- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring Efficient and Secure Fund Transfer Methods: A Complete Guide to Transfer Speed and Limits to Thailand

Image Source: pexels

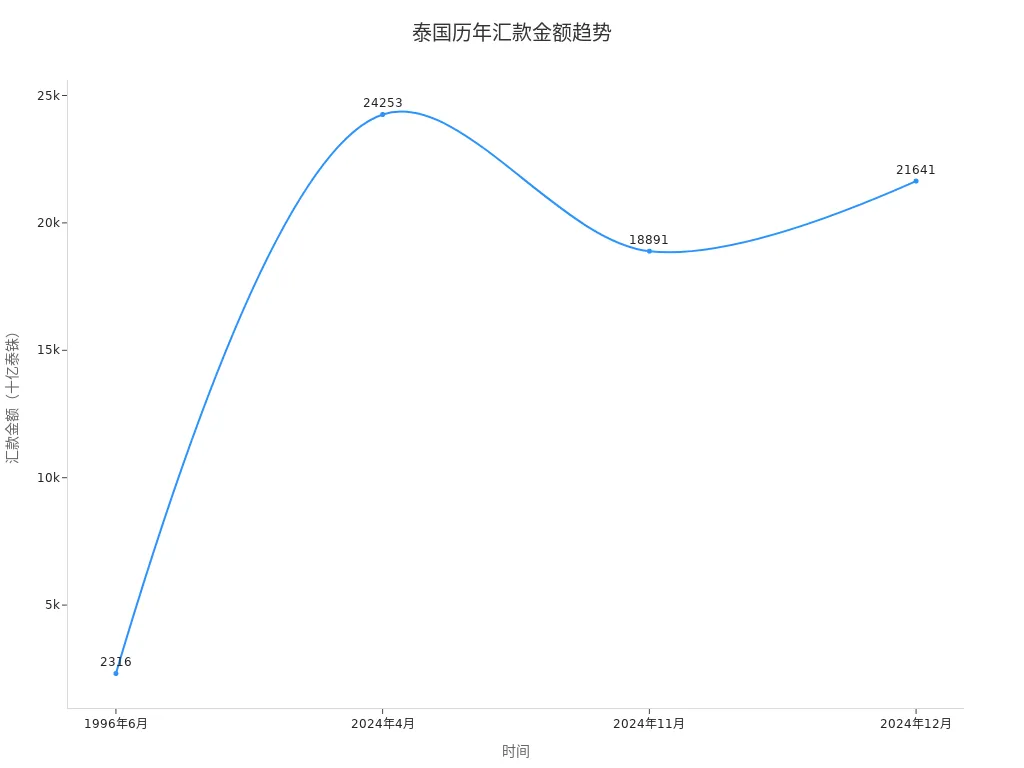

You can transfer funds to Thailand through various efficient remittance methods. Bank transfers, international remittance platforms, digital wallets, and blockchain technology are continuously improving speed and security. Thailand’s real-time clearing system and emerging technologies offer low-cost, fast-arrival experiences. The table below shows the trend of remittance amounts to Thailand in recent years:

| Time | Remittance Amount (THB Billion) |

|---|---|

| November 2024 | 18891 |

| December 2024 | 21641 |

| April 2024 | 24253 |

| June 1996 | 2316 |

| Average (1996-2024) | 8070.23 |

You can flexibly choose the appropriate channel based on the scale and frequency of funds, balancing speed, limits, and security.

Key Points

- When choosing a remittance method, consider fees, arrival speed, and security. Fee differences across channels may affect the actual amount received.

- Bank transfers typically take 1-2 business days to arrive, while international remittance platforms like Paysend can complete transfers in seconds, ideal for urgent needs.

- Digital wallets and mobile payment tools offer convenient remittance experiences, suitable for small-amount, high-frequency transactions, but have per-transaction and monthly limits.

- Blockchain technology provides fast, low-cost remittance options, but you should pay attention to platform compliance and security to ensure fund safety.

- When selecting remittance channels, be sure to understand compliance requirements to ensure legal fund flow and avoid delays due to over-limits or non-compliance.

Overview of Efficient Money Transfer Methods

Image Source: unsplash

In Thailand, you can choose from multiple efficient money transfer methods. Each method has unique features in terms of speed, cost, and security. You can select flexibly based on your needs.

Bank Transfers

Bank transfers are the most common remittance channel in Thailand. You can transfer funds to Thai bank accounts through licensed Hong Kong banks. Many banks support real-time clearing systems, ensuring fast arrivals. When using bank transfers, you may encounter USD conversion fees and exchange rate markups. Cash remittances or branch transactions typically incur higher fees. Choosing the best exchange rate can help you save costs.

International Remittance Platforms

International remittance platforms like TransFi are designed for global transactions. You can enjoy real-time tracking and competitive exchange rates. These platforms typically charge lower service fees and have short processing times. When transferring from the U.S. market, the platform automatically calculates USD fees, making it easy to compare costs across channels.

Digital Wallets and Mobile Payments

Digital wallets and mobile payment tools like PromptPay support transfers via phone numbers or ID numbers. You can complete remittances anytime, anywhere, making them suitable for small-amount, high-frequency transactions. Digital wallets typically have low fees and fast arrivals. From mainland China, you can also use certain international wallets for cross-border remittances.

Blockchain and Emerging Technologies

Blockchain technology introduces new options for efficient money transfers. You can use decentralized platforms for low-cost, fast-arriving transfers. Emerging technologies employ biometric and two-factor authentication to enhance security. When choosing blockchain remittances, pay attention to platform compliance and USD exchange rate fluctuations.

Tip: Different remittance methods vary significantly in cost and security. You can refer to the table below to compare the features of traditional and new methods:

| Remittance Method | Cost (USD) | Processing Time | Security |

|---|---|---|---|

| Traditional Methods | Higher fees | May take days or longer | Documents may be lost or stolen |

| New Methods (EFT) | Lower fees | Usually completed within hours | Protected by biometric and two-factor authentication |

When choosing efficient money transfer methods, focus on fees, arrival speed, and security. World Bank data shows that global remittance fees average 6.49% of the sent amount. By comparing different channels, you can select the most suitable method.

Arrival Speed

Image Source: pexels

When choosing efficient money transfer methods, arrival speed is a critical factor. The processing times of different channels vary significantly, directly impacting your fund flow efficiency. Below is a detailed analysis of the arrival times for mainstream methods.

Bank Transfer Speed

When transferring funds to Thai bank accounts through licensed Hong Kong banks, it typically takes 0-2 business days. Interbank transfers within Thailand also rely on real-time clearing systems, significantly improving arrival speed. Refer to the table below:

| Sending Country | Processing Time |

|---|---|

| Thailand | 0-2 business days |

For cross-border remittances, traditional bank channels may take 3-5 business days. Real-time clearing systems like PromptPay enable near-instant local transfers, significantly enhancing fund liquidity.

International Platform Speed

When using international remittance platforms, arrival speed is much faster than traditional banks. Some platforms, like Paysend, deliver funds to Thai accounts within seconds. Refer to the table below:

| Transfer Method | Speed |

|---|---|

| Paysend | Arrives within seconds |

| Traditional Bank Transfer | 3-5 business days |

- Using Paysend, funds typically arrive in Thailand within seconds.

- Traditional bank transfers may take 3-5 business days.

When transferring from the U.S. market, international platforms can save you significant waiting time.

Digital Wallet Real-Time Performance

Digital wallets and mobile payment tools offer a more efficient money transfer experience. Through systems like PromptPay, you can complete instant transfers using just a phone number or ID number. Ideally, digital wallet remittances arrive within 1-2 business days, though full availability may take 3-5 business days in practice. You can initiate transactions anytime, anywhere, with infrastructure supporting round-the-clock processing, greatly enhancing reliability.

Tip: Thailand’s real-time clearing systems, like PromptPay, have significantly improved remittance speed and reliability. Users now expect international remittances to be as fast as local transfers.

Blockchain Transfer Speed

When using blockchain technology for cross-border remittances, fund processing is nearly instant. Using stablecoins like USDT-TRC20 or USDC on the Stellar network, recipients can receive USD funds within minutes. Blockchain payments are not only fast but also cost-effective, making them ideal for scenarios with high time sensitivity.

- Blockchain payments are nearly instant, with recipients receiving funds within minutes.

When choosing efficient money transfer methods, you can flexibly match different needs based on arrival speed to improve fund management efficiency.

Amount Limits

When choosing efficient money transfer methods, amount limits are a critical factor. Different channels have varying rules for single, daily, or monthly remittance limits, directly affecting fund flow efficiency and compliance.

Bank Channel Limits

When transferring funds to Thailand through licensed Hong Kong banks, banks set different limits based on customer type and risk assessment. The Bank of Thailand (BOT) sets a daily transfer cap of 50,000 THB (approximately 1,400 USD) for certain groups (e.g., children and the elderly) to prevent fraud. Limits for other customers are dynamically adjusted based on transaction history and KYC (Know Your Customer) assessments.

- Daily transfer limits are divided into three tiers:

- S Tier: Below 50,000 THB (approx. 1,400 USD)

- M Tier: Below 200,000 THB (approx. 5,600 USD)

- L Tier: Above 200,000 THB (over 5,600 USD)

- If you frequently need large transfers, banks may increase your limit based on your transaction habits.

Tip: You can obtain higher remittance limits by completing identity verification and maintaining a good transaction record.

International Platform Limits

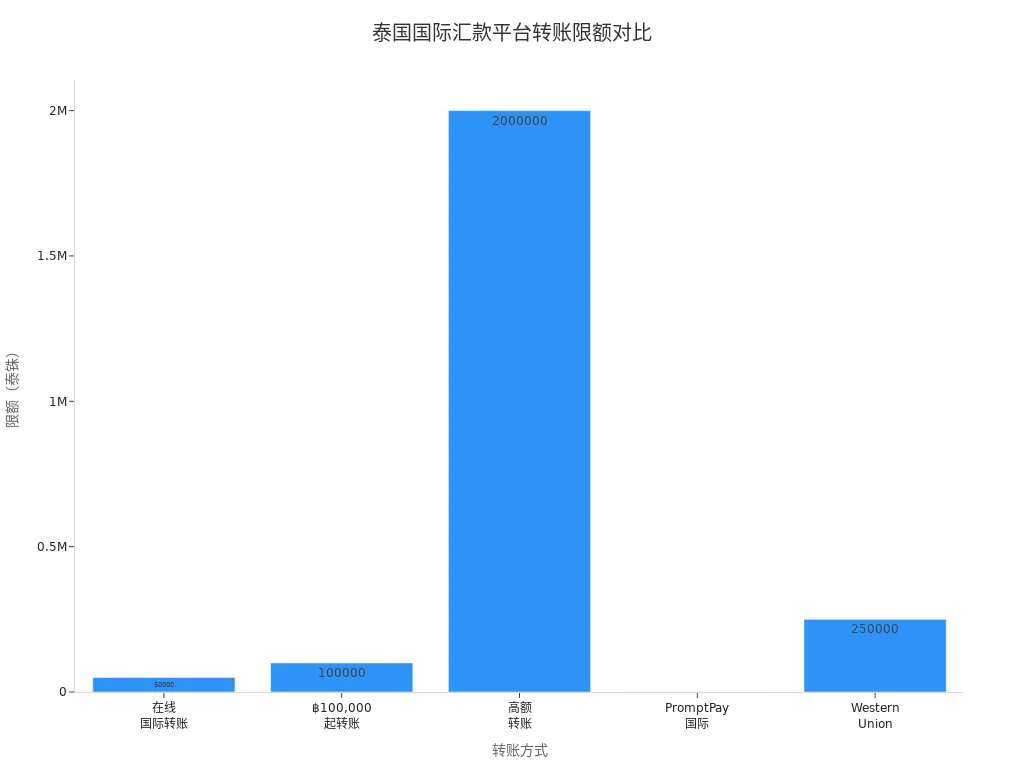

International remittance platforms have clear regulations on amount limits. When using these platforms, you need to provide different documents and information based on the remittance amount. The table below shows the limit requirements for common international platforms:

| Remittance Method | Single Transaction Limit (USD) | Additional Requirements |

|---|---|---|

| Online International Transfer | Approx. 1,400 | Requires remittance purpose code |

| Above 10,000 USD | Approx. 2,800 | Requires recipient details |

| Above 56,000 USD | Over 56,000 | Requires declaration to the Anti-Money Laundering Office (AMLO) |

| PromptPay International | Approx. 28 | Limited to Thailand-Singapore transfers, fee approx. 4.2 USD |

| Western Union | Approx. 7,000 | Instant cash pickup, bank arrival in 1-3 days |

When transferring from the U.S. market, be sure to understand the platform’s limits and declaration requirements in advance to avoid delays due to exceeding limits.

Digital Wallet Limits

Digital wallets and mobile payment tools offer convenient fund flow experiences but come with strict amount limits. Each transaction, deposit, and monthly total has a cap. The table below summarizes the limits for common digital wallets:

| Type | Limit (USD) |

|---|---|

| Single Transaction | Approx. 2,800 |

| Single Deposit | Approx. 2,800 |

| Monthly Total | Approx. 8,400 |

| Daily Withdrawal | Approx. 280 |

When using digital wallets, they are suitable for small-amount, high-frequency daily remittance needs. For large fund flows, consider banks or international platforms.

Blockchain Remittance Limits

Blockchain technology offers flexible cross-border remittance options. Most blockchain platforms impose certain limits on daily and monthly transfers, mainly to prevent money laundering and ensure compliance. The table below shows the limit descriptions for common blockchain remittances:

| Transfer Type | Description |

|---|---|

| Daily Limit | May restrict large transactions |

| Monthly Limit | May restrict large transactions |

When choosing blockchain channels, pay attention to the platform’s compliance policies and limit settings. Some platforms dynamically adjust limits based on your identity verification level.

Reminder: Always check each channel’s amount limits in advance, plan fund flows reasonably, and ensure smooth remittances.

Security and Risk Prevention

Fund Safety Assurance

When choosing efficient money transfer methods, fund safety is the top priority. Various channels employ multiple security mechanisms to protect your funds. For example, banks and international platforms require identity verification to ensure account security. When transferring through licensed Hong Kong banks, the system automatically detects unusual transactions to prevent theft. Digital wallets and blockchain platforms often use biometric and two-factor authentication to further enhance security. Financial institutions also strictly comply with anti-money laundering regulations, actively monitoring large and unusual transactions. The table below summarizes common security risks and compliance requirements:

| Risk Type | Description |

|---|---|

| Anti-Money Laundering Compliance Risk | Non-compliance with Thailand’s anti-money laundering laws may lead to severe penalties, including fines, imprisonment, and license revocation. Financial institutions must take proactive measures to ensure compliance. |

When transferring from the U.S. market, platforms require detailed information to ensure legal and compliant transactions, effectively preventing money laundering and illegal fund flows.

Risk Prevention Measures

During the remittance process, you may encounter various risks, including exchange rate fluctuations, transaction delays, fraud, and hidden fees. Service providers implement several measures to help you mitigate these risks:

- Offer competitive exchange rates to reduce unexpected costs from rate fluctuations.

- Provide transaction tracking features, allowing you to monitor fund flows in real-time and reduce concerns about processing delays.

- Customer support teams help you understand relevant regulations, avoiding legal issues due to compliance complexities.

- Platforms clearly list all fees to prevent hidden charges from affecting the received amount.

Reminder: When choosing remittance channels, verify the platform’s security mechanisms and fee details, plan fund flows reasonably, and enhance fund safety.

By completing identity verification, selecting compliant channels, and monitoring transactions in real-time, you can effectively prevent fraud and information leakage risks. This ensures both fund safety and the reliability of efficient money transfer methods.

Regulations and Compliance Requirements

Foreign Exchange Management Policies

When transferring funds to Thailand, you must understand local foreign exchange management policies. The Thai government strictly regulates all foreign exchange transactions through the Foreign Exchange Control Act. You can only conduct foreign exchange transactions through commercial banks or authorized institutions with foreign exchange licenses. Individuals receiving foreign currency exceeding 1 million USD must immediately convert it to THB at an authorized bank. If you carry more than 20,000 USD in cash into or out of Thailand, you must declare it to customs. Certain groups, such as foreign embassies in Thailand and international organizations, are exempt from these restrictions. For international trade or investment, you need to submit relevant documents to ensure compliant fund use. Companies can also engage in derivative transactions through authorized banks to hedge foreign exchange risks. Service income exceeding 1 million USD must be converted to THB within 360 days.

| Regulatory Requirement | Details |

|---|---|

| Foreign Exchange Transaction Management | Foreign exchange transactions are governed by the Foreign Exchange Control Act and related regulations |

| Transaction Institutions | Limited to commercial banks and authorized institutions with foreign exchange licenses |

| Foreign Exchange Amount Limit | Individuals receiving over 1 million USD must immediately convert to THB |

| Declaration Requirement | Carrying over 20,000 USD in cash into or out of Thailand requires customs declaration |

| Exceptions | Foreign embassies in Thailand, international organizations, etc., are exempt from these requirements |

| Fund Use | International trade and investment require submission of relevant documents |

| Derivative Transactions | Companies can engage in derivative transactions with authorized banks to hedge foreign exchange risks |

| Income Conversion | Service income exceeding 1 million USD must be converted to THB within 360 days |

Anti-Money Laundering Regulations

When choosing remittance channels, you must comply with Thailand’s anti-money laundering regulations. All financial institutions are required to conduct mandatory identity verification (KYC/CDD) and report suspicious transactions. Thailand implemented its Anti-Money Laundering Act in 1999, focusing on combating drug trafficking and other criminal activities. As a customer, you must cooperate with financial institutions to complete identity verification, especially for high-risk clients and politically exposed persons, who face stricter due diligence. Non-bank financial institutions must also comply with the Money Laundering Control Act and Anti-Terrorism Financing Act to ensure all fund sources are legitimate.

| Regulation Type | Description |

|---|---|

| Customer Due Diligence | All customers must undergo mandatory KYC/CDD procedures |

| Suspicious Transaction Reporting | Suspicious transactions must be reported |

| Anti-Money Laundering Act | Enacted in 1999, targeting drug trafficking and other criminal activities |

| Compliance Requirements | Include enhanced due diligence for high-risk clients and politically exposed persons |

| Fund Sources | Money Laundering Control Act and Anti-Terrorism Financing Act apply to non-bank financial institutions |

| Obligations | All institutions must comply with AML/CFT regulations |

Compliant Channel Selection

When choosing legal remittance channels in Thailand, focus on whether the channel holds a payment operator license and has stable financial conditions and cybersecurity measures. Compliant channels must strictly enforce anti-money laundering and anti-terrorism financing requirements, including customer due diligence, transaction monitoring, and suspicious transaction reporting. Commercial banks and financial institutions must conduct enhanced due diligence, while money service businesses must submit suspicious transaction reports and cash transaction reports. Other financial service providers must retain transaction records for at least 5 years and establish internal anti-money laundering procedures. When transferring from the U.S. market, prioritize compliant channels to ensure fund safety and legal flow.

| Compliance Standard | Description |

|---|---|

| Anti-Money Laundering and Anti-Terrorism Financing Requirements | Include customer due diligence, transaction monitoring, and suspicious transaction reporting |

| Payment Operator License | Requires stable financial conditions and comprehensive cybersecurity measures |

| Reporting Entity | Obligations |

|---|---|

| Commercial Banks and Financial Institutions | Conduct customer due diligence and enhanced due diligence |

| Money Service Businesses | Submit suspicious transaction reports and cash transaction reports |

| Other Financial Service Providers | Retain records for at least 5 years and establish internal AML procedures |

Reminder: When choosing remittance channels, verify the channel’s compliance qualifications and security measures to ensure smooth fund arrivals.

Selection Recommendations

Recommendations for Individual Users

When choosing a remittance method, focus on several key factors. First, consider transaction fees, as fee differences across channels significantly affect the actual amount received. Second, pay attention to exchange rates, as fluctuations impact the final amount received. Transfer speed is also critical, especially if you or the recipient urgently needs funds. Additionally, understand the recipient’s preferences, as some prefer bank account deposits, while others favor cash pickup or digital wallets.

Sometimes, recipients may prefer certain methods. Before choosing, confirm their preferences. If the recipient urgently needs funds and can visit a cash pickup location, cash pickup may be the best option.

Refer to the table below for fees and speeds of common individual remittance channels:

| Service | Fees | Speed |

|---|---|---|

| Paysend | $1 or €1.5 | Usually seconds, up to three days |

| Remitly | No hidden fees | Fast, depending on the method |

Paysend offers transparent fees and competitive exchange rates. Remitly promises on-time delivery with refunds for delays. When transferring from the U.S. market, these platforms can save costs and improve efficiency.

Follow these steps to choose efficient money transfer methods:

- Calculate the total costs (including service fees and exchange rate differences) for each channel.

- Compare arrival speeds and select the method that best meets your needs.

- Communicate with the recipient to confirm they can receive funds smoothly.

- Focus on the platform’s security and compliance to ensure fund safety.

Recommendations for Business Users

As a business user, you typically handle large or high-frequency international remittances. Prioritize secure, compliant platforms that support large transactions. Beyond fees and speed, consider the platform’s global coverage and customer service quality.

The table below summarizes mainstream remittance services suitable for business users and their advantages:

| Remittance Service | Advantages |

|---|---|

| DeeMoney | Convenient user experience, global coverage, secure transactions |

| MoneyGram | Fast and flexible remittances, reliable service |

DeeMoney provides a user-friendly app and competitive exchange rates, ideal for businesses with frequent cross-border transactions. MoneyGram allows transfers from the U.S. to Thailand and over 200 other countries, with simple operations, fast arrivals, and reliable service. Choose based on your business’s actual needs, prioritizing these efficient money transfer methods.

For business remittances, consider the following:

- Choose platforms supporting batch processing and automated reconciliation to improve financial management efficiency.

- Focus on the platform’s compliance qualifications to meet Thailand and U.S. regulatory requirements.

- Evaluate the platform’s customer support capabilities for timely assistance with issues.

Comparison of Efficient Money Transfer Methods

In practice, different remittance methods have their pros and cons. Refer to the table below to quickly understand the applicable scenarios and considerations for each method:

| Type | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | High security, traceable, suitable for large transfers | Longer processing times, higher fees, errors hard to recover |

| International Platform | Transparent fees, fast, suitable for small and high-frequency remittances | Limited amounts, additional reviews for large transactions |

| Digital Wallet | Convenient, fast, suitable for daily small payments | Lower single and monthly limits, restricted withdrawals |

| Blockchain Transfer | Fast, low-cost, decentralized, ideal for high-time-sensitivity scenarios | Irreversible transactions, limited regulation, high value volatility, requires enhanced security |

Consider the following scenarios when choosing:

- For large, one-time remittances, bank transfers are safer and more reliable.

- For low-cost and fast arrivals, international platforms and digital wallets are suitable for daily use.

- For high time sensitivity and familiarity with digital assets, consider blockchain transfers, but note security and compliance risks.

Tip: When choosing efficient money transfer methods, adjust flexibly based on amount, urgency, and recipient needs to ensure fund safety and smooth arrivals.

When selecting efficient money transfer methods, focus on arrival speed, amount limits, security, and compliance. Bank fees average 10.8% (USD), while digital channels are lower. Digital currencies and technologies like PromptPay enable arrivals within 1-2 days. Choose flexibly based on urgency, fee transparency, and compliance requirements. Recent policy adjustments also offer more convenience and tax benefits. Stay informed about technological innovations and policy changes to plan each remittance rationally.

FAQ

How Fast Can a Remittance to Thailand Arrive?

When using international platforms or blockchain technology, funds can arrive in seconds. Bank transfers typically take 1-2 business days. Digital wallets also enable real-time arrivals.

Are There Limits on Single Remittance Amounts?

When transferring through licensed Hong Kong banks or international platforms, single transaction limits typically range from 1,400 USD to 2,800 USD. Large remittances require additional documents or declarations, and digital wallets have lower limits.

How Can I Ensure Remittance Safety?

Choose compliant channels and complete identity verification. Banks and platforms use multiple verification and anti-money laundering measures. Avoid unknown channels and protect personal information.

What Compliance Requirements Must Remittance Channels Meet?

In Thailand, choose channels with payment operator licenses. All financial institutions must perform customer identity verification and transaction monitoring to ensure legal fund flows.

What Are Recommended Channels for Remitting from the U.S. Market to Thailand?

You can choose international remittance platforms, licensed Hong Kong banks, or digital wallets. Each channel has different fees and speeds. Select flexibly based on fund scale and urgency.

You have completed a thorough analysis of money transfers to Thailand, gaining a deep understanding of the speed, cost, and limit performance of bank transfers, international remittance platforms, digital wallets, and blockchain technology. You clearly know that while platforms like Paysend can deliver funds in seconds with costs lower than the traditional banking average of 10.8%, to achieve same-day fund arrival and mitigate USD exchange rate volatility and hidden fees, you need a more integrated and competitive solution.

Facing Thailand’s strict anti-money laundering regulations and reporting requirements for large transactions, you need a FinTech platform that can bypass the high costs and long processing times of traditional banks, offer real-time exchange rates, and ensure same-day fund arrival.

BiyaPay is your ideal solution for efficient and secure international fund management. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5% and zero commission for contract limit orders, helping you maximize cost control and avoid complex hidden bank fees. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and utilize peak capital efficiency and transparent fees to make your cross-border remittances secure, fast, and compliant!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.