- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Market Forces Impact Autho Stock Movement

Image Source: unsplash

Market forces shape Autho stock prices through a combination of economic indicators, investor sentiment, and supply-demand dynamics. Investors who understand these factors can use data-driven approaches, such as regime detection and multifactor models, to predict market stability and volatility. This knowledge allows them to adjust Autho stock portfolios, optimize allocation, and manage risk more effectively. By leveraging historical and real-time market data, investors enhance performance and reduce downside risk in their stock strategies.

Key Takeaways

- Autho stock prices change mainly because of supply and demand, investor feelings, and economic trends.

- Investor sentiment can cause quick price swings, so watching news and market mood helps predict short-term moves.

- Central bank policies, inflation, and government actions strongly influence stock prices by affecting the economy.

- Strong company earnings, smart debt management, and steady investment in research boost Autho’s long-term stock value.

- Using both technical tools and understanding industry competition helps investors make better decisions about Autho stock.

Key Factors Affecting Autho Stock

Supply and Demand

Supply and demand serve as the foundation for understanding Autho stock price movements. These key factors shape the market dynamics that drive both short-term and long-term stock performance. When demand for Autho stock exceeds supply, prices tend to rise. Conversely, when supply outpaces demand, prices often fall. Several elements influence this balance:

- Earnings base measures, such as earnings per share (EPS) and dividends per share, directly affect investor interest and demand.

- Expected earnings growth attracts buyers, increasing demand and pushing stock prices higher.

- The discount rate, which inflation impacts, alters the present value of future cash flows and affects valuation.

- Perceived risk of the stock influences both supply and demand, as higher risk can deter buyers or prompt selling.

- Inflation levels often show an inverse relationship with valuation multiples, impacting how investors value Autho stock.

- The economic strength of the overall market and peer companies can shift demand between sectors.

- Substitute asset classes, including bonds, commodities, and real estate, compete for investor capital and affect demand for stocks.

- Incidental transactions, such as insider trades and hedging, can temporarily disrupt supply and demand.

- Investor demographics, especially the proportion of middle-aged versus older investors, influence trading activity and liquidity.

- Trends and momentum in stock price movements can attract short-term traders, amplifying price swings.

- Liquidity, or how easily shares can be bought or sold, plays a crucial role in price stability.

Research highlights that changes in the money supply significantly influence demand for stocks, including Autho stock. Monetary policy can cause stock prices to deviate from their fundamental values, leading to periods of overpricing or underpricing. This monetary influence remains a key demand-side factor in Autho stock price fluctuations.

Trading volume and liquidity also play a vital role in shaping market dynamics. Increased retail trading volume, especially through mobile platforms, has led to greater return co-movement among stocks. This trend limits diversification benefits and can increase the risk of market crashes. Liquidity co-movement, where liquidity changes in one stock affect others, makes the market more vulnerable to shocks. During periods of high trading volume, Autho stock may experience greater price volatility and sharper swings in stock performance.

Investor Sentiment

Investor sentiment represents the collective mood and expectations of market participants. This psychological factor often drives short-term changes in Autho stock prices, sometimes causing them to diverge from fundamental values. Empirical studies confirm that investor sentiment significantly impacts stock returns and market volatility. Sentiment proxies, such as mutual fund flows and fund manager sentiment indices, help predict short-term stock price movements.

- Optimistic investor expectations can push prices above fundamental values, while pessimism can drive them below.

- Sentiment links closely to increased market volatility and affects both stock and bond markets.

- Stocks with higher individual investor participation, such as Autho stock, are more sensitive to sentiment shifts.

- Sentiment indices based on consumer confidence, option-to-stock volume ratios, and online sentiment data provide valuable insights into short-term stock performance.

- Positive sentiment can inflate market bubbles, while negative sentiment can trigger sharp declines.

Investor sentiment arises from behavioral trends and cognitive biases. During periods of uncertainty, such as global crises, psychological pressures intensify investor reactions. Media coverage and news sentiment strongly influence investor psychology. Pessimistic news can drive prices down, while optimistic news supports price growth. Unscheduled corporate events, such as management changes or unexpected announcements, increase uncertainty and influence sentiment, leading to significant price swings in Autho stock.

Behavioral finance research shows that sentiment-driven price movements often deviate from fundamental values due to irrational investor behavior. These effects are stronger for stocks that are hard to value or arbitrage, such as small, volatile, or unprofitable firms. Sentiment reflects investors’ overall optimism or pessimism about future price developments and is influenced by both fundamental and technical factors.

Investor confidence and consumer confidence both play a role in shaping these dynamics. When confidence is high, demand for stocks rises, supporting higher stock prices and stronger stock performance. When confidence falls, demand weakens, and prices may decline. Monitoring these key factors helps investors understand the market dynamics that drive Autho stock and make informed decisions.

Macroeconomic Influences

Image Source: unsplash

Central Bank Policies

Central bank policies play a major role in shaping market dynamics and stock performance. When central banks, such as the Hong Kong Monetary Authority, adjust interest rates, they influence borrowing costs and investment decisions. Lower interest rates often encourage businesses to expand and consumers to spend, which can boost stock prices. Higher rates tend to slow economic activity and reduce demand for stocks. Central banks also use monetary tools to manage liquidity in the market. These actions affect the availability of capital and the overall market dynamics. Investors watch central bank announcements closely because changes in policy can lead to rapid shifts in stock performance.

Inflation and Fiscal Policy

Inflation and fiscal policy are important economic factors that impact Autho stock prices. Inflation refers to the rise in prices over time. Historical data from the United States shows that the relationship between inflation and stock prices changes over different periods. Sometimes, inflation leads to higher stock prices, especially when monetary easing increases dividend growth. At other times, inflation causes stock prices to fall due to higher discount rates and tax distortions. Fiscal policy, which includes government spending and taxation, also affects market dynamics. When governments increase spending, businesses may see higher sales and profits, which can improve stock performance. However, contractionary policies can slow growth and reduce investor confidence.

Positive GDP growth and strong employment rates signal a healthy economy. These conditions encourage investment and support higher stock prices. Weak employment data, such as rising unemployment, can lower investor confidence and lead to declines in stock performance. Investors use these indicators to gauge market dynamics and adjust their strategies.

Geopolitical Events

Geopolitical events create uncertainty in the market and can cause sudden changes in stock prices. Events such as trade disputes, political instability, or natural disasters disrupt market dynamics and affect investor sentiment. For example, tensions between China and other countries may lead to changes in trade policies, which impact business operations and stock performance. Investors monitor global news to anticipate how these factors might influence market dynamics and stock prices.

Company Performance Metrics

Earnings and Profitability

Earnings and profitability metrics give investors a clear view of Autho’s ability to generate income and manage expenses. Key indicators include earnings per share (EPS) and net profit margin. EPS shows how much profit Autho earns for each share, while net profit margin reveals how efficiently the company turns revenue into profit. Investors use these figures to estimate future cash flows and judge the company’s financial performance. Strong earnings growth often signals that Autho can deliver higher future cash flows, making the stock more attractive. Consistent profitability also builds trust among investors, supporting stable stock prices.

Debt and Solvency Ratios

Debt and solvency ratios help investors assess Autho’s long-term stability and risk. Important ratios include debt-to-equity, debt-to-assets, equity ratio, and interest coverage ratio. These numbers show how much Autho relies on borrowed money and its ability to pay back debts. Research shows that when investor sentiment is high, companies often increase leverage, which can signal confidence in future earnings. However, higher leverage sometimes leads to lower stock returns later. Investors closely watch these ratios to understand risk and compare Autho to other companies.

- Solvency ratios measure Autho’s ability to meet long-term obligations.

- Debt-to-equity and debt-to-assets ratios reveal how much of the company is financed by debt.

- A high equity ratio means more assets are funded by shareholders, which lowers risk.

- The interest coverage ratio shows how easily Autho can pay interest on its debt.

Changes in the debt-to-equity ratio affect Autho’s stock price by influencing the cost of capital and expected returns. When Autho manages debt wisely, it can improve financial performance and support higher stock prices. Investors use these ratios to predict future cash flows and make informed decisions.

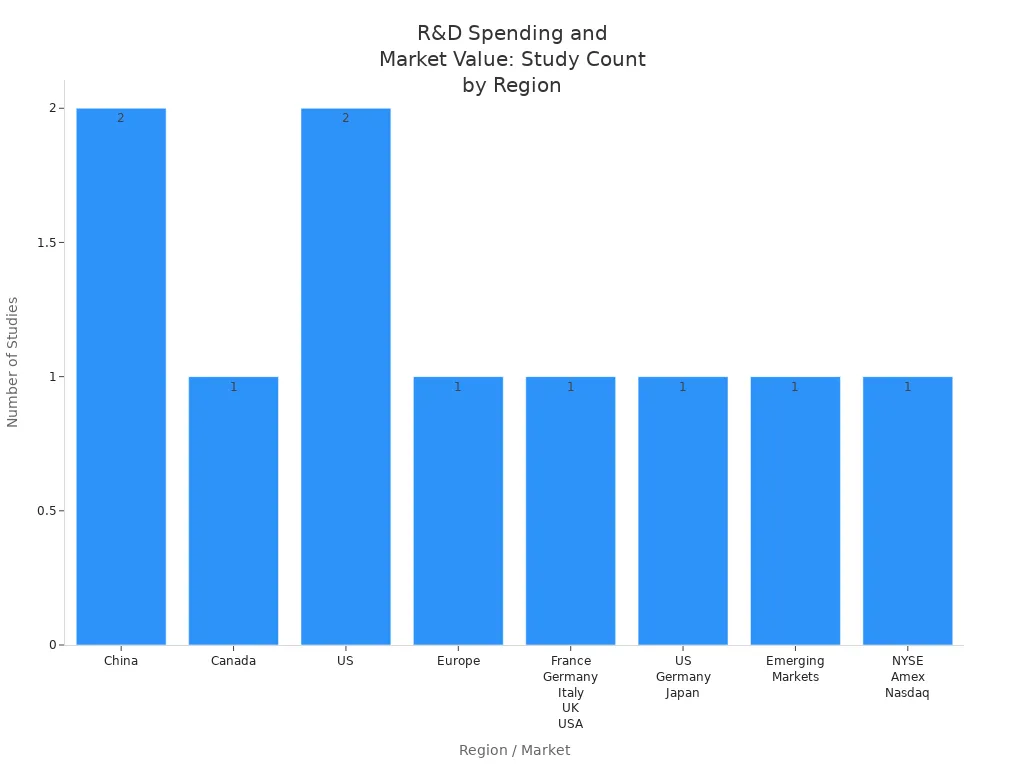

R&D Investment

Innovation stands at the core of Autho’s long-term growth. R&D investment allows Autho to create new products and improve existing ones, setting the company apart from competitors. Investors value innovation because it signals future growth and the potential for higher future cash flows. Studies from China, the US, and Europe show that companies with strong R&D spending often achieve better stock returns and higher market value.

| Study / Source | Market(s) Covered | Key Findings |

|---|---|---|

| Xu and Zhang (2004) | China | R&D investment leads to innovation, higher profitability, and market share, improving firm performance. |

| Lewis and Bohumir (1993) | Canada | Positive correlation between R&D spending and market value, signaling expected profitability and growth. |

| Lev and Sougiannis (1996) | US | R&D intensity predicts higher subsequent stock returns and profitability after controlling for other factors. |

| Hall and Oriani (2006) | France, Germany, Italy, UK, USA | Significant positive relationship between R&D investments and market performance. |

| Bae and Kim (2003) | US, Germany, Japan | Positive and significant relationship between R&D investment and market value after controlling for cash flow, growth, and risk. |

Hedge funds often target high innovation stocks, and their investments predict higher future returns. Innovation gives Autho a competitive edge by creating products and processes that rivals cannot easily copy. This advantage helps Autho capture more market share and boosts investor confidence. Over time, steady R&D spending supports strong financial performance and signals the potential for robust future cash flows.

Technical and Industry Factors

Image Source: pexels

Price History and Chart Patterns

Technical analysis helps investors understand market dynamics by examining Autho’s price history and chart patterns. Analysts use indicators to spot trends and forecast future movements. The table below summarizes some of the most effective tools for predicting Autho stock price trends:

| Indicator | Description | Usefulness in Predicting Stock Price Trends |

|---|---|---|

| Simple Moving Average (SMA) | Calculates average stock price over a chosen time frame (e.g., 50-day, 200-day) | Helps identify general price trends by smoothing out daily volatility, useful for spotting durable trends and near-future movements. |

| Bollinger Bands | Bands created by applying standard deviation above and below the SMA | Indicates stock volatility and stability; widening bands suggest stability, converging bands suggest upcoming volatility. |

| 52-Week High/Low | Measures highest and lowest stock prices over the past year | Establishes support and resistance levels, helping predict where price movements may slow or reverse. |

| P/E Ratio | Compares stock price to earnings per share | Helps determine if a stock is overbought or oversold, signaling potential price corrections. |

| Parabolic SAR | Tracks price acceleration using parabolic curves | Identifies trend reversals by signaling when a trend is leveling off, useful for timing buy/sell decisions in trending markets. |

Research shows that combining indicators like MACD and RSI with machine learning models, such as LSTM networks, improves the accuracy of stock trend predictions. Chart patterns also play a key role in understanding market dynamics. Patterns like symmetrical triangles, pennants, and head and shoulders often signal major price moves or reversals. Volume analysis confirms the strength of these patterns, making it essential for reliable trading decisions.

Industry Competition

Competition shapes Autho’s position in the market. Companies face constant pressure from rivals to innovate and capture market share. Strong competition can drive Autho to improve products, lower costs, and enhance customer service. When competition intensifies, Autho may need to adjust pricing or invest more in marketing. Market dynamics shift quickly as new entrants or disruptive technologies emerge. Investors monitor competition to gauge Autho’s ability to maintain or grow its market share. High competition can lead to price wars, which may reduce profit margins and affect stock performance. On the other hand, if Autho outperforms competitors, it can attract more investor interest and support higher stock prices.

Technological Changes

Technological changes influence both market dynamics and investor perception. Enterprise digital transformation attracts more investor attention and increases stock liquidity. Digital transformation reduces information gaps and improves transparency, creating a fairer environment for all investors. However, these changes can also increase stock price volatility, especially when retail investors react to news about new technologies. Mutual funds often favor companies that embrace digital transformation, which can boost fund flows but also raise volatility. As Autho adopts new technologies, it may see improved investor sentiment and stronger market performance, but it must also manage the risks that come with rapid change.

External Events Impacting Stock Performance

Regulatory Changes

Government regulations can quickly change the direction of Autho stock. New rules from financial authorities often affect how companies operate. For example, when Hong Kong banks face stricter lending standards, companies may find it harder to borrow money. This can slow business growth and reduce investor interest in the stock. Changes in tax policy or accounting standards also influence how investors value Autho. Sometimes, new regulations increase transparency, which builds trust in the market. In other cases, sudden rule changes create uncertainty and lead to sharp price swings. Investors watch regulatory news closely because it can signal new risks or opportunities for Autho.

Note: Regulatory changes often have a direct impact on stock prices. Investors should monitor announcements from government agencies and financial regulators to stay informed.

Political and Natural Events

Political events can disrupt the market and cause volatility in Autho stock. Elections, trade negotiations, and policy shifts in China or other countries may change investor confidence. For instance, a trade dispute between China and the United States can affect business operations and stock prices. Political instability sometimes leads to rapid changes in market sentiment. Investors often react quickly to news about leadership changes or new government policies.

Natural disasters also influence Autho stock. Events like earthquakes, floods, or typhoons can damage company assets and interrupt supply chains. These disruptions may lower sales and hurt stock performance. Investors track weather reports and news about natural disasters to assess possible risks. When a major event occurs, trading volume often rises as investors adjust their positions.

| Event Type | Example Impact on Autho Stock | Investor Response |

|---|---|---|

| Regulatory Change | New tax law in China | Reassess valuation, adjust trades |

| Political Event | Trade dispute with US | Increase caution, monitor news |

| Natural Disaster | Typhoon in Hong Kong | Review supply chain, reduce risk |

External events create uncertainty in the market. Investors who understand these risks can make better decisions and protect their investments.

Short-Term vs Long-Term Stock Performance

Daily Price Drivers

Short-term changes in Autho stock prices often happen quickly. These movements usually last for days or weeks. Several factors can cause these fast changes:

- Political news, such as new economic policies or election results, can create sudden shifts in stock prices.

- Economic updates, including inflation rates or recession fears, often lead to quick reactions from investors.

- Technical trading, where traders use recent price trends and chart patterns, can drive daily price swings.

- Investor confidence and consumer confidence play a big role. When confidence is high, more people buy stocks, pushing prices up. When confidence drops, selling increases and prices fall.

These daily price drivers often lead to volatility. Investors may react emotionally to news or events, causing sharp rises or drops in stock prices. Short-term trends are usually unpredictable and less stable than long-term movements.

Long-Term Value Factors

Long-term factors shape Autho stock prices over years or even decades. These trends are more stable and reflect deeper changes in the market. Some important long-term factors include:

- Fundamental economic changes, such as steady GDP growth or shifts in employment rates, influence stock prices over time.

- Technological advancements, like digital transformation, can change how companies operate and grow.

- Societal shifts, such as the move toward renewable energy, create new opportunities and risks for companies.

Long-term factors help investors see the bigger picture. They guide decisions about holding stocks for many years. Investors who focus on long-term trends often look past daily news and short-term volatility.

To monitor Autho stock performance across different timeframes, investors can use several strategies:

- Set clear investment goals and decide on a timeframe and risk level.

- Choose a mix of assets that matches these goals.

- Review the portfolio regularly and rebalance when needed to keep the right balance.

- Compare results to benchmarks to track progress.

- Update the plan each year or when goals change.

By understanding both daily price drivers and long-term factors, investors can manage risk and make better decisions about Autho stock.

Autho stock moves in response to many market forces, including supply and demand, investor sentiment, and economic trends. Investors who track these factors can make better decisions. Staying informed helps reduce risk and improve results.

- Watch news and reports about the company and the market.

- Review key financial data often.

- Use simple tools to track price changes.

Staying alert to these signals helps investors build stronger strategies.

FAQ

What causes sudden changes in Autho stock prices?

Sudden changes often result from news events, shifts in investor sentiment, or unexpected economic data. Political developments in China or global markets can also trigger rapid price movements.

How do Hong Kong banks influence Autho stock?

Hong Kong banks impact Autho stock by adjusting lending rates and credit policies. Changes in these rates affect business costs and investor confidence. For current USD to HKD rates, visit XE Exchange Rates.

Why does investor sentiment matter for Autho stock?

Investor sentiment reflects how investors feel about the market. Positive sentiment can drive prices higher, while negative sentiment may cause declines. Sentiment often changes quickly based on news or economic reports.

How does inflation affect Autho stock performance?

Inflation changes the value of future cash flows. High inflation can lower stock prices by increasing discount rates. Investors monitor inflation trends to adjust their strategies.

What role does R&D investment play in Autho’s stock value?

R&D investment signals innovation and future growth. Companies that invest in research often outperform competitors. Investors view strong R&D spending as a sign of long-term value.

Investing in stocks like Autho requires a comprehensive understanding of complex market forces, from macroeconomic trends to company-specific metrics. But navigating different platforms, facing high remittance fees, and dealing with slow transfers can undermine your returns.

BiyaPay is designed to simplify your global investment journey. We offer a true one-stop platform where you can participate in US and Hong Kong stocks without needing an overseas bank account. Our platform provides real-time currency exchange rates and offers a low remittance fee of just 0.5%, ensuring your capital flows efficiently. Check out our real-time exchange rate converter to see how you can maximize your returns.

Join over a million users who trust BiyaPay for their global financial needs and simplify your journey today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.