- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Open a Bank Account in Singapore? Introduction to DBS, UOB and Citibank Accounts - BiyaPay

Image Source: unsplash

When opening a bank account in Singapore, you need to prepare personal identification documents and proof of address in advance. The account opening process typically includes filling out an application form, submitting documents, completing identity verification, and making an initial deposit. The required documents vary slightly depending on the applicant’s status:

| Status | Required Documents |

|---|---|

| Singapore Citizen | NRIC, Singpass (can apply online) |

| Permanent Resident | NRIC, Singpass (can apply online) |

| Foreigner | Valid passport, relevant pass, proof of address, possibly employment letter or student letter |

You can choose to visit a branch in person, use the bank’s online platform, or complete the process via remote video verification. Online and remote account opening are suitable for applicants with a Singapore mobile number or local residential address. Compliant documents and a streamlined process can effectively improve account opening efficiency.

Key Points

- Before opening a Singapore bank account, prepare identity proof and address proof to ensure all documents are complete.

- Choose the account opening method that suits you; in-person, online, and remote account opening each have their pros and cons, and the decision should be based on your situation.

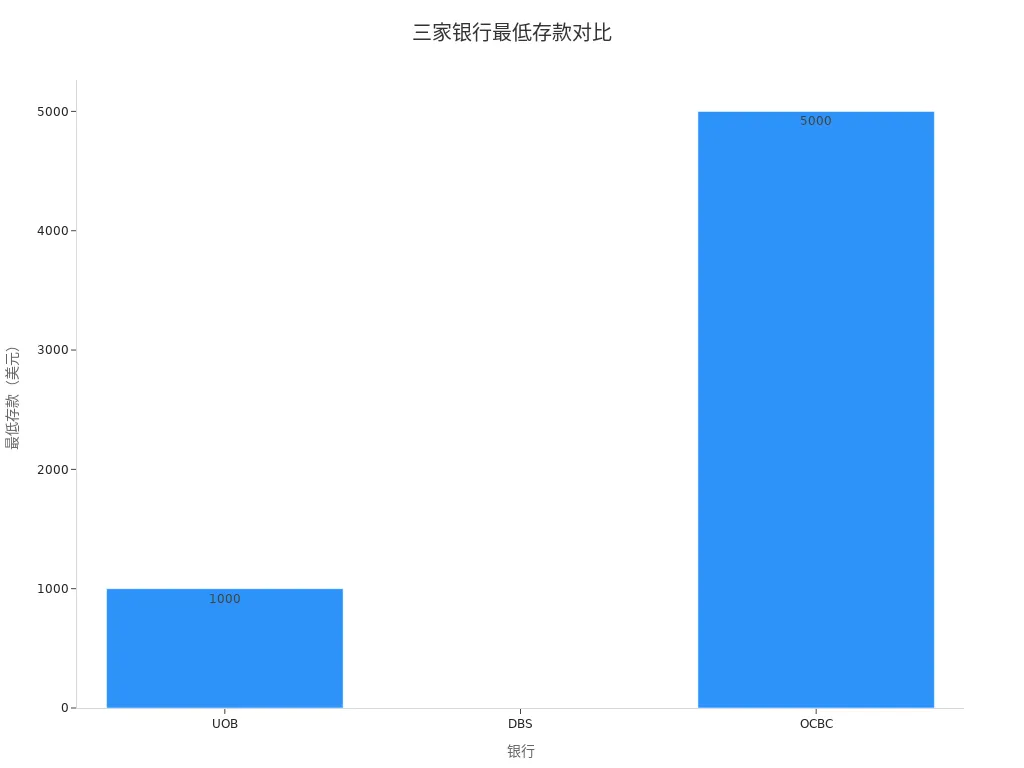

- Understand the minimum deposit requirements of different banks: DBS requires 0 USD, UOB requires 1,000 USD, and OCBC requires 5,000 USD.

- After opening an account, manage funds through the BiyaPay platform, which supports multi-currency collections and transfers, enhancing fund management efficiency.

- Keep documents updated and operate compliantly to reduce compliance risks and ensure account security.

Singapore Bank Account Opening Process

Image Source: pexels

Main Steps for Account Opening

When opening a bank account in Singapore, you need to follow these steps:

- Prepare all necessary personal or business documents, including identity proof and address proof.

- Fill out the bank account application form, ensuring the information is accurate.

- Submit relevant documents to bank staff or upload them via the bank’s online platform.

- Complete identity verification; some banks may require video verification or an in-person interview.

- Make an initial deposit (usually in USD) as required by the bank.

- Wait for the bank to review your documents; the bank will notify you of the account opening result upon approval.

- After receiving account information, you can activate the account and start using it.

Tip: The account opening process for corporate accounts is more complex, requiring additional submission of company registration proof, articles of association, board resolutions, shareholder and ultimate beneficial owner information, etc. Corporate account reviews typically take 2 to 6 weeks, while personal accounts take a few working days to a few weeks.

Required Documents

When applying for a Singapore bank account, you need to prepare the following common documents:

| Document Type | Description |

|---|---|

| Government-issued ID | Valid passport or Singapore ID card. |

| Proof of Residence | Utility bill, lease agreement, or bank statement. |

| Tax Identification Number | Tax identification number from your country of residence. |

| Proof of Income | Pay stubs, employer letter, or proof of investment income. |

| Bank Reference Letter | Reference letter from an existing banking relationship (required by some banks). |

| Reason for Account Opening | Written explanation of the reason for opening an account in Singapore. |

As a Singapore citizen or permanent resident, if your address does not match Myinfo, you need to provide additional proof of residential address. If you declare a tax residency outside Singapore, you must provide proof of tax residency. During the application, you can upload photos or scanned copies of documents via the online platform to improve review efficiency.

Account Opening Methods

You can choose different account opening methods based on your situation:

- In-person account opening: You can visit a bank branch in person, suitable for first-time applicants or those needing face-to-face consultation. The bank will verify documents and identity on-site.

- Online account opening: You can submit an application through the bank’s website or mobile app, suitable for applicants with a Singapore mobile number and local address. Some banks allow Chinese/China mainland residents to upload documents remotely.

- Remote account opening: Some banks, such as DBS, OCBC, and UOB, support video verification and remote document submission, suitable for foreigners who have not yet arrived in Singapore but have the required documents. OCBC allows residents from Malaysia, Indonesia, and other countries to open accounts digitally, but not all banks accept non-residents for online account opening.

Note: Different account opening methods have varying requirements for document compliance and identity verification. You need to confirm the bank’s policies in advance and choose the most suitable account opening channel.

The choice of account opening method affects the review speed. Personal accounts are typically completed within a few working days to a few weeks, while corporate accounts take 2 to 6 weeks. Local companies with complete documents can be approved in as little as 1 to 2 weeks.

DBS Bank Account Opening Process

In-Person Account Opening

You can choose to visit a DBS bank branch in person to open a Singapore bank account. You need to bring all required documents, including a valid passport, visa, proof of address, and a Singapore mobile number. Bank staff will verify your identity and documents on-site. After filling out the application form, the bank will require you to make an initial deposit, usually in USD. In-person account opening is suitable for first-time applicants or those needing face-to-face consultation. You can directly discuss account opening details with bank staff and learn about account types and services.

Online/Remote Account Opening

DBS Bank supports online and remote account opening, particularly convenient for Chinese/China mainland residents and other non-Singapore locals. You can submit an account opening application through the DBS Bank website or mobile app. For remote account opening, you need to prepare the following documents:

- Proof of employment

- Valid PIO/OCI card (copy) or other proof of PIO status

- Proof of overseas and Indian address

You can choose to open an NRE savings account or an NRO savings account. The bank will verify your identity via video, and you will be notified of the account opening result after document review. The online platform is user-friendly, suitable for applicants with a Singapore mobile number and local address. Remote account opening provides convenience for foreigners who have not yet arrived in Singapore but have complete documents.

Tip: The processes for online and in-person account opening differ. In-person account opening requires you to visit a branch, with stricter document verification. Online/remote account opening relies on electronic document uploads and video verification, offering faster review times.

Account Opening Requirements

When opening an account with DBS Bank, you need to meet the following conditions:

- Be at least 18 years old

- Hold valid identification (e.g., passport, Aadhaar card, PAN card)

- Maintain a monthly average balance (MAB) of 10,000 USD

- Provide address and tax information

As a Chinese/China mainland resident, you need to submit additional identity and address proof. DBS Bank’s account opening requirements are clear, and complete documents can improve review efficiency.

UOB Account Opening Process

In-Person Account Opening

If you are a Chinese/China mainland resident and want to open a UOB account in Singapore, you typically need to visit a UOB branch in person. You can follow these steps:

- Collect all important documents, including a valid passport and proof of address.

- If you are not a Singapore resident but frequently visit Singapore, you can attend a meeting at a branch and explain your account opening needs to bank staff.

- Prepare a reference letter from your current bank or an existing UOB customer to improve approval chances.

- Submit the account opening application at a UOB branch, providing all documents in person.

- The bank will evaluate your application individually based on your situation; ensure all documents are complete.

- Wait for the bank’s review result, and you will receive account information upon approval.

Tip: UOB’s in-person account opening process has high requirements for document compliance. Preparing all documents in advance can improve efficiency.

Online Account Opening

If you already have a Singapore mobile number and local address, you can try submitting an account opening application through the UOB website or mobile app. Online account opening is suitable for individuals living or working long-term in Singapore. You need to upload photos or scanned copies of identity proof and address proof. The bank will conduct a preliminary review via the online platform, and in some cases, may require video identity verification. The online account opening process is simple and faster, but for Chinese/China mainland residents, some banks may still require in-person document supplementation.

Document Requirements

When applying for a Singapore bank account, you need to prepare the following documents. The required documents vary by identity type as follows:

| Category | Required Documents |

|---|---|

| Working Professionals | Valid passport, employment pass, proof of address (e.g., employer letter or utility bill) |

| International Students | Valid passport, student pass, proof of enrollment or registration card, birth certificate, academic certificates and transcripts, recent bank or financial statements |

| Personal Account | Valid passport (original and copy), proof of address (e.g., utility bill or bank statement), proof of income (e.g., pay stubs or tax documents, required by some banks) |

Preparing the above documents in advance can effectively improve the account opening review speed. The bank will evaluate based on your identity type and document completeness, and complete documents are more likely to pass the review.

Citibank Account Opening Process

Image Source: unsplash

In-Person Account Opening

You can choose to visit a Citibank branch in person to open a Singapore bank account. You need to prepare all documents in advance. You can use Citibank’s branch locator on their website to find the nearest branch. Upon arriving at the branch, you will meet with bank staff to discuss your account opening needs. You submit identity proof, address proof, and other documents. Bank staff will assist you in filling out the application form and verify documents on-site. You need to prepare an initial deposit (in USD) based on the account type. In-person account opening is suitable for first-time applicants or those seeking detailed consultation. You can learn about different account types and services on-site.

Tip: During in-person account opening, the bank conducts strict document reviews. Preparing all documents in advance can improve review efficiency.

Online Account Opening

You can also choose to open an account online via the Citibank website. Visit the Citibank website and click the “Open an Account” option. Fill out the application form on the website, ensuring all information is accurate. You need to upload identity proof, address proof, and social security number (if applicable). The online account opening process is simple, suitable for applicants with a Singapore mobile number and local address. The bank will review your documents via the online platform. In some cases, the bank may require video identity verification. Online account opening typically has a faster review process, suitable for those preferring remote handling.

The following table compares the main processes for Citibank’s in-person and online account opening:

| Process Type | Steps | Description |

|---|---|---|

| Online Account Opening | 1. Visit Website | Visit the Citibank website and click the “Open an Account” option. |

| 2. Fill Out Application Form | Complete the application form on the website, ensuring accuracy. | |

| 3. Upload Documents | Upload identity proof, address proof, and social security number (if applicable). | |

| In-Person Account Opening | 1. Find Nearby Branch | Use Citibank’s branch locator to find the nearest branch. |

| 2. Meet with Bank Representative | Meet with Citibank staff for account opening assistance. | |

| 3. Submit Documents | Submit the same documents as required for online applications for review. |

Document Requirements

When opening an account with Citibank, you need to prepare different documents based on your identity type. Singapore citizens and permanent residents need to provide NRIC and proof of address (if different from NRIC). As a foreigner, you need to prepare a passport, work pass, dependent pass, or student pass, and proof of address in Singapore (e.g., utility bill or lease agreement). You also need to prepare an initial deposit, with the amount varying by account type (in USD).

The following table summarizes the required documents for different customer types:

| Customer Type | Required Documents |

|---|---|

| Singapore Citizens and PRs | NRIC, proof of address (if different from NRIC) |

| Foreigners | Passport, work pass, dependent pass, or student pass, proof of address in Singapore, initial deposit (USD) |

Preparing all documents in advance can significantly improve account opening efficiency. If you have any questions, you can consult bank staff in advance to ensure documents are complete.

Account Opening Conditions and Services Comparison

Account Opening Threshold Comparison

When choosing a Singapore bank account, the account opening threshold is an important consideration. Different banks have varying minimum deposit requirements. The following table shows the minimum deposit thresholds for three banks:

| Bank | Minimum Deposit (USD) |

|---|---|

| UOB | $1,000 |

| DBS | $0 |

| OCBC | $5,000 |

If you prefer a lower account opening threshold, you can prioritize DBS. UOB and OCBC are suitable for applicants with some capital reserves. For Chinese/China mainland residents, some banks may require additional identity and address proof.

Fees and Service Features

After opening an account, you should also consider account maintenance fees and service features. The following table compares the maintenance fees and unique service features of the three banks:

| Bank | Account Maintenance Fee (USD) | Unique Service Features |

|---|---|---|

| DBS | $350K | Up to 4% cashback, fee-free ATM withdrawals, exclusive investment services, and relationship manager. |

| Citibank | $250K | Personalized wealth solutions, preferential rates, dedicated relationship manager, global lifestyle and dining privileges. |

| UOB | $350K | Travel, dining, and lifestyle privileges, up to 20% dining bill discounts. |

You can choose a bank based on your capital size and service needs. DBS and UOB are suitable for clients seeking premium wealth management and lifestyle services. Citibank focuses more on globalization and personalized wealth management.

Remote Account Opening for Singapore Bank Accounts

If you cannot travel to Singapore in person, you can opt for remote account opening. The remote account opening process is as follows:

- Provide scanned copies of valid identification documents.

- Describe your field of activity, employment type, and income sources.

- Fill out and sign bank forms.

- Scan proof of residence.

- Send original documents and notarized copies to the bank via DHL courier.

- Wait for bank staff to contact you.

- Answer bank questions, and the bank will complete the account opening.

The following table shows the remote account opening eligibility for the three banks:

| Bank | Minimum Deposit (USD) | Remote Account Opening | Offshore Non-Residents |

|---|---|---|---|

| DBS | $350,000 | No | Yes |

| UOB | $350,000 | No | Yes |

| Citibank | $200,000 | Yes | No |

If you are a Chinese/China mainland resident, Citibank supports remote account opening with a relatively lower threshold. DBS and UOB are more suitable for offshore non-residents but do not support remote account opening. You need to choose the most suitable account opening method based on your identity and financial situation.

BiyaPay Account Management

Account Linking Process

You can easily link your Singapore bank account through the BiyaPay platform. First, log in to your BiyaPay account and go to the “Account Management” page. Select “Add Bank Account” and fill in your Singapore bank account details, including account number, bank name, and account holder’s name. Upload relevant proof documents, such as a passport and proof of address. The system will automatically verify your information, and in some cases, video identity verification may be required. After successful linking, you can view account details and balances on the BiyaPay platform.

Tip: During the linking process, ensure all information is accurate to avoid delays in review due to mismatched documents.

Fund Management

You can manage multi-currency funds through BiyaPay. The platform supports collections, transfers, and currency conversion for major currencies like USD. You can transfer funds between accounts and view fund movements in real-time. BiyaPay provides detailed transaction records and bill download functions for easy financial auditing. You can also set up fund alerts to stay informed of account changes. For corporate users, BiyaPay supports batch payments and automated fund allocation, improving fund management efficiency.

| Function | Description |

|---|---|

| Multi-Currency Management | Supports collections and payments in USD and other currencies |

| Bill Download | One-click export of transaction details |

| Fund Alerts | Real-time notifications of account changes |

| Batch Payments | Enables businesses to process transfers in bulk |

Security and Compliance

When using BiyaPay to manage your Singapore bank account, the platform places a high priority on security and compliance. BiyaPay has established strict internal policies and procedures to ensure all operations comply with Singapore’s banking regulatory requirements. The platform employs a risk-based anti-money laundering monitoring mechanism and conducts regular compliance training for employees to help them identify and handle suspicious activities. BiyaPay conducts due diligence on accounts, verifies customer and beneficial owner identities, and promptly reports suspicious transactions to regulatory authorities. When managing your account, pay attention to the following compliance challenges:

- Inactive accounts or low usage

- Non-compliance with anti-money laundering/anti-terrorism financing regulations

- Delayed or missing documentation

- Suspicious transaction behavior

- High-value transactions with high-risk jurisdictions

- Frequent transfers with personal accounts

By updating documents promptly and operating funds normatively, you can effectively reduce compliance risks and ensure account security.

When opening a Singapore bank account, you need to prepare identity proof, address proof, and tax identification number in advance. You can choose a personal or business account based on your needs and compare the minimum deposit requirements and service fees of different banks. You should also consider the bank’s experience, accessibility, and other services. Choosing the right account opening method can improve efficiency. Through BiyaPay, you can better manage funds and ensure account security. It is recommended to choose a bank and account opening channel that suits your needs.

FAQ

How long does it take to open a Singapore bank account?

You can usually complete personal account opening within a few working days. Corporate account reviews take longer, possibly 2 to 6 weeks.

Can Chinese/China mainland residents open accounts remotely?

As a Chinese/China mainland resident, you can open accounts remotely through some banks. You need to prepare all documents and complete video identity verification.

Is proof of address mandatory for account opening?

You need to submit proof of address. Banks require documents like utility bills, lease agreements, or bank statements to verify your residential address.

How can I manage funds after opening an account?

You can link your Singapore bank account to the BiyaPay platform. It enables multi-currency collections, transfers, and fund alerts for convenient account management.

What are the minimum deposit requirements for account opening?

Minimum deposit requirements vary by bank. DBS requires 0 USD, UOB requires 1,000 USD, and OCBC requires 5,000 USD. You need to choose a bank based on your financial situation.

You’ve gained a comprehensive understanding of the process, material requirements, restrictions for different nationalities, and the account thresholds and features of DBS, UOB, and Citibank for opening a bank account in Singapore. You know that whether you choose to visit a branch in person or complete a remote video verification, precise documentation and meeting minimum deposit requirements are crucial. However, even after successfully opening the account, you still face challenges in multi-currency management, cross-border transfer efficiency, and meeting stringent compliance mandates.

In a global financial hub like Singapore, which demands highly efficient fund flow, you need a professional FinTech platform that can seamlessly connect with your bank account and support real-time multi-currency exchange and transfers to manage your global wealth.

BiyaPay is the ideal solution for efficiently managing your Singapore bank account funds. Through the BiyaPay platform, you can easily link your Singapore bank account and manage multiple currencies (including USD), enjoying convenient real-time exchange services. Our remittance fees as low as 0.5% and zero commission on contract limit orders help you maximize control over transaction costs, and we ensure same-day fund remittance and arrival, making your capital allocation fast and compliant. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and use one platform to achieve efficient fund management and global asset allocation (such as Stocks), maximizing the functionality of your Singapore bank account!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.