- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Opening a Bank Account in South Korea: How International Students Can Choose the Most Suitable Account

Image Source: unsplash

When choosing a bank account in South Korea, you should focus on convenience, fees (such as international transfers costing approximately 15-30 USD per transaction), language services, and online banking features. The bank account opening guide recommends prioritizing banks with multilingual services and online management capabilities. You can determine transfer frequency and account type based on your study and living needs to avoid limitations that may affect daily financial management.

Key Points

- When selecting a bank, prioritize those offering multilingual services and online banking features for better financial management.

- Before opening an account, clarify your cash flow needs and understand whether frequent international transfers or multi-currency accounts are necessary.

- Prepare required documents such as a passport, visa, and Alien Registration Card (ARC) to ensure a smooth account opening process.

- Use budgeting apps to plan monthly income and expenses effectively, helping to alleviate financial stress.

- Regularly check account statements to promptly identify any unusual fees and ensure fund security.

Account Opening Needs

Study and Living Needs

While studying in South Korea, you first need to consider expenses for tuition, accommodation, and daily living. Costs vary significantly depending on the program and lifestyle. The table below outlines major expense types and estimated ranges (in USD):

| Expense Type | Estimated Range (Per Semester) |

|---|---|

| Undergraduate Programs | Public Universities: 1,500–6,000 |

| Private Universities: 3,000–8,000 | |

| Master’s Programs | 2,000–9,000 |

| MBA Programs | 5,000–11,000 |

| Doctoral Programs | 2,000–7,000 |

| Accommodation Costs | University Dormitory: 200–600 |

| Off-Campus Housing: 400–800 | |

| Food Costs | Groceries: 200–300 |

| Dining Out: 100–200 | |

| Transportation Costs | Public Transport: 40–60 |

| Utilities and Internet | 80–150 |

| Personal Expenses | 50–100 |

You can reduce financial pressure through scholarships or part-time work. For example, the Korean Government Scholarship (GKS) covers full tuition, airfare, and living allowances. Universities like Seoul National University and Yonsei University also offer various scholarships. Students with a D-2 visa can work up to 20 hours per week during the semester and full-time during holidays. When choosing a bank account, prioritize those that facilitate easy receipt of scholarships, wages, and family remittances.

Financial Management

You need to manage monthly income and expenses effectively. Many students create budgets, tracking income from scholarships, part-time jobs, and family support, and allocating expenses for rent, food, transportation, and entertainment. You can use apps like Money Manager, Spendee, or Mint to help manage your budget.

In South Korea, some accommodations, such as university dormitories, may require a one-time semester payment, while off-campus housing often allows monthly payments. You can also opt for shared apartments or small accommodations (goshwons) to reduce living costs.

The bank account opening guide recommends clarifying your cash flow needs before opening an account, such as whether you require frequent international transfers, multi-currency accounts, or convenient online banking services. This way, you can manage tuition, living expenses, and other daily costs more efficiently.

Bank Account Opening Guide: Process

Image Source: unsplash

Document Preparation

When opening a bank account in South Korea, you need to prepare the required documents in advance. The bank account opening guide suggests organizing all documents to avoid delays due to incomplete materials. The table below lists common required documents and their descriptions:

| Document Type | Description |

|---|---|

| Passport/Visa | Provide a passport and visa as proof of identity. |

| Alien Registration Card (ARC) | Having an ARC grants access to more banking services, such as online banking and ATM cards. |

| Proof of Employment or Student Status | Major banks may require proof of employment or student status documents. |

| Korean Phone Number | Banks require a valid Korean phone number to contact you. |

During orientation week, you can fill out application forms to apply for a Korean bank account and debit card. Some banks may also require an admission letter or proof of enrollment. If you have a recommendation letter, prepare it in advance. The bank account opening guide reminds you that the Alien Registration Card (ARC) typically takes 1-2 months to be issued, but some banks allow you to open an account first and submit the ARC later.

Application Steps

You can choose to apply in person or make an online appointment. The bank account opening guide suggests calling the bank in advance to inquire about English services and required documents and account types to communicate more smoothly with bank staff. The general process is as follows:

- Visit the bank counter or book an appointment through the bank’s website.

- Submit all prepared documents, including passport, visa, student proof, and Korean phone number.

- Fill out the account application form and select the account type (e.g., savings account or fixed-term deposit account).

- Wait for the bank to review your documents; some banks issue a debit card on the spot, while others may take a few days.

- If you don’t yet have an ARC, the bank may open a basic account, which can be upgraded once you receive your ARC.

The bank account opening guide reminds you that opening a local bank account is the first step to living in South Korea. Having the right account helps you manage tuition, living expenses, bill payments, and wage receipts. Pay attention to the bank’s operating hours, as some banks are closed on weekends, so plan your visit accordingly.

Online Features

When using a bank account in South Korea, online and mobile banking features are crucial. The bank account opening guide recommends prioritizing banks that support multilingual services and international transfers. South Korea’s online banking systems are highly secure, using multiple authentication tools to protect account safety. You can use online banking to check balances, transfer funds, pay bills, and manage accounts anytime.

- KEB Bank offers specialized services for foreigners and expatriates, making it particularly suitable for international students.

- KEB’s online banking system requires re-registration for international transfers, which may cause some inconvenience.

- KEB offers low wire transfer fees and convenient online transfer functions, ideal for students needing to transfer funds to China/Chinese mainland or other countries.

- You can manage your account anytime via mobile banking apps, with some banks offering English interfaces for easier operation.

The bank account opening guide suggests keeping login information and security tools secure when enabling online and mobile banking. You can set up transaction alerts to monitor account activity and ensure fund safety. Understanding the differences in online features among banks helps you choose the most suitable account.

Bank Comparison

Image Source: pexels

When choosing a bank account in South Korea, you need to consider language services, fees, convenience, and online banking features. Below is a detailed introduction to the features of four major banks to help you make an informed choice.

KB Kookmin Bank

KB Kookmin Bank offers the most comprehensive multilingual services for international students. You can use Korean, English, Chinese, Japanese, and other major languages at counters and online banking, as well as Southeast Asian languages like Vietnamese, Filipino, Thai, and Indonesian. The table below shows KB Kookmin Bank’s language service options:

| Language Category | Language Options |

|---|---|

| Major Languages | Korean, English, Chinese, Japanese |

| Southeast Asian Languages | Vietnamese, Filipino, Thai, Indonesian, Cambodian, Burmese |

| Other Languages | Mongolian, Russian, Uzbek, Sinhala, Nepali, Bengali, Urdu |

After opening an account with KB Kookmin Bank, you can easily use mobile and online banking. The KB Star Banking app ranks first among South Korean banking apps, offering comprehensive features, including international transfers and multi-currency management. Fees are reasonable, with international transfers to China/Chinese mainland costing approximately 15-30 USD.

Shinhan Bank

Shinhan Bank offers an English interface and limited Chinese services. The Super SOL mobile banking app supports customized interfaces and secure login, suitable for users needing personalized management. Shinhan Bank has branches in major cities, offering high convenience. International transfer fees are similar to KB Kookmin Bank, around 15-30 USD.

Hana Bank

Hana Bank’s 1Q Bank app focuses on asset management and cash transfers. You can access basic English services, but Chinese support is limited. Hana Bank is suitable for students needing multi-account management and asset allocation. International transfer fees are comparable to other banks.

Woori Bank

Woori Bank’s One Touch Personal Banking app offers diverse account management functions. You can access English services at some branches. Woori Bank has branches in Seoul and major cities, making it convenient for transactions. International transfer fees are consistent with other banks.

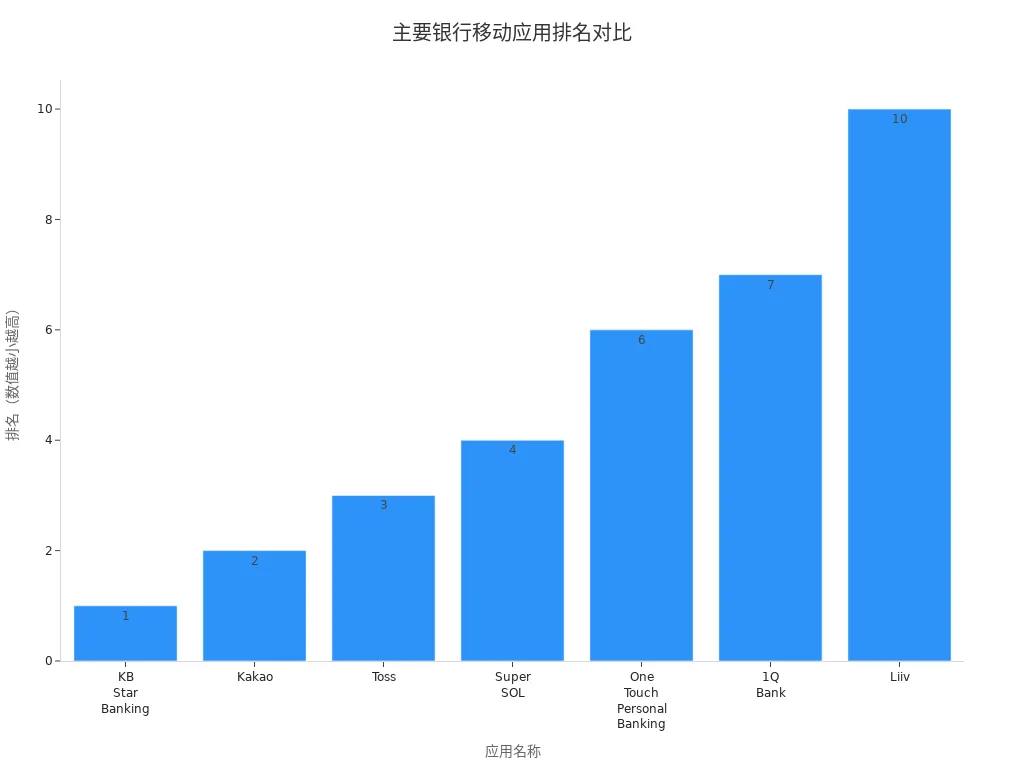

The chart below shows user rankings and feature comparisons of major bank mobile apps:

When choosing a bank, prioritize KB Kookmin Bank for its multilingual services and robust mobile banking features. If you value personalized interfaces or asset management, Shinhan Bank and Hana Bank are also good options. Woori Bank is suitable for users needing diverse account management.

Account Types

Savings Account

While studying in South Korea, a savings account is the most common choice. Savings accounts are suitable for daily financial management, such as receiving scholarships, wages, and family remittances. You only need a valid passport and Alien Registration Card (ARC) or student ID to apply. The account opening process is simple, ideal for students new to South Korea. Savings accounts support online and mobile banking, allowing you to check balances and transfer funds anytime.

Savings accounts have low interest rates, but some banks offer exclusive products for youth and students. For example, the Youth Hope Savings Product offers an annual interest rate of about 5%, with government subsidies up to 3~4%. If you meet income requirements, you can enjoy higher rates. Regular savings products have significantly lower rates, suitable for students with high liquidity needs.

The table below outlines eligibility requirements for different account types:

| Account Type | Eligibility Requirements |

|---|---|

| Savings Account | Valid passport and Alien Registration Card (ARC) or student ID |

| Fixed-Term Deposit Account | Valid passport and Alien Registration Card (ARC), typically requires higher deposit amounts |

Fixed-Term Deposit Account

If you aim to preserve or grow your funds, consider a fixed-term deposit account. These accounts are suitable for students with savings who don’t need frequent withdrawals in the short term. You need a valid passport and ARC, and banks typically require higher deposit amounts. Fixed-term deposit accounts offer higher interest rates than savings accounts, ideal for students planning long-term studies or with idle funds.

| Account Type | Annual Interest Rate | Notes |

|---|---|---|

| Youth Hope Savings Product | ~5% | Requires meeting income conditions, with government subsidies up to 3~4% |

| Youth Leap Account | TBD | Launched in June 2023, monthly deposit limit of 700,000 KRW |

| Regular Savings Product | Lower | Significantly lower rates compared to youth products |

When choosing an account type, consider your cash flow needs and financial goals. A savings account is more suitable for flexible daily expense management, while a fixed-term deposit account helps you earn higher interest on long-term idle funds. Consult the bank before opening an account to understand the latest products and rates to choose the most suitable account type.

Common Issues

Language Barriers

Language barriers are one of the most common issues when opening a bank account in South Korea. Many bank staff do not speak English. If you don’t speak Korean, communication can be challenging. Banking terms are complex and can be confusing. You need to communicate clearly with bank staff to accurately understand required documents and account requirements.

It’s recommended to prepare common banking phrases in Korean or English or have a Korean-speaking friend accompany you. Some banks offer multilingual services, so prioritize these to reduce communication barriers.

- Most Korean bank staff rarely speak English.

- Banking terms are complex and prone to misunderstanding.

- You need to clearly communicate required documents and account requirements.

Functional Limitations

Student accounts in South Korea often have strict functional limitations. Your daily withdrawal limit via ATM or transfer is 300,000 KRW (approximately 225 USD).

| Type | Limit |

|---|---|

| ATM/Transfer Withdrawal Limit | 300,000 KRW daily (~225 USD) |

Single international transfer amounts are subject to the laws of the recipient country. Transfer processes and fees vary depending on the destination country’s regulations. You should consult the bank in detail before proceeding to avoid liquidity issues due to restrictions.

International Transfers

When processing international transfers through Korean banks, you may encounter high fees and compliance challenges. Some banks charge 15-30 USD per international transfer. You may also face issues like same-name account fraud or anti-money laundering investigations.

- High fees

- Compliance challenges

- Fraud risks

- Same-name account fraud

- Anti-money laundering investigations

You should understand the transfer process in advance and ensure recipient information is accurate to avoid failed transfers due to mismatched details. Choose banks with international transfer experience to minimize unnecessary issues.

Account Security

Account security is a critical concern during your studies in South Korea. You must safeguard your bank card, password, and mobile banking login information. Avoid sharing personal information to prevent account misuse.

It’s recommended to enable transaction alerts and regularly check account balances and transaction records. If you notice anything unusual, contact the bank immediately. Choosing a bank with strong security measures effectively protects your funds.

Precautions

Fee Management

When using a bank account in South Korea, managing fees effectively is crucial. Many banks offer no-fee accounts, typically requiring no minimum deposit or monthly service fees. By selecting the right account type, you can reduce unnecessary expenses. The table below outlines common bank fee types and their features:

| Bank Type | Features |

|---|---|

| No-Fee Accounts | Most Korean financial institutions offer no-fee accounts with no minimum deposit or monthly service fees. |

| ATM Fees | Using another bank’s ATM typically incurs a small withdrawal fee. |

You can take the following steps to save on bank fees:

- Choose banks offering no-fee accounts.

- Understand the fee structures of different banking services.

- Avoid using other banks’ ATMs to reduce withdrawal fees.

In daily life, regularly check account statements to promptly identify unusual fees. This helps protect your funds effectively.

Account Upgrades and Closures

During your studies in South Korea, you may need to upgrade or close a bank account. Follow the bank’s procedures to ensure account security. Common steps include:

- Visit your bank to process account closure.

- Complete account closure before the expiration date on the back of your ARC.

- If you choose to keep the account, set up and regularly update online banking services and certificates.

When upgrading an account, consult bank staff to learn about the latest account features and services to better meet your study and living needs.

Document Storage

After opening an account in South Korea, securely store all important documents, including your passport, ARC, account opening proof, and bank card. Keep copies in a safe place to prevent loss or theft.

It’s recommended to regularly check document validity and update expired documents promptly. If documents are lost or damaged, contact the bank and relevant authorities immediately. Good document management habits help you handle unexpected situations and ensure account security.

When opening an account in South Korea, prioritize the following:

- Choose banks offering English services

- Clarify account types

- Prepare required documents

- Understand bank processes and convenience

- Be aware of ATM usage restrictions

- Register and familiarize yourself with online banking services

Common mistakes include bringing incomplete documents, not understanding account types, and overlooking language support. Choosing the right bank account can make your study abroad experience smoother. Continuously monitor account security and bank policy changes, and make informed choices based on your needs.

FAQ

Can you use a Chinese mainland bank card to withdraw money at ATMs in South Korea?

You can use a Chinese mainland bank card to withdraw cash at some ATMs in South Korea. Banks charge approximately 3-5 USD in fees. You need to choose ATMs with a “Global” logo.

How long does it take to activate online banking for a Korean bank account?

You can usually apply for online banking on the account opening day. Some banks require an Alien Registration Card (ARC). You can complete registration at the counter or via the mobile app.

How long does an international transfer to Chinese mainland take?

International transfers to Chinese mainland typically take 1-3 business days. Banks charge 15-30 USD in fees. Ensure recipient information is accurate.

Can a student account be linked to U.S. market investment platforms?

You can link a Korean bank account to U.S. market investment platforms. Some platforms require accounts that support international transfers and USD transactions. Consult the bank’s policies in advance.

What should you do if you lose your bank card?

If you lose your bank card, contact the bank immediately to freeze the account and prevent fund theft. Bring your passport to the counter to replace the card.

You have thoroughly reviewed the guide for opening a bank account in South Korea, clearly understanding the multilingual advantages of KB Kookmin Bank, the convenience of Shinhan Bank, and the essential documents required, such as your passport, visa, and Alien Registration Card (ARC). During your studies in Korea, whether managing tuition, receiving scholarships, or handling international remittances (which cost about $15-$30 USD per transaction), you need an efficient, low-cost financial solution.

However, traditional Korean banking services still charge relatively high fees for international transfers and are primarily focused on local payments. For users with global asset management needs or those who require frequent cross-border fund transfers, you need a modern platform that can connect global financial markets and offer more transparent rates.

BiyaPay is your ideal choice for connecting global assets and achieving high-efficiency cross-border fund flow. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively reducing your cross-border fund transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to provide strong financial support for your student life in South Korea.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.