- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How RUM Stock Is Performing in 2025

Image Source: pexels

RUM stock has delivered a remarkable performance in early 2025, with the price increasing 253% over the past twelve months. The stock recently tested support at $8.12, showing signs of consolidation after a sharp rally. Analysts have maintained a moderate buy rating, reflecting optimism about the trend. Rumble Inc. reported a 12% year-over-year revenue increase and stable earnings, while adjusted EBITDA loss improved by $8.2 million. These trends highlight strong user growth, improved earnings, and positive signals for investment. Recent earnings also show that RUM continues to outperform its sector, with past performance outpacing industry trends.

| Metric | Value | Context |

|---|---|---|

| Stock price increase (12 months) | +253% | Outpaces sector and industry |

| Price/Book Ratio | 28.74 | Above average, stretched valuation |

| Revenue estimate (2025) | $113.38M USD | 18.49% YoY growth |

| Zacks Rank | #3 (Hold) | Cautious optimism |

Key Takeaways

- RUM stock showed strong growth in 2025, rising 253% over the past year despite some price volatility and corrections.

- The company improved its financial health by growing revenue and reducing adjusted EBITDA losses, signaling better operational efficiency.

- Analysts remain mixed but mostly optimistic, with many recommending buy or hold based on growth potential and improving earnings.

- Short-term risks include high volatility, negative net income, and competition, but long-term prospects look promising with expected revenue growth and strategic partnerships.

- Investors should watch upcoming earnings, user engagement, and progress toward profitability to make informed decisions about RUM stock.

RUM Stock Price Trends

Image Source: pexels

2025 Performance

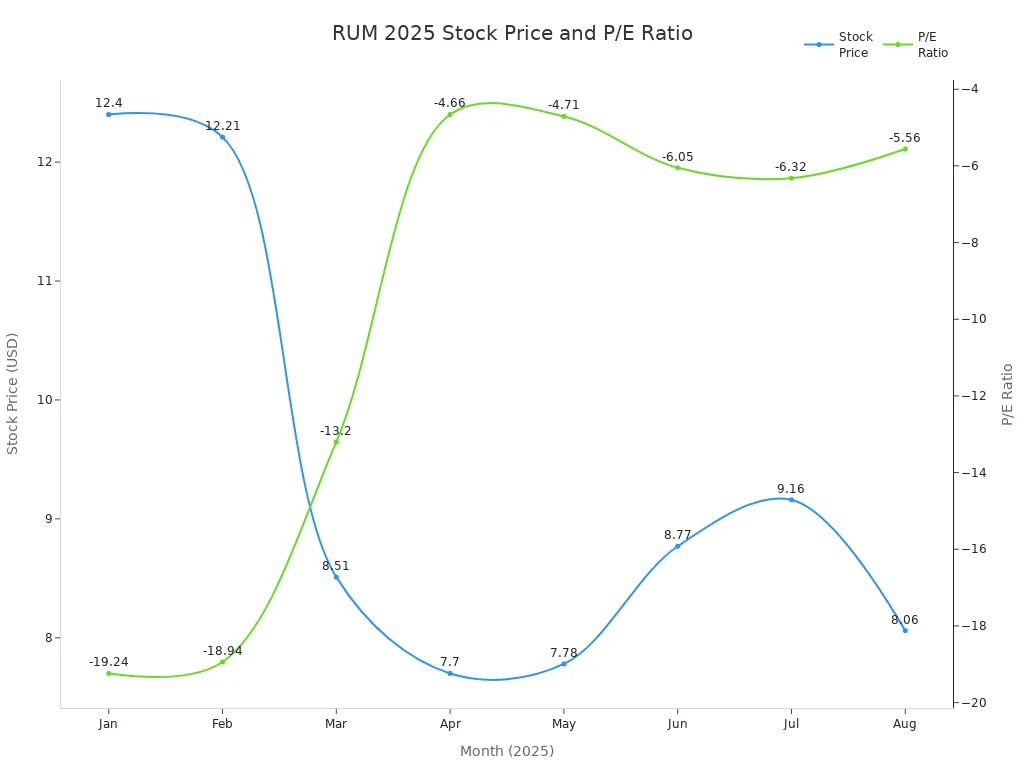

RUM stock has shown significant movement throughout 2025. The share price started the year at $12.40 and experienced a sharp decline by March, reaching $8.51. This drop reflected broader market uncertainty and sector rotation. By April, the share price stabilized near $7.70, followed by a modest recovery in June and July, peaking at $9.16. In August, the share price settled at $8.06, indicating a period of consolidation after earlier volatility.

The overall trend for rum stock in 2025 highlights rapid gains and sharp corrections. The stock price surged during key events, such as quarterly earnings releases and strategic announcements. For example, after Rumble Inc. reported strong second-quarter results and announced an all-stock bid for Northern Data, the share price jumped by 9.29% intraday and continued to rise by 12.2% to $8.84. These moves demonstrate how performance can shift quickly in response to company news.

A comparison with the NASDAQGM index shows that rum stock outperformed the broader market on several occasions. On August 12, 2025, the share price closed at $7.92, up 3.3% for the day, while the NASDAQ Composite Index gained only 1.4%. The table below summarizes key performance metrics:

| Metric | RUM Stock (Aug 12, 2025) | NASDAQ Composite Index (Aug 12, 2025) |

|---|---|---|

| Closing Price | $7.92 | N/A |

| Daily % Change | +3.3% | +1.4% |

| Intraday High % Gain | +19.3% | N/A |

| Market Cap | $3 Billion USD | N/A |

| Quarterly Results (Q2 2025) | Loss of $0.12/share on $25.08M sales | N/A |

| Monthly Active Users (Q2 2025) | 51 million (down from 59 million in Q1 2025) | N/A |

| Revenue per User (YoY) | +24% to $0.42 | N/A |

The historical context for rum stock’s valuation also reveals improvement. The P/E ratio, which remained negative for several years, improved from -19.24 in January to -5.56 in August. This shift suggests narrowing losses and better market expectations. The chart below illustrates monthly changes in share price and P/E ratio for 2025:

Volatility and Volume

RUM stock experienced high volatility during 2025, especially around earnings announcements and major company events. The share price often moved sharply in response to news, with notable spikes in trading volume. For instance, on August 11, 2025, the share price surged by 8.76% intraday, moving from $7.88 to $8.57. The intraday price range extended from $8.50 to $9.39, reflecting active trading and rapid price changes.

Periods of high volatility coincided with increased option activity. Technical indicators, such as the Relative Strength Index (RSI) and Bollinger Bands, signaled oversold conditions and short-term rebounds. The table below highlights key volatility metrics and technical signals:

| Event/Metric | Details/Values |

|---|---|

| Intraday Surge on August 11, 2025 | +8.76% increase, price moved from $7.88 to $8.57 |

| Intraday Price Range | $8.50 to $9.39 |

| Turnover | 6.22 million shares (4.19% of float) |

| RSI | 22.01 (oversold) |

| MACD Histogram | -0.1386 |

| Bollinger Bands Lower Band | $7.53 |

| Resistance Level | $8.95 - $9.16 |

The average daily trading volume for rum stock in 2025 ranged between 17 million and 18 million shares. On August 13, 2025, the regular trading session saw a volume of 22.9 million shares, well above the 30-day average of 17.3 million shares. This elevated trading volume often accompanied periods of high volatility and price movement.

The 52-week high and low for rum stock as of mid-2025 are shown below:

| Metric | Value |

|---|---|

| 52-Week High | $17.40 |

| 52-Week Low | $4.92 |

Note: The wide gap between the 52-week high and low reflects the stock’s volatile nature and the impact of market sentiment on share price.

RUM stock’s trading patterns in 2025 reveal a trend of rapid price changes, high volume, and frequent volatility spikes. Investors observed opportunities for gains during these periods, but also faced risks from sharp corrections. The combination of strong performance, active trading, and technical signals shaped the overall trend for rum stock throughout the year.

RUM Financials

Image Source: pexels

Revenue and Net Income

RUM’s financials in 2025 show both progress and ongoing challenges. The company reported revenue of $25.1 million for Q2 2025, up 12% from $22.5 million in Q2 2024. This revenue growth came mainly from audience monetization and new initiatives. However, revenue missed the consensus estimate of $26.78 million. Net income remained negative, with a loss of $30.2 million in Q2 2025, compared to a loss of $26.8 million in the same quarter last year. The adjusted EBITDA loss improved to $20.5 million, narrowing by $8.2 million year-over-year. This improvement signals better operational efficiency, even as net losses widened.

| Metric | Q2 2025 Amount | Q2 2024 Amount | Year-over-Year Change | Notes |

|---|---|---|---|---|

| Revenue | $25.1 million | $22.5 million | +$2.6 million (+12%) | Growth from monetization and initiatives |

| Net Income (Loss) | -$30.2 million | -$26.8 million | -$3.4 million (worsened) | Net loss widened |

| Adjusted EBITDA | -$20.5 million | -$28.7 million | +$8.2 million (improved) | Operational improvement |

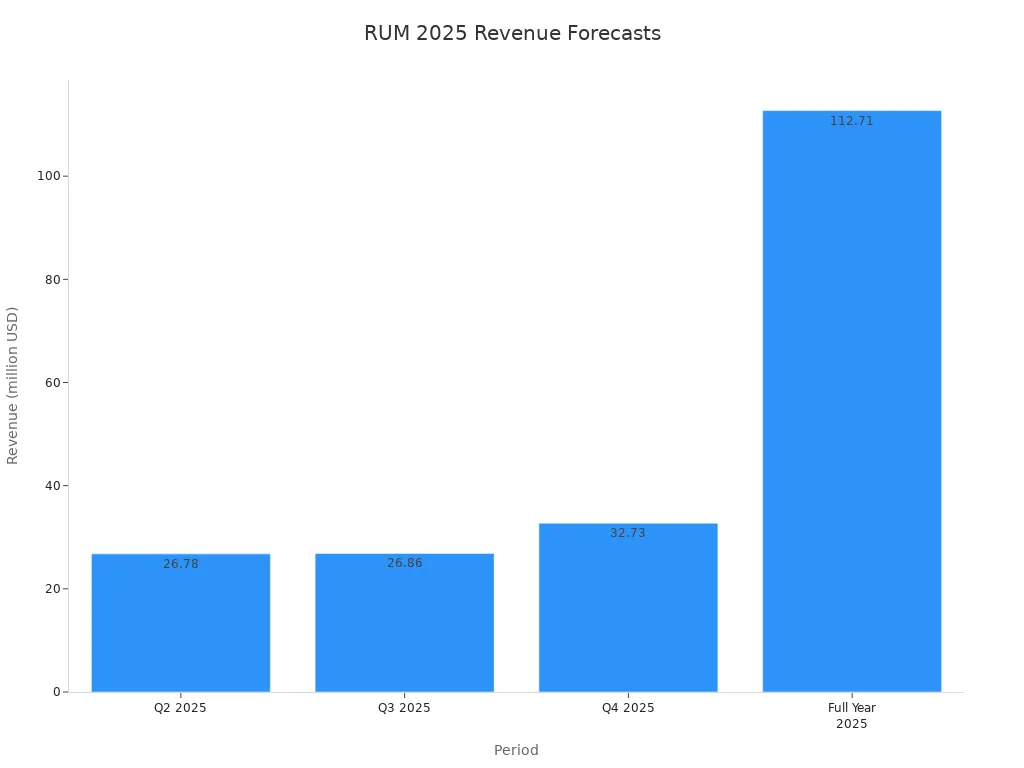

Analysts forecast continued revenue growth for RUM through the rest of 2025. The consensus revenue estimate for Q3 stands at $26.86 million, with Q4 projected at $32.73 million. Full-year revenue is expected to reach $112.71 million, reflecting upward revisions over the past 90 days. The chart below illustrates these trends:

Margins and Growth

RUM’s profit margins have improved in 2025. The adjusted EBITDA loss narrowed by $8.2 million year-over-year, driven by a 26% reduction in cost of services. Programming and content expenses dropped by $10.1 million, helping the company move closer to profitability. Analysts project RUM’s revenue growth rate for 2025 to average 19.2%, with estimates ranging from 13.7% to 26.1%. Total revenues are expected to rise from $95.49 million in 2024 to $113.84 million in 2025.

| Period | Revenue Forecast (million USD) | Notes on Trend/Change |

|---|---|---|

| Q2 2025 | 26.78 | Consensus estimate |

| Q3 2025 | 26.86 | Continued growth |

| Q4 2025 | 32.73 | Continued growth |

| Full Year 2025 | 112.71 | Upward revision |

Analysts expect RUM to reach adjusted EBITDA break-even within the next 12 months. The company also benefits from a $775 million investment, which supports growth and accelerates the path to profitability.

RUM’s financials show strong liquidity, with a current ratio of 7.71, well above industry averages. However, profitability ratios remain negative, reflecting ongoing challenges in financial performance. The latest earnings report highlights both the progress in earnings and the work still needed for sustained profitability.

NASDAQGM:RUM Analyst Ratings

Buy and Hold Recommendations

Analysts continue to provide mixed analysis for NASDAQGM:RUM in 2025. Most research firms issue either buy or hold recommendations. The stock attracts attention due to its strong earnings momentum and rapid price changes. Several analysts highlight the company’s improved financials and narrowing losses as a buy signal. They point to the recent earnings report, which shows better operational efficiency and higher revenue per user.

A few analysts, however, issue a sell recommendation. They express concern about the company’s negative net income and the risk of further volatility. These experts warn that the stock may face pressure if user growth slows or if earnings miss expectations in future quarters. The table below summarizes the latest analyst recommendations for NASDAQGM:RUM:

| Recommendation | Number of Analysts | Key Reasoning |

|---|---|---|

| Buy | 7 | Strong earnings, growth |

| Hold | 5 | Volatility, wait for clarity |

| Sell | 3 | Net loss, risk factors |

Note: Analysts often update their analysis after each earnings release. Investors should review the latest reports before making decisions.

Price Targets

Price targets for NASDAQGM:RUM reflect a wide range of analysis. The average 12-month target stands at $11.50 USD (see exchange rates), with the highest estimate at $15.00 USD and the lowest at $6.00 USD. Analysts who issue a buy rating expect the stock to benefit from new partnerships and continued user growth. They see the current price as an opportunity, especially if the company delivers on its earnings forecasts.

On the other hand, analysts who issue a sell signal believe the stock could fall below $7.00 USD if the company fails to meet revenue targets. Some analysis points to the risk of dilution or increased competition. Two analysts recently issued a sell signal after the Q2 earnings report, citing concerns about slowing user growth.

Key points from recent analysis include:

- Most analysis highlights the importance of upcoming earnings for future price direction.

- Buy recommendations focus on the company’s path to profitability.

- Sell recommendations stress the risk of missing growth targets.

Investors should consider both buy and sell signals when reviewing NASDAQGM:RUM. The stock remains sensitive to earnings results and analyst analysis.

Investment Outlook

Short-Term Prospects

RUM stock faces a complex short-term environment in 2025. Technical indicators present a mixed picture. The stock currently shows four buy signals and three sell signals, resulting in an overall neutral technical rating. Short and mid-term simple moving averages (SMAs) remain negative, which points to a downtrend. The long-term SMA, however, stays positive, suggesting underlying support for the stock.

| Factor | Details |

|---|---|

| Technical Signals | 4 buy signals, 3 sell signals; overall technical rating: Neutral |

| Moving Averages | Short and mid-term SMAs negative (downtrend), long-term SMA positive |

| Seasonality | January highest probability of positive returns; June lowest |

| Price Trend | Downtrend starting 2025-07-24 with -18.52% price change |

| Volume | Decreasing volume alongside price drop, indicating potential rebound |

| Short Sale Ratio & Volume | Considered as additional factors influencing stock behavior |

Rumble’s short-term performance depends on several factors. Macroeconomic conditions and sentiment in the crypto market contribute to volatility. The company must execute its blockchain and cloud strategies effectively and stabilize its user base to support a rebound. Recent declines in user numbers and ongoing losses raise concerns about near-term earnings. Insider selling and broader market sentiment around technology and media stocks add further uncertainty.

Analysts remain divided on the stock’s short-term investment case. Some see potential for a rebound if Rumble delivers on upcoming earnings and revenue targets. Others urge caution due to the risk of further volatility and the possibility of missing growth expectations. The niche platform position may limit immediate revenue gains, which tempers optimism for the rest of 2025.

Note: Investors should monitor upcoming earnings releases and user engagement metrics closely. These data points will likely drive short-term price movements.

Long-Term Potential

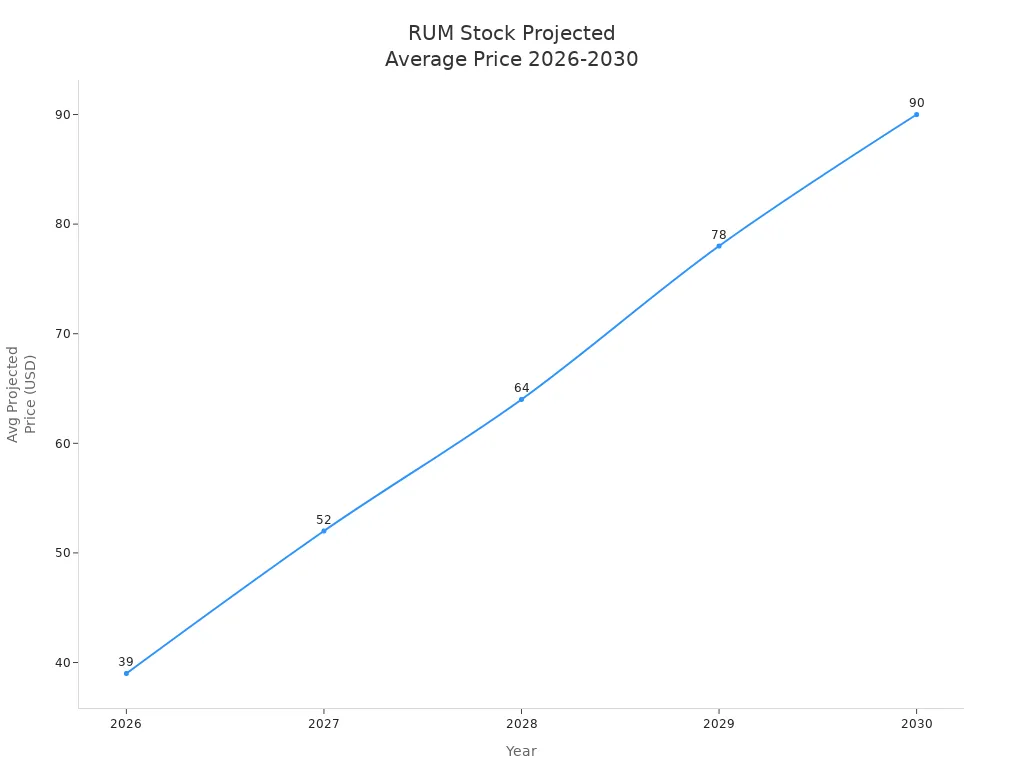

The long-term outlook for RUM stock appears more optimistic. Analysts project significant future growth through 2027, supported by expansion in the online streaming market, strategic content partnerships, and improved financial health. The company has demonstrated strong operational performance, with revenue surging 468% in Q2 2023 and user engagement rising to 11.8 billion minutes watched monthly.

| Year | Average Projected Price (USD) | Price Range (USD) | Key Supporting Factors |

|---|---|---|---|

| 2026 | 39 | 32 - 43 | Expansion in online streaming market, tech trends, financial health |

| 2027 | 52 | 45 - 59 | Continued capitalization on emerging trends, strategic content diversification |

| 2028 | 64 | 57 - 72 | Portfolio diversification, enhanced user experience |

| 2029 | 78 | 70 - 86 | Established market position, operational performance |

| 2030 | 90 | 84 - 99 | Solidified gains, market stability |

Rumble’s strong cash reserves of $296.7 million provide a solid foundation for ongoing investment in technology and content. Strategic partnerships with high-profile influencers and sports organizations support user growth and engagement. Analysts forecast a revenue compound annual growth rate (CAGR) of 23% over the next three years, building on a past three-year CAGR of 116%. The average one-year price target stands at $13.6 USD, with a range from $10.1 to $21 USD.

Long-term projections suggest that RUM stock could benefit from continued growth in digital media and streaming. The company’s focus on content diversification and enhanced user experience positions it well for future growth. However, the path to sustained profitability depends on the ability to convert user engagement into consistent revenue and earnings. Analysts expect Rumble to reach adjusted EBITDA break-even within the next 12 months, which would mark a key milestone for the company.

| Metric | Forecast / Estimate | Past Growth / Accuracy |

|---|---|---|

| Revenue CAGR (next 3 years) | 23% | Past 3 years CAGR: 116% |

| 1-Year Price Target Average | $13.6 USD (see exchange rates) | Low: $10.1 USD, High: $21 USD |

Investors with a long-term horizon may find RUM stock attractive, given its strong growth trajectory and improving financials. Monitoring progress toward profitability and revenue milestones will be essential for assessing future performance.

Risks and Opportunities

Market Risks

RUM stock faces several important risks in 2025. Investors see brand-safety concerns as a major issue. Advertisers may hesitate to spend on the platform if they worry about content moderation. Legal and regulatory challenges also create uncertainty. Laws about platform liability and content rules can change quickly, which may impact the company’s operations.

Competition in the digital media space remains fierce. Many companies fight for the same audience and advertising dollars. RUM stock also carries the risk of potential dilution. If the company issues more shares to raise capital, current shareholders could see their value decrease.

High volatility in stock trading adds another layer of risk. The price can swing sharply in response to news or earnings. RUM has not yet reached profitability, so unprofitability increases the downside risk for investors. The company uses leverage to fund growth, which can magnify losses if performance falls short. Investors must pay close attention to risk management strategies.

Note: RUM stock’s risk profile is shaped more by its financial performance and market position than by recent regulatory changes. Most industry regulations target the rum beverage sector, not Rumble Inc.

Growth Drivers

Despite these risks, RUM stock has several strong growth drivers. Subscriber growth continues to rise, supported by strategic partnerships with major content creators. The company reports robust engagement metrics, showing that users spend more time on the platform. New advertising models help RUM monetize its audience more effectively.

The company expands its content offerings and launches new features, such as live-streaming. User retention strategies keep monthly active users above 50 million. International expansion opens new markets and increases revenue potential. RUM also benefits from partnerships with firms like Cumulus Media and AI companies, which improve ad technology and user experience.

RUM’s management invests in aggressive growth, backed by strong financial support. The upcoming launch of Rumble Wallet aims to boost creator acquisition and international growth through crypto transactions. The cloud business grows with new government and enterprise contracts. Analysts from JP Morgan and Goldman Sachs maintain a positive outlook, citing improved adjusted EBITDA and higher average revenue per user.

Investors should watch for continued innovation, new partnerships, and progress toward profitability as key factors supporting long-term growth.

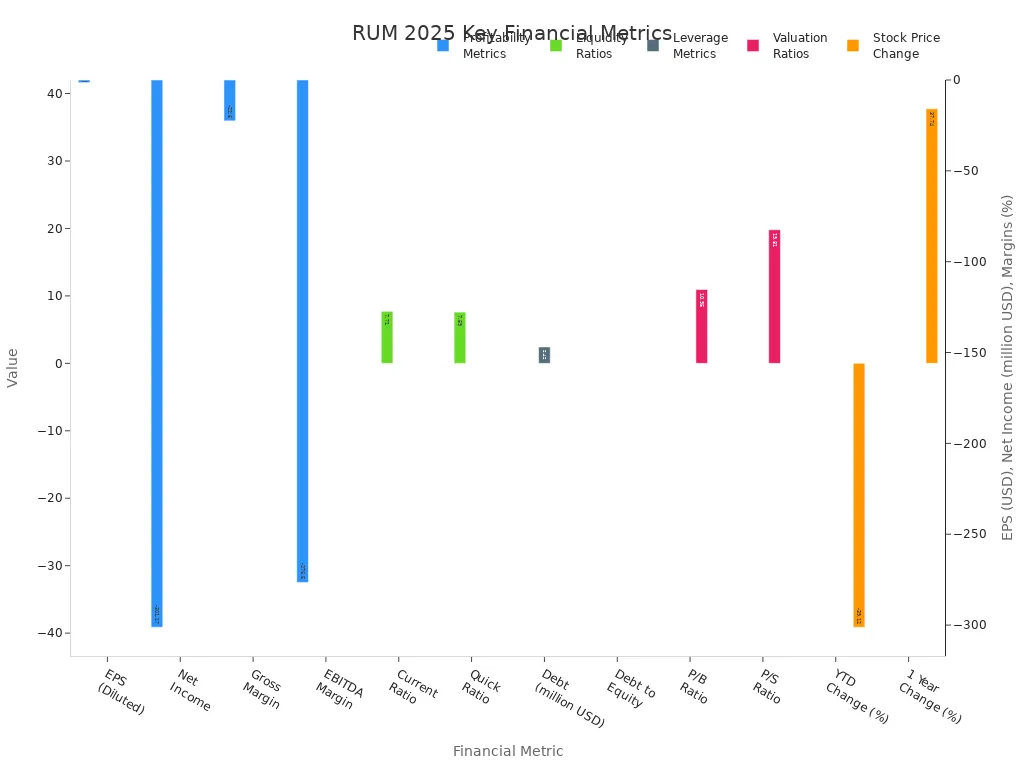

RUM stock displayed high volatility in 2025, with a 37.74% one-year gain but a 39.12% year-to-date decline. The company improved operational efficiency and maintained strong liquidity, yet continued to report large net losses and negative margins. Analyst sentiment remains mixed, with notable institutional interest.

| Financial Metric | Value / Trend | Implication for 2025 Performance |

|---|---|---|

| EPS (Diluted) | -$1.44 | Continued losses per share |

| Net Income | -$301.17 million | Large net losses persist |

| Gross Margin | -22.5% | Negative gross profitability |

| Current Ratio | 7.71 | Strong short-term liquidity |

| Debt to Equity | 0.01 | Very low leverage |

| Stock Price YTD Change | -39.12% | Significant price decline year-to-date |

| Stock Price 1 Year Change | +37.74% | Strong gain over one year despite recent volatility |

Investors should watch for revenue growth, user engagement, and strategic partnerships in upcoming quarters. Key milestones include progress in cloud initiatives, executive appointments, and acquisition developments. RUM stock offers potential for long-term growth, but short-term risks remain significant.

For all USD references, see current exchange rates.

FAQ

What caused the sharp changes in Rumble Inc.'s share price in 2025?

Rumble Inc.'s share price moved sharply due to earnings releases, strategic announcements, and changes in user numbers. High trading volume and market reactions to news also played a major role in these price swings.

How did Rumble Inc.'s financials improve during 2025?

The company reduced its adjusted EBITDA loss and improved operational efficiency. Revenue growth came from new monetization strategies and partnerships. Analysts noted better cost control and higher revenue per user in their analysis.

What are the main risks for investors considering Rumble Inc. stock?

Investors face risks from high volatility, negative net income, and competition. Regulatory changes and the potential for dilution also add uncertainty. The company’s financial performance remains a key factor for future growth.

How do analysts view Rumble Inc.'s future growth prospects?

Analysts expect continued revenue growth and improved financial performance. They highlight strong user engagement and new partnerships as positive trends. Most analysis points to long-term potential, but short-term risks remain.

What should investors watch for in upcoming earnings reports?

Investors should focus on revenue, user engagement, and progress toward profitability. Key trends include changes in trading volume, new partnerships, and updates on strategic initiatives. These factors will shape future performance.

The analysis of RUM stock highlights the high-risk, high-reward nature of the digital media market. A volatile investment like this demands a flexible and efficient financial tool. When dealing with complex cross-border transactions and frequent currency conversions, high remittance fees and opaque exchange rates can erode your investment returns.

BiyaPay was built to solve this. We provide an integrated global financial solution that lets you participate in US and Hong Kong stocks from a single platform, without needing an overseas bank account. Our service supports seamless conversion between various fiat and digital currencies and offers a low remittance fee of just 0.5%, ensuring your capital flows efficiently and securely. Check our real-time exchange rate converter to see the potential savings. Register now to experience smarter, more efficient global asset management and seize every investment opportunity.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.