- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

FOXO Stock’s 2025 Performance and What It Means for Investors

Image Source: pexels

FOXO stock currently stands as a clear sell for 2025. The price has dropped over 53% in just ten days, with FOXO technologies showing extreme volatility and no support below current levels. Investors face urgent risks as the market cap for FOXO has fallen to $3.071 million and technical analysis signals further downside. The following table highlights the latest FOXO stock data:

| Metric | Value | Description |

|---|---|---|

| Closing Price (Aug 12, 2025) | $0.102 | Latest closing price of FOXO stock |

| Price Decline Over Last 10 Days | -53.45% | Sharp drop in recent 10-day period |

| Intraday Volatility (Aug 12, 2025) | 19.21% | Percentage fluctuation within the day |

| 52-Week Low | $0.0724 | Lowest price in last year |

| Market Cap (Aug 12, 2025) | $3.071M | Company valuation |

FOXO technologies presents significant financial instability, making careful analysis essential for all investors.

Key Takeaways

- FOXO stock dropped sharply over 53% in ten days and shows high volatility, making it a risky investment in 2025.

- The company faces ongoing financial losses despite strong revenue growth from acquisitions, leading to a low market value and negative earnings.

- Technical analysis signals a strong sell trend, with the stock trading near its lowest levels and limited chances for a quick rebound.

- FOXO completed a reverse stock split to meet exchange rules, but this action does not fix the underlying financial problems.

- Investors should watch upcoming earnings reports and company updates closely while using risk management tools like stop-loss orders and diversification.

Buy, Sell, or Hold?

FOXO Stock Recommendation

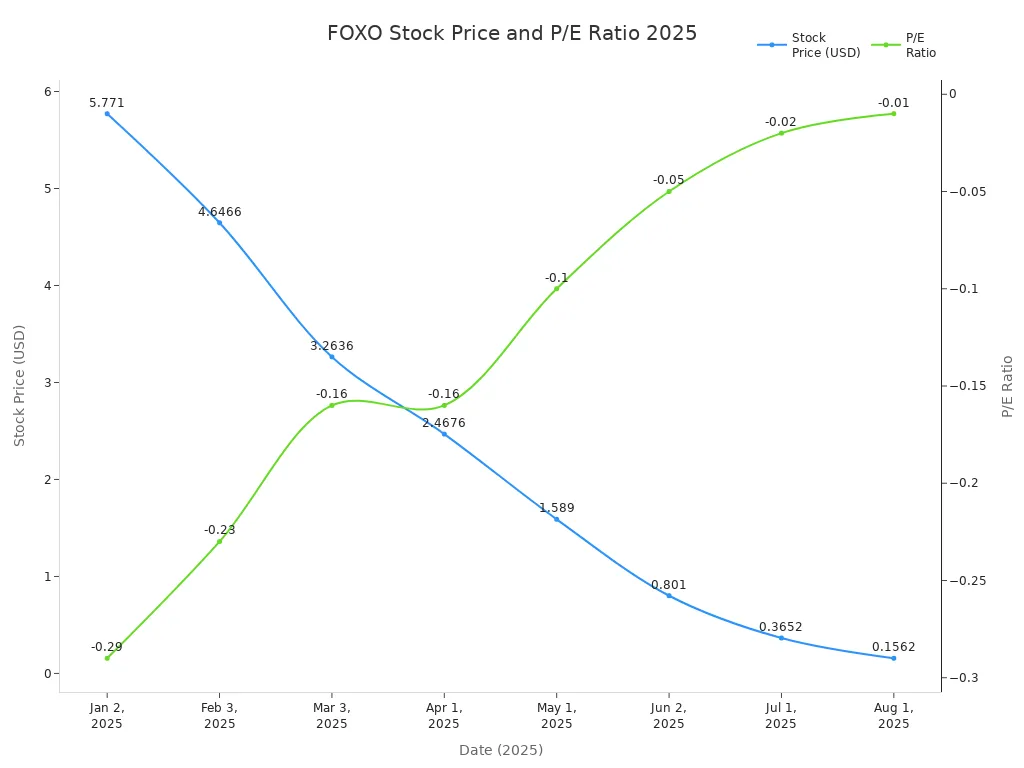

The 2025 performance of foxo stock presents a challenging landscape for investors. The annual report and recent analysis show a persistent downward trend in price and earnings. The following table summarizes the historical data supporting a sell recommendation:

| Date | Stock Price (USD) | P/E Ratio | Trend/Change Summary |

|---|---|---|---|

| Jan 2, 2025 | 5.771 | -0.29 | Start of year, higher price, negative earnings |

| Feb 3, 2025 | 4.6466 | -0.23 | Price and P/E ratio decline, still negative earnings |

| Mar 3, 2025 | 3.2636 | -0.16 | Continued decline in price and P/E ratio |

| Apr 1, 2025 | 2.4676 | -0.16 | Price continues to fall, P/E stable but negative |

| May 1, 2025 | 1.589 | -0.10 | Sharp price drop, slight P/E improvement but still negative |

| Jun 2, 2025 | 0.801 | -0.05 | Price halved again, P/E ratio improving but negative |

| Jul 1, 2025 | 0.3652 | -0.02 | Price near all-time low, P/E close to zero but negative |

| Aug 1, 2025 | 0.1562 | -0.01 | Lowest price, P/E ratio almost zero but negative |

The chart above illustrates the steep decline in foxo stock price and the negative P/E ratio throughout 2025. The annual report confirms that foxo technologies faces deep net losses and weak market confidence. The fundamentals remain poor, with negative earnings per share and no dividends paid. The market capitalization has dropped to micro-cap levels, and the beta value of 2.97 signals high volatility. The analysis points to a sell recommendation for foxo stock, as the financial health continues to deteriorate.

Investors should note that the next earnings report is scheduled for August 18, 2025. This event may provide further insight into the company’s prospects, but current data supports a sell stance.

Key Drivers

Several key drivers influence the buy, sell, or hold decision for foxo stock in 2025. The annual report and technical analysis highlight the following factors:

- Technical signals present a mixed outlook, with five buy and four sell signals, resulting in a neutral rating.

- Moving averages for short, mid, and long terms remain negative, indicating bearish momentum.

- Some bullish technical indicators, such as RSI below 30 and stochastic oscillator below 20, suggest possible rebound opportunities.

- The stock has been in a downtrend since July 23, 2025, with a price decline exceeding 70%.

- Seasonality analysis identifies February as the month with the highest probability of positive returns, while January is the weakest.

- Decreasing trading volume amid price decline may hint at a potential rebound.

Recent company developments also impact foxo stock’s outlook:

- FOXO technologies completed a 1-for-10 reverse stock split, reducing shares and aiming to enhance per-share value.

- The split received approval from the board and majority shareholders, reflecting strategic consensus.

- The company reported 2024 revenue of approximately $4.05 million, showing room for growth.

- Despite a perfect gross margin, foxo maintains a negative EBIT margin and deep net losses.

- Strategic acquisitions and the issuance of Series E Preferred Stock aim to fund growth and improve cash flow.

- Expansion of wound care services and behavioral health operations, such as Myrtle Recovery Centers, signal potential revenue growth.

The analysis shows that foxo technologies is attempting to stabilize operations and pursue growth. However, the persistent financial instability and high volatility suggest that a sell recommendation remains appropriate for most investors. Those considering a buy should closely monitor upcoming earnings and operational developments.

FOXO Stock Price Action

2025 Decline Overview

FOXO experienced a dramatic selloff in 2025, with the stock price falling over 85% year-to-date. The current price sits at $0.102 USD, a sharp contrast to the $5.77 USD level seen at the start of the year. The 52-week low reached $0.0724 USD, highlighting the severity of the decline. On several occasions, the stock recorded intraday lows that triggered automatic trading halts due to extreme volatility. The 20.64% drop in a single session during July marked one of the steepest selloffs for FOXO in recent memory.

The company implemented a reverse stock split at a 1-for-1.99 ratio effective July 27, 2025. This move aimed to keep the share price above the $0.10 USD threshold required by the NYSE American exchange. The table below summarizes the impact of this corporate action:

| Aspect | Details |

|---|---|

| Reverse Stock Split Ratio | 1 for 1.99 shares effective July 27, 2025 |

| Purpose | To comply with NYSE American listing requirement to keep share price above $0.10 |

| Effect on Share Price | Mechanical increase by reducing outstanding shares; no change in company value |

| Impact on Business Operations | No expected impact |

| Investor Sentiment - Positive | Maintains listing compliance; fractional shares rounded up benefiting small shareholders |

| Investor Sentiment - Negative | Signals underlying share price weakness; may indicate financial distress; potential liquidity reduction |

| Governance Concern | Approved by majority stockholder without broader shareholder vote |

| Hedge Fund Activity in Q1 2025 | 14 institutional investors reduced holdings significantly; notable large share sell-offs by multiple funds |

The reverse split provided temporary support for the current price, but it did not address the underlying bearish trend or restore investor confidence.

Volatility and Trading Trends

Trading activity in FOXO stock remained elevated throughout 2025. The stock saw a 134% surge after the annual report in May, driven by optimism around acquisitions and a possible turnaround. However, this rally quickly faded, and the price resumed its downward trajectory. The 52-week low and persistent selloff reflected ongoing bearish sentiment.

The table below outlines key trading and volatility patterns:

| Aspect | Evidence Summary |

|---|---|

| Price Surge | FOXO stock surged by 134% after the annual report release in May 2025, driven by growth-oriented acquisitions and potential financial turnaround despite prior negative earnings. |

| Price Decline | Experienced a steep year-to-date decline of over 52%, indicating high volatility and investor uncertainty. |

| Corporate Action | Completed a reverse stock split in April 2025 aimed at stabilizing the stock and meeting listing standards. |

| Earnings Reports Impact | Earnings announcements cause significant volatility; Q4 2024 showed a 146% improvement in EPS compared to the previous year. |

| Macroeconomic Influence | Stock is sensitive to broader economic factors like interest rates and market sentiment, showing more pronounced reactions to downturns than broader indices. |

| Trading Recommendations | Traders should monitor earnings, corporate strategies, and macroeconomic conditions, using risk mitigation tools such as diversification and stop-loss orders. |

Volatility remained a defining feature, with frequent price swings and unpredictable trading volumes. Bearish momentum dominated most sessions, and traders faced challenges in timing entry and exit points. The current price reflects both the impact of the reverse split and the ongoing selloff. FOXO continues to trade near its 52-week low, and bearish signals persist in technical analysis.

Technical Analysis

Image Source: pexels

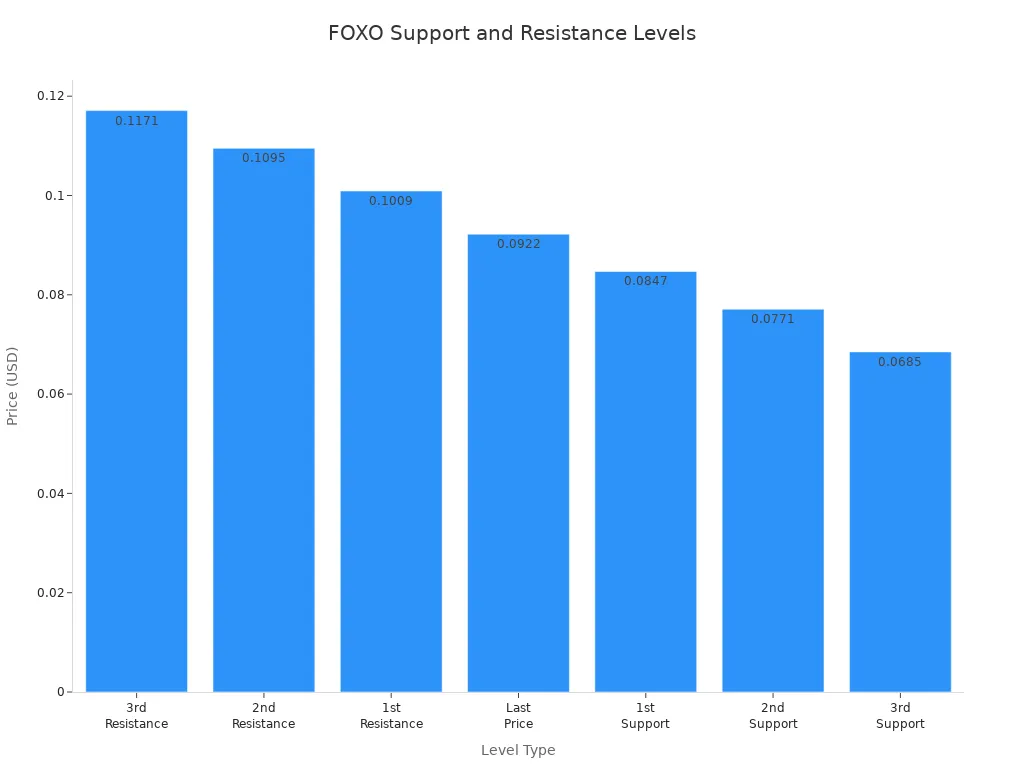

Support and Resistance

Technical analysis of FOXO stock in 2025 highlights clear support and resistance levels. These levels help investors understand where the stock might pause or reverse direction. The table below shows the current support and resistance points based on the pivot point method, which uses the day’s high, low, and close values.

| Level Type | Value |

|---|---|

| 3rd Resistance Point | 0.1171 |

| 2nd Resistance Point | 0.1095 |

| 1st Resistance Point | 0.1009 |

| Last Price | 0.0922 |

| 1st Support Level | 0.0847 |

| 2nd Support Level | 0.0771 |

| 3rd Support Level | 0.0685 |

The current price sits just above the first support level. If the price falls below $0.0847, the next support appears at $0.0771. These levels act as warning signs for further bearish movement. The technical indicator analysis gives a strong sell signal, with a 96% sell rating. This rating reflects the ongoing bearish sentiment and signals that sellers control the market. Resistance levels at $0.1009 and above may limit any short-term rebounds, keeping the overall trend bearish.

Oversold Signals

Traders often look for signs that a stock is oversold, which can suggest a possible rebound. For FOXO, several technical indicators provide insight:

- The Relative Strength Index (RSI) helps identify if FOXO is oversold. A low RSI value means the stock may have dropped too far, too fast, and could bounce back.

- The Average True Range (ATR) measures how much the price moves each day. High ATR values show strong volatility, which often happens during bearish trends.

- The Average Directional Index (ADX) and its components (+DI and -DI) show the strength and direction of the trend. While these do not directly show oversold conditions, a strong bearish trend often matches with low RSI readings.

- Historic Volatility tracks how much the price changes over time. High volatility can signal that the bearish trend may reverse soon.

Note: The current RSI value for FOXO is not available, but the presence of a strong bearish trend and high volatility suggests the stock may be oversold. Investors should watch for a shift in momentum before considering any action.

FOXO Financial Health

Image Source: pexels

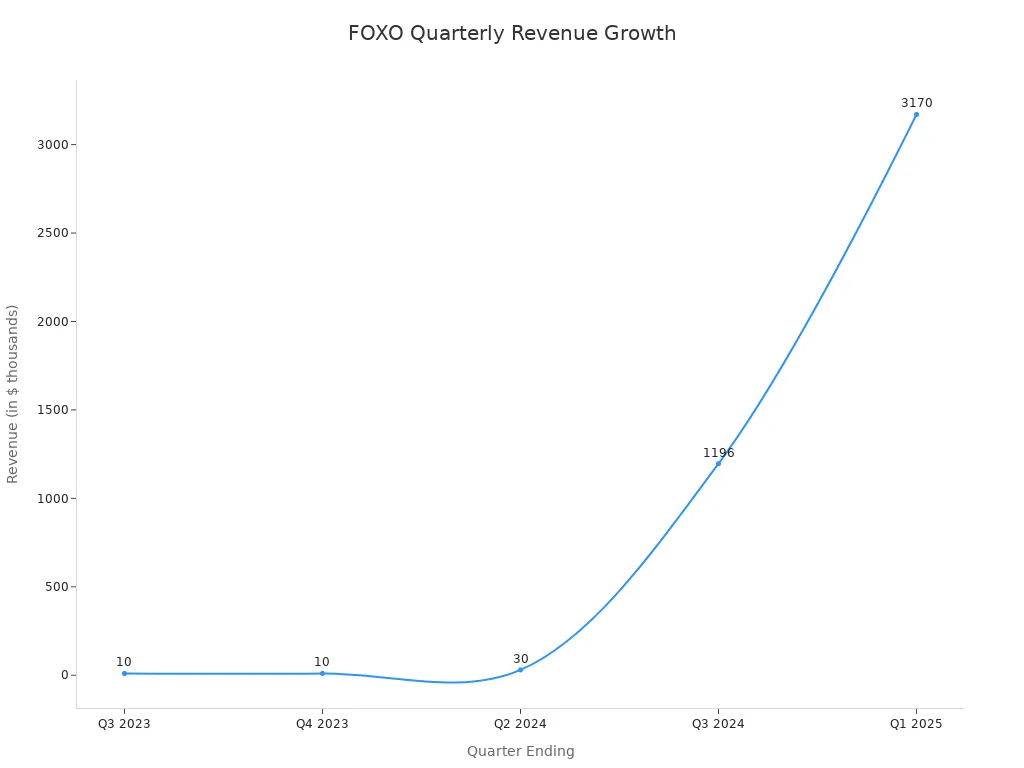

Earnings and Revenue

FOXO Technologies reported strong revenue growth in recent quarters. The company achieved annual revenue of $4.05 million USD in 2024, which marked a 2,688.61% increase compared to the previous year. The trailing twelve months revenue reached $7.21 million USD, showing a 5,072.65% growth. For the quarter ending March 31, 2025, FOXO posted revenue of $3.17 million USD, representing a 44,049.30% increase. This rapid expansion resulted mainly from acquisitions, including Myrtle Recovery Centers and Rennova Community Health.

Despite these gains, FOXO continues to report net losses. The company’s earnings per share (EPS) remained negative in previous quarters, with -4.78 USD in Q2 and Q4 2024, and -14.93 USD in Q3 2023. The following table summarizes recent earnings and revenue figures:

| Date | Quarter | Reported EPS | Revenue (in $ millions) |

|---|---|---|---|

| 08/19/2024 | Q2 2024 | -4.78 | 0.03 |

| 06/28/2024 | Q4 2023 | -4.78 | 0.01 |

| 01/19/2024 | Q3 2023 | -14.93 | 0.01 |

The chart below illustrates FOXO’s quarterly revenue growth from Q3 2023 to Q1 2025.

Although revenue increased, FOXO’s financial statements show ongoing net losses. The company’s market cap has dropped to $3.071 million USD, reflecting investor concerns about long-term profitability.

Balance Sheet and Cash Flow

FOXO Technologies faces significant financial challenges. The company’s balance sheet reveals very low cash reserves, with only $5,757 USD available. Total current liabilities stand at $2,395,872 USD. Loans from the parent company total $453,782 USD, and the note payable to the parent is $1,610,617 USD. The stockholders’ deficit is -$1,885,755 USD.

| Category | Amount (USD) |

|---|---|

| Cash | 5,757 |

| Total Current Liabilities | 2,395,872 |

| Loans from Parent | 453,782 |

| Note Payable to Parent | 1,610,617 |

| Stockholders’ Deficit | (1,885,755) |

Negative net income and operating cash flows continue to affect FOXO. In FY 2024, net income was -$2.84 million USD, and in FY 2023, it was -$6.64 million USD. The company relies on debt financing, especially related party loans, to maintain cash flow. Financing activities, such as issuing debt, have helped FOXO keep its cash balances stable, but this approach increases financial risk.

Operational instability remains a concern for investors. FOXO’s shares dropped 10.9% in pre-market trading after announcing a reverse stock split, which signaled distress. The 2024 annual report included an auditor’s going concern warning, highlighting uncertainty about the company’s ability to continue operations. These factors reduce investor confidence and raise questions about FOXO’s future.

Market Sentiment

Short Interest

Short interest in FOXO Technologies remains relatively low compared to industry peers. The latest data shows 499,000 shares sold short, which accounts for 2.50% of the float. This figure stands below the levels seen in similar companies, such as Marin Software Incorporated, which has a short interest of 10.00%. The short interest ratio for FOXO is 0.1 days, indicating that short sellers can cover their positions quickly due to high trading volume. The table below compares FOXO’s short interest statistics with industry examples:

| Metric | FOXO Technologies (FOXO) | Industry Peers Examples |

|---|---|---|

| Short Interest (shares) | 499,000 | Sparta Commercial Services, Inc.: N/A |

| Short Interest (% of float) | 2.50% | Marin Software Incorporated: 10.00% |

| Change from Previous Month | +91.19% | Ryvyl Inc.: 22.49% |

| Short Interest Ratio (days) | 0.1 | Mullen Automotive, Inc.: 412.59% |

| Float Size | 19,990,000 shares | VCI Global Limited: 2.22% |

Short interest in FOXO increased by 91.19% from the previous month, but the overall percentage remains modest. This suggests that bearish sentiment from short sellers is limited. Most traders focus on volatility and quick price movements rather than long-term short positions. The low days-to-cover ratio further supports the view that short-term risk from short selling is minimal.

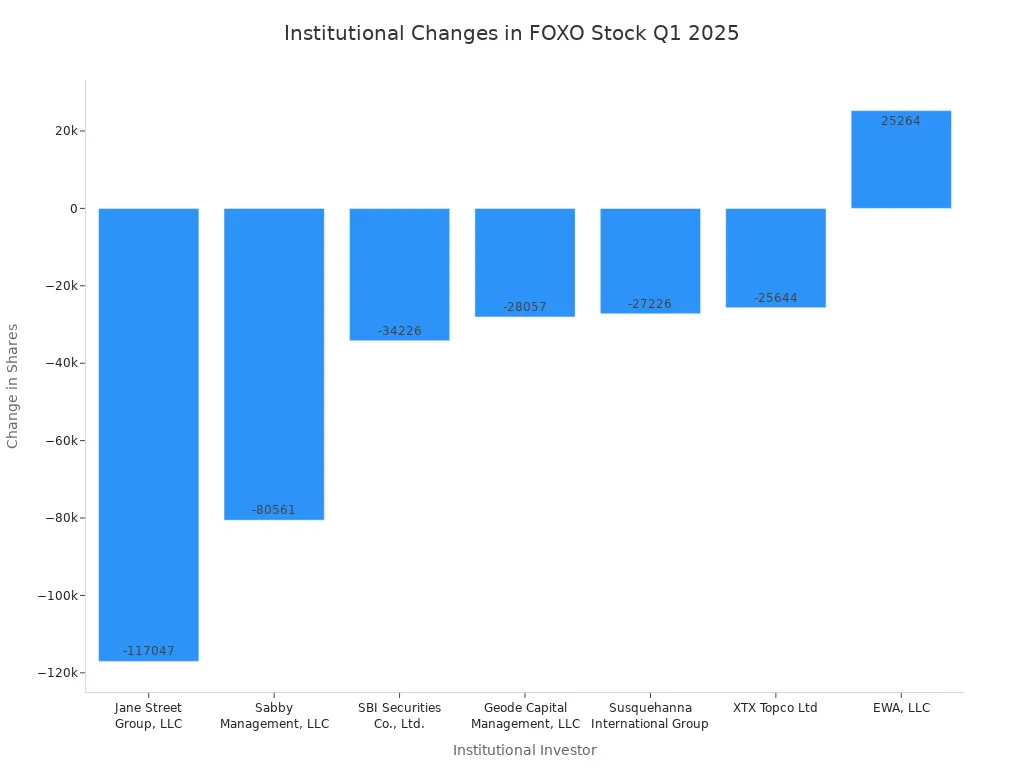

Institutional Activity

Institutional investors have shown a clear trend of reducing their positions in FOXO stock during 2025. Many large investors, including Jane Street Group, LLC and Sabby Management, LLC, sold all their holdings in the first quarter. Only a few institutions, such as EWA, LLC, increased their shares. The table below summarizes these changes:

| Institutional Investor | Change in Shares | Percentage Change | Quarter |

|---|---|---|---|

| Jane Street Group, LLC | -117,047 | -100% | Q1 2025 |

| Sabby Management, LLC | -80,561 | -100% | Q1 2025 |

| SBI Securities Co., Ltd. | -34,226 | -87% | Q1 2025 |

| Geode Capital Management, LLC | -28,057 | -66.1% | Q1 2025 |

| Susquehanna International Group | -27,226 | -100% | Q1 2025 |

| XTX Topco Ltd | -25,644 | -100% | Q1 2025 |

| EWA, LLC | +25,264 | Increase | Q1 2025 |

Order flow data during FOXO’s nearly 10% price drop revealed no block trades or significant institutional activity. This indicates that retail investors or organic market forces drove the selloff. The absence of institutional buying or selling during sharp declines signals cautious or negative sentiment among major investors. Most institutions have exited or reduced their positions, which reflects diminished market confidence in FOXO stock.

Recent social media and news analysis show mixed but cautious optimism among investors. CEO Mark White’s communications about commercializing new technology and pursuing acquisitions have sparked some interest. However, ongoing financial instability and trading volatility have led many traders to adopt disciplined risk management strategies. The balance between hope for growth and wariness of risk defines the current market sentiment for FOXO.

Risks and Opportunities

Downside Risks

FOXO stock faces several significant risks that investors must consider before making any decisions. Market analysts highlight intense competition in the biotech sector, which makes gaining market share difficult. Regulatory requirements in the industry can lead to unexpected costs and compliance challenges. FOXO reported a net loss last year, which raises concerns about financial stability. The stock’s low trading price and ongoing uncertainties require careful risk management strategies, such as stop-loss orders.

Recent price history shows a 20.1% decline over five consecutive days, reaching the lowest price since April 2025. This pattern often signals further downward movement in the short and medium term. Technical indicators, including “Death Cross” patterns and “Double Tops Short-Term,” reinforce bearish momentum. The stock’s microcap status, with a market cap near $3.071 million USD (see current USD exchange rates), increases volatility and risk. High Average True Range values also point to substantial price swings. The lack of clear communication from FOXO has increased uncertainty and contributed to the recent selloff.

Investors should monitor technical signals and price trends closely. Persistent weakness may continue unless FOXO delivers positive news or operational improvements.

Upside Potential

Despite the risks, FOXO stock presents several opportunities for investors willing to accept volatility. The company’s recent acquisitions, such as Myrtle Recovery Centers, have driven rapid revenue growth. Quarterly revenue reached $3.17 million USD, showing a strong upward trend. Some technical indicators, including a high Relative Strength Index (RSI) of 73, suggest the stock is currently overbought. This condition may lead to a short-term correction, but it also signals strong momentum.

The biotech sector offers long-term opportunity for innovation and expansion. FOXO’s strategic moves, including the reverse stock split and expansion into behavioral health, create a potential opportunity for future growth. The low Price-to-Earnings ratio of 1.19 may indicate undervaluation if the company improves its financial health. Investors who seek opportunity in turnaround stories may find FOXO attractive, but they must use disciplined risk management.

Careful analysis of upcoming earnings reports and operational updates will help investors identify the best opportunity for entry or exit.

What Investors Should Watch

Key Events Ahead

Investors should pay close attention to several critical events in 2025 that may affect FOXO stock. On August 12, 2025, NYSE American began delisting proceedings against FOXO Technologies Inc. This action could impact the stock’s trading status and valuation. Delisting often leads to reduced liquidity and may force shares to trade on less regulated markets.

Several important financial filings are scheduled throughout the year. FOXO Technologies Inc. plans to file its 10-K Annual Report in April 2025. The 10-Q Quarterly Report is expected in May 2025. On July 18, 2025, the company submitted an 8-K Material Event filing. Additional regulated disclosures and financial exhibits will occur during mid-2025. Investors should monitor all quarterly earnings releases and annual reports for updates on financial health and business strategy.

A summary of key events to watch:

- NYSE American delisting proceedings (August 12, 2025)

- 10-K Annual Report filing (April 2025)

- 10-Q Quarterly Report (May 2025)

- 8-K Material Event filing (July 18, 2025)

- Additional financial disclosures throughout mid-2025

For investors tracking monetary values, all figures are in USD. For current exchange rates, refer to XE.com.

Risk Management

Managing risk is essential when investing in highly volatile stocks like FOXO. Investors should set clear stop-loss orders to limit potential losses. Diversification remains a key strategy. Allocating funds across different sectors can reduce the impact of a single stock’s decline.

Monitoring liquidity is important, especially if delisting occurs. Stocks that move to over-the-counter markets often see lower trading volumes. Investors should review each financial report for signs of improvement or further risk. Staying informed about regulatory actions and company announcements helps investors make timely decisions.

A simple risk management checklist:

- Set stop-loss orders

- Diversify investments

- Monitor liquidity and trading volumes

- Review each financial report and company announcement

- Stay updated on regulatory changes

Investors who follow these steps can better navigate the uncertainty surrounding FOXO stock in 2025.

FOXO’s sharp decline in 2025 highlights the importance of caution for investors. The company’s reliance on preferred stock and reverse splits offers only temporary relief, while liquidity remains a concern. Investors should recognize that foxo’s equity changes reflect accounting moves, not operational strength. Strategic acquisitions may help, but only if foxo achieves real growth. The current outlook supports a sell stance rather than a buy, especially with ongoing governance risks and warnings about insufficient funds. Monitoring upcoming reports and market signals remains essential for anyone considering foxo.

FAQ

What caused FOXO stock’s sharp decline in 2025?

FOXO stock dropped due to persistent net losses, high volatility, and a reverse stock split. Investors lost confidence after financial reports showed weak earnings and a shrinking market cap. The NYSE American delisting proceedings also pressured the share price.

Is FOXO stock likely to recover soon?

Analysts see limited recovery potential unless FOXO improves its financial health. The company must show consistent revenue growth and reduce losses. Investors should watch for positive earnings reports or new business developments before expecting a rebound.

How does the reverse stock split affect shareholders?

A reverse stock split reduces the number of shares but increases the price per share. This action does not change the company’s value. Shareholders keep the same overall investment, but the move often signals financial distress.

What risks should investors consider with FOXO stock?

Investors face risks such as possible delisting, ongoing net losses, and high price volatility. The company’s low cash reserves and heavy reliance on debt financing add to the uncertainty. Careful risk management is essential.

Where can investors find FOXO’s latest financial reports?

Investors can access FOXO’s financial reports on the company’s official website or through the U.S. Securities and Exchange Commission (SEC) database. Monitoring these reports helps investors stay informed about earnings, revenue, and business strategy.

Investing in highly volatile stocks like FOXO, especially after a delisting event, highlights the critical need for a robust and diversified investment strategy. Navigating the complex risks of low liquidity and financial instability requires a reliable partner.

BiyaPay offers a versatile platform that allows you to manage a wide range of assets, including stocks, cryptocurrencies, and other global assets, all from one account. We empower you to act on market opportunities with confidence, thanks to competitive fees as low as 0.5% and efficient fund transfers. Avoid the pitfalls of single-stock risk and expand your horizons. Register with BiyaPay today to build a more resilient portfolio and simplify your financial life.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.