- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Frequently Asked Questions About Sending Money to Thailand from Around the World

Image Source: pexels

Do you want to send money to Thailand safely, quickly, and cost-effectively from anywhere in the world? Nowadays, bank transfers, wire transfers, online international platforms, and mobile payments can help you complete global remittances. According to the latest statistics, the amount of remittances received by Thailand annually is as follows:

| Type | Amount (2025) |

|---|---|

| Domestic Remittances | USD 1.181 billion |

| International Remittances | USD 895 million |

Key Points

- When choosing a remittance method, consider processing speed and fees. Bank transfers are suitable for large amounts, while online platforms and mobile payments are more convenient.

- Before sending money, ensure you have the recipient’s information, including name, bank account number, and SWIFT code, to avoid delays due to incorrect details.

- Use regulated service providers to protect personal information and passwords, ensuring secure remittances. Contact customer support promptly if issues arise.

Global Remittance Methods

Image Source: unsplash

When choosing global remittances to Thailand, you can select different channels based on your needs. Common methods include bank transfers, online remittance platforms, and mobile payments. Each method has unique features in terms of processing speed, applicability, and convenience. Below, we detail these mainstream channels to help you make an informed choice.

Global remittance channels are mainly divided into four categories: agent services, online platforms, mobile apps, and ATM networks. You can refer to the table below to understand the types of different channels:

| Remittance Channel | Type |

|---|---|

| Agent Services | Physical locations |

| Online Platforms | Websites |

| Mobile Apps | Mobile applications |

| ATM Networks | Automated teller machine networks |

Bank Transfers

Bank transfers are a traditional global remittance method chosen by many. You can use licensed banks in mainland China or Hong Kong to send funds directly to a Thai bank account. Bank transfers are suitable for large remittances, offering high security and wide applicability.

You need to pay attention to the following points:

- You must provide valid identification documents, such as a passport or driver’s license.

- The recipient also needs to provide a Thai ID or other valid identification.

- For larger amounts, banks may require additional documents.

- You need to specify the purpose of the remittance in accordance with Thai banking regulations.

Bank transfer processing times typically range from 1 to 5 business days. You can refer to the table below for processing times of different payment methods:

| Payment Method | Processing Time |

|---|---|

| Bank Transfer | 1 to 5 business days |

| Online Remittance Platforms (e.g., WorldRemit) | 1 to 2 business days |

| Inpay | Average of 30 minutes |

| Mobile Payments (e.g., PromptPay) | Instant transfer |

If you operate through online banking, you typically need to pay multiple fees, with basic fees ranging from USD 50 to USD 200. For non-registered recipients, the maximum per transaction is USD 400,000, and for registered recipients, it’s up to USD 3,000,000. Bank transfers are suitable for users needing large, formal fund transfers.

Online Remittance Platforms

Online remittance platforms offer greater convenience for global remittances. You can easily send funds to Thailand via websites or mobile apps. Common platforms include PayPal, Xoom, Western Union, Wise, and Remitly. These platforms support various receiving methods, such as direct deposits, cash pickups, and digital wallets.

| Platform | Features |

|---|---|

| PayPal | High security, widely used, supports transfers via email and phone numbers |

| Xoom | Designed for international transfers, fast and secure |

| Western Union | Offers cash pickup services with wide coverage |

| Wise | Competitive exchange rates and low fees, fast transfers |

| Remitly | Direct transfers to Thai bank accounts with real-time tracking |

When choosing a platform, focus on processing speed and fees. For example, with Airwallex, 70% of transactions can arrive on the same day, with no account opening fees, monthly fees, or hidden charges. Most platforms have no strict limits on single transactions, but specific amounts depend on platform rules.

Mobile Payments

Mobile payments are becoming a new trend in global remittances. You can complete transfers anytime, anywhere via mobile apps. Common mobile payment services in Thailand include PromptPay, Rabbit LINE Pay, and TrueMoney Wallet.

| Service Name | Transaction Volume | Transaction Fees |

|---|---|---|

| PromptPay-PayNow | Over 65,000 transactions monthly | 150 THB per transaction in Thailand (approx. USD 4) |

| Average transaction of USD 150-200 | Free in Singapore for now |

The biggest advantage of mobile payments is fast processing. For example, with PromptPay, funds can arrive instantly. You can also enjoy lower fees and a convenient user experience. In terms of security, apps like TrueMoney Wallet use multiple encryption and credential verification methods, allowing users to lock cards via the app to prevent fraudulent transactions. Rabbit LINE Pay also provides various security measures for user accounts.

| App Name | Market Share | Security Features | Convenience Features |

|---|---|---|---|

| Rabbit LINE Pay | 25% | Offers multiple security measures to protect user accounts. | Users can perform transfers, merchant payments, utility bill payments, and more. |

| TrueMoney Wallet | Over 50% | TrueMoney Mastercard provides an extra security layer, allowing users to lock cards via the app to prevent fraud. | Offers a simple interface, supports transfers to local bank accounts, other TrueMoney Wallets, or foreign banks, with real-time exchange rate visibility. |

| All Digital Payment Apps | N/A | Use multiple encryption methods and credential-based authentication to ensure access only with the correct password. | Considered safer than carrying cash, reducing loss risks. |

When choosing mobile payments, select an app based on your needs and the recipient’s preferences. Mobile payments are ideal for small, frequent global remittances, especially for younger users and scenarios requiring instant transfers.

Tip: When making global remittances, check the processing times and fees of each channel in advance to choose the most suitable method.

Remittance Process

Account Opening and Verification

Before making global remittances, you typically need to open an account with a bank or international remittance platform. Different channels have varying requirements for account opening. For example, with licensed banks in Hong Kong, you need to prepare the following documents:

| Required Documents | Description |

|---|---|

| Passport | A valid passport is required |

| Non-Immigrant Visa | A non-tourist visa, such as a work or student visa, is needed |

| Proof of Thai Residence | Such as a Thai residence permit, utility bill, or lease agreement |

| Proof of Address | Such as utility bills, bank statements, or driver’s license |

| Reference Letter | From an embassy, home country bank, or Thai educational institution |

You also need to provide an initial deposit. Some platforms support online account opening, making the process more convenient. During account opening, banks or platforms require identity verification. Common verification methods include:

| Method | Steps |

|---|---|

| Online Verification | Log into your profile, select “Online Verification,” and upload ID and a selfie |

| In-Person Verification | Visit a designated agent location with a government-issued ID for verification |

You also need to provide registration details, including full name, email, phone number, gender, date of birth, and address. Some platforms verify phone numbers via a one-time password (OTP) to ensure account security.

Reminder: Ensure all information is accurate and consistent during account opening and verification. Inconsistencies may prevent account activation or hinder future remittances.

Required Information

Before initiating a global remittance, you must prepare the recipient’s detailed information. The accuracy of this information directly affects processing speed and fund security. Below are common recipient information requirements:

| Information Type | Description |

|---|---|

| Recipient’s Full Name | The recipient’s complete name is required |

| Address | The recipient’s detailed address |

| Bank Name | The name of the receiving bank |

| Bank Account Number | A 5-16 digit bank account number |

| Reason for Remittance | The purpose of the remittance must be specified |

| BIC or SWIFT Code | The bank’s international identification code |

| National Clearing Code | The bank’s national clearing code |

| Bank Address | The detailed address of the receiving bank |

| Message to Beneficiary | Optional remarks or notes for the recipient |

When filling out this information, verify each item carefully. Entering incorrect recipient details can lead to serious consequences:

- The transaction may be delayed, typically requiring 3 to 5 days for verification.

- If inquiries arise, delays can last from days to weeks.

- In extreme cases, resolution may take up to 90 days.

- Banks cannot refund funds without the recipient’s consent.

- Fund recovery may require legal proceedings, potentially involving courts.

Suggestion: Before confirming the transaction, carefully review all recipient information, especially the bank account number and SWIFT code, to avoid fund losses due to errors.

Operation Steps

After completing account opening and preparing the necessary information, you can follow these steps to initiate a global remittance. Using mainstream banks and international platforms as examples, the common process is as follows:

- Log into the bank or platform’s online banking system or mobile app.

- Select “International Transfer” or “Global Remittance” service.

- Choose the receiving method (e.g., bank account, digital wallet) and destination country (Thailand).

- Enter the remittance amount (in USD or THB), and the system will display real-time exchange rates.

- Fill in the recipient’s details, including name, bank account, SWIFT code, and bank address.

- Review all information and submit after confirming accuracy.

- The system will generate an electronic transaction receipt and send a notification indicating the remittance has been processed.

- You can track the remittance status in real-time until the recipient confirms receipt.

Common errors include entering incorrect SWIFT codes, using generic codes instead of branch-specific codes, etc. These errors can cause transaction delays or rejections, with fund recovery potentially taking weeks or months. Choose reputable remittance services, compare platform exchange rates and fees, and ensure each step is accurate.

By following the above process, you can efficiently and securely complete global remittances to Thailand. Preparing all information in advance and verifying each detail will significantly reduce error risks and enhance the remittance experience.

Fees and Exchange Rates

Image Source: pexels

Transaction Fees

When making global remittances, transaction fees are one of the most direct costs. Different channels have varying fee structures. Banks typically charge fixed fees or a percentage of the remittance amount. Intermediary banks in the SWIFT network may charge additional fees, up to three intermediaries, with amounts difficult to predict. The receiving bank may also charge fees for incoming wire transfers. You should also be aware of exchange rate markups, which are often hidden in the final amount received.

| Fee Type | Description |

|---|---|

| Sending Bank Fees | Charged by the sending bank, either fixed or a percentage of the amount |

| Intermediary Bank Fees | Up to 3 intermediary banks in the SWIFT network may charge unpredictable fees |

| Exchange Rate Markup | Banks add a margin to the mid-market rate, increasing actual costs |

| Receiving Bank Fees | Fees charged by the recipient’s bank for receiving wire transfers |

You can refer to the table below for average remittance fees to Thailand from major countries (for sending USD 200):

| Country | Remittance Fees (Sending $200) |

|---|---|

| Thailand | $26 |

| Tanzania | $115 |

| Turkey | $53 |

| Senegal | $29 |

| Rwanda | $35 |

Exchange Rate Impact

Exchange rate fluctuations directly affect the final amount received. When sending USD 1,000 to Thailand, a higher exchange rate means the recipient receives more THB, while a lower rate results in less. Banks and remittance services typically add a profit margin to the mid-market rate, meaning the rate you receive is usually lower than the market rate. You also need to account for international transaction fees, which may be fixed or a percentage of the amount.

| Provider | Exchange Rate Markup Range |

|---|---|

| Wise | 2.35% - 3.34% |

| Monito | 1.28% - 1.96% |

Tip: Before sending money, compare real-time exchange rates and markup ranges across platforms to choose the best option.

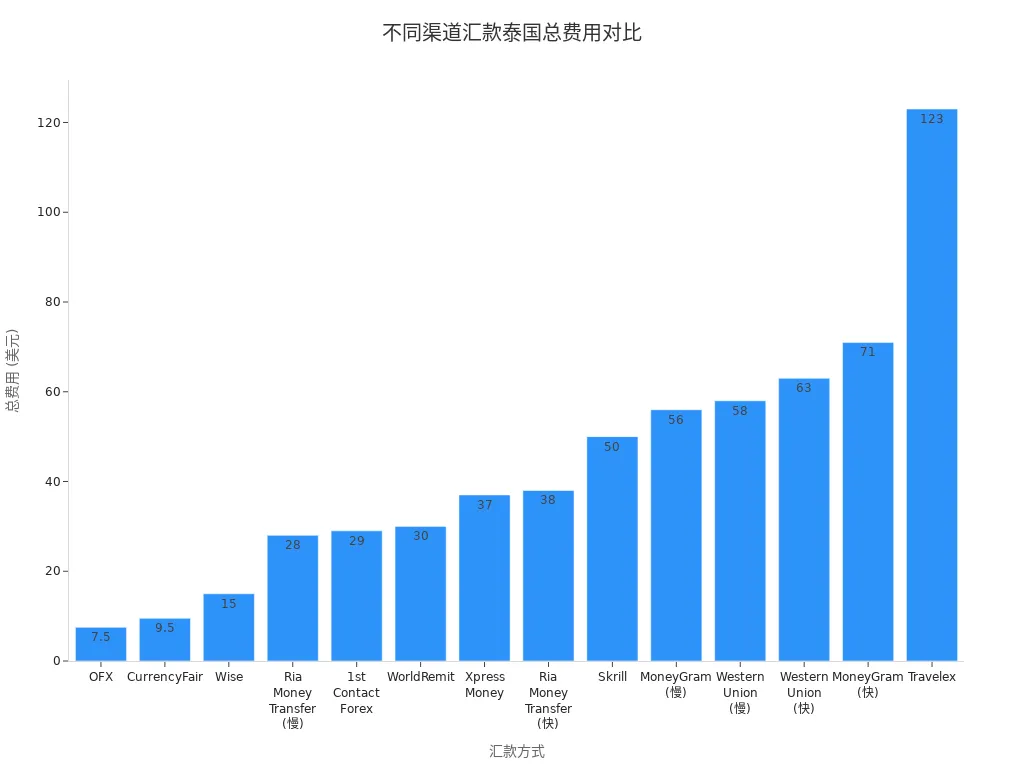

Global Remittance Costs

When choosing a remittance channel, consider the total cost, including transaction fees and exchange rate conversion fees. The table below shows the total costs and processing times for sending USD 1,000 to Thailand via different channels:

| Remittance Method | Fees for Sending $1,000 USD | Hidden Exchange Rate Fees | Total Cost | Transfer Arrival Time |

|---|---|---|---|---|

| OFX | $0 | $7.5 | $7.5 | 1-2 days |

| CurrencyFair | $4 | $5.5 | $9.5 | 1-2 days |

| Wise | $15 | $0 | $15 | 1-2 days |

| Ria Money Transfer (Slow) | $5 | $23 | $28 | 3-5 days |

| 1st Contact Forex | $10 | $19 | $29 | 1-3 days |

| WorldRemit | $5 | $25 | $30 | 1-3 days |

| Xpress Money | $17 | $20 | $37 | 3-5 days |

| Ria Money Transfer (Fast) | $15 | $23 | $38 | Minutes |

| Skrill | $10 | $40 | $50 | 3-5 days |

| MoneyGram (Slow) | $5 | $51 | $56 | 1-3 days |

| Western Union (Slow) | $5 | $53 | $58 | 1-3 days |

| Wire Transfer | $25-40 | $10-20 | $35-60 | 3-5 days |

| Western Union (Fast) | $10 | $53 | $63 | Minutes |

| MoneyGram (Fast) | $20 | $51 | $71 | Minutes |

| Travelex | $0 | $123 | $123 | 3-5 days |

When comparing global remittance channels, focus on the final amount received, not just the visible fees. Total costs vary significantly, as do processing times. Choose based on your needs and the recipient’s situation to plan remittances effectively.

Receiving Methods

When receiving global remittances in Thailand, you can choose from multiple methods. Common options include bank accounts, cash pickups, and digital wallets. Different methods suit different needs, allowing you to choose flexibly based on your situation.

You can refer to the table below for the main advantages and disadvantages of the three receiving methods:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Typically lower fees, high reliability | Longer processing times, may take days |

| Cash Pickup | Fast, over 2,300 locations for instant cash withdrawal | May require visiting specific locations, limited by availability |

| Digital Wallet | Convenient, real-time fee tracking | Not accepted everywhere, may incur usage fees |

Bank Accounts

You can choose to have remittances deposited directly into a Thai bank account. This method is highly secure and suitable for large fund transfers. You only need to provide the recipient’s name, bank account number, and SWIFT code. When processing international remittances through licensed Hong Kong banks, you typically need to verify all information to ensure fund security. The downside is longer processing times, generally 1 to 5 business days.

Cash Pickup

If you need quick access to funds, you can opt for cash pickup services. Simply bring valid identification to a designated location to collect cash. Thailand has over 2,300 partner locations, making withdrawals convenient. Cash pickup is ideal for urgent needs but requires visiting specific locations, which may be less convenient in some areas.

Digital Wallets

You can also receive funds via digital wallets. Digital wallets support instant transfers and allow you to check fees anytime. Simply link a phone number or account to receive funds. Digital wallets are suitable for small, frequent remittances. However, not all merchants accept digital wallet payments, and some services may charge fees.

Confirmation and Tracking

Transaction Confirmation

After completing a global remittance, the first step is to confirm the transaction’s success. Most banks and international remittance platforms automatically generate an electronic receipt upon submission. You can view transaction details in your account history. Some platforms also send notifications via SMS or email to update you on the remittance status. Save these receipts for future reference or in case of issues.

Some mobile apps, such as DeeMoney, send real-time notifications after transactions. You can check the latest transaction status and promotional information directly in the app. This allows you to track fund movements and ensure every remittance is secure.

Tip: After receiving transaction confirmation, take a screenshot or download the electronic receipt for future reference.

Status Inquiry

While waiting for funds to arrive, you may want to know if they’ve reached the recipient. Most platforms now support real-time tracking. You can check the remittance status as follows:

- Access apps like DeeMoney to view real-time remittance progress and exchange rates.

- Monitor transaction status notifications from platforms to stay updated on fund movements.

If you use licensed Hong Kong banks for international remittances, you can perform detailed inquiries through their dedicated website. Follow these steps:

- Visit https://swiftgpiinquiry.scb.co.th/custinquiry.

- Enter transaction details, such as reference number, currency, amount, or UETR code.

- Complete security verification and select the information language.

- Click the confirm button to view the current remittance status.

Using these tools, you can monitor fund transfers at any time and contact customer service immediately if issues arise, ensuring fund security.

Cancellation and Modification

Cancellation Process

If you need to cancel a global remittance after initiation, follow these steps. First, contact the bank or international remittance platform promptly. For licensed Hong Kong banks, you can submit a cancellation request via online banking, customer service hotline, or in-person at a branch. The bank will require the transaction reference number, remittance amount (e.g., USD 1,000), and recipient details. The bank will verify the transaction status. If the funds have not yet arrived, the bank can cancel the remittance. Some platforms support online cancellation by clicking the “Cancel” button on the transaction details page. Note that cancellations may incur fees, typically USD 10-30.

Reminder: If you notice incorrect information or a change in remittance needs, apply for cancellation promptly. Once funds arrive, cancellation becomes significantly more difficult.

Information Correction

If you discover errors in the remittance information, you can request corrections. Contact the bank or platform’s customer service to specify the details needing changes, such as bank account numbers, recipient names, or SWIFT codes. The bank will require supporting documents, such as identification or the original transaction receipt. Some platforms support online corrections by submitting a change request on the transaction page. The bank will update the information after review.

Below are common correctable details and required documents:

| Correctable Information | Required Documents |

|---|---|

| Bank Account Number | Identification, transaction receipt |

| Recipient Name | Identification |

| SWIFT Code | Bank proof |

Note that corrections may delay processing times, and banks may charge USD 5-20 for the service. Before proceeding, carefully verify all information to minimize the need for corrections.

Security and Services

Security Measures

Security is critical when making global remittances. Choose regulated service providers to ensure their credibility. Verify that the provider complies with financial regulatory requirements to reduce risks. Protect your personal information and passwords to prevent identity theft. Use secure network connections and check for valid SSL certificates. Enable two-factor authentication to enhance account security.

Reminder: When using licensed Hong Kong banks or international platforms, regularly update passwords and avoid remittances on public networks.

- Use regulated service providers to ensure credibility.

- Ensure providers comply with financial regulatory requirements.

- Protect personal information and passwords to avoid identity theft.

- Use secure network connections and verify SSL certificate validity.

- Adopt two-factor authentication to enhance account security.

Customer Support

If you encounter issues during global remittances, you can seek help through multiple channels. Call the provider’s customer service hotline to speak directly with the support team. Alternatively, contact customer support via email to detail your issue. Many platforms offer live chat options for real-time communication with support staff to resolve queries quickly.

Suggestion: If you face remittance delays, incorrect information, or account issues, contact customer support promptly and keep all communication records for future reference.

- Contact the provider’s customer support team by phone

- Reach customer support via email

- Use live chat options to communicate with customer support

When choosing global remittance channels, security and customer service are equally important. Understand the provider’s security measures and support capabilities in advance to ensure fund safety and a smooth remittance experience.

You can choose bank transfers, online platforms, or mobile payments based on your needs. Bank transfers are suitable for large remittances with high security. Online platforms and mobile payments are convenient and fast. Pay attention to fees, exchange rates, and processing times. Prepare all information in advance and contact customer service promptly if issues arise.

FAQ

1. What information do you need to send money to Thailand from mainland China?

You need the recipient’s name, bank account number, SWIFT code, and receiving bank address. Verify each detail carefully.

Suggestion: Prepare all information in advance to avoid delays due to errors.

2. How long does it take to receive funds sent from licensed Hong Kong banks?

Typically, you can receive funds within 1 to 5 business days. Processing time depends on the bank’s speed.

| Remittance Channel | Processing Time |

|---|---|

| Licensed Hong Kong Banks | 1-5 business days |

| Online Platforms | 1-2 business days |

| Mobile Payments | Instant |

3. What fees do you need to pay to complete a global remittance?

You need to pay sending bank fees, intermediary bank fees, and exchange rate conversion fees. Total costs typically range from USD 7 to USD 60.

Compare the total costs of different channels to choose the most suitable option.

You have completed a detailed analysis of sending money to Thailand from across the globe, understanding the significant differences in speed (from minutes to 5 business days) and total cost (ranging from $7.5 to $123 per $1000 USD sent) across bank wires, online platforms, and mobile payments. You are aware that in selecting a method, you must not only compare surface fees but also watch out for intermediary bank fees, hidden exchange rate markups, and the risk of delays or losses caused by errors in complex SWIFT codes.

In the face of a complicated global financial environment, you need a professional FinTech platform that can bypass the high costs of traditional banks, offer real-time exchange rates, and ensure same-day fund arrival for efficient and low-risk fund deployment.

BiyaPay is your ideal solution for secure and high-efficiency global fund management. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5% and zero commission for contract limit orders, helping you maximize cost control and avoid complex bank fee traps. With BiyaPay, you can seamlessly convert between various fiat and digital currencies and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas bank account, and you can enjoy same-day fund remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and utilize peak capital efficiency and transparent fees to make your global transfers to Thailand easier and more secure!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.