- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Analysis of Credit Card APR: Meaning and Calculation Methods

Image Source: pexels

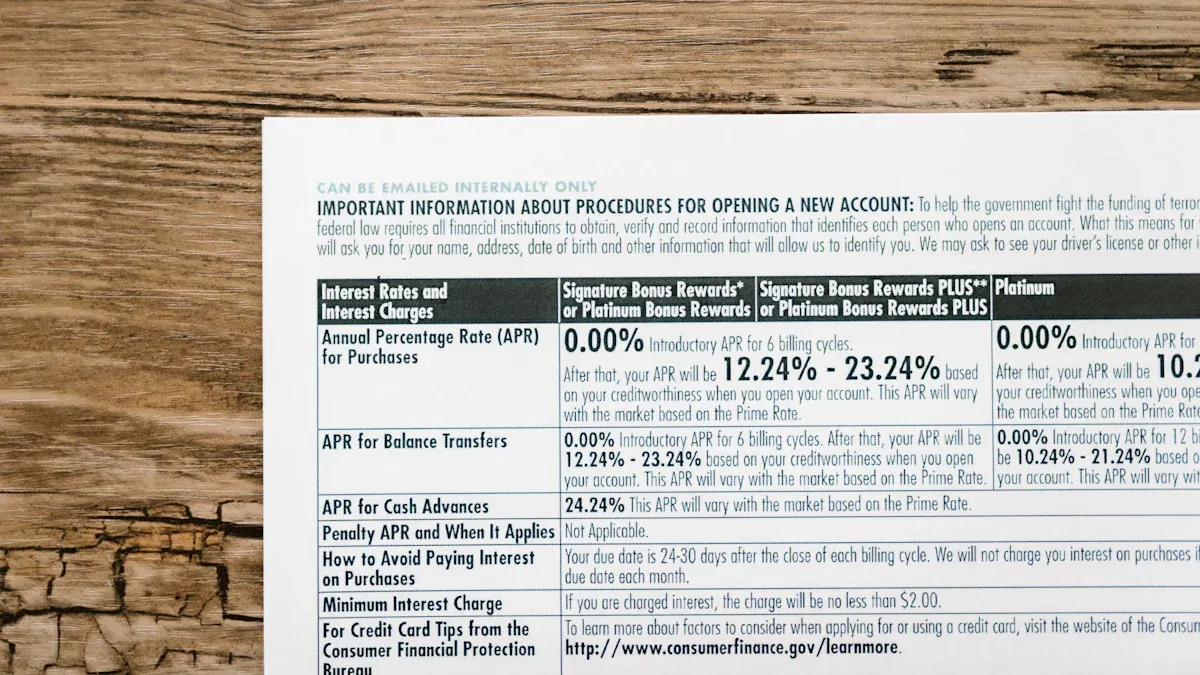

When using a credit card, you often encounter the term “credit card APR.” APR stands for Annual Percentage Rate, which is a key measure of the cost of borrowing on a credit card. The average APR for Chinese credit card users is approximately 18.25% or higher, with significant variations depending on qualifications and platforms. APR not only includes interest but also encompasses various fees, such as late fees, over-limit fees, cash advance fees, and annual fees. You can refer to the table below to understand common APR fee types:

- Late fees

- Over-limit fees

- Cash advance fees

- Balance transfer fees

- Annual fees

- Setup fees

- Credit limit increase fees

- Interest charges

- Minimum interest charges

- Penalty interest rates

APR plays a central role in the borrowing costs of credit cards in China, and both laws and policies use it as a benchmark to help you better understand the true cost of using a card.

Key Points

- Credit card APR is the annual percentage rate, encompassing interest and various fees, reflecting the true cost of borrowing.

- APR is calculated based on the monthly interest rate multiplied by 12, and all related fees must be included to avoid focusing solely on daily or monthly rates.

- High APR increases repayment burdens, and paying only the minimum amount due leads to accumulating interest over time.

- When choosing a credit card, prioritize comparing APRs and pay attention to whether additional fees are included to avoid being misled by low interest rates.

- Reasonable repayment strategies and utilizing grace periods can effectively reduce interest expenses, while maintaining a good credit history helps secure lower rates.

Meaning of Credit Card APR

Image Source: pexels

Full Name and Definition of APR

When learning about credit card APR, you first need to know its full name. APR has multiple meanings, but in the credit card context, the most common interpretation is “Annual Percentage Rate,” or the annualized percentage rate. Below are common full names for APR:

- Augmented Pay Reality (augmented payment reality technology)

- Apache Portable Run-time libraries (Apache portable runtime libraries)

- Annual Percentage Rate (annual interest rate, used for credit cards)

- Automatic Place & Route (automatic layout and routing)

- April (abbreviation for the month of April)

In the credit card context, APR refers to the total annual cost you pay for borrowing, including interest and related fees. You can use APR to quickly assess the true borrowing cost of a credit card. Credit card APR is not just a simple interest rate; it also includes fees like late fees, cash advance fees, and annual fees. This allows you to gain a more comprehensive understanding of the actual expenses of using a credit card.

Tip: When choosing a credit card, you should prioritize APR, as it helps you compare the true costs of different credit cards.

Difference Between APR, Daily Rate, and Monthly Rate

In daily life, you often see banks advertise daily or monthly interest rates for credit cards. The daily interest rate refers to the interest proportion you pay daily, such as 0.05% per day. The monthly interest rate is typically expressed in per mille, such as 3.2‰, or 0.32% per month. The annual percentage rate (APR) is generally calculated by multiplying the monthly rate by 12, for example, a 3.2‰ monthly rate multiplied by 12 months equals a 3.84% APR.

APR calculation doesn’t solely depend on the interest rate; it also considers fees, annual fees, and other costs. For instance, if you borrow 1,000 USD with 50 USD in interest and 100 USD in fees, the total cost is 150 USD, so the APR is 15%. You can see that daily and monthly rates are the foundation of APR, but the final APR is influenced by other fees. Changes in daily and monthly rates directly affect the APR value, impacting your actual interest costs.

- The daily interest rate is typically expressed as the daily interest proportion, such as a 0.05% daily overdraft rate for credit cards.

- The monthly interest rate is expressed in per mille, such as 3.2‰, meaning a 0.32% monthly rate.

- The annual percentage rate (APR) is generally calculated by multiplying the monthly rate by 12, for example, a 3.2‰ monthly rate multiplied by 12 months equals a 3.84% APR.

- Changes in daily and monthly rates directly affect APR calculations, impacting the actual interest costs borne by the borrower.

Difference Between APR and EIR

When comparing credit card products, you may also encounter EIR (Effective Interest Rate). Both APR and EIR measure borrowing costs, but they differ significantly. APR primarily reflects the total annual cost you pay, including interest and related fees, but it typically does not account for compound interest. EIR includes the compounding effect, meaning that if you don’t repay on time, interest generates additional interest, and EIR more accurately reflects your actual interest burden.

When choosing a credit card, you should prioritize APR, as it helps compare the baseline costs of different cards. If you frequently use installments or fail to repay in full, EIR more closely reflects your actual expenses. Understanding the difference between the two helps you make wiser card usage decisions.

Credit Card APR Calculation

Image Source: pexels

Calculation Formula

When learning about credit card APR, you first need to master its standard calculation method. The APR calculation steps are straightforward:

- You need to divide the credit card’s borrowing costs by the loan amount to obtain the monthly interest rate in decimal form.

- Then multiply the monthly rate by 100 to convert it to a percentage.

- Finally, multiply the monthly rate by 12 to get the annual percentage rate (APR).

You can refer to the table below to understand the conversion relationships between different interest rates:

| Rate Type | Calculation Method | Description |

|---|---|---|

| Monthly Rate | Borrowing Costs ÷ Loan Amount | Monthly basis |

| Annual Rate (APR) | Monthly Rate × 12 | Annual basis |

| Daily Rate | Annual Rate ÷ 365 | Daily basis |

APR comes in three types: fixed rate, variable rate, and structured rate. When choosing a credit card, you should pay attention to the type of APR, as different types affect your actual borrowing costs.

Tip: When calculating credit card APR, include all related fees, such as annual fees and cash advance fees, to obtain the true annualized borrowing cost.

Daily Rate Conversion

When applying for a credit card from a Hong Kong bank, you often see daily interest rate promotions. For example, a Hong Kong bank’s credit card may have a daily rate of 0.05%. You might wonder how to convert this daily rate to an annualized APR. You can use the following method for conversion:

Suppose you borrow 1,000 USD (1 USD ≈ 7.2 CNY) with a daily rate of 0.05%. You can first calculate the daily interest: 1,000 USD × 0.05% = 0.5 USD. Assuming a 30-day month, the monthly rate is approximately 0.05% × 30 = 1.5%. The annual rate (APR) is then 1.5% × 12 = 18%. However, you should note that actual conversions cannot simply multiply the daily rate by 365, as this does not account for compound interest.

The People’s Bank of China’s announcement states that loan APR calculations can use either compound or simple interest methods. The compound interest method (IRR) more accurately reflects the actual cost of a loan. When converting, you should use the loan principal, periodic repayment amounts, and loan term to calculate the annualized yield after compounding using the IRR formula for a more accurate APR. This helps avoid being misled by low daily or monthly rates.

Calculation Pitfalls

When calculating credit card APR, you may encounter some pitfalls. The most common misconception is assuming APR equals the daily rate multiplied by 365 or the monthly rate multiplied by 12. In reality, standard APR calculations typically do not account for compound interest. The APR formula is: (Interest / Principal) × (365 / Days) × 100%, based on simple interest. Compound interest calculations are more complex, increasing the final amount, but APR mainly reflects the simple interest annualized rate.

You also need to note that different financial institutions may use different interest calculation methods. When signing financial agreements, you should carefully read the terms to understand the actual interest calculation method. If you frequently use installments or fail to repay in full, the actual interest may exceed the cost indicated by APR. In such cases, you can refer to EIR (effective interest rate), which includes compounding and better reflects your actual expenses.

Note: APR calculations generally do not consider compound interest; only EIR includes compounding factors. When comparing credit card products, you should consider both metrics.

Impact of Credit Card APR

Impact on Repayment Amount

When using a credit card, APR directly affects your repayment amount. If you choose installment repayments, the higher the APR, the more total interest you need to pay. For example, if you use a Hong Kong bank credit card to spend 1,000 USD (1 USD ≈ 7.2 CNY) and choose a 12-month installment plan, an 18% APR will result in a higher monthly repayment amount than a 12% APR. You can calculate the monthly repayment amount, multiply by 12 to get the total repayment, and subtract the principal to find the total interest. The higher the APR, the heavier your interest burden. APR helps you clearly understand the true cost of installment repayments, avoiding underestimation of borrowing expenses.

Installments and Minimum Payments

When repaying your credit card bill, you may choose the minimum payment amount. The interest portion of the minimum payment is typically calculated based on the monthly rate derived from the APR. For example, with an 18% APR, the monthly rate is 1.5%. The monthly interest you pay equals the outstanding principal × 1.5%. If you only pay the minimum amount due long-term, the unpaid principal continues to accrue interest, significantly increasing the total repayment amount. The actual interest rate (IRR) is typically higher than the APR, meaning your actual interest burden exceeds what the APR indicates. You should create a repayment plan based on the credit card’s APR and avoid only paying the minimum amount.

Risks of High APR

When choosing a credit card, high-APR products significantly increase borrowing costs. A high APR means you pay more interest monthly if you don’t repay in full. If you frequently use installments or only pay the minimum amount, the interest burden accumulates, potentially exceeding the principal. Over time, your financial pressure will grow. You should prioritize low-APR credit cards, repay in full on time to reduce interest expenses, and avoid the debt risks associated with high APRs.

Card Usage Recommendations

Comparing Credit Card APRs

When choosing a credit card, you should prioritize comparing the APRs of different products. A lower APR means a lower total annual borrowing cost. You can compare APRs from various Hong Kong banks, noting whether additional fees like annual or cash advance fees are included. Some banks advertise only daily or monthly rates, so you should actively inquire about the annualized APR to avoid being misled by low rates. You can create a simple table listing the APR, annual fees, cash advance fees, and other details of different credit cards to make a more informed choice.

Reducing Interest Expenses

You can take several steps to reduce credit card interest expenses:

- Full repayment: Repay the full amount before the due date to avoid interest.

- Utilize grace periods: Some Hong Kong banks offer 1-5 day repayment grace periods; seize this opportunity to repay on time.

- Installment repayments: Choose installment plans, which, despite fees, reduce short-term interest burdens.

- Adjust billing dates: Request a billing date change to extend repayment time for better fund planning.

- Transfer balances: Move high-interest credit card balances to lower-interest cards to reduce overall interest.

- Increase credit limits: Higher limits reduce overdraft chances, lowering interest.

- Maintain a good credit history: Repay on time to avoid late fees and improve chances for lower rates.

If you face repayment difficulties, proactively negotiate with the bank for interest waivers. Preparing relevant documents and reasons in advance can help gain the bank’s understanding and support.

Avoiding High APRs

When applying for a credit card, carefully review the APR information disclosed by Hong Kong banks. High-APR credit cards significantly increase borrowing costs, especially if you don’t repay in full, as interest accumulates quickly. You should prioritize lower-APR cards and avoid focusing solely on daily or monthly rates. You should also regularly monitor credit card policies and fee changes to adjust your usage strategy and prevent falling into high-APR traps.

Friendly Reminder: 1 USD ≈ 7.2 CNY, with all fees priced in USD for easier comparison and personal financial planning.

You now understand the core concepts and calculation methods of credit card APR. Focusing on APR helps you more accurately understand the true annual interest rate of loans and investments, rationally manage the time value of money, and optimize cash flow. You can select the appropriate rate type based on your financial goals to reduce repayment pressure and enhance investment returns. When managing credit card finances scientifically, you can:

- Through sustained or temporary credit limit increases, manage spending limits reasonably to avoid overspending.

- Enable automatic transfer repayments to ensure timely payments and prevent late fees.

- Use installment payment services to enjoy interest-free or low-fee options, spreading repayment pressure.

- Actively participate in points redemption to enhance credit card value.

- Plan primary and supplementary card limits to avoid conflicts.

You should also continuously monitor credit card policies and fee changes, adjusting your usage strategy to manage personal finances effectively.

FAQ

What fees are included in credit card APR?

When calculating APR, you need to include all related fees, such as interest, annual fees, cash advance fees, and late fees. This allows you to understand the true borrowing cost.

Why do different credit cards have significantly different APRs?

You’ll notice that APRs vary significantly across banks and credit card products. Banks set different APRs based on your credit profile, card type, and service offerings.

What are the consequences of only paying the minimum amount due?

If you only pay the minimum amount due long-term, the unpaid principal continues to accrue interest. This significantly increases the total interest you pay and adds repayment pressure.

How can I quickly check a credit card’s APR?

You can find APR information on the issuing bank’s website, billing statements, or customer service hotline. You can also compare APRs across cards to choose the most suitable product.

Which is more important, APR or EIR?

When repaying in full, APR is more relevant. If you frequently use installments or fail to repay in full, EIR more accurately reflects your actual interest expenses.

This guide provides a comprehensive analysis of credit card APR, from its basic definition to its calculation methods and how to effectively use it to manage your credit cards. You’ve learned that APR is not just a simple interest rate but also includes various fees, and you now understand why APR is a better indicator of the true cost of borrowing than a daily or monthly rate.

However, in real life, you might face a more fundamental issue: how to efficiently and securely manage your finances to better handle credit card bills, reduce interest expenses, and even use funds for investment. For example, if you need to transfer overseas funds (like USD or HKD) back to your account or want to use a low-fee platform for currency exchange to save costs, traditional bank transfers or payment methods can be expensive and inefficient.

To solve these challenges, we recommend a more efficient and economical global financial service platform: BiyaPay. BiyaPay offers ultra-low transfer fees as low as 0.5% and supports same-day remittance and arrival, greatly simplifying your cross-border fund management. Whether you need to convert USD, HKD, or other fiat currencies and cryptocurrencies, BiyaPay provides a secure and transparent service. You can also use its real-time exchange rate lookup to complete transactions at the best possible rate. Register now to begin your new global financial journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.