- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Analyze KOLD Stock Before Investing

Image Source: unsplash

To analyze kold stock before you invest, you need to understand how the kold etf works as a leveraged and inverse etf. You must look at how kold etf uses trading strategies that move opposite to natural gas stocks. Many investors focus on the daily performance of the kold etf and how trading impacts risk. You should always check the unique risks with leveraged etf products, since kold stock can move quickly. Good research and strong risk management help investors make better trading choices in these kinds of stocks.

Key Takeaways

- KOLD ETF is a leveraged inverse fund that aims to deliver twice the opposite of daily natural gas price moves, making it suitable only for short-term trades.

- Holding KOLD ETF for long periods can lead to losses due to daily leverage resets and volatility drag, so monitor your position closely and use stop-loss orders.

- Natural gas price trends and major news events greatly affect KOLD ETF’s performance, so stay updated to manage risks effectively.

- High fees and tracking errors can reduce returns, so research costs and how well the ETF matches its target before investing.

- Set clear investment goals and only invest amounts you can afford to risk, using brokers with good tools and support for leveraged ETFs.

KOLD ETF Basics

Image Source: pexels

What Is KOLD ETF

You may wonder what makes the KOLD ETF different from other funds. KOLD ETF is a leveraged inverse ETF. It aims to deliver twice the opposite, or -2x, of the daily performance of the Bloomberg Natural Gas Subindex. This means if natural gas prices fall by 1% in a day, KOLD ETF seeks to rise by 2%. If natural gas prices rise by 1%, KOLD ETF aims to drop by 2%. You can see how this ETF is designed for traders who expect natural gas prices to go down.

Here is a table to help you understand how KOLD ETF works:

| Aspect | Explanation |

|---|---|

| Performance Objective | Tracks -2x daily performance of Bloomberg Natural Gas Subindex |

| Financial Instruments Used | Primarily natural gas futures contracts; also uses swaps during market emergencies or impractical trading |

| Investment Strategy | Takes short positions on an index of natural gas futures contracts to achieve leveraged inverse exposure |

| Reason for Using Futures | Futures provide exposure to natural gas price movements; spot price behaves differently due to volatility |

| Use of Swaps | Employed during trading halts, flash crashes, high volatility, or illiquidity to maintain exposure |

| Fund Details | Launched Oct 4, 2011; managed by ProShare Capital Management LLC and affiliates; domiciled in the USA |

How KOLD Stock Works

You need to know how KOLD stock operates before you start trading. KOLD ETF uses natural gas futures contracts to get its exposure. It does not invest in natural gas itself. Instead, it uses futures and sometimes swaps to match its goal of -2x daily inverse performance. This structure makes KOLD ETF very different from traditional natural gas ETFs.

- KOLD ETF is a leveraged inverse ETF. It targets twice the inverse (-2x) of the daily return of the Bloomberg Natural Gas Subindex. This design suits short-term bearish trading on natural gas prices.

- The fund uses natural gas futures contracts with cash equivalents as collateral. This helps maintain margin requirements for trading.

- KOLD ETF resets its leverage daily. This daily reset can cause something called volatility drag. Over time, this can make returns unpredictable, especially if you hold KOLD stock for more than a day.

- KOLD ETF has a high expense ratio of 0.95%. Over the past ten years, it has shown a poor long-term return of -17.96% per year. This highlights the risk of holding KOLD ETF for long periods.

- Traditional natural gas ETFs, like UNG, invest directly in natural gas futures without leverage or inverse performance. These funds are better for longer-term investing.

- Some other ETFs, such as FCG, invest in natural gas-related stocks. These funds may have lower volatility and sometimes pay dividends.

You should also know that KOLD ETF has a 30-day average trading volume of about 8,289 shares. This means you can usually buy or sell shares without much trouble, but trading volume can change quickly.

Key Metrics for Research

Performance Indicators

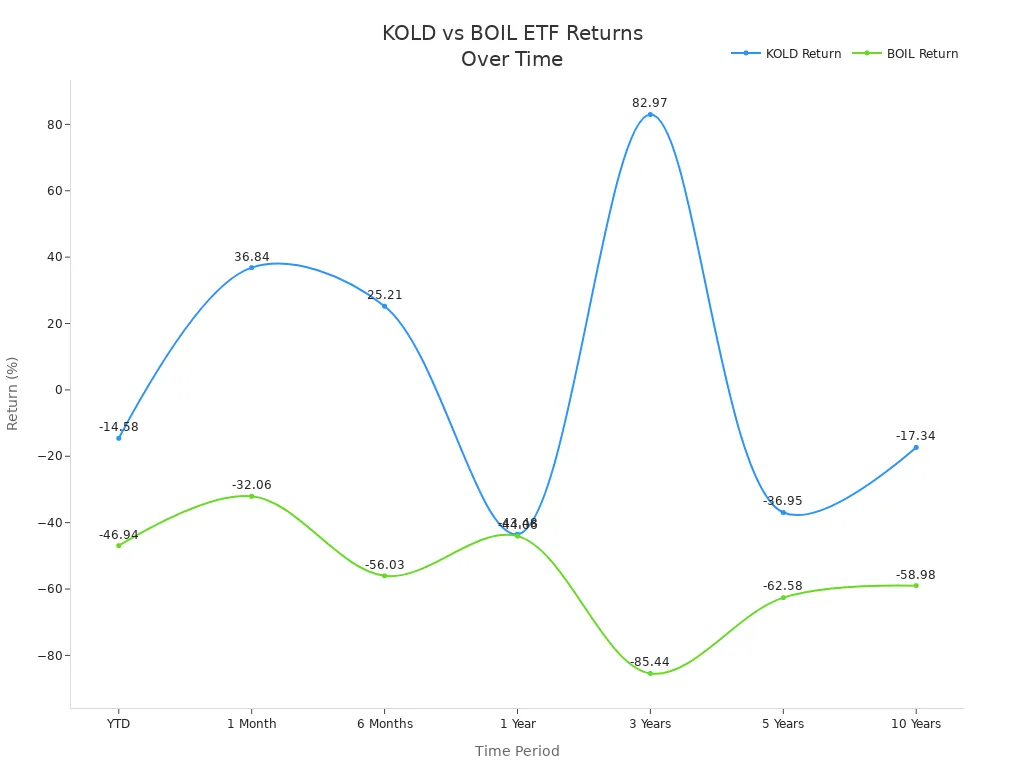

When you research proshares ultrashort bloomberg natural gas, you need to look at how the kold etf performs over different time frames. KOLD ETF aims to deliver -2x the daily return of natural gas futures. This means the fund can move quickly, and you must watch for sharp changes. Over the past year, kold etf had a total return of -43.99%. This shows that holding kold stock for long periods can lead to large losses. You should always check recent returns, as they can change fast. For example, in the last month, kold etf gained 36.84%, but over one year, it lost much more. These swings show why you need to research proshares ultrashort bloomberg natural gas often and understand the risk.

Fees and Expenses

You must also research the costs of kold etf. The expense ratio for kold etf is 0.95%. This is equal to the FactSet segment average and lower than the ETF Database category average of 1.09%. The table below shows how kold etf compares to other leveraged etfs:

| Metric | Value for KOLD | Comparison Benchmark |

|---|---|---|

| Expense Ratio | 0.95% | Equal to FactSet Segment Avg (0.95%) |

| Expense Ratio | 0.95% | Lower than ETF Database Category Avg (1.09%) |

| Expense Rating (ETF Database) | B+ | Indicates relatively favorable cost efficiency |

You should research proshares ultrashort bloomberg natural gas to see if these fees fit your trading plan. Lower fees can help reduce risk over time, especially if you trade often.

Tracking Error

Tracking error measures how well kold etf matches its target of -2x the daily move of natural gas futures. You need to research this because leveraged etfs can drift from their goals, especially if you hold them for more than one day. KOLD ETF uses futures and swaps, which can add to tracking error. Over time, compounding and volatility can make the returns of kold etf very different from the index. When you research proshares ultrashort bloomberg natural gas, always check how closely the etf tracks its benchmark. This helps you manage risk and avoid surprises. If you want to trade kold stock, you must watch for tracking error and adjust your position as needed. This is key for anyone trading leveraged etfs instead of regular stocks.

Market Factors

Natural Gas Trends

You need to watch natural gas prices closely when you analyze the kold etf. The price of natural gas changes often because of supply, demand, and market speculation. These changes can have a big impact on the performance of any etf that tracks natural gas, especially a leveraged inverse fund like kold etf.

Here is a table showing how recent trends in natural gas prices have affected kold etf:

| Period | KOLD Performance | Natural Gas Price Trend | Interpretation |

|---|---|---|---|

| 1-Month | +36.84% | Mixed, slight decline | KOLD gained as natural gas prices declined or were volatile |

| 3-Month | +71.89% | General decline | KOLD’s strong gain reflects inverse relation to falling natural gas prices |

| 52-Week | -43.48% | Earlier higher prices, then decline | KOLD lost value over longer term when natural gas prices were higher earlier |

You can see that kold etf often rises when natural gas prices fall. Over the past three months, natural gas prices dropped, and kold etf gained over 70%. In the past year, natural gas prices were higher at first, so kold etf lost value. Kold etf also shows high implied volatility, which means you should expect large price swings. Technical analysis points to oversold zones and breakout patterns, so you may see sudden reversals.

Kold etf uses futures contracts to keep its -2x exposure. The fund rolls these contracts forward before expiration. This process can affect performance, especially when the market is in contango or backwardation. In contango, rolling contracts can reduce returns. In backwardation, rolling can help returns. You need to understand these trends to manage your risk.

News Impact

Major news events can move natural gas prices quickly. You should pay attention to these events if you trade kold etf or any natural gas etf. Some key news factors include:

- Geopolitical events, such as sanctions on Russia or tariffs on Canadian imports, can limit supply and push natural gas prices higher.

- Extreme weather, like bitter cold, increases demand for heating and can disrupt production, causing prices to rise.

- Global demand for liquefied natural gas, especially from Asia and Europe, supports higher prices.

- Low natural gas inventories compared to the five-year average signal tight supply and possible shortages.

When these events happen, natural gas prices often spike. This can cause kold etf to drop sharply, since it moves opposite to the price. Other etfs, such as UNG, UNL, and BOIL, may gain during these times. You need to monitor news and market updates to manage your risk and make better trading decisions.

Risk Management

Image Source: pexels

Volatility Risks

You face unique risks when you trade leveraged and inverse ETFs like the kold etf. The kold etf resets its leverage every day. This daily reset means that your returns can change quickly, even if natural gas prices move back to where they started. Volatility drag can cause your investment to lose value over time, especially if prices swing up and down. You must understand and apply risk management to protect your money. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) warn that leveraged ETFs are not for long-term holding. These agencies say that these products are complex and can lead to large losses if you do not monitor investment closely. You should always read the fund’s prospectus and make sure you know how the daily reset works.

Tip: Leveraged ETFs like the kold etf can perform very differently from what you expect over weeks or months. Always check your position often and do not assume that long-term trends will match the daily target.

Leverage Effects

The kold etf uses -2x leverage. This means it aims to double the opposite of the daily move in natural gas prices. Leverage can increase your gains, but it also increases your risk. If natural gas prices rise, your losses can add up fast. Compounding makes this effect stronger over time. Even if natural gas prices end up where they started, you can still lose money because of daily resets and volatility. The SEC has placed limits on new leveraged ETF products because of these risks. The agency wants to make sure that investors understand the dangers. FINRA has also taken action against firms that recommend leveraged ETFs to people who do not understand the risks. You must understand and apply risk management when you use leverage. Keep your position size small and set clear entry and exit points.

Here is a table to help you see how leverage can affect your returns:

| Day | Natural Gas Change | KOLD ETF Expected Change | Cumulative KOLD ETF Return |

|---|---|---|---|

| 1 | +5% | -10% | -10% |

| 2 | -5% | +10% | -1% |

| 3 | 0% | 0% | -1% |

You can see that even if natural gas prices return to the starting point, the kold etf does not. This is because of compounding and daily resets.

Position Monitoring

You need to monitor investment in the kold etf very closely. Leveraged ETFs require you to check your positions often, sometimes every day. The daily reset and volatility decay mean that your returns can change quickly. You should use stop-loss orders to limit your losses. Set clear rules for when to enter and exit trades. Many financial advisors say you should not hold leveraged ETFs overnight. News can cause big price moves when markets are closed. If you must hold overnight, focus on ETFs with tight spreads and know how the futures market works. Always manage your position size to control your exposure. Trade during regular market hours for better liquidity.

- Monitor investment daily or at least every few days.

- Use stop-loss orders to protect your capital.

- Limit your holding period to short-term windows.

- Adjust your position if the market moves against you.

- Have a clear plan before you start trading.

Note: Leveraged ETFs like the kold etf often send investors a Schedule K-1 for tax reporting. You may need to report both capital gains and partnership income. This can make your taxes more complex and may delay your filing. You should talk to a tax professional if you have questions.

By following these steps, you can understand and apply risk management to your kold etf trades. Always stay alert and be ready to act quickly. Leveraged ETFs are powerful tools, but they require discipline and constant attention.

Investment Suitability

Setting Goals

Before you invest in the kold etf, you need to set clear goals. The kold etf is not for everyone. It is a highly volatile etf that uses leverage to move twice the opposite of natural gas prices each day. You should only use this etf if you have short-term trading goals. If you want long-term growth or stable income, this investment will not fit your needs. Most investors who use the kold etf want to make quick trades or speculate on falling natural gas prices. You must decide how much to invest based on your risk tolerance and trading plan.

Here are some points to help you match your goals with the kold etf:

- Use the kold etf for short-term trades, not for long-term holding.

- Only invest if you can handle large price swings and high risk.

- Avoid using the kold etf if you want steady returns or low volatility.

- Decide how much to invest by looking at your overall investment portfolio and risk budget.

- Make sure your investment goals match the nature of this etf.

Note: The kold etf works best for investors who can watch the market closely and react quickly. You should always use strict risk controls.

Assessing Fit

You need to check if the kold etf fits your investment strategy and portfolio. Start by looking at your broker options. Learn how to choose broker and open account with a platform that offers good trading tools and low fees. Make sure your broker supports leveraged etfs and provides real-time data.

When you decide how much to invest, keep your exposure to natural gas small compared to your total investment. Financial experts suggest that investors should:

- Review the broker’s reputation and regulatory status.

- Check the broker’s security measures and transparency.

- Compare expense ratios and trading costs for each etf.

- Match the kold etf’s risk level to your own risk tolerance.

- See how the kold etf fits with your other investments in your portfolio.

A table can help you review your fit:

| Step | What to Check |

|---|---|

| Broker Selection | How to choose broker and open account, fees, tools |

| Decide How Much to Invest | Risk budget, portfolio size, exposure limits |

| Portfolio Fit | Does kold etf match your investment goals? |

If you want to build a strong investment portfolio, always review your goals and risk before you trade. The kold etf is best for investors who want to take short-term positions and can manage risk well.

You can analyze the KOLD ETF by following a clear process. Investors should start with research on the ETF’s structure and risks. Use your broker’s tools to compare options and set alerts. Review your investment goals often. Here is a checklist for investors:

- Understand the KOLD ETF’s leveraged and inverse structure.

- Assess your risk tolerance and investment size.

- Use your broker to monitor price levels and news.

- Set stop-loss orders to manage risk.

- Review your investment plan and adjust as needed.

Stay disciplined. Investors who monitor their investments and update their strategy can manage risk better.

FAQ

What is the main risk of investing in KOLD ETF?

You face high volatility and leverage risk. KOLD ETF can lose value quickly if natural gas prices rise. You must monitor your position daily and use stop-loss orders to protect your investment.

Can you hold KOLD ETF for long-term investment?

You should not hold KOLD ETF for long periods. The fund resets daily and can lose value due to volatility drag. KOLD ETF works best for short-term trades.

How do fees affect your returns with KOLD ETF?

You pay an expense ratio of 0.95% each year. High fees can reduce your returns, especially if you trade often. Always check the latest expense ratio before investing.

What happens if natural gas prices spike overnight?

KOLD ETF may drop sharply if natural gas prices rise overnight. You should avoid holding leveraged ETFs during major news events. Use stop-loss orders and monitor market news closely.

Where can you find the latest USD exchange rates?

You can check current USD exchange rates at XE.com or OANDA. Always use reliable sources when converting currencies for international investments.

The analysis of KOLD ETF proves that in highly volatile markets, risk management and trading efficiency are crucial. If you are struggling with high fees from frequent trades, complex fund transfers, and the hassle of managing multiple platforms, it’s time for a more efficient solution.

BiyaPay is dedicated to providing global investors with a one-stop financial service, allowing you to participate in US and Hong Kong stocks from a single platform, without needing an overseas bank account. We support seamless conversion between various fiat and digital currencies and offer a low remittance fee of just 0.5%, ensuring your capital flows efficiently and securely. Use our real-time exchange rate converter to see your savings, and register now to experience smarter, lower-cost trading, and easily navigate complex market volatility.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.