- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Basic Knowledge of the Colombian Peso and Remittance Precautions: How to Ensure Accurate and Error-Free Transactions

Image Source: unsplash

When you are making a remittance in Colombian Pesos, you must understand the basic knowledge of the Colombian Peso. Carefully verifying each step can effectively avoid common mistakes. The table below shows some common errors and their financial consequences:

| Error Type | Description | Financial Consequences |

|---|---|---|

| Incorrectly reporting investment purpose | Investors misdeclare the purpose of funds, leading to fines during audits | Fines can reach up to 200% of the misreported amount |

| Ignoring exit strategies for profit repatriation | Violating repatriation requirements may lead to visa revocation and legal obstacles | May face tax audits and future investment barriers |

| Underreporting transaction value in legal documents | Underreporting transaction prices leads to increased capital gains tax | Affects legitimate fund repatriation |

| Using remittance platforms for investment | Funds do not meet investment requirements, making visa applications impossible | Funds are unprotected and cannot be legally repatriated |

| Failing to verify IMC documents | Document errors lead to visa rejection or frozen funds | May result in unusable or lost funds |

Accurate operations at every step can ensure your funds arrive safely.

Key Points

- Understand the basic knowledge of the Colombian Peso to accurately judge exchange rate changes during remittances and avoid losses.

- Choose legitimate channels for remittances to ensure fund safety and avoid losses due to using unregulated platforms.

- When verifying recipient information, ensure every detail is accurate to avoid remittance failures due to errors.

- Pay attention to remittance fees and real-time exchange rates, reasonably estimating the received amount to avoid losses due to fees and exchange rate fluctuations.

- Keep all remittance receipts to quickly provide evidence in case of issues, protecting your rights.

Basic Knowledge of the Colombian Peso

Image Source: unsplash

Currency and Denominations

When learning about the Colombian Peso, you should first understand its official symbol and international code. The official symbol of the Colombian Peso is “” or “COL”, and its international standard code is “COP”. In international transactions and banking, you will usually see the abbreviation “COP”. The table below shows related information:

| Official Symbol | ISO Code | Common Representation in Transactions |

|---|---|---|

| $ or COL$ | COP | Banks and currency exchange |

In daily life, the Colombian Peso comes in various denominations. Common coin denominations include 50, 100, 200, 500, and 1,000; banknotes include 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, and 100,000. You can refer to the table below:

| Type | Denominations |

|---|---|

| Coins | 50, 100, 200, 500, 1,000 |

| Banknotes | 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000 |

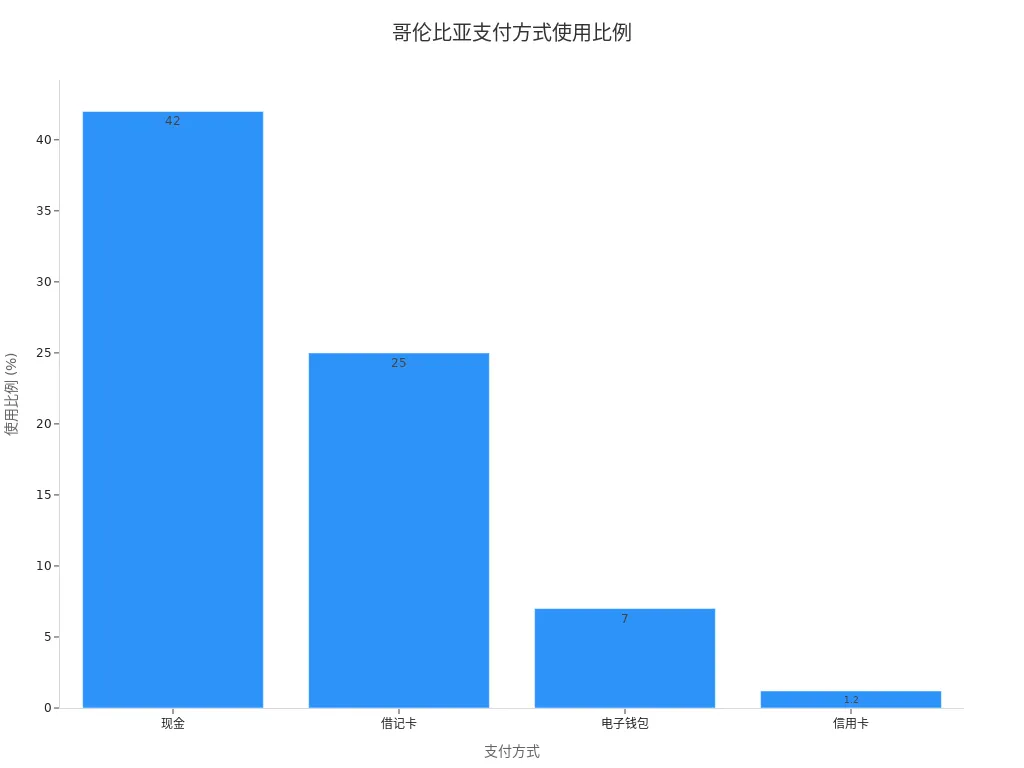

In Colombia, cash remains the most commonly used payment method. Surveys show that over 70% of transactions use cash, especially for small purchases and street shopping. The use of credit and debit cards is gradually increasing, particularly in online shopping. The chart below shows the proportion of different payment methods:

When dining in restaurants, you will typically see a 10% voluntary tip (propina voluntaria) on the bill, which most people pay. If the service is particularly good, customers may add an extra tip of 2,000 to 5,000 pesos. For porters and room service, it is recommended to leave a tip of 1 to 2 USD per piece of luggage or per day.

Exchange Rates and Influencing Factors

When making remittances, you must pay attention to exchange rate changes of the Colombian Peso. Exchange rates are influenced by several factors, including:

- Interest rate hikes by the U.S. Federal Reserve can lead to dollar appreciation, affecting the peso exchange rate.

- Uncertainty in Colombia’s local economic policies, especially during large fiscal deficits, can exacerbate currency fluctuations.

- International market trends also affect the peso’s value. For example, when the dollar weakens and global oil prices rise, the peso may appreciate. As a major oil exporter, Colombia sees increased export revenue from rising oil prices, improving its trade balance.

- Uncertainty in U.S. trade policies can indirectly affect Colombia’s export demand.

Only by fully understanding the basic knowledge of the Colombian Peso can you accurately judge exchange rate changes during remittances and avoid losses due to fluctuations.

Pre-Remittance Preparations

Choosing Legitimate Channels

Before remitting Colombian Pesos, you must prioritize legitimate channels. Colombian law stipulates that all remittances must be completed through authorized entities. These channels include banks, remittance companies, and certain non-bank financial institutions. You can refer to the following common channels:

- Banks (e.g., licensed banks in Hong Kong offering international remittance services)

- Licensed remittance companies

- Non-bank financial institutions (must have official authorization)

Choosing these channels ensures the safety of your funds, avoiding losses or freezes due to using unregulated platforms. When handling remittances in China/Mainland China, you can consult bank counters or official customer service to confirm whether the selected service is recognized by Colombian financial regulators.

Tip: When choosing a remittance channel, it is recommended to prioritize banks or large remittance companies with international business experience. This reduces delays and risks due to unfamiliar processes.

Verifying Recipient Information

When filling out recipient information, you must ensure every detail is accurate. Errors can lead to remittance failures or even fund losses. You should focus on verifying the following:

- Recipient name (must match the ID exactly)

- ID number

- Address (including province and city)

- Phone number (must include country code)

- Bank name

- Account type (e.g., checking account, savings account)

- Account number (Colombian account numbers are 9 to 16 characters long)

When handling remittances through licensed banks in Hong Kong, bank staff will require you to fill out the above information item by item. You can prepare recipient details in advance to avoid delays due to incomplete information.

Note: When verifying the recipient’s name, it is recommended to refer directly to the recipient’s ID or official documents to ensure spelling and format are identical. Any minor error may lead to the bank refusing to process the remittance.

Fees and Real-Time Exchange Rates

When remitting Colombian Pesos, you must pay attention to fees and real-time exchange rates. These factors directly affect the final amount received. You can refer to the following impacts:

- Remittance service fees reduce the final amount received in Colombian Pesos. For example, some banks or remittance companies charge a fee of 10-30 USD.

- Real-time exchange rates vary depending on payment and withdrawal methods. Rates may differ slightly when using bank counters, online banking, or mobile apps.

- Exchange rates are typically estimates and are influenced by international markets, policy changes, and other factors. You can check the day’s exchange rate before remitting to reasonably estimate the received amount.

When handling remittances in China/Mainland China, you can request detailed fee and exchange rate explanations from the bank or remittance company. Record all fee and rate information for future reference.

| Item | Description | Reference Amount (USD) |

|---|---|---|

| Remittance Fee | Service fee charged by banks or remittance companies | 10-30 |

| Exchange Rate Fluctuation | Rates adjust in real time based on market changes | Subject to the day’s rate |

| Received Amount | Calculated after deducting fees and applying real-time rates | Depends on remittance amount |

Suggestion: Before remitting, you can use the bank or remittance company’s online calculator to estimate the actual received amount. This avoids discrepancies due to fees and exchange rate fluctuations.

Only by fully grasping the basic knowledge of the Colombian Peso can you prepare adequately before remitting, ensuring every step is accurate.

Remittance Operations

Image Source: pexels

Filling Out Information

When filling out remittance information, you must be highly meticulous. Many people experience delays or returns due to errors. Common mistakes include incorrect recipient name spelling, wrong account numbers, or errors in country or currency selection. You can refer to the table below for common errors and solutions:

| Error Type | Solution |

|---|---|

| Inaccurate sending information | Double-check recipient name, account number, country, currency, and amount before confirming the transfer. |

| Not checking amount and exchange rate | Verify the actual amount sent and exchange rate to avoid losses due to assumptions. |

| Not saving transfer receipt | Keep receipts or tracking codes for future tracking. |

When handling remittances through licensed banks in Hong Kong, it is recommended to prepare all recipient details in advance and verify each item to ensure accuracy.

Confirming Amount

When confirming the remittance amount, you need to consider fees and exchange rate fluctuations. The actual received amount may differ from expectations. You can take the following steps:

- Understand exchange rate differences, transfer fees, and payment methods of various providers.

- Note that some providers advertise zero fees but may compensate with lower exchange rates.

- Compare fees and rates from multiple providers to choose the best option.

You can use the bank or remittance company’s online calculator to estimate the actual received amount, avoiding discrepancies due to fees and rate changes.

Saving Receipts

After completing the remittance, you must properly save all related receipts. These documents are crucial for resolving issues or filing complaints. Common receipts include:

| Document Type | Description |

|---|---|

| Error Notification | Your submitted error description |

| Documents Provided by Sender | Proof materials related to the error |

| Investigation Results | Investigation conclusions issued by the remittance service provider |

You can save electronic receipts, tracking numbers, and related documents in a secure location. This allows quick evidence provision when needed, protecting your rights.

Remittance Verification

Checking Arrival

After completing the remittance, the first step is to check the arrival status promptly. Many remittance providers offer online tracking tools. For example, you can use Ria Money Transfer’s “Track Transfer” feature. You only need to enter the unique Personal Identification Number (PIN) to check the remittance status at any time. This PIN is usually found in your account or transfer confirmation email. Even without a Ria account, the recipient can use this tool to check transfer progress.

Arrival times vary by channel and country. Remittances from the U.S. to Colombia typically take 1 to 5 business days. You can refer to the table below:

| Sending Country | Receiving Country | Typical Time Range |

|---|---|---|

| USA | Colombia | 1 to 5 business days |

During the waiting period, it is recommended to check the status regularly. If the received amount is lower than expected, it may be due to hidden fees in exchange rates from providers like Efecty or Western Union. For small remittances (below 200 USD), fees can be higher, typically 10% to 20%.

Tip: When remitting through licensed banks in Hong Kong from China/Mainland China, you can request transfer tracking services to monitor progress at any time.

Filing Complaints

If you encounter issues with the remittance, such as incorrect amounts, delays, or non-delivery, you can follow the standard procedure to file a complaint. The general process is as follows:

| Step | Description |

|---|---|

| 1 | Request a refund or correction of the incorrect amount. |

| 2 | The remittance provider must provide written investigation results within three days, explaining your rights. |

| 3 | You can request copies of documents related to the error investigation. |

| 4 | If dissatisfied with the results, you can reassert the error, and the provider must retain related records. |

When filing a complaint, it is recommended to prepare all remittance receipts and transfer records. This helps the provider locate the issue faster. You can also request written explanations from the bank or remittance company to protect your rights.

Risk Prevention

Operation Verification

When remitting Colombian Pesos, you must carefully verify each operation step. Many remittance failures or fund losses stem from inaccurate information. You can take the following steps:

- Before initiating the transaction, carefully check all details, including the recipient’s name and account number. Any spelling error may prevent funds from arriving.

- Understand cancellation fees or restrictions. Different remittance companies and banks (e.g., licensed banks in Hong Kong) have varying cancellation policies, and some may charge additional fees.

- If you notice an error, contact the remittance company or bank immediately. Cancelling before the transaction is processed can minimize losses.

Tip: When remitting through licensed banks in Hong Kong from China/Mainland China, prepare all recipient details in advance and double-check before submission to reduce operational risks effectively.

Anti-Fraud Advice

When remitting Colombian Pesos, you must stay vigilant against various fraud risks. In recent years, international remittance fraud cases involving Colombian Pesos have been frequent. Common types are shown in the table below:

| Evidence Type | Description |

|---|---|

| Legal Case | Colombian currency broker sentenced to nearly a decade for involvement in international money laundering conspiracy. |

| Legal Case | Colombian man sentenced for participating in a money laundering conspiracy. |

| Legal Case | U.S. Drug Enforcement Agency reports on fund flows involving Colombian drug money laundering organizations. |

| Legal Case | Treasury Department takes action against dirty money flowing to Colombia. |

You can take the following measures to effectively prevent fraud:

- Always verify the recipient’s identity to ensure they are trustworthy.

- Stay cautious of suspicious fund requests, especially from strangers or sudden “relatives” or “friends.”

- Use only official and secure channels for remittances, avoiding unregulated platforms.

When encountering requests for transfers from strangers, ask yourself: “Do I really know this person? Why do they suddenly need money? Is there a fraudulent pretext?” Be extra cautious if someone requests funds citing inheritance or lottery winnings to avoid scams.

Before remitting, mastering the basic knowledge of the Colombian Peso is crucial. You can enhance fund safety through the following key steps:

- Choose reputable remittance companies

- Confirm that the recipient bank and recipient have received the funds

- Comply with relevant regulations

- Use services with SMS or email notifications

You should also note that choosing regulated channels and verifying information can improve data accuracy. The table below shows related statistical evidence:

| Evidence Type | Description |

|---|---|

| ITRS Report | Covers only institutions regulated by the central bank; other transfer methods may lead to data gaps. |

| New Data Sources | Provide additional checks and verifications, enhancing the reliability and accuracy of statistics. |

By developing good remittance habits and keeping all receipts, you can effectively prevent risks and ensure funds arrive smoothly.

FAQ

What basic information is required to remit to a Colombian Peso account?

You need the recipient’s name, ID number, address, phone number, bank name, account type, and account number. When handling remittances through licensed banks in Hong Kong, preparing this information in advance can improve efficiency.

How long does it take for a remittance to arrive?

Remittances to Colombia through licensed banks in Hong Kong typically take 1 to 5 business days. Arrival time is affected by bank processing speeds and international clearing processes.

How do remittance fees and exchange rates affect the received amount?

Fees typically range from 10-30 USD. Real-time exchange rates impact the final received amount. You can use the bank’s online calculator to estimate the actual amount.

What to do if account information is entered incorrectly?

If you notice an error, contact the remittance bank or company immediately. Cancelling before processing can minimize losses. Keep all receipts to aid in complaints.

How to prevent remittance fraud?

Verify the recipient’s identity and use only legitimate channels. Stay vigilant against suspicious requests. Keeping all remittance receipts can effectively protect your funds.

When remitting Colombian Pesos, you must contend with high bank fees, complex compliance reviews, and volatile exchange rates. While meticulous verification helps ensure transactional accuracy, the drawbacks of traditional channels in terms of speed and cost can still lead to missed investment opportunities or added hidden losses.

If you are seeking a solution that offers superior efficiency, lower costs, and seamless access to global investment markets, BiyaPay provides an experience that goes beyond mere remittance. You can achieve zero-barrier global investment with our quick registration, completed in just 3 minutes without needing an overseas bank account. We not only provide real-time exchange rate inquiry and fiat conversion services, allowing you to monitor rate dynamics and effectively avoid hidden losses, but also offer the ultra-low advantage of remittance fees as low as 0.5%, saving you up to 90% versus conventional banks.

A single BiyaPay account enables you to trade both US and Hong Kong stocks, eliminating platform switching for unified, quicker asset management. Furthermore, we support the conversion between fiat and digital currencies (like USDT), ensuring quick funding by bypassing complex channels. Whether for daily transfers or large-scale investments, we guarantee global remittance with same-day sending and arrival, meaning your funds arrive the same day, ensuring you never miss a trading window. Active traders also benefit from zero commission for contract limit orders, a preferred method for low-cost position building. Start exploring today for safer, more efficient cross-border financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.