- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Best Way to Send Money to Colombia? Analysis of Fees, Security, and Arrival Time

Image Source: pexels

When you send money to Colombia via remittance, choosing the best remittance method is very important. You need to focus on fees, security, and arrival time. In the first quarter of 2025, Colombia received remittances amounting to USD 31.31 billion. Remittance amounts continue to grow, with a 42% increase in 2023 compared to pre-pandemic levels. You can choose from various channels such as banks, remittance companies, digital platforms, e-wallets, or cash pickups. Each method suits different needs, such as the amount, frequency, or receiving method. You can quickly identify the most suitable solution based on your situation.

Key Points

- When choosing a remittance method, focus on fees, security, and arrival time. Different channels suit different needs.

- Bank channels are suitable for large transactions, offering high security but higher fees and longer arrival times.

- Remittance companies offer flexible options, low fees, and fast arrival, suitable for small remittances.

- Digital platforms and e-wallets are ideal for frequent small remittances, with low fees and quick arrivals.

- Cash pickups are suitable for situations requiring immediate cash, simple to operate but with potential hidden fees.

Overview of Remittance Methods and Best Options

Image Source: unsplash

When sending money to Colombia, you can choose from multiple channels. Each method has different use cases and characteristics. You need to weigh fees, security, and arrival time to find the best remittance method. Below, I will detail five mainstream channels and compare their advantages and disadvantages.

Bank Channels

Bank channels are suitable for high-value commercial transactions. Licensed Hong Kong banks typically provide secure and reliable cross-border remittance services. You can initiate remittances through bank counters, online banking, or mobile banking. The advantage of bank channels lies in high security, strict regulation, and complete transaction records. You can track remittance progress at any time to ensure fund safety. However, bank channels have higher fees, typically between USD 25-50. Exchange rate markups are also significant, with total costs potentially reaching USD 45-90. Arrival time generally takes 2-5 business days. If you need fast arrivals or frequent small remittances, bank channels may not be the best option.

Remittance Companies

Remittance companies offer flexible remittance options. You can initiate remittances at physical stores or online platforms. Remittance companies typically support cash pickups and account deposits, suitable for recipients without bank accounts. Fees are lower, usually between USD 5-25, with exchange rate markups around 1-3%. Some remittance companies can achieve arrivals in minutes, with the fastest completing within an hour. When choosing a remittance company, you need to focus on its compliance and service coverage. Some companies may lack service points in remote areas. While arrival times are fast, some companies charge hidden fees, and the actual amount received may be lower than expected.

Digital Platforms

Digital platforms are transforming the landscape of cross-border remittances. You can initiate remittances anytime, anywhere via mobile or computer. Digital platforms often integrate with mobile wallets and blockchain technology, achieving low-cost, fast arrivals. Some platforms support stablecoins and digital dollars, completing international transfers in seconds. Fees are as low as USD 3.99-7.42, with exchange rate markups of only 0.5-2%. Digital platforms are suitable for frequent small remittances or when real-time arrival is needed. You don’t need a bank account; registering a platform account is sufficient. The innovative technology of digital platforms makes the remittance process more transparent and efficient. When choosing a digital platform, you need to focus on its compliance and user reviews to mitigate potential risks.

E-Wallets

E-wallets provide a convenient remittance experience. You can transfer funds directly to the recipient’s e-wallet account via a mobile app. E-wallets are suitable for users without bank accounts, supporting 24/7 transactions. Some e-wallets collaborate with digital platforms to achieve low-cost, fast arrivals. You can check balances and transaction records anytime to ensure fund safety. However, e-wallets have lower daily transaction limits, typically COP 3,000,000 (about USD 750). Some banks do not support e-wallet top-ups, which may affect the user experience. When choosing an e-wallet, you need to confirm whether the recipient has registered for the service.

Cash Pickups

Cash pickups are suitable when you need the recipient to receive cash directly. You can initiate remittances at remittance company stores or partner locations, and the recipient can collect cash with an ID. Cash pickups do not require a bank account, are simple to operate, and have fast arrival times. Some services support arrivals in minutes, ideal for urgent remittance needs. Cash pickup exchange rates often include hidden surcharges, and the actual amount received may be lower than expected. You need to check the distribution of service locations to ensure the recipient can conveniently collect cash. Cash pickups are suitable for one-time small remittances but not recommended for large or frequent transfers.

Tip: When choosing the best remittance method, consider the remittance amount, frequency, and receiving method comprehensively. Digital platforms and e-wallets are ideal for small, frequent remittances, bank channels suit large transactions, and remittance companies and cash pickups are suitable for recipients without bank accounts.

Comparison of Advantages and Disadvantages by Channel

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Suitable for high-value commercial transactions, secure and reliable. | May have high fees, longer processing times. |

| Digital Platforms | Fast transactions, easy to use, 24/7 availability, low fees for users. | Lower daily transaction limits, some banks unsupported. |

| E-Wallets | Direct deductions from e-wallet accounts, secure and widely used. | Requires e-wallet registration, some users may be unfamiliar. |

| Remittance Companies | Offers multiple services, supports international remittances, no fees for recipients. | Exchange rates often include hidden surcharges, potentially reducing received amounts. |

| Cash Pickups | Fast processing, secure and efficient, suitable for various payments and transfers. | May incur fees, depends on service location availability, coordinating multiple entities can be challenging. |

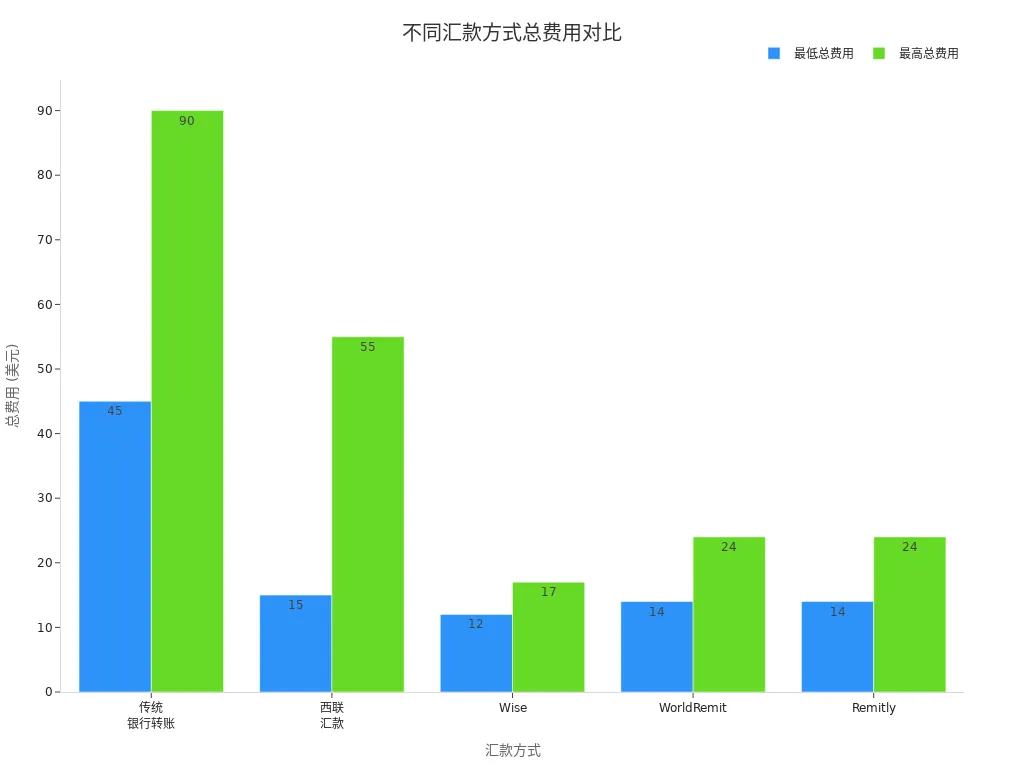

Fee and Arrival Speed Comparison by Channel

| Method | Transfer Fee (USD) | Exchange Rate Markup | Total Cost (USD) | Speed |

|---|---|---|---|---|

| Bank Transfer | 25-50 | 2-4% | 45-90 | 2-5 business days |

| Remittance Companies | 5-25 | 1-3% | 15-55 | Minutes to 1-2 business days |

| Digital Platforms | 3.99-7.42 | 0.5-2% | 12-24 | 1-2 business days |

| E-Wallets | 3.99-7.42 | 0.5-2% | 12-24 | 1-2 business days |

| Cash Pickups | 5-25 | 1-3% | 15-55 | Minutes to 1-2 business days |

Latest Trends and Regulatory Requirements

When choosing the best remittance method, you also need to consider the latest technologies and regulatory policies. Digital financial services and cryptocurrencies are rapidly evolving, with blockchain technology making international transfers decentralized, auditable, and efficient. The popularity of mobile wallet services allows users without bank accounts to remit conveniently. In terms of regulation, all foreign currency transactions must be processed through authorized financial institutions, with over 90% of cross-border commercial payments handled through these intermediaries. You need to ensure complete transaction records and promptly report suspicious transactions to relevant authorities. Discussions on remittance taxation and compliance continue, with experts noting that excessive taxation may drive funds to informal channels, increasing risks.

Tip: During actual operations, prioritize compliant platforms to ensure fund safety. Keeping up with technological developments and leveraging digital platforms and e-wallets can improve remittance efficiency and reduce costs.

Fee Comparison

Image Source: unsplash

When choosing the best remittance method, the fee structure is one of the most critical factors. The cost components of different channels include handling fees, exchange rate differences, and potential hidden costs. You need to understand the specific fee structures of each method to make informed choices.

Bank Fees

Bank channels typically charge higher fees. When using a licensed Hong Kong bank for cross-border remittances, handling fees are generally USD 25-50. Banks also add a 2-4% exchange rate markup. Some banks display exact fees and received amounts, but you should note that banks profit from currency exchange. If you choose the best remittance method for large transfers, bank channels offer high security and compliance, but total costs will also increase accordingly.

| Fee Type | Description |

|---|---|

| Transaction Fees | Exact fees and received amounts displayed during remittance |

| Exchange Rate Markup | Banks profit from currency exchange |

| Best Rate Option | Choosing the best rate can yield a better exchange ratio |

Remittance Company Fees

Remittance companies offer flexible fee structures. Handling fees typically range from USD 5-25, with exchange rate markups of about 1-3%. When using remittance companies, some services may charge hidden fees, and the actual amount received may be lower than expected. Traditional remittance companies have an average fee of about 5.5% (e.g., USD 11 for USD 200), with arrival times of 1-5 business days. You need to carefully compare the fee standards of different companies to avoid impacting the recipient’s interests due to high fees.

Digital Platform Fees

Digital platforms generally have lower fees. When remitting through digital platforms, handling fees are typically USD 3.99-7.42, with exchange rate markups of only 0.5-2%. Some platforms use blockchain or stablecoin technology, with fees as low as USD 1-2 and total costs below 3%. Digital platforms are suitable for frequent small remittances, offering fast arrivals and transparent fees. You can refer to the table below to understand the average fees and arrival speeds of different methods:

| Transfer Method | Average Fee (%/USD 200) | Speed |

|---|---|---|

| Traditional Remittance Companies | 5.5% (~USD 11) | 1–5 business days |

| USDC/Stablecoin Services | <3% (usually $1–$2) | Minutes (blockchain settlement) |

E-Wallet Fees

E-wallet remittance fees are similar to those of digital platforms. You typically pay handling fees of USD 3.99-7.42, with exchange rate markups of 0.5-2%. E-wallets are suitable for users without bank accounts, with simple fee structures and fast arrivals. When choosing an e-wallet, prioritize platforms with transparent fees to avoid hidden costs.

Cash Pickup Fees

Cash pickup fees vary significantly. Some providers, like major banks, may not charge handling fees, but most companies charge high and variable commissions and use uncompetitive exchange rates. High fees and unfavorable rates can affect the actual amount received. When choosing cash pickups, you should review the fee policies of service locations to avoid losses due to excessive costs.

- High remittance fees reduce the actual amount received.

- Unfavorable exchange rates also cause additional losses.

Tip: When choosing online remittance services, you can often enjoy lower fees. Bank channels are suitable for large transfers, while some digital platforms like Paysend offer fixed handling fees, ideal for small, frequent remittances. Considering both fees and arrival speed helps you find the best remittance method.

Security Analysis

Bank Security

When using a licensed Hong Kong bank for cross-border remittances, you can achieve high security. Banks employ multi-factor authentication and encryption technology to ensure the safety of your funds and personal information. You can track remittance progress anytime and detect anomalies promptly. Banks strictly comply with international anti-money laundering regulations, with all transactions fully recorded. Bank channels are suitable for scenarios requiring high security and compliance, making them a key reason many users choose them as the best remittance method.

Remittance Company Security

Remittance companies ensure your fund safety through multiple measures.

- Use biometric technology (e.g., fingerprint recognition) to verify the identity of transacting parties, reducing fraud risks.

- Comply with local and international regulations to prevent money laundering and financial crimes.

- Conduct regular risk assessments and employee training to enhance compliance levels.

- Use fintech and regtech tools to streamline compliance processes. When choosing a remittance company, prioritize platforms with strong compliance and robust risk control measures.

Digital Platform Security

Digital platforms are continuously improving security.

- Platforms emphasize compliance, strictly enforcing anti-money laundering (AML) and know-your-customer (KYC) procedures.

- Adopt high security standards and API security best practices, including smart contract audits and strong authentication protocols.

- Stablecoin and fiat currency API integration ensures data encryption and regular security audits to protect sensitive financial data. When using digital platforms, you should check if the platform is recognized by financial regulators to avoid losses due to compliance risks.

E-Wallet Security

E-wallet providers use multiple security protocols to ensure your fund safety:

| Security Protocol | Purpose |

|---|---|

| PCI DSS | Ensures payment data security |

| SARLAFT | Prevents money laundering, transaction monitoring, and customer due diligence |

When using e-wallets for remittances, you can monitor transactions in real time, reducing theft risks. Platforms regularly update security measures to enhance overall protection.

Risk Prevention

When conducting cross-border remittances, you need to be vigilant about common fraud and scam types. The table below summarizes major risks and prevention measures:

| Fraud Type | Description | Prevention Measures |

|---|---|---|

| Phishing | Impersonating banks or remittance services to steal personal information | Verify recipient identity, use secure channels |

| Emergency Scams | Posing as family members requesting urgent remittances | Verify request authenticity |

| Fake Websites | Creating fraudulent sites to steal banking information | Use only official and secure channels |

When choosing the best remittance method, prioritize compliant platforms, regularly check account security, and avoid losses due to negligence.

Arrival Time Analysis

When choosing the best remittance method, arrival time is a key consideration. Different channels have varying arrival speeds, affecting the recipient’s fund usage efficiency. You can select the most suitable remittance method based on your actual needs.

Bank Arrival Time

Bank channels typically take 1-5 business days. When using a licensed Hong Kong bank for cross-border remittances, arrival speed is affected by various factors. For example, incorrect payment details can cause delays or returns. The payment method you choose (e.g., credit or debit card) also impacts processing time. The recipient country’s banking processing speed, time zone differences, bank holidays, and anti-money laundering regulations all affect arrival time. You need to verify information in advance to avoid unnecessary delays.

Remittance Company Arrival Time

Remittance companies can provide faster arrival experiences. Some companies like Inpay average just 30 minutes, WorldRemit typically takes 1-2 business days, and Western Union may take up to 5 days for initial transfers but can arrive same-day for subsequent ones. Cash pickup services usually complete in minutes. In urgent situations, you can prioritize remittance companies with fast arrival times.

Digital Platform Arrival Time

Digital platforms offer very fast arrival times. When remitting through platforms like Paysend, funds are typically available within minutes. Debit card and mobile wallet transfers can also achieve real-time arrivals. Digital platforms are suitable for scenarios requiring efficient, instant arrivals, especially for small, frequent remittances.

E-Wallet Arrival Time

E-wallet arrival times depend on the specific app. Just Wallet supports real-time arrivals, while Nequi’s registration process may take up to 13 days. When using e-wallets, confirm in advance whether the recipient has completed registration to ensure timely fund arrivals.

Cash Pickup Arrival Time

Cash pickup methods have extremely fast arrival times. Through services like Wells Fargo or Boss Revolution, cash can typically be collected within minutes. Ria Money Transfer arrival times range from minutes to five business days, depending on service locations and processes. When choosing cash pickups, focus on service coverage and actual arrival speed.

You can refer to the table below to quickly compare the arrival times of different remittance methods:

| Remittance Method | Estimated Arrival Time |

|---|---|

| Bank Channels | 1-5 business days |

| Remittance Companies | 30 minutes to 5 business days |

| Digital Platforms | Minutes to 1 business day |

| E-Wallets | Real-time or up to 13 days |

| Cash Pickups | Minutes to 5 business days |

During actual operations, choose the best remittance method based on the remittance amount and urgency to enhance fund flow efficiency.

Case Studies and Selection Tips

Best Remittance Methods for Different Scenarios

When sending money to Colombia, your specific scenario influences your choice. Different needs correspond to different channels.

- If you need to pay medical expenses, you can choose direct payments to medical service platforms. This ensures funds are used for their intended purpose, reducing remote management stress.

- For family daily expenses like grocery shopping, cash remittances or prepaid cards are more convenient. You can help families maintain traditional diets, strengthening family ties.

- In education scenarios, you can use a licensed Hong Kong bank or digital platform to pay tuition directly. This ensures funds reach educational institutions directly, reducing intermediaries and enhancing security.

You can refer to the table below to quickly understand recommended remittance methods for different amounts:

| Transfer Amount | Recommended Method | Description |

|---|---|---|

| Small Transfers | Cash, Prepaid Cards | Suitable for small transfers, convenient and fast. |

| Large Transfers | International Wire Transfer | Direct transfers from bank accounts, typically take 2-3 days. |

During actual operations, you can flexibly choose the best remittance method based on the purpose and amount.

Amount and Frequency Selection Tips

Before remitting, you need to clarify the amount and frequency.

- Small, frequent remittances are suitable for digital platforms or e-wallets. These channels have low fees and fast arrivals, ideal for daily support.

- Large, infrequent remittances are best suited for bank channels. Licensed Hong Kong banks offer high security and compliance, suitable for one-time large transfers.

- For monthly regular remittances, compare platform fees and exchange rates in advance to choose the most cost-effective channel long-term.

You can create a simple remittance plan, recording the amount, channel, and arrival time for each transfer. This helps optimize fund flows and avoid unnecessary losses.

Impact of Receiving Methods

When choosing a remittance method, the recipient’s needs are crucial.

- If the recipient lacks a bank account, cash pickups or e-wallets are better choices. You can enable recipients to collect cash at local points or receive funds via a mobile app.

- If the recipient has a bank account, bank transfers or digital platforms are more efficient. Funds can arrive directly, reducing intermediaries.

- For specific scenarios like medical or educational payments, you can choose direct payments to service providers to ensure clear fund usage.

Before remitting, communicate with the recipient to confirm their receiving method and preferences. This improves remittance efficiency and reduces errors.

Practical Remittance Tips

During the remittance process, you can follow these practical tips to avoid common issues:

- Always verify recipient information. Ensure the recipient’s name, account number, country, currency, and amount are accurate.

- Use secure and supported platforms. Avoid unknown channels and prioritize compliant, reputable providers.

- Compare fees and exchange rates. Understand each platform’s handling fees, rates, and potential taxes before sending to choose the most cost-effective option.

- Maintain communication and follow-up. Coordinate with the recipient, informing them of the remittance time and channel to ensure timely arrivals.

Tip: When choosing the best remittance method, consider the remittance amount, frequency, and receiving method comprehensively. Advance planning and communication can effectively enhance the remittance experience and ensure fund safety.

When choosing a method to send money to Colombia, you need to consider the following factors:

- Fees and Exchange Rates: Compare handling fees and currency conversion costs across platforms.

- Transfer Limits: Confirm the maximum and minimum amounts per remittance.

- Geographic Availability: Ensure the service supports your country and Colombia.

- Security: Focus on the platform’s encryption and anti-fraud measures.

- User Experience: Choose platforms with simple operations and responsive customer support.

- Arrival Speed: Select platforms with fast arrivals based on fund urgency.

It’s recommended to weigh these factors based on your needs to devise the most suitable remittance plan.

FAQ

What basic information is needed to send money to Colombia?

You need to provide the recipient’s full name, ID number, bank account information, or e-wallet account. You also need to confirm the recipient’s city and contact details to ensure accuracy.

Are there limits on remittances to Colombia?

Limits vary by channel. Bank channels typically support large remittances, while e-wallets and digital platforms are suited for small, frequent transfers. Check specific limits with the provider in advance.

How long does it take for a remittance to arrive in Colombia?

Arrival time depends on the channel. Bank channels generally take 1-5 business days, while digital platforms and cash pickups can arrive in minutes. Choose based on urgency.

How can I ensure fund safety during remittances?

Choose compliant licensed Hong Kong banks or reputable digital platforms. Verify recipient information and avoid unknown channels. Regularly check your account to prevent anomalies.

How do I calculate total remittance costs?

Pay attention to handling fees and exchange rate markups. Some platforms display total fees and actual amounts received. Compare fee standards across channels in advance to choose the most cost-effective option.

Navigating remittances to Colombia often means facing steep fees, opaque exchange rates, delayed arrivals, and security worries—issues that can make cross-border transfers costly and stressful. What if a platform offered a total fee as low as 0.5% , seamless conversion between 30+ fiat currencies and 200+ digital assets, support for most countries worldwide, and same-day delivery?

BiyaPay delivers exactly that. As a top-tier digital finance platform, we provide real-time exchange rate checks to help you lock in optimal rates and avoid hidden charges. With a quick mobile signup, you can initiate secure, efficient transfers anytime, whether for family support or business needs. Backed by multi-layer encryption and global compliance standards, BiyaPay ensures every transaction is safe and arrives instantly.

Transform your remittance experience now! Visit BiyaPay to explore real-time rates and plan your transfer. Sign up for a BiyaPay account today and unlock low-cost, instant, and secure remittances to Colombia, making global money transfers effortless and trustworthy.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.