- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 TSMC Explosion? Can Four Major Highlights Make You Earn a Billionaire?

As the world’s largest semiconductor foundry, TSMC has always held a pivotal position in the semiconductor industry. Despite the market uncertainties in 2025, TSMC’s prospects are still very promising. With strong demand in the AI field, the upcoming N2 process node, and the growth of orders from ASIC customers, TSMC is expected to continue to lead the industry development.

Next, let’s take a look at how TSMC will drive revenue growth in 2025 through AI demand and other high-growth areas, as well as how it will respond to possible weakness in the smartphone and PC markets. Finally, we will also delve into TSMC’s four major highlights and valuation to help investors better understand its future performance.

2025 TSMC Performance Expectations: Revenue and Gross Profit Growth

Entering 2025, TSMC’s revenue growth prospects are very promising. It is expected that the company will achieve a revenue growth of over 25% in 2025, mainly due to several key factors: firstly, the launch of the N2 process node, and secondly, strong demand from AI accelerators and ASIC customers. With the continuous explosion of AI technology, TSMC’s advanced process technology will provide strong support for major AI companies, especially for AI chips produced by companies like Nvidia and AMD. The demand from these customers is expected to significantly increase TSMC’s revenue in 2025.

In addition, TSMC’s orders at mature process nodes cannot be ignored. For example, with the popularity of technologies such as Wifi7, the demand for old process nodes will gradually recover, especially the N7 node will still play an important role in some consumer electronics products. The combination of these factors indicates that TSMC will usher in a year full of opportunities in 2025.

In addition, TSMC’s gross profit margin is expected to reach over 57% by 2025, maintaining a stable financial performance. This gross profit level not only reflects the company’s technological advantage, but also reflects TSMC’s pricing power in the market. Especially after the launch of the N2 node, TSMC will have stronger pricing power, driving further improvement in gross profit margin.

Behind TSMC’s high gross profit margin is its advanced technology and strong customer base. With the advent of the N2 node, it is expected that TSMC’s customer base will further expand to more high-end markets, including automotive electronics, smart homes, and high-performance computing, all of which will bring higher added value and gross profit.

It is expected that TSMC will bring excellent performance in 2025. For those who want to seize investment opportunities, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting transactions in US and Hong Kong stocks and digital currencies.

Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Four Highlights of TSMC in 2025

As 2025 approaches, TSMC’s leading position in semiconductor foundry will continue to be consolidated. In addition to strong market demand, TSMC will also drive growth in the coming years through technological innovation and capacity expansion. Next, let’s take a closer look at TSMC’s four major highlights, which will have a significant impact on its performance in 2025.

1. Launch of N2 process node

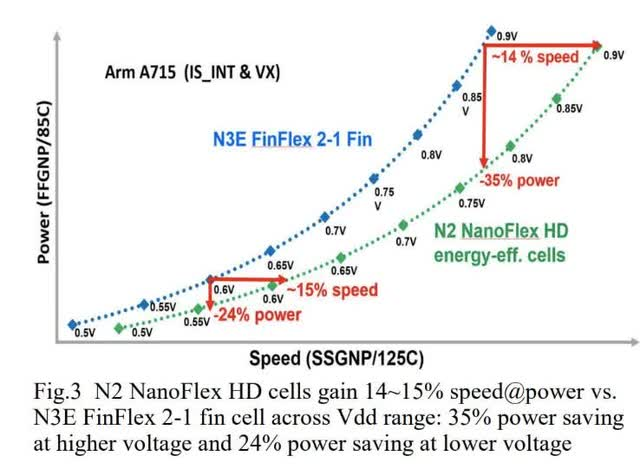

In the second half of 2025, TSMC will launch the highly anticipated N2 process node. The debut of this node is undoubtedly a highlight in TSMC’s technological development. Compared with the previous N3 node, the N2 process will achieve a performance improvement of about 15%, a power efficiency improvement of 30% -35%, and an increase of about 1.15 times in transistor density compared to the N3 node.

The core advantage of the N2 process is that it uses the latest gated all-around (GAA) nanochip transistor technology, which allows chip designers to adjust channel widths more flexibly and further optimize chip performance and power consumption.

Currently, TSMC’s N2 node has achieved a yield rate of over 60%, far exceeding the production levels of competitors Intel and Samsung. This yield advantage means that TSMC is expected to achieve large-scale mass production of N2 nodes smoothly in the second half of 2025, further consolidating its leadership position in the global semiconductor foundry market.

2. Strong demand for AI

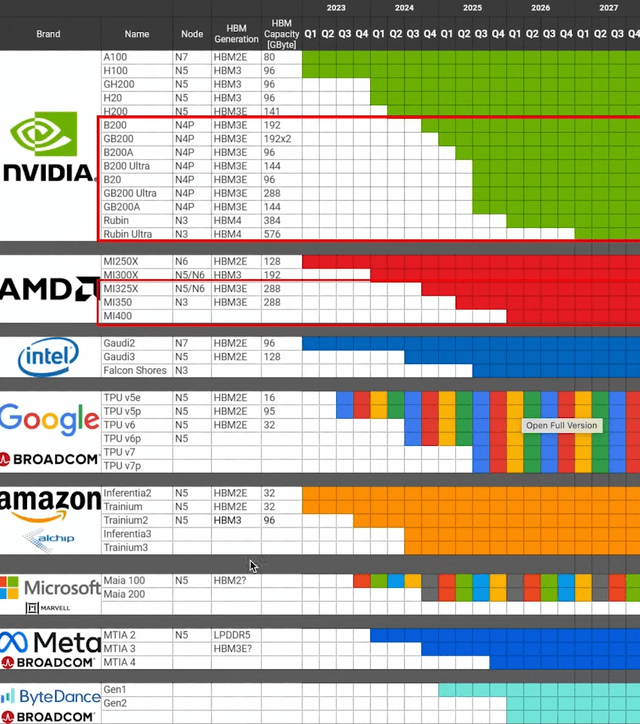

The development of AI technology will become an important driving force for TSMC’s performance growth in 2025. As major AI companies continue to expand their computing needs, TSMC’s role in providing high-performance computing (HPC) solutions for these companies is becoming increasingly important. It is expected that TSMC will continue to provide a large number of AI accelerator chips to companies such as Nvidia and AMD in 2025, and the demand from ASIC customers will also continue to increase.

The rapid growth rate of AI accelerators and ASIC markets means that TSMC is expected to receive a large number of orders from them. These high value-added orders will not only directly drive TSMC’s revenue growth, but also further enhance its gross profit margin. In 2025, the AI market is expected to become one of TSMC’s main sources of revenue.

3. Price hikes and production expansion at US Arizona plant

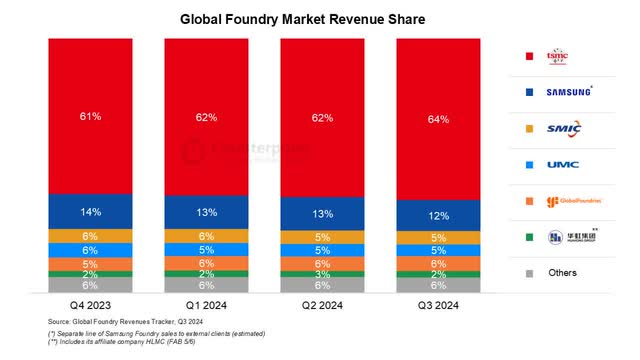

According to Counterpoint Research, TSMC’s market share in the third quarter of 2024 is about 64%, the highest level in the past few years. It is expected that the gap between TSMC and SMIC, Intel and Samsung will further widen in 2025, and the market share will reach about 66-67% , and the market share of advanced nodes will exceed 90%.

TSMC plans to increase the price of its N2 and N3 process wafers by 10% -20% in 2025, which will help further improve its gross profit margin. Although the price increase may bring some risk of customer loss, considering TSMC’s competitive advantage in high-end technology, customers are likely to accept price increases, especially in the AI field where chip demand is strong.

In addition, TSMC’s new factory in Arizona, US, will also accelerate production, which will help the company’s layout in the US market. It is expected that in the first half of 2025, the Arizona factory will begin large-scale production of 4nm chips. As production capacity gradually increases, this factory will alleviate the pressure on TSMC’s production facilities in Taiwan and further enhance its competitiveness in the global market.

4. New generation advanced packaging technology (FOPLP)

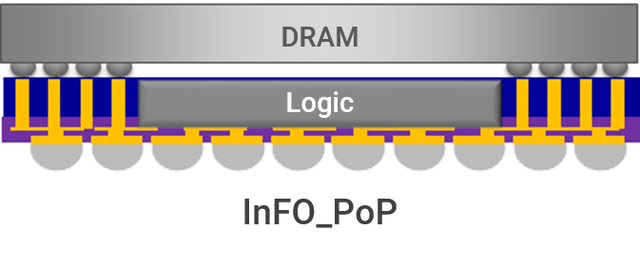

TSMC is actively developing a new generation of advanced packaging technology - FOPLP (Fan-Out Panel-Level Packaging). This technology is expected to become a major growth point for the company in the coming years.

FOPLP can reduce unit costs and improve the flexibility of packaging size, thus meeting the demand for advanced packaging of high-performance chips such as AI accelerators. Currently, TSMC’s advanced packaging technology is facing production capacity bottlenecks, but with the expansion of production capacity, it is expected that by 2025, the company will be able to significantly increase the capacity of FOPLP packaging to meet the needs of AI accelerator customers such as Nvidia and AMD.

The successful development of FOPLP technology will bring higher added value to TSMC, especially in the AI accelerator market, where it is expected to become TSMC’s leading advantage in packaging technology.

Valuation Analysis: TSMC Investment Value

Entering 2025, TSMC’s strong performance expectations will undoubtedly provide support for its stock valuation. When evaluating the investment value of TSMC’s stock, we can analyze it from multiple dimensions.

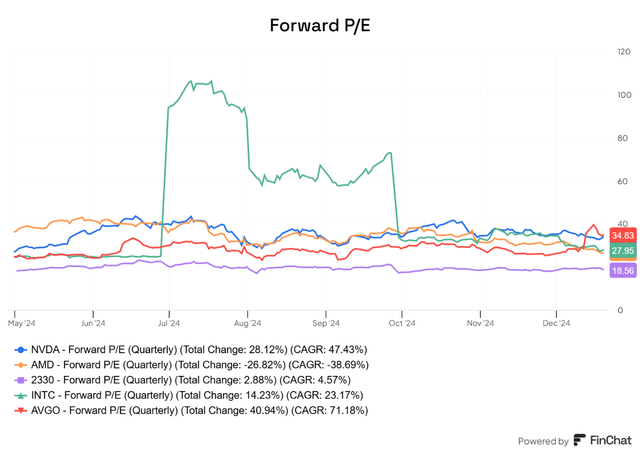

As of now, TSMC’s Price-To-Earnings Ratio (P/E) in Taiwan’s securities market is about 18.5 times. If its American Depositary Shares (ADR) are included, TSMC’s Price-To-Earnings Ratio reaches 22 times. Compared with its main competitors - Nvidia (34 times), Intel (27.9 times), AMD (26.4 times), and Broadcom (34.8 times), TSMC’s valuation is within a reasonable range, even slightly conservative.

Compared with other semiconductor companies, TSMC’s valuation is more attractive. For example, SMIC’s Price-To-Earnings Ratio is 34.6 times, and Huahong Semiconductor’s Price-To-Earnings Ratio is 29.8 times. Although TSMC is the leader in the global semiconductor foundry field, with a market share of 64%, especially in advanced process nodes (such as N3 and N2), its valuation is still lower than some peers.

However, TSMC still faces some risks, especially the weak demand in the smartphone and PC markets, which may have a certain impact on its revenue, especially when the demand from large customers such as Apple is lower than expected. Nevertheless, TSMC’s market share and technological advantages are sufficient to cope with these challenges. Especially as the AI and high-performance computing markets continue to heat up, TSMC’s growth will rely more on these high-value customer groups.

Although TSMC’s stock price is currently reasonably valued, given its technological advantages in advanced process nodes, strong market demand, and sustained growth potential, we believe its stock still has attractiveness. If TSMC’s Price-To-Earnings Ratio can rebound to 27 times the industry average and assuming earnings per share (EPS) reach $8.93 in 2025, TSMC’s target stock price can reach $240 per share, which means that its stock still has about 20% room for growth in 2025.

Overall, TSMC is expected to achieve revenue growth of over 25% and maintain a gross profit margin of over 57% by 2025 due to its technological advantages and strong market demand. Despite the potential weakness in the smartphone and PC markets, the demand from AI accelerators and ASIC customers will strongly support its overall growth.

From the perspective of valuation, TSMC’s Price-To-Earnings Ratio is at a reasonable level. With the launch of N2 technology in the future, the stock price has further room to rise. As a long-term investment target, TSMC is still worth paying attention to, especially with huge potential in the fields of AI and high-performance computing.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.