- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Achieve Fast Cash Withdrawal and International Transfers with MoneyGram

Image Source: unsplash

You can achieve fast cash withdrawals and international transfers through MoneyGram at over 347,000 agent locations worldwide. MoneyGram’s digital transformation has driven continuous growth in transaction volume and customer base, with digital transaction volume growing by 47% year-over-year in 2022. You only need to prepare a valid ID and relevant documents, and cash can typically be received within minutes. The table below compares the number of global agent locations for MoneyGram and other major remittance providers:

| Provider | Number of Agent Locations |

|---|---|

| MoneyGram | 347,000 |

| Western Union | 500,000 |

Key Points

- MoneyGram has over 347,000 agent locations worldwide, supporting fast cash withdrawals and international transfers, making it convenient for users to access services anytime, anywhere.

- When using MoneyGram for transfers, funds typically arrive within minutes, making it especially suitable for urgent financial needs.

- MoneyGram offers same-day cash pickup with no transfer fees, allowing users to benefit from competitive exchange rates and lower remittance costs.

- Users can choose online or in-person methods for transfers, with online operations being more convenient, especially for those with limited mobility or in remote areas.

- Before transferring, it’s recommended that users review fees and exchange rates to plan each transfer carefully, ensuring fund security and cost optimization.

MoneyGram Service Overview

Main Features

You can use MoneyGram for various international transfer and cash withdrawal services. MoneyGram supports same-day cash pickup with no transfer fees, offering competitive exchange rates. You can choose to operate online or complete transfers via the mobile app. The maximum transfer amount is up to $50,000 per 24 hours. Most cash pickups and bank transfers arrive within one business day. MoneyGram also periodically offers cashback and exchange rate discount promotions.

| Feature | Description |

|---|---|

| No Transfer Fees | Same-day cash pickup with no fees available through certain channels |

| Competitive Exchange Rates | Offers competitive exchange rates |

| Online Convenience | Supports online and mobile app transfers |

| Transfer Limit | Up to $50,000 per 24 hours |

| Same-Day Arrival | Cash pickups and most bank transfers arrive within one business day |

| Promotions | Offers cashback and exchange rate discount promotions |

Global Network

MoneyGram operates over 350,000 agent locations worldwide, covering more than 200 countries and regions. You can easily find MoneyGram service points globally to meet cross-border transfer and cash withdrawal needs.

- MoneyGram operates in over 200 countries and regions.

- Global agent locations exceed 350,000.

Service Advantages

By choosing MoneyGram, you can enjoy multiple benefits such as global coverage, convenience, and security. MoneyGram allows transfers to nearly every country, with cash payments typically arriving within minutes. You can process transfers online, via the app, or at agent locations. With over 80 years of international transfer experience, MoneyGram offers affordable and convenient services.

| Advantage | Description |

|---|---|

| Global Coverage | Transfers to nearly every country, with cash payments arriving in minutes |

| Convenience | Multiple transfer methods and a vast global network of agent locations |

| Security | Strict identity verification, recommending transfers only to trusted recipients to prevent fraud risks |

MoneyGram Transfer Process

Image Source: pexels

Online Operations

You can quickly complete international transfers through MoneyGram’s official website or mobile app. Online operations are suitable for those who prefer handling transfers from home or anywhere with internet access. You only need to follow these steps:

- Register or log in to MoneyGram’s official website or app.

- Enter the recipient’s name, country, receipt method (e.g., cash pickup or bank account), and the USD amount you wish to send.

- Choose a payment method (e.g., credit card, debit card, or bank transfer).

- Review the information, then confirm and pay any applicable fees.

- The system will generate a transaction reference number, which you need to share with the recipient.

Online transfers typically have lower fees and better exchange rates. Funds usually arrive within minutes, allowing the recipient to pick up cash or have it deposited based on the chosen method. Online operations eliminate the need to queue, making them ideal for those with limited mobility or in remote areas.

Tip: When transferring online, ensure your identity and recipient information are accurate to avoid delays due to errors.

| Feature | Online Transactions | In-Person Transactions |

|---|---|---|

| Convenience | Complete transactions with a few clicks, ideal for home use | Requires visiting an agent location, which may involve waiting in line |

| Accessibility | Suitable for those in remote areas or with limited mobility | May not be suitable for those with limited mobility or in remote areas |

| Fees | Generally lower fees with higher exchange rates | Generally higher fees |

| Speed | Funds typically arrive directly within minutes | Processing may take hours or days |

| Personal Interaction | No interaction with agents | Face-to-face interaction with agents for assistance |

Agent Location Transactions

If you prefer in-person service, you can visit a MoneyGram agent location to process transfers. You need to prepare the following materials:

- Valid photo ID (e.g., passport, Hong Kong ID, or residence permit)

- Foreign currency cash or deposit certificate

- Recipient’s name and country information

The process is as follows:

- Locate a nearby MoneyGram agent location.

- Inform the staff of your transfer needs and complete the transfer form.

- Submit your ID, recipient information, and USD cash or deposit certificate.

- Pay the transfer amount and any applicable fees.

- Receive a transaction reference number and share it with the recipient.

When processing at an agent location, you can receive assistance from staff to ensure each step is accurate. Some locations also offer self-service kiosks where you can enter information on a touchscreen before paying at the counter.

Note: Some countries or regions may require proof of address. Prepare relevant documents in advance to avoid delays.

Cash Pickup

Recipients can pick up cash at any MoneyGram agent location worldwide. The process is very simple:

- The recipient brings a valid photo ID (e.g., passport, Hong Kong ID) and the transaction reference number to a MoneyGram location.

- Completes a receipt form and submits it to the counter staff.

- After verification, the recipient can collect cash within minutes.

| Delivery Method | Transfer Time |

|---|---|

| Cash Pickup | Typically available within minutes after a successful transfer |

Cash pickups are fast, usually available within minutes of a successful transfer. Actual arrival times may be affected by agent operating hours and compliance reviews. You can track the transfer status at any time to ensure fund security.

Tip: To ensure fund security, transfer only to trusted recipients and keep the transaction reference number and ID secure.

Fees and Exchange Rates

Image Source: unsplash

Fee Details

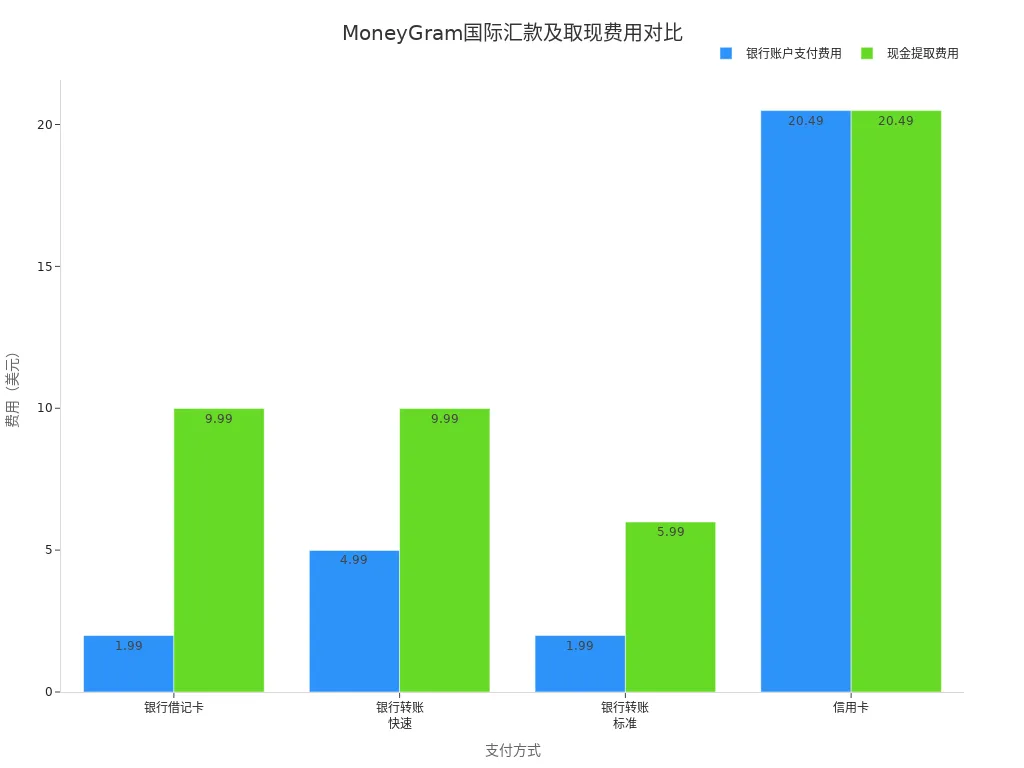

When using MoneyGram for international transfers and cash withdrawals, you need to consider the fees associated with different payment methods. Fees vary based on the payment channel, transfer amount, and receipt method. For example, when sending $500 to Europe, bank account payment fees are $1.99, while cash pickup fees are $9.99. If you use a credit card, fees increase significantly to $20.49. The table below shows fee details for different payment methods:

| Sending $500 to EUR | Bank Account Payment Fee | Cash Pickup Fee |

|---|---|---|

| Using Debit Card | $1.99 | $9.99 |

| Using Bank Transfer - Fast | $4.99 | $9.99 |

| Using Bank Transfer - Standard | $1.99 | $5.99 |

| Using Credit Card | $20.49 | $20.49 |

| Cash Payment | Varies by sending location | Varies by sending location |

You can refer to the chart below for a visual comparison of fees across different payment methods:

Tip: When processing MoneyGram transfers through licensed banks in Mainland China or Hong Kong, check specific fees in advance to avoid unexpected costs due to different payment methods.

Exchange Rate Inquiry

When transferring with MoneyGram, the exchange rate directly affects the received amount. MoneyGram determines exchange rates based on the bid and ask prices for currency trading. Each institution has different bid and ask prices, with the difference known as the spread. The spread determines the actual exchange rate you receive. You can check current exchange rates in real-time on the MoneyGram website or at agent locations to maximize your transfer amount.

- MoneyGram sets exchange rates based on bid and ask prices for currency trading.

- Spreads vary by institution, leading to differences in exchange rates.

- You can check real-time exchange rates at any time to plan your transfer timing effectively.

The table below compares MoneyGram’s fees and exchange rate features with other major remittance providers:

| Feature | MoneyGram | Wise |

|---|---|---|

| Transfer Fees | Varies | Starts from 0.57% |

| Exchange Rate | Includes markup | No markup |

| Minimum Transfer | $0+ | $1 |

| Maximum Transfer | Up to $5,000 or less | Up to $1,600,000 |

Influencing Factors

When transferring with MoneyGram, fees and exchange rates are influenced by multiple factors. You can optimize transfer costs by considering the following:

- Payment Method: Fees vary significantly by payment channel.

- Transfer Speed: Faster transfers typically have higher fees.

- Destination Country: Fees and exchange rates differ by country.

- Transfer Amount: Larger amounts may have lower proportional fees.

- Fee Structure: Includes transfer fees and exchange rate spreads.

Tip: When choosing a transfer method, consider fees, exchange rates, and arrival speed to plan fund transfers effectively, ensuring security and cost optimization.

Limits and Security

Transfer Limits

When using MoneyGram for international transfers, you need to understand the transfer limits for different countries. The maximum single transfer amount for most countries is $10,000. In the U.S., the maximum limit is $15,000. Some countries, like Chile, have a maximum limit of $5,000. MoneyGram has no minimum transfer amount, but some agent locations may have their own policies. Refer to the table below for transfer limits in major countries:

| Country | Maximum Transfer Limit | Minimum Transfer Limit |

|---|---|---|

| Most Countries | $10,000 | None |

| United States | $15,000 | None |

| Chile | $5,000 | None |

When processing MoneyGram transfers through licensed banks in Mainland China or Hong Kong, check with local locations in advance to confirm specific limits and policies.

Identity Verification

MoneyGram requires strict identity verification for both senders and recipients. When processing large transfers or using credit/debit card payments, you must complete identity checks. You need to prepare the following materials:

- Government-issued valid ID showing your legal name.

- Personal information, including full name, date of birth, and address.

- Transaction reference number (provided by the sender).

- In some cases, proof of address may be required.

- For first-time bank account transfers, MoneyGram may request additional information to verify your and the recipient’s identity.

When receiving funds, you also need to present a valid ID and reference number to prevent unauthorized collection and ensure fund security.

Risk Prevention

MoneyGram implements multiple anti-fraud measures to protect your funds. During the transfer process, you benefit from the following security measures:

- MoneyGram is equipped with fraud prevention tools to detect and block suspicious transactions.

- The company has a dispute resolution process to help address issues or concerns with transactions.

- MoneyGram offers a refund guarantee, allowing you to request a full refund if funds have not been collected.

When transferring, send funds only to trusted recipients and keep reference numbers and personal information secure. If you encounter any issues, contact MoneyGram customer service or the relevant bank promptly to prevent fund loss.

Arrival Time

Speed Details

When using MoneyGram for international transfers, arrival speed is a key concern. One of MoneyGram’s greatest advantages is that cash pickups can typically be completed within minutes. Once the transfer is successful, the recipient can collect cash at any MoneyGram agent location worldwide with a transaction reference number and valid ID.

Bank account deposits take longer, with arrival times affected by bank processing procedures. Some banks may require a few hours, while others may take 1–2 business days. For MoneyGram account-to-account transfers, funds can arrive within minutes, depending on system availability and receipt method.

The table below shows average arrival times for different payment options:

| Payment Option | Transfer Time |

|---|---|

| Cash | Within minutes |

| Bank Account Deposit | May take longer |

| MoneyGram Account-to-Account Transfer | Within minutes (depending on system availability) |

When processing MoneyGram transfers through licensed banks in Mainland China or Hong Kong, cash pickups are the fastest, while bank account deposits require waiting for bank processing.

Tip: For urgent funds, choose cash pickup, which typically arrives within minutes.

Influencing Factors

Arrival time depends not only on the payment method but also on multiple factors. Consider the following before transferring to plan fund transfers effectively:

- Destination Country: Financial systems and regulatory requirements vary by country, affecting arrival speed.

- Payment Method: Cash pickups are the fastest, while bank account deposits and other methods may take longer.

- Bank Processing Time: The efficiency and procedures of banks directly impact arrival speed.

- Bank Infrastructure: Some countries’ banking systems are less advanced, resulting in slower processing.

- Accuracy of Recipient Bank Information: Incorrect information can cause delays or failures.

When choosing a transfer method, adjust the channel based on the recipient’s country and needs.

Common Questions

When using MoneyGram for transfers, you may encounter the following questions:

- Online bank transfers are typically processed in real-time, but in some cases, funds may take up to 2 business days to reach the recipient. Bank holidays and weekends may extend arrival times.

- When using the MoneyGram app for international transfers, arrival time depends on the payment option and receipt method. Debit card payments typically result in faster arrivals.

- If funds do not arrive on time, contact MoneyGram customer service to initiate an investigation. MoneyGram will verify identity information per regulatory requirements to assist in resolving issues. If funds have not been collected, you can request a refund, which MoneyGram will issue through agent locations.

The table below summarizes common processes for handling delayed or failed transfers:

| Event Description | Resolution |

|---|---|

| Funds not arriving on time | MoneyGram investigates, apologizes for errors, and assists in resolution |

| Customer needs to contact MoneyGram to initiate investigation | MoneyGram requires sender to provide identity information for verification |

| Refund check processing delayed | MoneyGram issues refunds, and customers can collect cash at agent locations |

| Transaction successfully delivered but not rejected or returned | MoneyGram cannot issue refunds |

If you encounter delays, contact MoneyGram customer service or the relevant bank promptly to ensure fund security. You can also track transfer status at any time to monitor fund movement.

Tip: Ensure recipient information is accurate to avoid delays due to errors. Choosing the right payment and receipt channels can significantly improve arrival speed.

You can achieve fast and convenient international transfers and cash withdrawals with MoneyGram. Many users report that the platform offers fast transfer speeds, with funds arriving in minutes and operations being highly convenient. For urgent transfers or cross-border financial needs, MoneyGram is a top choice. Before selecting a service, carefully compare fees, exchange rates, and limits to plan each transfer effectively. If you encounter issues, online customer service can provide timely solutions.

FAQ

How do I check the status of a MoneyGram transfer?

You can log in to the MoneyGram website or app and enter the transaction reference number to track transfer progress. You can also contact MoneyGram customer service for assistance.

Tip: Keep the transaction reference number secure to avoid information leaks.

What receipt methods does MoneyGram support?

You can choose cash pickup, bank account deposits, or MoneyGram account receipts. The specific method depends on the recipient’s country and region.

What if I enter incorrect recipient information?

Contact MoneyGram customer service immediately. They will assist in correcting information or canceling the transaction. If funds have not been collected, you can request a refund.

Can MoneyGram transfers be withdrawn?

As long as the recipient has not collected the funds, you can request to withdraw the transfer. Provide the transaction reference number and valid ID.

Are there limits for MoneyGram transfers through licensed banks in Mainland China or Hong Kong?

Yes. The maximum single transfer limit for most countries is $10,000. Check with local banks in advance to confirm specific policies and limits.

MoneyGram excels with over 400,000 global agent locations and online ease for quick cash pickups and international transfers, but fees (from $1.99 for small amounts to $20.49 for larger ones) and exchange spreads can diminish received funds, particularly amid 2025’s projected $8+ trillion global remittances where costs and verification delays frustrate users. For a lower-fee, more dependable cross-border solution, explore BiyaPay. At just 0.5% transfer fees, BiyaPay surpasses traditional services, maximizing recipient value with complete transparency.

BiyaPay spans most countries and regions, with registration in minutes and same-day delivery, no agent visits needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, with zero fees on contract orders. Sign up today and leverage the real-time exchange rate tool to capture optimal rates, revolutionizing your remittances into a secure, efficient global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.