- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How JNUG Stock Responds to Gold Price Movements in Today's Market

Image Source: pexels

JNUG stock moves in response to gold price changes with amplified speed and magnitude, reflecting its design as a 2x leveraged ETF. This ETF seeks to deliver double the daily performance of the junior gold miners index, causing sharp and volatile swings. Investors often see opportunities for quick gains, but the short-term nature and daily resets of this ETF also create unique risks. Technical analysis shows that JNUG stock requires precise timing due to its volatility and the compounding effect of leverage.

Key Takeaways

- JNUG is a 2x leveraged ETF that moves twice as much as junior gold miners, making it very volatile and risky.

- The ETF resets its leverage daily, so it is designed for short-term trading, not long-term holding.

- Gold price increases often lead to bigger gains in JNUG because junior gold miners benefit more from rising gold prices.

- Investors must manage risk carefully using tools like stop-loss orders due to JNUG’s amplified gains and losses.

- JNUG’s high volatility and daily reset can cause its returns to differ greatly from gold prices over time.

JNUG Stock Basics

What Is JNUG Stock

JNUG stock represents a specialized exchange-traded fund (ETF) that seeks to provide investors with double the daily performance of the MVIS Global Junior Gold Miners Index. This ETF focuses on junior, or small-cap, gold mining companies. These companies often experience higher volatility than larger mining firms. JNUG stock does not invest directly in physical gold. Instead, it tracks an index that includes companies generating at least 50% of their revenue from gold or silver mining. The ETF uses a synthetic replication method, relying on derivatives and swaps to achieve its investment goals.

Note: JNUG stock is managed by Rafferty Asset Management LLC under the Direxion brand. The ETF distributes dividends and has an expense ratio of 1.02%. Investors should understand that JNUG stock is structured as an open-ended fund and follows a passive management style.

The table below summarizes the key attributes of this ETF:

| Attribute | Description |

|---|---|

| Leverage | 2x daily leveraged ETF |

| Objective | To provide twice the daily performance of the MVIS Global Junior Gold Miners Index |

| Index Tracked | MVIS Global Junior Gold Miners Index (companies with ≥50% revenue from gold or silver mining) |

| Exposure Caps | Silver mining firms capped at 20% during quarterly reviews |

| Company Size Focus | Junior (small-cap) gold mining companies |

| Structure | Open-Ended Fund |

| Replication Method | Synthetic replication |

| Management Style | Passive |

| Issuer | Rafferty Asset Management LLC |

| Brand | Direxion |

| Dividend Treatment | Distributes dividends |

| Expense Ratio | 1.02% |

| Risk Note | Focus on daily returns with potential for amplified gains or losses due to leverage |

How Leverage Works

Leverage is a key feature of this ETF. JNUG stock uses financial instruments such as derivatives and swaps to amplify the daily returns of the underlying index. For every 1% move in the MVIS Global Junior Gold Miners Index, the ETF aims to move 2% in the same direction. This leverage only applies to daily returns. Over longer periods, the effects of compounding can cause the ETF’s performance to diverge from the expected multiple of the index.

Leveraged ETFs like JNUG stock are designed for short-term trading. They reset their leverage daily, which means holding them for more than one day can lead to unpredictable results. The compounding effect can magnify both gains and losses, especially in volatile markets. Investors should use these ETFs with caution and understand the risks involved. JNUG stock is not intended for long-term holding, as the daily reset and volatility can erode returns over time.

Gold and Gold Miners Relationship

Image Source: pexels

Gold Price Impact

Gold price movements play a crucial role in shaping the fortunes of junior gold miners. When gold prices rise, junior gold miners often see their projects become more valuable. Higher gold prices can lower the cut-off grades for mining, which means more of the resource becomes profitable to extract. This change can lead to a significant increase in the value of these companies. Investors usually notice that junior gold miners experience larger gains than the actual increase in gold prices.

- Rising gold prices boost the economic value of junior gold miners’ projects.

- Net present value and internal rate of return for these companies often improve more than the gold price itself.

- Investors tend to see outsized returns in junior gold miners during gold price rallies.

- Increased gold prices attract more investor interest, making it easier for junior gold miners to raise capital.

- Higher prices allow junior gold miners to expand exploration and production.

- Improved economics can lead to updated studies and higher company valuations.

- A strong gold market encourages mergers, acquisitions, and partnerships among junior gold miners.

Junior gold miners also benefit from increased exploration budgets and new technology adoption when gold prices are high. These companies may increase production and seek strategic partnerships to share costs and expertise. As a result, junior gold miners become more attractive to investors and larger mining firms.

Gold Miners Index

JNUG tracks the MVIS Global Junior Gold Miners Index, which includes junior gold and silver mining companies. These companies are smaller and often in the early stages of exploration or production. Because of their size and stage, junior gold miners face higher risks and greater price swings than larger gold miners.

- JNUG is a 2x leveraged ETF, aiming to deliver twice the daily performance of the junior gold miners index.

- Junior gold miners have higher operational risks and weaker financials compared to established gold miners.

- The index includes companies with at least half of their revenue from gold or silver mining.

- JNUG’s focus on junior gold miners makes it more volatile than standard gold ETFs, which track the price of gold directly.

- The leverage in JNUG amplifies these swings, leading to sharp moves in both directions.

Investors should understand that JNUG’s volatility comes from both its focus on junior gold miners and its leveraged structure. This combination can lead to rapid gains but also steep losses, especially during periods of gold price volatility.

JNUG Stock Performance Trends

Image Source: unsplash

Recent Gold Price Moves

Gold prices have shown strong momentum over the past year. In mid-2024, gold futures reached a high of $2,537.70, marking a significant rally. This upward trend continued into 2025, with gold gaining about 8% over the last twelve months. These rallies have created a favorable environment for gold-focused exchange-traded funds (ETFs), especially those with leveraged exposure.

When gold prices rise, junior gold miners often experience even larger price swings. The value of their mining projects increases, and investors become more interested in these companies. As a result, ETFs that track junior gold miners, such as JNUG stock, tend to outperform during gold rallies. The 2x leverage built into this ETF amplifies both gains and losses, making timing and risk management very important.

Analysis of recent gold price movements shows that leveraged ETFs like JNUG can deliver outsized returns during bullish periods. However, the same leverage also increases volatility and risk. Investors must pay close attention to daily price changes and market trends. The structure of this ETF, which resets leverage daily, means that holding it for long periods can lead to performance decay. This decay happens because of the compounding effect of daily returns, which can erode gains if the market moves sideways or becomes highly volatile.

JNUG Stock Price Action

Over the past twelve months, JNUG stock has demonstrated remarkable price action. The ETF traded in a wide range, from a low of $34.83 to a high of $91.21. As of August 12, 2025, the latest price stood at $90.44, near its three-year high. This performance reflects the amplified impact of gold price rallies on junior gold miners.

The table below summarizes key metrics for JNUG stock compared to the broader market ETF, SPY:

| Metric | JNUG Stock | SPY |

|---|---|---|

| 12-month price return | +129.4% | +21.9% |

| 3-month price return | +45.4% | +10.5% |

| 2-week price return | +19.0% | +1.2% |

| Latest stock price (Aug 12, 2025) | $90.44 | - |

| 3-year high price | $91.21 | - |

| 3-year low price | $20.45 | - |

| Beta | 1.45 | - |

| Correlation to SPY | 0.11 | - |

| Support level | $84.52 | - |

| Resistance level | $91.66 | - |

Analysis of these figures shows that JNUG stock has outperformed the broader market by a wide margin. The ETF’s high beta indicates greater sensitivity to market movements, while the low correlation to SPY suggests that it behaves independently from general market trends. Technical analysis points to strong support and resistance levels, which traders use to identify potential entry and exit points.

Risk analysis further highlights the unique profile of this ETF. JNUG’s volatility stands at 17.47% on a rolling one-month basis, nearly double that of broader gold miners ETFs like GDX, which sits at 8.90%. The ETF’s risk-adjusted performance, measured by ratios such as Sharpe and Sortino, remains comparable to other gold miners ETFs, but the higher volatility means that both gains and losses are magnified.

| Metric | JNUG (2x Leveraged ETF) | GDX (Broader Gold Miners ETF) |

|---|---|---|

| Volatility (Rolling 1-month) | 17.47% | 8.90% |

| Sharpe Ratio Rank | 89 | 89 |

| Sortino Ratio Rank | 88 | 88 |

| Omega Ratio Rank | 82 | 84 |

| Calmar Ratio Rank | 80 | 80 |

| Martin Ratio Rank | 88 | 84 |

| Expense Ratio | 1.17% | 0.53% |

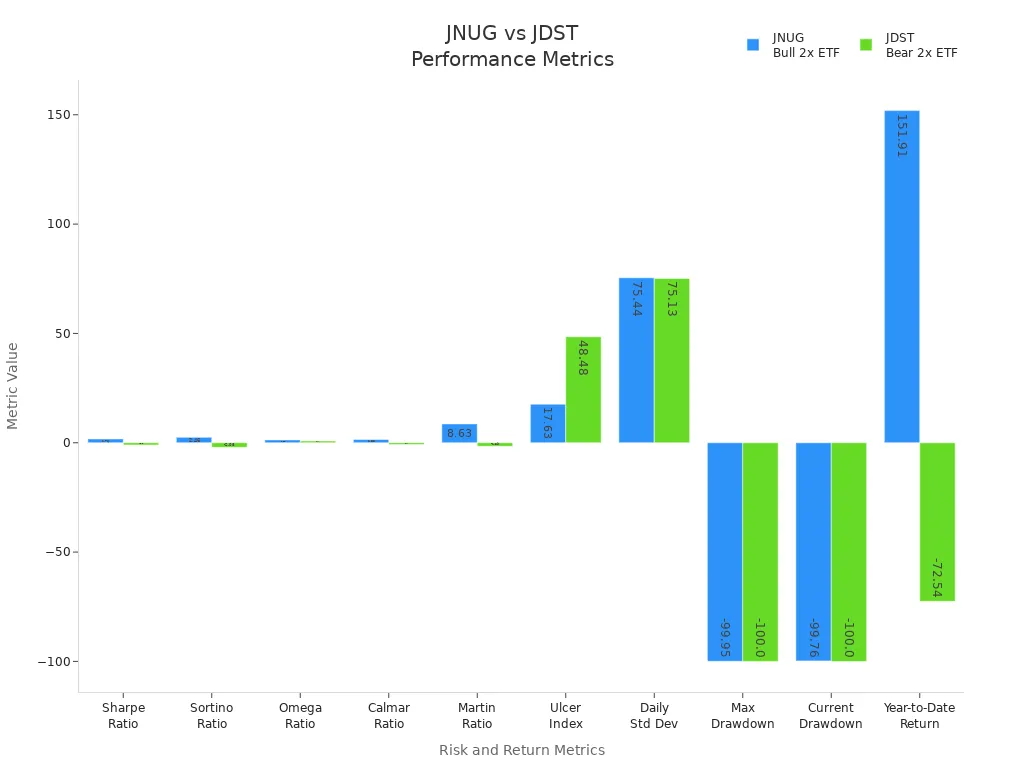

Analysis of risk and return metrics shows that JNUG’s 2x leverage leads to higher volatility and greater return variability. The ETF’s daily and weekly returns can swing widely, especially during periods of high gold price volatility. This pattern is visible in the chart below, which compares JNUG and JDST (the bear 2x ETF) across several risk and return metrics:

Further analysis of JNUG’s performance shows that the ETF achieved a year-to-date return of 151.91%, with a maximum drawdown of -99.95%. These figures highlight the potential for both large gains and steep losses. The ETF’s daily standard deviation of 75.44% underscores the extreme volatility that investors face.

Statistical analysis reveals that JNUG’s high volatility can negatively affect its risk-adjusted returns, even when average monthly returns exceed 1%. The ETF’s performance tends to improve following months with high volatility in the underlying index. However, the impact of leverage means that returns can vary greatly from day to day and week to week.

Leverage and Volatility

Daily Reset Effect

Leveraged ETFs like JNUG use a daily reset mechanism to maintain their target leverage. Each trading day, the fund manager rebalances the portfolio to ensure it delivers twice the daily return of the MVIS Global Junior Gold Miners Index. This process involves using derivatives and swaps, which can increase both risk and cost.

Note: The daily reset means that the ETF’s leverage is recalibrated every day, not over longer periods.

The daily reset effect creates several important outcomes for investors:

- The ETF aims to deliver 2x the daily performance of its benchmark, not the long-term performance.

- Over time, the returns of the ETF can diverge from the expected multiple of the underlying index, especially in volatile markets.

- The compounding effect of daily rebalancing can intensify volatility, causing gains or losses to accumulate in a non-linear way.

- The ETF becomes more suitable for short-term trading rather than long-term holding.

- Investors must actively manage their positions, using tools like stop-loss orders and limiting exposure to control risk.

- Higher expense ratios and the use of derivatives add to the cost and volatility of the ETF.

JNUG’s daily reset mechanism makes it unique among ETFs. While regular gold mining ETFs track the performance of gold miners over time, JNUG recalibrates its leverage every day. This feature can lead to significant deviations from the underlying index if held for more than one day. For example, if the index moves up and down over several days, the ETF’s value may erode even if the index ends flat. This effect is especially pronounced in volatile sectors like junior gold miners.

Market conditions play a major role in the ETF’s volatility. During periods of high market stress, such as the early 2020 selloff, JNUG experienced sharp declines. Factors like investors selling gold to cover losses, unexpected reactions to interest rate changes, and a flight to cash all contributed to extreme volatility. The ETF’s risk profile increased as a result, making it more speculative than traditional investments.

Compounding Risks

Compounding risk is a key factor that affects the long-term performance of leveraged ETFs. When an ETF resets its leverage daily, the returns compound in a way that can lead to unexpected results over time. This effect becomes more pronounced in volatile markets.

- The ETF’s daily reset causes the compounding effect, which can lead to performance deviations over longer holding periods.

- Long-term returns can differ significantly from the underlying asset’s price movements.

- The ETF is generally designed for short-term trading, usually from one day to a few weeks.

- Compounding and volatility make the ETF unsuitable for long-term investments.

- Gold futures may offer more flexibility for medium-term trading, but they also require active management.

- Effective risk management and a clear understanding of daily price movements are essential when trading leveraged ETFs.

Analysis of JNUG’s performance compared to non-leveraged gold mining ETFs shows a clear difference. Over a 12-month period, regular gold mining ETFs increased by about 42% to 55%. In contrast, leveraged ETFs like JNUG achieved higher returns, ranging from 71% to 79%. However, this higher return potential comes with greater risk. The ETF can also experience amplified losses, especially during periods of high volatility.

JNUG invests in some of the riskiest gold miners and faces ongoing gold price volatility. The ETF’s daily reset and compounding effects make it highly volatile and risky compared to ETFs like SPDR Gold Shares or VanEck Vectors Junior Gold Miners ETF. Losses can accumulate quickly, making the ETF unsuitable for long-term holding.

Tip: Investors should use analysis tools and risk controls to manage their exposure. Monitoring daily price movements and using stop-loss orders can help reduce the impact of compounding risks.

Risks and Opportunities

Short-Term Trading

Traders use JNUG as a tactical etf for short-term strategies. The etf amplifies both gains and losses through its leverage, making it attractive during periods of gold price movement. Many traders identify technical patterns such as the cup and handle, aiming for profit targets around 20%. They rely on indicators like MACD, RSI, and AI-driven buy signals to time entries. JNUG often mirrors gold price swings and sometimes anticipates moves, offering leveraged exposure to junior gold miners. Traders monitor geopolitical events and macroeconomic factors that influence gold prices, using JNUG as a proxy for leveraged gold exposure. Due to restrictions on shorting the etf directly, many traders use alternatives like JDST for bearish positions. Swing trades and technical breakouts are common, especially during market uncertainty.

However, JNUG carries significant risks for short-term traders:

- The etf uses leverage on daily movements, amplifying both gains and losses.

- Small declines in the index can cause large losses.

- The daily reset leads to compounding effects and potential decay in sideways or declining markets.

- High volatility and unpredictability require strict risk management, such as stop-loss orders.

- Market downturns or prolonged flat periods increase the risk of substantial losses.

- JNUG is recommended only for experienced traders with a short-term focus.

Long-Term Holding Risks

Financial experts warn against holding JNUG long-term. The etf resets leverage daily, causing cumulative returns to diverge from the benchmark over time. JNUG does not pay dividends and is intended for intraday trading by professionals who understand leverage risks.

- The etf is designed for short-term trading, not long-term holding.

- Daily resets create market timing risk, leading to significant deviations from the underlying index.

- Liquidity risk is high because junior gold mining stocks are often illiquid.

- Junior miners face business and operational risks due to their small size and volatility.

- Forced asset sales during market panics can cause severe value collapses.

- During the COVID-19 panic in March 2020, JNUG’s value collapsed due to mass redemptions and illiquid markets.

- Large investors exiting positions can worsen liquidity problems and losses.

Market Sentiment

Market sentiment plays a major role in JNUG’s price and trading volume. The etf recently traded near $90.44 with an average volume of about 383,995 shares, showing active investor engagement. JNUG’s exposure resets daily and is capped in certain sectors, emphasizing its use as a tactical trading tool. Positive sentiment toward gold and junior miners amplifies gains, while negative sentiment or falling gold prices cause amplified losses. The etf’s high beta and volatility highlight its sensitivity to sentiment shifts. Historical examples show that extreme sentiment changes, such as buying near market bottoms, can lead to dramatic performance swings. JNUG remains highly speculative and is best suited for tactical, short-term trading.

JNUG stock closely tracks the performance of junior gold miners, with price movements amplified by its leveraged structure. Investors should understand that daily resets and compounding effects can cause returns to diverge from gold prices, especially over longer periods. JNUG suits active traders who manage risk and seek short-term opportunities.

| Key Considerations | Expert Insights |

|---|---|

| Volatility | High due to leverage and junior miner exposure |

| Risk Management | Essential for short-term trading |

| Suitability | Not recommended for long-term holding |

FAQ

How does JNUG stock react to gold price changes?

JNUG stock moves twice as much as the underlying junior gold miners index. When gold prices rise, JNUG usually increases sharply. When gold prices fall, JNUG drops quickly. The ETF amplifies both gains and losses.

Is JNUG suitable for long-term investment?

JNUG is not designed for long-term holding. The ETF resets leverage daily, which can cause returns to diverge from the index over time. Most financial experts recommend JNUG for short-term trading only.

What risks do investors face with JNUG?

Investors face high volatility, compounding risk, and potential for large losses. The ETF uses leverage and derivatives, which can magnify both gains and losses. Active risk management is essential for anyone trading JNUG.

How does JNUG differ from regular gold ETFs?

JNUG tracks junior gold miners with 2x leverage. Regular gold ETFs usually track the price of gold or large gold mining companies without leverage. JNUG shows higher volatility and risk compared to standard gold ETFs.

Can investors use JNUG to hedge against market downturns?

JNUG does not provide effective hedging during market downturns. The ETF amplifies price movements in junior gold miners, which can be unpredictable. For hedging, investors often choose other instruments like gold futures or inverse ETFs.

The volatility of JNUG stock highlights a key truth: success in today’s market demands precision, speed, and the right tools. Just as traders use JNUG to gain leveraged exposure to gold, they also need a financial platform that’s equally powerful. Traditional banking and exchange services often fall short, with high fees and slow transfers that erode returns.

BiyaPay offers a one-stop solution for managing your diverse financial assets. Our platform allows you to seamlessly convert between various fiat currencies and digital currencies, with highly competitive fees as low as 0.5%. We prioritize efficiency, with transfers that are same-day and accessible in most countries and regions worldwide. Check our real-time exchange rate converter to see how you can maximize your capital.

Take control of your financial destiny and register with BiyaPay today to empower your global trading strategies.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.