- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Western Union International Transfer Guide: Fees, Process, Timing, and Pickup in China

Image Source: unsplash

You can receive Western Union transfers in China through the following methods:

- Partner bank branches, such as China Everbright Bank, Bank of China, China Construction Bank, Shanghai Pudong Development Bank, etc., with a valid ID and Money Transfer Control Number (MTCN).

- Alipay, requiring only a Chinese phone number to register and complete real-name verification for quick receipt.

- Bank account deposit, where funds are transferred directly to your bank account after providing account details and passing identity verification.

Electronic channels are convenient, and the pickup process is secure. The Western Union international transfer guide helps you understand the best options for efficient pickup.

Key Points

- You can receive Western Union transfers through partner bank branches, Alipay, or bank account deposits, choosing the most suitable channel for convenience and speed.

- When collecting funds, prepare a valid ID, Money Transfer Control Number (MTCN), and recipient name to ensure accurate information and avoid delays.

- Fees vary based on transfer amount and payment method; choosing the right timing and channel can effectively save costs.

- Processing times differ by pickup method, with Alipay and in-person counter pickup being the fastest, typically within minutes to hours.

- Verify identity and information carefully during pickup, stay vigilant against fraud, and contact official support promptly for any issues to ensure fund security.

Pickup Methods

The Western Union international transfer guide outlines the main methods for receiving funds in China. You can choose the most suitable pickup channel based on your needs. Below is a detailed explanation of each method’s features, convenience, and security.

Partner Bank Branch Pickup

You can visit partner bank branches in China to receive Western Union transfers. Major partner banks include:

- China Postal Savings Bank

- Bank of China

- China Everbright Bank

- China Construction Bank

- Shanghai Pudong Development Bank

- Zhejiang Chouzhou Commercial Bank

- Jilin Bank

- Harbin Bank

- Fujian Haixia Bank

- Yantai Bank

- Wenzhou Bank

- Huishang Bank

- Longjiang Bank

- Guangzhou Rural Commercial Bank

- Zhejiang Tailong Commercial Bank

These banks have over 28,000 partner branches across most cities and regions in China. You only need to bring a valid ID, Money Transfer Control Number (MTCN), and sender’s name, then fill out a receipt form to collect the funds. Some banks, like China Everbright Bank, Shanghai Pudong Development Bank, and Bank of China, also support receiving funds via mobile or online banking, enhancing convenience.

Tip: Prioritize larger branches for Western Union services, as some smaller branches may not offer this service.

Alipay Pickup

You can also receive Western Union transfers via Alipay. Simply register an Alipay account with a Chinese phone number and complete real-name verification, then enter transfer details in the “Western Union” service section to receive funds within minutes. Alipay is simple to use, fast, and ideal for users seeking efficiency and a mobile experience.

Alipay pickup offers the following advantages:

- No need to visit a bank branch; complete the process via mobile

- Funds are available quickly, typically within minutes

- Supports real-time transfer progress tracking

In terms of security, Alipay uses multi-factor authentication and encryption to protect your funds.

Bank Account Deposit

You can also choose to have Western Union transfers deposited directly into your bank account. Common deposit methods include ACH transfers and wire transfers. The table below compares supported banks, processing speeds, and security for different deposit methods:

| Deposit Method | Supported Banks | Processing Speed | Security Features and Risks |

|---|---|---|---|

| ACH Transfer | Primarily U.S. banks | Generally 1-3 business days, longer for larger amounts; under $25,000 often same-day (1 USD ≈ 7.2 CNY) | Reversible transactions, high security; requires detailed account info; has time and frequency limits |

| Wire Transfer | U.S. and international banks | Same-day in China, 1-2 business days for cross-border | Non-reversible, good security but hard to recover if errors occur; higher fees for both sender and receiver |

| Peer-to-Peer Transfer | Requires both parties to use the same app | Within minutes | Lower security, suitable for small transfers; fraud risk; some apps may charge fees; limited acceptance |

| Check Deposit | Any bank | Longer processing, especially for large checks | Risk of lost or altered checks; convenient (mobile photo deposit) |

| Third-Party Transfer Services | Primarily for cross-border transfers | Fast processing | Higher fees; non-reversible; suitable for those without bank accounts or cross-border needs |

When choosing bank account deposits, you need to provide accurate account information. Wire transfers are faster, ideal for large amounts. ACH transfers suit U.S. bank accounts but take longer. Select the method based on your needs and bank support.

Mobile Wallet Pickup

Mobile wallet pickup is increasingly popular in rural China. Since 2012, the People’s Bank of China has piloted mobile payments in 20 provinces and cities, with over 4.6 million merchant users and 14,000 agent service points by June 2013. You can use mobile wallets for account inquiries, transfers, bill payments, and small cash withdrawals. This method is simple, efficient, and low-cost, greatly facilitating daily payment needs for rural residents.

However, mobile wallet pickup in some areas faces challenges like lagging infrastructure, high payment fees, and limited user awareness. The government is promoting rural mobile payments through policies and technological innovation, drawing on Kenya’s M-Pesa model, emphasizing agent network development and technical management. Overall, mobile wallet pickup is growing in rural China, with improving user experiences but room for further development.

Note: When choosing mobile wallet pickup, check local network coverage and service point availability to ensure fund security and timely receipt.

Pickup Process

Image Source: unsplash

Bank Counter Pickup Process

You can choose to collect Western Union transfers at partner bank branches in China. For example, many Hong Kong banks have branches in China that support Western Union services. When collecting at a bank counter, you typically follow these steps:

- Inform the bank staff that you need to receive a Western Union transfer.

- Present your ID for verification.

- Provide your name and related payment information, ensuring it matches the transfer details.

- Prepare the Money Transfer Control Number (MTCN), a necessary credential usually found on the payment receipt.

- Fill out the receipt application form, including sender’s country, currency, and payout currency. You can ask staff for assistance with details.

- Submit all materials to the staff, who will process the pickup after verifying the information.

Reminder: Prepare all materials in advance to save time during pickup. Some banks may require additional forms, so call the target branch beforehand.

Alipay Pickup Process

You can also receive Western Union transfers via Alipay. The process is highly convenient, ideal for users seeking efficiency and a mobile experience. Follow these steps:

- Open the Alipay app and access the “Western Union” service section.

- Enter your Money Transfer Control Number (MTCN), recipient name, and transfer amount.

- Complete identity verification as prompted, typically requiring linked ID information.

- Submit the application after confirming accuracy, and the system will process the transfer.

- Funds typically arrive within minutes and can be viewed in your Alipay balance.

Alipay pickup doesn’t require visiting a bank branch, with the entire process completed online. You can track transfer progress anytime, with secure fund handling.

Bank Account Deposit Process

You can also choose to have Western Union transfers deposited directly into your bank account. Many Chinese and Hong Kong banks support this service. Follow these steps:

- Log in to the Western Union international transfer guide’s recommended official platform or partner bank’s online banking.

- Select “Bank Account Deposit” or “Transfer to Account” service.

- Enter your bank account number, bank name (e.g., Hong Kong bank), and recipient name.

- Provide the Money Transfer Control Number (MTCN) and transfer amount (in USD, reference 1 USD ≈ 7.2 CNY).

- The system will require identity verification, typically uploading an ID photo or entering a verification code.

- After submitting, the bank will deposit funds into your account within 1-3 business days. Some banks support same-day deposits, depending on their policies.

Bank account deposits are suitable for large transfers. Ensure account information accuracy to avoid transfer failures.

Required Documents and Information

When collecting Western Union transfers, regardless of the method, you need to prepare the following documents and information:

- Valid ID (e.g., ID card, passport)

- Money Transfer Control Number (MTCN)

- Recipient name (matching the transfer form)

- Transfer amount (in USD, reference real-time exchange rate)

- Sender’s country and currency information

- Linked phone number (for receiving verification codes)

- For bank account deposits, provide the bank account number and bank name

Recommendation: Verify all information in advance to ensure completeness, greatly improving processing efficiency and avoiding delays.

The Western Union international transfer guide outlines various pickup processes and required documents. You can choose the most suitable method based on your needs to ensure secure and timely fund receipt.

Western Union International Transfer Guide: Fees

Image Source: pexels

Fee Standards

When using Western Union transfers, fees vary based on the transfer amount and payment method. Generally, larger amounts incur higher fees. The table below shows fee standards for different payment methods and amount ranges (for transfers from the U.S. to China, reference 1 USD ≈ 7.2 CNY):

| Payment Method | Fee (USD) |

|---|---|

| Bank Transfer | 0 |

| Debit Card Payment | 2.99 |

| Agent Payment | 8 |

| Credit Card Payment | 29.99 |

| Transfer Amount Range (USD) | Fee (USD) |

|---|---|

| Below 500 | 15 |

| 500-1000 | 20 |

| 1000-2000 | 25 |

| 2000-5000 | 30 |

| 5000-10000 | 40 |

| Over 10000 | Additional 20 per 500 |

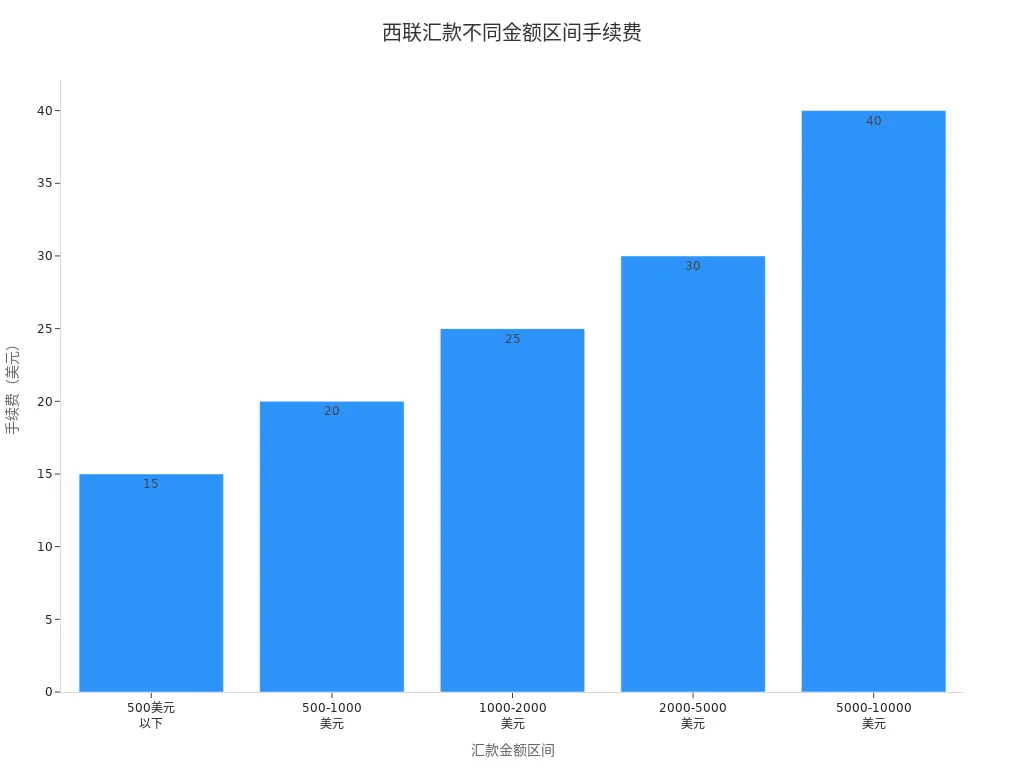

You can refer to the bar chart below for a visual representation of fee variations by amount range:

Influencing Factors

Fees are influenced not only by the amount but also by the transfer method, payment method, currency, and pickup channel. The table below outlines key influencing factors:

| Transfer Method | Payment Method | Fee Range (USD) | Exchange Rate Example |

|---|---|---|---|

| Bank Account Deposit | Cash Payment | 1.99 - 8 | 1 USD = 7.0808 CNY |

| Alipay/WeChat Deposit | Cash Payment | 0.99 - 8 | 1 USD = 7.1460 CNY |

| Cash Pickup | Cash Payment | 9.99 - 14.49 | 1 USD = 7.1641 CNY |

When choosing a pickup method, consider exchange rate differences in addition to fees. The exchange rate variance between cash pickup and bank account deposits can range from 1.16% to 2.3%, affecting the final amount received.

Cost-Saving Tips

You can reduce Western Union transfer fees with these methods:

- Avoid transferring on weekends or holidays, as fees are typically higher during these periods.

- If China supports multiple currency options, compare fees and exchange rates for different currencies.

- Monitor promotions and discounts from Western Union or partner banks (e.g., Hong Kong banks) to leverage savings.

- Understand China’s payment regulations and all related fees in advance to avoid unexpected costs.

Reminder: When using the Western Union international transfer guide, choose the optimal transfer and pickup method based on your needs and circumstances to save money and ensure efficiency.

Transfer Process

Online Transfer Process

You can complete Western Union transfers online. Many banks (e.g., Hong Kong banks) support online banking, self-service terminals, or mobile banking. Follow these steps:

- Log in to online banking or a self-service terminal and select the “International Transfer” service.

- Complete the International Transfer Application Form, including transfer currency, amount (in USD, reference 1 USD ≈ 7.2 CNY), recipient name, address, bank account number, bank name, and SWIFT code.

- Pay the transfer principal and fees, referring to the fee table above.

- Print the application form, sign it, and provide contact information.

- The system generates a transfer receipt, which you can save for future reference.

The online transfer process requires detailed bank account information and is formal, suitable for large or official transfer needs.

Agent Branch Transfer Process

You can also visit a bank or post office Western Union agent branch to process transfers. The steps are simpler, ideal for small, quick transfers:

- Provide your ID and recipient’s name (in Pinyin), no bank account required.

- Fill out the transfer form, specifying the transfer amount (USD), recipient’s country, and currency.

- Pay the transfer principal and fees.

- Receive the Money Transfer Control Number (MTCN) and share it with the recipient.

| Transfer Method | Process Description | Key Features |

|---|---|---|

| Online Transfer | Requires detailed bank account info, formal and complex process | Suitable for large, official transfers |

| Agent Branch Transfer | No bank account needed, uses ID and recipient name, simple and relies on information sharing | Ideal for small, quick transfers |

Transfer Information Entry

When filling out Western Union transfer information, pay attention to these details to avoid transfer failures due to errors:

- Confirm the sender and recipient’s names and surname spellings are accurate and match the ID.

- Enter the amount in USD, referencing the real-time exchange rate (e.g., 1 USD ≈ 7.2 CNY).

- The MTCN must be a 10-digit number; any digit errors will affect pickup.

- Transfer information must be in an individual’s name, not a company name.

- Pickup relies on system-entered information; the receipt is for reference only.

- Check transfer progress via phone or the Western Union website to ensure accuracy before notifying the recipient.

- If information is incorrect, confirm and correct it promptly with the counterparty to avoid delays.

Carefully verify each detail when entering transfer information to significantly improve success rates and ensure fund security.

Processing Times

Processing Times by Method

When using Western Union in China, processing times vary significantly by pickup method. Below are reference times for common methods:

- Counter or Alipay pickup typically takes minutes to hours, offering fast processing.

- Wire transfers generally require 1 to 3 business days, depending on bank efficiency and regional differences.

- International bank transfers may take 3 to 5 business days or longer.

- Other services like MoneyGram have similar processing times to Western Union, typically minutes to hours.

Choose the method based on your needs. For urgent funds, prioritize counter or Alipay pickup.

Factors Affecting Processing Speed

Processing speed depends not only on the pickup method but also on several factors. Consider these during operations:

- Limited partner banks may cause processing delays, affecting speed. For example, some Hong Kong banks have fewer branches in China, leading to delays during peak periods.

- The transfer process is complex, typically requiring one business day to complete.

- During holidays (e.g., Chinese or U.S. statutory holidays), banks pause operations, delaying transfers.

- Western Union transfers are mostly processed offline, only during business days.

- Incomplete or incorrect transfer information (e.g., missing bank account details or SWIFT code) extends processing time.

- Bank internal reviews (e.g., anti-money laundering checks) and intermediary bank processing speeds also affect progress.

Verify all information before transferring, avoid holidays, and choose efficient partner banks to improve processing speed.

Tracking Transfer Progress

You can track Western Union transfer progress to ensure fund security. Follow these steps:

- Visit the Western Union website and find the “Track Transfer Status” section.

- Enter the Money Transfer Control Number (MTCN) provided by the sender.

- Provide the sender or recipient’s name.

- Enter the verification code and click query.

- The results show the transfer status. Four checkmarks indicate funds have arrived; partial checkmarks mean the transfer is in progress; incorrect information prompts re-entry.

You can also check status via partner bank counters (e.g., Hong Kong banks) or customer service hotlines. Keep the MTCN and related information secure for easy tracking.

Pickup Security and Considerations

Identity Verification

When collecting Western Union transfers in China, identity verification is the first step to ensure fund security. Verification processes vary by pickup method:

- If you receive via bank account for the first time, you need to call Western Union customer service to verify account holder information or wait for the Western Union China Customer Service Center to contact you within 24 hours after the transaction.

- During verification, provide the recipient’s name (English or Chinese), ID number, bank account number, and MTCN.

- After verification, future receipts with the same bank account will be faster.

- For cash pickup, bring a personal ID and MTCN to the bank branch.

- For example, with Bank of China, you need to open a bank account to process cash pickup.

- Not all bank branches support Western Union services, so confirm in advance if the target branch offers this service.

Recommendation: Choose branches with convenient hours and high security, prioritizing major institutions like Hong Kong banks, to ensure a smooth pickup process.

Information Verification

Before collecting, carefully verify all account and personal information to avoid delays or losses due to errors. Common risks include incorrect account information, outdated information, insufficient identity verification, and compromised account passwords. Take these measures to enhance information security:

- Check the completeness and accuracy of account information, updating errors or outdated details promptly.

- Follow identity verification requirements, submitting necessary documents to ensure transaction legitimacy.

- Securely store account passwords and personal information, changing passwords regularly to prevent theft.

- Monitor account security and contact Western Union’s official customer service for professional assistance if abnormalities occur.

Stay vigilant during operations, avoiding inputting sensitive information in public places or insecure network environments.

Fraud Prevention

In recent years, Western Union-related fraud tactics have evolved. For example, some users receive fraudulent prize notifications, with scammers using fake company names and amounts to lure victims. Stay cautious of high-return or prize claims from unknown sources. Experts recommend safeguarding personal and bank card information and promptly notifying banks or authorities if abnormalities are detected.

Prevent fraud with these measures:

- If you suspect fraud, immediately call Western Union’s anti-fraud hotline at 400 8199377 to report.

- If the transfer hasn’t been paid to the recipient, request to stop the transaction and apply for a refund.

- For paid transactions, file a formal fraud complaint with Western Union and report to local law enforcement.

- Western Union provides fraud prevention through automated alerts, agent branch information, and anti-scam tips on its website and social media.

- Learn to identify common fraud tactics, avoiding prize or impersonation scams.

- Forward suspicious emails to spoof@westernunion.com for reporting.

Stay highly vigilant during pickup, seeking official and bank assistance for any suspicious activity to protect your funds.

Transfer Limits and Common Issues

Transfer Limits

When using Western Union, you need to be aware of transfer limits. China has clear regulations on international transfers. You can receive up to $50,000 annually (approximately 360,000 RMB, 1 USD ≈ 7.2 CNY). For online transfers from the U.S. to China, the single-transaction limit is typically $7,000. Agent branch limits may vary, with some banks adjusting single or daily limits based on their policies. Consult Hong Kong or partner banks in advance to understand the latest limit regulations to avoid transfer failures or delays due to exceeding limits.

Tip: Verify the amount when filling out transfer information, ensuring it doesn’t exceed China’s annual limit. For large amounts, split transfers and plan timing accordingly.

Common Issues

You may encounter common issues when processing Western Union transfers. Western Union and banks provide multiple solutions:

- You can use online banking or mobile apps from 12 partner banks like China Postal Savings Bank and China Construction Bank for quick transfers. Hong Kong banks also support online and offline transfer processes.

- Western Union provides detailed fee explanations. Estimate costs based on destination, amount, and payment method, e.g., $2.99 for debit card, $8 for agent payment, $29.99 for credit card.

- Transfer limits are clear: $7,000 per online transaction, with an annual receipt limit of $50,000. Understand regulations in advance.

- Choose offline branch or online transfers. Offline requires valid ID and a transfer form; online is processed via the website or mobile banking, with a simple process.

If issues arise, consult bank customer service or Western Union’s official hotline for professional assistance. Understanding processes and regulations in advance ensures smoother and safer transfers.

You can choose the most suitable pickup method based on your needs. The Western Union international transfer guide recommends focusing on fees and processing times to improve efficiency. Western Union’s performance in China includes:

- Fast processing, with transfers under $10,000 typically arriving within 10 minutes, enhancing efficiency.

- Secure funds, with status tracking via the website and customer service hotline.

- Professional services from partner banks like Hong Kong banks and China Postal Savings Bank, with high security.

- Higher fees and limited amounts, suitable for small transfers.

Refer to this guide to mitigate risks and ensure fund security.

FAQ

How do I check the status of a Western Union transfer?

You can check transfer progress on the Western Union website by entering the Money Transfer Control Number (MTCN) and recipient name. Four checkmarks indicate funds have arrived.

What documents are needed for pickup?

You need a valid ID, Money Transfer Control Number (MTCN), recipient name, and transfer amount (in USD, reference 1 USD ≈ 7.2 CNY). For bank account deposits, provide the account number and bank name.

Which banks support Western Union transfers?

You can collect transfers at partner branches like Hong Kong banks, China Postal Savings Bank, Bank of China, China Everbright Bank, etc. Some banks support online and mobile banking pickup.

How are fees calculated?

Fees depend on the transfer amount, payment method, and pickup channel. Refer to the table below:

| Transfer Amount (USD) | Fee (USD) |

|---|---|

| Below 500 | 15 |

| 500-1000 | 20 |

| Over 1000 | 25+ |

What are the transfer limits?

You can receive up to $50,000 annually (approximately 360,000 RMB, 1 USD ≈ 7.2 CNY). Single online transfers are typically limited to $7,000. Split large transfers and plan timing accordingly.

When using Western Union for international transfers to China, you have multiple withdrawal options, from traditional bank counters to convenient Alipay, or even direct deposits to your bank account. This guide explains the process, fees, and transfer times for each method, helping you make informed decisions.

However, despite the convenience offered by Western Union, you may still face challenges when handling cross-border funds. For example, Western Union’s fees can be relatively high, and exchange rate differences between channels can affect the final amount you receive. Moreover, if you need to make large transfers or handle more frequent international payments, their transfer limits and delivery times might not fully meet your needs.

To solve these challenges, we recommend a more efficient and economical global financial service platform: BiyaPay. BiyaPay offers ultra-low transfer fees as low as 0.5% and supports same-day remittance and arrival, greatly simplifying your cross-border fund management. Whether you need to convert USD, HKD, or other fiat currencies and cryptocurrencies, BiyaPay provides a secure and transparent service. You can also use its real-time exchange rate lookup to complete transactions at the best possible rate. Register now to begin your new global financial journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.