- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Guide to Opening a Bank Account in Thailand: Bangkok Bank, Kasikornbank, Krungsri Bank, Siam Commercial Bank – BiyaPay

Image Source: pexels

You can open a bank account in Thailand, but you must meet stricter regulations. Starting in 2025, Thai banks have tightened scrutiny for foreigners opening accounts, and short-term tourist visas are generally not accepted. Banks will verify your identity information, requiring complete and up-to-date documents. Some nationalities, such as Russian, may face restrictions due to international policies. You must be present in person and prepare all necessary documents.

Key Points

- Foreigners opening an account in Thailand must be present in person, with a valid passport, visa, and proof of residence, ensuring all documents are authentic and valid.

- Choose the appropriate account type, such as a savings account or fixed deposit, based on your personal needs and minimum deposit requirements.

- Confirm the required document checklist with the bank in advance to ensure complete documentation, which can effectively improve account opening efficiency and save time.

- Understand the service quality and branch convenience of each bank to select one that suits your needs, enhancing your daily financial experience.

- After opening an account, securely store your bank card and related information to ensure account safety and prevent information leaks.

Eligibility for Opening a Bank Account in Thailand

Conditions for Foreigners

You can open a bank account in Thailand, but you must meet certain conditions. You must personally visit the bank to complete the process, as delegation to others is not allowed. Banks will strictly verify your identity information. You need to prepare a valid passport and visa. Most banks also require proof of residence, such as utility bills or a rental contract. If you work in Thailand, banks may request a work permit. Some banks have additional requirements for specific nationalities, with policies adjusting based on international circumstances.

Tip: When preparing documents, it’s advisable to confirm the required document checklist with the target bank in advance. Different branches may have slight variations, and preparing in advance can save time.

The table below summarizes the common documents required for opening a bank account in Thailand:

| Type | Required Documents |

|---|---|

| Foreign Nationality | Valid passport, visa, proof of residence (e.g., utility bill), sometimes a work permit |

When opening a bank account in Thailand, you must ensure all documents are authentic and valid. Bank staff will verify originals on-site and may request copies.

Account Types and Minimum Amounts

When opening a bank account in Thailand, you can choose from different account types. The most common include savings accounts, current accounts, fixed deposit accounts, and foreign currency deposit accounts. Different banks offer slightly different account types. The table below shows the account types offered by major banks for foreigners:

| Bank Name | Account Types |

|---|---|

| Bangkok Bank | Savings account, current account, fixed deposit, foreign currency deposit account |

| TTB Bank | Savings account, current account, fixed deposit, foreign currency deposit account |

| Kasikorn Bank | Savings account, current account, foreign currency deposit account |

| Krungsri Bank | Savings account, current account, fixed deposit |

| UOB Bank | Savings account, current account, foreign currency deposit account |

When choosing an account type, you can decide based on your actual needs. If you only need it for daily expenses and receiving payments, a savings account is the most common. If you have investment or foreign currency needs, consider a fixed deposit or foreign currency account.

Different account types have varying minimum opening deposit requirements. Generally, savings and current accounts have lower minimum deposits, typically between 50-100 USD. Fixed deposit and foreign currency accounts have higher thresholds, with some banks requiring 500 USD or more. You can inquire about specific amount requirements with bank staff before opening an account.

Reminder: Some banks may decide whether to allow certain account types based on your visa type and proof of residence. When preparing materials for opening a bank account in Thailand, prioritize a savings account for a simpler process.

After completing the account opening process, you will receive a passbook and a debit card. Some banks also provide online banking services, allowing you to manage your account anytime.

Required Documents for Opening an Account

Image Source: pexels

Passport and Visa

When opening a bank account in Thailand, a passport and a valid visa are the most basic required documents. Bank staff will check your passport original, confirming the visa type and validity period. Most banks only accept long-term visas, such as work visas, student visas, or Thailand Privilege visas. Short-term tourist visas generally do not meet the requirements for opening an account. You also need to prepare passport copies, and some banks may require your bank statements from the past six months, translated and certified in Thailand. If you work in Thailand, you may also need to provide a company registration certificate or corporate tax filing documents as supplementary materials.

Proof of Residence

Proof of residence is one of the most critical documents in the process of opening a bank account in Thailand. Banks will require documents proving your actual residence in Thailand. Common proofs of residence include rental agreements, utility bills, a Thai phone number, and a local residential address. Different banks have slightly different requirements for proof of residence. The table below shows the types of proof of residence accepted by major banks:

| Document Description | Siam Commercial Bank | Kasikorn Bank | Bangkok Bank |

|---|---|---|---|

| Passport with Thailand Privilege Visa | ✓ | ✓ | ✓ |

| Thailand Privilege Membership Card + Certification Letter | ✓ | ✓ | ✓ |

| Driver’s License / Home Country ID | ✓ | ||

| Rental Agreement / Property Ownership Document / Consent Letter | ✓ | ||

| Utility Bill | ✓ | ||

| Thai Phone Number | ✓ | ✓ | ✓ |

| Local Residential Address (Non-Hotel/Commercial) | ✓ | ✓ | ✓ |

When preparing proof of residence, prioritize rental agreements or utility bills, ensuring your name and address are listed on the documents.

Other Supporting Documents

In some special cases, you may need to provide additional documents. You may need to submit a work permit, especially if you hold a work visa. Banks may sometimes require proof of income, such as pay stubs or bank statements from mainland China. If you cannot provide standard proof of residence, you can apply for a residence certificate from the local immigration office. When preparing documents, it’s advisable to communicate with the bank in advance to ensure all documents are complete, avoiding delays due to missing materials.

Tip: The more complete your documents are when opening a bank account in Thailand, the faster the review process. Preparing all supporting documents in advance can significantly improve your chances of success.

Thailand Bank Account Opening Process

Image Source: unsplash

When opening a bank account in Thailand, you must be present in person. Banks do not accept applications by proxy. The entire process requires you to follow the bank’s specific requirements step-by-step. Below, I will detail each step to help you complete the account opening smoothly.

Appointment and Branch Visit

You can book an appointment in advance through the bank’s website, phone, or app. Some banks support online booking, while others require you to visit the branch directly. It’s recommended to choose a non-peak time, such as weekday mornings or afternoons, to reduce waiting time. You need to bring all required documents, including your passport, visa, and proof of residence. Upon arriving at the bank, you can take a queue number at the counter and wait for your turn.

Tip: When choosing a branch, prioritize those that are conveniently located near your residence or workplace to make future transactions easier.

Form Filling and Verification

When it’s your turn, bank staff will provide an account opening application form. You need to accurately fill in personal information, including your name, date of birth, nationality, contact details, and residential address in Thailand. Staff will verify the originals of your passport, visa, and proof of residence and may request copies. Some banks will also require you to complete a tax residency declaration, confirming your tax status in mainland China or other countries.

You need to make an initial deposit as per the bank’s requirements. The initial deposit amount varies by bank, typically ranging from 50-100 USD. Staff will introduce account types, features, and related fees. You can proactively ask about details such as ATM withdrawal and account maintenance fees. The form filling and verification process takes about 30-40 minutes. If your documents are complete, the process will be smoother.

- Check eligibility requirements: You need a valid passport and non-immigrant visa; a work permit or proof of residence can strengthen your application.

- Prepare necessary documents: Including passport, proof of address, work permit or residence certificate, and tax identification number.

- Visit a local branch: Choose a bank and bring the required documents, preferably during non-peak hours.

- Fill out the application form: Provide accurate information, and bank staff will explain the account’s features.

- Make an initial deposit: Most banks require an initial deposit, with amounts varying by bank.

- Receive your bank card and online banking information: You can ask about setting up online banking passwords and mobile banking apps.

- Understand bank fees: Proactively inquire about any account-related fees, especially ATM withdrawal fees.

- Familiarize yourself with bank hours and ATM locations: Banks typically operate from 8:30 AM to 3:30 PM on weekdays, with ATMs widely available.

Account Activation and Card Collection

After completing the forms and document verification, the bank will open your account. Staff will activate your account on-site and issue a passbook and debit card. You can set your card’s PIN immediately. Some banks will assist you in registering for online and mobile banking services. You can test the account on-site to ensure it functions properly.

- The typical process for foreigners to open a bank account in Thailand takes about one hour, provided you submit all required documents.

- After receiving your bank card, you can make your first deposit and check your balance at the counter or ATM.

- It’s recommended to keep all account opening documents and bank-issued materials for future reference in case of issues.

Note: After activating your account, ensure you securely store your bank card and related passwords. Do not disclose personal information to ensure account security.

By following the above process, you can successfully open a bank account in Thailand. During the process, prepare all documents in advance and maintain good communication with bank staff to significantly improve efficiency and save time and effort.

Bangkok Bank Account Opening Guide

Process Features

When opening an account with Bangkok Bank, you’ll find the bank very foreigner-friendly. Bangkok Bank has extensive experience serving foreign clients. You may encounter English-speaking staff at the counter who will assist you in understanding each step of the process. Bangkok Bank also offers international services, making international remittances convenient. You only need to prepare your passport, long-term visa, and proof of residence and visit a branch in person. The bank will thoroughly verify your documents to ensure accuracy. You can reduce waiting time by booking an appointment. After opening the account, you’ll receive a passbook, debit card, and access to online banking services for easy account management.

- Bangkok Bank has extensive experience with foreign clients and a clear process.

- English-speaking staff help ensure smooth communication.

- Convenient international remittance services are ideal for clients with cross-border needs.

Pros and Cons

When opening an account with Bangkok Bank, you can enjoy several advantages but should also be aware of some drawbacks.

Pros:

- Transfers and withdrawals using a Thai account typically incur no additional fees.

- Convenient mobile banking services allow you to manage funds anytime.

- Bangkok Bank accounts meet the requirements for long-term residency visas.

Cons:

- You may encounter language barriers, as some services are primarily in Thai.

- Account opening regulations in Bangkok are stricter than in other cities, with more detailed document reviews.

Notes

When opening an account with Bangkok Bank, pay special attention to the following requirements. The table below summarizes the key points:

| Requirement Type | Description |

|---|---|

| Visa Type | You need a long-term or non-immigrant visa. |

| Marital Status | Marriage to a Thai national can serve as supporting documentation. |

| Property Ownership | Owning property in Thailand increases your chances of success. |

| Tourist Visa Restrictions | Foreign tourists with tourist or destination visas cannot open an account. |

When preparing documents, confirm specific requirements with the branch in advance. Complete and accurate documentation can significantly improve account opening efficiency.

Kasikorn Bank Account Opening Guide

Process Features

When opening an account with Kasikorn Bank, you’ll notice the process differs slightly from other major Thai banks. You must be present in person with your passport, valid visa, and proof of residence. Kasikorn Bank typically requires you to purchase a one-year personal accident insurance policy costing approximately 70 USD, with renewal optional in the second year. You’ll also need to pay card and SMS withdrawal fees. Bank staff will assist you in filling out the application form, verifying documents, and guiding you through the initial deposit. You can collect a passbook and ATM card at the counter and set your PIN on-site. Kasikorn Bank is relatively lenient regarding work permits, with some branches not requiring them. You can book an appointment via the app to save queuing time.

| Bank Name | Additional Fees and Requirements |

|---|---|

| Kasikorn Bank | One-year insurance purchase required (~70 USD), card fees, ATM fees, SMS fees |

| Other Major Banks | Typically no insurance requirement, some do not require work permits |

Tip: When preparing documents, confirm with the branch in advance whether insurance and work permits are required to avoid delays due to policy differences.

Pros and Cons

When opening an account with Kasikorn Bank, you can enjoy unique advantages but should also be aware of potential challenges. Kasikorn Bank has no strict minimum deposit requirement, allowing flexibility in deposit amounts. You can easily obtain a passbook and ATM card, making account management convenient. The Kasikorn Bank app is feature-rich, ideal for daily transfers and spending. However, popular branches may have long queues, so you may need to book an appointment. Some branches are stricter with applicants without work permits, which may pose challenges during the process.

| Pros | Cons |

|---|---|

| No minimum deposit requirement | Long queues at popular branches |

| Easy access to passbook and ATM card | Potential difficulties for applicants without work permits |

Note: When choosing a branch, avoid peak hours in city centers and prioritize conveniently located branches.

Notes

When opening an account with Kasikorn Bank, pay attention to insurance fees and document requirements. You must be present in person, and documents must be authentic and valid. Some branches may require bank statements from mainland China or licensed Hong Kong banks as supporting proof. After opening the account, securely store your passbook and bank card to prevent information leaks. The Kasikorn Bank app supports multiple languages, allowing you to check balances and transfer funds anytime. When using ATMs, note the fee standards, as some transactions may incur 1-2 USD fees. If you have international remittance needs, consult bank staff in advance to understand the process and fees.

Reminder: Before opening an account, thoroughly understand branch policies and fee standards, and choose an account type that suits your needs.

Krungsri Bank Account Opening Guide

Process Features

When opening an account with Krungsri Bank, the process is relatively straightforward. You must be present in person with your passport, valid visa, and proof of residence. Some Krungsri Bank branches offer English services, making communication easier. After filling out the application form, staff will verify your documents. You need to make an initial deposit, typically 50-100 USD. You can collect a passbook and debit card on-site. Some branches will assist with registering for online banking services. If you have international remittance needs, consult staff about the specific process.

Tip: When choosing a branch, prioritize those with convenient access. Some branches are more foreigner-friendly, so it’s advisable to call and confirm in advance.

Pros and Cons

When opening an account with Krungsri Bank, you can experience unique advantages but should also note potential drawbacks.

Pros:

- The process is relatively efficient with short waiting times.

- You can access basic account services for daily spending and transfers.

- Some Krungsri Bank branches are flexible with proof of residence requirements.

Cons:

- English services may be limited at some branches, making communication challenging.

- Krungsri Bank has fewer branches than Bangkok Bank, which may be less convenient in some areas.

- If you need a foreign currency account, some branches may not offer this, so confirm in advance.

Notes

When preparing documents, ensure all files are authentic and valid. Bank statements from mainland China or licensed Hong Kong banks can serve as supporting documents. Pay attention to initial deposit amounts and account maintenance fees when opening an account. Some Krungsri Bank branches have specific visa requirements, so confirm with the branch in advance. For international remittances, understand the related fees, typically 10-30 USD. After receiving your bank card, store it securely to prevent information leaks. If you encounter issues, contact the bank’s customer service for assistance.

Note: Before opening an account, thoroughly understand branch policies and fee standards, and choose an account type that suits your needs.

CIMB Thai Bank Account Opening Guide

Process Features

When opening an account with CIMB Thai Bank, the process is relatively straightforward. You only need to be present in person with your passport or citizen ID. The bank requires you to be at least 15 years old to open an account. You can choose to open a personal savings account, current account, or joint account. Bank staff will assist you in filling out the application form and verifying documents. You need to make an initial deposit, typically 50-100 USD. You can collect a debit card and passbook on-site. Some branches offer English services for easier communication. You can also register for online banking to manage your account and funds anytime.

Tip: When preparing documents, confirm the required document checklist with the branch in advance. Some branches are flexible with proof of residence, allowing rental agreements or utility bills as supporting documents.

- You must be present in person to complete the account opening process.

- You need to provide a passport or citizen ID.

- You must be at least 15 years old.

- You can choose a personal savings account, current account, or joint account.

- You need to make an initial deposit, typically 50-100 USD.

Pros and Cons

When opening an account with CIMB Thai Bank, you can enjoy unique advantages but should also note potential drawbacks.

Pros:

- You can open an account with just a visitor visa, which has a lower threshold.

- You can access online banking services for convenient fund management.

- CIMB Thai Bank is one of Southeast Asia’s largest banking groups, offering a wide range of financial products and transparent services.

- You can choose savings or fixed deposit accounts with competitive personal loan rates.

Cons:

- Some account types have high minimum deposit requirements.

- Debit cards have limitations for online shopping and international transfers, with some features not supporting cross-border spending.

- English services may be limited at some branches, potentially causing communication difficulties.

Note: When choosing an account type, prioritize savings accounts for a simpler process. For international remittance needs, consult bank staff in advance to understand the process and fees.

Notes

When opening an account with CIMB Thai Bank, pay attention to the following details. You must be present in person, and documents must be authentic and valid. Bank statements from mainland China or licensed Hong Kong banks can serve as supporting documents. Note the initial deposit amount and account maintenance fees. Some branches have specific visa requirements, so confirm with the branch in advance. For international remittances, understand the related fees, typically 10-30 USD. After receiving your bank card, store it securely to prevent information leaks. If you encounter issues, contact the bank’s customer service for assistance.

- You must be present in person and cannot delegate the process.

- You need to prepare a passport, visa, and proof of residence.

- Bank statements from mainland China or licensed Hong Kong banks can serve as supporting documents.

- Understand account maintenance fees and international remittance fees, typically 10-30 USD.

Reminder: Before opening an account, thoroughly understand branch policies and fee standards, and choose an account type that suits your needs. For special requirements, communicate with the bank in advance to improve efficiency.

Fee Details

Card and Passbook Fees

When opening a bank account in Thailand, you typically need to pay card and passbook fees. Most banks charge a one-time card fee when issuing a debit card, usually 5-10 USD. Some banks charge a passbook issuance fee of 2-5 USD. Fees vary slightly by bank and branch. Confirm the exact amounts with staff during the process. Some banks charge different fees based on card types (e.g., UnionPay, Visa, Mastercard), with international cards incurring higher fees.

Account Maintenance Fees

While holding a Thai bank account, some banks charge account maintenance fees. Savings account maintenance fees are typically low, around 1-2 USD per month. Some banks charge additional management fees for accounts below the minimum balance. Inactive accounts may incur dormant account fees. You can avoid extra fees by regularly depositing funds or keeping the account active. Maintenance fee standards vary by bank, so inquire in detail before opening an account.

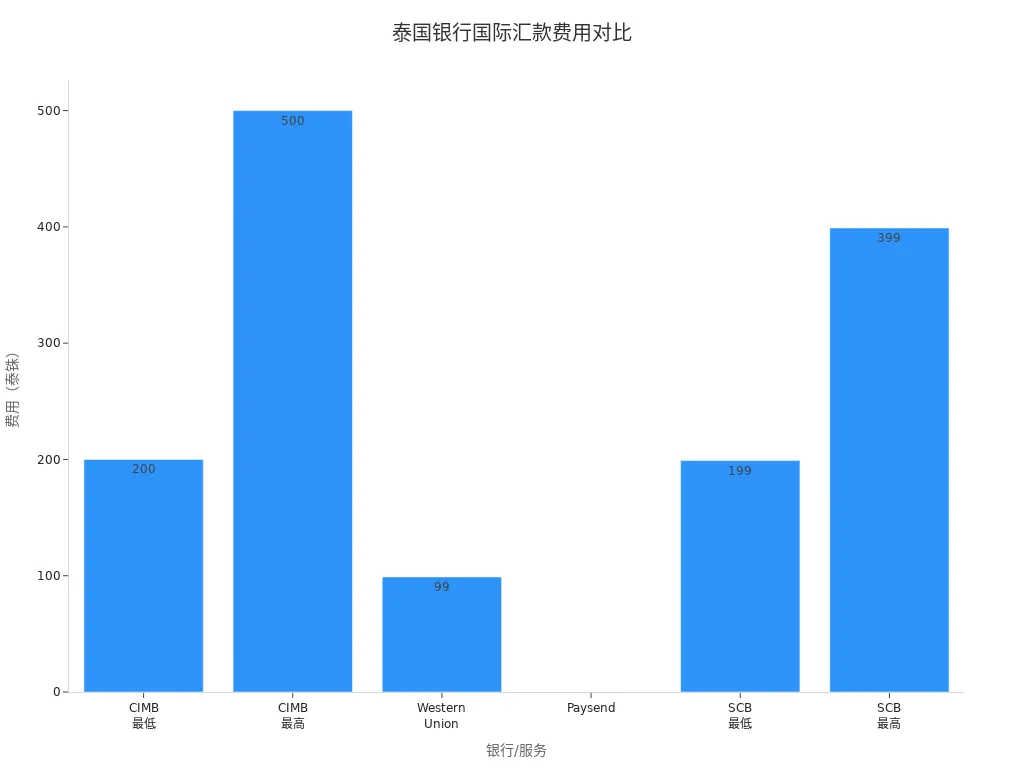

International Remittance Fees

If you need to transfer funds to a Thai account, international remittance fees are a key consideration. Fees vary significantly across banks and third-party platforms. The table below outlines fee details for mainstream channels:

| Bank/Service | Fee Details |

|---|---|

| CIMB Thai International Remittance | ASEAN transfers: 0.25% service fee, minimum 6 USD, maximum 15 USD; global transfers: starting at 7.5 USD, maximum 15 USD. |

| Western Union | Fixed transfer fee of 3 USD for online transfers to overseas bank accounts. |

| Paysend | No transfer fees for transfers to Thai bank accounts via the Paysend platform. |

| SCB EASY App | Standard transaction fee of 6-12 USD per transfer. |

You can see that fees vary significantly across channels. Some platforms like Paysend offer zero fees, while some banks or apps charge fixed or percentage-based fees. When choosing a remittance method, consider your needs and transfer speed.

Reminder: When making international remittances, check exchange rates and transfer times in advance. Some banks charge additional intermediary bank fees. If using licensed Hong Kong banks or third-party platforms, review their policies and terms of service.

Remitting to Thai Accounts

Mainstream Remittance Methods

You can choose various methods to transfer funds to a Thai bank account. Different channels vary in transfer speed, fees, and convenience. The table below summarizes common international remittance methods and their key details:

| Transfer Method | Features | Fees (USD) |

|---|---|---|

| DeeMoney | Supports 55 countries, real-time exchange rates, mobile app operation, fast transfers | Approx. 3.5-4.2 USD per transfer (including tax) |

| Skrill | Supports debit/credit cards, bank transfers, instant debit card transfers | 2.99% for credit card payments, 4.99% exchange rate markup |

| SWIFT | Traditional interbank transfers, suitable for large amounts, 1-5 days for delivery | Varies by bank, typically 10-30 USD |

| PromptPay | Mobile banking app for instant transfers, limited to Thailand and Singapore | Approx. 4.2 USD per transfer |

| Western Union | Supports cash pickup or direct-to-account, available online and offline | Maximum limit of ~7,000 USD |

| MoneyGram | Offline store transfers, delivered within 24 hours | Varies by store |

When choosing a remittance method, weigh transfer speed, fees, and convenience. If using a licensed bank in mainland China or Hong Kong for SWIFT transfers, understand the bank’s policies and fee standards in advance.

Remittance Process

When remitting to a Thai account, follow these steps:

- Choose a suitable remittance channel, such as a bank counter, online banking, third-party platform, or mobile app.

- Fill in the recipient’s details, including the Thai bank account name, account number, bank code, and recipient address.

- Enter the remittance amount and confirm the exchange rate and fees.

- Submit the remittance request and save the transaction receipt.

- Wait for the funds to arrive, typically 1-2 days for third-party platforms and 1-5 days for SWIFT transfers.

Tip: When filling in recipient details, double-check the account name and number to avoid transfer failures or delays due to incorrect information.

BiyaPay Service

If you seek an efficient and secure cross-border remittance experience, consider using BiyaPay. BiyaPay supports multi-currency settlements, ideal for users with accounts in mainland China, Hong Kong, or the US. Through the BiyaPay platform, you can enjoy real-time exchange rates, low fees, and fast transfers. BiyaPay also provides dedicated customer support to address questions during the remittance process. Simply register an account on the platform, link your recipient bank details, and complete the transfer easily.

When using BiyaPay, you can flexibly choose currencies and transfer methods based on your needs. The platform supports multiple payment channels, suitable for individual and business users. For large or frequent remittances, BiyaPay offers customized services to improve fund transfer efficiency.

Bank Selection Tips

Service Quality

When choosing a Thai bank, service quality is a key factor. You can assess a bank’s professionalism through its counter service. While electronic banking is rapidly developing in Thailand, many customers still value face-to-face counter service. The responsiveness and attitude of bank staff during account opening or inquiries directly impact your satisfaction. The bank’s reliability and empathy are also crucial. Whether the bank can promptly resolve issues and understand your needs determines the quality of service.

The table below summarizes key service quality factors for Thai banks:

| Service Quality Factor | Description |

|---|---|

| In-Person Counter Service | Electronic banking is widespread, but counter service remains important |

| Customer Satisfaction | Service quality directly affects customer satisfaction with the bank |

Consider the following to evaluate bank service quality:

- Tangible aspects of service, such as the cleanliness of the environment and facilities

- The bank’s responsiveness to customer needs

- The bank’s reliability in fulfilling commitments

- The bank’s empathy toward customer needs

- The bank’s ability to instill confidence in customers

Bangkok Bank excels in service quality, making it suitable for foreigners opening accounts. You can access English services and detailed guidance. Kasikorn Bank’s app is feature-rich, ideal for those who prefer mobile banking.

Branch Convenience

When living or working in Thailand, branch convenience impacts your daily financial experience. Choose banks with numerous and widely distributed branches for easier transactions. Bangkok Bank has many branches across Thailand, offering convenient access for those residing long-term or frequently handling transactions. While Kasikorn Bank has fewer branches, its app is user-friendly, ideal for those who prefer online banking.

Consider the following suggestions:

- Choose banks with wide branch coverage for convenient transactions

- Prioritize branches near your residence or workplace

- Check branch operating hours to plan visits effectively

If you have accounts with licensed banks in mainland China or Hong Kong, you can use SWIFT or third-party platforms to transfer funds to Thai accounts, improving fund transfer efficiency. When choosing a bank, consider both service quality and branch convenience to select the best option for your needs.

When opening a bank account in Thailand, prepare your passport, visa, and proof of residence in advance. You must be present in person, complete forms, and have your documents verified. Before opening an account, thoroughly understand each bank’s policies and fee standards. Choose a bank and account type based on your needs. Proper planning of the account opening and remittance process can help avoid common pitfalls and improve fund management efficiency.

FAQ

Can foreigners open a bank account in Thailand with a tourist visa?

You cannot open a bank account in Thailand with a tourist visa. Banks typically only accept long-term visas, such as work visas, student visas, or Thailand Privilege visas.

Must I be present in person to open an account?

You must be present in person to complete the account opening process. Banks do not allow proxy applications. Bring all required documents.

Can I open an account without proof of residence in Thailand?

Opening an account without proof of residence in Thailand is challenging. Some banks may accept bank statements from mainland China or licensed Hong Kong banks as supporting documents, but success rates are low.

How long does it take to receive a bank card after opening an account?

You can usually collect your bank card and passbook on the day of account opening. Some banks will assist with setting up your PIN and activating the account on-site.

Can I transfer funds from mainland China or Hong Kong accounts to a Thai account?

You can transfer funds from licensed banks in mainland China or Hong Kong to a Thai account via SWIFT or third-party platforms. Pay attention to fees and transfer times.

You have successfully completed your study on opening a bank account in Thailand, covering the guides for Bangkok Bank, Kasikorn Bank, Krungsri Bank, and CIMB Thai Bank, including the account conditions, required documents, and the mandatory in-person visit. You also recognize that successfully opening the account is only the first step; the subsequent challenges of international fund transfers, multi-currency management, and effectively mitigating high international remittance fees and exchange rate losses are key to managing your finances in Thailand.

In the cross-border financial landscape, you need a professional FinTech platform that can seamlessly connect with your new Thai account, offer real-time exchange rates, and ensure same-day fund arrival to make your capital allocation efficient and economical.

BiyaPay is your ideal solution for high-efficiency, low-cost remittances to Thailand and fund management. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5% and zero commission for contract limit orders, helping you maximize cost control and avoid complex traditional bank fees. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and utilize peak capital efficiency and transparent fees to make your life and financial management in Thailand more convenient!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.