- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is ACH Payment? A Deep Dive into ACH Transfers and Payment Methods

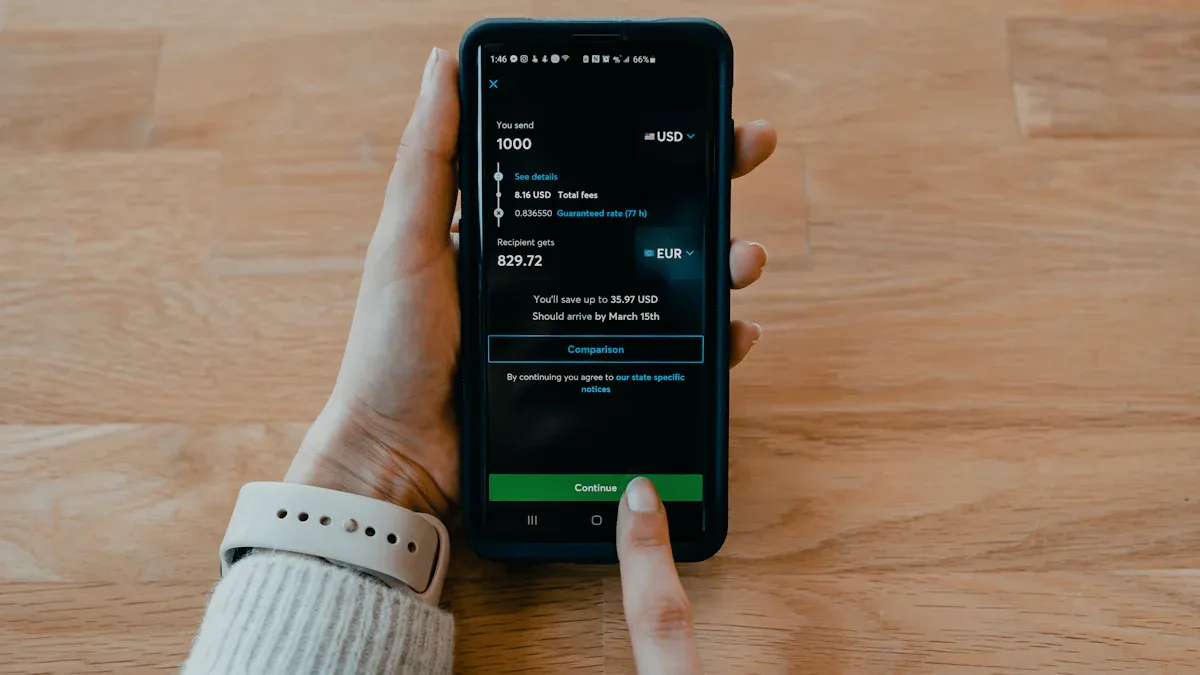

Image Source: unsplash

ACH payment refers to electronic fund transfers between U.S. banks through the Automated Clearing House (ACH) network. Nacha manages the entire network. Users commonly use it for payroll, bill payments, or business transactions. Bank accounts within the U.S. can securely and quickly complete transfers with low fees and convenient operations.

Key Points

- ACH payment is an electronic transfer method between U.S. banks via the Automated Clearing House, secure and low-cost, suitable for daily small-amount payments.

- Users submit transfer requests through online banking, with the system processing them in batches, typically arriving in 1 to 3 business days, though holidays may cause delays.

- Main uses include direct deposit for payroll, automatic bill payments for utilities, and bulk business payments, offering convenience and reducing manual errors.

- Compared to wire transfers, ACH has lower fees but slower processing; compared to credit cards, fees are lower and suitable for automated payments, but it does not support instant transactions.

- The ACH system only supports U.S. domestic account transfers, and users must protect account information to avoid security risks from leaks.

Introduction to ACH Payment

Definition and Mechanism

The full name of ACH payment is Automated Clearing House payment. Nacha manages the entire ACH system. This system is designed for electronic fund transfers between bank accounts within the U.S. Users initiate transfer requests through financial institutions, and the system groups all requests into a single batch.

The ACH system uses a batch processing mode, handling all transfer requests collectively at specific times on business days. After processing, the receiving bank deposits the funds into the designated account. The entire process requires no cash or physical checks, greatly improving the efficiency and security of fund transfers. Below is the basic mechanism of ACH electronic fund transfers:

- The National Automated Clearing House Association (Nacha) manages the ACH system, enabling automated clearing and electronic fund transfers.

- Users initiate transfer requests through banks or financial institutions, and the system groups the requests into batches.

- The ACH system processes all batch transfers on business days.

- After processing, the receiving bank handles the transfer, depositing funds into the target account.

- The system requires no cash or physical checks and is commonly used for bill payments, direct payroll deposits, and similar scenarios.

- Compared to wire transfers, ACH transfers are slower, typically taking a few business days, but they have lower fees, making them suitable for daily small-amount payments.

Main Uses

ACH payment is widely used in the U.S. Businesses commonly use it to issue employee salaries, while individuals use it to pay utility bills, phone bills, and other daily expenses. Many companies also use the ACH system for vendor settlements and bulk payments.

Many financial institutions support automatic debit functions, allowing users to set up recurring payments for mortgages, insurance premiums, and more. Businesses often choose ACH payment for large-scale payments to reduce costs and improve efficiency. Bank-to-bank fund transfers, government benefit distributions, and tax payments also heavily rely on the ACH system. Compared to traditional checks or cash payments, ACH payment is safer, simpler to operate, and has lower fees.

ACH Transfer Process

Image Source: unsplash

Operation Steps

When users conduct ACH transfers between U.S. bank accounts, they typically follow these steps:

- Log in to online banking or a mobile banking app.

- Select the “Transfer” or “Pay Bills” function.

- Enter the recipient’s bank account information.

- Fill in the transfer amount and any notes (if needed).

- Confirm all information is correct and submit the transfer request.

- The bank system sends the transfer request to the ACH network for batch processing.

The bank automatically groups the user’s request into the day’s ACH batch in the background, requiring no manual user action.

Required Information

To complete an ACH transfer, users need to prepare the following key information:

- Recipient’s name

- Recipient’s bank account number

- Recipient’s bank ABA routing number

- Transfer amount

- Payment purpose description (optional)

This information ensures funds are accurately and securely deposited into the target account. U.S. banks typically provide clear prompts for the required details on the transfer page.

Processing Time

ACH transfers use a batch processing mode, and processing speed is affected by business day schedules. Generally:

| Type | Estimated Arrival Time |

|---|---|

| Standard ACH Transfer | 1-3 business days |

| Expedited ACH Transfer | As fast as same-day arrival |

Banks process ACH batches multiple times on business days. If there are holidays or weekends, arrival times may be delayed. Users needing faster processing can opt for expedited services, though some banks may charge additional fees.

Types of ACH Payment

Direct Deposit

Direct deposit is one of the most common types of ACH payment. Businesses use the banking system to deposit salaries, bonuses, or benefits directly into employees’ bank accounts. Employees do not need to collect paper checks or visit the bank for deposits. Many U.S. companies use direct deposit for payroll, improving fund transfer efficiency. Government agencies also use this method to distribute social security benefits and tax refunds.

Direct deposit is suitable for scenarios requiring regular payments, such as salaries, pensions, and subsidies.

Automatic Debit

Automatic debit is another common ACH payment method. Users authorize businesses or service providers to periodically deduct fees from their bank accounts. Utility bills, phone bills, mortgages, and insurance premiums are typically paid via automatic debit. Users only need to set up authorization through the bank or service provider’s platform, and the system automatically deducts payments on the agreed date. Automatic debit helps users avoid missing payments, reducing the risk of late fees. Businesses can also better manage their collection processes.

Other Types

In addition to direct deposit and automatic debit, ACH payment includes bulk payments and recurring settlements. Businesses often use bulk payment functions for vendor settlements or large-scale fund transfers. Recurring settlements are suitable for long-term partnerships or institutions, with the system automatically completing fund settlements based on agreed cycles.

| Type | Typical Use Cases |

|---|---|

| Bulk Payments | Vendor settlements |

| Recurring Settlements | Long-term contracts, lease payments |

These types enable businesses and individuals to achieve efficient and secure fund management within the U.S. banking system.

Advantages and Disadvantages of ACH Payment

Advantages

ACH payment provides an efficient, low-cost solution for electronic transfers between U.S. bank accounts. Many businesses and individuals choose this method primarily because its fees are significantly lower than traditional wire transfers. According to data from financial industry associations, the processing fees for ACH transfers typically range from 3 to 10 dollars, and recipients usually incur no additional fees. In contrast, wire transfer fees typically range from 15 to 50 dollars, and some banks also charge recipients additional fees.

Using batch processing, the ACH system can handle large volumes of transfer requests, making it suitable for small-amount, bulk, and recurring payment scenarios. Businesses issuing payroll, paying vendors, and individuals paying utility or insurance bills can use ACH for automated operations, reducing manual errors and the use of paper checks.

Additionally, ACH payment has a high level of automation, simplifying the operation process. Businesses using ACH for payroll can save labor and time costs. Consumers using ACH to pay daily bills can avoid late fees due to missed payments. For small-amount payment tasks with low time-sensitivity, ACH’s settlement speed generally meets demands.

Disadvantages

Despite its many advantages, ACH payment has some limitations. First, ACH transfers are relatively slow. Standard ACH transfers typically take 1 to 3 business days to arrive, and holidays or weekends may extend this time. For urgent payments requiring instant arrival, ACH is not the best choice.

Second, the ACH system is primarily designed for transfers between U.S. domestic bank accounts. Cross-border payments cannot be completed via ACH, and users needing to send money to China or other countries must choose alternative methods. Additionally, some banks impose limits on ACH transfer amounts, which may affect large fund transfers.

In terms of security, while the ACH system is generally reliable, there is still a risk of unauthorized transactions if account information is leaked. Users should securely store their account and routing numbers to prevent information breaches.

In summary, ACH payment is suitable for daily small-amount, bulk, and automated payments but has limitations in processing speed, applicability, and amount restrictions. Users should choose the appropriate payment method based on their actual needs.

ACH Compared to Other Methods

Image Source: pexels

Comparison with Wire Transfers

Many U.S. users consider ACH payment and wire transfers for bank-to-bank transfers. The two differ significantly in fees, speed, and applicability.

Wire transfers are processed in real-time, with funds typically arriving on the same day. Banks charge higher fees, generally between 15 and 50 dollars (1 USD ≈ 7.2 RMB), and some banks also charge recipients additional fees. ACH payment uses batch processing, with arrival times of 1 to 3 business days and lower fees of about 3 to 10 dollars. The table below highlights the main differences:

| Item | ACH Payment | Wire Transfer |

|---|---|---|

| Processing Speed | 1-3 business days | Same-day arrival |

| Fees | 3-10 dollars | 15-50 dollars |

| Applicability | U.S. domestic bank accounts | Global bank accounts |

| Security | High | High |

Wire transfers are suitable for urgent, large-amount, and cross-border payments. For example, when sending money to banks in China or Hong Kong, wire transfers are preferred. ACH payment is better suited for daily small-amount and bulk transfers within the U.S.

Comparison with Credit Cards

Credit card payments and ACH payment are both common in the U.S. Credit card payments are fast, allowing users to complete transactions instantly. Banks and merchants typically charge 2% to 3% fees. For example, a 100-dollar bill payment incurs about 2 to 3 dollars in fees.

Credit cards are suitable for consumption, shopping, and online payments. Users can enjoy benefits like points and cashback but face high interest rates for late repayments. ACH payment is primarily used for bank-to-bank transfers with lower fees, ideal for automatic debits and direct deposits. Businesses issuing payroll or individuals paying utility bills often use the ACH system. The table below compares their features:

| Item | ACH Payment | Credit Card Payment |

|---|---|---|

| Processing Speed | 1-3 business days | Instant |

| Fees | 3-10 dollars | 2%-3% |

| Use Cases | Automatic debits, direct deposits | Consumption, shopping |

| Credit Impact | None | Yes |

Credit cards are suitable for scenarios requiring instant payments and credit benefits. ACH payment is better for automated, bulk, and low-cost bank account transfers.

ACH payment provides a secure, low-cost electronic transfer solution for U.S. users. Many businesses and individuals choose it for payroll and bill payments. Users should consider arrival times and applicability when choosing. By leveraging ACH payment appropriately, users can improve fund management efficiency.

FAQ

Can ACH transfers be used for cross-border remittances?

The ACH system only supports transfers between U.S. domestic bank accounts. Users needing to send money to banks in China or Hong Kong must choose wire transfers or other methods.

How much are the fees for using ACH payment?

Most banks charge 3 to 10 dollars in fees (1 USD ≈ 7.2 RMB). Some banks do not charge recipients additional fees. Fees are significantly lower than wire transfers.

Is ACH transfer secure?

Banks and Nacha jointly manage the ACH system. The system uses multiple encryption and authentication measures. Users must securely store account information to prevent leaks.

What are common reasons for ACH transfer failures?

Incorrect account information, insufficient balance, bank system maintenance, or closed recipient accounts can lead to ACH transfer failures.

What is the difference between ACH and credit card automatic debits?

ACH automatic debits deduct directly from bank accounts with low fees. Credit card automatic debits deduct from credit lines with higher fees, and late repayments incur interest.

By diving into ACH payment methods, you now understand it as an efficient, low-cost tool for domestic U.S. transfers. However, ACH transfers typically take 1-3 business days to settle and cannot be used for cross-border payments. If you need to send funds from the U.S. to China or make urgent large-sum transfers, these limitations become particularly apparent. With the need for global financial management, you need a comprehensive solution that can cross borders while balancing speed and cost.

BiyaPay offers a more comprehensive cross-border financial solution. Our platform not only supports deposits and withdrawals of various fiat currencies like USD and HKD but also allows you to directly convert digital currencies into fiat and deposit them into your Hong Kong bank account. With a simple registration, you can benefit from our ultra-low transaction fees, starting from just 0.5%, and transfer funds quickly to most countries and regions worldwide, with transfers often completed on the same day. Whether you need to make a large transfer or bridge the gap between digital and fiat currencies, BiyaPay enables you to manage your global funds with ease and provides real-time exchange rate inquiries, giving you access to more flexible and efficient financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.