- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Richtech Robotics Stock Could Perform in the Evolving Robotics Market

Image Source: unsplash

Richtech Robotics stock attracts attention from investors who seek reliable prediction and forecast data amid rapid changes in robotics. The current market capitalization stands at $243.38 million, with a recent trading volume of 13,156,156 shares. Analysts offer a strong buy rating and expect a year-over-year EPS growth of 20%, which influences both price prediction and price analysis. Investors often examine short-term volatility and long-term growth when making a prediction or forecast. Richtech Robotics continues to generate interest due to frequent price changes and ongoing analysis of forecast trends.

| Metric | Value |

|---|---|

| Market Capitalization | $243.38 million |

| Recent Trading Volume | 13,156,156 shares |

| Metric | Value |

|---|---|

| Analyst Rating | Strong Buy (2 analysts) |

| Next Quarter EPS Estimate (09/30/25) | -0.04 |

| Year-over-Year EPS Growth Estimate | +20% |

Key Takeaways

- Richtech Robotics stock has grown strongly, driven by new AI robots and strategic partnerships that boost market presence.

- The company uses a Robot-as-a-Service model, which helps customers lower costs and provides steady income for Richtech Robotics.

- Despite growth, Richtech Robotics faces financial challenges like ongoing losses and high stock price volatility.

- Analysts expect the stock price to rise significantly by 2030 if the company can improve profits and expand its business.

- Investors should watch for risks such as market volatility, valuation concerns, and the company’s ability to execute its plans.

Richtech Robotics Stock Overview

Image Source: pexels

Recent Performance

Richtech Robotics stock has shown remarkable growth over the past year. The stock price increased by 291.07% in the last 12 months, reflecting a strong upward trend. This performance stands out in the robotics market, even though direct comparisons to the sector average are not available. Several key events have driven this positive stock forecast. Richtech Robotics announced its inclusion in the US small-cap Russell 2000® and Russell 3000® indices as of July 1, 2025. This move increased visibility among investors and supported a favorable forecast for future price movements.

The company also expanded its reach in Asia’s AI robotics market through a $4 million sales agreement with a joint venture partner. This agreement covers product purchases, services, and licensing, strengthening Richtech Robotics’ position and supporting its growth trend. At CES 2025, Richtech Robotics unveiled new AI-powered robots, ADAM and Scorpion, targeting hospitality and healthcare sectors. These innovations generated market optimism and contributed to a positive stock forecast. Following these announcements, the stock price closed at $1.32 on December 24, 2024, showing a clear upward trend.

Note: Richtech Robotics maintains a strong cash reserve of $9.2 million, but faces financial challenges such as a negative pretax profit margin of -130.9% and net income losses exceeding $1.3 million. These factors may influence future stock forecast and price trends.

Volatility Trends

Richtech Robotics stock experiences frequent and significant price swings. On August 12, 2025, the stock price fluctuated between $1.93 and $2.15, with a daily volatility of 11.40%. Over the past week, the average daily volatility reached 7.38%, indicating a pronounced trend of short-term price movements. In a two-week period, the stock increased by 11.58%, highlighting the dynamic nature of its price trend.

Compared to major robotics stocks, Richtech Robotics shows higher volatility, although direct comparative data is unavailable. The frequent price swings and rapid changes in stock forecast make Richtech Robotics a notable choice for investors seeking exposure to the robotics sector. The trend of high volatility suggests that investors should closely monitor stock forecast updates and price movements to manage risk effectively.

Key Factors

Financials

Richtech Robotics demonstrates a conservative financial structure. The most recent quarterly report for Q3 2025 shows total revenue of $1.18 million USD, which marks a 0.86% increase from the previous quarter. Net income for the same period stands at a loss of $4.06 million USD. This financial data highlights the company’s ongoing challenge to achieve profitability while maintaining steady revenue growth. The debt-to-equity ratio for Richtech Robotics is 0.01, which is extremely low compared to larger robotics companies that often have ratios ranging from 3.75 to 84.86. Many peers in China also report zero debt, but Richtech Robotics still maintains a very conservative capital structure.

| Company Name | Debt-to-Equity Ratio | Commentary |

|---|---|---|

| Richtech Robotics | 0.01 | Minimal financial leverage; conservative capital structure. |

| Several robotics peers | 0.00 | No financial leverage. |

| Larger related companies | 3.75 to 84.86 | Substantial leverage. |

Richtech Robotics continues to focus on financial stability, which supports long-term growth and reduces risk for investors.

Business Model

Richtech Robotics operates a diversified business model that supports scalability and recurring revenue. The company has shifted toward a Robot-as-a-Service (RaaS) subscription model, which reduces upfront costs for customers and generates predictable income. Strategic partnerships with organizations such as Zipphaus Plus LLC, Peet’s Coffee, and Kaiser Permanente allow Richtech Robotics to deploy robots in hospitality, healthcare, and retail sectors across China and internationally. Product sales include robots for indoor transport, sanitation, and food & beverage automation. The company also operates robotic restaurants in Walmart locations, integrating automated food and beverage services.

| Revenue Stream | Description |

|---|---|

| Robot-as-a-Service (RaaS) | Stable, recurring revenue; lowers upfront costs for customers. |

| Strategic Partnerships | Joint ventures and collaborations expand market reach. |

| Product Sales | Robots for service automation in multiple sectors. |

| Hospitality Sector Deployment | Robots in restaurants, hotels, casinos, and healthcare facilities. |

| Operational Robotics Restaurants | Automated food and beverage services in Walmart locations. |

| Future Expansion Plans | Growth into healthcare, automotive, and new restaurant franchises. |

The RaaS model and flexible deployment options enable Richtech Robotics to scale quickly. Customers often see a full return on investment within three to six months, and some sectors achieve ROI in just one month. The company’s partnership with NVIDIA enhances technological capabilities and operational efficiency, supporting further growth.

Industry Position

Richtech Robotics holds a strong position in the robotics industry, especially in China. The company specializes in service robots for catering, hospitality, healthcare, and retail. Its product offerings include autonomous delivery, cleaning, guiding, and disinfection robots. Richtech Robotics faces competition from companies such as Bear Robotics, Keenon Robotics, Yunji Technology, Pangolin Robot, and Aethon. These competitors also focus on hospitality, healthcare, and food service sectors.

| Company | Specialization / Product Offering | Sector Focus |

|---|---|---|

| Richtech Robotics | Service robots for catering, hospitality, healthcare, retail; autonomous delivery, cleaning, guiding, disinfection | Catering, hospitality, healthcare, retail |

| Bear Robotics | Autonomous mobile robots for hospitality and food service | Hospitality, food service |

| Keenon Robotics | Autonomous delivery, cleaning, guiding, disinfection robots | Catering, hospitality, healthcare, retail |

| Yunji Technology | Intelligent robots with indoor positioning, navigation, large-scale data processing | Hospitality, government, community services |

| Pangolin Robot | AI service robots for delivery, hotel services, outdoor unmanned vehicles | Hospitality, retail, education, healthcare, finance |

| Aethon | Autonomous mobile robots automating delivery and transportation tasks | Healthcare, hospitality |

Richtech Robotics leverages advanced AI and flexible deployment to overcome adoption barriers. The company’s focus on recurring revenue and rapid ROI supports its competitive edge. Industry analysis shows that regulatory and technological changes, such as advancements in autonomous robots and AI integration, will shape the market over the next five years. Richtech Robotics is well-positioned to benefit from these trends and drive future growth.

Richtech Robotics Stock Predictions

Short-Term Outlook

Richtech Robotics stock faces a dynamic short-term environment shaped by technical signals, market sentiment, and recent corporate developments. Analysts have issued a range of price predictions for the next year, reflecting both optimism and caution. The average analyst price target for 2025 stands at $3.57, with a high estimate of $6.71 and a low estimate of $0.42. This price target range highlights the uncertainty in the current stock forecast.

Several factors drive short-term price movements:

- Technical indicators present mixed signals. Pivot points and MACD suggest a sell, while moving averages indicate a buy.

- Volume-price divergence has emerged. The trading volume dropped by 4 million shares even as the price increased, signaling caution for traders.

- Support levels at $2.01 and $1.94 are critical. If the price falls below these, further declines may follow.

- The stock remains in a wide, falling short-term trend. Analysts predict an 18.46% drop over the next three months unless support holds.

- Daily volatility is high. The intraday price range reaches 11.40%, and the average daily volatility over the last week is 7.38%.

Note: Inclusion in the Russell 2000 and 3000 indexes has boosted investor confidence and may increase passive capital inflows. Strategic partnerships, such as the one with Beijing Tongchuang Technology Development Co., Ltd., focus on AI-powered service robots for hospitality and healthcare. These alliances are expected to expand market share and support the stock forecast.

Short-term price predictions also reflect the impact of recent breakthroughs. The stock price surged 8.33% after positive news and partnerships. However, financial challenges remain. The company reported a net loss of $4.1 million in Q3 2025, and revenue declined by 16% year-over-year. Operating expenses rose to $6.11 million due to increased R&D investment in AI and robotics. Despite these hurdles, the market responded positively to new AI-driven robots, with the stock rallying 11.75% after their launch.

Investors should monitor technical levels, volume trends, and news catalysts. The predicted fair opening price for the next quarter depends on these factors. Analysts continue to update their price forecast and stock forecast as new data emerges.

Long-Term Outlook

The long-term forecast for Richtech Robotics stock reflects both industry-wide growth and company-specific challenges. Analyst predictions for 2026 show an average price target of $8.27, with a high estimate of $13.41 and a low estimate of $3.13. By 2030, the average price target rises to $32.03, indicating strong confidence in the company’s future. These price predictions for 2026 and beyond suggest significant upside if Richtech Robotics can execute its strategy.

| Year | Average Price Target | High Estimate | Low Estimate |

|---|---|---|---|

| 2025 | $3.57 | $6.71 | $0.42 |

| 2026 | $8.27 | $13.41 | $3.13 |

| 2030 | $32.03 | N/A | N/A |

Industry projections support this optimism. The global robotics market is expected to reach $283 billion by 2032. The overall sector is projected to grow at a compound annual growth rate (CAGR) of 16.1% to 18.4% from 2024 to 2030. Segments such as collaborative robots may see even higher growth rates, up to 24.6%. These trends align with Richtech Robotics’ focus on AI-driven service robots and the Robot-as-a-Service (RaaS) model.

| Segment | Projected CAGR (%) | Period |

|---|---|---|

| Overall Global Robotics | 16.1% - 18.4% | 2023/2024-2030 |

| Collaborative Robots | 24.6% | Not specified |

| Industrial Robotics | 9.9% | 2025-2030 |

Richtech Robotics aims to capture this growth by targeting sectors like healthcare, hospitality, and logistics. The RaaS model lowers adoption barriers for small and medium businesses and generates recurring revenue. The company’s strategic partnerships and investments in AI position it to benefit from rising demand for automation.

Despite these strengths, the long-term stock forecast must account for ongoing financial risks. Richtech Robotics reported consecutive earnings misses and a 32.2% year-to-date stock decline. The company’s price-to-sales ratio of 27.55 reflects high market expectations, but profitability remains a challenge. The predicted fair opening price for future years depends on the company’s ability to scale the RaaS model, retain clients, and expand gross margins.

Revenue growth remains a key metric. Analysts expect year-over-year revenue growth of approximately 13.34%. EPS growth estimates stand at 20%, but negative operating income and margins persist. The stock forecast will depend on whether Richtech Robotics can convert innovation into sustainable cash flow.

Investors should view Richtech Robotics as a high-risk, high-reward opportunity. The long-term price forecast and stock forecast rely on successful execution, industry growth, and the company’s ability to overcome financial hurdles. Analyst predictions and price targets reflect both the potential and the risks in this evolving sector.

RR Stock Forecast and Risks

Image Source: pexels

Upside Potential

Richtech Robotics presents several opportunities for growth in the evolving robotics market. The stock forecast highlights multiple catalysts that could drive significant upside. Technical indicators show the stock price holding above both the 50-day and 200-day moving averages, which signals medium- and long-term uptrends. The positive MACD value of 0.13 points to bullish momentum, while increased average trading volume confirms rising investor interest. These buy signals suggest that the stock could break out if current trends continue.

Recent developments also support a positive forecast. The preliminary inclusion of Richtech Robotics in the Russell 2000 small-cap index increases institutional visibility and may attract index-based inflows. This event often leads to higher trading volumes and can support the stock price over the medium term. The company’s focus on AI-driven robotics aligns with global trends, providing a thematic growth catalyst that strengthens the long-term stock forecast.

Key partnerships and product launches further enhance the upside potential. The following table summarizes recent initiatives and their expected impact on the stock forecast:

| Partnership/Product Launch | Description | Potential Impact on Stock Price |

|---|---|---|

| ADAM Robotic Beverage System Rollout | Installed at Walmart Ghost Kitchens and One Kitchen locations with a planned 240-location US rollout, including major venues like Texas Rangers’ Globe Life Field. | Demonstrates scalability and market penetration, likely increasing revenue and investor confidence. |

| Medbot Launch | New healthcare robot designed for continuous medication delivery in hospitals and pharmacies, addressing staff shortages and improving operational efficiency. | Opens new healthcare market segment, potentially boosting sales and market presence. |

| Strategic Reseller Agreement with MetaDolce Technologies | MetaDolce authorized to market and sell Medbot in the US starting Q2 2024. | Expands distribution channels, accelerating product adoption and revenue growth. |

| Joint Venture with Zipphaus | Launch of robot-operated cafes and expansion into Asian markets through Boyu AI Technology Co., Ltd. | International expansion with a $4 million sales agreement in China, enhancing global footprint and recurring revenue potential. |

| Launch of AlphaMax Management Subsidiary | Focused on optimizing robot integration and AI cloud technology in restaurant operations across multiple US states. | Improves operational efficiency and scalability of robotic solutions, supporting long-term growth. |

| Richtech Accelerator Program | Partnership with Columbia University to advance AI and robotics research. | Strengthens innovation pipeline, potentially leading to future product advancements and competitive advantage. |

These initiatives support the rr stock forecast by expanding market reach, improving operational efficiency, and driving innovation. The company’s ability to scale its Robot-as-a-Service model and secure recurring revenue streams increases investor confidence. If Richtech Robotics achieves profitability and confirms a technical breakout, the stock forecast could shift further upward.

Investor sentiment also supports the upside. Short interest in the stock has decreased by 18.42%, and the consensus analyst rating is Buy, based on two buy ratings and no hold or sell ratings. News sentiment remains moderately positive, and media mentions have doubled in the current week. MarketBeat followers increased by 633% in the last 30 days, and search interest surged by 140% over the past month. These trends indicate growing attention and cautious optimism, which can reinforce upward price momentum.

Downside Risks

Despite the strong upside opportunities, Richtech Robotics faces several risks that could impact the stock forecast. The company’s forward-looking statements highlight risks and uncertainties related to products, industry conditions, and the broader economic environment. Actual results may differ from any prediction or forecast due to execution risks and market volatility. Investors should review the company’s SEC filings for a full list of risks, as new challenges may emerge over time.

The stock forecast also reflects fundamental concerns. Richtech Robotics continues to report ongoing losses and negative discounted cash flow, which indicate underlying weaknesses. The current market price appears speculative, driven by expectations of future growth rather than present financial health. The company lacks a clear path to profitability and positive cash flow, which increases valuation risk. Elevated trading volume and market volatility add to execution risk, making it essential for investors to balance growth potential against these challenges.

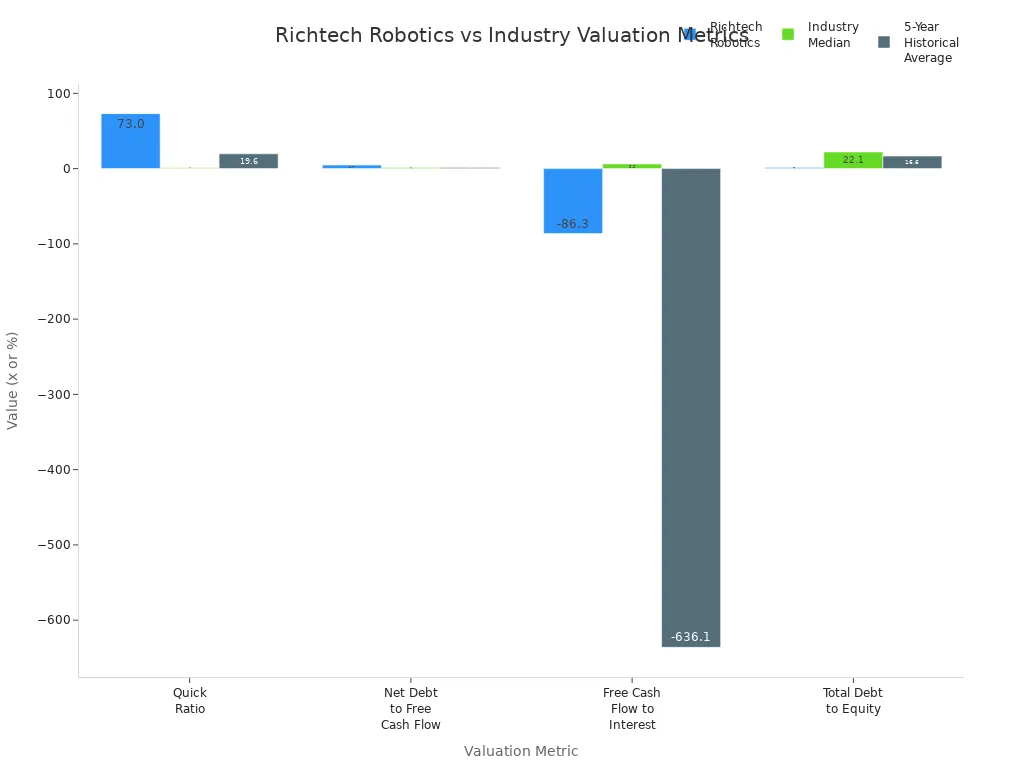

Valuation metrics further highlight these risks. The table below compares Richtech Robotics to industry norms:

| Metric | Richtech Robotics | Industry Median | 5-Year Historical Average | Interpretation / Risk |

|---|---|---|---|---|

| Quick Ratio | 73.0x | 1.0x | 19.6x | Extremely high liquidity ratio suggests possible inefficiencies or excess liquidity buffer |

| Net Debt to Free Cash Flow | 4.7x | 1.4x | 1.4x | Higher leverage relative to cash flow, indicating increased financial risk |

| Free Cash Flow to Interest | -86.3x | 6.2x | -636.1x | Negative coverage ratio signals difficulty covering interest expenses from cash flow |

| Total Debt to Equity | 1.5% | 22.1% | 16.6% | Very low debt reliance, which is a positive aspect |

The intrinsic value analysis shows that Richtech Robotics is overvalued, with a relative value of $1.0 compared to the current stock price of $2.10. The discounted cash flow value is unavailable, and the reverse DCF implies an unrealistically high free cash flow growth rate of 100%. These factors suggest that the current price may not be supported by fundamental cash flow expectations, presenting valuation risk to investors.

The analyst consensus rating for Richtech Robotics is a Zacks Rank #3 (Hold), which indicates expected performance in line with the market. Over the past year, the company has consistently missed consensus EPS and revenue estimates for the last four quarters. The estimate revisions trend before the recent earnings release was mixed, and the stock has underperformed the market, losing about 32.2% since the start of the year. The consensus EPS estimate for the upcoming quarter is -$0.04 on $1.64 million in revenues, and for the current fiscal year, -$0.15 on $5.49 million in revenues. These sell signals highlight the need for caution in any stock forecast or prediction.

Volatility remains a key concern. Recent price surges amid high trading volume raise the risk of speculative trading. Investors should exercise caution, as these market dynamics add to the financial risks already indicated by valuation and liquidity metrics. The rr stock forecast must account for these downside risks, as well as the potential for new challenges to emerge in the evolving robotics sector.

Investors should weigh both the upside opportunities and downside risks when considering Richtech Robotics as an investment. The stock forecast and prediction for this company depend on successful execution, improved profitability, and the ability to manage volatility and valuation concerns. Ongoing monitoring of financial performance and market trends remains essential for making informed investment decisions.

Richtech Robotics stock shows strong growth potential, driven by AI innovation and strategic partnerships. Analysts highlight rising prices, robust liquidity, and rapid ROI, but warn about profitability challenges and possible overvaluation.

| Key Takeaway | Details |

|---|---|

| Stock Trend | Upward trend, closing prices rose from $2.36 to $3.27 after the Las Vegas launch of ADAM. |

| Technological Innovation | AI-powered robot ADAM targets hospitality and food service, signaling market disruption. |

| Financial Strength | Current ratio of 72.6 shows good short-term financial health. |

| Profitability Concerns | Negative EBIT margins and return on equity (-19.5%) highlight ongoing financial challenges. |

| Valuation Metrics | High price-to-book (7.65) and price-to-sales (38.92) ratios suggest caution. |

| Market Sentiment | Stock rally driven by AI excitement and partnerships; analysts advise financial scrutiny. |

| Investment Outlook | Success in commercialization could lead to profitability, but risks remain. |

Investors should monitor these factors:

- Inclusion in the Russell indices signals market recognition.

- Robotics investments often yield ROI within 3 to 6 months.

- The subscription-based RaaS model creates predictable revenue.

- Proprietary AI algorithms drive continuous improvement.

- Risks and uncertainties in SEC filings require attention.

- Progress in scaling partnerships and market presence is critical.

Ongoing research and market monitoring remain essential for informed investment decisions.

FAQ

What drives Richtech Robotics stock price changes?

Richtech Robotics stock price changes result from new product launches, strategic partnerships, and inclusion in major indices. Market sentiment and trading volume also play important roles. Investors should monitor company news and industry trends for the latest updates.

How does Richtech Robotics generate revenue?

The company earns revenue through Robot-as-a-Service (RaaS) subscriptions, direct product sales, and strategic partnerships. These streams provide recurring income and support growth in sectors like hospitality, healthcare, and retail.

What risks should investors consider with Richtech Robotics stock?

Investors face risks such as high volatility, ongoing net losses, and uncertain profitability. The stock may also be overvalued based on current financial metrics. Market conditions and competition in China and globally can impact performance.

How do analysts predict Richtech Robotics stock will perform by 2030?

Analysts forecast an average price target of $32.03 by 2030. This prediction depends on the company’s ability to expand its RaaS model, grow revenue, and achieve profitability. Market growth in robotics also influences these estimates.

Does Richtech Robotics have international partnerships?

Yes. Richtech Robotics partners with companies in China and other regions. Recent agreements include a $4 million sales deal in Asia and collaborations with global firms. These partnerships help expand the company’s market reach and support future growth.

The analysis of Richtech Robotics stock demonstrates the high-risk, high-reward nature of the robotics market. With its fluctuating price, positive forecast, and ongoing profitability challenges, it’s a perfect example of a speculative investment that requires a precise, data-driven approach. However, navigating these complex trends and executing timely trades can be a challenge on traditional platforms. If you are an investor looking to capitalize on such opportunities, consider a modern solution.

BiyaPay offers a robust global trading platform that supports seamless conversion between different currencies and digital assets with a low remittance fee of just 0.5%, and transfers arriving the same day. Our platform allows you to participate in US and Hong Kong stocks from a single account, streamlining your investment strategy. Check our real-time exchange rate converter to see the savings, and start your journey by registering with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.