- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Bank Transfers to Australia: Fees, Exchange Rates, Transfer Limits, and FAQs

Image Source: pexels

When conducting bank transfers in Australia, you typically need to pay international wire transfer fees ranging from 10 to 35 USD, and intermediary banks may charge additional fees. Platforms like Wise often charge fees starting at 0.33% with no intermediary fees. Most banks apply an exchange rate markup, reducing the actual amount received. Banks set single-transaction or annual limits, such as 10,000 USD per transaction or 50,000 USD annually. The fees, exchange rates, and limits of different banks and platforms significantly impact the USD amount you receive. Refer to the table below for key differences:

| Type | International Bank (SWIFT) Fees | Wise Fees |

|---|---|---|

| Sending Transfer Fees | 10 USD - 35 USD | Starting at 0.33% |

| Intermediary Bank Fees | Yes | No |

| Exchange Rate Markup | Yes | No |

| Receiving Transfer Fees | 0 USD - 9 USD | No |

Key Points

- When choosing a transfer method, compare fees and exchange rate differences. Platforms like Wise typically have lower fees and more transparent exchange rates.

- Understand the amount limits for each transfer. Different banks have varying rules for single and annual transfers, so confirm in advance to avoid issues.

- Prepare recipient information and identification. Ensure accuracy to reduce transfer errors and delays.

- Pay attention to processing times. International transfers usually take 1-5 days, with holidays potentially causing delays.

- Ensure fund security. Verify all account details to avoid losses due to input errors.

Bank Transfer Fees

Image Source: pexels

When transferring money, you need to consider three main fees: transaction fees, service fees, and exchange rate differences. Fee structures vary significantly across banks and platforms, affecting the actual amount received.

Transaction Fees

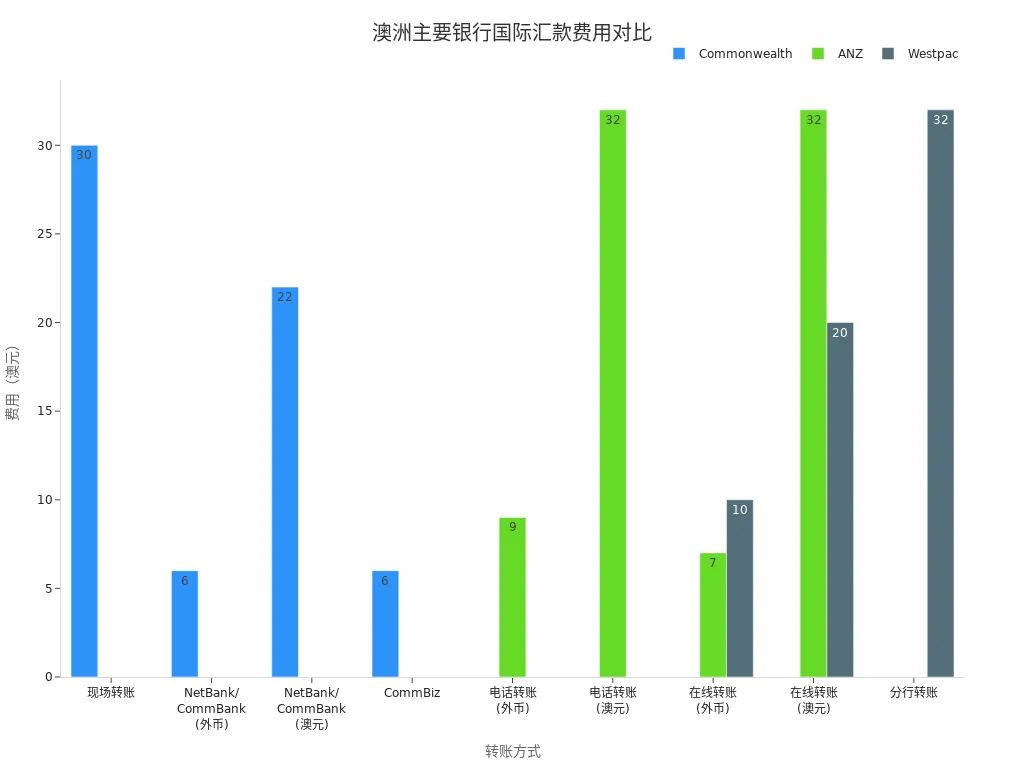

When using bank transfers in Australia, transaction fees vary depending on the bank and transfer method. Below is a comparison table of international wire transfer fees for three major Australian banks (in AUD, approximately equivalent to USD, 1 AUD ≈ 0.67 USD, for reference only):

| Bank | Transfer Method | Fee (AUD) | Fee (USD, Approx.) |

|---|---|---|---|

| Commonwealth | In-Person Transfer | 30 | 20 |

| NetBank/CommBank | 6 (Foreign Currency)/22 (AUD) | 4/15 | |

| CommBiz | 6 | 4 | |

| ANZ | Phone Transfer | 9 (Foreign Currency)/32 (AUD) | 6/21 |

| Online Transfer | 7 (Foreign Currency)/32 (AUD) | 5/21 | |

| Westpac | Online Transfer (Foreign Currency) | 10 | 7 |

| Online Transfer (AUD) | 20 | 13 | |

| Branch Transfer | 32 | 21 |

Online transfers typically have lower fees. In-person or phone transfers incur significantly higher fees. Platforms like Wise and Revolut charge proportional fees, starting at 0.33%, with no intermediary bank fees, making them suitable for frequent small transfers.

Service Fees

During bank transfers, service fees include intermediary bank fees and receiving bank fees. When initiating an international wire transfer from an Australian bank, you may encounter the following service fees:

- Intermediary Bank Fees: If your funds pass through a third-party bank for clearing, additional fees of 10-25 USD may apply. Platform transfers do not have these fees.

- Receiving Bank Fees: Some banks charge recipients 0-9 USD for incoming transfer fees. Check with the receiving bank in advance to avoid reduced received amounts.

Tip: When choosing a bank transfer, always inquire about all possible service fees, especially hidden intermediary and receiving bank fees.

The service fee structure of Australian banks is relatively complex. Small businesses and individual users may face significantly higher fees for electronic and debit card transactions compared to large enterprises. When signing payment agreements, carefully review terms to avoid unexpectedly high fees due to bundled or mixed plans.

Exchange Rate Differences

When bank transfers involve currency exchange, exchange rate differences significantly affect the received amount. Australian banks typically add a 2.5% to 4.5% markup on the market exchange rate. Platforms like Wise and Revolut have markups of only 0.4% to 1.2%, offering greater transparency.

| Currency Transfer Provider | Exchange Rate Markup (Profit) |

|---|---|

| Banks | 2.5% – 4.5% |

| Currency Brokers | 0.15% – 2% |

| Transfer Apps | 0.4% – 1.2% |

| Cash Delivery Services | 0.8% – 4% |

| PayPal | 4% |

When transferring via banks, the actual received amount decreases due to exchange rate markups. For example, transferring 10,000 USD with a bank’s 2.5% to 4.5% markup results in tens to hundreds of USD less compared to platform transfers. Platform transfers use rates closer to the market rate, ideal for users sensitive to received amounts.

Reminder: Before making a bank transfer, use the bank’s or platform’s exchange rate calculator to estimate the actual received amount to avoid unnecessary losses due to rate differences.

Bank transfer fee structures are complex, involving multiple hidden costs. When choosing a transfer method, consider transaction fees, service fees, and exchange rate differences, and make the best choice based on your needs.

Exchange Rate Mechanism

Exchange Rate Calculation

When making bank transfers, the exchange rate calculation directly impacts the received amount. Australian banks typically use retail exchange rates with a markup on the market rate. Platforms like OFX and Wise use different exchange rate mechanisms. Refer to the table below for key differences:

| Platform | Exchange Rate Calculation | Fee Structure | Processing Time |

|---|---|---|---|

| OFX | Retail exchange rate, possible markup | $15 for transfers under $10,000, free above | 1-2 business days |

| Wise | Mid-market exchange rate, no markup | Transparent fee structure | Minutes to days |

Banks typically add a 2.5% to 4.5% profit margin to the exchange rate. Platforms like Wise use the mid-market exchange rate with lower, more transparent fees. When choosing a transfer channel, compare exchange rates and fee structures to estimate the actual received amount.

Exchange Rate Impact

Exchange rates play a critical role in international transfers. You need to understand that exchange rate fluctuations directly affect the amount received by the recipient:

- The closer the rate is to the market rate, the less loss you incur on transferred funds.

- Platform transfers typically offer better rates, resulting in higher received amounts.

- Understanding exchange rate mechanisms helps minimize losses and ensures more funds reach the destination.

When transferring to Chinese mainland from Australia, pay attention to China’s foreign exchange controls. The State Administration of Foreign Exchange in China stipulates that mainland Chinese residents can receive up to 50,000 USD annually. You need to complete identity verification to ensure compliance. The table below outlines relevant limits:

| Type | Annual Limit |

|---|---|

| Chinese Mainland Residents | $50,000 |

| Foreigners in China | Based on legal income limits |

These controls ensure economic stability but restrict fund flows. Before transferring, understand the limits and identity verification requirements to avoid transfer failures due to exceeding limits or incomplete documentation. Special purposes like education or medical expenses may qualify for exemptions but require supporting documents.

Amount Limits

Single Transaction Limits

When conducting international bank transfers in Australia, you must note the maximum amount limits per transaction. Different banks have varying rules for single international transfer limits. For example, NAB (National Australia Bank) sets a maximum of $5,000 per international transfer. Refer to the table below for single transfer limits of major banks:

| Bank | Single International Transfer Limit |

|---|---|

| NAB | $5,000 |

When using Hong Kong-licensed banks or other international banks, single transaction limits may vary. Some banks allow larger transfers through in-person services, but online channels typically have lower limits. Platforms like Wise and Revolut adjust single transaction limits based on account verification levels and the country. Before proceeding, confirm the latest single transaction limit with your bank or platform.

Reminder: When planning large fund transfers, consider splitting funds into multiple transactions to avoid failures due to single transaction limits.

Daily/Annual Limits

In addition to single transaction limits, you need to consider daily and annual total transfer limits. Australian banks and transfer platforms often impose restrictions on daily cumulative transfer amounts. For example, Osko, a commonly used instant transfer platform in Australia, has daily transfer limits set by some banks between $2,000 and $5,000. Actual limits may vary when using Osko services with different banks.

For annual limits, China/Chinese mainland has strict regulations on the total international transfers individuals can receive annually. According to the State Administration of Foreign Exchange, mainland Chinese residents can receive up to $50,000 per year. When transferring to China/Chinese mainland, you must complete identity verification to ensure compliance. Exceeding the annual limit typically requires additional documentation, such as proof of tuition or medical expenses.

When choosing bank or platform transfers, consider the following:

- Daily and annual limits vary significantly across banks and platforms; confirm with customer service before proceeding.

- Some banks allow you to increase limits by enhancing account security levels or submitting additional documents.

- If planning multiple large transfers, schedule in advance to avoid issues due to annual limits.

Note: For large transfers, banks and platforms may require proof of fund source or purpose. Prepare relevant documents in advance to ensure smooth transfers.

Amount limits are critical factors affecting transfer efficiency and compliance during international fund transfers. Choose a bank or platform based on your needs and fully understand the relevant regulations to ensure funds arrive securely and promptly.

Bank Transfer Process

Image Source: unsplash

Operation Steps

When initiating an international bank transfer in Australia, follow these steps:

- Prepare the recipient’s full name, address, and account information.

- Obtain the recipient’s International Bank Account Number (IBAN) and international bank code (SWIFT/BIC).

- Provide your identification, such as a passport or driver’s license.

- Complete the bank or platform’s form, specifying the transfer purpose and fund source.

- Carefully verify all information and submit the transfer request.

These steps apply to international transfers through Hong Kong-licensed banks or Australian local banks. Prepare all documents in advance to improve efficiency.

Required Documents

When processing international bank transfers, you typically need the following:

| Required Information Type | Specific Requirements |

|---|---|

| Recipient Information | Account name, street address, account number (or IBAN) |

| Bank Information | Bank name, street address, bank code (SWIFT/BIC) |

| Personal Identification | Passport, driver’s license, or other identity proof |

| Additional Information | Fund source, purpose, additional documents may be required in some countries |

When transferring to China/Chinese mainland, banks may require additional supporting documents to ensure compliance.

Processing Time

Transfer processing times vary based on the transfer type and destination. Refer to the table below:

| Type | Processing Time |

|---|---|

| Domestic Australian Transfers | Usually same day or next business day |

| International Transfers | 1-5 days, with initial transfers to China/Chinese mainland taking up to 5 days, subsequent transfers as fast as minutes |

Processing times may be delayed due to bank regulations, currency exchange, public holidays, time zone differences, or intermediary bank processing. Allow extra time for transfers around holidays.

Tip: Check with the bank for estimated processing times before transferring to plan funds appropriately.

Security Tips

When conducting international bank transfers, prioritize security. Australian banks and Hong Kong-licensed banks typically employ multiple anti-fraud measures, including:

| Anti-Fraud Measure | Purpose |

|---|---|

| Recipient Verification System | Ensure funds are transferred to the correct account |

| Enhanced Identity Verification Process | Prevent identity fraud and account misuse |

| High-Risk Transaction Alerts | Increase vigilance for suspicious transactions |

| Biometric Checks | Provide additional security |

Avoid using unknown links or third-party platforms for transfers, and contact bank customer service immediately if you encounter suspicious information. Verifying recipient details and protecting personal account information are key to preventing fraud.

When choosing a bank transfer, focus on the following:

- Exchange Rates and Fees: Transfer providers have significant differences in rates and fees. Compare options to choose the lowest-cost method.

- Transfer Methods and Limits: Wire transfers have higher fees, while platform transfers are more flexible. Understand single and annual limits to avoid rejections.

- Document Preparation: Prepare detailed recipient information and identity proof to reduce transfer errors.

- Fund Security: Verify all account details to avoid losses due to input errors. According to the Australian Securities and Investments Commission, 83% of transfer errors stem from incorrect account information.

Tip: Refer to the table below for a quick overview of common issues:

| Feature | Description |

|---|---|

| Exchange Rate | Relationship between the transfer currency and the recipient country’s currency |

| Fees | Fixed rates or percentages, may include recipient fees |

| Limits | Maximum single or annual transfer amounts |

| Processing Time | Usually 1-5 days, some platforms as fast as minutes |

Before transferring, use a foreign exchange calculator to estimate costs, monitor rate changes, and consult bank or platform customer service if needed to avoid unnecessary losses.

FAQ

What information is needed for a bank transfer from Australia to China/Chinese mainland?

You need the recipient’s name, bank account number, bank name, SWIFT/BIC code, and recipient address. Some banks may require a statement of fund purpose and identity proof.

How long does a transfer to China/Chinese mainland take?

Bank transfers typically take 1-5 business days. Platform transfers may complete in minutes. Holidays or intermediary bank processing may delay receipt.

Are there limits on transfer amounts?

Single international transfers are usually capped at 10,000 USD. Chinese mainland residents can receive up to 50,000 USD annually. Plan ahead to avoid exceeding limits.

What to do if a transfer fails?

Contact the bank or platform customer service to verify account details and documents. If rejected due to limits or document issues, the bank will notify you to provide additional information or resubmit.

What’s the difference between platform and bank transfers?

Platform transfers have more transparent fees and rates, with faster processing. Bank transfers are more complex, with higher fees and slower processing. Choose based on your needs.

Managing bank transfers in Australia demands attention to fees and exchange rates, yet steep international wire costs ($10-$35), hidden intermediary bank charges, and China’s annual forex cap ($50,000) often complicate cross-border flows. These hurdles can shrink received amounts or cause delays, disrupting your financial strategy. As a globally-minded user seeking efficiency, you need a transparent, low-cost platform to streamline operations.

BiyaPay offers a seamless answer, featuring real-time exchange rate queries to track AUD-to-USD or other rates (currently ~0.67 USD) and convert fiat to crypto, dodging unfavorable shifts. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Better still, trade US and Hong Kong stocks directly on the platform without overseas accounts, optimizing post-transfer capital.

Sign up for BiyaPay today for cost-effective, high-speed cross-border finance. From navigating compliance limits to routine transfers, it saves you money and hassle. Don’t let hefty fees stall your global cash flow—join BiyaPay now for a smoother transfer journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.