- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money to the UK via Online Banking: A Comprehensive Guide to Transfer Process, Fees, and Security

Image Source: unsplash

You can transfer funds from China to the UK through online banking remittance in various ways, with simple operations. Common options include traditional banks like Bank of China and Industrial and Commercial Bank of China, as well as third-party platforms like Wise and Revolut. You can also use online remittance services, international wire transfers, cash pickup services, or mobile remittance apps. Each method has its own characteristics, suitable for different needs.

Key Points

- Choose reputable banks or third-party platforms for remittances to ensure the safety of funds and information protection.

- Understand the fee structures and exchange rates of each platform to avoid hidden fees and select the most suitable remittance method.

- Carefully verify all information when filling out remittance details to avoid fund losses due to errors.

- Use real-time tracking features to monitor the remittance status and stay informed about the arrival of funds to ensure a smooth transfer.

- Implement security measures, such as using strong passwords and two-factor authentication, to protect your account from cyber scams and attacks.

Online Banking Remittance Methods

Image Source: unsplash

Bank Channels

You can choose licensed banks in mainland China or Hong Kong for online banking remittances. These banks typically support international wire transfer services. You need to log into your online banking account, fill in the recipient’s information, and specify the remittance amount. The online banking remittance process of mainland Chinese banks is relatively standardized, suitable for users requiring large transfers. Hong Kong licensed banks are known for their flexibility and international features, and many users prefer them for fund transfers due to simple procedures and faster processing times. When choosing bank channels, you should pay attention to each bank’s handling fees and exchange rates. Some banks charge fixed handling fees, while others charge proportional fees based on the amount. The transfer time typically ranges from 1 to 3 business days, depending on the bank’s processing speed and intermediary bank arrangements.

Third-Party Platforms

You can also choose third-party platforms for online banking remittances. Platforms like Wise and Revolut are popular due to their low fees, fast processing, and user-friendly operations. Many users prefer these platforms for the following reasons:

- Lower fees: Online banking remittances through third-party platforms are usually more cost-effective than traditional banks.

- Better exchange rates: You can get rates closer to the market, reducing losses.

- Faster transfers: Some platforms complete transfers within minutes.

- User-friendly platforms: Simple interfaces make it easy to complete transactions on both mobile and desktop devices.

The following table compares the main fees and transfer speeds of Wise and Revolut:

| Bank/Platform | Transfer Fees | Transfer Speed | Other Fees |

|---|---|---|---|

| Wise | Fixed fees, depending on currency and payment method | Usually within 24-48 hours | $1.50 per withdrawal after exceeding $100 |

| Revolut | Free (within plan limits), $3 thereafter | Usually within minutes | 1% markup on weekend forex |

When choosing an online banking remittance method, you can weigh fees, transfer speed, and operational convenience based on your needs. Third-party platforms are suitable for users seeking efficiency and low costs, while bank channels are better for large amounts or scenarios requiring high security.

Remittance Process

Document Preparation

Before making an online banking remittance to the UK, you need to prepare the necessary documents in advance. Requirements may vary slightly between banks or third-party platforms, but in most cases, the following information is essential:

| Required Documents | Description |

|---|---|

| Identity and Address Proof | Passport and utility bill (only for counter services) |

| Recipient’s Name and Address | |

| Recipient’s IBAN Number | |

| Recipient’s Bank Name and Address | |

| Recipient’s Bank SWIFT Code | |

| Payment Amount | |

| Payment Currency |

You need to ensure all information is accurate and valid. For online banking remittances from China/mainland China, paper documents are usually not required, but some banks may ask for additional identity information. Third-party platforms like Wise and Revolut require identity verification during the first use. Thorough preparation can significantly improve remittance efficiency and avoid delays due to missing documents.

Information Entry

When filling out online banking remittance information, you must carefully verify each detail. Banks and third-party platforms typically require you to enter the recipient’s name, IBAN number, SWIFT code, recipient’s bank name and address, remittance amount, and currency. You also need to confirm that your account balance is sufficient to cover the remittance amount and related fees.

Common operational steps are as follows:

- Log into your online banking account or third-party platform account.

- Prepare all required details, including recipient’s bank information and your account funds.

- Enter the recipient’s bank details (IBAN, SWIFT/BIC code, etc.).

- Enter the remittance amount and select the recipient currency (e.g., USD or GBP).

- Carefully review all information, amounts, exchange rates, and fees, then submit after confirming accuracy.

Tip: The information entry stage is prone to errors. You may enter incorrect account numbers or SWIFT codes due to typos, leading to failed transfers. The following table lists common error types and their impacts:

| Error Type | Description |

|---|---|

| Customer Error | Customers may enter incorrect sort codes or account numbers. |

| Bank Error | Banks may cause payment errors due to staff input errors or system failures. |

| Non-Refunded Funds | In some cases, erroneously paid funds may not be refunded, especially if the beneficiary refuses to return them. |

You should repeatedly verify information, especially IBAN and SWIFT codes. Any error may lead to transfer failure or fund loss.

Submission and Tracking

After completing all information entry, you can submit the remittance request. Banks and third-party platforms will automatically process your online banking remittance. You can track the remittance progress through the following steps:

- After submitting the remittance, the system will generate a transaction reference number.

- You can check the remittance status in the “transaction history” section of your online banking or third-party platform.

- Many banks and platforms send remittance confirmation and progress updates via email or SMS.

- International remittances typically generate a SWIFT tracking number (UETR), which you can use to inquire about progress with the bank.

- Remittance statuses are generally categorized as: In Progress, Available for Pickup, Received, Paid, or Delivered. You can judge whether the funds have arrived based on the status.

Effective ways to monitor online banking remittance status include:

- Using the bank or platform’s real-time tracking features

- Checking transaction reference numbers and SWIFT tracking numbers

- Monitoring email or SMS notifications

During the entire remittance process, you should keep all transaction receipts and reference numbers. If you encounter anomalies or delays, you can use this information to contact the bank or platform’s customer service promptly to ensure fund safety.

Although the online banking remittance process is convenient, every step requires your careful attention. Only by ensuring complete documentation, accurate information, and timely tracking can you successfully complete fund transfers from China/mainland China to the UK.

Remittance Fees

Fee Types

When making online banking remittances to the UK, you will encounter various fees. Understanding these fees helps you plan your funds effectively. Common fees include:

- Service Handling Fees: Banks or third-party platforms charge fixed or proportional handling fees.

- Currency Conversion Fees: If the remittance currency is not GBP, banks or platforms will charge a currency exchange fee.

- Communication Fees: Some banks charge international communication fees to cover the cost of cross-border information transmission.

- Intermediary Bank Fees: International remittances often pass through one or more intermediary banks, each of which may charge additional fees.

The following table summarizes the main fee types and details:

| Fee Type | Details |

|---|---|

| Intermediary Bank Fees | Each intermediary bank typically charges $15–50. |

| Bank Wire Transfer Fees | The average international wire transfer fee for the top 10 U.S. banks is about $38. |

| Currency Conversion Fees | Intermediary or receiving banks may charge currency conversion fees. |

| International Transfer Fees | The receiving bank may charge suppliers for international transfers. |

You should carefully review the fee descriptions before remitting to avoid increased costs due to overlooked fees.

Fee Comparison

Fee structures vary significantly among service providers. You can choose the most suitable platform based on your needs. The following table compares the fees of mainstream banks and third-party platforms in China/mainland China:

| Service Provider | Transfer Fees | Notes |

|---|---|---|

| Wise | Starting from 0.33% | Consistent fees, single transfers up to $1,000,000. |

| Revolut | Varies by amount, currency, and destination | Additional 1% fee for weekend currency conversion, extra fees for exceeding plan limits. |

When using Wise for online banking remittances, fees are transparent and low, suitable for frequent small or large transfers. Revolut’s fee structure is flexible but incurs higher costs during weekends or when exceeding free limits. Traditional banks like Bank of China and Industrial and Commercial Bank of China typically charge fixed handling fees and intermediary bank fees, resulting in higher overall costs. P2P platforms like Wise can save 75% to 90% on international transfer fees, have no minimum limits, use real mid-market exchange rates, and offer more transparent fees.

The following table shows the speed and fees of different remittance methods:

| Method | Speed | Minimum Limit | Fees |

|---|---|---|---|

| Wise | A few seconds | None | $7.03 + 0.33% |

| Western Union | 32 minutes | $1 | Higher fees |

| Traditional Banks | 32 minutes | Possibly none | Significant fixed fees |

You can choose the most suitable method based on the remittance amount and required speed.

Cost Reduction

You can effectively reduce the cost of online banking remittances to the UK through the following methods:

- Pay in GBP to avoid currency conversion fees charged by banks or card issuers.

- Use multi-currency debit cards to hold, spend, and withdraw multiple currencies, automatically using the local currency to avoid non-GBP transaction fees.

- Prioritize P2P platforms like Wise for transparent fees and near-market exchange rates to save on international transfer costs.

- Avoid currency conversions on weekends, as some platforms charge extra fees during this time.

- Compare fee structures of platforms and banks before remitting to choose the most suitable option.

Tip: You can use the fee calculators provided by platforms to estimate total costs in advance and plan accordingly.

By reasonably selecting remittance methods and timing, you can significantly reduce the total cost of online banking remittances and improve fund utilization efficiency.

Limits and Arrival Times

Remittance Limits

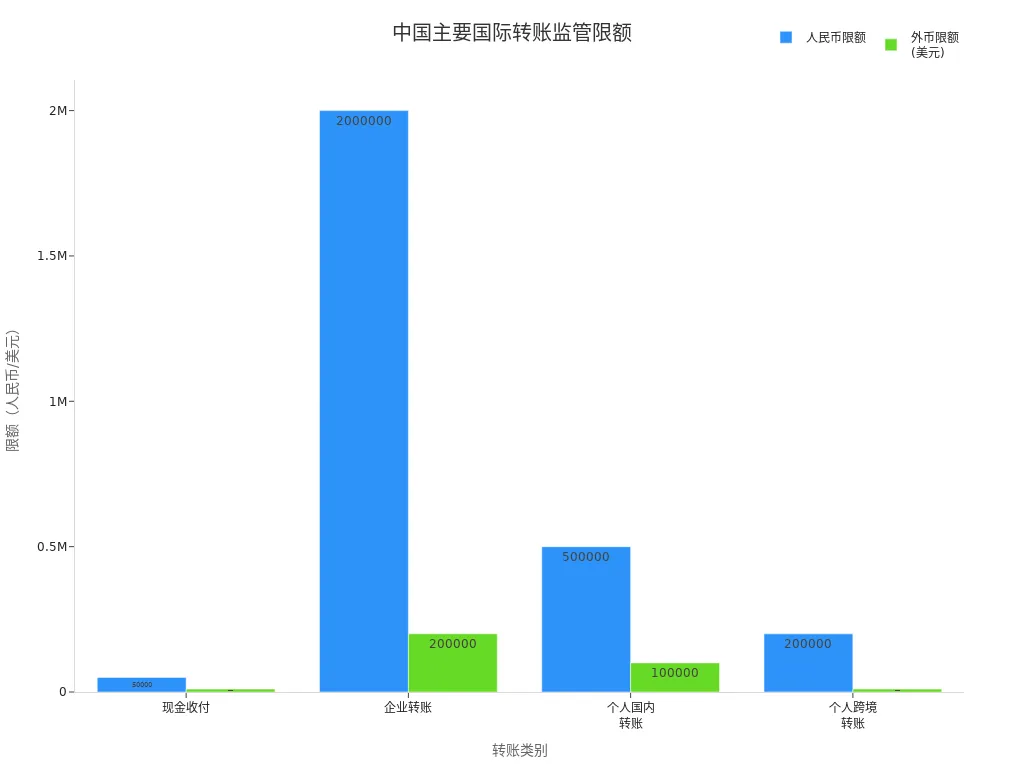

When using online banking in China/mainland China to remit to the UK, you must pay attention to remittance limits. China/mainland China has clear regulations on personal annual foreign exchange, allowing a maximum of 50,000 USD per person per year for overseas transfers. Exceeding this limit requires additional supporting documents. Different types of transfers also have varying limit requirements. The following table shows the maximum and minimum limits for major transfer types:

| Transfer Type | Maximum Limit | Minimum Limit |

|---|---|---|

| International Wire Transfer | Transfers exceeding 10,000 USD require additional documents | No additional document requirements |

| Annual Foreign Exchange Limit | 50,000 USD | None |

You also need to understand the restrictions imposed by Chinese/mainland Chinese regulatory authorities on different categories of transfers. The following table summarizes the relevant regulations:

| Category | Restriction |

|---|---|

| Individual Cross-Border Transfers | Foreign currency equivalent to 10,000 USD or more |

| Individual Annual Foreign Exchange Quota | 50,000 USD |

Reminder: You should check your annual foreign exchange quota in advance to avoid transfer failures due to insufficient limits.

Arrival Times

After completing an online banking remittance, your primary concern is when the funds will arrive. Generally, international bank transfers take 1 to 5 business days. Arrival times vary depending on the platform and payment method chosen. The following table compares the processing times of common payment methods:

| Payment Method | Processing Time |

|---|---|

| Faster Payments | Usually within a few hours |

| BACS | Three business days |

| CHAPS | Same-day settlement |

| International Bank Transfer | 1–5 business days |

If you choose third-party platforms like Wise, the arrival time is usually faster, sometimes completing within minutes. Traditional bank channels may take longer, especially during holidays or when multiple intermediary banks are involved.

Influencing Factors

During the remittance process, you may encounter various factors affecting arrival speed and success rates. Common factors include:

- Insufficient Funds: Inadequate account balance can lead to payment failure.

- Incorrect Details: Entering incorrect account numbers or SWIFT codes may result in transaction rejection.

- Card or Account Restrictions: Some bank cards or accounts have restrictions on international transactions.

- Expired Cards: Using expired cards will automatically reject transactions.

- Network Issues: Unstable networks may interrupt the transaction process.

- Payment Gateway or Bank Server Issues: Technical problems can cause delays or failures.

- Security Flags: Suspicious transactions detected by the system may be automatically rejected.

- Currency Conversion Issues: Cross-border transactions may face exchange rate fluctuations or conversion failures.

- Compliance and Regulatory Issues: Transactions may be rejected if regulatory requirements are not met.

Before remitting, you should carefully verify all information, ensure sufficient account funds, choose reliable platforms, and stay informed about the latest policies and technical maintenance schedules through bank or platform announcements.

Security and Precautions

Image Source: unsplash

Risk Types

When making online banking remittances from China/mainland China to the UK, you must take security risks seriously. Common risks include:

- Fraudulent Phishing: Fake websites, emails, or SMS posing as banks or remittance platforms may trick you into entering sensitive information.

- Malware Attacks: Hackers may steal your account data and passwords through viruses or trojans.

- Account Takeover: Hackers may gain unauthorized access to your account and conduct fraudulent transfers, causing financial losses.

You may also encounter various international remittance scams, such as immigration scams, prize scams, job and employment scams, family emergency scams, investment scams, romance scams, cryptocurrency scams, technical support scams, and extortion or threat scams. These tactics are constantly evolving, making it easy to fall victim.

Recent cases show that scammers caused a Singapore company to lose over $42 million through business email scams. The U.S. market has also seen fraudulent activities related to the Sendwave app, harming consumer rights.

Anti-Scam Tips

You can take several measures to protect your funds and information:

- Conduct online banking operations only on secure Wi-Fi networks.

- Avoid sharing personal information on social media or in public settings.

- Regularly check account activity to detect unusual transactions promptly.

- Keep your phone and computer software updated to prevent hacker attacks.

- Be cautious of any requests for account information and verify their authenticity.

- Use strong passwords and enable two-factor authentication.

- Perform remittances only through official bank apps or websites.

- Verify recipient information to avoid erroneous transfers.

If you notice unauthorized activity in your account, contact the bank’s customer service immediately, freeze the account, and report to the authorities.

Legitimate Channels

When choosing remittance channels, you must use reputable banks or third-party platforms. Official channels typically:

- Implement daily or monthly transfer limits to prevent abnormal large transactions.

- Restrict the number of debit or prepaid cards to reduce risks.

- Establish monitoring programs to flag unusual remittance activities promptly.

- Control maximum balances for accounts and debit cards to ensure fund safety.

- Strictly manage debit card mailing and fund allocation processes.

The U.S. market requires banks to implement Customer Identification Programs (CIP) for all new accounts, verifying identities regardless of customer nationality. When remitting from China/mainland China, you should also choose qualified, regulated platforms to ensure fund safety and compliance.

When making online banking remittances from China/mainland China to the UK, you need to focus on the following points:

- Choose legitimate channels and ensure the website uses HTTPS encryption to protect personal and financial information.

- Understand the fee structures, transfer limits, and exchange rates of each platform to avoid hidden fees.

- Compare different banks and online services to choose the most suitable remittance method.

- Select regulated service providers to receive customer support and reduce financial risks in case of issues.

The following table lists several mainstream, secure, and reputable remittance platforms:

| Bank Name | Features | Fees | Services |

|---|---|---|---|

| Wise | Transparent exchange rates, low fees, fast transfers | Low fees | Supports over 40 currencies, covering 80+ countries |

| Revolut | Multi-currency accounts, real-time exchange rates | Competitive fees | Global payments, ideal for frequent transactions |

| Monzo | Easy account opening, suitable for individuals and small businesses | Moderate fees | 24-hour customer support |

You can flexibly choose remittance methods based on your needs and regularly monitor policy and fee changes to ensure fund safety and efficient transfers.

FAQ

How long does it take to transfer money to the UK via online banking?

You typically receive funds within 1 to 5 business days. When using third-party platforms like Wise, transfers are faster, sometimes completing within minutes.

What should I do if I enter incorrect information during a remittance?

You should immediately contact the bank or platform’s customer service, provide the transaction reference number, and explain the error details. The bank will assist in recovering the funds, but success depends on the specific situation.

Are there minimum or maximum limits for online banking remittances?

You can exchange up to 50,000 USD annually for overseas remittances. Some banks or platforms also impose limits on single transactions. You should check the relevant regulations in advance.

What should I do if there’s a delay in the remittance process?

You can check the progress using the transaction reference number in online banking or the platform. If the delay exceeds the normal timeframe, contact customer service to investigate the cause.

Is online banking remittance safe?

Choosing reputable banks or regulated platforms ensures fund safety. You should protect your account information and avoid operating in insecure network environments.

You have gained a comprehensive understanding of the entire process for safely and effectively remitting funds to the UK via online banking, mastering the comparison of fees, speed, and security between traditional banks and third-party platforms like Wise and Revolut. You clearly know that you must not only adhere to China’s annual foreign exchange limit of 50,000 USD but also guard against high intermediary fees and opaque exchange rate differences. In pursuing secure, compliant, and highly efficient fund transfers, you need a modern financial platform that can offer a lower overall cost, faster transfer speeds, and support for global asset management.

However, traditional international remittance processes are complex and expensive, and you still face annual foreign exchange limits and exchange rate opacity across multiple banks. For users with global asset allocation needs or those who require flexible switching between fiat and digital assets, a more integrated and modern financial solution is necessary.

BiyaPay is your ideal choice for high-efficiency fund transfers. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively reducing your transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to ensure your funds reach the UK safely, compliantly, and quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.