- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Convenient Remittance to Japan: From Recurring Transfers to Emergency Remittances, How to Operate More Efficiently!

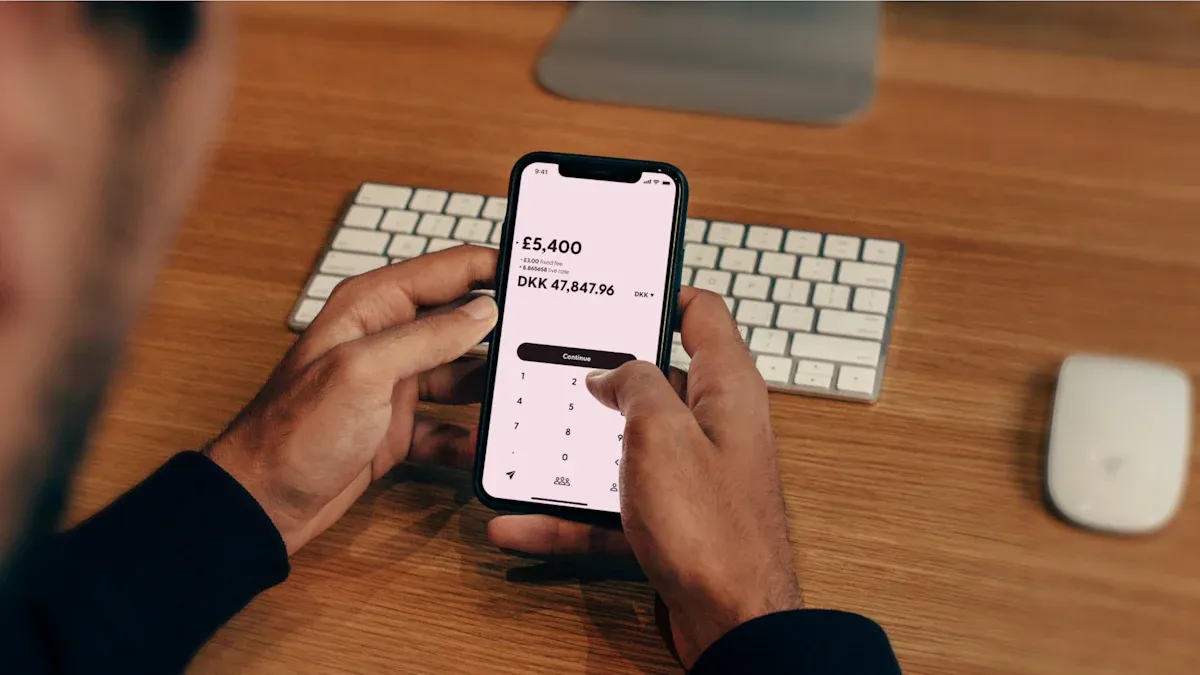

Image Source: pexels

When you choose efficient remittance to Japan, formal international remittance platforms or bank wire transfers can help you achieve efficient transfers. You are most concerned about speed, security, and fees. Digital remittance apps are considered the safest method, while hidden fees are a common pain point for users. You can set up automatic operations for regular transfers, while urgent transfers require prioritizing speed. In different scenarios, you need to balance transfer time and fees to choose the most suitable remittance solution.

Key Points

- When choosing a remittance method, consider transfer speed, fees, and security to ensure you select the most suitable solution.

- Using international third-party platforms like Wise and Remitly typically offers lower fees and faster transfer speeds.

- Setting up regular automatic transfers can simplify the remittance process, avoid missing payment deadlines, and save time and effort.

- In urgent situations, prioritize wire transfers or digital transfer platforms to ensure funds arrive quickly.

- Ensure you choose a legitimate platform, complete identity verification, protect personal information, and avoid remittance fraud risks.

Methods for Efficient Remittance to Japan

Image Source: unsplash

When choosing efficient remittance to Japan, you can flexibly select different remittance methods based on your needs and the recipient’s situation. Common methods include bank wire transfers, international third-party platforms, ACH transfers, and Alipay/WeChat international remittances. Below, we detail the process, fees, transfer speed, and applicable scenarios for each method to help you efficiently complete cross-border transfers.

Bank Wire Transfers

Bank wire transfers are a traditional method many users choose for efficient remittance to Japan. You can initiate a wire transfer through a licensed Hong Kong bank’s counter, online banking, or mobile banking. Bank wire transfers typically use the IBAN or SWIFT system, suitable for large transfers and formal business purposes.

The main features of bank wire transfers are as follows:

- Transfer Speed: Generally 1-3 business days, with some banks offering same-day transfers.

- Fees: Typically $10-$50 per transaction, with some banks charging intermediary bank fees.

- Exchange Rate: Banks usually offer rates lower than the mid-market rate, which may affect the actual amount received.

- Applicable Scenarios: Suitable for formal purposes like tuition, rent, or salaries, supporting mainstream Japanese bank accounts.

Tip: When choosing bank wire transfers, it’s advisable to consult the bank in advance about fee and exchange rate details to avoid reduced amounts due to hidden fees.

| Provider | Fee Range | Exchange Rate Type |

|---|---|---|

| Traditional Banks | $10 to $50 | Usually lower |

| Online Remittance Platforms | 1% to 3% + fixed fees | Mid-market rate |

International Third-Party Platforms

International third-party platforms provide more options for efficient remittance to Japan. You can use platforms like Wise, Western Union, OFX, Remitly for operations. These platforms typically support web and mobile apps, offering simple processes, transparent fees, and exchange rates.

- Transfer Speed: Fastest transfers arrive in minutes, typically completed within 1-2 business days.

- Fees: Wise charges about 0.6% (e.g., $18 for a $3,000 transfer), Western Union starts at $2, and Remitly is suitable for small transfers.

- Exchange Rate: Most platforms use mid-market rates with transparent fees, resulting in higher amounts received.

- Applicable Scenarios: Suitable for personal remittances, family support, tuition, and living expenses.

| Remittance Service | Fees | Speed | Applicable Scenarios |

|---|---|---|---|

| Wise | ~0.6% ($18 for $3,000 transfer) | 1–2 business days | Low-cost interbank transfers |

| Western Union | Starting at $2 | Minutes | Cash pickup |

| OFX | Low | 1-2 days | Large transfers |

| Remitly | Low | 2-10 minutes | Small transfers |

| Revolut | Low | 1-2 days | Multi-currency accounts |

When choosing third-party platforms, prioritize those with transparent fees and exchange rates. Services like Wise are known for mid-market rates, ideal for cost-conscious users.

ACH Transfers

ACH transfers are primarily used for electronic transfers between U.S. banks, but some international platforms also support ACH channels for remittances to Japan. You can initiate ACH transfers through licensed Hong Kong banks or international platforms, suitable for regular small transfers.

- Transfer Speed: Typically 2-4 business days, with some platforms offering faster processing.

- Fees: Often low or even free on some platforms.

- Exchange Rate: Some platforms do not directly display rates, so check the actual amount received.

- Applicable Scenarios: Suitable for regular salaries, family living expenses, and other small, frequent transfers.

| Transfer Method | Fees | Exchange Rate | Transfer Time |

|---|---|---|---|

| ACH | Usually no direct fees | N/A | 2-4 business days |

ACH transfers are suitable if you have a U.S. account or need regular automatic transfers, but the slower speed requires advance planning.

Alipay/WeChat International Remittance

Alipay and WeChat international remittances offer a convenient mobile experience. You can bind a mainland China bank card or international credit card to complete remittances to Japan directly in the mobile app.

- Transfer Speed: Typically 3-5 business days, with some cases faster.

- Fees: Alipay charges $15 or 3% through East West Bank, with WeChat international remittance fees similar.

- Exchange Rate: Uses marked-up rates, slightly below mid-market rates.

- Applicable Scenarios: Suitable for small living expenses or transfers to friends and family, with some platforms supporting tuition payments.

| Feature | WeChat / Alipay | Bank Transfer | Panda Remit |

|---|---|---|---|

| Transfer Speed | Hours to days | 1-3 business days | 2-10 minutes |

| Exchange Rate | Moderate | Less competitive | Near mid-market |

| Fees | Sometimes hidden | High | Low, transparent |

| Tuition Support | Limited | Yes | Full support |

| App Operation | Yes | No | Yes |

When using Alipay or WeChat for international remittances, you need to complete identity verification, bank card binding, and security settings. Each transaction is limited to $900 (about 6,500 RMB). For higher limits, bind a mainland China bank account.

Alipay/WeChat International Remittance Process

- Download and register a WeChat or Alipay account.

- Complete identity verification and bind a bank card or international credit card.

- Access the “remittance” function, enter recipient details and amount.

- Confirm exchange rate and fees, then submit the transfer request.

Note: Alipay and WeChat international remittances are suitable for daily small, convenient transfers to Japan, but for large or urgent transfers, prioritize bank wire transfers or third-party platforms.

Regular Transfer Operations

Image Source: unsplash

Automatic Transfer Setup

You can easily set up regular remittances to Japanese accounts through online banking or remittance company automatic transfer functions. Most trusted remittance services allow you to select fixed intervals like weekly, biweekly, or monthly for automatic fund transfers. Automatic transfers are ideal for international students paying tuition, family members supporting living expenses, or businesses handling recurring payments.

When setting up automatic transfers, you only need to enter recipient details, transfer amount, and frequency in online banking or a remittance platform, and the system will automatically deduct and transfer funds on the specified date. This avoids manual operations each time, reducing the risk of missing payments or deadlines. Some services offer better exchange rates or lower fees for regular transfer users, helping you save costs.

By setting up regular international transfers, you can simplify the remittance process, making budgeting and cash flow management easier. Many providers also support locking exchange rates to reduce currency fluctuation impacts.

Considerations

When setting up regular automatic transfers, you need to pay attention to exchange rate fluctuations, cumulative fees, and amount limits. Exchange rate changes directly affect the amount you transfer, and over time, yen appreciation or depreciation may introduce additional risks. While single transaction fees may be low, cumulative fees over time can become significant.

Different banks and platforms impose minimum and maximum limits on automatic transfers. The table below shows common regular transfer limits for banks (in USD equivalent):

| Bank Type | Daily Limit (USD) | Monthly Limit (USD) |

|---|---|---|

| General Banks | About 35 | About 70 |

| Commercial Banks | Higher limits | Higher limits |

You can reasonably arrange transfer frequency and amounts by choosing reputable licensed Hong Kong banks or international remittance platforms to reduce risks and costs. For efficient remittance to Japan, it’s advisable to regularly monitor exchange rate trends and adjust automatic transfer plans as needed to ensure fund safety and transfer efficiency.

Urgent Remittance Process

Wire Transfer Priority

When facing urgent fund needs, wire transfers and digital transfer platforms are the fastest options. Many digital currency transfer platforms like Wise and Remitly can complete international remittances in minutes. Online transfer services like PayPal, Venmo, and Western Union also support instant transfers, ideal for emergencies. Traditional bank wire transfers typically take 1 to 5 business days, but some platforms like TransFi can achieve same-day settlement. When choosing efficient remittance to Japan, prioritize transfer speed and service stability.

You can follow these steps to complete an urgent wire transfer:

- Select the international transfer type.

- Prepare recipient information, including full name, address, bank name, account number, and SWIFT/BIC code.

- Check and confirm related fees and limits.

- Choose the appropriate transfer method, balancing speed and cost.

- Ensure sufficient account balance to cover the transfer amount and fees.

- Double-check all information before transferring and, if necessary, contact the recipient’s bank for confirmation.

Tip: When operating, carefully verify recipient information to avoid delays or fund losses due to errors.

Avoiding Delays

When making urgent remittances, note Japanese bank operating hours. Japanese banks are typically closed on weekends and public holidays, which can extend processing times. For example, during New Year holidays and Golden Week, banks suspend services, and remittances are deferred to the next business day. If you initiate a transfer on a weekend, banks will process it starting the following Monday.

- Understand Japan’s holiday schedule and plan remittance timing in advance.

- Avoid initiating urgent remittances on weekends or before holidays.

- In emergencies, prioritize providers offering instant transfers.

By understanding these potential delays in advance, you can better arrange funds to ensure timely transfers. For highly urgent situations, choose digital platforms or online services to reduce uncertainties caused by holidays or weekends.

Security and Risk Prevention

Platform Verification

When choosing an international remittance platform, you must prioritize identity verification and legitimate channels. Legitimate platforms require you to complete identity verification, upload identification documents, and bind a mainland China or licensed Hong Kong bank account. You should prioritize platforms licensed by financial regulators and avoid using unverified third-party services.

Common security risks include:

- Unauthorized transactions may lead to fund losses.

- Personal and financial information may be compromised during storage or transmission.

- Cybersecurity issues can affect your trust in the platform.

- The level of protection for transaction data and sensitive information directly impacts your fund security.

You can verify a platform’s legitimacy by checking its official website, financial regulatory license number, and user reviews. Legitimate platforms disclose fees, exchange rates, and terms on their websites, with minimal hidden fees.

| Verification Point | Description |

|---|---|

| Identity Verification | Submit ID proof and bind a bank account |

| Regulatory License | Holds financial regulator approval |

| Information Transparency | Publicly discloses fees, rates, and transfer times |

| User Reviews | Refer to other users’ experiences |

Anti-Fraud Tips

When making cross-border remittances, beware of various fraud schemes. Common remittance fraud types include:

- Impersonating police or embassy officials: Scammers claim via phone that your phone number is linked to fraud, demanding transfers as bail.

- Investment scams: Individuals on social media lure you into investing, and funds cannot be recovered after transfer.

- Currency exchange and overseas transfer scams: Scammers promise fee-free exchanges, tricking you into transferring funds, leading to losses.

Avoid remitting through social media or channels recommended by strangers. If you receive calls or messages demanding urgent transfers, verify the other party’s identity first. Legitimate platforms will not request account information or transfers to personal accounts through private channels.

You should also protect personal information, avoiding sharing bank card numbers, verification codes, or other sensitive data. Regularly check the platform’s security settings and enable two-factor authentication to further enhance account security.

Selection Tips and Practical Advice

Selection Tips

When choosing a remittance method, consider transfer speed, fees, security, and ease of operation. The best choice varies by scenario. The table below compares common remittance methods to help you make quick decisions:

| Criteria | Bank Wire Transfer (Licensed Hong Kong Banks) | Online Remittance Services | Cash Pickup Services |

|---|---|---|---|

| Transfer Time | 3-5 days | Instant or minutes | Varies by provider |

| Fees | High, with rate markups | Low, transparent pricing | Relatively high |

| Required Documents | ID, address proof, etc. | ID, simplified process | ID, varies by provider |

| Exchange Rate | Usually marked up | Competitive, better rates | Varies by provider |

If you prioritize speed and low fees, online remittance services are ideal. For large, formal purposes, bank wire transfers are more suitable. For small urgent remittances, cash pickup services are an option. PayPal is suitable for small transfers, while TransferWise (Wise) and XE Money Transfer are known for low fees and favorable rates.

Practical Tips

You can use the following methods to obtain better exchange rates and lower fees:

- Use online remittance platforms like Remitly or WorldRemit, which are typically cheaper than banks, especially for economy transfers.

- Compare exchange rates and fees across providers to choose the most cost-effective option.

- Monitor market exchange rate fluctuations and remit when rates are favorable to increase the amount received.

- Understand fee structures to avoid increased costs due to hidden fees.

- Use real-time exchange rate monitoring tools to stay updated on yen rate changes. For example, some platforms support real-time exchange rate checks and international transfer status tracking to help you mitigate budget risks.

- For large transfers, consult currency exchange experts to secure better rates and services.

Before remitting, plan ahead and choose the optimal timing and method to save costs and ensure funds arrive safely and on time.

When remitting to Japan, focus on transfer speed, fees, and fund security. Japan’s remittance market continues to grow, projected to reach $2.12 billion in 2024. Japan’s payment infrastructure is continuously upgrading, with the government encouraging digital platform remittances. You can flexibly choose the right method based on your needs. Regularly monitor exchange rate changes and platform policies to optimize your remittance plan and ensure funds arrive efficiently and securely.

FAQ

How long does it take for a remittance to Japan to arrive?

When using bank wire transfers, it typically takes 1-3 business days. International third-party platforms can deliver in minutes. Holidays and weekends may cause delays.

What hidden fees are involved in remitting to Japan?

When using bank wire transfers, you may encounter intermediary bank fees. Some platforms add markups to exchange rates. Check all fee details in advance to avoid reduced amounts received.

Are there limits on remittance amounts?

When remitting through licensed Hong Kong banks or international platforms, there are per-transaction and daily limits. Alipay and WeChat international remittances have a $900 per-transaction limit. For large transfers, choose bank wire transfers.

How to ensure remittance security?

Choose platforms with financial regulatory licenses and complete identity verification. Avoid transferring through unknown channels. Regularly check account security settings to protect personal information.

Do exchange rate fluctuations affect the amount received?

Exchange rate changes directly impact the amount received during remittance. Some platforms allow locking exchange rates. Monitor real-time rates and choose favorable timing for transfers.

You have completed a comprehensive exploration of convenient money transfers to Japan, detailing the speed, fees, and use cases for methods like bank wires, international third-party platforms (Wise, Remitly), ACH transfers, and mobile payments. You clearly understand that whether it’s setting up regular recurring transfers to save time or choosing an instant digital platform for emergency remittances, you need a solution that truly offers transparent exchange rates, avoids hidden intermediary fees, and ensures efficient, secure fund movement.

Facing the complexities of SWIFT codes, exchange rate volatility, and potential scam risks during the transfer process, you need a professional FinTech platform that can bypass the high costs and long processing times of traditional banks, offer real-time exchange rates, and ensure same-day fund arrival.

BiyaPay is your ideal solution for secure and convenient remittances to Japan. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5% and zero commission for contract limit orders, helping you maximize cost control and avoid complex bank fee traps. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and utilize peak capital efficiency and transparent fees to make your yen remittances secure, fast, and compliant!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.