- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Latest Wise Account Opening Tutorial: Step-by-Step Guide to Opening an Account and Transferring RMB

Image Source: unsplash

Do you want to transfer funds to China safely and conveniently? The Wise account opening tutorial provides a simple and efficient solution. You only need to register online and upload identification documents, without the need to visit a Hong Kong bank branch in person. The review is usually completed in 2-3 business days, much faster than traditional bank processes. Wise supports RMB transfers, with about half of the transfers arriving instantly and most completed within 24 hours, significantly faster than traditional methods. You can easily experience the safety and efficiency of international transfers.

Key Points

- Opening a Wise account is simple and fast, requiring only online registration and uploading identification documents, with the review generally completed in 2-3 business days, without needing to visit a bank in person.

- Personal and business accounts have different functions, and users can choose based on their needs; personal accounts support ID card verification, suitable for cross-border small-amount transfers and receipts.

- Wise supports RMB transfers to Chinese UnionPay cards, Alipay, and WeChat, with fast transfer speeds, approximately 60% arriving instantly and 80% completed within 24 hours.

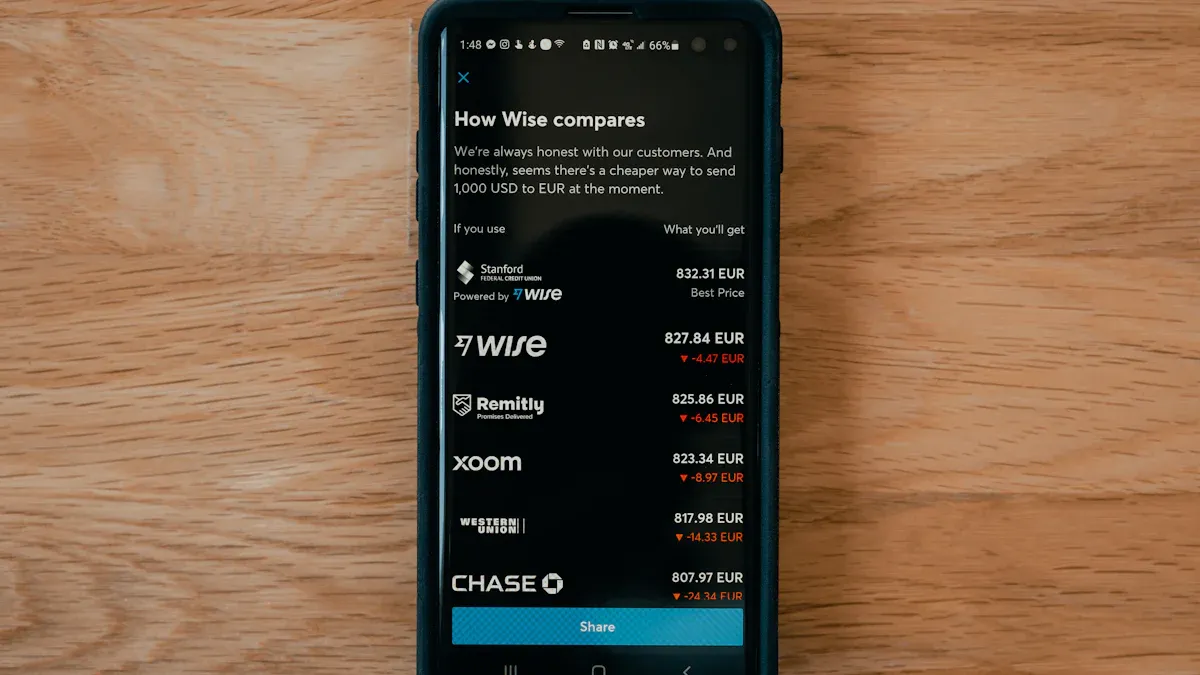

- Wise fees are low and transparent, typically between 0.5%-1%, with exchange rates close to the market mid-rate, saving significant costs compared to traditional bank fees.

- Wise accounts are secure, regulated by multiple countries’ financial authorities, and use multiple identity verification and security measures to ensure the safety of funds and information.

Wise Account Opening Tutorial

Image Source: unsplash

Registration Process

You can easily complete registration through the Wise website or app. The Wise account opening tutorial suggests following these steps:

- Log in to the Wise website or download the Wise app.

- Choose a registration method: You can register using your email, Facebook, Apple, or Google ID.

- Fill in personal information, including name (preferably in Pinyin, consistent with your passport), date of birth, phone number, and a valid Chinese address.

- Select the account type (personal or business account).

- Enter your phone number and complete SMS verification.

- Set a login password to ensure account security.

- Upload identification documents (such as a Chinese ID card or passport) and a selfie to complete identity verification.

- If you choose a business account, you also need to provide business information and upload relevant business documents.

The Wise account opening tutorial emphasizes that you must provide authentic information during registration, especially your name and address. This ensures smooth transfers and receipts later. Chinese users can directly use their ID card to verify a personal account, without needing a passport, making the registration process very convenient.

Account Type Selection

The Wise account opening tutorial details the differences between personal and business accounts. You can choose the appropriate account type based on your needs. The table below helps you quickly understand the functions and applicable scenarios of both:

| Dimension | Personal Account Functions and Scenarios | Business Account Functions and Scenarios |

|---|---|---|

| Functions | Multi-currency sending and receiving, local bank account support, linking personal bank cards for withdrawals, suitable for small transfers, cross-border consumption, freelance income collection | Multi-currency receiving accounts (global banking details), batch payment functions, international receipt invoice issuance, integration with accounting software (Xero, QuickBooks), API support |

| Target Users | Students, cross-border shoppers, individual investors, freelancers | Registered companies, foreign trade businesses, cross-border e-commerce sellers, team-based freelance businesses |

| Applicable Scenarios | Cross-border transfers to family and friends, bill payments, international travel, online shopping, freelancer payments | Cross-border e-commerce, foreign trade companies, team operations, employee salary payments, supplier settlements |

| Fees | Free account opening, currency conversion fees 0.35%-1% (priced in USD, exchange rate fluctuates in real-time) | Free account opening, some advanced features (batch payments, API calls) may incur charges |

| Account Positioning | Personal daily cross-border transfers and receipts | Enterprise-level cross-border receipts and financial management |

The Wise account opening tutorial reminds you that Chinese users cannot currently use RMB for direct deposits or top-ups. You can open a HKD or other currency account and use a Hong Kong bank’s HKD bank card to top up, saving on fees. It’s recommended to use an English name during registration to facilitate linking foreign accounts and performing transfers. Personal accounts support ID card verification, while business accounts do not currently support ID card verification.

Materials and Verification

The Wise account opening tutorial requires you to upload identity proof materials during the registration process. You need to prepare the following documents:

| Identity Proof Material Category | Specific Material Examples |

|---|---|

| Identification Documents | Passport, national ID card, driver’s license with photo |

| Address Proof | Utility bill, bank statement, tax document, other documents issued by government or financial institutions |

You only need to upload a Chinese ID card or driver’s license to complete personal account identity verification. In some cases, a passport may be required. Address proof is generally not mandatory, but if you register from outside China, it may be required. When uploading documents, it’s recommended to use the mobile web version and try multiple times to ensure clear photos. For business account openings, in addition to personal identification documents, you need to upload relevant business documents.

The Wise account opening tutorial notes that identity verification usually takes 2-3 business days. You need to upload document photos and a selfie via the Wise app or website and wait patiently for the review. If you encounter issues, you can contact customer service at any time.

Account Activation

The final step in the Wise account opening tutorial is account activation. Chinese users cannot currently deposit RMB directly. You can activate your account using the following methods:

- Use a Hong Kong bank account to transfer HKD to Wise’s Singapore virtual bank account.

- Wise supports lossless HKD deposits, and using a Hong Kong bank’s HKD bank card to top up can save on fees.

- If you hold an OCBC bank account, you can transfer funds to OCBC via Wise to complete activation. The fee is approximately 20 USD (settled at the real-time USD exchange rate), generally taking 4-5 days.

- If your Wise account already has funds, you can directly use the Wise Singapore account for fast transfers, which are quick and fee-free.

- OCBC account activation requires a deposit of 1,000 SGD within six months (converted to USD at the exchange rate).

The Wise account opening tutorial suggests using an English name during registration to facilitate linking foreign accounts and transfers. Personal account verification requires only an ID card, while business accounts do not currently support ID card verification. After activation, you can start using Wise for multi-currency receipts and transfers, enjoying efficient and convenient international financial services.

RMB Transfer Process

Image Source: unsplash

Adding a Recipient

When transferring RMB via Wise, you first need to add recipient information. Wise supports transfers to Chinese UnionPay cards, Alipay, and WeChat accounts. You need to provide the following details:

- Recipient’s name (preferably in Pinyin, consistent with the bank account)

- Recipient’s address (a valid Chinese address)

- Recipient’s bank account information (e.g., UnionPay card number)

- Alipay ID or WeChat ID (if choosing these receiving methods)

- Transfer reason (e.g., “transfer to family” or “salary payment”)

Wise will require you to confirm the transfer amount and recipient information. You can transfer funds to your own Chinese bank card or to family, friends, or business partners. Wise supports multi-currency conversion, allowing you to convert USD, HKD, EUR, or other major currencies to RMB for transfers. You only need to add the recipient in your Wise account, and the system will automatically save the information for quick future transfers.

Tip: Wise supports recipients mainly in Europe, Australia, and some Asian countries, including China. You can receive payments through your Wise account by sharing the corresponding currency’s bank account details with companies, clients, or friends for transfers.

Transfer Limits

Wise RMB transfers have clear limit regulations, which must comply with China’s foreign exchange policies. Different receiving methods have different limits, as follows:

| Recipient Type | Single Transaction Limit (USD) | Daily Limit (USD) | Monthly Limit | Annual Limit (USD) | Notes |

|---|---|---|---|---|---|

| UnionPay Recipient | Approx. 2,500 USD (based on real-time exchange rate) | Approx. 10,000 USD | Max 20 transactions per month | 50,000 USD | Max 5 transactions per day, limits are cumulative across all platforms |

| Alipay/WeChat Recipient | Approx. 7,000 USD (based on real-time exchange rate) | N/A | Max 5 transactions per month | Approx. 70,000 USD | Limits are cumulative across all platforms |

Wise supports RMB accounts for transfers via UnionPay cards and Alipay. Each transfer is capped at approximately 3,100 USD (approximately 31,000 RMB, based on real-time exchange rates). Each recipient has a daily limit of 10,000 USD and an annual limit of 50,000 USD. You must ensure the receiving account is under your name to avoid triggering foreign exchange regulatory scrutiny. China has strict foreign exchange controls, with an individual annual foreign exchange purchase limit of 50,000 USD, and Wise transfer limits align with this policy. For large fund repatriation, you can use Alipay international accounts or Hong Kong banks and other compliant channels.

Note: Wise is a legally compliant transfer company with cooperative agreements with China UnionPay and Alipay. When transferring, distribute amounts reasonably to avoid large single transfers.

Arrival Time

The arrival time for Wise RMB transfers is mainly affected by the currency type, amount, and payment method. You can refer to the following arrival time patterns:

- Approximately 60% of transfers can arrive instantly, with over 80% completed within 24 hours.

- Payments via credit or debit cards are usually faster than bank transfers but incur higher fees.

- If the bank supports instant transfers, bank transfers can also arrive quickly.

- Wise will inform you of the estimated arrival time when setting up the transfer, and you can track the transfer status in real-time via the Wise app or website.

- Although there is no specific timeline for RMB transfers, the overall arrival time follows the above patterns.

You can see the estimated arrival time when initiating a transfer. The Wise system automatically calculates the optimal route based on your payment method and recipient information, ensuring funds arrive quickly and safely at the Chinese recipient’s account.

Tip: Compared to traditional bank wire transfers (which typically take 2-3 business days), Wise transfers are faster and support real-time tracking.

Payment Methods

Wise RMB transfers support multiple payment methods. You can choose the appropriate method based on your account type and fund source:

| Account Type | Supported RMB Transfer Payment Methods | Notes |

|---|---|---|

| Personal Account | Wise account balance transfers, receiving methods include UnionPay bank cards, Alipay ID, WeChat ID (requires real-name authentication) | Does not support RMB transfers via bank transfers or credit/debit card deductions |

| Business Account | Wise account balance transfers, supports transferring RMB to Chinese local business recipient accounts (UnionPay) | Does not support transfers to Alipay or WeChat accounts |

Wise allows you to use USD, HKD, EUR, JPY, and other currencies as source currencies, converting them to RMB for transfers to China. You can only transfer RMB through your Wise account balance, and direct bank transfers or credit/debit card deductions are not supported for RMB transfers. You can first deposit funds into your Wise account and then perform conversion and transfer operations.

Wise RMB transfer fees and arrival speeds vary depending on the payment method. Payments via Wise balance, credit cards, and debit cards have the shortest processing times, with the fastest achieving instant arrivals. Wise’s fee structure is transparent, with fees varying based on the transfer currency and payment method, displayed before confirming the transaction, with no hidden fees. Compared to traditional bank transfers, Wise offers exchange rates closer to the market mid-rate, lower fees, and avoids SWIFT network intermediary bank fees, ensuring full-amount arrivals.

Suggestion: Before transferring, check real-time exchange rates and fees via the Wise website or app, choose the payment method wisely to save costs and improve arrival speed.

Fees and Security

Fee Explanation

When using Wise for RMB transfers, you can enjoy low and transparent fees. The fees for Wise RMB transfers are typically between 0.5% and 1%. For example, when transferring 1,000 GBP, the fee is 9.67 GBP, approximately 0.967%, within the 0.5%-1% standard. Compared to Hong Kong banks and other traditional banks, Wise’s cross-border transfer fees are lower. Traditional bank transfers via SWIFT typically charge fixed fees, with a 1,000 USD transfer incurring about 80 USD in bank fees, plus possible intermediary bank fees. Wise charges proportionally, with no hidden fees, making it suitable for small cross-border transfers.

| Transfer Amount | Wise Fee (USD) | Hong Kong Bank SWIFT Fee (USD) | Exchange Rate Advantage | Arrival Speed | Applicable Scenarios |

|---|---|---|---|---|---|

| 1,000 | Approx. 10 | Approx. 80 | Exchange rate close to mid-rate | Approx. 3 hours | Small personal or business transfers |

| 20,000 | Approx. 90 | Fixed high fees | Exchange rate advantage less significant | N/A | Traditional banks better for large transfers |

Wise supports multi-currency accounts, offering free opening of 10 currency sub-accounts, suitable for cross-border e-commerce, students, and overseas workers.

Exchange Rate Transparency

Wise provides real market exchange rates without hidden fees. When initiating a transfer, you can use the calculator on the Wise website or app to view real-time exchange rates, fees, and estimated arrival amounts. Wise uses the mid-market exchange rate, avoiding the 2%-3% rate markups common with traditional banks like Hong Kong banks. For example, for transfers from the US to China, Wise fees are approximately 1%, far lower than traditional banks’ rate markups. You can clearly see every fee, ensuring a transparent fund conversion process.

- Wise exchange rates are based on real-time market rates, with no hidden markups, and fees are calculated proportionally, typically less than 1%.

- Wise’s fee structure is transparent, with all fees and estimated arrival amounts displayed when initiating a transfer.

- Wise uses the mid-market exchange rate, avoiding high exchange rate spreads, ensuring better conversion results.

Account Security

Wise places high importance on your account and fund security. As a regulated electronic money institution, Wise is authorized by the UK Financial Conduct Authority (FCA), the US Financial Crimes Enforcement Network (FinCEN), the Australian Prudential Regulation Authority (APRA), and other regulatory bodies. The company keeps operational funds separate from client funds, ensuring your funds are not affected by company operations. Wise has a professional anti-fraud team monitoring every transaction around the clock to prevent fraudulent activities. During registration and use, you need to undergo strict identity verification, including identity and address proof, to prevent fake account creation. Wise also employs two-factor authentication, mobile verification, and fingerprint recognition to ensure your account and information security.

Suggestion: Before transferring, carefully verify recipient information, protect personal account details, change passwords regularly, and enable two-step verification to further enhance account security.

The Wise account opening tutorial helps you quickly open an account and easily complete RMB transfers. You can experience the practical applications of multi-currency accounts, including transfers, cross-border receipts, and PayPal withdrawals. Wise fees are lower than traditional service providers, using real-time exchange rates, saving an average of about 30.97 USD per RMB transfer. User reviews indicate that Wise is highly secure, user-friendly, and supports multiple payment methods with a simple interface. By following the steps, you can enjoy efficient and transparent international transfer services.

FAQ

What Chinese receiving methods does Wise support?

You can choose UnionPay cards, Alipay, or WeChat accounts as receiving methods. Wise will automatically display the required information fields based on your selection. All transfer amounts are settled in USD and converted to RMB at real-time exchange rates.

Tip: Ensure the receiving account is real-name authenticated and the information is accurate.

Can Chinese users open an account with an ID card?

You can directly use a Chinese ID card to register and verify a Wise personal account. Wise supports Chinese ID card uploads, with no need for a passport. The verification process typically takes 2-3 business days.

What are the limits for transfers to China?

Wise has single transaction and annual limits for transfers to China. For example, UnionPay cards have a single transaction limit of approximately 2,500 USD and an annual limit of 50,000 USD. All limits are in USD and adjusted based on real-time exchange rates.

| Receiving Method | Single Transaction Limit (USD) | Annual Limit (USD) |

|---|---|---|

| UnionPay Card | 2,500 | 50,000 |

| Alipay | 7,000 | 70,000 |

What are Wise transfer fees?

When transferring with Wise, fees are typically 0.5%-1%. For example, a 1,000 USD transfer incurs about 10 USD in fees. Wise displays all fees before the transaction, settled at real-time exchange rates, with no hidden fees.

Is a Wise account secure?

Wise is regulated by the UK FCA and other international financial institutions. You need to complete identity verification, and the system uses multiple security measures. Wise keeps client funds separate from company funds, ensuring your funds’ safety.

Following this Wise account setup guide, you’ve learned how to conduct safe and efficient cross-border transfers. While Wise offers a convenient channel, you might find that transferring funds between different platforms can still be restrictive, or that large transfers face additional scrutiny. Furthermore, if you want to use digital assets for cross-border payments or remittances, traditional financial services like Wise do not yet support this.

BiyaPay offers a more comprehensive cross-border financial solution. Our platform not only supports deposits and withdrawals of various fiat currencies like USD and HKD but also allows you to directly convert digital currencies into fiat and deposit them into your Hong Kong bank account. With a simple registration, you can benefit from our ultra-low transaction fees, starting from just 0.5%, and transfer funds quickly to most countries and regions worldwide, with transfers often completed on the same day. Whether you need to make a large transfer or bridge the gap between digital and fiat currencies, BiyaPay enables you to manage your global funds with ease and provides real-time exchange rate inquiries, giving you access to more flexible and efficient financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.