- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Transfer Money with Panda Remit? Is Panda Remit Reliable?

Image Source: unsplash

You can transfer money through Panda Remit, easily completing the process online without visiting a Hong Kong bank, with a straightforward procedure. The platform has served nearly 3 million users and processed over 11 million transactions, demonstrating its large scale. Panda Remit offers full Chinese-language support, with fees as low as 1 USD, and funds can arrive in minutes, making it secure, compliant, and ideal for transfers to China with strict identity verification.

Key Points

- Panda Remit supports over 40 countries and regions globally, covering multiple currencies, ideal for small, frequent cross-border transfers, with simple and convenient operations.

- Registration and identity verification are completed entirely online; uploading identity documents allows quick approval, ensuring fund security.

- The transfer process is clear, supporting multiple payment methods like Alipay, WeChat, and bank cards, with funds typically arriving in minutes, faster than traditional banks.

- Fees are low and transparent, with exchange rates better than Hong Kong banks, and the platform provides real-time exchange rate queries to maximize fund value.

- The platform uses bank-grade encryption and multi-factor authentication, holds a legal financial license, and has positive user reviews, ensuring safety and reliability.

Service Scope

Supported Countries and Regions

You can use Panda Remit to transfer money to over 40 countries and regions worldwide. The platform covers major regions including Oceania, Asia, Europe, and North America. You can send money to Hong Kong, the United States, Australia, Singapore, Japan, the Philippines, Canada, the United Kingdom, the European Union, and more. Panda Remit supports over 500 banks in mainland China, and you can also choose payment methods like WeChat and Alipay.

If you have family, friends, or clients in these countries and regions, Panda Remit can meet your transfer needs. Compared to traditional Hong Kong banks, Panda Remit’s online service eliminates the need to visit a bank branch, making it more convenient.

Supported Currencies

Panda Remit supports 17 mainstream currencies. You can choose currencies like Chinese Yuan (CNY), Hong Kong Dollar (HKD), Singapore Dollar (SGD), British Pound (GBP), Euro (EUR), and others for transfers.

- If you need to transfer HKD, USD, or other currencies to a Chinese bank card, you can do so directly on the platform.

- The platform is ideal for distributed transfer scenarios below 50,000 USD, particularly for small, frequent cross-border transfer needs.

- When a single transfer reaches 6,000 HKD (approximately USD, subject to real-time exchange rates), the platform waives the handling fee.

- You need to ensure the receiving account is in your name to avoid triggering foreign exchange scrutiny.

As a third-party platform, Panda Remit is suitable for individuals transferring funds compliantly. If you have small, frequent transfer needs, Panda Remit is a cost-effective choice.

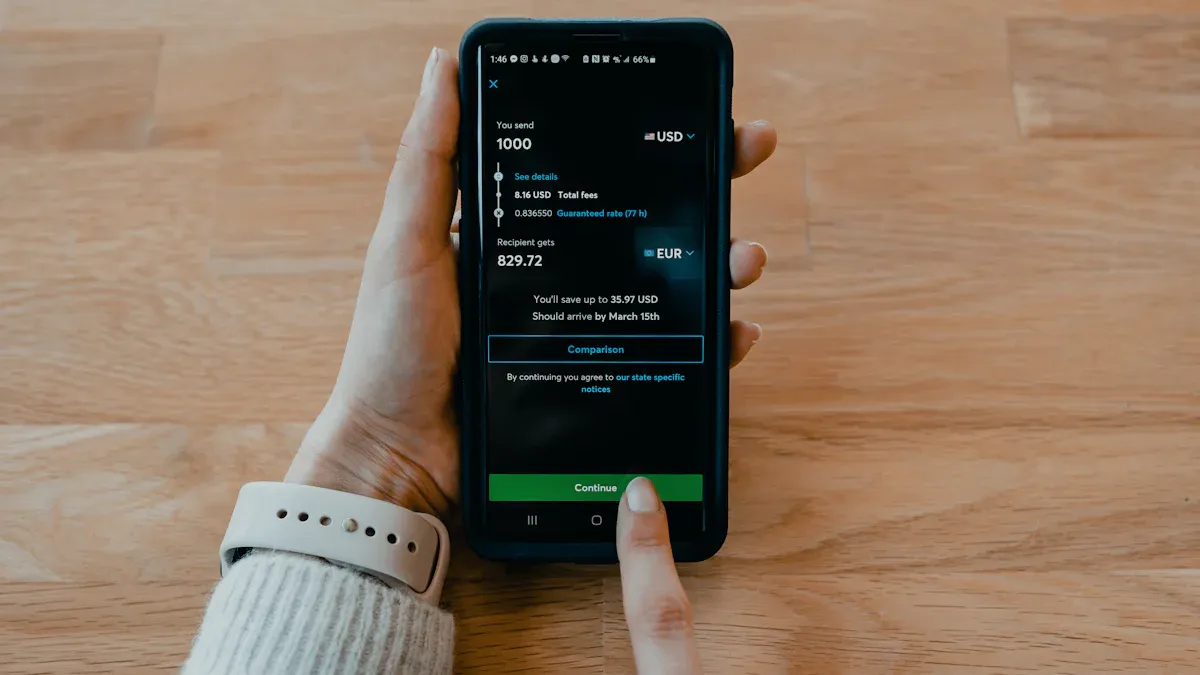

Panda Remit Transfer Process

Image Source: unsplash

Registration and Identity Verification

Before starting a transfer with Panda Remit, you need to complete account registration and identity verification. The entire process is conducted online, with no need to visit physical locations. The specific steps are as follows:

- You can register an account on the Panda Remit website or app, using an email or phone number to log in.

- After registration, the system will prompt you to complete personal information, including your name and contact details.

- You need to upload identity documents. Supported documents include mainland Chinese ID cards or residence permits issued by your country/region.

- The system will review your identity information. Once approved, you can officially proceed with Panda Remit transfers.

Tip: Prepare clear photos or scans of your ID in advance, ensuring the information is accurate and valid. Identity verification is a compliance requirement and a critical step in ensuring fund security.

Online Transfer Operation

The entire Panda Remit transfer process can be completed on a phone or computer, without visiting a Hong Kong bank branch. You simply need to follow these steps:

- Log in to your Panda Remit account and confirm that your account information is complete.

- On the main interface, select the sending and receiving locations. For example, you can choose Singapore as the sending location and China as the receiving location.

- Enter the amount you wish to transfer. Note that some payment channels, like OCBC Bank’s PayNow, have a daily payment limit of 1,000 SGD (approximately USD, subject to real-time exchange rates), so you may need to adjust the limit or transfer in batches.

- Click “Start Transfer”; if you need to change the sending location, the system will prompt you to resubmit account opening documents. You need to follow the prompts to complete the account opening process and upload your ID and proof of address (e.g., Chinese ID and a Singapore hotel address).

- Add recipient information. You can choose Alipay, WeChat, or a Chinese bank card, and provide the recipient’s name, bank card number, phone number, ID number, and transfer purpose.

- After binding recipient information, the system will generate Panda Remit’s UEN code and transfer remarks, displaying the total amount (including fees, typically 10 SGD, approximately USD).

- Open the OCBC Bank app, go to “Transfer and Pay,” select the PayNow payment method, manually enter the UEN code and transfer remarks, and complete the transfer.

- After confirming payment, funds typically arrive in the Chinese bank account within 2 minutes.

Notes:

- Transfer amounts and fees must be calculated within the daily limit.

- DDA fast payments may fail authorization; it’s recommended to prioritize PayNow.

- Ensure recipient information is accurate during transfers to avoid delays or loss of funds due to errors.

Progress Tracking and Common Issues

You can track transfer progress in real-time on the Panda Remit platform. The system displays the status of each transfer, including submitted, processing, and completed, allowing you to monitor fund movements and enhance security.

Common issues include:

- Credit card transfers have transaction limits, which vary by issuing bank, transaction type, and country. You need to confirm specific limits with your bank and Panda Remit in advance.

- Single transfers typically have an upper limit, but frequent use or completing account verification may increase your limit.

- Large transfers may incur additional fees or trigger anti-fraud reviews, so it’s advisable to understand relevant policies in advance.

- Prepaid cards can be used for international transfers, but terms and fees vary significantly. You should choose cards with low fees, favorable rates, and flexible limits, ensuring the recipient in China can access funds smoothly.

- Transfer fees and hidden costs need to be understood in advance, as rates and fees across services affect the final received amount.

- Transfer speed varies by payment method and bank processing times. Panda Remit transfers are generally faster than traditional Hong Kong banks, but delays may occur in special cases.

- Carefully verify recipient information during transfers to avoid fund loss or delays due to errors.

Suggestion: Before making a Panda Remit transfer, thoroughly review the platform’s fee details and limit policies, plan transfer amounts and frequency wisely, and ensure funds arrive safely and efficiently.

Payment Methods and Arrival Speed

Supported Methods (Alipay, WeChat, Bank Card)

You can choose multiple payment methods on the Panda Remit platform. The platform primarily supports Alipay, WeChat, and bank card payments. After registering a Panda Remit account, you can flexibly select payment channels based on your needs.

- If you choose Alipay, you need to enable the small-amount password-free payment feature in Alipay. This allows funds to arrive quickly with fewer steps.

- WeChat payments are equally convenient, ideal for scenarios where you want funds transferred directly to a WeChat wallet.

- Bank card payments cover over 500 banks in China. You simply provide the recipient’s name, bank card number, and related information, and funds will be transferred directly to the Chinese bank account.

Panda Remit integrates multiple payment channels. You can mix and match based on your needs, enhancing the flexibility and experience of cross-border transfers. Compared to Hong Kong banks, Panda Remit offers more diverse payment options, catering to various user needs.

Arrival Time

When using Panda Remit for transfers, the arrival speed is typically faster than Hong Kong banks. In most cases, funds can arrive in the recipient’s Chinese account within minutes.

Arrival times are influenced by the following factors:

- The payment method you choose. Alipay and WeChat payments are generally faster, while bank card payments may experience slight delays.

- The transfer amount. Larger amounts may require additional review, extending arrival times.

- Payment channel processing speed. Some banks or payment platforms may slow down during peak periods.

- Transfer timing. Transfers on weekdays are typically faster, while holidays or nighttime transfers may face delays.

| Payment Method | Estimated Arrival Time | Notes |

|---|---|---|

| Alipay | 2-10 minutes | Requires password-free payment enabled |

| 2-10 minutes | Ideal for small transfers | |

| Bank Card | 2-60 minutes | Depends on bank processing speed |

You can track transfer progress in real-time on the Panda Remit platform. The system displays the status of each transfer, allowing you to monitor fund movements. Overall, Panda Remit’s arrival speed is significantly faster than traditional Hong Kong banks, making it suitable for time-sensitive cross-border transfer needs.

Fees and Exchange Rates

Fee Standards

When using Panda Remit for transfers, you can enjoy relatively transparent and low fees. The platform sets tiered standards based on transfer amounts:

- For transfers of 500 USD or less, fees are a fixed amount, approximately tens of USD (specific amounts subject to real-time exchange rates).

- For transfers between 500 USD and 50,000 USD, fees decrease proportionally, automatically calculated based on the transfer amount, typically ranging from hundreds to thousands of USD.

- For transfers exceeding 50,000 USD, fees depend on the specific amount and transfer method; it’s recommended to contact Panda Remit customer service for confirmation.

Panda Remit focuses on the Asian market, with fees significantly lower than traditional channels like Hong Kong banks. For example, transferring from China to Singapore incurs a fixed fee of about 80 USD per transaction, notably lower than Hong Kong banks’ 200-300 USD standard. The platform also periodically offers fee discount coupons, and first-time users can enjoy fee waivers or other promotions. You can check the latest fee standards in real-time via the Panda Remit app, ensuring transparency.

| Item | Panda Remit | Hong Kong Banks and Other Platforms |

|---|---|---|

| Fees | As low as 9 USD | Fixed transfer fees + 0.6%-1.5% currency conversion fees |

| Arrival Time | As fast as 2 minutes, typically within 1 business day | Usually several hours to 1 business day |

Tip: Fee standards may vary by time and region; check the latest information through official channels before transferring.

Exchange Rate Explanation and Risks

Panda Remit provides real-time market exchange rates, typically 2%-3% higher than Hong Kong banks, helping you maximize fund value. The platform updates rates daily, clearly displaying fees, rate differences, and final received amounts before transfers. You can access the latest exchange rate information by opening the Panda Remit app, with a simple operation.

Panda Remit uses bank-grade encryption to ensure fund and information security. During the transfer process, the platform will remind you to be aware of exchange rate fluctuations and currency conversion risks. While Panda Remit’s rates are better than Hong Kong banks and arrival times are faster, cross-border transfers may still be affected by market fluctuations. You should focus on rate transparency and verify the final received amount to avoid losses due to rate changes.

Suggestion: Before transferring, check real-time exchange rates and fee details, plan transfer timing and amounts wisely to reduce exchange rate risks and ensure fund safety.

Security

Image Source: pexels

Technical Safeguards

When using Panda Remit, you can feel confident that the platform employs bank-grade security technology. The platform uses SSL encryption throughout to protect your account information and fund security. Panda Remit has also passed PCI DSS (Payment Card Industry Data Security Standard) certification, a globally recognized security standard in the financial industry. During transfers, all sensitive data is encrypted to prevent information leaks. The platform also features multi-factor authentication to ensure only you can operate the account. Panda Remit’s technical team continuously monitors system security, promptly identifying and addressing potential risks.

Compliance Credentials

Panda Remit holds a U.S. MSB (Money Services Business) financial license, granting it legal authority for cross-border transfers. Every transfer you make on the platform is supervised by relevant financial regulatory authorities. The platform is also backed by several well-known investment institutions, enhancing its financial strength and compliance capabilities. You can prioritize regulated transfer platforms to further ensure fund safety. Panda Remit continuously improves its compliance measures, committed to providing secure and reliable cross-border transfer services.

User Reviews

You can refer to user ratings on mainstream platforms to understand Panda Remit’s actual performance. Overall, users rate Panda Remit highly for its security and convenience. The ratings on major platforms are as follows:

| Platform | User Rating |

|---|---|

| Google Play | 4.8 |

| App Store | 4.5 |

| Trustpilot | 4.2 |

Positive user feedback focuses on the following points:

- Ideal for small currency exchange users, especially first-time users

- New users can use coupons for better exchange rates

- Low exchange rate losses and fast arrival times

Some negative feedback includes:

- Security depends on platform credentials, with some risks

- It’s recommended to prioritize platforms regulated by FCA or HKMA for fund safety

When choosing Panda Remit, you can evaluate its suitability for your cross-border transfer needs based on your requirements and risk tolerance.

When selecting Panda Remit for transfers, you should focus on the following key factors:

- Security: The platform uses encryption to ensure fund safety.

- Fees: Lower than Hong Kong banks, with no hidden costs.

- Service convenience and reliability: Positive user experience and high ratings.

- Transfer speed: Funds arrive in as little as a few minutes.

- Identity verification requirements: Simple document preparation.

Panda Remit is suitable for individuals needing small, frequent transfers to China. You should monitor exchange rate changes and plan transfer timing and amounts wisely.

FAQ

What payment methods does Panda Remit support?

You can choose Alipay, WeChat, or Chinese bank cards for receiving funds. The platform supports multiple payment channels, allowing you to select flexibly based on your needs.

How can I confirm receipt after a transfer?

You can check transfer progress in the Panda Remit app or website. The system displays the arrival status. The recipient will also receive a notification from the bank or payment platform.

What should I do if a transfer fails?

If a transfer fails, you should first check if the recipient information is correct. If issues persist, contact Panda Remit customer service, and the platform will assist in resolving them.

Are there amount limits with Panda Remit?

The maximum per transfer is 50,000 USD. Some payment channels, like PayNow, have a daily limit of 1,000 SGD (subject to real-time exchange rates); plan your transfer amounts accordingly.

How is transfer safety ensured?

Panda Remit uses SSL encryption and multi-factor authentication. The platform holds a U.S. MSB financial license, strictly adhering to compliance requirements, ensuring safe use and fund security.

You have a detailed understanding of how to use Panda Remit for money transfers, along with its advantages in service scope, fees, exchange rates, and security. You can now confidently make a choice, especially for small, frequent cross-border transfers, for which Panda Remit is indeed an efficient and economical option.

However, despite the convenience of Panda Remit, you might find its service scope and features limited when handling large sums of money or requiring more flexible global asset allocation. For instance, the $50,000 annual transfer limit may not meet your needs for large transactions, and its focus on the Asian market restricts your global financial operations. Furthermore, if you need to transfer funds from one overseas account to another or wish to exchange large amounts between different currencies, Panda Remit may not provide the most comprehensive solution.

To address these challenges, we recommend a more comprehensive and flexible global financial service platform: BiyaPay. BiyaPay offers ultra-low transfer fees as low as 0.5% and supports same-day remittance and arrival, greatly simplifying your cross-border fund management. Whether you need to make large transfers or want to conduct fast, low-cost exchanges between USD, HKD, and cryptocurrencies, BiyaPay provides a secure and transparent service. You can also use its real-time exchange rate lookup to complete transactions at the best possible rate. Register now to begin your new global financial journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.