- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use UPRO Stock for Aggressive Growth with 3x Leverage

Image Source: pexels

Many investors look to upro stock for aggressive growth because of its unique structure. UPRO stock acts as a triple-leveraged ETF, aiming to deliver three times the daily performance of the S&P 500. You can see strong growth in its value, with a 5-year return of +245.66% and a market capitalization of about $4.49 billion.

| Metric | Value |

|---|---|

| 5-Year Return | +245.66% |

| Market Capitalization | $4.49 billion |

| Stock Price (Recent) | $101.21 |

You should understand how leverage, daily resets, and volatility decay can increase both reward and risk before you invest.

Key Takeaways

- UPRO is a triple-leveraged ETF that aims to triple the daily returns of the S&P 500, offering high growth potential but also high risk.

- Daily resets and market volatility can cause losses over time, making UPRO better suited for short-term trading rather than long-term holding.

- Investors must manage risk carefully by setting clear limits, using stop-loss orders, and rebalancing their portfolios often.

- UPRO is not recommended for conservative investors or retirement accounts due to its high volatility and complexity.

- Combining UPRO with safer assets like bonds and limiting its share in your portfolio can help balance risk and reward.

UPRO Stock and 3x ETFs

What Is UPRO Stock

You may wonder what makes upro stock different from other funds that track the s&p 500. UPRO stock is a triple-leveraged ETF. This means it aims to deliver three times the daily performance of the s&p 500 index. You do not get ordinary exposure like you would with standard ETFs such as IVV, SPY, or VOO. Instead, you get amplified results—both gains and losses.

UPRO stock uses a unique approach. It does not buy all the stocks in the s&p 500 directly. Instead, it uses financial tools called derivatives. These include total return swaps and options. With these tools, UPRO can exchange a multiple of the s&p 500’s return with a counterparty. This process involves paying financing costs and posting margin. The swaps are set up to give you three times the daily return of the index. This method also brings extra risks, such as margin requirements and the chance that contracts could end early if the market moves sharply.

Note: Triple-leveraged ETFs like UPRO and SPXL use derivatives to achieve their goals. They are not the same as standard ETFs, which hold the actual stocks in the index. Leveraged shares like UPRO are designed for traders who want to take bigger risks for bigger rewards.

How 3x ETFs Work

You need to understand how 3x ETFs operate before you invest. These funds use leverage to try to triple the daily movement of an index. For UPRO stock, the target is the s&p 500. The fund uses swaps and futures contracts with major banks. These contracts let UPRO amplify the daily returns of the index by three times, before fees and expenses.

Here is how the process works:

- The fund enters into agreements with banks to receive three times the daily return of the s&p 500.

- It uses futures contracts, such as S&P 500 E-mini futures, to boost exposure.

- The fund does not need to own all the stocks in the index. Instead, it uses these financial instruments to create leveraged shares.

3x ETFs like UPRO reset their leverage every day. This means the fund recalculates its exposure at the end of each trading day. If the s&p 500 rises by 1% in a day, UPRO aims to rise by 3%. If the index falls by 1%, UPRO aims to fall by 3%. This daily reset is important. Over longer periods, the results can differ from what you might expect due to compounding and volatility.

Triple-leveraged ETFs are not meant for long-term holding. They are built for short-term trading. The daily reset and the use of derivatives make them risky if you hold them for weeks or months. You can see large swings in value, especially during volatile markets. Leveraged shares like these can magnify both your gains and your losses.

Tip: Always remember that 3x ETFs are for short-term strategies. If you want to invest for the long term, standard ETFs may be a better choice. Leveraged shares require active monitoring and a clear understanding of how leverage works.

Triple-Leveraged ETFs: Risks and Rewards

Image Source: unsplash

Amplified Gains and Losses

When you invest in triple-leveraged etfs, you can see both large gains and large losses. These funds use leverage to try to triple the daily movement of an index, like the S&P 500. If the market goes up, your returns can be much higher than with regular funds. If the market drops, your losses can be much bigger too.

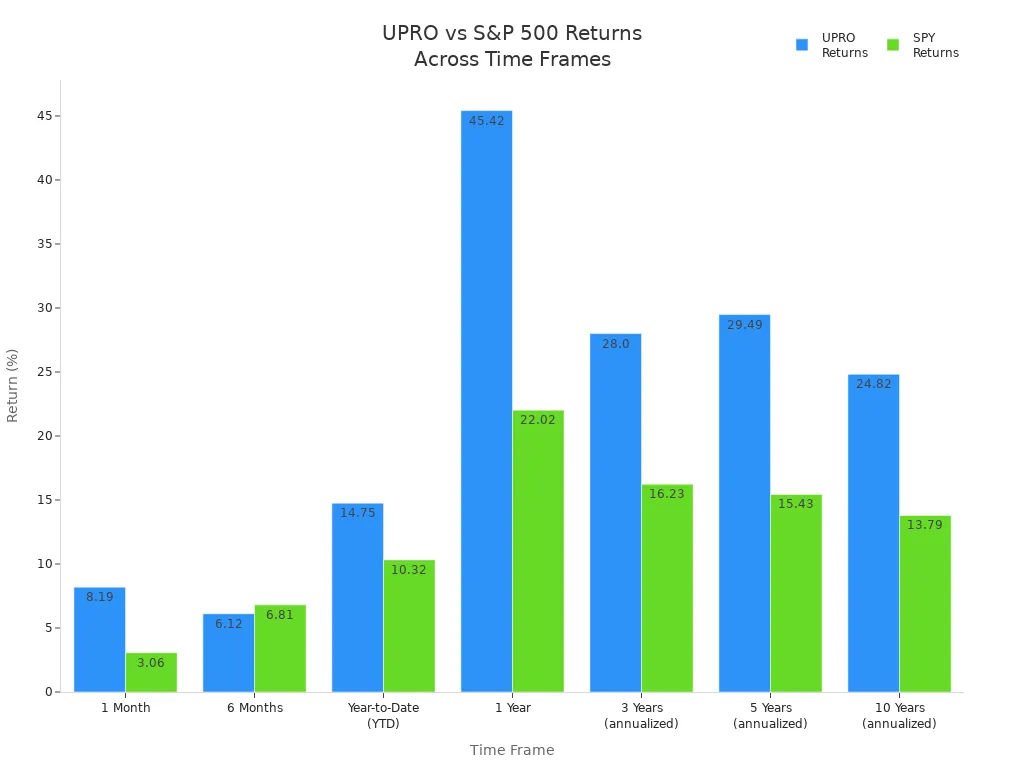

You can see this effect in the historical returns of UPRO, a popular 3x etf. The table below shows how UPRO performed over different time periods:

| Time Period | Approximate Total Return (%) |

|---|---|

| 3-Year | +290.17% |

| 5-Year | +315.05% |

| 10-Year | +1,312.89% |

These numbers show that leveraged shares can deliver huge gains during long bull markets. However, you must remember that these results come with high risk. In a sharp market drop, triple-leveraged etfs can lose most or all of their value very quickly. For example, if the S&P 500 falls by 10% in one day, a 3x etf like UPRO could drop by about 30%. In extreme cases, leveraged shares may even face trading halts or forced liquidation.

You can compare UPRO’s returns to the S&P 500 index, tracked by SPY, to see how much more volatile leveraged shares can be:

| Time Frame | UPRO Returns | SPY Returns |

|---|---|---|

| Year-to-Date (YTD) | 14.75% | 10.32% |

| 1 Month | 8.19% | 3.06% |

| 6 Months | 6.12% | 6.81% |

| 1 Year | 45.42% | 22.02% |

| 3 Years (annualized) | 28.00% | 16.23% |

| 5 Years (annualized) | 29.49% | 15.43% |

| 10 Years (annualized) | 24.82% | 13.79% |

You can see that UPRO often outperforms the S&P 500 in strong markets. However, the risk is much higher. Triple-leveraged etfs can magnify both your gains and your losses.

Volatility Decay and Beta Slippage

You need to understand two important ideas when you use 3x etfs: volatility decay and beta slippage. These effects can make your long-term results very different from what you expect.

Volatility decay happens because leveraged shares reset their leverage every day. If the market moves up and down a lot, the compounding of daily returns can eat away at your gains. For example, in 2020, the S&P 500 finished the year much higher than it started. However, UPRO only ended the year slightly above its starting point. It did not reach a new high until the next year. This shows how volatility decay can hurt your returns, even in a rising market. High fees and daily rebalancing costs also reduce your gains over time.

Beta slippage is another problem with triple-leveraged etfs. You can see how it works with a simple example:

1. The S&P 500 index starts at $100. A 3x etf also starts at $100.

2. On day one, the index rises by 10% to $110. The 3x etf rises by 30% to $130.

3. On day two, the index falls by 9.09% back to $100. The 3x etf falls by 27.27%, dropping to about $94.55.

4. Even though the index is back where it started, the leveraged shares have lost about 5.45%.

5. This loss comes from the compounding of daily returns, not just the market’s movement.

6. Management fees and borrowing costs make the loss even bigger over time.

Note: Volatility decay and beta slippage mean that 3x etfs often underperform what you might expect if you simply multiplied the index’s return by three. This is especially true in choppy or sideways markets.

You must watch out for the risk of near-total loss in extreme market drops. Triple-leveraged etfs can lose almost all their value in a short time if the market falls sharply. Leveraged shares are not for everyone. You need to understand the risks and monitor your investment closely.

Using UPRO Stock in Your Strategy

Image Source: pexels

Risk Management

You need a strong plan when you add leveraged shares like UPRO to your portfolio. Leveraged shares can triple both your gains and your losses, so you must control your risk at all times. Many investors use stop-loss orders or hedging strategies to protect their investments. You can use put options, short selling, or inverse ETFs to offset possible losses. Some investors use automated systems that monitor the market and adjust positions in real time. These systems can switch between different investment modes, such as Surge or Defense, to match current market conditions. You should set clear entry and exit points and decide how much you are willing to lose before you invest. Leveraged shares require you to follow strict rules and limits to keep your risk under control.

Tip: Always check the fees for leveraged shares. UPRO has an expense ratio of 0.91% per year, which reduces your returns over time. No sales or redemption fees apply, but the ongoing expense ratio matters.

Time Horizon

You should only hold leveraged shares like UPRO for short periods. UPRO is not built for long-term investing. It works best for traders who watch the market closely and can react quickly. The daily reset and high volatility mean that holding leveraged shares for weeks or months can lead to unexpected results. Traditional S&P 500 ETFs are better for long-term goals. Leveraged shares suit investors with high risk tolerance and a focus on short-term trades.

Rebalancing Tips

You must rebalance your portfolio often when you use leveraged shares. The value of UPRO can change quickly, so you need to adjust your holdings to keep your target allocation. Many investors use automated tools to help with this task. You can combine leveraged shares with safer assets like bonds or cash to reduce swings in your portfolio. Some investors use inverse ETFs to hedge their positions. There is no single best rebalancing schedule, but regular checks help you manage risk and keep your strategy on track. Diversification and frequent rebalancing can help you avoid large losses and improve your long-term results.

Is UPRO Stock Right for You?

Investor Suitability

You need to know if UPRO stock fits your investor profile. UPRO is a triple-leveraged ETF that aims to deliver three times the daily performance of the S&P 500. This means you face high risk and high reward. Many experts warn that UPRO is not for every investor. If you prefer steady growth and want to hold investments for a long time, UPRO may not suit you. The Motley Fool Stock Advisor team does not recommend UPRO for typical buy-and-hold investors. You should consider UPRO only if you have experience with leveraged products and can manage your positions actively.

Financial advisors and fund providers like Direxion say leveraged ETFs are for short-term trading. They are not meant for retirement portfolios or long-term asset allocation. Brokerages often require you to sign special disclaimers before you trade leveraged ETFs. You must read the fund prospectus and factsheets to understand the risks. If you have a high risk tolerance and can handle large swings in value, you may find UPRO suitable.

Tip: Define your risk tolerance before you invest. Automated tools can help you manage risk based on your profile.

Here are some points to consider:

- UPRO is best for investors who understand leverage and volatility.

- You should be comfortable with the chance of losing all or more than your initial investment.

- Leveraged ETFs like UPRO are not for conservative investors or those seeking stable returns.

Aligning with Goals

You should match your investment goals with the features of UPRO stock. If you want to make short-term tactical bets and can monitor your portfolio closely, UPRO may help you reach your goals. Financial advisors suggest limiting leveraged ETFs to a small part of your portfolio, usually between 5% and 20%. You can use UPRO for short-term strategies, not as a core holding.

| Aspect | Recommendation / Explanation |

|---|---|

| Portfolio Allocation | Limit leveraged ETFs to 5%-20% of your portfolio. |

| Investment Horizon | Use for short-term trades, not long-term investing. |

| Risk Management & Diversification | Combine with other assets and rebalance often. |

| Investor Suitability | More suitable for younger investors with higher risk tolerance. |

Some investors use strategies like the Hedgefundie approach. This method combines UPRO with 3x leveraged long-term treasury bonds (TMF) to balance risk and improve returns. Regular rebalancing is key. You should always have a clear plan and know how much you can afford to lose.

Note: Regulatory agencies like FINRA warn that leveraged ETFs are not appropriate for most retirement accounts. Always read the fund’s disclosures before you invest.

UPRO stock offers you the chance for aggressive growth, but it comes with high risk. The table below highlights key lessons from its history:

| Key Takeaway | Explanation |

|---|---|

| Leverage Impact on Returns | UPRO’s 3x leverage can boost short-term gains, but long-term results may suffer from volatility drag. |

| Risk of Large Market Drops | Sharp declines in the S&P 500 can quickly erase your investment in UPRO. |

| Portfolio Integration Strategy | Combining UPRO with bond ETFs can help manage risk. |

Before you invest, consider these important risks:

- Daily resets can cause losses in volatile markets.

- Recovering from large drawdowns is very difficult.

- Leveraged ETFs work best for short-term trading.

Stay informed by reading ETF prospectuses, using tools like FINRA’s Fund Analyzer, and consulting investment professionals. Always use strong risk management when you trade leveraged ETFs.

FAQ

What is the main risk of holding UPRO for a long time?

You face volatility decay and beta slippage. These effects can reduce your returns over time. UPRO resets daily, so holding it for weeks or months can lead to unexpected losses, even if the S&P 500 rises.

Can you lose more than your initial investment with UPRO?

You cannot lose more than you invest in UPRO. The ETF structure limits your loss to your original amount. However, you can lose almost all your money if the market drops sharply.

How much does it cost to own UPRO?

UPRO charges an annual expense ratio of 0.91%. You pay this fee automatically. You do not pay sales or redemption fees. For current USD exchange rates, check XE.com.

Is UPRO suitable for retirement accounts?

Most experts do not recommend UPRO for retirement accounts. The high risk and daily reset make it unsuitable for long-term goals. You should use standard ETFs for retirement investing.

How often should you rebalance your portfolio with UPRO?

You should check your portfolio at least once a week. Frequent rebalancing helps you manage risk and keep your target allocation. Automated tools can help you adjust your holdings quickly.

The analysis of UPRO stock proves that for aggressive growth, efficient trading tools and strict risk management are just as important. If you’re tired of high fees and complex fund transfers from frequent trading, or juggling multiple platforms for portfolio rebalancing, it’s time to simplify your investment process.

BiyaPay provides an all-in-one global financial solution, allowing you to easily trade US and Hong Kong stocks on a single platform without needing an overseas bank account. Our service supports seamless conversion between various fiat and digital currencies, with a low remittance fee of just 0.5%, ensuring your funds flow efficiently and securely to most countries and regions worldwide. Use our real-time exchange rate converter, and register now to experience smarter, lower-cost global investing.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.