- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Capital One Bank Account Opening Guide: What Are the Requirements for Opening a Capital One Account?

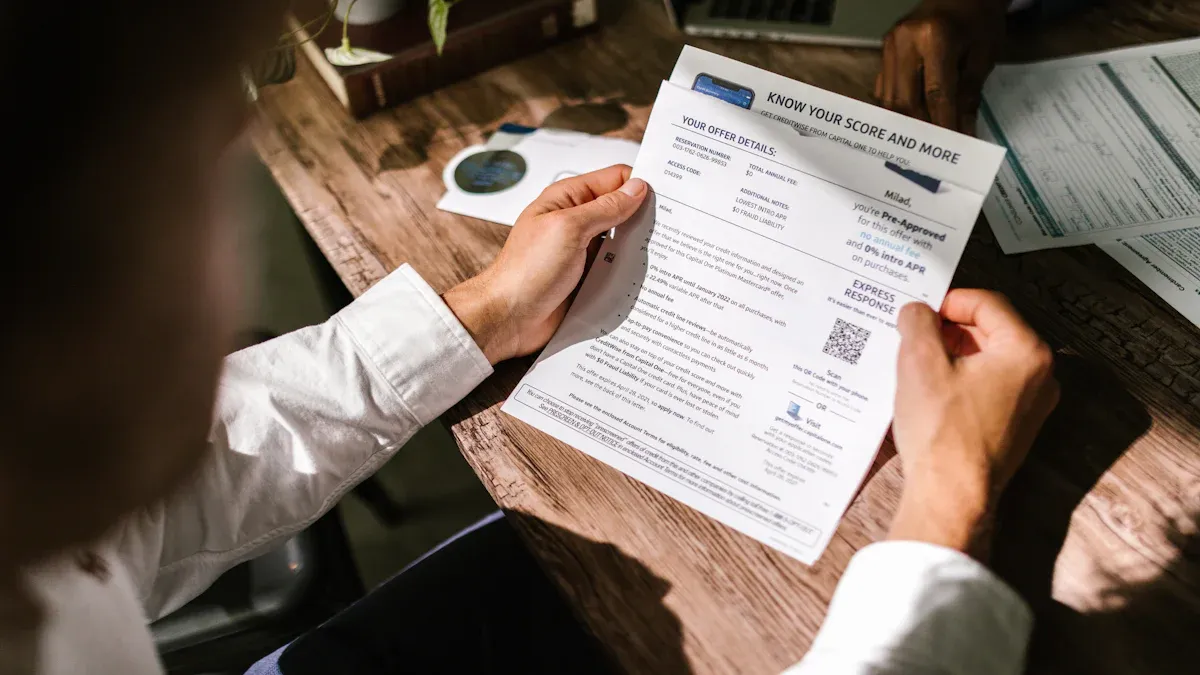

Image Source: pexels

To open an account with Capital One Bank, you need to meet several basic requirements. You must be at least 18 years old and have U.S. citizenship or legal permanent resident status. You need to provide a valid U.S. address and prepare a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). You must also have a U.S. phone number. You can assess whether you meet these requirements based on your status.

Key Points

- To open an account with Capital One Bank, you must be at least 18 years old, have U.S. citizenship or legal permanent resident status, and provide a valid U.S. address.

- You need to prepare proof of identity (e.g., passport, driver’s license), a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and a valid U.S. phone number.

- You can choose to open an account online or at a branch; online is convenient and fast but requires clear document uploads, while branch applications allow for in-person consultation and assistance.

- Ensure all submitted information and documents are authentic and valid; the address must be your actual residence, as false information may lead to account closure.

- Pay attention to the bank’s account opening promotions, as maintaining reasonable deposits and account usage can earn extra cash rewards, enhancing the value of opening an account.

Capital One Bank Account Opening Requirements

Image Source: pexels

Age and Status

When opening an account with Capital One Bank, you must be at least 18 years old. The bank requires you to be a U.S. citizen or legal permanent resident. If you are not yet 18, the bank will not approve your account application. U.S. law stipulates that only adults can independently manage bank accounts. You need to prepare identification documents, such as a U.S. passport, green card, or state-issued ID. The bank will assess your eligibility based on your status.

U.S. Address Requirement

You must provide a valid U.S. address. Capital One Bank does not accept post office boxes (PO Boxes) as registered addresses. The bank requires you to provide a residential or compliant commercial address. This is to comply with U.S. anti-money laundering and anti-terrorism financing regulations, ensuring your address information is authentic and reliable. The address you provide must match the zip code, city, and state information. The bank will verify your address by sending registered mail or courier. If you provide a false address, the bank may close your account or even blacklist you. Credit cards and other important documents can only be sent to a valid address to prevent interception.

Tip: When filling in your address, it’s recommended to use your permanent residential address. If you don’t have a U.S. address temporarily, you can consider using a friend or family member’s address, but ensure you can receive bank mail and couriers.

SSN and ITIN

You need to provide a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Capital One Bank uses these numbers to verify your identity and credit history. U.S. citizens and permanent residents typically have an SSN. If you are an international student or non-U.S. resident, you can apply for an ITIN. The bank requires you to provide the complete number, which will be cross-checked with government databases. Without an SSN or ITIN, you cannot complete the account opening process. You can learn about the specific steps for applying for an ITIN on the IRS website.

U.S. Phone Number

You must have a U.S. phone number. Capital One Bank uses the phone number to send verification codes to confirm your identity. The bank does not accept virtual phone numbers or VoIP service numbers. You need to provide a valid U.S. local phone number capable of receiving texts. The phone number is used not only for account opening but also for account security and transaction notifications. If you don’t have a U.S. phone number, you can get a local SIM card after arriving in the U.S. The bank will not accept Chinese or other international phone numbers.

Note: During the account opening process, ensure your phone number is active. The bank may periodically send security alerts or account change notifications to your phone.

Required Documents

Image Source: unsplash

Proof of Identity

When opening an account with Capital One Bank, you must prepare valid proof of identity documents. Common identity proofs include a passport, U.S. driver’s license, green card, or visa. If you are a U.S. citizen, you can use a U.S. passport or driver’s license directly. If you are a Chinese international student, a passport and valid visa can also serve as proof of identity. Bank staff will verify the original documents to ensure the information is authentic. Similar identity proof documents are required when opening an account with a Hong Kong bank.

Tip: The proof of identity you submit must be within its validity period, with clear photos and personal information.

Proof of Address

Capital One Bank requires you to provide proof of a U.S. local residential address. You can use utility bills, bank statements, lease agreements, or post office box rental agreements as proof. The bill or contract must display your name and complete address. The bank will use these documents to verify your residency. Similar local address proof is required when opening accounts with Chinese or Hong Kong banks.

- Common proof of address documents include:

- Utility bills

- Bank statements

- Lease agreements

- Post office box rental agreements

Personal Information

You also need to provide detailed personal information. The bank will require your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). These numbers are used to verify your identity and credit history. You also need to provide your date of birth, contact information, and occupation details. All information must be accurate and truthful. If you don’t have an SSN, you can apply for an ITIN in advance. During the account opening process, the bank will cross-check your personal information through its system to ensure security and compliance.

Note: The personal information you provide must match the details on your proof of identity and address documents; otherwise, the bank may reject your application.

Status and Account Opening Process

U.S. Citizens/Permanent Residents

If you are a U.S. citizen or legal permanent resident, the account opening process is relatively straightforward. You only need to prepare proof of identity, proof of address, and a Social Security Number. Capital One Bank supports both online and in-branch account opening. You can choose Capital One 360 online banking or visit a branch to apply. The specific steps for opening an account are as follows:

- Choose the appropriate account type, such as a savings or checking account.

- Prepare proof of identity (e.g., U.S. passport, driver’s license), proof of address (e.g., utility bill, lease agreement), Social Security Number, and proof of income (e.g., pay stub, tax document).

- Fill out the application form online, entering personal and income information.

- Submit the application and wait for the bank’s review. Results are typically available within a few business days.

- Once approved, the bank will mail your debit card. After receiving it, you need to activate it on the bank’s website or by phone.

Tip: When filling out information, ensure all documents are authentic and valid; otherwise, the bank may reject your application.

Non-U.S. Residents

If you are not a U.S. citizen or permanent resident, you can still attempt to open an account with Capital One Bank. You need to provide a passport, ITIN (Individual Taxpayer Identification Number), and U.S. local proof of address. The bank will require you to present the original passport and verify your ITIN. You also need to provide utility bills or lease agreements as proof of address. Some branches may require you to apply in person, as online applications have a lower approval rate.

- Required documents include:

- Passport

- ITIN

- U.S. proof of address (e.g., utility bill, lease agreement)

Note: If you don’t have an ITIN, you can apply for one through the IRS. Without an ITIN, the bank generally won’t approve your account application.

International Students

As a Chinese international student, you can use your passport and valid visa as proof of identity. You also need an ITIN and U.S. local proof of address. Some banks may require a student ID or I-20 form. You can apply at select Capital One branches. Online applications are more challenging for international students, so it’s recommended to prepare all documents in advance.

- Common required documents include:

- Passport and visa

- ITIN

- Student ID or I-20 form

- U.S. proof of address

Tip: When applying for an ITIN in China, you can learn about the process through the U.S. Embassy in China or Hong Kong banks. When opening an account in the U.S., all documents must be originals or officially certified.

Capital One Bank Account Opening Process

Online Account Opening

You can apply for an account directly on the Capital One Bank website or mobile app. You need to prepare proof of identity, a U.S. address, SSN or ITIN, and a U.S. phone number. After accessing the website, select the desired account type, such as a savings or checking account. The system will guide you to fill in personal information, including name, date of birth, contact details, and tax number. You also need to upload photos of your proof of identity and address. After submitting the application, the system will conduct a preliminary review. In most cases, you’ll receive initial results within minutes. If additional documents are needed, the bank will notify you via email or text.

Tip: Online account opening is convenient and fast, but ensure the uploaded document photos are clear and the information is accurate. If the system review fails, you can visit a branch to submit additional documents.

In-Branch Account Opening

You can also visit a Capital One Bank physical branch to open an account. You need to bring all original documents, including your passport, U.S. proof of address, SSN or ITIN, and U.S. phone number. At the branch, staff will assist you in filling out the application form and verify your documents on the spot. The advantage of in-branch applications is the ability to consult in person and resolve issues immediately. Some branches offer Chinese-language services, convenient for Chinese international students and new immigrants. When opening an account at a branch, you can usually receive account information on the spot, with the debit card mailed to your U.S. address within a few days.

- In-branch account opening process:

- Bring all documents to the branch.

- Fill out the account opening application form.

- Staff verify and enter your information.

- Wait for the review results and receive account information.

Review and Activation

After the bank receives your application, it will review your identity and documents. Upon approval, you will receive an account activation notice and debit card. You need to follow the instructions to activate the debit card. After activation, you can log in to online banking, set up your account password, and configure security questions. It’s recommended to enable two-factor authentication and account alerts immediately to enhance account security and prevent fraud. You can use Zelle for sending and receiving payments. When using Zelle, you can only link one phone number or email, with a weekly transfer limit of 500 USD (approximately 3600 CNY, calculated at 1 USD = 7.2 CNY). If the recipient hasn’t registered with Zelle, the payment can be canceled, and funds will be refunded after 14 days. Businesses and small enterprises can also use Zelle for quick payments, with funds typically arriving within minutes.

Note: After activating your account, regularly check your security settings and stay updated on the bank’s security alerts. This can effectively prevent account misuse.

Account Opening Precautions

Virtual Phone Numbers Not Accepted

When opening an account with Capital One Bank, you must use a valid U.S. phone number. The bank does not accept virtual phone numbers, such as Google Voice or VoIP service numbers. The bank uses text verification codes to confirm your identity, and virtual numbers cannot ensure information security. You need to get a U.S. local SIM card to ensure you can receive bank texts. When opening accounts with Chinese or Hong Kong banks, a valid phone number is also required. The bank will periodically send account security alerts to your phone to help you stay informed about account activities.

Tip: When getting a U.S. SIM card, you can choose operators like AT&T or T-Mobile. Monthly fees typically range from $30-$50 (approximately 216-360 CNY at 1 USD = 7.2 CNY).

Account Opening Bonuses

Capital One Bank frequently offers account opening promotions. After opening an account, meeting certain conditions can earn you cash rewards. For example, a recent savings account opening bonus is $200 (approximately 1440 CNY at 1 USD = 7.2 CNY), requiring a $10,000 deposit within 60 days of opening. You need to check the bank’s website or branch announcements for the latest promotions. When opening accounts with Chinese or Hong Kong banks, you can also compare different banks’ bonus policies to choose the most suitable account type.

| Bonus Type | Bonus Amount | Conditions |

|---|---|---|

| Savings Account Bonus | $200 | Deposit $10,000, received within 60 days |

| Checking Account Bonus | $250 | Set up direct deposit, received within 90 days |

Note: After receiving a bonus, the bank may require you to maintain a certain account balance. Review the promotion details in advance to avoid losing eligibility due to unmet conditions.

Common Issues

When opening an account with Capital One Bank, you may encounter the following issues:

- What if I don’t have a U.S. address? You can use a friend or family member’s U.S. address, but ensure you can receive bank mail.

- What if I don’t have an SSN? You can apply for an ITIN; refer to the IRS website for the detailed process.

- How long does it take to receive the debit card after opening an account? It’s typically mailed within 3-7 business days, subject to bank notification.

- Can I use a Chinese phone number? The bank only accepts U.S. local phone numbers, not Chinese numbers.

- Is there a minimum deposit requirement for opening an account? Most Capital One accounts have no minimum deposit requirement or monthly maintenance fees.

Suggestion: Before opening an account, prepare all documents in advance and carefully review the bank’s policies. If you encounter issues, consult branch staff or call the bank’s customer service. This can improve your success rate and avoid unnecessary hassle.

When opening an account with Capital One Bank, you need to be at least 18 years old and prepare proof of identity, a U.S. address, SSN or ITIN, and a U.S. phone number. You can choose to open an account online or at a branch. Preparing all documents in advance can make the process smoother. You should also stay informed about Capital One Bank’s latest policies and promotional activities. This way, you can better manage your account.

FAQ

Can I open an account without a U.S. address?

You can use a friend or family member’s U.S. address. Ensure you can receive bank mail. Hong Kong banks also require valid proof of address.

What if I don’t have an SSN?

You can apply for an ITIN. The IRS website provides detailed instructions. Hong Kong banks often use passports and proof of address for account opening.

How long does it take to receive the debit card after opening an account?

You will typically receive the debit card within 3 to 7 business days. The bank will mail it to your U.S. address. Check your mail promptly.

Does Capital One have a minimum deposit requirement?

There is no minimum deposit requirement for opening an account. Accounts also have no monthly maintenance fees. You can manage funds flexibly. Some Hong Kong bank accounts also have no minimum deposit threshold.

When you are preparing documents to open a Capital One account, the complex requirements for identity verification, address proof, and SSN/ITIN can be inconvenient, especially for non-U.S. residents. A bigger challenge is how to manage cross-border funds efficiently and securely after opening the account, such as transferring money from China to your U.S. account or vice versa. Traditional wire transfers are expensive, slow, and have opaque exchange rates, which severely impacts fund liquidity and your financial efficiency.

To solve these issues, we recommend a more efficient and cost-effective global financial service platform: BiyaPay. BiyaPay offers ultra-low transfer fees as low as 0.5% and supports same-day remittance and arrival, greatly simplifying your cross-border fund management. Whether you need to transfer funds from China to the U.S. or the other way around, BiyaPay provides a secure and transparent service. You can also use its real-time exchange rate lookup to complete transactions at the best possible rate. Register now to start your new global financial journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.