- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Alipay Withdrawal Guide: Fees, Limits, and How to Avoid Them

Image Source: pexels

When withdrawing money from Alipay, you need to pay attention to fees and free withdrawal limits.

- Regular verified users share a free withdrawal limit of approximately 2,800 USD (calculated at 1 USD = 7.1 CNY, equivalent to 20,000 CNY) across all accounts under the same ID.

- Beyond this limit, each withdrawal incurs a 0.1% service fee, with a minimum of about 0.014 USD (0.1 CNY).

- You can use Ant Points to redeem additional free withdrawal limits, with each point convertible to 1 USD of free withdrawal allowance.

Since 2016, third-party payment platforms like Alipay have started charging withdrawal fees, with limited free allowances, making fees for large withdrawals common. This Alipay withdrawal guide helps you understand how to withdraw efficiently and minimize fees.

Key Points

- Verified Alipay users enjoy a free withdrawal limit of about 2,800 USD; withdrawals exceeding this incur a 0.1% fee, with a minimum of 0.014 USD.

- Redeeming free withdrawal limits with Alipay points, where 1 point equals 1 USD of free allowance, effectively reduces withdrawal fees.

- Transferring funds to Yu’e Bao for withdrawals not only avoids fees but also earns some returns, making it a cost-saving method.

- Corporate users benefit from more favorable withdrawal fees, ideal for frequent or large withdrawals, and binding multiple bank cards can distribute withdrawal amounts.

- Avoid non-compliant operations and plan withdrawal amounts and frequency wisely to ensure account safety and prevent financial or legal risks.

Alipay Withdrawal Guide

Fee Standards

When withdrawing from Alipay, you first need to understand the fee standards for different account types. According to the Alipay withdrawal guide, fees are divided into personal and corporate accounts.

- Personal accounts have a daily free withdrawal limit of about 7,040 USD (50,000 CNY, at 1 USD = 7.1 CNY). Beyond this, a 0.1% fee is charged per withdrawal. For example, withdrawing 10,000 USD incurs a 10 USD fee.

- Corporate account fee standards differ from personal accounts. Generally, corporate account fees are close to 0.1%, but specific rates vary based on merchant agreements. Corporate accounts also offer free withdrawal limits for high-frequency withdrawals and other preferential measures.

- Whether you withdraw to a bank card or from your Alipay balance, the fee rate is based on the withdrawal amount, with the channel having little impact on the rate.

You can refer to the Alipay withdrawal guide to choose the account type and withdrawal method best suited for you.

Free Withdrawal Limits

As a regular verified user, you can benefit from the free withdrawal limit policy outlined in the Alipay withdrawal guide.

- All verified accounts under the same ID share a free withdrawal limit of about 2,800 USD (20,000 CNY).

- Non-verified accounts do not qualify for free withdrawal limits and incur a 0.1% service fee for bank card withdrawals, with a minimum of 0.014 USD (0.1 CNY).

- Corporate accounts typically have higher free withdrawal limits, suitable for users with frequent or large withdrawals.

You can redeem additional free withdrawal limits using Ant Points, with 1 point equaling 1 USD of free allowance. This can effectively reduce withdrawal costs.

Excess Charges

When your withdrawal amount exceeds the free limit, Alipay charges a fee. You can refer to the table below to understand limits and charges for different withdrawal methods and account types:

| Limit Type | Description |

|---|---|

| Single Withdrawal Limit | Up to 7,040 USD (50,000 CNY) per transaction |

| Real-Time/2-Hour Arrival Daily Limit | Up to 21,130 USD (150,000 CNY) per day |

| Next-Day Arrival | Single transaction still capped at 7,040 USD, but multiple withdrawals possible with no daily limit |

| Shared Free Limit | Multiple verified accounts under the same ID share a 2,800 USD free limit; excess incurs a 0.1% fee, minimum 0.014 USD |

| Non-Verified Account Restrictions | No free limit; bank card transfers incur a 0.1% fee, minimum 0.014 USD |

| Central Bank Draft Restrictions | Single transfer not exceeding 141 USD (1,000 CNY), annual cumulative transfers not exceeding 1,410 USD, single consumption not exceeding 705 USD, monthly cumulative consumption not exceeding 1,410 USD |

You should note that while there’s no upper limit on withdrawal amounts, each transaction incurs a minimum fee. Corporate accounts have more favorable fee structures, suitable for frequent and large withdrawals. You can follow the Alipay withdrawal guide to plan withdrawal amounts and frequency to reduce fee expenses. If you use a Hong Kong bank as the receiving account, the fee standards are the same as for mainland Chinese banks, and the withdrawal process is identical.

Methods to Avoid Fees

Image Source: pexels

When withdrawing from Alipay, you can use several methods to effectively reduce or even eliminate fees. Below are three common and practical methods.

Points Redemption

You can use Alipay points to redeem free withdrawal limits. Whenever you make payments, invest, or pay bills through Alipay, the system automatically accumulates Ant Points. You simply need to visit the Alipay Points Mall and select the “Free Withdrawal Limit” redemption option. Each point can be redeemed for 1 USD (calculated at 1 USD = 7.1 CNY) of free withdrawal allowance. This way, you can flexibly increase your free withdrawal limit based on your points balance, reducing fees during withdrawals.

Tip: You can earn more points through daily spending, bill payments, or purchasing financial products to gain additional free withdrawal limits.

Yu’e Bao Transfer

You can also transfer your Alipay balance to Yu’e Bao and then withdraw to a bank card. This method not only avoids withdrawal fees but also allows your funds to earn returns in Yu’e Bao. You simply select “Yu’e Bao” on the Alipay homepage, transfer your balance, and then click “Transfer Out” to a bank card.

If you’ve linked a Hong Kong bank account, the withdrawal process is the same as for Chinese bank accounts, with identical fee standards. You can use Yu’e Bao’s flexible transfer-out feature for efficient fund movement.

Note: Yu’e Bao transfers to bank cards are usually processed instantly, but some banks may experience delays. You can plan withdrawal timing based on your funding needs.

Merchant Certification

If you’re a merchant user, you can enjoy more free withdrawal options through a certified merchant account. You can refer to the following methods:

- Use Yu’e Bao for withdrawal transfers. You transfer your Alipay balance to Yu’e Bao and then withdraw to a bank card, with the entire process being free, and Yu’e Bao funds earning returns.

- Upgrade to a certified merchant account. You receive a monthly free withdrawal limit, with no fees for withdrawals within this limit and fees only for excess amounts.

- Bind multiple bank cards to distribute withdrawals. You can split withdrawal amounts across multiple bank cards, such as Chinese and Hong Kong bank accounts, to save on fees.

- Take advantage of Alipay’s limited-time fee-free promotions. You can seize these opportunities for free withdrawals.

You can also transfer funds from Alipay to a MyBank account and then withdraw to a bank card. This process typically incurs no withdrawal fees, making it ideal for merchants with frequent withdrawals.

When choosing a withdrawal method, pay attention to processing times and security. Different methods have varying processing speeds, so select based on your needs.

Additionally, you can further reduce withdrawal fees by participating in Alipay and Huabei promotional activities. For example, during major shopping festivals, Alipay and Huabei offer interest-free coupons and installment promotions. You can use these activities for spending and installments to reduce withdrawal needs, indirectly lowering fees. Properly utilizing Huabei’s interest-free periods and installment features to optimize repayment plans can also reduce withdrawal frequency and fee burdens.

You can combine the above methods to flexibly choose the most suitable free withdrawal option. The Alipay withdrawal guide provides practical suggestions to help you save costs in daily fund management.

Operation Process

Image Source: unsplash

Points Redemption Process

You can follow these steps to redeem free withdrawal limits with Alipay points:

- Open the Alipay app, search for and enter the “Pay with Rewards” official mini-program.

- On the mini-program homepage, select the free withdrawal limit you wish to redeem.

- Click “Redeem Now” and use your membership points to complete the redemption.

Reminder: You can earn points through daily spending and bill payments. Each point can be redeemed for 1 USD of free withdrawal limit (at 1 USD = 7.1 CNY), effective immediately upon redemption.

Yu’e Bao Withdrawal Process

To withdraw funds from Yu’e Bao to a bank card, you can follow these steps:

- On the Alipay homepage, click “Yu’e Bao” to access the asset page.

- Select “Transfer Out” and enter the amount you wish to withdraw.

- Choose the receiving bank card (e.g., a Hong Kong bank account), confirm the details, and submit the request.

- Wait for the system to process; funds are typically credited instantly, though some banks may have delays.

When withdrawing, verify bank card details in advance to ensure fund safety. The Yu’e Bao withdrawal process for Hong Kong bank accounts is the same as for mainland Chinese accounts, with identical fee standards.

Merchant Certification Process

If you have a certified merchant account, the withdrawal process involves two main steps:

- Account Certification: You need to add a corporate UnionPay or credit card, log into the account backend, link the bank card, provide the registered phone number, and enter the verification code. For credit cards, wait for the 4-digit code on your statement and enter it to complete certification.

- Bind Withdrawal Card: You can link a corporate bank account (ensuring it can receive USD and matches the corporate name) or a Hong Kong personal bank account or Payoneer corporate USD account. Submit relevant bank details and supporting documents to complete the binding.

During the process, carefully verify bank details to ensure account safety and avoid withdrawal failures or delays.

Risks and Pitfalls

Non-Compliance Risks

When withdrawing from Alipay, you must comply with platform rules. Non-compliant operations can lead to serious consequences.

- Your account may be frozen, preventing normal use.

- Account functions may be restricted, affecting daily fund transfers.

- Personal information may be at risk of leakage, potentially exploited by malicious actors.

- Your personal credit may be affected, impacting future loan and credit card applications.

- Engaging in activities like money laundering, account renting/selling, assisting with account unfreezing, trading virtual currencies, or transferring to unknown accounts may involve illegal activities.

- Money laundering activities are linked to fraud, gambling, or money laundering, and public security authorities may freeze related accounts.

- Renting/selling accounts or assisting with unfreezing may lead to legal liability.

- Trading virtual currencies or transferring to unknown accounts carries risks of financial loss and legal consequences.

Alipay and Chinese public security authorities remind you to use accounts responsibly, avoid high-risk operations, and protect fund safety.

Common Pitfalls

Many users have misconceptions during withdrawals. You need to be aware of the following:

- You may think all withdrawals are free. In reality, regular verified users have a 2,800 USD (20,000 CNY, at 1 USD = 7.1 CNY) free withdrawal limit, with a 0.1% fee on excess amounts, minimum 0.014 USD (0.1 CNY).

- If you frequently make large withdrawals, financial institutions will closely monitor your account. Cumulative cash transactions exceeding 141,000 USD (1 million CNY) in a short period or single cash transactions over 7,040 USD (50,000 CNY) may flag your account for scrutiny by banks (e.g., Hong Kong banks).

- If you frequently open and close accounts or intentionally split large withdrawals into smaller ones, banks and tax authorities may view your fund flows as suspicious, potentially triggering joint investigations.

- If the source and purpose of funds are unclear, your account may be questioned, facing fines or criminal liability.

When withdrawing, plan amounts and frequency carefully to avoid being flagged as a suspicious account. Use legitimate channels and comply with Chinese regulations to ensure fund safety.

Pros and Cons Comparison

Method Comparison

When choosing an Alipay withdrawal method, you can refer to the table below to understand the pros and cons of different methods. This helps you select the most suitable method based on your needs:

| Withdrawal Method | Operation Steps | Pros | Cons |

|---|---|---|---|

| Using Yu’e Bao | Search “Yu’e Bao” in Alipay, select transfer in and out | Instant arrival, supports withdrawals to any bank card (e.g., Hong Kong banks) | No significant drawbacks |

| Points Redemption | Redeem free withdrawal limits with Alipay membership points | Easy to operate, suitable for withdrawals to any bank card | Requires points, redeemed limits have expiration dates |

| Becoming a Merchant | Apply via Alipay merchant services, follow prompts | Free withdrawals for collection code amounts, instant point redemption, convenient | Suitable for users with physical stores |

| Enabling Intimate Pay | Search “Intimate Pay” in Alipay, issue a family card | One-time setup avoids transfer fees | Limited to close relationships, smaller scope |

You can also compare Alipay’s withdrawal policies with other mainstream payment platforms. Alipay’s free withdrawal limit for personal users is 20,000 USD (at 1 USD = 7.1 CNY), far higher than WeChat Pay’s 1,000 USD. Excess fees for both are 0.1%. Alipay also supports redeeming free withdrawal limits with points, offering broader policy coverage. The table below compares major platforms:

| Payment Platform | Free Withdrawal Limit | Excess Withdrawal Fee | Free Limit Acquisition | Fee Reduction Policies and Impact |

|---|---|---|---|---|

| Alipay | 20,000 USD | 0.1% | Points redemption | Fee reduction extended to September 30, 2025, with over 210 billion USD in concessions, benefiting 54 million merchants |

| WeChat Pay | 1,000 USD | 0.1% | Activity-based point redemption | Requires purchasing a physical collection code to activate point redemption |

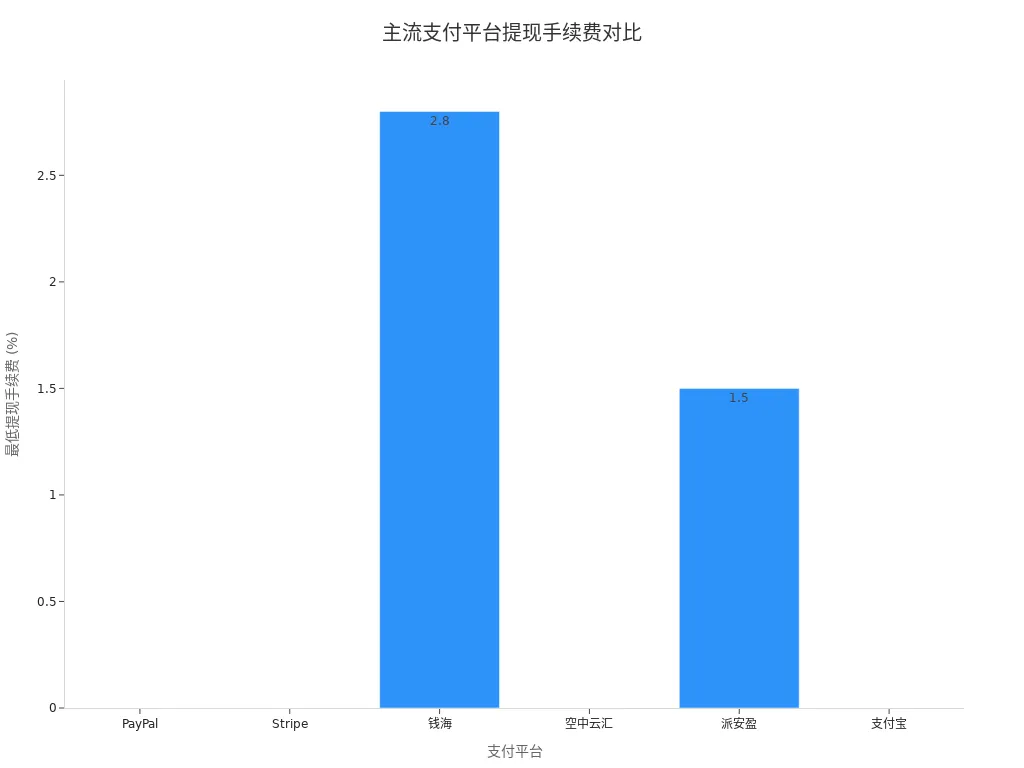

You can also refer to the chart below for a comparison of minimum withdrawal fees across mainstream payment platforms:

User Recommendations

When performing withdrawals, you can follow these suggestions based on your account type and funding needs:

- If you’re a personal user, prioritize points redemption and Yu’e Bao withdrawals for low fees and fast processing.

- If you’re a corporate user, pay attention to fee standards for withdrawals to third-party bank cards or large amounts, and operate in batches.

- Choose to withdraw between 9:00 AM and 6:00 PM on weekdays, as banks like Hong Kong banks process faster during these hours, with potential delays on holidays.

- Avoid single large withdrawals; batch operations can reduce risks and processing times.

- Ensure account safety by regularly checking account details to prevent withdrawal failures or additional fees.

When choosing a withdrawal method, carefully read platform instructions and plan fund transfers flexibly based on your situation to ensure safety and efficiency.

When using Alipay for withdrawals, you should pay attention to fees and free withdrawal limits. You can reduce fees through points redemption and Yu’e Bao transfers. Note that Alipay collection code withdrawals remain free, with the policy extended to September 30, 2025, with no withdrawal amount restrictions. You can follow these suggestions to choose the optimal withdrawal method:

- Withdraw during weekday mornings or evenings to increase success rates.

- Choose “Instant Arrival” or “Real-Time Arrival” based on your needs.

- Regularly check account and withdrawal records to ensure fund safety.

It’s recommended to stay updated with Alipay’s latest announcements, plan withdrawal activities wisely, and ensure secure and compliant operations.

FAQ

How long does it take to withdraw to a Hong Kong bank account via Alipay?

You can typically receive funds within minutes. During peak periods, Hong Kong banks may experience delays. You can plan withdrawals in advance to avoid waiting.

Reminder: Withdrawals during holidays or at night may process more slowly.

How are fees calculated after exceeding the free withdrawal limit?

After exceeding the 2,800 USD (at 1 USD = 7.1 CNY) free withdrawal limit, each withdrawal incurs a 0.1% fee, with a minimum of 0.014 USD. You can redeem additional free limits with points.

Can non-verified accounts withdraw for free?

You cannot enjoy free withdrawal limits. Each withdrawal incurs a 0.1% fee, with a minimum of 0.014 USD. You can complete identity verification to access the 2,800 USD free withdrawal limit.

How do I redeem free withdrawal limits with points?

You can access the “Pay with Rewards” mini-program in the Alipay app. Use 1 point to redeem 1 USD of free withdrawal limit (at 1 USD = 7.1 CNY). The limit takes effect immediately.

Are there limits on withdrawals to Hong Kong bank accounts?

You can withdraw up to 7,040 USD (50,000 CNY, at 1 USD = 7.1 CNY) per transaction. The daily maximum is 21,130 USD (150,000 CNY). You can withdraw in batches to meet larger needs.

You’ve gained a comprehensive understanding of Alipay’s withdrawal rules, including fee standards, free limits, and how to use methods like points redemption and Yu’e Bao transfers to avoid fees. This guide provides you with detailed strategies to manage your funds more efficiently and economically.

However, while Alipay offers convenience for domestic withdrawals, you might encounter significant limitations and pain points when dealing with large-scale cross-border fund transfers. For instance, the withdrawal limits mentioned in the guide (a daily maximum of around $21,130 USD) might be insufficient for users with large financial needs. When withdrawing funds to a Hong Kong bank account, you might still face complex procedures and potential losses due to exchange rates. If you need to transfer funds from Alipay to an overseas bank account, or exchange RMB for multiple currencies like USD and HKD, Alipay’s features might not fully meet your needs.

To solve these challenges, you can choose a more efficient and economical global financial service platform—BiyaPay。BiyaPay offers remittance fees as low as 0.5% and supports same-day transfers, allowing you to handle large fund transfers at a much lower cost without being restricted by Alipay’s withdrawal limits. On the BiyaPay platform, you can flexibly exchange between USD, HKD, and cryptocurrencies, and use these funds directly for international payments. Its real-time exchange rate lookup feature allows you to always get the best exchange rates, avoiding unnecessary losses. Register now and start your new global financial journey, making every fund transfer more effortless and cost-effective.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.