- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

EFSH Stock Plummets in 2025 What Investors Should Watch Now

Image Source: pexels

EFSH stock experienced an almost total collapse in 2025, with its price dropping by 100% from $0.0710 to nearly zero. Investors now face urgent concerns as the company received a delisting notice and trading has been suspended. Financial instability, including overwhelming debt and a suspended dividend, adds to the uncertainty for shareholders.

Investors must closely watch regulatory actions and company updates to navigate this volatile situation.

Key Takeaways

- EFSH stock dropped nearly 100% in 2025 due to delisting and trading suspension, making it hard for investors to buy or sell shares.

- The company faces serious financial problems like high debt, equity deficit, and suspended dividends, increasing investment risks.

- Technical analysis shows strong sell signals and no signs of recovery, with very low trading volume and high price volatility.

- Investors should closely follow regulatory updates and company announcements, as these will impact the stock’s future and trading status.

- Only investors with high risk tolerance should consider EFSH stock now; monitoring news and setting clear risk limits is essential.

EFSH Stock Decline

Image Source: pexels

Delisting and Suspension

EFSH stock faced a significant decline in 2025, triggered by a delisting notice from NYSE American. The sequence of events unfolded rapidly:

- On April 3, 2025, NYSE American notified EFSH of the delisting notice due to the low stock price problem.

- Trading of EFSH stock was suspended immediately, eliminating liquidity for shareholders.

- The company requested a review of the delisting notice.

- On July 1, 2025, the listing qualifications panel upheld the delisting notice after the appeal process.

- On July 9, 2025, NYSE American filed Form 25 with the SEC, formally delisting EFSH stock.

- EFSH applied to quote its shares on the OTCQB Venture Market, but approval remains pending.

The suspension of trading led to a complete halt in daily trading volumes. Investors could not buy or sell shares, resulting in a lack of liquidity. Even if trading resumes on the OTCQB Venture Market, the lower regulatory standards and fewer market makers suggest that liquidity and volume will remain limited. Shareholders may find it difficult or impossible to sell their shares, which highlights the severe impact of the delisting notice and trading suspension.

Financial Red Flags

The financial health of EFSH stock deteriorated sharply during the decline. Several warning signs emerged:

- The company reported high levels of debt, which strained its balance sheet.

- EFSH faced an equity deficit, meaning liabilities exceeded assets.

- Management suspended dividends, removing a key incentive for investors.

- The delisting notice further damaged investor confidence, as it signaled regulatory concerns about the stock price problem.

A table below summarizes the main financial red flags:

| Financial Indicator | Status in 2025 | Impact on Investors |

|---|---|---|

| Debt Level | High | Increased risk |

| Equity Deficit | Present | Lower shareholder value |

| Dividend | Suspended | No income from holdings |

| Delisting Notice | Multiple issued | Regulatory uncertainty |

Technical Signals

Technical analysis of EFSH stock revealed several negative signals during the decline:

- The stock price dropped by more than 99%, indicating extreme volatility.

- Technical indicators showed the stock as oversold, with little buying interest.

- Daily trading volume fell to zero after the suspension, confirming the absence of market activity.

- Investor sentiment turned negative, with most market participants expecting further losses.

Analysts observed that the significant decline in EFSH stock price, combined with the delisting notice and lack of liquidity, created a high-risk environment. The technical signals suggest that recovery will be difficult without major changes in company strategy or market conditions.

Recent Events

Key Announcements

EFSH made several important announcements in 2025 that shaped investor sentiment and market direction. The company reported strong revenue growth and improved profitability early in the year. Management approved an exchange offer, allowing shareholders to swap common stock for newly issued Series G preferred shares. EFSH received a delisting notice from NYSE American and responded by requesting a review of the decision. The company also began transitioning to the OTCQB market after the delisting panel upheld the notice. Strategic moves included engaging Two Roads Advisors to facilitate the sale of Wolo Manufacturing Corp and exploring alternatives for CMD due to increased interest.

| Date | Announcement Type | Key Details |

|---|---|---|

| Q1 2025 | Financial Performance Update | Revenue grew 384% to $10.1M; Gross profit rose 478% to $5.2M; Net loss improved by $10.4M to $227K. |

| April 2, 2025 | Board Approval | Approved exchange offer: common stock for Series G preferred shares. |

| April 4, 2025 | Delisting Notice | Received NYSE American delisting notice; company expects to proceed with exchange offer. |

| April 7 & 16, 2025 | Delisting Review Request | Requested review of delisting determination; trading suspended. |

| July 8, 2025 | Market Listing Change | Initiated transition to OTCQB market after delisting decision. |

| January 16, 2025 | Strategic Sale Engagement | Engaged Two Roads Advisors for sale of Wolo Manufacturing Corp. |

| March 6, 2025 | Profit Projection Announcement | Projected first net income of $1.3M in 2025, increasing to $5.0M in 2026. |

| March 25, 2025 | Strategic Alternatives Exploration | Exploring strategic alternatives for CMD due to strong inbound interest. |

These announcements reflect EFSH’s efforts to address financial challenges and regulatory pressures. The company focused on improving profitability, restructuring equity, and seeking new market opportunities.

Market Reaction

Investors responded quickly to EFSH’s announcements. The initial financial performance update created optimism, as revenue and gross profit showed significant growth. The board’s approval of the exchange offer raised questions about shareholder value and future returns. The delisting notice and subsequent trading suspension caused panic among investors. Many shareholders lost confidence and tried to exit their positions, but the suspension made selling impossible.

Trading volumes dropped to zero after the suspension. The transition to the OTCQB market did not restore investor confidence. Most market participants viewed the move as a downgrade, expecting lower liquidity and higher risk. Strategic sale and profit projection announcements did little to reverse negative sentiment. Investors remained cautious, watching for further regulatory updates and company actions before making decisions.

The market reaction highlights the importance of transparency and timely communication. EFSH’s announcements influenced investor behavior, but regulatory uncertainty and trading limitations created a challenging environment for shareholders.

Technical Analysis

Image Source: unsplash

Price Trends

EFSH stock showed a persistent downward trend throughout 2025. Technical analysis revealed that every major indicator signaled a sell, with no signs of reversal. The 20-day, 50-day, 100-day, 150-day, and 200-day moving averages all pointed to a weak sell signal. The Trend Seeker® indicator also confirmed the strongest sell direction. This pattern remained consistent across short, medium, and long-term time frames.

The table below summarizes the main price trend signals for EFSH stock:

| Time Frame | Indicator | Signal | Strength | Direction |

|---|---|---|---|---|

| Composite | Trend Seeker® | Sell | Weak | Strongest |

| Short Term | 20 Day Moving Average | Sell | Weak | Strongest |

| Medium Term | 50 Day Moving Average | Sell | Weak | Strongest |

| Long Term | 200 Day Moving Average | Sell | Weak | Weakest |

Support and resistance levels further reinforced the bearish outlook. The last recorded price stood at $0.0707. Resistance levels appeared at $0.1049, $0.1392, and $0.1595, while support levels dropped as low as $0.0300. These levels suggest that any price forecast for EFSH stock remains negative, with little chance of a rebound in the near term.

Investors should note that the price target for EFSH stock continues to fall below key support levels. Most forecasts predict further declines unless the company announces a major turnaround.

Volume and Volatility

Trading volume for EFSH stock collapsed after the delisting notice and trading suspension. Before the halt, volume had already declined, reflecting weak investor interest. High volatility marked the final trading days, with sharp price swings and wide bid-ask spreads. This volatility made it difficult for investors to set a reliable price target or develop a stable price forecast.

Analysts observed that the lack of trading volume and extreme volatility signaled a high-risk environment. Most price forecasts for EFSH stock remain bearish. The technical analysis shows no signs of stabilization. Investors should approach any price target with caution and monitor for sudden changes in trading volume or volatility.

In summary, EFSH stock’s technical analysis points to a sustained downtrend. Price trends, trading volume, and volatility all support a negative price forecast. Investors should remain cautious and rely on updated analysis before making any decisions.

Investor Watch

Regulatory Updates

Investors should monitor regulatory developments closely, as these updates can influence the forecast for EFSH stock. The delisting process has followed a strict timeline:

- On April 3, 2025, NYSE American notified 1847 Holdings LLC of its decision to delist the company’s common shares and suspended trading.

- On April 9, 2025, 1847 Holdings requested an oral hearing before the NYSE American Listing Qualifications Panel to challenge the delisting.

- The hearing will be scheduled within about 45 days of the request, with deadlines for submitting briefs and supporting materials.

- The company can present arguments during the hearing to support its position.

- After the hearing, the Panel will issue a written decision, either upholding or overturning the delisting.

- The Panel’s decision takes effect immediately, but the company may request a further review within 15 calendar days.

- Trading of 1847 Holdings’ common shares remains suspended while the review is underway.

Investors should track each regulatory step. The outcome of the hearing and any further review will shape the forecast for EFSH stock. Regulatory actions can trigger sharp moves in price and may create a potential buying opportunity or force investors to sell at a loss.

Company Actions

EFSH management has taken several steps to address the crisis and influence the forecast. The company has focused on restructuring and strategic moves:

- Management approved an exchange offer, allowing shareholders to swap common stock for Series G preferred shares. This action aims to stabilize equity and improve the balance sheet.

- EFSH began the process to move its shares to the OTCQB Venture Market. This transition could restore limited trading, but the forecast remains uncertain due to lower liquidity and fewer market makers.

- The company engaged Two Roads Advisors to facilitate the sale of Wolo Manufacturing Corp. This sale could generate cash and reduce debt, which may improve the forecast for financial health.

- EFSH announced plans to explore strategic alternatives for CMD, responding to increased interest from potential buyers.

Investors should evaluate each company action and consider how it affects the forecast. Management decisions can create both risks and opportunities. A successful asset sale or new market listing could improve the outlook, while delays or failed transactions may force investors to sell.

Risks and Opportunities

EFSH stock presents high risk and a speculative profile. Investors must weigh the potential for loss against any possible reward. The forecast for EFSH remains negative due to the following factors:

- Delisting and trading suspension have eliminated liquidity. Investors cannot buy or sell shares easily, which increases risk.

- Financial instability, including high debt and an equity deficit, threatens the company’s survival. These issues weigh heavily on the forecast.

- Technical analysis shows persistent sell signals. The stock has not shown any signs of reversal, and most indicators suggest further declines.

- Regulatory uncertainty adds another layer of risk. The outcome of the hearing and any further review could force investors to sell or create a brief window to buy.

Despite these challenges, some investors may see a potential buying opportunity if the company succeeds in restructuring or selling assets. However, the forecast remains highly speculative. Investors should:

- Monitor regulatory updates and company announcements daily.

- Review technical indicators and sentiment before making any buy or sell decisions.

- Set clear risk limits and avoid investing more than they can afford to lose.

The current environment favors caution. EFSH stock carries significant risk, and the forecast suggests that only experienced investors with a high risk tolerance should consider any buy or sell action. Most should wait for clear signs of recovery before making a move.

EFSH Stock Risks

Delisting Impact

The delisting notice from NYSE American triggered immediate consequences for EFSH stock. The stock price dropped by 40.34% after the announcement. Investors experienced increased volatility, with daily swings averaging 43.56%. Shares moved to the OTC PINK Market, where liquidity decreased and trading volume fell. Wider bid-ask spreads made it harder for investors to buy or sell shares at favorable prices. Market perception shifted negatively, causing many to sell their holdings. Despite these challenges, the company’s core business operations remained stable. Management implemented a 1-for-25 reverse stock split to regain compliance, but this did not change proportional ownership. The CEO emphasized efforts to strengthen the balance sheet and improve cash flow. Preferred shares with a 15% annual cumulative dividend were introduced to attract investors and support shareholder value.

- Delisting reduces liquidity and makes trading difficult.

- OTC markets offer less transparency and higher transaction costs.

- Investors may find it challenging to sell shares and realize value.

- Voluntary delisting sometimes includes buyback offers at a premium, but involuntary delisting leaves shares illiquid.

Financial Health

EFSH stock faces ongoing financial risks. The company received a deficiency letter due to a sustained low stock price below $0.20 per share. Management restructured convertible notes to reduce dilution risk. The CEO expressed confidence in business growth and announced plans to repurchase shares. These actions aim to improve the price forecast and restore investor confidence. However, trading on OTC markets means lower liquidity and reduced market participation. Investors must monitor the balance sheet, cash flow, and dividend status before making buy or sell decisions. The price target remains uncertain due to financial instability.

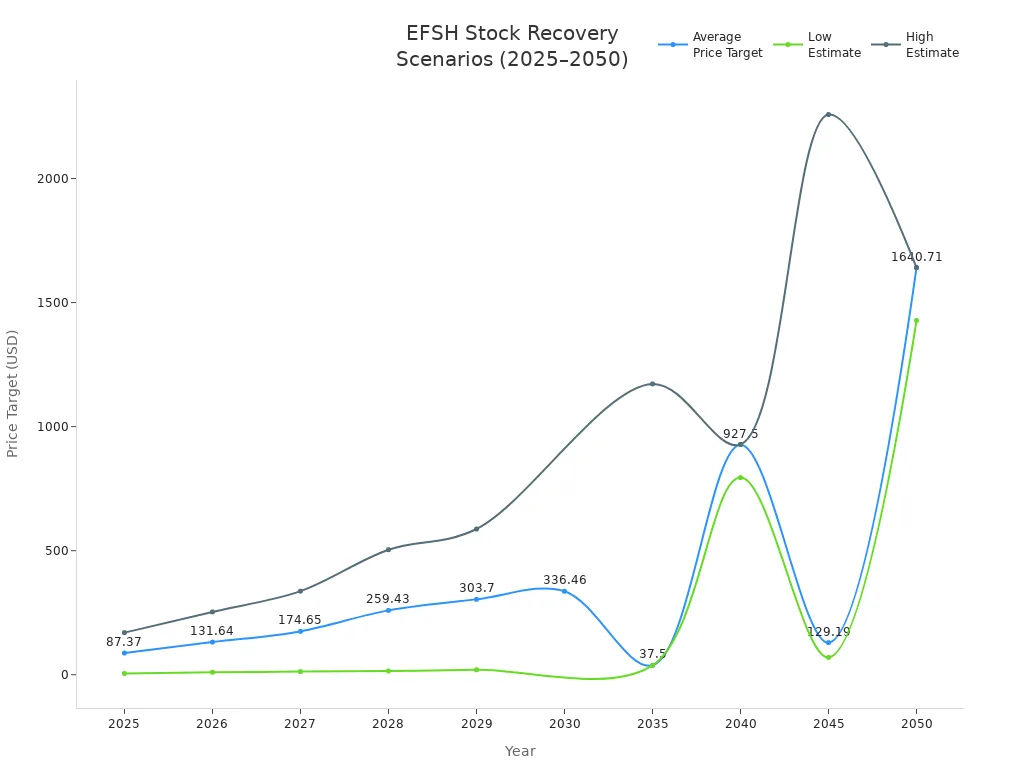

Recovery Scenarios

Market analysts have proposed several recovery scenarios for EFSH stock. Technical indicators show oversold conditions, suggesting a possible rebound. The price forecast varies widely, with strong sell signals dominating but some oscillators indicating potential for recovery. Historical examples show that companies like Netflix and NIO Inc. recovered from delisting by trading on OTC markets and implementing reverse stock splits. Mergers or acquisitions, such as Blockbuster’s merger with Dish Network, also offer possible paths to recovery.

| Year | Average Price Target | Low Estimate | High Estimate | Notes on Likelihood |

|---|---|---|---|---|

| 2025 | $87.37 | $5.06 | $169.69 | Oversold indicators suggest rebound potential. |

| 2026 | $131.64 | $10.05 | $253.22 | Upward forecast, wide range. |

| 2027 | $174.65 | $12.54 | $336.76 | Gradual increase, bullish outlook. |

| 2028 | $259.43 | $15.04 | $503.83 | Growing confidence in recovery. |

| 2029 | $303.70 | $20.03 | $587.36 | Sustained upward trend. |

| 2030 | $336.46 | N/A | N/A | Long-term bullish forecast. |

| 2035 | $37.50 | $37.49 | $1,172.11 | High uncertainty, speculative upside. |

| 2040 | $927.50 | $794.71 | $928.30 | Strong bullish forecast. |

| 2045 | $129.19 | $69.93 | $2,258.06 | Extremely wide range, speculative. |

| 2050 | $1,640.71 | $1,427.65 | $1,641.39 | High confidence in long-term recovery. |

Investors should review the price forecast and technical signals before deciding to buy or sell. Recovery remains speculative, and only those with high risk tolerance should consider entering or exiting positions.

EFSH stock collapsed due to trading suspension, delisting, and severe financial instability. Investors face major risks, including no active trading market, extreme dilution from warrants, and a $95.6 million equity deficit. Experts describe EFSH as highly speculative and warn of unpredictable price swings, conflicts of interest, and unreliable information. Investors should monitor regulatory and company updates, consult advisors, and prepare for possible total loss. Only those with high risk tolerance should consider any action, as EFSH remains a speculative and unstable investment.

FAQ

What does EFSH’s delisting mean for shareholders?

Shareholders cannot trade EFSH stock on NYSE American after delisting. The stock may move to the OTCQB market, but trading could remain limited. Investors should monitor company updates for any changes in trading status.

Can investors still sell EFSH stock after the trading suspension?

Trading suspension prevents investors from selling shares on the main exchange. If EFSH lists on the OTCQB market, limited trading may resume. Liquidity will likely remain low, making it hard to sell large positions.

What are the main risks of holding EFSH stock now?

EFSH stock faces high risks, including lack of liquidity, financial instability, and regulatory uncertainty. Investors may lose most or all of their investment. Only those with high risk tolerance should consider holding or buying shares.

How can investors stay informed about EFSH developments?

Investors should check official company press releases, regulatory filings, and financial news sources daily. Monitoring updates from the NYSE American and the OTCQB market helps track important changes affecting EFSH stock.

Is there any chance for EFSH stock to recover?

Recovery remains uncertain. EFSH must resolve financial issues and regain investor confidence. Success depends on asset sales, restructuring, and regulatory approval. Most analysts consider the stock highly speculative at this stage.

The collapse of EFSH stock is a stark reminder that liquidity and risk management are paramount in investing. When your investments are tied up due to a delisting or trading suspension, you urgently need a reliable and diversified platform to mitigate risks and explore new opportunities.

BiyaPay is that all-in-one global investment solution. We not only offer convenient trading for , but also support seamless conversion between various fiat and digital currencies, with remittance fees as low as 0.5%. This ensures your funds move efficiently and securely. There’s no need for a complicated overseas account—just a quick registration to start building a global portfolio. Use our real-time exchange rate converter, and register now to navigate market volatility with confidence, turning risk into new growth opportunities.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.