- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

U.S. Tax Rates: How Much Income Is Exempt from Filing Taxes in the U.S.? Understanding U.S. Individual Income Tax Rates

Image Source: pexels

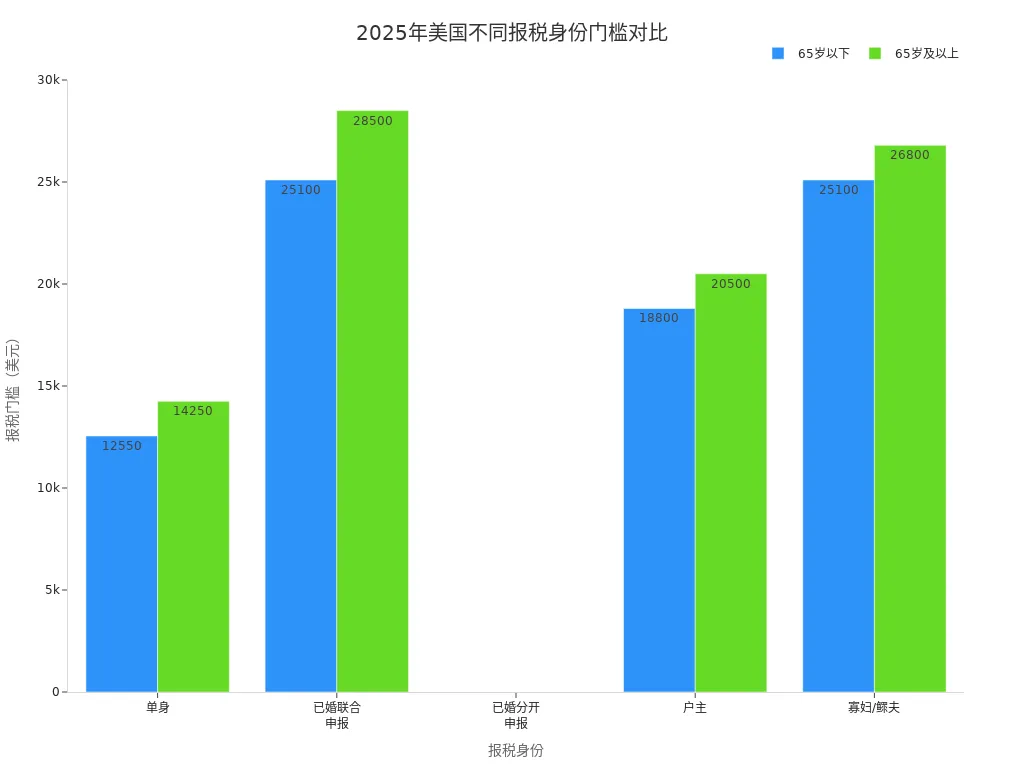

You can quickly determine whether you need to file U.S. individual income taxes based on the filing thresholds. According to the IRS announcement, the 2025 standard deduction is $15,000 for single filers and $30,000 for married couples filing jointly. The thresholds for different filing statuses are as follows:

| Filing Status | Filing Threshold Under 65 (USD) | Filing Threshold 65 and Older (USD) |

|---|---|---|

| Single | 12,550 | 14,250 |

| Married Filing Jointly | 25,100 | 28,500 (both 65 and older) |

| Married Filing Separately | 5 | 5 |

| Head of Household | 18,800 | 20,500 |

| Widow/Widower | 25,100 | 26,800 |

You need to note that if you are self-employed, you must file taxes if your annual income exceeds $400. Dependents and U.S. citizens living abroad also have special filing requirements.

Key Points

- In 2025, different filing statuses have different filing thresholds. Single and married filing jointly have higher thresholds, while married filing separately has an extremely low threshold. Choose the appropriate status based on your situation.

- Self-employed individuals must file taxes if their annual income exceeds $400. Other special statuses, such as dependents and U.S. citizens abroad, also have specific filing requirements.

- U.S. individual income tax uses a progressive tax rate system: the higher the income, the higher the applicable tax rate, with the highest rate at 37%. Different income brackets correspond to different tax rates.

- In addition to federal taxes, each state has its own tax policies. Some states have no individual income tax. When filing, you need to consider both federal and state tax requirements.

- You can use various tax credits to reduce your tax liability. The withholding mechanism helps avoid owing taxes, and those with income below the threshold may still file to claim a refund.

Filing Thresholds

Image Source: pexels

Filing Status Categories

When filing taxes in the U.S., you first need to determine your filing status. The IRS categorizes taxpayers into several types: single, married filing jointly, married filing separately, head of household, and widow/widower. Each status corresponds to a different filing threshold. If you are single, the threshold is typically lower. If you are married and choose to file jointly, the threshold is higher. The head of household status applies if you are solely supporting a child or other relative. The widow/widower status applies to taxpayers with dependent children after the death of a spouse. You need to choose the most suitable status based on your family and living situation, which directly affects whether you need to file taxes.

Tip: Choosing the correct filing status not only affects the filing threshold but may also impact the tax benefits you can claim.

2025 Standard Deduction

In 2025, the IRS has set new standard deductions for different filing statuses. When determining whether you need to file taxes, you should first understand these standard deductions. The standard deduction is an amount you can subtract from your income when calculating taxable income. In 2025, the standard deduction for single filers is $15,000, for married couples filing jointly it is $30,000, and for heads of household it is $22,000. If your annual income is below the corresponding standard deduction, you generally do not need to file taxes. However, if you are 65 or older, the standard deduction is higher. You can refer to the table below:

| Filing Status | 2025 Standard Deduction (USD) |

|---|---|

| Single | 15,000 |

| Married Filing Jointly | 30,000 |

| Head of Household | 22,000 |

You need to note that the threshold for married filing separately is extremely low, typically requiring you to file taxes if you have any income. You should pay special attention to this when choosing your filing status.

Self-Employment and Special Statuses

If you are self-employed, the filing threshold differs from that of regular employees. According to the official guidelines for the 2025 tax season, if your self-employment income reaches or exceeds $400, you must file a tax return. This threshold is much lower than the standard deductions for other filing statuses. U.S. individual income tax rates apply to all taxpayers who meet the filing threshold, including the self-employed.

If you are a dependent student or minor, the filing threshold will also vary. You need to calculate whether your income (such as wages, interest, or investment income) meets the filing requirements based on the income type. If you are a U.S. citizen living abroad long-term, you also need to pay attention to whether your foreign income meets the U.S. filing threshold. The U.S. taxes global income, so even if you are in China or another country, you still need to file if your income exceeds the threshold.

Reminder: If you have any special status or income sources, it is recommended to review the latest IRS regulations in advance to ensure compliant filing and avoid penalties due to unfamiliarity with policies.

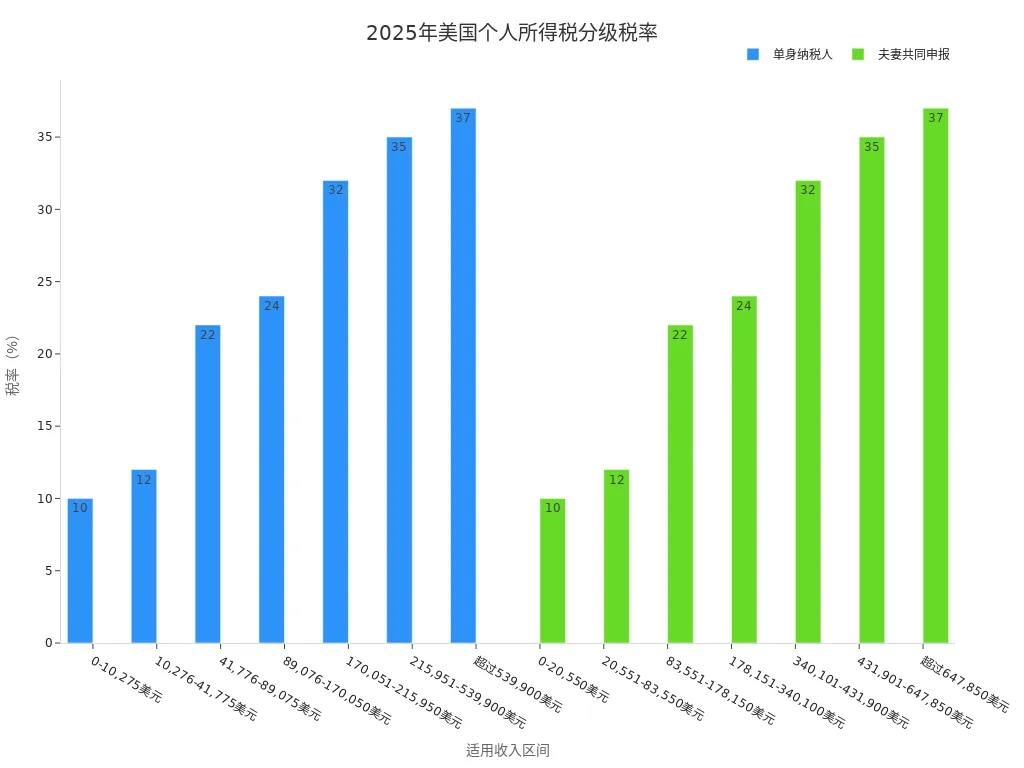

U.S. Individual Income Tax Rates

Image Source: pexels

Tax Rate Tiers

When filing taxes in the U.S., you must understand the tiered system of U.S. individual income tax rates. The U.S. uses a progressive tax rate system, meaning the higher your income, the higher the applicable tax rate. In 2025, U.S. individual income tax rates are divided into seven tiers. You can refer to the following list to understand the tax rates for different income brackets:

- 10% tax rate: applies to income from $0 to $11,000

- 12% tax rate: applies to income from $11,001 to $44,725

- 22% tax rate: applies to income from $44,726 to $95,375

- 24% tax rate: applies to income from $95,376 to $182,100

- 32% tax rate: applies to income from $182,101 to $231,250

- 35% tax rate: applies to income from $231,251 to $578,125

- 37% tax rate: applies to income exceeding $578,125

When calculating your tax liability, your income is taxed at different rates for each bracket. For example, if your income is $50,000, the first $11,000 is taxed at 10%, the next $33,725 at 12%, and the remaining $5,275 at 22%. The U.S. individual income tax rate structure has remained stable for years, with the main changes being adjustments to standard deductions and exemptions.

Tip: Before filing taxes each year, it is recommended to review the latest IRS tax rate tables to ensure accurate calculations.

Income Brackets

You need to determine the applicable tax rate bracket based on your annual income. U.S. individual income tax rates are closely tied to income brackets. Each tax rate tier has a clear income range. If your income is lower, you will be subject to a lower tax rate. Higher earners will fall into higher tax rate brackets. In 2025, personal exemptions have been eliminated, but some dependents can still claim deductions. The IRS adjusts standard deductions and tax rate brackets based on inflation. If your income exceeds $578,125, you will be subject to the highest tax rate of 37%.

When filing taxes, you need to combine all income sources (including wages, investment income, and foreign income) for calculation. U.S. individual income tax rates apply to global income, whether you work in China or are employed locally in the U.S., as long as you meet the threshold, you must file. If you have foreign accounts, such as bank deposits in Hong Kong, you must also accurately report related interest income.

Reminder: If your income sources are complex, it is recommended to use the IRS online calculation tools to accurately determine your tax rate bracket.

State Tax Overview

When filing taxes in the U.S., in addition to federal taxes, you need to consider state taxes. Federal taxes are uniformly levied by the federal government, with consistent tax rates and thresholds nationwide. State taxes are set by individual state governments, and policies vary widely. Some states, such as Florida and Texas, have no individual income tax. Other states use either a flat tax rate or a progressive tax rate, with varying rates and brackets. You can refer to the table below to understand the main differences between federal and state taxes:

| Item | Federal Tax | State Tax |

|---|---|---|

| Levying Authority | U.S. Federal Government | State Governments |

| Main Tax Types | Individual income tax, Social Security tax, corporate tax, estate tax, gift tax, etc. | Individual income tax, corporate tax, sales tax, property tax, estate tax, etc. (varies by state) |

| Taxable Entities | U.S. citizens, resident aliens (taxed on global income), non-resident aliens (taxed only on U.S.-source income) | State residents and businesses, some states have no individual income tax or tax only specific income |

| Tax Rate Structure | Progressive tax rate, 7 tiers, rates and thresholds adjusted by IRS based on inflation | Some states use flat rates, others use progressive rates, with significant variation in rates and brackets |

| Scope | Nationwide, covers global income | Local, primarily limited to state residents and businesses |

| Other Features | Uniform collection, transparent rate adjustments, highest individual income tax rate of 37% | Diverse state tax policies, some states have no individual income tax, sales and property taxes are common |

When filing taxes, you need to declare both federal and state taxes. U.S. individual income tax rates apply only to federal taxes, while state taxes must be calculated separately based on local policies. If you live or work in different states, you need to pay special attention to each state’s tax rates and deduction policies.

Note: If you work in China but are still a U.S. tax resident, you must declare global income, and some states may require you to file state taxes. It is recommended to consult a professional tax advisor in advance to avoid underreporting or errors.

Special Filing Circumstances

Tax Credits

When filing taxes in the U.S., you can use various tax credits to reduce your tax liability. Common credits include the Child Tax Credit, education credits, and earned income credits. If you qualify, you can apply for these credits directly on your tax return. Tax credits are typically more direct than deductions because they reduce your tax liability dollar-for-dollar. If your income is low, some credits may even result in a refund. The IRS updates credit programs and standards annually, so you should review the latest policies before filing.

Tip: If you are unsure whether you qualify for credits, you can use the IRS online tools for a preliminary assessment.

Withholding and Refunds

When you work in the U.S., your employer withholds taxes based on your wages and estimated tax rate. This withholding mechanism ensures that a portion of your taxes is paid each time you receive a paycheck. Self-employed individuals need to estimate their income and pay quarterly taxes. Withholding rates are typically high to avoid owing taxes at year-end. During annual filing, you can recalculate your tax liability based on actual income. If your income is below the filing threshold but taxes were withheld, you can still file a return to claim a refund of overpaid taxes. Approximately 31.4% of taxpayers have a taxable income of zero due to exemptions and deductions, meaning they owe no federal income tax, but they can still claim refunds for withheld taxes.

- Employees have taxes withheld by their employer, known as withholding tax.

- Self-employed individuals must proactively pay quarterly taxes, with deadlines on April 15, June 15, September 15, and January 17 of the following year.

- You can use the IRS Form 1040-ES or the Tax Withholding Estimator tool to more accurately estimate your quarterly tax payments.

Overseas and Temporary Residence

If you are a U.S. citizen or tax resident, even if you live long-term in China or other countries, you must declare global income. The definition of a U.S. tax resident is strict, including green card holders, non-immigrant visa holders with extended U.S. residency, or those meeting the substantial presence test. The substantial presence test requires you to be in the U.S. for 183 days in the past year, or a cumulative 183 days over three years. Even if you have no U.S.-source income, you must file if you meet the tax resident criteria. Many temporary residents in the U.S. mistakenly believe that paying taxes abroad exempts them from U.S. filing obligations. In fact, you can use taxes paid abroad to offset your U.S. tax liability, but the filing obligation remains. Failure to file as required may result in penalties and could affect immigration status or future citizenship applications.

Reminder: If you have a special status or complex income sources, it is recommended to consult a professional tax advisor in advance to ensure compliant filing.

When filing taxes, you should pay attention to the latest 2025 thresholds and tax rate tiers. Different filing statuses and income types affect your filing requirements. The table below shows the tax rate tiers for single and married filing jointly:

| Tax Rate | Single Income Bracket (USD) | Married Filing Jointly Income Bracket (USD) |

|---|---|---|

| 10% | 0 - 10,275 | 0 - 20,550 |

| 12% | 10,276 - 41,775 | 20,551 - 83,550 |

| 22% | 41,776 - 89,075 | 83,551 - 178,150 |

| 24% | 89,076 - 170,050 | 178,151 - 340,100 |

| 32% | 170,051 - 215,950 | 340,101 - 431,900 |

| 35% | 215,951 - 539,900 | 431,901 - 647,850 |

| 37% | Over 539,900 | Over 647,850 |

You should review the latest policies promptly and plan your tax filing appropriately to avoid penalties and legal risks due to underreporting or errors. State tax rates vary significantly, so it is recommended to prepare your documents in advance and verify filing details.

FAQ

Do you need to file U.S. taxes if you work in China?

If you are a U.S. citizen or tax resident, even if you work in China, you must declare global income. The U.S. taxes worldwide income. You should accurately report all income sources.

Do you need to file taxes if your income is below the filing threshold?

If your income is below the threshold, you generally do not need to file taxes. However, if taxes were withheld or you wish to claim a refund, it is recommended to file voluntarily.

Do you need to report interest income from a Hong Kong bank?

If you have interest income from a Hong Kong bank and are a U.S. tax resident, you must report this income. The U.S. requires reporting of all global income.

How do you determine your filing status?

You can determine your status based on your marital status, family members, and dependents. Common statuses include single, married filing jointly, married filing separately, head of household, and widow/widower.

What happens if you miss the tax filing deadline?

If you miss the deadline, you may face penalties. You should file as soon as possible and pay any taxes owed. The IRS calculates penalties based on the number of days overdue.

Navigating the complexities of U.S. taxes, especially when dealing with global income, can be daunting. From figuring out currency exchange rates for your overseas earnings to managing cumbersome international wire transfers with hefty fees, these challenges can complicate your tax compliance journey. Fortunately, there’s a simpler, more efficient way to handle it all.

BiyaPay is your trusted partner for seamless cross-border financial services, built to streamline your global asset management. Our platform provides real-time exchange rate queries for various fiat currencies, helping you accurately convert your foreign income for tax reporting. With a quick and easy registration, you can enjoy our ultra-low transaction fees, starting from just 0.5%, and benefit from same-day transfers to most countries and regions worldwide. BiyaPay ensures that your cross-border remittances are not only fast and affordable but also secure, allowing you to manage your global finances with confidence and ease. It’s the perfect solution for staying compliant with U.S. tax regulations while enjoying unparalleled financial convenience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.