- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Enjoy Convenient Remittance: How to Easily, Securely, and Cost-Effectively Send Money to Japan!

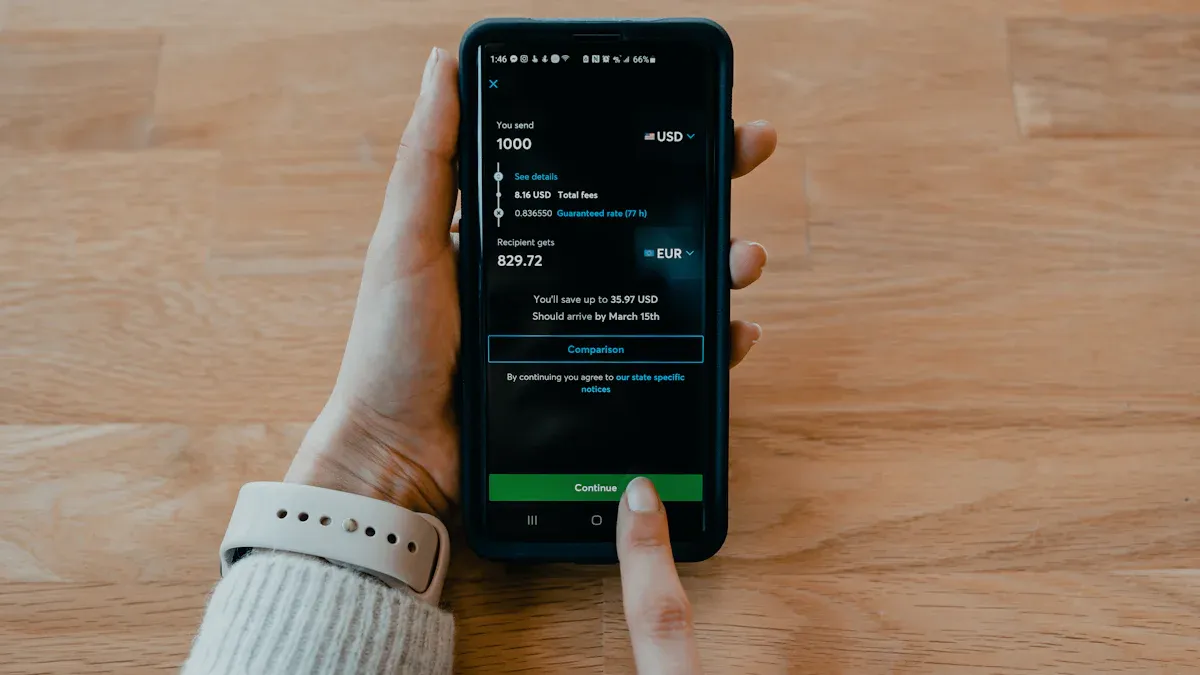

Image Source: unsplash

You can choose various methods to achieve convenient remittances to Japan. Many users prefer using Wise, Revolut, Xoom, Airwallex, TorFX, and Western Union.

Many people choose the following service providers for remittances:

- MoneyGram

- PayPal Holdings, Inc.

- Digital Wallet Corporation

- WorldRemit Ltd.

You need to focus on security, fees, processing speed, and operational processes. You can complete cross-border remittances easily and securely while saving money by choosing the right channel.

Key Points

- Choose a suitable remittance service provider, focusing on security, fees, and processing speed to ensure fund safety.

- Use third-party platforms like Wise and Revolut, which typically have low handling fees and fast processing, ideal for frequent small remittances.

- When conducting bank transfers, verify recipient information to ensure accuracy and avoid delays or fund losses.

- Understand the handling fees and hidden costs of different providers to choose the most cost-effective remittance method and save money.

- For large remittances, comply with regulatory requirements and prepare necessary documents to ensure smooth transactions.

Convenient Remittance Methods

Image Source: pexels

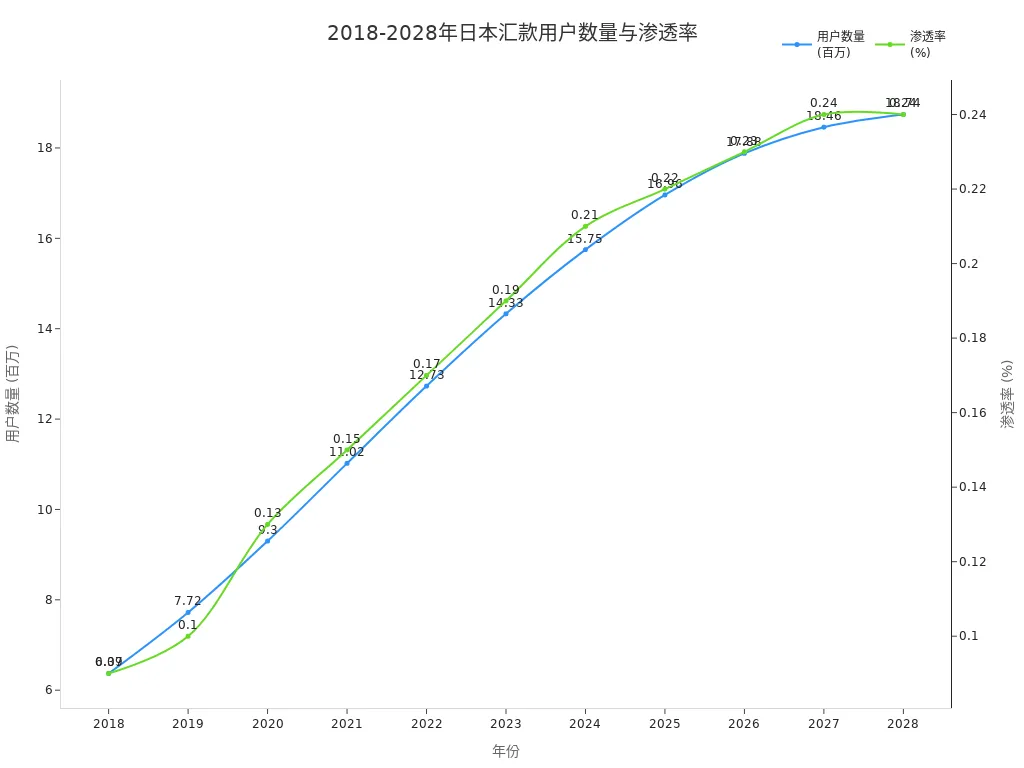

In recent years, more users have opted for convenient remittance methods to transfer funds from China/mainland China to Japan. You can choose the most suitable channel based on your needs. The table below shows the trend in the number of remittance users and penetration rate in Japan from 2018 to 2028:

| Year | Number of Users (Million) | Penetration Rate (%) |

|---|---|---|

| 2018 | 6.37 | 0.09 |

| 2019 | 7.72 | 0.10 |

| 2020 | 9.30 | 0.13 |

| 2021 | 11.02 | 0.15 |

| 2022 | 12.73 | 0.17 |

| 2023 | 14.33 | 0.19 |

| 2024 | 15.75 | 0.21 |

| 2025 | 16.96 | 0.22 |

| 2026 | 17.88 | 0.23 |

| 2027 | 18.46 | 0.24 |

| 2028 | 18.74 | 0.24 |

You can see that with the popularity of digital remittance services, the number of users and penetration rate continue to grow. Digital remittance services are particularly popular among urban users due to their ease of use, cost-effectiveness, and fast processing.

Bank Transfers

Bank transfers are a familiar traditional remittance method for many. You can transfer funds directly to a recipient’s bank account in Japan through a licensed bank in China/mainland China or Hong Kong.

You need to pay attention to the following steps:

- Verify recipient information. You must ensure the recipient’s full name, address, and bank account number are accurate to avoid errors or delays in fund delivery.

- Choose a reliable bank. You should prioritize compliant and reputable banks to ensure fund safety.

- Confirm whether the bank supports remittances to Japan. Some banks require pre-activation of international remittance functions.

- Fill out the remittance application. You need to provide recipient information, remittance amount (in USD), and purpose of the transfer.

- Keep transaction records. You should save the remittance receipt for future reference.

Bank transfers are suitable for large remittances or users with high fund security requirements. Processing time is generally 1-3 business days, with higher fees, typically between 15-50 USD.

Tip: When choosing bank transfers, it’s advisable to consult the bank in advance about remittance limits and procedures to avoid delays due to incomplete documents.

Third-Party Platforms

Third-party platforms like Wise, Revolut, Xoom, Airwallex, and TorFX offer more flexible and convenient remittance options. These platforms typically have lower fees and faster processing times.

You can follow these steps:

- Register and verify your account. You need to upload identification documents.

- Add recipient information. You must enter the recipient’s Japan bank account details.

- Select the remittance amount and currency. The platform will display real-time exchange rates and estimated processing times.

- Make the payment and submit the order. You can pay via bank transfer, credit card, or debit card.

- Track remittance progress. Platforms usually provide real-time status tracking.

Third-party platforms are ideal for frequent small remittances or users seeking cost-effectiveness. Processing times can be as fast as a few minutes, with fees generally between 2-10 USD. Some platforms also support locking exchange rates to help you save costs.

Traditional Remittance Companies

Traditional remittance companies like Western Union and MoneyGram have extensive offline networks and mature service systems. You can choose cash remittances or bank deposits.

The basic process is as follows:

- Visit a remittance company’s branch or use their official website.

- Provide the recipient’s name and Japan address.

- Choose the remittance method (cash pickup or bank deposit).

- Pay the remittance amount and fees (in USD).

- Obtain the remittance reference number and notify the recipient.

Traditional remittance companies are suitable for recipients without bank accounts or urgent cash pickup scenarios. Processing times range from a few minutes to 1 day, with fees typically between 10-30 USD.

Digital Wallets

Digital wallets like PayPal and Alipay international remittances offer a convenient mobile remittance experience. You can complete remittances anytime, anywhere via a mobile app or website.

The process is as follows:

- Log into your digital wallet account.

- Add the recipient’s email or phone number (some platforms require linking a Japan bank account).

- Enter the remittance amount and currency.

- Confirm the information and make the payment.

- The recipient can receive funds via the digital wallet or a linked bank account.

Digital wallets are ideal for daily small remittances and transactions between friends and family. Processing is fast, with low fees, and some platforms support instant transfers.

When choosing a convenient remittance method, you should consider the remittance amount, processing speed, and recipient needs. Regardless of the method, verify recipient information, keep transaction records, and ensure fund safety.

Fees and Security

Image Source: pexels

Fee Comparison

When choosing a convenient remittance method, you should pay attention to the handling fees and hidden costs of different providers. The table below shows typical transaction fees for remittances to Japan by major service providers:

| Sending Amount | Transaction Fees |

|---|---|

| $200 | $15 |

In addition to explicit fees, you should also be aware of hidden costs. The following factors affect your final remittance costs:

- Hidden costs, such as exchange rate differences, reduce the amount the recipient actually receives.

- Some remittance providers add a markup to the exchange rate, which is not easily noticeable.

- Banks typically apply higher exchange rate spreads, resulting in fewer yen received by the recipient.

- Professional remittance providers often offer better exchange rates, helping you maximize remittance value.

- Understanding these potential fees can help you avoid unexpected losses and ensure the recipient receives the expected amount.

Processing Speed

Processing speed is an important consideration when choosing a remittance method. The average processing times for different providers are as follows:

| Provider | Average Transfer Time |

|---|---|

| WorldRemit | 1-2 working days |

| Western Union | Up to 5 days (initial), same day for subsequent transfers |

| Inpay | Average 30 minutes |

You can see that some digital platforms, like Inpay, can complete remittances in as little as 30 minutes. Traditional remittance companies like Western Union may take up to 5 days for initial transfers but can process subsequent transfers on the same day. You should choose the appropriate processing speed based on the recipient’s needs.

Fund Security

Fund security is a key focus when conducting cross-border remittances. You can take the following measures to ensure fund safety:

- Choose reputable remittance providers to ensure secure fund transfers.

- Use encryption and anti-fraud systems to protect your personal information.

- Adopt multi-factor authentication (MFA) to ensure only authorized individuals can access funds.

- Verify recipient details before initiating a transfer to avoid delays or fund losses.

- Avoid sending money to unknown or unverified individuals to prevent fraud.

- Consider transfer fees and exchange rates comprehensively to ensure the provider is trustworthy and secure.

When choosing a convenient remittance service, prioritize fund safety and compliance to ensure every remittance arrives smoothly.

Providers and Processes

When choosing a convenient remittance method to Japan, you can select different providers based on your needs. Each platform’s process and required documents vary slightly. Below is a detailed explanation of the operation steps, document requirements, and processing methods for Wise, Xoom, Airwallex, and TorFX.

Wise Process

Wise is known for transparent exchange rates and low fees, ideal for cost-conscious users. You can follow these steps to complete a remittance:

- Register and log into your Wise account.

- Verify your identity by uploading identification documents (e.g., MyNumber card or residence card).

- Add recipient information, including full name, address, bank name, branch, account number, and SWIFT/BIC code.

- Enter the remittance amount and choose USD or JPY.

- Wise will display real-time exchange rates and estimated receipt amounts. You can compare with the mid-market rate to ensure fairness.

- Select a payment method (e.g., bank transfer, credit card) and complete the payment.

- After submitting the order, you can track remittance progress in real time on the platform.

Wise typically completes transfers within 1-2 business days. You can check order status anytime to ensure fund safety.

Xoom Process

Xoom, a PayPal-owned international remittance platform, is ideal for users needing fast processing. You can follow these steps:

- Log into your Xoom account or use your PayPal account to log in directly.

- Enter recipient details, including full name, bank name, branch, account number, and SWIFT/BIC code.

- Input the remittance amount and choose a payment method (e.g., bank transfer, debit card, or credit card).

- Xoom will display estimated processing times and all fees. You can know the recipient’s actual receipt amount in advance.

- Confirm the information and submit the remittance request.

- You can track the remittance status in real time on the Xoom platform.

Xoom supports bank deposits and some cash pickup services, with processing times as fast as a few minutes, ideal for urgent remittance needs.

Airwallex Process

Airwallex provides efficient cross-border payment solutions for businesses and individuals. You can follow these steps:

- Register an Airwallex account and complete identity verification.

- Add recipient information, including full name, bank name, branch, account number, SWIFT/BIC code, and recipient address.

- Enter the remittance amount and select the currency.

- Airwallex will display real-time exchange rates and all fees. You can compare rates across providers to choose the best option.

- Choose a payment method and complete the payment.

- After submitting the order, you can track remittance progress on the platform.

Airwallex has fast processing, ideal for users needing bulk or large remittances. The platform supports multi-currency account management, convenient for businesses handling global funds.

TorFX Process

TorFX offers personalized services and dedicated exchange rate advisors, suitable for large remittances or users needing rate locks. You can follow these steps:

- Register a TorFX account and submit identification documents.

- Contact a dedicated exchange rate advisor to get real-time rates and remittance advice.

- Provide recipient details, including full name, bank name, branch, account number, and SWIFT/BIC code.

- Confirm the remittance amount and rate, lock the rate, and make the payment.

- TorFX will assist in completing the remittance process and provide progress tracking.

TorFX is suitable for users sensitive to exchange rates or needing tailored services. Processing times are generally 1-2 business days.

Required Documents Overview

When using the above providers for convenient remittances, you typically need to prepare the following documents:

| Required Information | Description |

|---|---|

| Identification | MyNumber card/notification or number |

| Residence Card | Required for new services needing identity verification |

| Recipient Full Name | Enter as per the bank account |

| Bank Name | Recipient’s bank name |

| Branch | Recipient’s bank branch |

| Account Number | Recipient’s account number (or IBAN) |

| SWIFT/BIC Code | Bank’s SWIFT/BIC code or routing number |

| Cash Pickup Service Name | Enter as per the recipient’s ID |

| Country/City Information | Recipient’s country and city information |

Tip: When filling out documents, verify each item to avoid remittance failures or delays due to errors.

Notes

Before choosing a provider and processing a remittance, you should note the following:

- Verify the recipient’s full name, address, and bank account details to ensure consistency with bank records.

- Confirm the correctness of the Japan bank’s SWIFT/BIC code to avoid funds being sent to the wrong account.

- Choose reputable remittance providers to ensure compliance with international financial regulations and fund safety.

- Confirm whether your bank or platform supports remittances to Japan and ensure the account has activated international remittance functions.

- In Japan, recipients receiving remittances via Japan Post Bank need to bring identification and a passbook to the branch for processing.

When conducting convenient remittances, consult providers in advance about processing times, fees, and exchange rate policies to plan remittance timing and improve fund efficiency.

Information and Limits

Required Documents

When making convenient remittances to Japan, you need to prepare some basic information. Requirements vary slightly by channel. You typically need:

- Sender and recipient names

- Recipient bank name and branch information

- Recipient bank account number or IBAN

- SWIFT/BIC code

- Recipient address and country/city information

- Proof of fund source or purpose (for large remittances)

If you use third-party platforms or digital wallets, the platform will require you to upload identification. U.S. financial institutions require additional information from both sender and recipient for transactions exceeding $10,000. In Japan, recipients of large remittances may need to comply with local laws for declarations.

Remittance Limits

When choosing a remittance method, you should understand the limits and regulatory requirements of each channel. Japan’s remittance transactions must comply with anti-money laundering laws. Generally:

- Single remittances exceeding ¥1,000,000 (approx. $7,000 USD) require additional documents or approval.

- Remittance providers may require you to explain the transaction purpose or fund source.

- Third-party platforms and digital wallets have varying limits for single and daily remittances, subject to platform regulations.

Before remitting, consult the provider to ensure complete documentation and avoid delays due to limits or compliance issues.

Exchange Rates and Timing

Exchange rates directly affect how much yen your remitted funds can convert to. You can monitor exchange rate trends and choose the right timing for remittances. Many platforms display real-time rates to help you make decisions. You can:

- Compare rates across providers to choose the best option.

- Monitor USD-to-JPY fluctuations and remit during favorable rate periods.

- Use platforms that support locking exchange rates to reduce losses from rate changes.

Choosing the right remittance timing can save significant costs.

Cost-Saving Tips

You can reduce remittance fees and improve fund efficiency with these methods:

- Use platforms like Wise to transfer funds directly to local bank accounts, avoiding unfavorable rates.

- Avoid traditional bank international transfers due to high fees and complex processes.

- Understand fee structures and choose providers with low fees and competitive rates.

- Explore online transfer platforms or peer-to-peer payment apps, which are typically more cost-effective.

- For large remittances, negotiate fees with providers for potential discounts.

- Consider currency exchange specialists for better rates and fees.

By planning remittance amounts and timing wisely, you can effectively save costs during convenient remittances.

Large and Special Needs

Compliance Declarations

When making large remittances to Japan, you must comply with relevant regulations. Financial institutions require detailed documentation to ensure transaction compliance. The table below lists common declaration items and descriptions:

| Item | Description |

|---|---|

| Payment Purpose | Specify the purpose, such as tuition, business payments, or living expenses. |

| Sender-Recipient Relationship | Confirm the relationship, e.g., family, employer-employee, or business partner. |

| Identification | Provide valid ID, such as a passport or driver’s license. |

| Address Proof | Provide utility bills or bank statements as proof of address. |

| Occupation and Business | Provide occupation or business-related information. |

| Nationality and Residence | Provide nationality and residence information. |

| Bank Information | Provide detailed bank account information. |

| Fund Source | Provide proof of fund source, such as payslips or tax documents. |

| Additional Identity Documents | Required for amounts exceeding ¥2 million (approx. $14,000 USD). |

| Reporting Requirements | Transactions exceeding ¥30 million (approx. $210,000 USD) must be reported to the Minister of Finance. |

| Bank/Remittance Service Limits | Banks and remittance services may set per-transaction or daily limits. |

When preparing large remittances, gather all necessary documents in advance to ensure smooth transactions.

Business and Tuition

If you need to remit funds to Japan for business, tuition, or living expenses, you must prepare relevant documents based on the scenario. Common documents include:

- Valid identification, such as a passport or government-issued ID

- Proof of fund source, such as bank statements, payslips, tax documents, or sales contracts

- Proof of transfer purpose, such as business payment invoices, tuition receipts, or property contracts

You can choose different remittance methods. The table below compares the pros and cons of common channels:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Wire | Secure and widely available | High fees, long processing (3-5 business days) |

| Online Remittance Services | Low fees, fast delivery | Potentially unfavorable rates |

| Western Union/MoneyGram | Offers cash pickup, fast transfers (instant or same day) | Higher fees |

| Remitly | Fast and cost-effective, some transfers arrive in minutes | Potentially unfavorable rates |

| PayPal/Xoom | Convenient for PayPal users | High fees, less competitive rates than Wise or Remitly |

When choosing a channel, consider the fund purpose, processing speed, and fees.

Risk Prevention

When making large or special-purpose remittances, you must prioritize risk prevention. You can take these measures:

- Verify recipient information to ensure the name, bank account, and address are correct.

- Choose compliant and reputable providers, prioritizing licensed Hong Kong banks or internationally recognized platforms.

- Keep all transaction records and declaration documents for future reference and fund tracking.

- Avoid remitting to strangers or unverified accounts to prevent fraud.

- Monitor exchange rates and fee changes to plan remittance timing wisely.

Tip: Before remitting, consult financial institutions about the latest policies and limit requirements to ensure fund safety and compliance.

Convenient Remittance Notes

Common Pitfalls

When remitting to Japan, you may encounter easily overlooked issues. Understanding these pitfalls helps you avoid unnecessary losses:

- Many people make errors when filling out recipient information, such as inaccurate names, bank account numbers, or SWIFT/BIC codes, leading to remittance failures or delays.

- You may lack understanding of different providers’ fees and rates. Some platforms have low fees but poor exchange rates, reducing the actual received amount.

- Language barriers can cause misunderstandings, especially when filling out English forms or communicating with customer service.

- Different remittance services have unique processes and requirements. Unfamiliarity can lead to missing critical steps.

It’s recommended to carefully verify all recipient information, compare fees and rates across providers, and choose platforms with multilingual support to reduce communication barriers.

Anti-Fraud Tips

In recent years, fraud targeting cross-border remittances has evolved. You can protect your funds with these methods:

- Investigate the background of the recipient company or individual to confirm legitimacy before remitting.

- Check if the recipient is certified by Japan’s anti-fraud organizations or relevant agencies.

- Avoid cash payments or direct bank transfers to strangers. Prioritize secure methods like credit cards or Japan trust payments.

- If the recipient only accepts cash, use Japan trust payments to ensure fund security.

- Conduct a “pre-purchase check” before remitting to avoid fraud due to product quality issues.

- Use services with transaction tracking to monitor remittance status and ensure funds arrive safely.

| Service Type | Advantages | Disadvantages |

|---|---|---|

| Traditional Banks | High reliability, suitable for large transfers | High fees, slow processing |

| Professional Remittance Services | Low costs, fast processing | Possible limits, security needs verification |

When choosing a provider, prioritize legitimate platforms, verify all information, and consider fees and processing speed. This reduces risks and ensures fund safety.

When choosing a convenient remittance method, you can refer to the table below for the pros and cons of major channels:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Wise | Transparent fees, fast processing, multi-currency support | Possible intermediary bank fees |

| Rakuten Bank | High credibility, low fees, convenient services | Intermediary bank fees still apply |

| Japan Post Bank | Familiar system, convenient services | Higher fees, including exchange and intermediary fees |

| SBI Remit | No intermediary fees, fast processing | Self-set rates, possible additional fees |

| Curfex | Low fees, fast processing, transparent rates | Lower brand recognition |

You should choose licensed, legitimate providers, carefully compare fees and rates, and plan remittance timing wisely. Select the most suitable method based on your needs and fund purpose to avoid losses due to errors or pitfalls.

FAQ

What are the minimum and maximum amounts for remittances to Japan?

You can remit a minimum of 1 USD. Most providers set a maximum limit of 10,000 USD per transaction. Large remittances require additional documents and compliance declarations.

How long does it take for a remittance to Japan to arrive?

Using digital platforms, funds can arrive in as little as 30 minutes. Bank transfers typically take 1-3 business days. Traditional remittance companies generally complete transfers within 1 day.

What recipient information is required for remittances?

You need the recipient’s full name, bank name, branch, account number, SWIFT/BIC code, and address. Large remittances also require proof of fund source.

Can I use a licensed Hong Kong bank to remit to Japan?

You can process international remittances through a licensed Hong Kong bank. You need to activate the international remittance function in advance and prepare recipient details and identification.

How are remittance fees calculated?

Fees vary by provider. Digital platforms charge 2-10 USD, while bank transfers cost around 15-50 USD. Some providers also charge exchange rate spreads.

You have gained a complete understanding of the key considerations for sending money to Japan, mastering the procedures and risk management for everything from traditional bank transfers (secure but high-cost and slow) to third-party platforms like Wise and Xoom (low fee, fast). When dealing with cross-border payments for tuition, rent, or business procurement, you certainly don’t want to be hindered by the high fixed fees, non-transparent exchange rate markups, and the 1-3 business day waiting period typical of conventional channels.

You need a modern financial solution that can bypass traditional barriers, balance security and compliance, and deliver maximum efficiency at a low cost.

BiyaPay is your ideal choice for seamless fund transfers to Japan. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, helping you maximize cost savings. BiyaPay supports most countries and regions globally and offers same-day fund arrival, significantly surpassing the speed of traditional banks. Furthermore, you can use one platform for global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account. Register quickly with BiyaPay now, and leverage transparent fees and superior efficiency to ensure your funds reach Japan safely, compliantly, and swiftly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.