- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Three major driving forces help Broadcom's stock price break through $250, with a return of over 7% in the next year

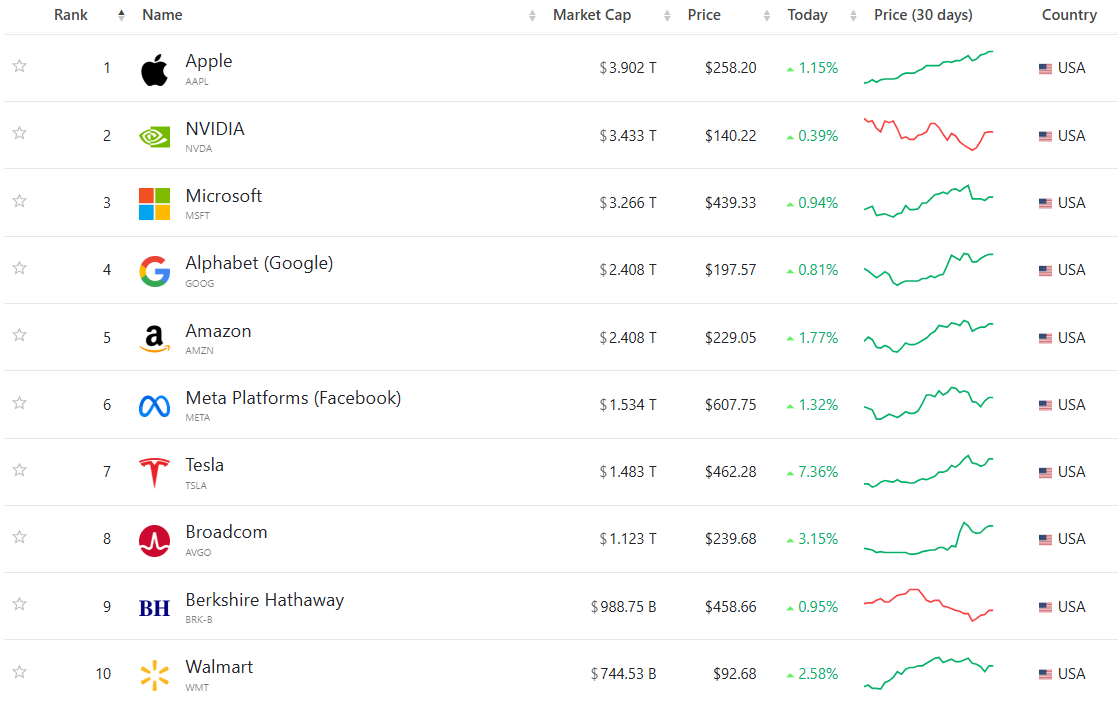

Broadcom (AVGO) recently surpassed a market capitalization of $1 trillion, placing it among the top eight U.S. companies by market value. This massive growth is driven by the company’s ambitions for the AI market in 2027. Despite Broadcom’s fourth-quarter revenue falling short of expectations and its first-quarter financial forecast slightly exceeding market predictions, the company’s management remains optimistic about the AI market.

In its fourth-quarter earnings call, management revealed that Broadcom targets a serviceable addressable market (SAM) of $60 billion to $90 billion in the AI space, covering custom silicon (XPU) and networking products.

“As you know, we currently have three hyperscale customers who have developed their multi-generation AI XPU roadmaps and will deploy them at different speeds over the next three years. By 2027, we believe each of them plans to deploy one million XPU clusters on a single architecture. We expect that, in fiscal year 2027 alone, this will generate $60 billion to $90 billion in AI revenue serviceable addressable market (SAM) from XPU and networking,” said the company.

This forecast, coupled with multi-generation AI roadmaps from three hyperscale clients and possibly two others (ByteDance and OpenAI), paints an impressive growth picture. Broadcom’s ambition to capture a significant share of this market seems highly attractive to investors, especially as management expects market share to reach 60%-70% (with AI revenue expected to hit $45 billion by fiscal year 2027).

Despite this, Broadcom’s AI revenue remains volatile and lags significantly behind competitors like NVIDIA. Broadcom faces intense competition in the AI sector, with NVIDIA leading the way with its CUDA platform and robust data center income. Additionally, Broadcom’s reliance on the Chinese market (which accounts for over 30% of its revenue) exposes it to potential trade risks.

Nonetheless, I believe Broadcom has the potential to continue growing, and at least in the next year, its stock price may continue to rise.

First Driver: Growth Momentum

While Broadcom’s recent quarterly revenue performance may not be as impressive as some peers, the company still exhibits strong overall growth momentum. Particularly when looking toward the first quarter of fiscal year 2025, Broadcom’s future is promising.

“We expect semiconductor revenue to grow approximately 10% year-over-year, reaching $8.1 billion. Demand for AI remains strong, and we expect AI revenue to grow 65% year-over-year to $3.8 billion. Non-AI semiconductor revenue is expected to decline by about 15% year-over-year.”

Overall, we expect first-quarter total revenue to be about $14.6 billion, up 22% year-over-year, and we anticipate this will drive first-quarter adjusted EBITDA to about 66% of revenue.

Additionally, Broadcom’s non-AI semiconductor business is expected to recover after hitting a cyclical bottom in 2024, with moderate single-digit growth expected. Given the current low base, overall growth rates are expected to accelerate next year.

Second Driver: VMware’s Strategic Value

Since acquiring VMware, the integration process is nearing completion.

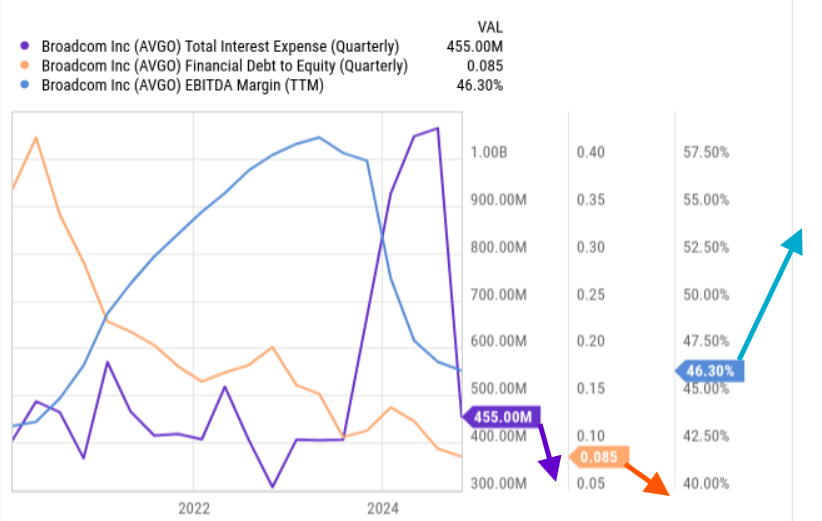

Currently, VMware’s EBIT margin is approaching 70%, meaning its high-margin software business is providing strong support to Broadcom’s AI semiconductor business. This high margin not only enhances Broadcom’s cash flow but also strengthens the company’s overall profitability stability.

Furthermore, Broadcom’s management plans to use free cash flow to reduce the company’s debt load and lower interest expenses. This strategy will further optimize the balance sheet, reduce financial leverage risk, and enhance Broadcom’s financial health.

Third Driver: Future Potential

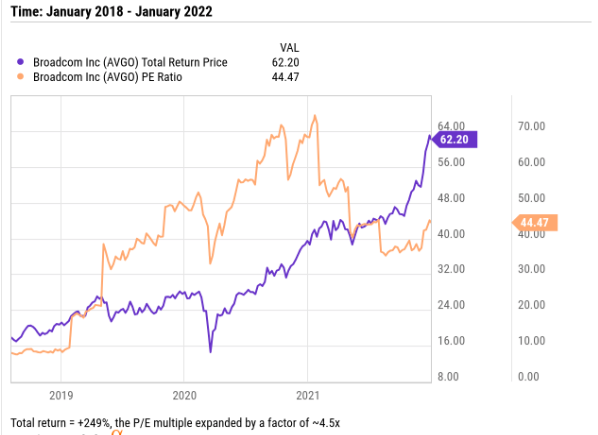

Although Broadcom’s reliance on a single market remains a risk, the current stock price does not seem excessively high. Reflecting on the trade war in 2018, Broadcom’s stock price surged 249% over the following four years. Although market demand back then wasn’t as robust as today, Broadcom successfully weathered the challenges and delivered solid results.

Currently, Broadcom’s forward price-to-earnings (P/E) ratio is about 38x, slightly higher than the 35x in 2018. However, considering the booming AI industry and Broadcom’s strong performance in this sector, this valuation remains reasonable. If Broadcom continues to exceed market expectations, the stock price is likely to continue rising.

From the current market trends, I believe Broadcom will maintain a P/E ratio of around 40x in the coming years. If Broadcom’s earnings per share continue to exceed historical expectations (about 0.4%-0.5%), the stock price could reach $250 to $255 by the end of 2025.

While the upside potential of the stock price may appear limited at present, Broadcom is likely to continue repurchasing shares, further driving the stock price upward, and may maintain a P/E ratio above 40x for the long term. Additionally, Broadcom’s dividend yield over the next three years is expected to exceed 1%.

Therefore, under the base-case scenario, Broadcom’s total return is expected to exceed 7-8% by 2025, which is a very attractive return for investors.

Technical Analysis: Buy or Hold?

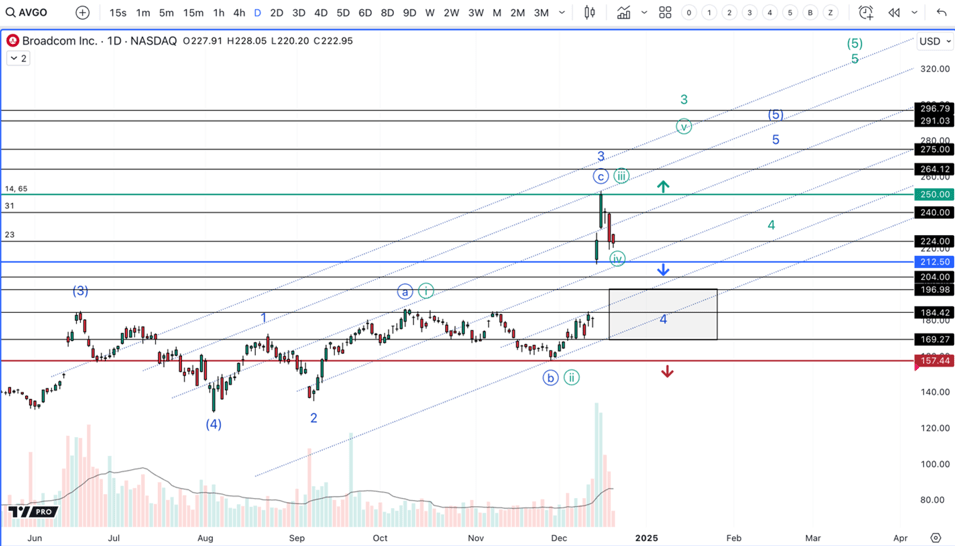

Broadcom’s stock price has recently reached new highs, largely driven by heavy buying volume. Heavy buying volume typically leads to vertical price movements, meaning market participants simultaneously recognize the direction of the trend, pushing short-sellers to cover and long positions to buy. This vertical rise often appears during the third wave of a five-wave uptrend, suggesting that Broadcom has just completed the third wave of its five-wave uptrend.

According to price trend tracking by Tech Insider Network, there are two possible scenarios:

Blue Scenario: Broadcom has completed its third wave and is now experiencing a deep pullback in the fourth wave. In this larger pattern, Broadcom may be in the final diagonal phase, a five-wave pattern with a deep retracement.

If the stock price drops below $212.50, this scenario may occur, followed by a pullback to a low point between $198 and $169. This retracement would set the stage for the fifth wave, which is expected to create new highs.

Green Scenario: Broadcom is still in the standard five-wave pattern, currently undergoing the fourth wave correction within the third wave. This means the stock price may find support above $212.50 and continue to rise, with at least two waves reaching new highs.

This scenario represents the most optimistic forecast for Broadcom’s stock price movement, suggesting the company may continue its upward trend into 2025.

Institutional activity has been particularly active in the $250, $240, and $224 regions. Given that the current stock price is significantly below these levels, it suggests that institutions were selling near these peaks. If the stock price rebounds at these levels, it would further confirm the blue scenario, signaling that the third wave has ended.

If the stock price drops below $212.50 and confirms the pullback scenario, as long as the fourth-wave retracement holds around $157, this would be considered a buy opportunity.

Risk Factors

While Broadcom’s future growth potential is promising, several risk factors should be considered.

First, Broadcom’s AI revenue projections rely heavily on the long-term strategies of a few hyperscale clients. If these clients delay their plans, shift spending priorities, or face more intense competition, Broadcom may not achieve its AI revenue targets.

Although Broadcom expects to capture 60%-70% of the market share by 2027, the strong performances of competitors like NVIDIA and AMD could limit Broadcom’s market share growth.

Second, Broadcom’s reliance on a single market creates a significant geopolitical risk. If international relations worsen, Broadcom could face tariffs or export restrictions, which would negatively impact its revenues in key markets.

Finally, the uncertainty of the macroeconomic environment and whether AI spending continues to grow could impact the valuations of high-growth tech stocks, placing pressure on Broadcom’s stock price. With market sentiment fluctuating, Broadcom’s stock price may face downside risk.

Is Broadcom Overvalued?

In the short term, it’s possible. While the stock price increase may be driven by market expectations and optimism, it’s not entirely driven by “hope.” Broadcom’s execution and conservative financial guidance provide a solid foundation for the company, especially in high-growth areas like AI XPU manufacturing.

The company’s SAM estimate is based on the demand from three hyperscale clients, excluding potential large clients like OpenAI and Apple. In reality, the future growth potential may far exceed current expectations.

Broadcom’s strength lies in its XPU solutions, which offer great performance and value for large-scale customers. These hyperscalers are willing to collaborate with Broadcom. In this context, Broadcom’s outlook is very clear: the company is at the technological forefront in custom solutions for large clients, and performance is expected to explode in the coming years, especially in the second half of 2025.

This growth momentum is likely to accelerate further in 2026 and 2027. Therefore, even though Broadcom’s performance hasn’t reached the heights of Nvidia’s “moment,” this breakthrough will come sooner or later.

Furthermore, as large language models (LLMs) are gradually replaced by smaller language models and with the widespread use of model calling, businesses will increasingly favor optimized XPU solutions. These solutions offer higher computational efficiency and lower costs, making AI applications more sustainable and ubiquitous. For this reason, Broadcom has outperformed all “Mag-7” component stocks, except Nvidia, in total return over the past three years, highlighting its growth potential and investor confidence.

Therefore, although Broadcom’s AI goals are very ambitious, management has clearly stated that the company is committed to becoming a leader in the AI semiconductor field, particularly by driving this strategy through custom silicon and networking products. While the company will face significant challenges in achieving this goal, I believe Broadcom has the potential to continue unlocking growth, especially with the gradual deployment of AI solutions by large-scale customers.

From my perspective, Broadcom is likely to achieve higher profit margins and stronger revenue growth in 2025, which will drive the stock price to new historical highs. Despite seeming expensive on the surface, my valuation model suggests that its current stock price is undervalued by approximately 7-8%.

Moreover, stock buybacks will help Broadcom maintain a price-to-earnings (P/E) ratio above 40, which not only supports the stock price but could also push it higher.

Considering all of these factors, I have decided to maintain my “buy” rating on Broadcom.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.