- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Five Best Ways to Transfer Money to Students in Germany: Fees, Limits, and Selection Guide

Image Source: unsplash

When you want to transfer money to friends or family studying in Germany remittance, the common best methods include Wise, Western Union, PayPal, bank wire transfers, and BiyaPay. Wise is known for low fees and transparent exchange rates, Western Union is suitable for cash pickups, PayPal is convenient for small and fast transfers, bank wire transfers are ideal for large amounts, and BiyaPay focuses on convenience and mobile operations. Data shows that in 2019, the total number of international students in Germany reached 400,000, a growth of over 50% compared to 2008. Approximately 30% of students from China/mainland China send remittances regularly, with an average monthly amount of 100–200 USD. When choosing, you should focus on security, convenience, cost, and transfer speed to ensure funds arrive safely and on time.

| Year | Total International Students | Notes |

|---|---|---|

| 2008 | 240,000 | |

| 2019 | 400,000 | Increased by over 50% |

| Proportion of Students Sending Remittances | Remittance Frequency | Average Remittance Amount |

|---|---|---|

| 30% | Regular sending | 100–200 USD/month |

Key Points

- When choosing a remittance method, focus on fees, transfer speed, and security to ensure funds arrive safely and promptly.

- Wise is suitable for low-cost and fast transfers, supports multiple currencies, and is easy to use, making it an ideal remittance choice.

- Western Union offers flexible transfer options, suitable for users needing cash pickups or global remittances.

- PayPal is ideal for small, fast transfers but has higher fees, suitable for daily living expenses.

- Bank wire transfers are suitable for large remittances, offering high security but longer transfer times, ideal for tuition and rent payments.

Best Remittance Methods

Image Source: pexels

When choosing the best way to transfer money to students in Germany, you need to focus on fees, exchange rates, transfer speed, and amount limits. Different methods suit different needs. Below, I will detail five mainstream methods to help you quickly find the most suitable solution.

Wise

Wise is one of the best methods for users in China/mainland China to remit to Germany. You can enjoy low fees and transparent exchange rates through Wise. Wise’s transfer calculator is very intuitive, allowing you to see the actual received amount before operating. Most transfers are completed within seconds, with a maximum of 24 hours. You don’t need to input complex recipient bank information, simplifying the process. Wise supports 160 countries and 40 currencies, offering broad coverage. You can also cancel unprocessed transfers and receive a full refund. Wise’s exchange rates are close to the mid-market rate, highly competitive.

| Advantages | Description |

|---|---|

| Convenient and Fast | Transfer calculator is easy to use, showing received amounts before operation. |

| Fast Transfers | Most transfers are completed in seconds, with a maximum of 24 hours. |

| Simplified Information Entry | No need to track complex bank account information, streamlined process. |

| Free Domestic Transfers | Offers free local transfers in China/mainland China. |

| Wide Coverage | Supports 160 countries and 40 currencies. |

| Cancelable Transfers | Can cancel pending transfers with full refunds. |

| Competitive Rates | Exchange rates close to mid-market, transparent fees. |

If you prioritize low costs, fast transfers, and ease of operation, Wise is one of the best methods.

Western Union

Western Union is one of the most globally covered remittance services. You can choose online transfers, mobile apps, or in-person services at agent locations. Western Union uses encryption technology to protect your information and collaborates with relevant institutions to prevent fraud. You can choose different payment and receiving methods based on your needs, offering high flexibility.

- Global coverage, supporting multi-country remittances

- Multiple transfer options: online, mobile, or in-person at agent locations

- Enhanced security measures to ensure user fund safety

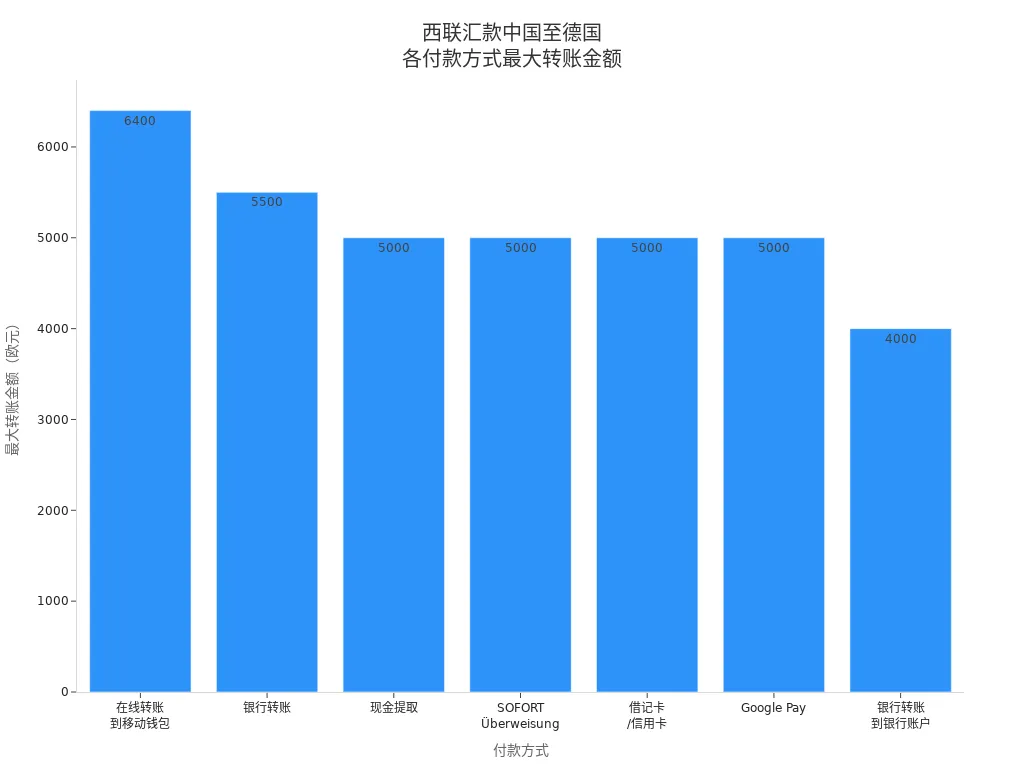

When using Western Union, you need to note the maximum transfer amounts for different payment methods. The following table shows the maximum transfer amounts for main payment methods (in USD, based on an estimate of 1 EUR = 1.1 USD):

| Payment Method | Maximum Transfer Amount (USD) |

|---|---|

| Online Transfer to Mobile Wallet | 7,040 |

| Bank Transfer | 6,050 |

| Cash Pickup | 5,500 |

| SOFORT-Überweisung | 5,500 |

| Debit/Credit Card | 5,500 |

| Google Pay | 5,500 |

| Bank Account Transfer | 4,400 |

For transfers exceeding 1,100 USD, you need to complete identity verification.

Western Union is suitable for users needing cash pickups, in-person services, or global multi-location remittances. If you value flexibility and global coverage, this is also one of the best methods.

PayPal

PayPal is suitable for small, fast international remittances. You can transfer funds directly through a PayPal account, and the recipient receives an email or SMS notification. PayPal’s advantages include fast transfer speeds, ease of operation, and high security. However, you need to note that PayPal’s fees are relatively high, especially for international remittances and currency conversions.

- Fast and secure sending and receiving of payments

- Suitable for small, daily living expense remittances

- Low risk of account freezing, but platform rules must be followed

PayPal’s fee structure is as follows (in USD):

| Item | Fee/Exchange Rate Description |

|---|---|

| Sending Fees | Usually free, may incur currency conversion fees |

| Receiving Fees | Additional 1.5%, typically 2.99% + 1.5% = 4.4% + fixed fee (varies by currency) |

| Currency Conversion Fees | Transaction rate + 3%–4% markup |

| Transfer Time | Usually instant, with recipient notification |

| Exchange Rate Markup | 3.5%–4% fee added to the exchange rate |

If you need fast, small remittances, PayPal is one of the best methods. However, if you prioritize costs, carefully calculate the total fees.

Bank Wire Transfer

Bank wire transfer is a traditional method for users in China/mainland China to remit to Germany, particularly suitable for large fund transfers. You can process international wire transfers through licensed Hong Kong banks, enjoying high security. Bank wire transfers are completed through regulated financial institutions, ensuring fund safety. For large remittances, bank wire transfers charge fixed fees, suitable for tuition, rent, and other large payments. Some banks support the SEPA protocol, where transfers within Europe have the same low fees as local transfers, further reducing costs.

| Features/Benefits | Description |

|---|---|

| Security | Processed through regulated financial institutions, ensuring fund safety. |

| Large Transfers | Suitable for large amounts, typically with fixed fees. |

| SEPA Protocol | Transfers within Europe can enjoy the same low fees as local transfers (supported by some banks). |

If you need to send large tuition or rent payments, bank wire transfer is one of the best methods. You need to prepare recipient bank information in advance and ensure accuracy.

BiyaPay

BiyaPay is an emerging cross-border remittance platform focusing on convenience and mobile operations. You can achieve instant cross-border transfers through BiyaPay without waiting in line. BiyaPay supports multi-currency wallets, allowing you to transfer funds between countries with low fees and real-time exchange rates. The platform also offers peer-to-peer currency exchange and smart savings tools to help you manage funds flexibly.

- Instant cross-border transfers completed with a few clicks

- Multi-currency wallet support with low fees and transparent rates

- Peer-to-peer currency exchange for better rates

- Smart savings tools supporting automatic savings and interest earning

- Supports cryptocurrency and fiat transfers, highly flexible

- Covers over 100 countries with no amount limits

- Fees as low as 1%, with instant fund arrival

- Blockchain-based technology for secure and transparent transactions

If you prioritize ultimate convenience, low fees, and flexibility, BiyaPay is one of the best methods, especially for frequent small transfers and multi-currency management.

When choosing the best method, consider your needs, focusing on fees, transfer speed, amount limits, and security. Each method has its advantages, so choose flexibly based on your scenario.

Comparison Table

Image Source: pexels

When choosing the best way to transfer money to students in Germany, you often focus on fees, transfer speed, and amount limits. The following table compares the core parameters of the five mainstream methods to help you quickly understand their advantages.

| Method | Fees (USD) | Exchange Rate | Transfer Speed | Maximum Single Transfer Limit (USD) | Applicable Scenarios |

|---|---|---|---|---|---|

| Wise | From 4.99, low and transparent | Mid-market rate | Seconds to 24 hours | Approx. 14,000 | Daily, tuition, living expenses |

| Western Union | Higher, more expensive in-person | Rate with markup | Minutes to 1 day | 7,040 | Cash pickup, urgent remittances |

| PayPal | 4% rate fee + fixed fee | 3–4% rate markup | Instant | 10,000 | Small, daily expenses |

| Bank Wire Transfer | 20–50, fixed | Bank posted rate | 1–3 business days | 50,000+ | Large tuition, rent |

| BiyaPay | From 1%, low fees | Real-time rate | Instant | No limit | Frequent small, multi-currency |

Wise has the most transparent fee structure, using mid-market rates, typically cheaper than traditional banks. Western Union’s fees are higher, especially for in-person services. PayPal is convenient but adds a 4% rate fee for cross-currency transfers. Bank wire transfers are suitable for large remittances, offering high security but slower speeds. BiyaPay focuses on low fees and instant transfers, ideal for frequent small remittances.

Based on your needs, combining fees, transfer speed, and amount limits, you can quickly select the best method. If you prioritize low costs and transparent rates, Wise and BiyaPay are more suitable. For urgent cash pickups, Western Union is a good choice. For large tuition or rent payments, bank wire transfers are more secure and reliable. For daily small expenses, PayPal is the most convenient.

Selection Recommendations

When choosing a method to transfer money to students in Germany, first clarify your actual needs. The best method varies by scenario. You can refer to the following table to quickly understand the applicability of different remittance methods based on urgency:

| Remittance Method | Settlement Time | Applicable Scenarios |

|---|---|---|

| Real-Time Payments (RTP) | Near-instant | Urgent transactions |

| Bank Wire Transfer | Relatively fast | Urgent domestic and international transactions |

| Global ACH | Slower | Non-urgent transactions |

If you need urgent remittances, such as for last-minute tuition or living expense shortages, choose real-time payments (RTP) or bank wire transfers. RTP systems are available 24/7, offering near-instant transfers, ideal for time-sensitive situations. Bank wire transfers are also relatively fast, suitable for large and urgent international transfers.

If you prioritize fees and rate transparency, Wise and BiyaPay are good choices. Wise uses mid-market rates with low, transparent fees. BiyaPay supports multi-currency management with fees as low as 1%, suitable for frequent small transfers.

If convenience is your priority, consider the following accounts and methods:

- Capital One 360 accounts support global ATM withdrawals with low fees, ideal for daily expense withdrawals.

- Schwab accounts also offer fee-free international withdrawals, convenient for parents supplementing living expenses.

- Avoid using prepaid cards due to high fees and inconvenience.

For large tuition or rent payments, bank wire transfers are more secure and reliable. You only need to prepare recipient bank information in advance and ensure accuracy.

When choosing, consider transfer speed, fees, convenience, and security comprehensively. Selecting the best method based on your needs ensures funds reach Germany efficiently and safely.

Precautions

When transferring money to students in Germany, pay attention to the following key points to ensure funds arrive safely and on time:

- Information Accuracy: You need to carefully verify the recipient’s name, bank account, and SWIFT code. Any errors may lead to transfer failure or fund loss.

- Regulatory Compliance: You should understand remittance regulations in China/mainland China and Germany. Large remittances may require additional declarations or identity verification.

- Retain Receipts: You should save transfer receipts and related records after each remittance. These documents can help you communicate with providers if issues arise.

- Fee Transparency: You need to understand all service fees and exchange rates in advance. Many banks and platforms hide fees or use unfavorable rates, reducing the actual received amount.

- Transfer Speed: You should note the arrival times of different methods. Some services may experience delays, especially during holidays or peak periods, affecting timely fund delivery.

- Customer Support: You should consider the platform’s customer service capabilities when choosing. Limited support may make it difficult to resolve issues promptly.

- Tracking Features: You should choose platforms with transfer status tracking. Lack of tracking can cause anxiety when waiting for large funds.

During the remittance process, stay vigilant to prevent fraud and information leaks. Operate only through official channels and avoid clicking unknown links or providing sensitive information. If you notice anything unusual, contact the provider or bank immediately to take measures to protect funds.

Before remitting, compare options and choose reputable platforms. Regularly check account activity to ensure every fund arrives safely.

When choosing to transfer money to students in Germany, you can refer to the pros and cons of different methods. Traditional bank cross-border remittances are secure and suitable for large transfers but have high fees and slower speeds. Panda Remit and digital platforms are convenient and cost-effective, but you need to monitor rates and compliance. Focus on fees, exchange rates, transfer speed, and security. Market data shows rapid growth in digital remittance platforms, offering more options in the future. Ensure information accuracy and regulatory compliance to avoid losses due to misleading claims or opaque fees. Choose the best method rationally based on your needs to ensure fund safety.

FAQ

What information is needed for Wise remittances?

You need to provide the recipient’s name, German bank account, and SWIFT code. Wise guides you through filling in the information to ensure accurate fund delivery.

Can Western Union transfer directly to a German bank card?

You can choose to transfer to a German bank card or allow the recipient to pick up cash at an agent location in Germany. Confirm the receiving method in advance.

Is PayPal safe for remittances to Germany?

PayPal uses encryption technology to protect your funds. Ensure account information is correct, and the platform will secure the transaction.

How long does a bank wire transfer take to arrive?

You typically receive bank wire transfers within 1 to 3 business days. The exact time depends on the bank’s processing speed and holiday schedules.

What currencies does BiyaPay support?

BiyaPay supports multiple mainstream currencies, including USD, EUR, and more. You can freely exchange and manage different currencies on the platform.

Sending money to students in Germany requires attention to fees (banks $20-$50, online $2-$10), transfer times (banks 1-5 days, digital platforms instant to 1 day), and compliance (>€12,500 to German central bank, >$10,000 to FinCEN). Hidden rate markups often add costs. As an efficiency-focused user, you need a low-fee, transparent platform to streamline cross-border transfers.

BiyaPay offers the ideal solution, with real-time exchange rate queries to track EUR-to-USD rates and convert fiat to crypto, mitigating volatility risks. Remittance fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From tuition to living expenses, it cuts costs and boosts speed. Don’t let high fees and delays disrupt your Germany study support—join BiyaPay today for a hassle-free remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.