- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Comprehensive Guide to Renting in Canada: From Rental Platforms to Rent Budget

Image Source: unsplash

When renting in Canada, you may notice that the ratio of renters to homeowners is not as imbalanced as in China/mainland China. The table below shows that 33% of people in Canada choose to rent, while 67% own their homes:

| Type | Percentage |

|---|---|

| Renters | 33% |

| Homeowners | 67% |

Many new immigrants and international students face various challenges during the rental process:

- Rising rents create financial pressure.

- Discrimination exists in the rental market.

- Substandard housing conditions and common safety hazards.

- Landlord harassment and improper evictions occur from time to time.

By understanding these issues, you can better plan your rental journey.

Key Points

- Understand Canada’s rental market: 33% of people rent, while 67% own homes. New immigrants and students should be aware of issues like rising rents and rental discrimination.

- Choose the right housing type: apartments suit those seeking convenience, detached houses are ideal for families or those who prefer quiet environments, while basements and shared rentals suit budget-conscious renters.

- Use multiple rental platforms to gather information: English platforms like Kijiji and Craigslist are suitable for large cities, while Chinese platforms like 51FindHouse are better for Chinese-speaking users.

- Create a reasonable rental budget by calculating monthly income and expenses to ensure rent and living costs stay within budget. Sharing expenses with roommates can effectively reduce living costs.

- Stay vigilant during the rental process to avoid common scams, ensure a formal lease agreement is signed, and keep all payment receipts to protect your legal rights.

Housing Type Selection

Image Source: unsplash

In Canada, you can choose from various housing types. Each type suits different needs and budgets. You need to understand their characteristics to make an appropriate choice.

Apartments and Detached Houses

Apartments (Apartment/Condo) are usually located in city centers, offering convenient transportation and high security. If you prefer modern living and value convenience, you can consider apartments. Detached houses provide more space and are suitable for families or those who prefer a quiet environment. You will have more private space and a garden, but they are usually farther from city centers, resulting in longer commutes.

Canada also has townhouses, which fall between apartments and detached houses, suitable for families needing some space but with limited budgets.

Note: Canadian landlords typically do not provide furniture. You need to supply your own furniture, which differs from rental practices in China/mainland China.

- In China/mainland China, apartments are mostly furnished, allowing renters to choose decor styles based on preference.

- Furnished rentals in Canada are scarce and more expensive, mainly appealing to short-term residents or those with specific needs.

| Region | Furnished Rental Average Rent | Unfurnished Rental Average Rent | Rent Difference | Rent Difference Percentage |

|---|---|---|---|---|

| Canada | $4,450 | $3,450 | $1,000 | 29% |

| China/mainland China | Furnished rentals common | Negotiable to remove furniture | N/A | N/A |

Basements and Shared Rentals

Basements are typically located in the lower levels of detached houses or townhouses. If you have a limited budget, you can consider basements, which have lower rents but limited lighting and ventilation. Shared houses/rooms are suitable for students or new immigrants to Canada. You can share rent with others to save on living costs.

When choosing a housing type, you need to consider your budget, lifestyle, and commuting needs. Understanding the pros and cons of each housing type will help you find the most suitable home.

Canadian Rental Platforms

When renting in Canada, choosing the right platform is crucial. Different platforms vary in information volume, user experience, and applicable cities. You can quickly learn about the local rental market online, saving time and effort.

English Platforms

Mainstream English rental platforms in Canada include Kijiji, Craigslist, PadMapper, and Rentals.ca. You can find numerous listings in large cities like Toronto and Vancouver using these platforms. PadMapper and Rentals.ca have user-friendly interfaces with map-based filtering, making it easy to search by location. Kijiji and Craigslist offer a large volume of listings, ideal for finding short-term or unique rentals. You need to be aware that some platforms may have slower updates or less detailed information.

Tip: Refer to the table below to understand the market share and user base of Canadian rental platforms.

| Platform | Market Share/User Base |

|---|---|

| Rentals.ca | N/A |

| PadMapper | N/A |

| Airbnb | ~20% |

| Canadian Rental Market | ~$2.3 billion (2023) |

Chinese Platforms

If you prefer communicating in Chinese, you can use Chinese rental platforms like “51FindHouse,” “VanPeople,” and “York BBS.” These platforms focus on listings in Chinese communities, with faster updates and easier communication. When renting in Canada, using Chinese platforms makes it easier to find shared or sublet rentals suitable for new immigrants and students. Some platforms also offer rental experience sharing and lifestyle service information.

Offline Channels

You can also find rentals through offline channels, such as community bulletins, school student service centers, or friend referrals. Offline channels provide reliable information but have limited listings. When renting in Canada, combining online and offline channels can increase your chances of finding an ideal home.

By leveraging online resources, you can gain a comprehensive understanding of Canada’s rental market trends and listing distribution. Comparing multiple platforms helps you make more informed choices.

Rental Budget

Image Source: unsplash

City Rental Rates

When renting in Canada, you first need to understand rental rates in different cities. Average apartment rents in Toronto and Vancouver typically exceed $2,500. Rental prices vary significantly by city and area. The table below shows the monthly rent ranges for major housing types:

| Housing Type | Rent Range (Monthly, USD) |

|---|---|

| Studio Apartment | $1,567 |

| Two-Bedroom Apartment | $2,080 |

| Three-Bedroom Apartment | $2,200 - $2,800 |

| Basement Suite | $900 - $1,400 |

| Detached House | $1,750 - $2,900 |

| Apartment | $1,600 - $2,800 |

You also need to pay attention to rent control policies. Ontario allows a 2.1% annual rent increase in 2026. Landlords must wait at least 12 months since the last increase or lease start to raise rent and provide 90 days’ written notice. British Columbia has similar regulations, allowing landlords to increase rent annually based on government-set rates with three months’ notice.

Housing Type and Location Impact

The housing type and location you choose directly affect rent. Downtown and popular areas typically have higher rents. For example, apartments in downtown or Beltline areas can cost up to $3,800 monthly, while two-bedroom apartments in suburbs like Tuscany range from $1,400 to $2,500. Basements and shared rentals have lower rents, suitable for those with limited budgets. You can weigh commuting distance, convenience, and safety when making your choice.

Budget Planning

You can follow these suggestions to create a scientific rental budget:

- Calculate your monthly income and expenses to determine the amount available for rent.

- Prioritize rent and essential utilities like water, electricity, and heating.

- Set up automatic payments to avoid extra fees due to missed payments.

- Regularly review your expenses to ensure they stay within budget.

- Choose roommates to share rent and utility costs or use community resources to save money.

Tip: You can effectively reduce living costs by sharing rentals, adopting energy-saving measures, or using public transportation.

Reasonable budget planning can help you manage finances better while renting in Canada, reducing economic pressure.

Canadian Rental Process

Finding and Viewing Rentals

When renting in Canada, the first step is to find suitable listings. You can gather information through various channels:

- Online rental platforms: Platforms like Rentals.ca, PadMapper, and Zumper offer large volumes of listings with map-based filtering, allowing you to quickly target specific areas.

- Local real estate agents: You can contact professional agents to access unlisted properties and get support with negotiations and contracts.

- Social and community networks: You can join Facebook, Reddit, or other social groups or get referrals from friends and colleagues for reliable rental information.

- Offline channels: You can also check community bulletin boards or school student service centers for local listings.

After finding a desirable listing, you need to schedule a viewing. During the viewing, pay attention to the following:

- Carefully check if the property’s facilities are complete and functioning, such as door locks, faucets, appliances, and heating.

- Ask the landlord about details like utilities, internet, garbage disposal, and laundry.

- Learn about the surrounding environment, including transportation, supermarkets, schools, and safety conditions.

- Document the property’s condition and take photos for future reference.

Tip: Prepare a viewing checklist in advance to ensure no important details are missed.

Application and Signing

After deciding on a rental, you need to submit a rental application to the landlord. Canadian landlords typically require the following documents:

- Proof of income (e.g., pay stubs, bank statements)

- Reference letters (from previous landlords or employers)

- Credit report

- Employment verification letter

- Recent pay stubs

- Contact information

- References

- Current and previous residency information

- Work history

- Authorization for a credit check

After preparing the documents, fill out the rental application form and await the landlord’s review. Once approved, the landlord will sign a lease agreement with you. When signing, pay attention to the following:

- Carefully read the contract terms, confirming rent, deposit, payment methods, lease term, and maintenance responsibilities.

- Request a signed copy of the lease from the landlord to avoid future disputes.

- Ensure the contract contains no illegal terms, such as restrictions on visitors or forced early move-outs.

- Clarify maintenance responsibilities, understanding which repairs are the landlord’s responsibility and which are yours.

- Understand rent increase rules to ensure the landlord provides advance notice and complies with local laws.

Note: Canadian laws protect tenant rights. Landlords can only enter your home with 24 hours’ notice. Landlords must ensure the property is safe and habitable and address maintenance issues promptly. You have the right to dispute unreasonable rent increases.

Move-In Preparation

After signing, you need to prepare for a smooth move-in. Follow these steps:

- Pay the first month’s rent and deposit as per the contract and request receipts as proof of payment.

- Agree on a move-in date with the landlord and understand the move-in process.

- Re-inspect the property’s condition before moving in and take photos to avoid disputes over damages.

- Learn about community or apartment rules, such as laundry, mail collection, and garbage sorting.

- If needed, promptly handle utility and internet account transfers or activations.

Throughout the Canadian rental process, maintaining good communication with the landlord and keeping all contracts and payment receipts can effectively protect your legal rights.

Avoiding Scams and Successful Applications

Common Scams

When renting in Canada, be vigilant about the following common scams:

- Scammers post listings far below market rates to attract your contact.

- Requiring you to pay a deposit before signing a formal lease agreement.

- Asking you to transfer money to overseas accounts or through unclear channels.

- Showing only exterior photos of the property or images that don’t match the actual listing.

- Requesting personal or financial information via email or directing you to suspicious websites.

- Listings that appear repeatedly or cannot arrange in-person viewings.

It’s recommended to visit the property address in person to verify its authenticity, request the landlord’s identification, and ensure both parties sign a formal lease agreement.

Contracts and Deposits

When signing a lease, pay close attention to deposit amounts and refund policies. Deposit policies vary by province:

| Province | Deposit Limit | Refund Time | Responsibility |

|---|---|---|---|

| Ontario | One month’s rent | Refunded promptly after lease ends | Landlord must hold deposit in a dedicated account |

| British Columbia | Up to half a month’s rent | Refunded promptly after lease ends | Landlord may charge a pet damage deposit |

In Ontario, deposits can only be used for the last month’s rent. In British Columbia, deposits cannot exceed half a month’s rent. Keep all payment receipts to avoid deposit disputes.

Application Tips

You can increase your rental application success rate with these methods:

- Stay flexible with housing types, neighborhoods, and move-in dates.

- Make quick decisions when listings are limited.

- Prepare income proof and employment documents and submit them promptly.

- Be ready to pay the deposit and first month’s rent immediately.

- Seek help from local experts or agents to understand landlord preferences and rental practices.

By mastering these techniques, you’ll be more competitive in Canada’s rental market, effectively avoiding risks and securing an ideal home.

Subsidized Housing Application

Eligibility Criteria

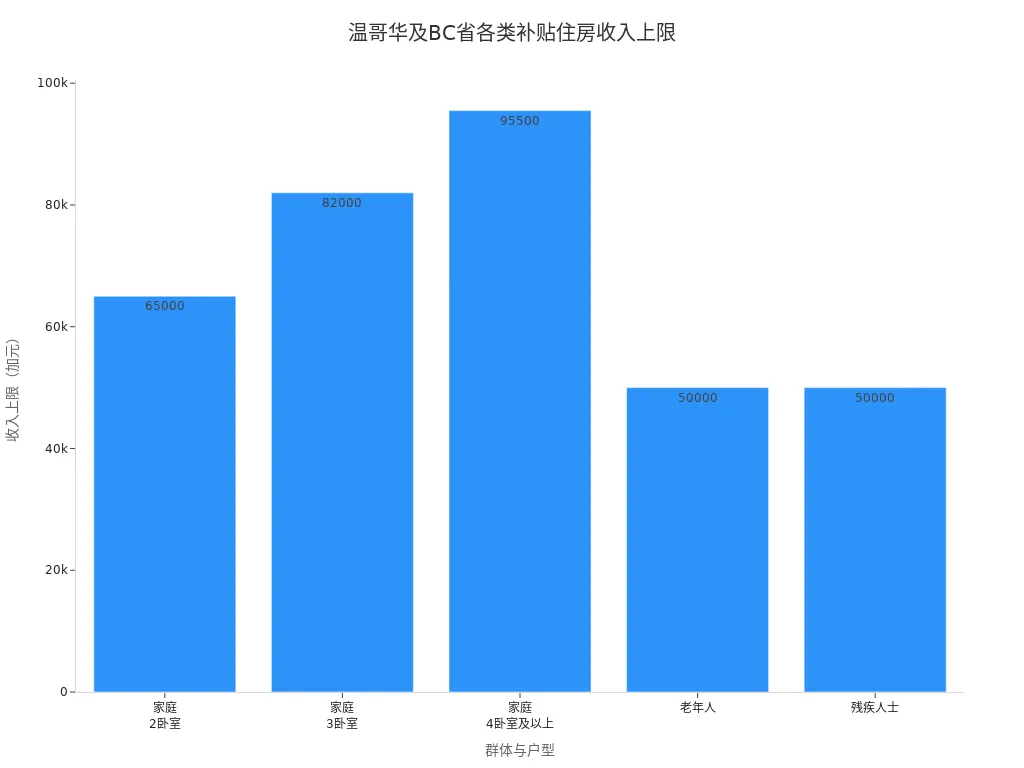

If you live in Vancouver or BC and want to apply for subsidized housing, you need to meet certain eligibility criteria. Subsidized housing is mainly for low-income families, seniors, and people with disabilities. You must have lived in BC for at least one year and have an income below the specified limit. Specific criteria for different groups are as follows:

| Group | Eligibility Criteria | Income Limit (USD/Year) |

|---|---|---|

| Families | At least two people, including a dependent child | 2-Bedroom: $65,000 |

| 3-Bedroom: $82,000 | ||

| 4-Bedroom and above: $95,500 | ||

| Seniors | Age 55 and above | $50,000 |

| People with Disabilities | Receiving permanent disability pension | $50,000 |

You can view the income limits for different groups in Vancouver and BC through the bar chart below:

Application Process

When applying for subsidized housing in BC, you can follow these steps:

- Seek help from support workers to understand the application process.

- Create a plan for subsidized housing, assessing your needs and waitlist status.

- Search online for relevant information and application forms.

- Review BC Housing’s subsidized building list and select suitable properties.

- Confirm you meet the eligibility criteria.

- Gather required documents, such as proof of identity and income.

- Submit your application through the BC Housing website.

- Apply only for units you are willing to move into.

- Fill out the application form carefully, ensuring accuracy.

- Provide up-to-date contact information for follow-up notifications.

- Track your application status and update information as needed.

- Regularly check to ensure you remain on the waitlist.

- Be realistic about wait times and prepare mentally.

If you belong to a high-demand group, wait times may be longer. Plan ahead, stay patient, and promptly update application materials to increase your chances of securing subsidized housing.

Full Process Checklist

Defining Needs

Before renting in Canada, you first need to clarify your needs. The following key points can help you organize your thoughts:

- Understand the basics of the local rental market.

- Identify available property types (e.g., apartments, detached houses, basements).

- Familiarize yourself with tenant rights and responsibilities.

- Understand the main components of a lease agreement.

- Pay attention to property safety measures, such as surveillance cameras or security doors.

- Verify listing information to avoid falling into scam traps.

You can also proactively ask: Are there safety concerns in the neighborhood? How is the local security situation? These questions help you filter out more suitable listings.

Information Screening

When screening rental information, stay vigilant to avoid being misled by fake listings. You can follow these practices:

- Verify the authenticity of the property and landlord before deciding.

- Use only reputable platforms or agents to find listings.

- Communicate directly with the landlord to confirm their identity.

- Request proof of property ownership from the landlord.

- Check if listing photos are authentic using Google Street View for comparison.

- Understand market rent levels and be cautious of significantly low-priced listings.

- Ensure all agreements are documented in writing, avoiding verbal promises.

- Do not pay any fees in advance, especially before signing a contract.

- Use traceable payment methods, avoiding cash or wire transfers.

- Consult current or previous tenants for accurate information.

If a landlord pressures you to sign quickly or refuses to answer questions, stay cautious and consider walking away if necessary.

Budget and Process

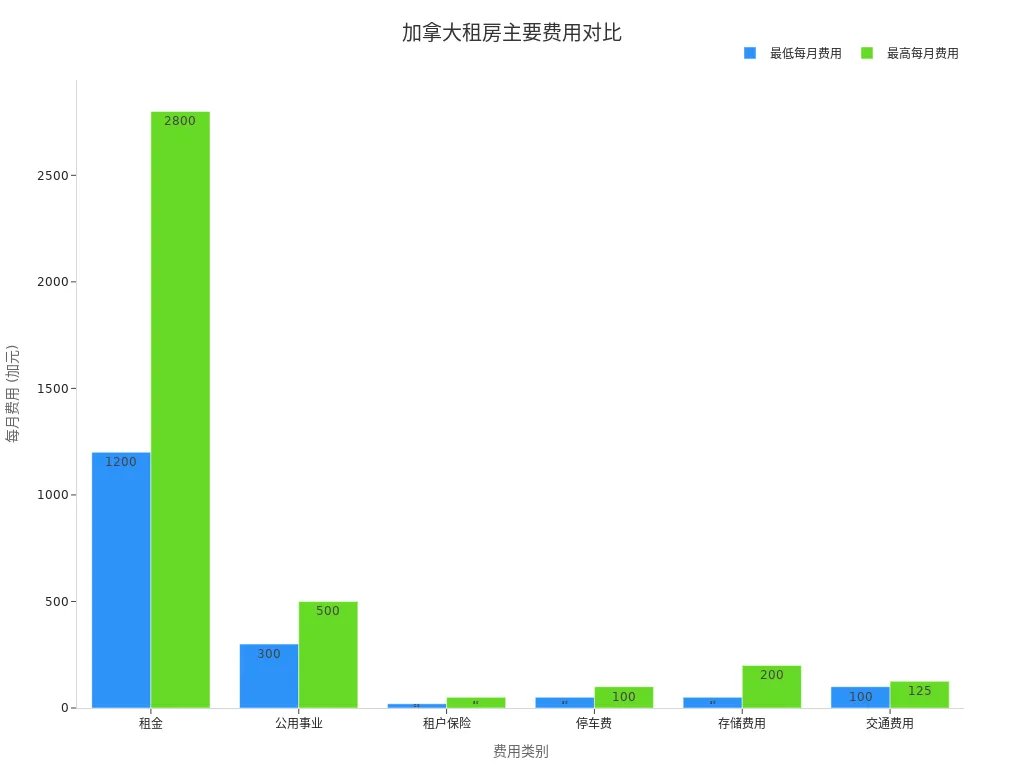

When creating a rental budget, consider not only monthly rent but also other common expenses. Refer to the table below to allocate monthly expenses reasonably:

| Expense Category | Monthly Expense Range (USD) |

|---|---|

| Rent | $1,200-2,800 |

| Utilities | $300-500 |

| Tenant Insurance | $20-50 |

| Parking Fees | $50-100 |

| Storage Fees | $50-200 |

| Transportation Costs | $100-125 |

Before renting, determine your affordable total expenses. It’s recommended to follow the 50/30/20 rule: allocate 50% of income to necessities (e.g., rent and living expenses), 30% to personal spending, and 20% to savings. This helps avoid financial stress.

Avoiding Traps

During the rental process, common traps include:

- Listings with rents far below market rates to lure you.

- Requiring payment of deposits or rent before viewing the property.

- Landlords claiming to be overseas and unable to meet.

- Communication with grammatical errors or inconsistent information.

- Pressuring you to sign quickly.

You can protect yourself by:

- Visiting the property in person or having a trusted person do so.

- Requesting the landlord’s identification and proof of property ownership.

- Using only traceable payment methods, such as bank transfers.

- Ensuring all agreements are documented in writing.

- Trusting your instincts and stopping if something feels off.

By staying vigilant and following these steps, you can significantly reduce the risk of scams and smoothly complete the Canadian rental process.

When renting in Canada, mastering every step of the process is crucial. You can avoid common mistakes by:

- Using a written lease to ensure all terms are clear, including lease term, deposit, and maintenance responsibilities.

- Understanding local rental laws by reviewing provincial tenancy board websites and complying with regulations.

- Paying attention to rights protection, such as landlords requiring 24 hours’ notice to enter your home and tenants’ right to live in a safe home.

You can refer to the rental checklist recommended by authoritative organizations:

- Set a realistic budget.

- Prepare documents in advance.

- Choose a suitable neighborhood.

- Document the property’s condition before moving in.

- Build a good relationship with the landlord.

You can also adjust strategies based on your needs:

| Strategy | Description |

|---|---|

| Rent Subsidy Programs | Reduce rent pressure for eligible households |

| Tenant Protection Funds | Protect against unfair rent increases and problematic landlords |

If you need assistance, leverage government and nonprofit resources, such as rent assistance programs and benefits navigation tools. By combining these methods with your situation, you can successfully complete the Canadian rental process. You can also refer to the checklist at the end for quick action at each step.

FAQ

How much is the deposit for renting in Canada?

You typically need to pay one month’s rent as a deposit. In Ontario, deposits can only be used for the last month’s rent. In British Columbia, deposits cannot exceed half a month’s rent. Keep payment receipts to avoid disputes.

Tip: Deposit amounts and rules vary by province, so check local policies in advance.

What documents are needed for renting?

You need to prepare proof of income, a credit report, reference letters, and identification. Some landlords may also require employment verification or reference information. Preparing these documents in advance can speed up the application process.

| Document Type | Description |

|---|---|

| Proof of Income | Pay stubs or bank statements |

| Credit Report | Credit score record |

| Reference Letters | From previous landlords or employers |

What are the key terms in a rental contract?

You should pay attention to rent amount, lease term, deposit, maintenance responsibilities, and early termination clauses. The contract should clearly outline both parties’ rights and obligations. Read every term carefully before signing to ensure accuracy and reliability.

Note: All terms should be documented in writing to avoid verbal promises.

How can I avoid scams during the rental process?

You should visit the property in person, verify the landlord’s identity, and avoid paying deposits upfront. Use only reputable platforms or agents to find listings. Keep all written agreements and payment receipts, and stop if anything seems suspicious.

- Visit the property in person.

- Verify the landlord’s identity.

- Use only traceable payment methods.

Can I pay rent in Canada using a China/mainland China bank card?

You can use an international credit card or transfer funds through a licensed Hong Kong bank account. Some landlords only accept Canadian bank transfers. Communicate payment methods with the landlord in advance to ensure a smooth transaction.

Suggestion: For cross-border payments, prioritize secure, traceable channels.

You’ve mastered the complete guide to renting in Canada, from choosing the right home type to avoiding scams. But as you begin your life in Canada, the challenge of cross-border fund management remains critical. For major expenses like rent and tuition, you shouldn’t have to deal with high international wire transfer fees, opaque exchange rate markups, or the frustrating 1-5 business day waiting period typical of traditional banks.

You need a secure, efficient, and transparent FinTech solution that ensures your funds can economically and instantly support your Canadian life and investments.

BiyaPay is your ideal platform for seamless global financial flow. We offer real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, helping you control transaction costs. Crucially, BiyaPay supports most countries and regions globally and offers same-day fund arrival, significantly boosting your financial efficiency. Plus, you can simultaneously engage in global asset allocation, including US and Hong Kong stocks—all on one platform, without needing a complex overseas account. Register quickly with BiyaPay now, and use peak capital efficiency to start your convenient new life in Canada!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.