- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Mitsubishi Bank International Remittance Guide: Fees, Transfer Times, and Frequently Asked Questions

Image Source: pexels

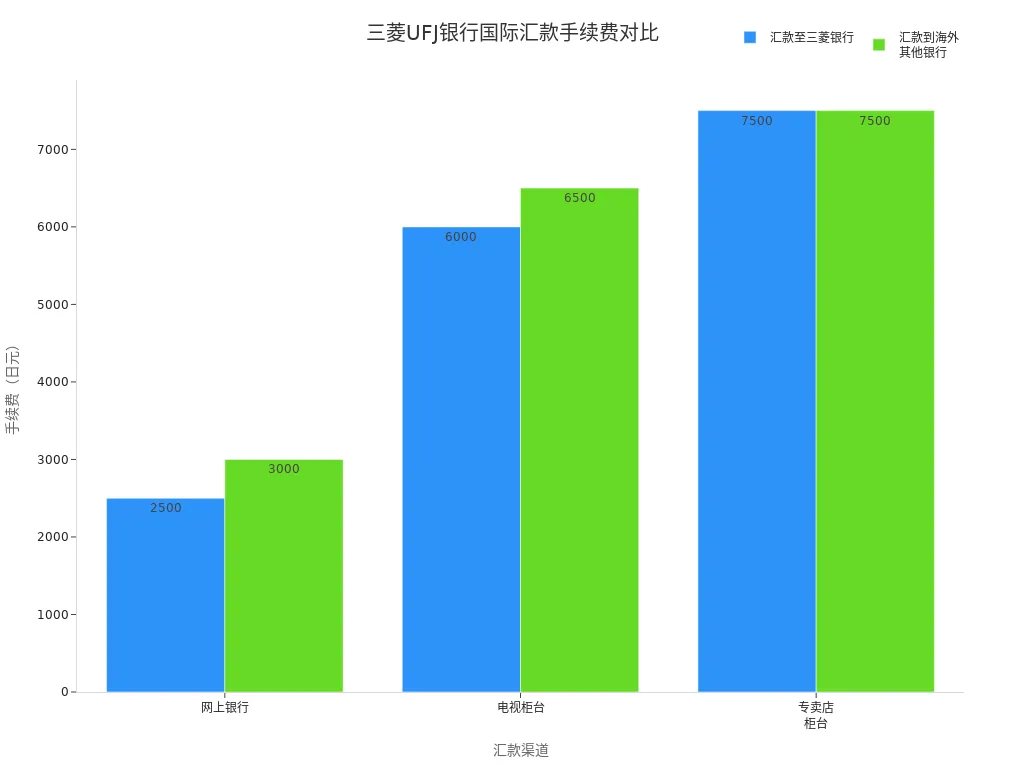

When you handle international remittance at Mitsubishi Bank, the fees and processing times are as follows:

| Remittance Method | Online Banking | Telephone Counter | Branch Counter |

|---|---|---|---|

| Remittance to Mitsubishi Bank Headquarters/Local Subsidiary | 2,500 JPY | 6,000 JPY | 7,500 JPY |

| Remittance to Another Overseas Bank | 3,000 JPY | 6,500 JPY | 7,500 JPY |

| An additional fee of 2,500 JPY will be charged for remittances in Japanese Yen. |

- Remittance processed on the same day, but actual receipt typically takes a few days or longer, with specific times varying depending on the receiving country and bank.

Key Points

- Choosing online banking for international remittance fees is the cheapest, typically 2,500 JPY, suitable for small transfers.

- Remittance processing time is usually 1 to 5 business days, depending on the receiving country and bank.

- Be mindful of hidden fees during remittance, such as intermediary bank fees and currency conversion fees; it’s advisable to consult the bank in advance.

- Ensure accurate recipient information and SWIFT CODE are provided to avoid remittance failures.

- Using third-party platforms like Wise or PayPal can offer lower fees and faster processing, ideal for small remittances.

Mitsubishi Bank Fees

Image Source: unsplash

Fee Standards

When you handle international remittances at Mitsubishi Bank, fees vary based on the recipient and channel. The main standards are as follows:

- If you remit to Mitsubishi Bank’s headquarters or its overseas subsidiaries, the fee is 25 USD.

- If you remit to other overseas banks, the fee is 30 USD.

- Handling through online banking incurs the lowest fees; telephone and branch counters have higher fees.

- If you choose to remit in Japanese Yen, the bank will charge an additional fee of 25 USD.

Tip: Remittance fees vary by bank and currency. Mitsubishi Bank typically uses fixed fees, but some smaller or local banks may offer lower fees or even promotional activities.

Influencing Factors

When handling international remittances, fees are not fixed. The following factors affect the final cost:

- Remittance Amount: Large remittances may enjoy lower fees or better exchange rates.

- Currency: Fees vary by currency, with additional charges for remittances in Japanese Yen.

- Recipient Bank: Fees are lower if the recipient is a Mitsubishi Bank branch; other banks incur higher fees.

- Remittance Method: Fees differ significantly between online and offline counter transactions.

- Exchange Rate Markup: Banks typically do not use the mid-market exchange rate for currency conversion, adding a markup that increases your actual costs.

Note that the fees charged by the bank include not only explicit remittance fees but also hidden costs like exchange rate markups.

Other Fees

In addition to basic fees, you may encounter the following additional costs:

- Intermediary Bank Fees: International remittances often involve intermediary banks, which deduct processing fees, typically between 20 USD and 40 USD.

- Currency Conversion Fees: If the remitted currency differs from the recipient account’s currency, the receiving bank will convert it at its own rate and may charge additional conversion fees.

- Hidden Fees: Some fees, such as unfavorable exchange rates or unlisted service fees, may not be easily noticeable.

It’s recommended to inquire about all possible fees with the bank before remitting to avoid reduced receipt amounts due to hidden costs.

Mitsubishi Bank Processing Time

Standard Processing Time

When you handle international remittances at Mitsubishi Bank, the bank processes your request on the same day. In most cases, funds do not arrive immediately in the recipient’s account. You typically need to wait 1 to 5 business days for the recipient to receive the funds. If you remit to Mitsubishi Bank’s overseas branches, the processing time may be faster, generally within 2 business days. If you submit remittance instructions at night or early morning, the bank will process them on the next business day. You can track remittance progress in real-time via online banking to stay updated on the funds’ status.

Reasons for Delays

In practice, you may encounter extended processing times. Common reasons for delays include:

- Bank Holidays: Statutory holidays in the sending or receiving country may pause processing, delaying receipt.

- Recipient Bank Review: Some banks conduct security or compliance checks on international remittances, which may require additional time.

- Intermediary Bank Processing: International remittances often involve intermediary banks, each adding processing time.

- Submission Timing: Non-business hour submissions are processed on the next business day, extending receipt time.

- Incomplete Information: Inaccurate recipient information may require additional materials or verification, causing delays.

You can plan remittance timing by checking the receiving country’s banking schedule to minimize unnecessary delays.

Regional Differences

Processing times vary significantly by region. Common scenarios include:

- Remittances to the United States, Canada, and other developed countries, where banking systems are efficient, typically take 1 to 3 business days.

- Remittances to Southeast Asia, South America, or similar regions may take 3 to 5 business days due to slower processing by some banks.

- Remittances to licensed banks in Hong Kong usually arrive within 2 business days, offering high efficiency.

- Some countries or banks have additional compliance requirements, which may require more documentation, extending processing times.

You can consult bank customer service in advance to understand specific processing times and special requirements for the recipient bank and currency.

Remittance Limits

Per-Transaction Limits

When handling international remittances at Mitsubishi Bank, the bank sets limits per transaction. Typically, the maximum limit per remittance ranges from 10,000 USD to 50,000 USD. Specific limits vary based on your account type, remittance channel, and receiving country. Online banking has lower per-transaction limits, suitable for daily small transfers. For large remittances, you can opt for branch counter services, which typically offer higher limits. You can check the latest limit regulations via the bank’s website or customer service before remitting.

Reminder: When handling international remittances at licensed banks in Hong Kong, some banks adjust limits based on your account level and transaction history. You can communicate with the bank in advance to ensure a smooth remittance.

Compliance Requirements

When conducting international remittances, the bank performs strict compliance checks to prevent money laundering, terrorist financing, and violations of international sanctions. Mitsubishi Bank focuses on the following:

- Recording transactions related to sanctioned countries, ensuring all information is fully preserved.

- Automatically flagging remittances involving sanctioned countries for further review.

- Verifying the completeness of remittance information to avoid violations due to missing or omitted details.

When filling out the remittance application, you must ensure the recipient information is accurate. The bank will require the recipient’s name, account number, receiving bank details, and a description of the remittance purpose. For large remittances, the bank may request proof of funds or related contracts. You must comply with the laws of mainland China and the receiving country to avoid delays or rejections due to compliance issues.

It’s recommended to understand the bank’s compliance requirements in advance and prepare all necessary documents to ensure a smooth remittance process.

Remittance Process

Image Source: unsplash

Online Process

You can handle international remittances through online banking. First, you need to log into the bank’s online banking system. After selecting the “international remittance” function, fill in the recipient information and remittance amount. The system will prompt you to upload or fill in relevant documents. You need to prepare the application form and valid identification documents. Some banks may require you to visit a designated branch for identity verification. After submitting the application, the bank will process the remittance during business hours. You can track the remittance progress in real-time via online banking. The online process is convenient and time-saving, ideal for daily small transfers.

Offline Process

If you need to remit large amounts or are handling an international remittance for the first time, you can opt for branch counter services. You need to bring all required documents, including the application form, identification documents, and recipient details. At the bank, staff will assist you in filling out the remittance application and verifying all information. The bank will review your documents and process the remittance upon confirmation. The offline process is suitable for customers requiring additional services or with special needs. You can consult staff on-site about remittance progress and related fees.

Required Documents

When handling international remittances, you need to prepare the following documents:

- Application form

- Valid identification documents (e.g., passport or residence permit)

- Recipient’s name, account number, and receiving bank details

- Description of remittance purpose

Some banks may require proof of funds or related contracts, especially for large remittances. You should confirm the required documents with the bank in advance to avoid delays due to incomplete materials.

Tip: You can consider using BiyaPay and other fintech services to assist with remittances. The table below compares the advantages and disadvantages of banks and fintech services:

| Type | Advantages | Disadvantages |

|---|---|---|

| Bank | High reliability, suitable for large transfers | High fees, poor exchange rates, slow processing |

| Fintech Services | Low fees, good exchange rates, fast transfers | May be less reliable than banks, suitable for small transfers |

You can choose the appropriate remittance method based on your needs. For high security and large transfers, bank channels are more suitable. For lower fees and faster processing, fintech services are an option.

Special Needs

Alipay Remittance

When handling international remittances at Mitsubishi Bank, you may consider transferring funds to an Alipay account. Some licensed banks in Hong Kong support direct remittances to Alipay international accounts. You need to confirm in advance that the recipient’s Alipay account has enabled international receipt functions.

The process is as follows:

- Log into online banking or visit a bank counter.

- Select “international remittance” and fill in the recipient’s information, including the Alipay account name and receiving bank details.

- Enter the remittance amount (in USD), confirm fees, and exchange rates.

- Submit the application, and the bank will process it within 1 to 3 business days.

Note: When filling in recipient information, ensure the Alipay account name matches the recipient’s real name. Some banks may require additional details on the remittance purpose. Alipay accounts have limits, with single transactions generally not exceeding 10,000 USD. You can consult bank customer service in advance for the latest policies.

Third-Party Platforms

When handling international remittances, you can use third-party platforms to assist with transfers. Common platforms include Wise, PayPal, and others, supporting remittances from licensed Hong Kong bank accounts to multiple countries and regions worldwide.

Advantages of third-party platforms:

- Lower fees and transparent exchange rates.

- Fast processing, with some platforms offering same-day receipt.

- Simple operation, ideal for small remittances.

When using third-party platforms, you need to register an account and complete identity verification. You can link a bank account through the platform, input recipient information, and the remittance amount (in USD). The platform will display fees and estimated receipt times.

The table below compares the main features of banks and third-party platforms:

| Channel | Fees (USD) | Processing Time | Applicable Scenarios |

|---|---|---|---|

| Bank | 25-40 | 1-5 business days | Large remittances |

| Third-Party Platforms | 5-15 | 1-2 business days | Small, frequent remittances |

Tip: When choosing third-party platforms, focus on their compliance and fund security. Some platforms do not support large remittances, so select the appropriate channel based on your needs. Contact bank or platform customer service if you have questions.

Common Questions

SWIFT CODE

When handling international remittances, you must provide the recipient bank’s SWIFT CODE. The SWIFT CODE is a unique identifier for banks in the global financial system. Mitsubishi UFJ Bank’s SWIFT CODE is BOTKJPJT. You can refer to the table below for the composition and purpose of SWIFT CODE:

| Component | Description |

|---|---|

| Bank Code | BOTK |

| Country Code | JP |

| Location Code | JT |

| Branch Code | XXX (indicating headquarters) |

| SWIFT Code | BOTKJPJT |

| Purpose | Routing and identifying banks in international financial transactions |

When filling out the remittance application, double-check the SWIFT CODE to ensure funds are accurately transferred to the recipient bank.

Recipient Information

When submitting an international remittance application, you need to provide complete recipient information. The bank will use this information to determine if the transfer can be processed smoothly. The table below lists the main details you need to provide:

| Information Type | Description |

|---|---|

| Recipient Full Name | As per the bank account |

| Bank Name | Name of the recipient’s bank |

| Branch | Recipient’s bank branch |

| Account Number | Recipient’s account number (or IBAN) |

| SWIFT/BIC Code | Bank’s SWIFT/BIC code or routing number |

| Cash Pickup Service Name | As per the recipient’s ID |

| Country/City Information | Recipient’s country and city details |

When filling out the information, carefully verify each item to avoid remittance failures due to errors.

Remittance Failures

When handling international remittances, you may encounter remittance failures. Common reasons include incorrect recipient information, incorrect SWIFT CODE, frozen accounts, or exceeding remittance limits. You can take the following steps:

- Verify the accuracy of all provided information.

- Contact bank customer service to understand the reason for the failure.

- Supplement or revise documents as prompted by the bank.

Reminder: If a remittance fails, don’t panic. Promptly contacting the bank can help resolve the issue quickly.

Progress Tracking

After remitting, you can track the progress in real-time via online banking or mobile banking. The bank will display statuses such as “Received,” “Processing,” or “Completed.” You can also call bank customer service for detailed progress information.

If the remittance has not arrived after an extended period, proactively contact the bank to check for anomalies. The bank will assist in tracking the funds’ flow to ensure they reach the recipient’s account safely.

It’s recommended to save transaction receipts after remitting for future reference and verification.

When handling international remittances at Mitsubishi Bank, preparing the application form and identification documents in advance is crucial. You can submit applications through the foreign exchange remittance network support service, and it’s advisable to book an appointment before visiting a branch. The bank typically requires at least 3 business days to process remittances. You should pay attention to remittance limits and compliance requirements. If you have questions, promptly consult bank customer service or use auxiliary tools to ensure a smooth remittance process.

FAQ

What is a SWIFT CODE?

When handling international remittances, you need to provide a SWIFT CODE. The SWIFT CODE helps the bank identify the recipient account. You can find the correct code on the recipient bank’s website.

How to Fill Out Recipient Information?

You need to accurately provide the recipient’s name, bank name, branch, account number, and SWIFT CODE. You can confirm all details with the recipient in advance to avoid remittance failures.

What to Do If a Remittance Fails?

You can first check if the provided information is correct. You can contact bank customer service to explain the situation. The bank will assist in identifying the cause and providing solutions.

How to Track Remittance Progress?

You can log into online banking or mobile banking to check the remittance status. You can also call bank customer service for detailed progress information.

What Are the Remittance Limits?

When handling international remittances at licensed banks in Hong Kong, the per-transaction limit is typically 10,000 USD to 50,000 USD. You can consult bank customer service in advance to confirm specific limits.

You’ve gained a comprehensive understanding of MUFG’s international money transfer fees, processing times, strict compliance requirements, and how to correctly use SWIFT CODE and recipient information. You clearly know that while the bank offers high reliability, you still face high fees (up to 7,500 JPY), potential intermediary bank costs, unfavorable exchange rate markups, and a long processing time of 1-5 business days.

In today’s pursuit of global fund allocation and efficient flow, you need a professional FinTech platform that can bypass the high costs and slow processes of traditional banks.

BiyaPay is your ideal solution for low-cost, high-efficiency international transfers. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5% and zero commission for contract limit orders, helping you maximize cost control and avoid complex hidden bank fees. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and utilize peak capital efficiency and transparent fees to make your cross-border remittances more free and convenient!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.