, with an annualized return of 23.96% per year. Investors who placed $10,000 in YMAX stock at launch saw their investment grow to $14,006.67 by August 2025. The fund’s closing price on August 12, 2025, was $13.18 USD, showing significant price appreciation. The table below summarizes key performance metrics:

| Metric | Value |

|---|---|

| Inception Date | January 16, 2024 |

| Total Return (Jan 17, 2024 - Aug 12, 2025) | +40.07% |

| Annualized Return (with dividends reinvested) | +23.96% per year |

| Growth of $10,000 invested at inception | $14,006.67 by Aug 12, 2025 |

| Year-to-Date Return 2025 | +10.93% |

| Return for 2024 | +26.26% |

| Worst Drawdown | -25.56% on April 8, 2025 |

| Current Drawdown | -2.96% as of Aug 12, 2025 |

| Closing Price (Aug 12, 2025) | $13.18 USD |

| 52-Week Price Range | $11.21 - $18.82 USD |

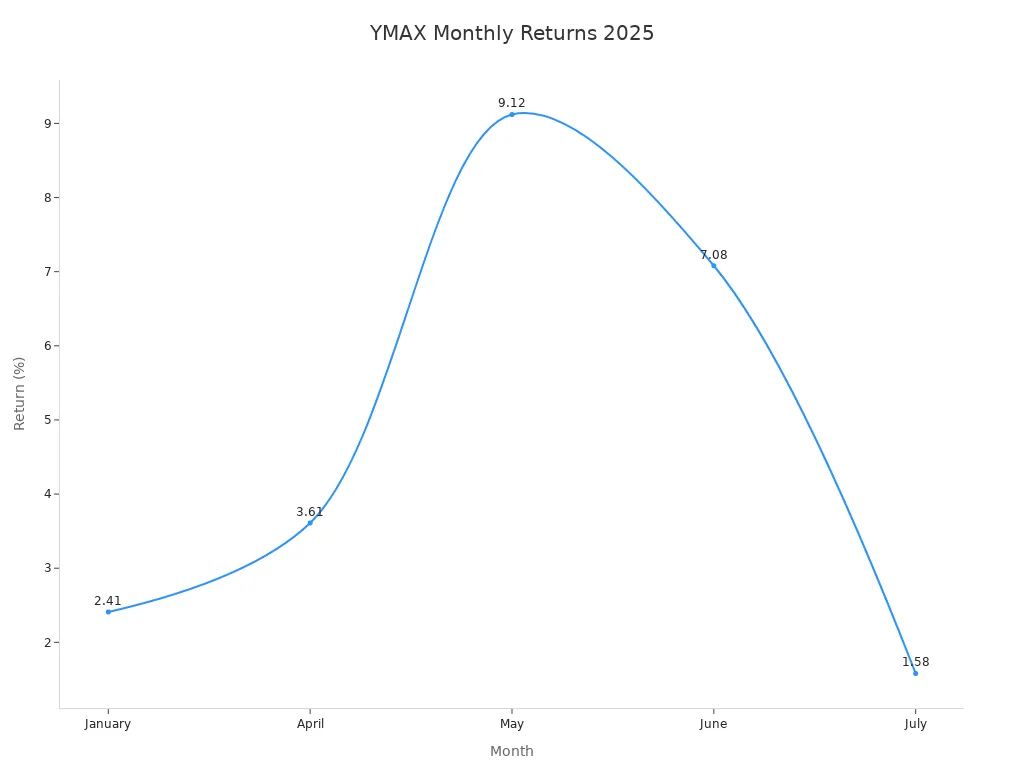

The fund’s monthly returns for 2025 show consistent performance, with notable gains in May and June:

| Month | Return |

|---|---|

| January | 2.41% |

| April | 3.61% |

| May | 9.12% |

| June | 7.08% |

| July | 1.58% |

YieldMax’s strategy focuses on generating high income, with distribution rates exceeding 65% and weekly payouts. This attracts income-focused investors, even during periods of market volatility. The fund’s total return, including dividends, reached 29.36% over the past year. Technical indicators show that the fund stabilized after previous NAV erosion, with prices above key moving averages. Strategy adjustments improved the outlook, despite challenges such as capped upside and high fees.

Setting Expectations

Investors should understand the balance between growth and income when considering YMAX stock. The fund uses synthetic covered call strategies, which generate income from option premiums but limit capital appreciation during strong market rallies. Distributions may include a return of capital, which can reduce NAV over time. The fund’s performance relies on active management and market conditions, making returns volatile and sometimes unpredictable.

Key expectations for funds like YieldMax include:

- Income generation remains the primary goal, with monthly payouts that often exceed those of traditional fixed income products.

- Capital appreciation is possible but capped due to the covered call strategy.

- Distributions can vary and may include return of capital, affecting NAV and long-term growth.

- The fund’s performance depends on market sentiment, technical indicators, and real-world events such as regulatory changes or adoption trends.

- Investors should expect higher risk and volatility compared to standard ETFs, with limited upside during strong market rallies.

The table below outlines typical characteristics of YieldMax funds:

| Aspect | Description |

|---|---|

| Income Generation | Focus on high current income via diversified high-yield securities and option premiums. |

| Capital Appreciation | Potential exists but may be capped or volatile due to covered call strategy. |

| Strategy | Actively managed to exploit market inefficiencies and credit opportunities. |

| Income Characteristics | Distributions can vary, may include return of capital affecting NAV. Higher income but with volatility. |

| Risk and Volatility | Higher risk and volatility inherent in high-yield and options-based strategies. |

| Investor Expectation | Balance between income generation and some capital appreciation, with moderate risk. |

Market conditions play a major role in shaping growth expectations for YMAX stock. Factors such as supply and demand, regulatory changes, and technical indicators influence price movements and fund performance. Large holders can impact price, and overall market sentiment drives volatility. Investors must conduct thorough research before investing in YieldMax funds.

YieldMax’s diversified, equal-weighted portfolio helps cushion downside during market corrections and capture upside during rebounds. The fund’s growth potential remains strong for aggressive investors seeking high income and some capital appreciation, but they must accept the risks of capped upside and NAV erosion.

Fund of Funds Structure

Image Source: pexels

How It Works

YMAX operates as an actively managed fund of funds, focusing on investments within the yieldmax universe fund. The fund does not purchase individual stocks. Instead, it allocates capital to a basket of yieldmax ETFs, each designed to generate monthly income through synthetic covered call strategies. The portfolio management team rebalances the investment portfolio monthly, maintaining equal weighting across the underlying yieldmax ETFs. This approach allows the fund to adapt to changing market conditions and optimize performance.

The selection process for the underlying ETFs relies on proprietary criteria. The fund prioritizes option income strategies that provide exposure to price returns with capped gains. The portfolio may also include direct investments in securities held by the underlying ETFs for tax purposes. The yieldmax universe fund structure simplifies ownership for investors, bundling multiple strategies into one investment portfolio.

Note: The fund’s structure uses synthetic long exposure and US Treasurys as collateral, which helps stabilize the portfolio and manage risk.

| Aspect | Details |

|---|---|

| Fund Structure | Actively managed open-ended fund of funds investing in yieldmax ETFs |

| Investment Objective | Generate monthly income through underlying yieldmax ETFs employing synthetic covered call strategies |

| Underlying ETFs Strategy | Use synthetic long exposure, covered call writing, and US Treasurys as collateral; no direct stock investments |

| Portfolio Management | Equal-weighted portfolio, rebalanced and adjusted monthly |

| Direct Investment Exception | May invest directly in securities held by underlying ETFs for tax purposes |

| Selection Criteria | Proprietary, focusing on option income strategies to provide exposure to price returns with capped gains |

| Weighting Scheme | Proprietary |

Diversification Benefits

The fund of funds structure provides significant diversification benefits for investors. By investing in multiple yieldmax ETFs, the fund spreads exposure across sectors such as technology, cryptocurrency, and consumer stocks. This diversified portfolio reduces single-issuer risk, which is common in single-stock focused ETFs like GOOY or PLTY. Monthly rebalancing ensures equal weighting, further enhancing stability.

- The portfolio pools yieldmax ETFs that employ covered call strategies on high-volatility securities.

- The fund includes a substantial allocation to US Treasurys and cash, which helps stabilize returns and reduce volatility.

- Diversification across sectors allows the fund to cushion against poor performance from any single issuer.

- The fund of funds approach narrows the range of returns, producing more consistent outcomes and lowering volatility compared to single-asset funds.

- Investors benefit from reduced downside risk, as the portfolio avoids concentration in the worst-performing investments.

Historical data from private equity and real estate funds of funds supports the idea that diversified structures reduce volatility and downside risk. By combining different asset classes and strategies, the yieldmax universe fund aims to deliver high income with more stable performance, though with capped upside.

Options-Based Income Strategy

Synthetic Covered Calls

YieldMax uses a unique options-based strategy to deliver high income for investors. The fund does not buy individual stocks directly. Instead, it uses synthetic covered calls to mimic stock ownership and generate option premiums. The fund buys deep-in-the-money call options, which provide price exposure similar to holding the underlying index or ETF. At the same time, it sells call options on the same securities. This approach allows the fund to collect premiums, but it also limits the upside if the price of the underlying asset rises above the strike price.

The fund also uses credit spreads. In this strategy, the fund sells call options at one strike price and buys calls at a higher strike price. This limits risk but also caps the amount of premium income. These strategies help the fund provide high yield and frequent distributions, often paid monthly or even weekly.

Note: The use of derivatives introduces risks such as counterparty risk, derivatives risk, and NAV erosion risk. The fund’s beta of 1.18 shows higher volatility than the market.

Income Generation

YieldMax stands out among high-yield ETFs for its high annual distribution yield. The fund’s current distribution rate reaches 72.34%, much higher than most high yield funds. This income generation comes from option premiums earned through covered call strategies on stocks like Carvana, Tesla, and NVIDIA. The fund invests in about 30 underlying YieldMax ETFs, each with less than 4% weighting, which helps diversify risk.

Distributions from the fund may include both income and return of principal. For example, on April 17, 2025, 54.00% of the fund’s distribution was classified as return of principal, while 96.57% was income. The return of principal means part of the investor’s original investment is being paid back, which can reduce the fund’s net asset value over time. Investors should understand that high yield does not always mean sustainable growth. During market downturns, the fund may see price and total return declines, even with high dividends.

- Key points about YieldMax’s income strategy:

- High income comes from option premiums, not traditional dividends.

- Distributions may include return of capital, which can erode NAV.

- The fund’s high expense ratio and frequent payouts may impact long-term capital growth.

- The fund is best suited for aggressive investors who can handle volatility and potential capital loss.

High-Yield Investing Risks

Capped Upside

YMAX uses a covered call strategy that limits gains when the underlying securities rise sharply. This approach generates high income from option premiums but restricts long-term growth potential. Investors in high-yield investments like YMAX often see underperformance compared to holding the underlying stocks directly, especially during strong market rallies. The fund’s structure means that even if the market performs well, the upside for investors remains capped. Frequent rebalancing and high fees further reduce the chance for significant capital appreciation. While recent adjustments have improved the outlook, the capped upside remains a core feature of the yieldmax approach.

- Covered call writing limits gains in rising markets.

- High-yield investing in yieldmax funds often trades growth for income.

- Underperformance risk increases during bullish periods.

NAV Erosion

Net Asset Value (NAV) erosion is a significant risk for high-yield investments like YMAX. The fund pays out high monthly distributions, but a large portion of these payments may come from Return of Capital (ROC). When investors receive ROC, they are getting back their own money, not earnings. Over time, this reduces the fund’s NAV and can lead to capital loss. For example, up to 96.86% of distributions may be classified as ROC, which erodes the investment’s value. Share price declines, such as a 22.57% drop year-to-date, highlight the impact of this risk. High operating fees, currently at 1.28%, also contribute to NAV erosion by reducing net returns.

- High ROC payouts reduce NAV over time.

- Share price can experience severe drawdowns.

- High fees further erode returns for yieldmax investors.

Tax Implications

Investors in yieldmax funds face complex tax consequences due to the nature of high-yield investments. Many distributions are classified as Return of Capital, which lowers the investor’s cost basis. For instance, if an investor starts with $10 and receives 96% ROC payouts, the cost basis could fall to $0.40 after one year. When the investor sells shares, the lower cost basis results in higher taxable capital gains, even if the fund’s NAV has dropped. Investors must track their adjusted cost basis to avoid unexpected tax bills. The dividend reinvestment plan can further complicate tax reporting, as reinvested distributions also affect the cost basis. Dividend sustainability remains a concern, as high yields may not persist and can lead to higher taxes in the future.

Note: Investors should consult a tax professional to understand the full impact of high-yield investing in yieldmax funds.

Suitability and Allocation

Ideal Investors

YMAX fits the needs of income-seeking investors who want steady payouts and can accept moderate risk. The fund uses covered call strategies across a diversified set of underlying yieldmax ETFs, which helps balance income and stability. Investors who prefer less volatility than more concentrated funds, such as ULTY, may find YMAX more appealing. Those who seek moderate growth and high yield, but understand the capped upside, are best suited for this fund. YMAX works well for individuals who can tolerate fluctuations in net asset value and are comfortable with options-based investments.

A suitable investor profile for YMAX includes:

- Individuals focused on generating monthly income rather than maximizing capital gains.

- Investors who accept the risk of NAV erosion due to return-of-capital distributions.

- Those who understand options strategies and do not expect uncapped equity growth.

- People willing to pair YMAX with other high-yield ETFs to reduce risk while maintaining income exposure.

- Investors who avoid buy-and-hold strategies focused on capital preservation.

YMAX does not suit inexperienced investors or those who cannot tolerate volatility. Conservative investors may prefer alternatives like JPMorgan’s JEPI, which offers lower risk and steadier returns.

Risk Management

Effective risk management is essential when adding YMAX to a portfolio. The fund’s covered call strategy caps upside gains and exposes investors to downside risk, especially during market declines. YMAX charges a double-fee structure, including a management fee of 0.29% and underlying ETF fees averaging 0.99%, which can erode returns over time. Distributions often include return of capital, reducing net asset value and potentially misleading investors about true wealth creation.

Investors should limit portfolio allocation to YMAX, with experts recommending no more than 5% of total investments. Pairing YMAX with a short volatility strategy ETF, such as Simplify’s SVOL, can help balance risk. An aggressive income portfolio might hold up to 5% in YMAX and 10% in SVOL, following a 1:2 allocation ratio. The fund’s diversification across 22 underlying ETFs reduces single-stock risk, but high volatility remains a concern.

Key risk management strategies include:

- Maintaining discipline with portfolio allocation and avoiding overexposure to high-yield funds.

- Monitoring NAV erosion and understanding the impact of return-of-capital distributions.

- Using hedging mechanisms and pairing YMAX with complementary strategies.

- Reviewing the fund’s performance regularly, especially during volatile or declining markets.

YMAX works best for investors who prioritize income generation, understand options-based ETF complexities, and can tolerate periods of underperformance. Conservative income investors should avoid YMAX due to its volatility and risk profile.

YMAX offers strong income potential through its fund-of-funds and options-based strategies, but investors face risks such as NAV erosion, high fees, and capped upside. Many advisors suggest blending YMAX with other covered call ETFs to balance income and capital preservation. Investors should align YMAX with their goals and risk tolerance, limit allocation, and diversify across asset classes.

Before investing, review educational resources, monitor fund performance, and consult a financial advisor for personalized guidance.

FAQ

What is the main goal of YMAX’s fund of funds strategy?

YMAX aims to generate high monthly income by investing in a diversified group of YieldMax ETFs. The fund uses options-based strategies to provide steady payouts for income-focused investors.

How does YMAX manage risk for investors?

YMAX spreads investments across multiple sectors and underlying ETFs. This diversification helps reduce single-issuer risk and cushions the impact of poor performance from any one area.

Can investors lose money with YMAX?

Yes. Investors can lose money if the fund’s net asset value declines due to market downturns, high fees, or return-of-capital distributions. The covered call strategy also limits potential gains.

Are YMAX distributions taxed as regular income?

Distributions may include both income and return of capital. Return of capital lowers the investor’s cost basis, which can lead to higher taxable capital gains when shares are sold. Consult a tax professional for details.

Where can investors find the current USD exchange rate?

Investors can check the latest USD exchange rates on XE.com or OANDA. These sites provide real-time currency conversion rates for global markets.

Investing in high-yield products like YMAX, with their complex options strategies and risks of NAV erosion, requires a platform that simplifies multi-asset management. While YMAX offers a unique approach to income, a robust, all-in-one financial solution is key to navigating the broader market.

BiyaPay provides just that, allowing you to seamlessly trade stocks, cryptocurrencies, and other global assets from a single account. Our platform is designed to be cost-effective, with remittance fees as low as 0.5%, ensuring your capital works harder for you. You can easily check real-time exchange rates to optimize every transaction. Stop juggling multiple accounts and consolidate your strategy. Register with BiyaPay today to streamline your portfolio and take full control of your financial growth.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.